Systemic Risk & Financial Stability: Intro & Case Studies

advertisement

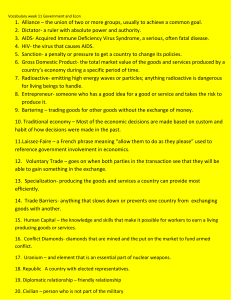

9/3/2022 Introduction to Systemic Risk and Financial Stability WEEK 1 Main reading: JD chapter 1. Tallman, Ellis. John Moen. “Lessons from the Panic of 1907” Economic Review, Federal Reserve Bank of Atlanta, May 1990. OECD „COVID-19 and Global Capital Flows” Talking Coronavirus. July 3. 2020. SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 1 1 Information Sigga Benediktsdottir sigridur.benediktsdottir@yale.edu 55 Hillhouse office #202 SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 2 2 1 9/3/2022 Information Grading a) Class participation and class presentation (40%) ◦ ◦ (20%) Presentation on a question connected to a topic in a given week. Students will choose a topic before the fourth class (September 9th) and the first presentation will be in the fifth class, third week, September 14th. The presentation will be 10 minutes (max 7 slides), followed by 5 minutes of discussions. It may be good for you to have this connected to the paper to deepen the research and get feedback from your peers on it.Discussions in class and cliffhanger notes. (20%) Cliffhanger notes and 2-4 relevant questions about the material. b) Paper (40%), 8-10 pages ◦ ◦ (10%) Prospectus, 2 pgs with 2-4 key references due Wednesday October 18th. (30%) Paper due last week of classes after thanks giving break c) Final (20%) ◦ Open book policy notes on the scheduled day of finals. SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 3 3 Information The paper is due December 6th and should be 8-10 pages. Students will hand in a one page prospectus for the paper on October 18th. The prospectus should include four or more good references. ◦ It could be good for the workload if the paper is on the same topic as the short presentation Exam is to write a short policy note on 2-3 policy question Important to read the material and I will ask students questions from the material in class ◦ I may pose questions to think about on Canvas SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 4 4 2 9/3/2022 Banking crises and financial stability Outline of course: Main readings is the book: ◦ Danielsson, Jon. Global financial systems: stability and risk. Pearson, 2013. ◦ I will post chapters, but the book is available online ◦ Website for the book: http://www.globalfinancialsystems.org/ Other readings will be primarily academic papers or material from the IMF, OECD, BIS and Central Banks (FED, ECB, BoE, BoJ etc.) The syllabus is in draft as this field is developing fast and some emphasis may change as the semester goes on. We will follow current events from the viewpoint of financial stability SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 5 5 Other interesting readings… Financial stability reports from different countries: http://www.centerforfinancialstability.org/fsr_reports.php Note this website is not updated often enough SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 6 6 3 9/3/2022 Important There are many interesting viewpoints, but in this class the point of view we are taking is financial stability I will motivate that viewpoint SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 7 7 This week Outline of course Case study crises 1907 and 1914 JD Chapter 1 (Systemic risk) Introduction, systemic risk JD Chapter 1 (Systemic risk) and BIS systemic risk how to deal with it https://www.bis.org/publ/othp08.htm Current events OECD: COVID-19 and Global Capital Flows SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 8 8 4 9/3/2022 Outline of course SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 9 9 Outline of course First part: Introduction to systemic risk and financial stability. Banks Capital Topic 1. Introduction to financial crises and definition of systemic risk ◦ Case: Panic of 1907 and financial crises of 1914 ◦ Case: Capital flows and EMEs during COVID Topic 2. Banking, balance sheet, capital and liquidity Topic 3. Motivation for supervision. Bank Runs and Deposit Insurance. ◦ Case: Great depression SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 10 10 5 9/3/2022 Outline of course Second part: Financial Stability. Underlying reasons for financial instability and banking crises 1. liquidity (fractional banking) 2. structural weakness and 3. leverage cycles Topic 4. Market liquidity and banking liquidity. Role of Central banks in liquidity crisis. ◦ Case. Current crisis and dash for cash. Topic 5. Financial stability and structural weakness. Financial deepening in emerging economies. ◦ Case. Savings and loans crisis in US Topic 6. Endogenous risk, Credit cycles and leverage cycles, theory. Introduction to counter cyclical capital buffer. Growth at Risk SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 11 11 Outline of course Third part: More emphasis on global factors and capital flows Topic 7. Capital flows, leverage and financial instability I. Short primer on Balance of payments. ◦ Case the Asian crises and Mexican financial crisis crisis Topic 8. Capital flows and financial instability II. Evaluating risks. Sudden stops and capital flights. ◦ International comparative studies SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 12 12 6 9/3/2022 Outline of course Fourth part: Lessons learned. Global financial crisis of 2007-2008, a motivation for a change and connect to how it may be working now in COVID times. Topic 9. Global financial crises of 2007-2008, lessons learned. ◦ Case. Iceland Topic 10. Policy responses, microprudential policy. Topic 11. Macroprudential policy, intermediate objectives and early warning indicators Topic 12. Capital flows, resilience and Capital flow management in emerging economies Topic 13. Lessons learned and preventing current health crisis and the resulting inflation from escalating into financial crisis SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 13 13 The US Panic of 1907 THE CREATION OF THE FEDERAL RESERVE SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 14 14 7 9/3/2022 Panic of 1907 World on the verge of economic collapse* “The Bank Panic of 1907 was so serious that it became a catalyst for the creation of America’s central bank” (Tallman and Moen 1990,) Listen to NPR from August 2007… https://www.npr.org/templates/story/story.php?storyId=14 004846 *Tallman, Ellis. John Moen. “Lessons From the Panic of 1907” Economic Review, Federal Reserve Bank of Atlanta, May 1990. “Panic of 1907”. Federal Reserve Bank of Boston. SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 15 SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 16 15 16 8 9/3/2022 Run up to the crises Global interconnectedness. US ◦ Booming economy ◦ High leverage ◦ …. and growth of trust companies which were unregulated… structural vulnerabilities ◦ Knickerbocker Trust Company SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 17 17 Run up to the crises Liquidity ◦ No central bank so money fluctuated with agriculture…. money flowed out of the city in the fall, ◦ Interest rates increased ◦ … in past years it had been partly replaced by foreign funds … but gold trade disputes with UK, further drained liquidity in NY in the fall of 1907 ◦ … the earthquake in San Francisco (April 1906) exuberated these flows out of NY in 1907. First 9 months of 1907 stocks declined almost 25% Fertile grounds for a crisis… SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 18 18 9 9/3/2022 Events Dry up the supply of shares … driving up the price Heinz attempted to corner the stock of United Copper and failed… Oct. 14, 1907 United Copper Co. increased in value from $39 to $60 ◦ The high was due to a leveraged driven manipulation of the shares… The short squeeze did not work since supply of shares increased as price went up Oct. 16, 1907 Value had declined to less than $15 ◦ Many banks lost money due to the share price decline. SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 20 20 Events Ownership and board membership interconnectedness became a focus… Otto and Augustus Heinze with Charles Morse Oct. 21, 1907 Deposit run on Knickerbocker Trust Company Knock on effects to other deposit institutions That evening J.P. Morgan organized a meeting for trust company executives … not enough information on the financial health of Knickerbocker so J.P. Morgan did not aid that trust Oct. 22, 1907 Run on Knickerbocker results in closure in the afternoon after a payout of $8 million SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 21 21 10 9/3/2022 Events Oct. 22, 1907 J.P. Morgan pledges to save Trust Co. of America Oct. 23-25, 1907 … anchor US GDP $30 billion US Treasury deposits $25 million in several NYC banks Rockefeller kicks in $10 million JPM pressures bankers to contribute an additional $25 million rescue pool ◦ made available to the NY stock exchange to prevent its collapse Trust Co. of America pays out 70% of its $50m in deposits but did not close SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 22 22 Events Deposit run was tempered by the New York Clearing House Association with currency substitutes and suspension of deposit payments via increasing transaction costs. ◦ Both illegal Oct. 29, 1907 New York City was running out of money and did not find any buyers for their bonds. Morgan and friends underwrote $30 million of the $500 million bond issuance. SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 23 23 11 9/3/2022 Aftermath and lessons Uneven regulations of banks and trusts may have increased risk due to less diversification. JPM heralded for saving the economy Senator Nelson Aldrich of RI introduces legislation for a central bank 1910 1913: Federal Reserve Act Severe economic costs costs: Motivation ◦ Production fell by 11%, ◦ Imports fell by 26%, ◦ Unemployment rose to 8% from under 3% SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 24 24 Typical financial crisis Run up of systemic risk and existing structural risks ◦ Structural … no Central Bank, seasonality in liquidity and hence fluctuating interest rates, gold and the gold dispute with the UK ◦ Run up of Systemic Risk … risks in trusts due to lack of diversification and growth, increased leverage in trusts, interconnectedness between trusts and the more systemically important banking system, governance interconnectedness in the financial industry and even into large firms Catalyst … ◦ Failed attempt at market manipulation, which was heavily leveraged, increasing volatility and exposing weaknesses and leading to a run on the trust that funded the failed market manipulation SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 25 25 12 9/3/2022 Typical financial crisis Amplification and contagion, ◦ Runs Failure of one trust leads to a run on all trusts and banks Fire sale of assets leads to asset price decline Further liquidity need and default resulting in Liquidity Spirals and Fire Sale Externalities ◦ Rapid loss of confidence in the financial system Run on Banks Banks forced to sell assets Banks call loans Investors Asset price decline Investors forced to sell assets SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 26 26 Typical financial crisis Attempts to halt the crisis … swift ◦ Increase in money supply or QE … here currency substitution. ◦ Slow deposits payout ◦ Try to install confidence. ◦ The New York Clearing House said the banks were fine, JPMorgan vouches for Trust Company of America. ◦ Announce liquidity support of the NY stock exchange ◦ Often public/private cooperation Repercussion ◦ Usually very costly in decline in GDP and Consumption SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 27 27 13 9/3/2022 COVID 19 28 SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 28 COVID Economy shut down Produc on ↓ Na onal income ↓ Layoffs Banks Financial markets Risk Loan loss account … future expected losses Banks solvency Credit Crunch Defaults and Loan losses Asset prices Typical firesale banking market crisis feedback loop Bank Liquidity Fire sale 29 14 9/3/2022 COVID Economy shut down Produc on ↓ Na onal income ↓ Layoffs Banks Financial markets Risk Loan loss account … future expected losses Defaults and Loan losses Asset prices Five types of messures 1. Capital relief 2. Liquidity support to banks Banks solvency Credit Crunch 3. Massive asset purchases Bank Liquidity 4. Liquidity rule relaxation Fire sale 5. Guidance on Expected Credit Losses 30 SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 31 31 15 9/3/2022 COVID-19 and Global Capital Flows OECD JULY 3 RD SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 32 32 Disruptions in exchange rates The COVID-19 crisis triggered major disruptions for exchange rates and global capital flows… ◦ Depreciation. Brazilian real (BRL), Mexican peso (MXN), Russian rouble (RUB), South African rand (ZAR), and later the Indonesian rupiah (IDR) and the Turkish lira (TRY) ◦ Appreciation. USD, EUR, JPY and CHF SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 33 33 16 9/3/2022 Capital flight Cross-border portfolio investment stopped in many emerging markets as well as in some advanced economies in March 2020. ◦ Repatriation and safe haven flows ◦ USD 103 billion were drawn from EMEs between mid-January and mid-May 2020 … equity flows then debt flows. 34 SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 34 40000 30000 20000 10000 0 -10000 -20000 -30000 -40000 -50000 South Africa (transactions on capital market; converted to USD) Brazil Chile India (converted to USD) Korea 9/1/2021 2/1/2021 7/1/2020 5/1/2019 12/1/2019 3/1/2018 10/1/2018 8/1/2017 1/1/2017 6/1/2016 4/1/2015 11/1/2015 9/1/2014 2/1/2014 7/1/2013 5/1/2012 12/1/2012 3/1/2011 10/1/2011 8/1/2010 1/1/2010 6/1/2009 4/1/2008 11/1/2008 9/1/2007 2/1/2007 7/1/2006 5/1/2005 12/1/2005 3/1/2004 10/1/2004 8/1/2003 1/1/2003 -60000 Poland 35 17 9/3/2022 Impacting External Funding for EMEs Tightening in dollar funding markets Sovereigns not the main focus … dollar denominated corporate debt has been increasing, driven by historically low borrowing costs and various (including tax) incentives favoring debt over equity. Differences across countries increases complexity SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 36 36 Policy responses Sudden stops in capital flows are typically associated with decreases in global risk appetite and contagion Policy to stand against capital outflow is difficult to formulate … options ◦ Monetary policy … increase interest rates? ◦ Interventions ◦ Brazil has conducted interventions in the spot currency and derivative markets, to support the BRL, which had depreciated by 15% since mid-February 2020. The magnitude of Brazil’s intervention amounted to USD 23 billion, corresponding to 6.4% of Brazil’s gross reserves, as of April 2020. ◦ Depends on Reserves and external position. SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 37 37 18 9/3/2022 Policy responses… cont. ◦ Federal reserve board made explicit swap agreements with large CB and opened a REPO facility to any CB holding US Treasuries Securities ◦ Macroprudential policy … ◦ Relax rules on capital inflows, f.x. India raised the limit for foreign portfolio investors’ investment in corporate bonds and China relaxed some controls on inflows for foreign institutional investors. ◦ Many lowered banks reserve requirement on FX funding (deposits) increase banks FX liquidity. ◦ Relaxation on liquidity requirements for banks (LCR) in foreign currency ◦ Korea relaxed macropurdential levy on non-deposit FX liabilities. ◦ Iceland … pension funds ◦ Capital controls … outflow controls ◦ Countries have not resorted to capital controls. SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 38 38 Systemic risk SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 45 45 19 9/3/2022 Systemic Risk Systematic risk ◦ Systematic risk: Non-diversifiable risk factor ◦ Systemic risk: Danger of the entire financial system collapsing Systemic risk, IMF, BIS, FSB definition the disruption to the flow of financial services that is (i) caused by an impairment of all or parts of the financial system; and (ii) has the potential to have serious negative consequences for the real economy. Systemic risk (definition 1.1.) The risk that the entire financial system may fail, causing a general economic collapse, as opposed to risk associated with an individual part of the system. Systemic risk arises from the interlinkages present in the financial system, where the failure of an individual institution may cause cascading failures, bringing down the entire financial system. The conditions for systemic risk tend to be created when all outward signs point to stability and low risk SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 46 46 Where is systemic risk the highest Countries that base their economies on finance and are exporters of financial services are often more vulnerable to systemic risk, other factors also matter ◦ Bank concentration ◦ Openness also matters In every country, except US, almost all financial intermediation is via banks ◦ 84% in UK, 92% in Germany, 96% in Spain. Same in Asia and Latin America ◦ In the US it is 34% SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 47 47 20 9/3/2022 Size of the banking sector % of GDP SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 48 48 Size and growth matter The size of the banking system matters for systemic risk … and also the growth of it SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 49 49 21 9/3/2022 50 SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 50 US Commercial Banks 25000 Commercial bank assets in the US 100% 20000 80% 60% % of GDP 15000 Billions dollars About 5000 commercial banks and saving institutions ◦ $23 trillion in total assets in August 2022 ◦ 6 largest with about $11.7 trillion, 50% 120% 10000 40% 5000 20% SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 Total Assets 2021-03-01 2018-05-01 2019-10-01 2015-07-01 2016-12-01 2011-04-01 2012-09-01 2014-02-01 2008-06-01 2009-11-01 2005-08-01 2007-01-01 2001-05-01 2002-10-01 2004-03-01 1998-07-01 1999-12-01 1997-02-01 1995-09-01 1992-11-01 1994-04-01 1991-06-01 1988-08-01 1990-01-01 1985-10-01 1987-03-01 1981-07-01 1982-12-01 1984-05-01 1978-09-01 1980-02-01 1975-11-01 1977-04-01 http://www.federalreserve.gov/releases/h8/current/default.htm 0% 1973-01-01 1974-06-01 0 Total assets % of GDP 51 51 22 9/3/2022 DATA… A lot of good data in the FRED database at the St. Louis FED, ◦ See for example on US banks https://fred.stlouisfed.org/categories/93 Federal Reserve Board also has a lot of good data ◦ http://www.federalreserve.gov/releases/h8/current/default.htm A website called global banking has good graphs but lacks the most current data often ◦ http://www.globalbanking.org/globalbanking.taf?section=key-charts&theme=too-big-to-fail&chart=7a BIS has many good data series ◦ e.g. data series with credit to GDP gap, http://www.bis.org/statistics/c_gaps.htm?m=6%7C347 World bank also has data series, especially about developing economies ◦ http://databank.worldbank.org/data/reports.aspx?source=global-financial-development IMF and the World bank have a database about financial crisis and banking crisis – paper about it and access. ◦ www.imf.org/en/Publications/WP/Issues/2016/12/31/Systemic-Banking-Crises-A-New-Database-22345 SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 54 54 Origins of systemic risk SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 55 55 23 9/3/2022 Systemic Risk When is systemic risk usually created? Former head of the BIS, Andrew Crockett in 2000: “The received wisdom is that risk increases in recessions and falls in booms. In contrast, it may be more helpful to think of risk as increasing during upswings, as financial imbalances build up, and materializing in recessions.” Profit–maximizing behavior can cause financial institutions to take on considerable risk. Minsky (1992) “stability is destabilizing” because financial institutions have a tendency to extrapolate stability into infinity, investing in ever more risky debt structures, followed by an abrupt correction SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 56 56 Fundamental origins of systemic risk 1. Fractional reserve banking 2. Pro-cyclicality 3. Information asymmetries 4. Interdependence and common risks 5. Perverse incentives SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 57 57 24 9/3/2022 1. Fractional reserves: Fragility Deposits are usually “on demand” Banks lend out some large percentage (e.g. 95%) of the deposits – and loans are usually long term If a sufficient number of depositors want their money, the bank can’t pay the depositors, this is called a bank run Bank runs are contagious ◦ If depositors lose confidence in banks they will withdraw at unpredictable rates which can cause bank failure and hence financial instability and systemic crises Usually now referred to as term mismatch between liability (deposits and other) and assets (loans) of financial institutions ◦ Issue for non-bank-financial-institutions (NBFIs) as well SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 58 58 1. Fractional reserve banking: Example US money supply What is money? Cash, your balance in you debit card account -- what about other liquid assets such as money market funds No clear one definition of money ◦ ◦ ◦ ◦ M0 Currency in circulation and reserves M1 Narrow money: M0 + checkable accounts M2 M1 + plus saving accounts M3 Broadest measure of money: M2 + large time deposits + institutional money market funds + short term repurchase and other larger liquid assets M2 and M3 are a good indication of inflation and credit expansion. ◦ They increase in booms and fall in recessions SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 59 59 25 9/3/2022 https://fred.stlouisfed.org/series/M2 Trillions US Money supply 20 18 16 14 12 10 8 6 4 2 0 Nov 05 Jul 20 Base M1 M2 M3 SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 60 60 Money supply through COVID … SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 61 61 26 9/3/2022 2. Pro-cyclicality: Capital and leverage Process that is positively correlated with economic