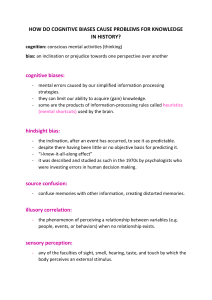

Behavioural Finance and Private Banking Behavioural Biases Thorsten Hens & Isabella Kooij Department of Banking and Finance Spring 2022 Finance Behavioral Finance Psychology Insights from Behavioral Finance • • • People often do not act rationally Systematic errors distort perception and behavior Effects on financial decisions and financial markets Emotions at the stocks market I think I see a trend. Let’s watch the market for a bit longer BUY SELL Good I didn’t wait any longer J If I wait any longer I wont’t profit form the trend anymore. BUY! I will use this opportunity to buy more. Great! At this price I double my investment Why does the government not intervene? Whatever, I buy again. It is cheaper than last time anyways. BUY I can’t believe it! The price is down by 50%. This has to be the all-time low. L I tell you, it will go down again! J I knew all the time that it would recover! What’s going on now? Enough! I sell and won’t ever touch stocks again Such a good decision to sell everything! I knew it… 3 Emotions at the stocks market J BUY J BUY SELL L Buy High Sell Low ? 4 Classroom Experiment Participants: Rules: Winner: Audience of this talk. Write down a number between 0 and 100. The player who is closest to 2/3 of the average number. Average: 26.4 2/3 of Average: 17.6 Winning number: 18 Recap - Overconfidence Bias • People are often not able to assess themselves correctly • Overestimating oneself in terms of knowledge and one's own abilities • Accuracy and reliability of own forecasts is overestimated Recap - Herding • Investors base their behavior on that of other investors • Too little attention is paid to fundamental values • Investors invest or disinvest "as a herd " • High volatility and large price fluctuations • Emergence of speculative bubbles 7 Behavioral Biases in the Decision making process Information Selection Information Processing Feedback Decision Behavioural Biases 8 Behavioral Biases in the Decision making process Information Selection Information Processing Feedback Decision Behavioural Biases 12 CONFIRMATION BIAS Behavioural Biases 13 Confirmation Bias • Tendency to interpret new evidence as confirmation of one's existing beliefs or theories • Ignoring or underweighting inconsistent information. • Overweighting of supporting information • Bias in information selection Behavioural Biases http://jamesclear.com/wpcontent/uploads/2015/09/confirmation-bias.jpg 14 Confirmation Bias Jonas, Schulz-Hardt, Frey and Thelen (2001) • All Participants: – Read an introductory article on the topic – Make a preliminary decision: Should health insurance cover alternative healing methods or should it only cover traditional medical treatments? • Pool of 16 one-page articles, e.g. – "The success of alternative healing methods cannot be ignored. Therefore, alternative treatments should also be paid by health insurance." – "In the absence of an unequivocal explanation of how certain methods work, it would be irresponsible to call such a method therapeutic. Thus, alternative treatments should not be paid by health insurance.” • Group A (simultaneous search): – 1. Choose the articles you want to read – 2. Read the chosen articles • Group 2 (sequential search): – 1. Choose from two articles one “supporting” and one “conflicting” – 2. read – 3. choose from two new articles – 4. read Behavioural Biases 15 in the simultaneous search condition (M = 3.17, ?(34) = 3.46, p < .01. As a consequence, the overall Confirmation Bias: An Example hosen articles was also higher in sequential informa- simultaneous information search, all information ti sented together; thus, the decision maker always has of the available pieces of information as well as his Table 1 Means and Standard Deviations for Information Search Dependent on Information Search Procedure in Experiment 1 Information Supporting Conflicting Confirma tion bias" Search procedurea M SD M SD M SD Simultaneous information search Sequential information search 3.17 5.28 1.89 1.78 2.39 2.94 1.79 1.76 0.78 2.33 1.56 2.81 a « = 18 in each condition. b The confirmation bias corresponds to the difference between the number of chosen supporting and the number of chosen conflicting articles. Source: Jonas, E., Schulz-Hardt, S., Frey, D., and Thelen, N. (2001). Confirmation bias in sequential information search after preliminary decisions: An expansion of dissonance theoretical research on selective exposure to information. Journal of Personality and Social Psychology, 80(4), 557–571. https://doi.org/10.1037//0022-3514.80.4.557 Behavioural Biases 16 Social Media and Confirmation Bias • Do you see a relation between social media and the confirmation bias? • What is different/similar for traditional and social media w.r. to the confirmation