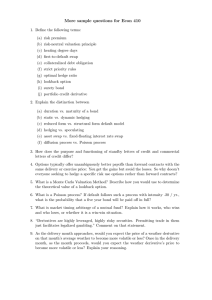

Lecture 4 • The option price should always be above the lower bound, and • The option price should always be below the upper bound. • If an option ever traded at a price outside this range, it presents an arbitrage opportunity. Formulas: Call upperbound: , Call lowerbound: Put upperbound: Lecture 5 Put lowerbound: , Compare actual with calculated: Overpriced call: Ce <= S0, but Ce > S0, overpriced -> sell -> short call T=0 St < 10 St > 10 Short call 9 0 -(St – 10) Buy share -8.5 St St Invest -0.5 0.53 0.53 0 St + 0.53 10.53 Underpriced call: -> buy -> long call: T=0 St > 20 (K) St < 20 (K) Long call -3.8(given in St -20 0 question Short sell stock 23 0 0 Invest -19.2 21.01 21.01 0 St + 1.01 21.01 Overpriced put: -> sell -> short put: T=0 St < 50 (K) St > 50 (K) Short put 49.5 (given in -(50 – St) 0 question) Invest -49.5 50.50 50.50 0 St + 0.5 50.50 Underpriced put: -> buy -> long put: T=0 St > 40 St < 40 Long put -0.8 0 40 – St Buy share -37 St St Borrow 37.8 -39.74 -39.74 0 St – 39.74 0.26 Lecture 6 Once we understand the basics of call and put options, we can start combining multiple “vanilla” options to form sophisticated option trading strategies. – Risk management: to re-engineer the payoff and risk of an existing position, or – Speculation: to take a specific position to profit from a predicted price movement. Put-call parity: – There is a relationship between the price of calls and puts which are written on the same stock (and have same strike and time to expiry). – Put-call parity says that, if we know the price of a call, we can derive the price of a put. – And vice versa: if we know the price of a put, we can derive the price of a call. Lecture 8 Valuation of options – Options must trade with a specific range: Lecture 9 and 10 European-style payoffs: – A derivative is “European” style if its payoff depends only on the finishing share price (ST ). – European derivatives can be valued very quickly using: • Pascal’s triangle (which tells how many paths lead to a specific ending node) • Path probabilities to each ending node Long call: max(0, ST- X) Long put: max(0, X - ST) Lecture 11 Many exotic derivatives have payoffs that depend in some way on the path travelled by the underlying asset over the life of the derivative: path-dependent payoffs. – Floating lookback call: max (0,ST - Smin) – Floating lookback put: max (0,Smax - ST ) – Fixed lookback call: max (0,Smax - X) – Fixed lookback put: max (0,X - Smin). – Asian call: max(0,Savg - X) – Asian put : max(0,X - Savg) Fixed Lookback call: Floating Lookback call: (follow each path and take min ignore initial): Asian call: