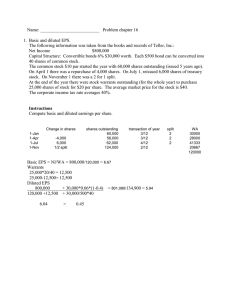

Chapter 12 Earnings per Share Copyright © 2019 by McGraw-Hill Education (Asia). All rights reserved. 1 Learning Objectives 1. Understand the significance of earnings per share; 2. Understand the difference between basic and diluted earnings per share; 3. Understand how new issues affect earnings per share through the weighted average number of shares; 4. Understand the concept of dilution; 5. Understand the concept of control number in diluted earnings per share; and 6. Use the methods for calculating diluted earnings per share: the if-converted method and the treasury method. 2 Content 1. Introduction 2. Computation of a Weighted Average Number of Shares 3. Diluted Earnings per Share 3 Significance of EPS 2 main functions: 1. Measure firm’s profitability 2. Denominator in price-earnings ratio (PE ratio) – – – PE ratio is widely used as a basis for comparing share-valuation with peers Historic PE • Current market price/EPS in the most recent FYE Prospective PE • Current market price/projected EPS for the upcoming FYE 4 Basic vs. Diluted EPS Capital Structure Simple Capital Structure Complex Capital Structure Does not include potential ordinary shares Includes potential ordinary shares, e.g. convertible bonds/preference shares, warrants, options, or other contractual rights which, when exercised, could in the aggregate decrease earnings per ordinary share Report basic EPS only Report basic and diluted EPS only 5 Basic EPS Basic EPS = Net profit attributable to ordinary shareholders of a parent entity* Weighted average no. of ordinary shares during a reporting period *after deduction of non-controlling interests’ share of net profit or loss Numerator: • After deducting amounts due to preference shareholders in respect of: – – – Preference dividends Gain/loss arising on the repurchase or early conversion of preference shares Amortization of discount or premium on increasing rate preference shares Types of Preference Shares: Cumulative preference shares: Requires the issuer to pay dividends, even if in arrears. Increasing rate preference shares: Shares that are issued at a discount and that provide a low initial dividend to compensate the issuer for selling at a discount. 6 Adjusting for Preference Dividends Scenario Treatment Non-cumulative preference shares Deducted when declared Cumulative preference shares Deducted when due Increasing rate preference shares Amortization of discount/premium treated as part of preference dividend Preference shares repurchased in Excess deducted from net profit a tender offer (FV > carrying value) attributable to ordinary equity holders of parent entity Early conversion of preference shares (Consideration > FV of ordinary shares issuable) This is a loss to the issuer and a return to the preference shareholders. Deduct loss from net profit attributable to ordinary equity holders of parent entity 7 Illustration 1: Preference Shares and Basic EPS GTO’s capital structure comprises the following: − 5,000,000 ordinary shares − 2,000,000 non-cumulative 6% preference shares − 1,000,000 cumulative 4.5% preference shares • Net profit for 20x3 and 20x4 were $300,000 and $5,000,000 respectively • No dividend was declared or paid in 20x3 • In 20x4, dividends were declared and paid on the non-cumulative preference shares and cumulative preference shares (for both 20x3 and 20x4) • During 20x4, 500,000 cumulative preference shares were repurchased in a tender offer at a premium of 50 cents over their carrying value • Assume that the preference dividends and gains or losses on repurchase of preference shares have no tax effects 8 Illustration 1: Preference Shares and Basic EPS Net profit attributable to ordinary shareholders 20x4 20x3 $5,000,000 $300,000 Less preference dividends: Non-cumulative (120,000) Cumulative (45,000) Repurchase of preference shares (250,000) (45,000) Net profit attributable to ordinary shareholders $4,585,000 $255,000 Number of ordinary shares 5,000,000 5,000,000 Basic EPS 91.7 cents 5.1 cents Actual amount of preference dividends paid in 20x4 is $210,000 ($120,000 being the non-cumulative preference dividend and $90,000 being the cumulative preference dividend) 9 Content 1. Introduction 2. Computation of a Weighted Average Number of Shares 3. Diluted Earnings per Share 10 Changes in Shares Issued during the Year • Generally, changes in the shares issued during the year are due to one of more of the following reasons: – Issue of new shares during the year for cash or other assets – Issue of new shares in the form of a bonus issue or share split – Issue of new shares at a discounted price as a result of the exercise of a rights issue – Consolidation of existing shares through a reverse split – Issue of new shares from the conversion of potential ordinary shares such as convertible bonds or convertible preference shares – Issue of new shares from the exercise of potential ordinary shares such as stock options issued to employees or creditors – Contingently issuable shares become actual issues when conditions have been met – Purchase of treasury shares and issue of previously purchased treasury shares 11 Basic EPS • When there are changes in the share capital during the year, adjustment have to be made to the denominator (number of shares) − Weighted number of shares outstanding during the period has to be calculated − The term “weighted average” refers to time-weighting, when there are changes in the number of ordinary shares during the financial year. • General rule: − Shares are time-weighted from the date consideration is receivable (usually the date of share issue) − Time-weighting is only performed when there is an inflow of resources 12 Basic EPS Examples: Date to use for time-weighting Shares issued for acquisition/Business combination Date of acquisition Conversion of mandatorily convertible instrument Date of contract Contingently issuable shares are issued Date when all necessary conditions are satisfied 13 Calculating Basic EPS for Various Scenarios Scenario 1: Issue of new shares for cash or other assets • • Issue of new shares for cash or other assets increases the resources available to the firm Additional resources have a positive impact on net earnings from the date they flow into the firm − Hence, number of shares has to be time-weighted 14 Illustration 2: Issue of New Shares at Fair Value Scenario • Company A had issued share capital of 5,000,000 ordinary shares at the beginning of the year. • On 30 June, it issued 3,000,000 shares at fair market value for cash. • Net profit attributable to ordinary shares was $300,000 for the first 6 months and $800,000 for the full year. 15 Illustration 2: Issue of New Shares at Fair Value Net profit = $300,000 Net profit = $500,000 1 January 30 June 31 December No. of shares No. of shares No. of shares = 5,000,000 = 8,000,000 = 8,000,000 $800,000 Basic EPS = = (5,000,000 x ½) + (8,000,000 x ½) 12.3 cents Note: Time-weighting is proportionate to the periods when the resources are made available to the firm. 16 Calculating Basic EPS for Various Scenarios Scenario 2: Issue of bonus shares (stock dividends) Reserves (Retained earnings + Capital reserves) Reserves Bonus issue Total Total Equity Equity Share capital Share capital shareholders 17 Calculating Basic EPS for Various Scenarios • • Bonus shares are issued out of reserves, such as capital reserves or retained earnings Total shareholders’ equity remains unchanged but composition of shareholders’ equity has changed – – – Share capital increase Capital reserves or retained earnings decrease Total number of shares increase • No inflow of resources Earnings are not affected by issue of shares Not time-weighted • Treatment: – – Any bonus issues taking place in a period are assumed to be issued at the beginning of the period (no time-weighting) Retroactively restate previous year’s EPS comparatives based on new number of shares 18 Illustration 3: Issue of Bonus Shares (or Stock Dividend) Scenario • Company A had a paid up share capital of $10,000,000 comprising 10,000,000 ordinary shares at the beginning of 20x3 • Net profit attributable to ordinary shareholders for YE 31 Dec 20x3 and 20x4 were $2,000,000 and $2,600,000 respectively • On 30 Jun 20x4, the company declared a 1-for-2 bonus issue, the bonus shares being issued from capital reserves • Total number of shares increased from 10,000,000 to 15,000,000 19 Illustration 3: Issue of Bonus Shares (or Stock Dividend) Without retroactive restatement to 20x3 comparative figure: Basic EPS (cents) 20x4 20x3 17.33¹ 20² With retroactive restatement to 20x3 comparative figure: Basic EPS (cents) 20x4 20x3 (restated) 17.33¹ 13.33³ ¹$2,600,000/15,000,000 ²$2,000,000/10,000,000 ³$2,000,000/15,000,000 20 Calculating Basic EPS for Various Scenarios Scenario 3: Share splits • An existing share is split into 2 or more shares • No inflow of resources not time-weighted • Retroactive restatement of comparative EPS Scenario 4: Consolidation of existing shares through reverse splits • 2 or more shares are consolidated into one share • No inflow of resources not time-weighted • Retroactive restatement of comparative EPS 21 Calculating Basic EPS for Various Scenarios Scenario 5: Rights issue at a discount to market price • Entitlement of existing shareholders to a rights issue is such that after subscribing to the new shares, their proportionate interest in the firm after the rights issue remains the same as before • Number of shares issued comprises of: 1. Number of shares that would have been issued at the full market price to achieve the same total proceeds 2. Number of shares that is deemed to be issued for no consideration or the “bonus element” 22 Illustration 4: Rights Issue Scenario • On 30 Sep 20x4, Atlantis Co. made a one-for-two rights issue at a subscription price of $1.50 per share to existing shareholders • The market price immediately before the exercise of rights issue was $3.00 • Atlantis Co’s paid-up capital consisted of 10,000,000 shares as at 1 Jan 20x4 • The company reported net profit attributable to ordinary shareholders of $2,500,000 for the year ended 31 Dec 20x4 23 Illustration 4: Rights Issue Additional points: • Total proceeds from the rights issue = $7,500,000 (5,000,000 x $1.50) – Inflow of new resources time-weighting involved • • If the issue was made at full market price, only 2,500,000 new shares needed to be issued ($7,500,000/$3) No. of shares in bonus element = 2,500,000 Total new shares issued 5,000,000 Comprising: Shares deemed issue at full market price 2,500,000 Shares deemed issued as bonus shares 2,500,000 5,000,000 • There is an inflow of new resources as cash is raised. Thus, earnings from 30 September onwards are positively affected by rights issue – Time-weighted by 3/12 for the full issue 24 Illustration 4: Rights Issue • Bonus factor should be applied retrospectively to outstanding shares before the rights issue • Bonus issue factor = Full market price/ Theoretical ex-rights price • Theoretical ex-rights price = Value of existing shares + Proceeds from the rights issue Total no. of shares after the rights issue = ($3 x 10,000,000) + ($1.5 x 5,000,000) 10,000,000 + 5,000,000 = $2.5 • Hence, bonus issue factor = $3/$2.5 = 1.2 25 Illustration 4: Rights Issue From 1 January 20x4 to 30 September 20x4 10,000,000 x 1.2 x 9/12 9,000,000 From 1 October 20x4 to 31 December 20x4 15,000,000 x 3/12 3,750,000 Weighted average number of shares 12,750,00 Net profit attributable to ordinary shareholders $2,500,000 Basic EPS (20x4) 19.6 cents 26 Calculating Basic EPS for Various Scenarios Scenario 6: New issue of shares from the conversion of debt • Capital structure of the issuer changes when the holders of convertible debt exercises their conversion rights • On conversion, − Equity increases, debt decreases − No inflow of cash and hence, increases the net assets of issuer − Interest expense on debt is saved and thus, earnings increase Earnings have to be time-weighted 27 Illustration 5: Additional Shares Issued on the Conversion of Debt Scenario • Capital Ltd had the following capital structure at Jan 20x5: − 10,000,000 ordinary shares − $10,000,000 8% convertible bond • Conversion ratio of bond: every $1,000 nominal value of bond was convertible into 500 ordinary shares • On 1 Jul 20x5, 40% of the bond holders exercised their conversion rights • Net profit for YE 31 Dec 20x5 was $3,300,000 which included interest expense save because of the partial conversion of the bonds 28 Illustration 5: Additional Shares Issued on the Conversion of Debt Number of new shares issued = 40% x $10,000,000/$1,000 x 500 = 2,000,000 Weighted average number of shares = (10,000,000 x ½) + (12,000,000 x ½) = 11,000,000 Basic EPS = $3,300,000/11,000,000 = 30 cents 29 Calculating Basic EPS for Various Scenarios Scenario 7: Contingently issuable shares • IAS 33:5: These are ordinary shares issuable for little/no cash or other consideration upon the satisfaction of specified conditions in a contingent share agreement • When contingent events have occurred, the outstanding shares are timeweighted from the date when all necessary conditions are satisfied, even if the shares have yet to be issued. 30 Illustration 6: Contingently Issuable Shares Scenario • On 1 Jan 20x5, Alpha Company acquired Beta Corporation, a franchisor for a reputable brand of footwear • Consideration was paid entirely in cash • Terms of acquisition included a contingent share agreement that required Alpha Company to issue 10,000 additional new shares to shareholders of Beta Corporation for each franchise contract secured in 20x5 • One contract was secured on 1 June 20x5 and another on 1 Dec 20x5 • Alpha’s share capital is comprised solely of 100,000 ordinary shares • There had been no issue of new ordinary shares during the year • Profit for the year ended 31 Dec 20x5 is $388,000 • Alpha’s Company interim financial statements were prepared half-yearly 31 Illustration 6: Contingently Issuable Shares First half Second half Full year Net profit attributable to ordinary shareholders $138,000 $250,000 $388,000 Ordinary share outstanding 100,000 100,000 100,000 1,667¹ 11,667² 6,667³ 101,667 111,667 106,667 $1.36 $2.24 $3.64 Contingently issuable shares Total shares Basic EPS ¹10,0000 x 1/6 (one month for the first half-year) ²10,0000 (issuable as at 1 Jul 20x5) + 10,0000 x 1/6 (one month for the second half-year) ³(10,000 x 7/12) + (10,000 x 1/12) 32 Calculating Basic EPS for Various Scenarios Scenario 8: Share repurchase and Treasury shares • IAS 32:33: The entity that reacquires its own equity instruments should deduct these instruments (“treasury shares”) from equity. No gain or loss is recognized in P/L • After repurchase, these shares should not be included in the weighted average number of ordinary shares. If bought back during the year, they should be time-weighted • For shares repurchased and held since the beginning of the previous financial year, they should not be included in the weighted average number of ordinary shares for both prior and current period 33 Illustration 7: Impact of Treasury Shares Scenario • Co X has issued share capital of 4,000,000 ordinary shares as at 31 Dec 20x5. • Profit for the year attributable to ordinary shareholders amounted to $1.2 million. • In 20x3, a total of 500k were repurchased from the market under the company’s share repurchase mandate and held in treasury. • On 31 Aug 20x5, X bought back another 800k shares from the market. Similarly, these shares are not cancelled and are held in treasury. • Movement in the share capital account: No. of Shares 1 Jan 20x5 Balance as at beginning 4,000,000 Less: Treasury shares (bought in 20x3) (500,000) 3,500,000 31 Aug 20x5 Shares repurchased during the year (800,000) 31 Dec 20x5 Balance as at end 2,700,000 Calculate weighted average number of ordinary shares and basic EPS 34 Illustration 7: Impact of Treasury Shares Time-weighting Shares in issue Less: Treasury shares No. of Shares 4,000,000 (500,000) x 12/12 (500,000) 3,500,000 Shares repurchased during the year (800,000) x 4/12 Weighted average no. of shares (266,667) 3,233,333 Basic EPS = Profit attributable to ordinary shareholders Weighted average no. of ordinary shares = 1,200,000/3,233,333 = 0.37 or 37 cents 35 Content 1. Introduction 2. Computation of a Weighted Average Number of Shares 3. Diluted Earnings per Share 36 Diluted EPS • An entity can issue both ordinary shares and potential ordinary shares. The following situations give rise to potential ordinary shares, requiring computation of diluted earnings per share if the shares are dilutive – – – The entity has outstanding potential ordinary shares in the form of options and warrants or convertible instruments The entity has contingently issuable shares, and the conditions have not been met The entity has entered into contracts that may be settled in ordinary shares or cash, either at the entity’s discretion or the holder’s discretion 37 Diluted EPS • It is EPS under the assumption of full conversion or exercise of potential ordinary shares or issuance on satisfaction of specified conditions − Potential ordinary shares are financial instruments or contracts that give rise to ordinary shares at the exercise or conversion by the holder or on satisfaction of specified conditions • It is the “worst-case scenario” EPS • What is the purpose of presenting diluted EPS? – Enhance comparability for firms with complex capital structures Focuses on profitability rather than timing of actual conversions – Provides indication of dilutive impact of existing potential ordinary shares 38 Anti-dilution • If a conversion/exercise of potential ordinary shares cause EPS to increase, anti-dilution occurs • IAS 33:41 – Potential ordinary shares that are anti-dilutive are excluded from the calculation of diluted EPS − • Diluted earnings (loss) per share should never be higher (lower) than basic EPS Use of profit or loss from continuing operations attributable to the parent entity as the “control number” to determine whether potential ordinary shares are dilutive or anti-dilutive 39 Anti-dilution Is diluted EPS from continuing operations > basic EPS from continuing operations? yes Anti-dilution occurs. Diluted EPS for (overall) profit/loss attributable to ordinary shareholders is equal to basic EPS. no No anti-dilution. Include the potential ordinary shares in the computation of diluted EPS for (overall) profit/loss attributable to ordinary shareholders. 