bias? Behavioural Biases 17 Confirmation Bias Examples: • Government decisions • Polarization in opinions and conspiracy theories – “Belief in conspiracy theories: Basic principles of an emerging research domain” Van Prooijen and Douglas (2018) – https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6282974/ • Investing – Active vs. passive investing Behavioural Biases 18 Confirmation Bias: Consequences and Counter Measures • Once a belief or opinion has been formed, it can be very resistive to change, even in the face of compelling evidence that it is wrong • Can the confirmation bias be benefitial? – Example: New England Puritans could establish a society • Is the confirmation bias really a bias? – People use inference startegies that identify potential rewards and avoid errors, but not to satisfy the logic of science • Counter measures: à Actively search for information contradicting your view à Be aware of how you search for information • • Good overview: https://www.britannica.com/science/confirmation-bias For a discussion see: Nickerson, R. S. (1998). Confirmation Bias: A Ubiquitous Phenomenon in Many Guises. Review of General Psychology, 2(2), 175–220. https://doi.org/10.1037/1089-2680.2.2.175 Behavioural Biases 19 ATTENTION BIAS AND AVAILABILITY Behavioural Biases 20 Attention Bias • Tendency to prioritize the processing of certain types of stimuli over others. • attention is focused on just a subset of the available information • Some options and pieces of information are ignored. https://medium.com/an-idea-for-you/8-ways-to-improve-your-focus-bf7c691413 Behavioural Biases 21 Attention Bias • Experiment: https://youtu.be/vJG698U2Mvo • When people focus too much on one task something unexpected can happen, that they may not notice • Security campaign of the City of London 2008: Link Behavioural Biases 22 Experiment 1, 24 radiologists (mean age = 48, range = menter spent roughly 10 min teaching these observers 28–70) had up to 3 min to freely scroll through each of how to identify lung nodules. This experiment began five chest CTs, searching for nodules as we tracked their with a practice trial, during which the experimenter took eye position. The five trials contained an average of 10 time to point out several nodules. The experimenter then nodules, and the observers were instructed to click on encouraged the observer to try to find nodules on his or nodule locations with the computer mouse. In the final her own. Once the observer was able to detect at least trial, we inserted a gorilla with a white outline into the one nodule, the practice trial was concluded, and the lung (see Fig. 1). A typical stack of images from a chest experimental trials began. As in Experiment 1, a subset CT contains 100 to 500 slices. In the current study, the (12) of observers completed the study on a slightly stack that contained the gorilla had 239 slices. smaller screen. We observed noetdifference in gorilla or 1850 Drew al. Nine radiologists were tested at Brigham and Women’s nodule detection as a result of equipment differences. final trial?” Twenty of the 24 radiologists to report Hospital in Boston, Massachusetts, and 15 expert examinExperiment 3 was a failed control experiment intended to seeingata gorilla. This was due to the gorilla being ers from the American Board of Radiology were tested ensure thatnot the gorilla was, in fact,dif-visible. Twelve naive ficult to perceive: All 24 radiologists a meeting of that organization in Louisville, Kentucky. observers (mean agereported = 37.3,seeing rangethe = 21–54) were shown gorilla when they were asked if they noticed anything The gorilla measured 29 × 50 mm. Because of equipment movies that progressed from the top unusual in Figure 1 after completing the experiment (seeto the bottom of the differences, the image size was slightly different also at the same chest CT 3). case that was used as the final trial in the results for Experiment two sites, and consequently the size of the gorilla differed Experiments 1 and 2. The to gorilla was inserted into the The radiologists had ample opportunity find the who missed the gorilla slightly (Boston: 0.9 × 0.5 degrees of visual gorilla. angle;On average, moviesthose in the same location on spent 50% of the 20 trials, and s viewingobservers the five slices containing (range = 1.1–12 Louisville: 1.3 × 0.65 degrees of visual angle). To5.8avoid were askeditto judge whether the gorilla was s) and spent an average of 329 ms looking at the gorilla’s large onset transients, we had the gorilla fade into and present or absent on each trial. A circular cue indicated location. Furthermore, eye tracking revealed that of the out of visibility over five 2-mm-thick slices (Fig. 1). The the possible location of the gorilla 20 radiologists who did not report the gorilla, 12 looked on each trial. The total volume of the rectangular box that could hold theat themovies presented at avisible. rate ofThe 35 or 70 ms per frame directly gorilla’swere location when it was mean time on the gorillawithin in this subjects). group was 547 ms. gorilla was more than 7,400 mm3, roughly the size of dwell a (manipulated Attention Bias of Experts Are experts better in avoiding biases? Figure 2b shows the eye positions of a radiologist who clearly fixated the gorilla but did not report it. Experiment 2 None of the 25 naive observers reported noticing the gorilla. As was the case with the radiologists in Experiment Fig. 2. Computed-tomography image containing the embedded gorilla 1, all of the naive observers reported seeing the gorilla (a)when and eye-position plot of a radiologist who did not report seeing the shown Figure 1. The results support the idea gorilla (b). In (b), circles represent recorded at 1-ms (Memmert, 2006) thatthe experts are somewhat less eye pronepositions to IB than novices are (Fisher’s exact test: p = .0497; see Fig. intervals. 3a). However, unlike in Memmert’s study, our two groups showed a sizable difference in performance on the primary task. As expected, radiologists were much better at detecting lung nodules (mean detection rate = 55%) than were naive observers (12%), t(47) = 12.3, p < .001 (see Fig. 3b). Eye movement data followed the pattern seen with the Source: Drew, Lo undWolfe (2013): “The Invisible Gorillaradiologists. Strikes Again: Inattentional Blindness The Sustained naive observers spent an average of in Expert Observers” Fig. 1. Illustration of the slices showing the gorilla in the final4.9 trial of Experiments 1 and in 2. which The opacity of thewas gorilla increased from 50% to 100% s searching the frames the gorilla visible and then decreased back down to 50% over the course of 5 slices a stack and within an average of of 157239. ms looking at the gorilla’s location. Although both measures showed that radiologists who missed the gorilla spent slightly more time searching in Fig. 2. Computed-tomography image containing the embedded gorilla its vicinity than did the naive observers, neither differ(a) and eye-position plot of a radiologist who did not report seeing the ence was significant, t(43) = 1.26, p = .22, and t(43) = Results Exper None gorilla. 1, all o when (Memm IB than 3a). Ho showe mary t detecti were n Fig. 3b Eye radiolo 4.9 s se and an Althou missed its vici ence w 1.23, p looked the gor Experiment 1 Exper The nodule detection task was challenging, even for expert radiologists. The overall nodule detection rate was 55%. While engaged in this task, the radiologists freely Althou seeing experim Availability Bias • Tendency to overestimate the probabilities of events that come readily to mind • Concrete, imaginable and exciting information is more easily perceived and stored than abstract or statistical data (more “available”) Behavioural Biases 24 Availability Bias Behavioural Biases 25 Availability Bias in Finance • Barber and Odean (2008): “All that glitters: The effect of attention on the buying behaviour on individual and on institutional investors” – “ individual investors are net buyers of attention-grabbing stocks, e.g., stocks in the news, stocks experiencing high abnormal trading volume, and stocks with extreme one-day returns” • Barber, Huang, Odean, Schwarz (2020): Attention-Induced Trading and Returns: Evidence from Robinhood Users – “Robinhood investors engage in more attention-induced trading than other retail investors, and Robinhood outages disproportionately reduce trading in high-attention stocks. The evidence is consistent with Robinhood attracting relatively inexperienced investors. However, we show that it can also be partially driven by the app’s unique features. – Consistent with models of attention-induced trading, intense buying by Robinhood users forecast negative returns.” Behavioural Biases 26 Attention and Availability Bias • Where have you experienced the attention and availability bias in your life? • In these situations: was it helpful or problematic? Behavioural Biases 27 Attention and Availability Bias: Consequences and Counter Measures • Stories told in the market: – – – – – IT-revolution Fight for natural resources (e.g. oil, gas, water ...) Aging of the society Globalization AI • Investors believe in the story if they see a price pattern supporting it • Stories that are more easily available get more attention Behavioural Biases 28 Attention and Availability Bias: Consequences and Counter Measures • Can the bias be benefitial? – Ability to focus is crucial – Attention is a scarce resource – Sometimes decisions must be made fast (availability bias) • Counter measure: à Am I neglecting any