cycle is said to be pro-cyclical Built into our current system, fx. ◦ Risk weighted capital, mark-to-market accounting and pro-cyclicality of financial regulation … see next class Banking is inherently pro-cyclical In good times ◦ banks have surplus funding and capital and lending increases. The lending growth tends to be increasingly to lower quality borrowers. This increased lending leads to more economic activity. In bad times ◦ Funding opportunities decrease, capital decreases and hence lending decreases. Leading to less economic activity. SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 65 65 2. Pro-cyclicality: Capital and leverage Borrowers also behave pro-cyclically In good times: ◦ they borrow too much and increase leverage, leading to increase in economic activity In bad times: ◦ They deleverage, increasing the economic slump We will discuss leverage cycles later in the course and also fire sale externalities SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 66 66 27 9/3/2022 3. Information asymmetry Those who fund financial institutions have only limed information on the banks assets they are funding, this matters especially for depositors and other providers of short term funding ◦ Risk of runs The quality of banks assets is difficult to evaluate ◦ Lending portfolios ◦ Other assets A loss in confidence can lead to bank failure through deposit run, wholesale funding runs, and other information related problems irrespectively of whether this is due to unfounded rumors or real negative information. We will discuss funding and liquidity in later classes 67 SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 67 4. Interdependence and common risks Financial system is a network of interwoven obligations where institutions can have direct and indirect connections This gives rise to potential for domino–style failure Common exposures Bank B Bank A A is dependent on D through B and C Bank D Financial institutions often also have common exposures, so if one is in trouble another is likely to also be in trouble … leading to multiple failures Bank C SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 68 68 28 9/3/2022 5. Pervasive incentives Many potential examples here In the subprime mortgage crises in the US it was thought that some banks did not have “proper” incentives to monitor the quality of the borrower due to them immediately selling the loan to other institutional investors. The bank hence had no incentive to minimize the likelihood of a default. ◦ Some banks even used teaser rates on the loans so that the borrower would take a loan which they obviously could not service. We will discuss this in examples later in the course. SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 69 69 Amplification of risk systemic risk Across different financial institutions and across time. Amplification across financial institutions. ◦ Common exposures ◦ Interconnectedness … exposures within the system ◦ Structure of financial system Across time ◦ Financial cycle … build up of risk and the pro-cyclicality of the financial system SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 70 70 29 9/3/2022 Systemic Risk – Some remedies 1. Central bank liquidity provision ◦ Lender of last resort and day to day liquidity 2. Higher capital requirements such as countercyclical capital 3. Higher liquidity requirements 4. Addressing too big to fail ◦ Not diversified but all systemically important ◦ Narrow banking ◦ Volkers rule (Glass-Steagall) – commercial v.s. investment banking ◦ Vickers national v.s. international SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 71 71 Systemic Risk – Some remedies 5. Resolution Regimes / living wills ◦ Good bank bad bank division 6. Market risk … Central counterparty (CCP), other? ◦ Trading halts ◦ Pro-cyclical margins. ◦ Swing pricing, redemption gates, liquidity requirements for funds. 7. Other Macroprudential policies ◦ For example for mortgages and Capital flow management tools 8. Leaning against the wind… use Monetary policy to address systemic risk ◦ Too low interest rates in good times? SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 72 72 30 9/3/2022 Other policies can support Monetary policy, microprudential policy and fiscal policy Institutional framework matters a lot also SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 73 SIGGA BENEDIKTSDOTTIR. GLBL 311 / ECON 480 74 73 Thank you 74 31