40 Illustration 8: Profit from continuing operations and overall loss Scenario • Regis Corporation had 10,000,000 ordinary shares and stock options outstanding throughout the year that potentially give rise to 1,000,000 ordinary shares • Regis Corporation had no other potential shares such as convertible preference shares or convertible debt • For the year ended 31 Dec 20x4, Regis Corporation reported the following: Profit from continuing operations $3,800,000 Loss from discontinued operations (4,200,000) Loss attributable to ordinary shareholders $(400,000) 41 Illustration 8: Profit from continuing operations and overall loss Basic EPS Earnings (loss) per share from continuing operations [$3,800,000/ 10,000,000] Earnings (loss) per share attributable to ordinary shareholders [$(400,000)/ 10,000,000] $0.38 $(0.04) Diluted EPS Earnings (loss) per share from continuing operations [$3,800,000/ 11,000,000] Earnings (loss) per share attributable to ordinary shareholders [$(400,000)/ 11,000,000] $0.345 $(0.036) 42 Adjustments to the Computation of Diluted EPS Adjustments to the numerator of diluted EPS: Scenario Impact on numerator Dividends on convertible preference shares Not deducted from net profit After-tax interest and amortization expenses on convertible bond Added back to net profit after tax Other expense (income) relating to potential ordinary shares Added back (deducted from) NPAT Adjustments to the denominator of diluted EPS: • Potential ordinary shares are included in the denominator at the beginning of reporting period or date of issue of potential ordinary shares, whichever is the later 43 Calculating Diluted EPS for Various Scenarios Scenario 1: Options/Warrants • Options and warrants are instruments that give their holder the right but not the obligation to subscribe for shares in the issuing firm at a specified price for a specified period • Assumption: all options and warrants are exercised either at the beginning of the period or at the date of issue if issued during the period • Call options and warrants are only dilutive if they are “in-the-money” − • Average market price of ordinary shares during the period exceeds the exercise price Use the treasury method to calculate dilutive EPS (the same method as applied to calculate EPS for a rights issue) 44 Treasury Method • The treasury method assumes that the issuing entity would buy back shares from the open market with the proceeds it collects from the option holders – If the option is “in-the-money”, the number of repurchased shares would be insufficient to issue to option holders – Additional shares will be issued to option holders for free Total number of shares issuable to option holders = N Number of shares repurchased in the open market at market price (MP) = N x EXP MP Bonus issue element in a stock option that is “inthe-money” = N – (N x EXP) MP – Assume that stock options are exercisable into ordinary shares at any time throughout the period Market price is the average for the period in which stock options are outstanding and not the price at the end of period 45 Illustration 9: Complex capital structure with options Scenario • The following information pertains to Supreme Corporation for year ended 31 Dec 20x6: Net profit for the year Preference shares Ordinary shares outstanding Shares to be issued under options Date options issued $2,000,000 None 2,000,000 400,000 1 January 20x6 Exercise price of options during 20x6 $6 Average market price of one ordinary share during 20x6 $8 Proceeds from the assumed exercise of 400,000 options $2,400,000 There are no other potential ordinary shares 46 Illustration 9: Complex capital structure with options Calculation of diluted earnings per share Shares to be issued on exercise of options 400,000 Shares that would have been issued at fair market value [$2,400,000 / $8] (300,000) Shares deemed to be issued for no consideration 100,000 Diluted EPS = $2,000,000 / 2,000,000 + 100,000 = $0.95 47 Calculating Diluted EPS for Various Scenarios Scenario 2: Convertible Instruments • Use the “if-converted” method to compute diluted EPS • All convertible instruments are assumed to be converted either at the beginning of the period or at the date of issue if issued during the period • Preference dividends or interest (net of tax) relating to the convertible instruments are added back to the net profit attributable to ordinary shareholders • If the amount of preference dividends declared (or accumulated) for the period or the interest (net of tax) per ordinary share on conversion is more than the basic EPS, the convertible preference shares is anti-dilutive 48 Calculating Diluted EPS for Various Scenarios Alternative approach to test whether convertible preference shares are anti-dilutive: • If