important pieces of information? à Should I invest more time to search for information? à Am I overly relying on easily available information? à Be aware of how you focus and potential blind spots Behavioural Biases 29 Decision Mistakes Information Selection Information Processing Feedback Decision Behavioural Biases 31 REPRESENTATIVENESS Behavioural Biases 32 Representativeness • • • • Judgements are often based on the degree to which an event A resembles event B The representative bias allows to make fast judgments in everyday life Can lead to misjudgements Probabilities for certain combinations of characteristics are over/underestimated Example: • A fund manager has the skill to beat the market in 2 of 3 years. Which of the following protocols is most likely: a) BFBBB b) FBFBBB c) FBBBBB p(a)=6.6%, p(b)=2.2%, p(c)=4.4% Behavioural Biases 33 Representativeness Experiment by Kahnemann and Tversky • Linda is 31 years old, single, outspoken, and very bright. She majored in philosophy. As a student, she was deeply concerned with issues of discrimination and social justice, and also participated in anti-nuclear demonstrations. • Which is more probable? – – a) Linda is a bank employee. b) Linda is a feminist and bank employee The majority rated the likelihood of Linda being "a bank employee and a feminist" much higher Some critical comments: https://www.psychologytoday.com/us/blog/the-superhumanmind/201611/linda-the-bank-teller-case-revisited Tversky, A., & Kahneman, D. (1983). Extensional versus intuitive reasoning: The conjunction fallacy in probability judgment. Psychological Review, 90(4), 293–315. https://doi.org/10.1037/0033-295X.90.4.293 Behavioural Biases 34 Representativeness: Problem of Stereotypes Experiment (Kahneman and Tversky, 1973): • 30 engineers and 70 lawyers • “Jack is a 45-year-old man. He is married and has four children. He is generally conservative, careful and ambitious. He shows no interest in political and social issues and spends most of his free time on his many hobbies, which include home carpentry, sailing, and mathematical puzzles.” Is Jack an engineer or a lawyer? • The probability that Jack is one of the 30 engineers in the sample of 100 is ______%. • “Dick is a 30-year-old man. He is married with no children. A man of high ability and high motivation, he promises to be quite successful in his field. He is well liked by his colleagues.” • The probability that Dick is one of the 30 engineers in the sample of 100 is ______% • People ignore base rates and only consider the case description Behavioural Biases 35 Representativeness • Problem of small samples Behavioural Biases 36 Gambler’s Fallacy • Number of runs until head shows 0.7" Random"Walk" Human"Percep=on" 0.6" Probability* 0.5" 0.4" 0.3" 0.2" 0.1" 0" 1" 2" 3" 4" 5" 6" 7" 8" 9" 10" Number*of*Runs* Behavioural Biases 37 Hot Hand • A player with a hot hand was one who had a better chance of making a basket after or more successful shots than after have missed a shot. • Statistical analysis shows however that streak shooting did not exist • Experiment: – Toss a fair coin 100 times and record the sequence, e.g. HTHHTHT… – Which series is more likely to have been produced by a non-random process? • HHHTTTHHTTHHTTHTHHTTT • HTTHTHTHHTTHTTTHHTHHT Behavioural Biases 38 Impact and Suggested Interventions • Impact – Belief among investors that companies with a good reputation are also a good investment – Using past performance as a predictor for future performance – Influence of skill is underestimated – Decision for active investment • Suggested Interventions – Critically question your own conclusions – Apply statistical methods before making judgements Behavioural Biases 39 Gambler’s Fallacy or Hot Hand? were generally more confident than forecasters [F(1,30) " 65.83, MSe " 48.55, p # .001], perhaps because the forecasters, told that outcomes were somewhat predictable, TON AND FISCHER Figure 2. Percent confidence (±SE) in predicting/gambling as a function of runs of success. of 1–5 for gamblers [t(16) turn in confidence for run prevents the corresponding tical significance [t(14) " across run lengths of 1– 4 linear trend for both fore .0001] and gamblers [t(16) We also collated the dat on confidence in prediction ure. Figure 3 shows that, were experienced, subjects tions generally decreased. A 2 (task) ! 5 (run len these effects were statistica failed predictions had a si confidence [F(4,120) " 28 There was also a signif [F(1,30) " 29.76, MS e " length, confirming that the less confident subjects we was also a significant facto erally less confident than MSe " 95.57, p " .001]. SUBJECTIVE and run length was also si action between choice and MSe ! 