earnings per preference share without conversion > earnings per preference share with conversion The convertible preference shares/ convertible debt is antidilutive Excluded from calculation of diluted EPS 49 Illustration 10: Potential Ordinary Shares that are Convertible Securities Scenario • Company A recorded net profit of $2,320,000 for YE 30 Jun 20x5 • Company had 50,000,000 ordinary shares outstanding at the beginning of the year • No new shares were issued during the year • Company A had outstanding 5,000,000 6.4% cumulative preference shares that are convertible into ordinary shares at the ratio of one preference share for one ordinary share 50 Illustration 10: Potential Ordinary Shares that are Convertible Securities Net profit for the YE 30 Jun 20x5 $2,320,000 Less: preference dividends (5,000,000 x 0.064) (320,000) Net profit attributable to ordinary shareholders $2,000,000 Basic EPS ($2,000,000/50,000,000) Diluted EPS ($2,320,000/55,000,000) 4 cents 4.22 cents Since diluted EPS > basic EPS, the convertible preference shares are antidilutive and excluded from the calculation of diluted EPS 51 Calculating Diluted EPS for Various Scenarios Scenario 3: Contingently Issuable Shares • If the contingent events are met, these shares are included in the calculation of diluted EPS, from beginning of period or date of agreement, if later • If the contingent events are not met, we take the number of shares issuable if the end of the period is the end of the contingency period (IAS 33:52) 52 Illustration 11: Contingently Issuable Shares when Conditions have been Met Scenario • On 1 Jan 20x5, Alpha Company acquired Beta Corporation, a franchisor for a reputable brand of footwear • Consideration was paid entirely in cash • Terms of acquisition included a contingent share agreement that required Alpha Company to issue 10,000 additional new shares to shareholders of Beta Corporation for each franchise contract secured in 20x5 • One contract was secured on 1 June 20x5 and another on 1 Dec 20x5 • Alpha’s share capital is comprised solely of 100,000 ordinary shares • There had been no issue of new ordinary shares during the year • Profit for the year ended 31 Dec 20x5 is $388,000 • Assume that there are no other potential ordinary shares other than the contingently issuable shares 53 Illustration 11: Contingently Issuable Shares when Conditions have been Met First half Second half Full year Net profit $138,000 $250,000 $388,000 Outstanding ordinary shares 100,000 100,000 100,000 Contingently issuable shares 10,000¹ 20,000² 20,000³ Total shares 110,000 120,000 120,000 $1.25 $2.08 $3.23 Diluted earnings per share ¹10,000 × 6/6 (contingent share issue agreement starts on 1 January 20x5) ²10,000 + 10,000 ³10,000 + 10,000 (contingent share issue agreement starts on 1 January 20x5) 54 Illustration 12: Contingently Issuable Shares when Conditions have not been Met Scenario • Delta Corporation entered into a contingent share issue agreement on 1 Jan 20x5 as part of the compensation plan for its CEO • Terms of agreement, which ended on 31 Dec 20x6, required Delta to issue a bonus of 1 ordinary share for every $2 of year-to-date consolidated, after-tax net profit in excess of $1,000,000 during the agreement period • Delta had 5,000,000 ordinary shares outstanding in 20x5 and had no outstanding options, warrants or convertible securities • Delta prepares financial statements on a quarterly basis Quarter ended Year-to-date consolidated aftertax net profit 31 March 20x5 $800,000 30 June 20x5 1,200,000 30 September 20x5 1,000,000 31 December 20x5 1,500,000 55 Illustration 12: Contingently Issuable Shares when Conditions have not been Met • The number of shares to be included in diluted EPS for each quarter and for the full year is as follows: First quarter 20x5 Second quarter 20x5 Third quarter 20x5 Fourth quarter 20x5 Full year 20x5 Numerator $800,000 $400,000 $(200,000) $500,000 $1,500,000 Denominator: Ordinary shares outstanding 5,000,000 5,000,000 5,000,000 5,000,000 5,000,000 16 8 (4) 10 30 Numerator $800,000 $400,000 $(200,000) $500,000 $1,500,000 Denominator: Ordinary shares outstanding 5,000,000 5,000,000 5,000,000 5,000,000 5,000,000 0 100,000 0 250,000 250,000 5,000,000 5,100,000 5,000,000 5,250,000 5,250,000 16 7.8 (4) 9.5 28.6 Basic EPS: Basic EPS (cents) Diluted EPS: Contingency shares Total shares Diluted EPS (cents) 56 Contracts that May be Settled in Ordinary Shares or Cash • Potential ordinary shares are present when a firm enters into a contract that gives the issuer or the holder the option for settlement of the contract in ordinary shares or cash • If the option lies with the entity, presumption is that the contract will be settled in ordinary shares − • Resulting potential ordinary shares are to be included in diluted EPS if the shares are dilutive If the option for settlement lies with the holder of the instrument, the more dilutive of the two options of cash settlement and share settlement is assumed in calculating EPS 57 Contracts that May be Settled in Ordinary Shares or Cash Example: written put option • If the option is “in-the-money” during the period (i.e. exercise price above average market price) − Dilutive effect on EPS calculated using treasury method for a share-buy-back arrangement (IAS 33 Para 63) − Assumes that at the beginning of the period, sufficient ordinary shares are issued at the average market price during the period to raise funds to finance the share buy-back − Incremental ordinary shares is the difference between the shares issued and the shares bought back 58 Contracts that May be Settled in Ordinary Shares or Cash Total number of shares to be bough back under a written option = N Exercise price = EXP Market price = MP Number of shares to be issued to finance the share buy back = (N x EXP)/MP Incremental ordinary shares from a written put option Number of shares to issue in = the open market to finance share buy-back = Number of – shares to be bought back (N x EXP) – N MP 59 Anti-dilution Sequencing • Purpose of reporting diluted EPS is to report maximum dilution • A potential ordinary share may be dilutive on its own, but may be anti-dilutive when included with other potential ordinary shares • There are so many permutations and combinations, so we need to find an order of inclusion – Start with the most dilutive, process stops when the inclusion of a potential ordinary share increases the diluted EPS 60 Anti-dilution Sequencing Approach to calculate diluted EPS: 1. Compute basic EPS 2. Compute earnings per incremental share (EPIS) for each class of potential ordinary shares EPIS = Increase in earnings from assumed conversion or exercise Incremental number of shares from assumed conversion or exercise • The class of shares with the lowest impact on the numerator (earnings) and the highest impact on the denominator (the no. of shares) has the lowest EPIS and is the most dilutive. 61 Anti-dilution Sequencing 3. Rank them from the most dilutive to the least dilutive and include the most dilutive first in diluted EPS calculation. 4. The process stops when all the potential ordinary shares have been included or when the inclusion of the next ranked potential ordinary share results in a higher diluted EPS than the previous provisional diluted EPS. * The reported diluted EPS is the lowest possible figure and must never be higher than the basic EPS. 62 Comprehensive Illustration Financial statement and share information of Company A for 20x6 are as follows: Net profit after tax Less preference dividends 12,000,000 -24,000 Net profit attributable to ordinary shareholders 11,976,000 No. of issued ordinary shares at 31 December 4,250,000 63 Comprehensive Illustration Information on movements in ordinary shares: 1 Jan 20x4 New issue for cash (incorporation) 1 April 20x5 New issue for cash 1 July 20x5 Bonus issue: 1 for 1 1 Oct 20x5 From conversion of preference shares 1 July 20x6 Rights issue: 1 for 2 1,000,000 200,000 1,200,000 500,000 1,450,000 1 new share for every 2 existing shares Exercise price: $2 Market price: $3 All rights were taken up 1 Oct 20x6 -100,000 Shares re-purchased at fair value 64 Comprehensive Illustration Information on Potential Ordinary Shares (dilutive instruments) 1. On 1 July 20x4, the company issued 1,000,000 6% non-cumulative preference shares that are convertible to 500,000 ordinary shares. The original conversion ratio is 2 preference shares to 1 ordinary share. After the bonus issue, each reference share was convertible to 1 ordinary share. (Ignore the effects of the rights issue on the conversion ratio) On 1 Oct 20x5, 500,000 preference shares were converted to ordinary shares. Preference dividends were declared on outstanding balance of preference shares as at 30 June of each year. 65 Comprehensive Illustration 2. On 1 July 20x5, the company issued 500,000 units of stock options. Each stock option unit entitles the holder to purchase 1 unit of ordinary share. Exercise price: $2.50 Average market price (20x6) $3.00 None were exercised during the period because of a vesting period requirement. 