111.26, p ! .039] p The interaction reveals predict that the wheel would became less confident as t ever, if they predicted tha would be different from the confident as the run length Figure 1. Percent probability (±SE) of predicting the same color as the last outcome. a noticeable decrease in co same outcome. Linear trend dictions the same as the last negative linear trend in conf ! 5 (run length) ANOVA on the confidence judged from a different standpoint: They may have been #2.30, p " .05]. For predi that run length (of successful past predic- dismayed by being unable to achieve higher expectations would be different, the posit significant factor affecting confidence of success. This may have reduced their confidence relaicant across run lengths of 1– 0.25, MSe " 4.97, p # .001]. Figure 2 shows tive to the gamblers, who had no reason to expect better tailed test], although it is dence expressed by subjects increases ac- than chance performance. e runs of success that they obtained in the There was also an interaction effect between run3. Percent confidence (±SE) in predicting/gambling as across run lengths of 1–5 [ Figure subjects’ confidence in the a function as a significant linear trend in confidence as length and task [F(4,120) " 12.82, MSe " 4.97, p # of runs of failure. cording to whether they pre run length of successes [F(1,30) " 14.70, .001]. Whereas both forecasters and gamblers showed an Source: Ayton, P. and I. Fischer (2004) recency; predictions consist , p # .001]; subjects experiencing a run of increase in confidence over runs of success, the pattern are more confident, and (at l edictions increased their confidence in their for each is somewhat different. Whereas there isMS a statise ! 6.67, p " .0001]. While both forecasters and Behavioural Biases creasingly so 40 with run lengt gamblers showed a decrease in confidence over the runs n. The ANOVA also revealed that gamblers tically significant positive linear trend across run lengths of failure, y more confident than forecasters [F(1,30) " of 1–5 for gamblers [t(16) " 3.79, p # .01], the down- the precise pattern for each is again somewhat sistent with the gambler’s fal Gambler’s Fallacy or Hot Hand? 1374 AYTON AND FISCHER Figure 5. (A) Probability of attributing sequences to basketball player scoring or coin toss. (B) Probability of attributing sequences to football team scoring or roulette. (C) Probability of attributing sequences to tennis player serving or throw of a die. Source: Ayton, P. and I. Fischer (2004) less, plainly the two sequences are psychologically per- vestigated expectations to one of each type of process. In ceived quite differently; subjects simultaneously exhib- ourBiases second experiment, we examined expectations for a Behavioural 41 ited both positive and negative recency—the hot hand wider sample of sequence sources. The two tasks studied fallacy and the gambler’s fallacy—for two binary se- in Experiment 1 differ in response format and modality • Shall the nationality of a person found guilty of the crime be revealed? • Do you see any interferences with biases you learned about today? Behavioural Biases 42 Anchoring France has 67 million inhabitants. Of these, 2.2 million people live in Paris. What is your estimate of the population of Nice? • People use information as anchor points • Often people are not aware of the anchor point of their estimate • Estimates can be deliberately manipulated by environmental information https://www.dreamstime.com/underwater-background-ship-anchor-lowered-to-bottom-drendering-image113789311 Behavioural Biases 43 Anchoring Wheel of Fortune Experiment • Wheel of Fortune is spun: Random number 1-100 Estimated percentage of African countries in • Estimate question: What is the percentage of African countries in the UN? • Estimated values are significantly influenced by the random number the UN → Random number unconsciously serves as an anchor → Estimated value is distorted by surrounding information Behavioural Biases Kahnemann & Tversky (1974) 44 Anchoring Financial Decisions • Investors assume that future index values will be (too) close to current values • Previous estimates are only reluctantly revised when new information becomes known • For equity investments, the purchase price is used as an anchor point • Investments are evaluated in relation to the price at which they were acquired Behavioural Biases 45 Anchoring • The anchoring effect describes the tendency to use a possibly random value as an anchor point for an estimate. • This will bias the estimated value towards the anchor value • It can be useful for making a quick guess • Irrationally, investors often use the purchase price of a stock as an anchor and adjust the valuation to it • If one is aware of the anchoring bias, biases in the evaluation can be noticed and the adverse consequences can be reduced Behavioural Biases 46