3. On 1 Oct 20x5, the company issued $10,000,000 convertible bonds which are convertible to 10,000,000 ordinary shares. Market interest rate: 5% per annum Tax rate: 20%. None were converted during 20x5 or 20x6 Required: Prepare diluted EPS for 20x6 66 Comprehensive Illustration Step 1: Determine the Earnings per Incremental Share (EPIS) for each type of potential ordinary shares. a) Convertible preference shares Incremental shares arising from the assumed conversion of the preference shares as at 1 Jan 20x6 Assumed converted from 1 Jan 20x6 to 31 Dec 20x6: 500,000 (500,000 x 12/12) (No partial conversions during the year; hence, assume the balance at year-end is converted at beginning of year) Impact on profit attributable to ordinary shareholders from assumed conversion: Avoidance of dividends declared on preference shares during 20x6 = 24,000 Earnings per Incremental Share = 0.048 (24,000/500,000) 67 Comprehensive Illustration b) Stock Options Incremental shares arising from the assumed exercise of options as at 1 Jan 20x6 No. of ordinary shares issued if outstanding options are exercised: 500,000 Equivalent number of shares at fair market value: 416,667 (500,000 x 2.5)/3.0 Incremental number of shares issued for no consideration: 83,333 • Apply a whole year’s weighting since the stock options were in existence at beginning of 20x6. Impact on profit attributable to ordinary shareholders from assumed exercise: Earning per Incremental Share = 0 68 Comprehensive Illustration c) Convertible Bonds Incremental shares arising from the assumed conversion of convertible bonds as at 1 Jan 20x6 No. of ordinary shares issued if the convertible bonds were converted = 10,000,000 (10,000,000 x 12/12) Impact on profit attributable to ordinary shareholders from assumed conversion as at 1 Jan 20x6: Savings of interest expense (after-tax) on convertible bonds =10,000,000 x 5% x 12/12 x 0.8 = 400,000 Earnings per Incremental Share = 0.04 69 Comprehensive Illustration Step 2: Ranking by EPIS 1) Stock Options 2) Convertible Bonds 3) Convertible Preference Shares EPIS 0 (most dilutive) 0.04 0.048 (least dilutive) 70 Comprehensive Illustration Changes in number of ordinary shares in 20x5 Date Item 1 Jan 20x5 Balance at start 1 Apr 20x5 New issue for cash 1 July 20x5 Bonus issue 1 Oct 20x5 Conversion of preference shares 31 Dec 20x5 Balance at year-end Increase in ordinary shares 1,000,000 200,000 1,200,000 500,000 2,900,000 71 Comprehensive Illustration Calculating weighted average number of shares in 20x6 Date Item Increase in ordinary shares Add bonus issue Cumulative balance Period outstanding Time weight Weighted average number of shares 1 Jan 20x6 1 July 20x6 1 Oct 20x6 Balance at start Rights issue Shares repurchased 2,900,000 1,450,000 (100,000) 362,500 (362,500) 3,262,500 4,350,000 4,250,000 1 Jan – 1 Jul 1 Jul – 1 Oct 1 Oct – 31 Dec 1/2 1/4 1/4 1,631,250 1,087,500 1,062,500 72 Comprehensive Illustration • Number of ordinary shares as at 31.12.20x6 = 2,900,000 + 1,450,000 – 100,000 = 4,250,000 • Weighted average number of shares in 20x6 = 1,631,250 + 1,087,500 + 1,062,500 = 3,781,250 73 Comprehensive Illustration Step 3: Introduce the most dilutive security first into aggregate DEPS calculation Profit Basic EPS Include effects of assumed exercise of options Aggregate DEPS Include effects of assumed conversion of convertible bonds Aggregate DEPS Include effects of assumed conversion of convertible preference shares Aggregate DEPS Reported DEPS (20x6) WA no. of shares 11,976,000 0 11,976,000 400,000 12,376,000 24,000 12,400,000 DEPS 3,781,250 3.167207 83,333 3,864,583 3.098911 Dilutive 10,000,000 13,864,583 0.892634 Dilutive 500,000 14,364,583 0.863234 Dilutive 0.863234 74 Presentation and Disclosures • Basic and diluted EPS to be presented in income statement, in respect of: − Profit attributable to ordinary shareholders of parent company from continuing operations − Profit attributable to ordinary shareholders of parent company for the period • Where there are discontinued operations, basic & diluted EPS for discontinued operations must be disclosed in the income statement or in the notes 75 Presentation and Disclosures Other information that should be in the notes (IAS 33:70): 1. Earnings used in numerator of EPS, as well as a reconciliation of earnings to the income statement. (Include individual earnings effect of each class of instruments on EPS) 2. Denominator in calculating basic and diluted EPS and a reconciliation of both denominators. (Include individual denominator effect of each class of instruments on EPS) 3. Potential ordinary shares that were not included in the calculation of diluted EPS, because they were anti-dilutive 4. Subsequent events – description of transactions which would have significantly changed the no. of ordinary shares/potential ordinary shares outstanding at the end of period 76