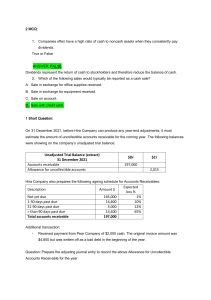

Page |1 Chapter 4 TRUE OR FALSE 1. Accounts receivable are to be reported at their net realizable value. 2. The direct write-off method for uncollectible accounts does not provide for the matching of current revenues with related expenses. 3. The use of the direct write-off method is acceptable under generally accepted accounting principles. 4. Doubtful accounts expense is normally reported as a deduction from sales in the income statement. 5. The entry to write off an uncollectible account under the allowance method is a debit to Doubtful Accounts Expense and a credit to Accounts Receivable. 6. The method of estimating uncollectible accounts expense based on the accounts receivable balance emphasizes the determination of the net realizable value of the receivables. 7. When estimating collectability based on an analysis of the accounts receivable balance, any existing balance in the allowance for doubtful accounts is ignored. 8. The aging method of estimating doubtful accounts is a variation of the percentage of ending receivables method. 9. The "list" sales price less any trade discount is the invoice amount. 10. Sales discounts are normally reported as selling expenses. “The heart of the discerning acquires knowledge, for the ears of the wise seek it out.” (Proverbs 18:15) - END – ANSWERS 1. TRUE 2. 3. TRUE FALS 6. 7. 8. TRUE FALS E TRUE Page |2 4. 5. E FALS E FALS E 9. 10. TRUE FALS E Page |3 1. Which of the following is incorrect? a. The operating cycle always is one year in duration. b. The operating cycle sometimes is longer than one year in duration. c. The operating cycle sometimes is shorter than one year in duration. d. The operating cycle is a concept applicable both to manufacturing and retailing enterprises. 2. The category "trade receivables" includes a. advances to officers and employees. b. income tax refunds receivable. c. claims against insurance companies for casualties sustained. d. none of these. 3. Which of the following should be recorded in Accounts Receivable? a. Receivables from officers b. Receivables from subsidiaries c. Dividends receivable d. None of these 4. When the direct write-off method of recognizing bad debt expense is used, the entry to write off a specific customer account would a. increase net income. b. have no effect on net income. c. increase the accounts receivable balance and increase net income. d. decrease the accounts receivable balance and decrease net income. 5. When comparing the allowance method of accounting for bad debts with the direct write-off method, which of the following is true? a. The direct write-off method is exact and also better illustrates the matching principle. b. The allowance method is less exact but it better illustrates the matching principle. c. The direct write-off method is theoretically superior. d. The direct write-off method requires two separate entries to write off an uncollectible account. 6. When the allowance method of recognizing bad debt expense is used, the entry to record the write-off of a specific uncollectible account would decrease a. allowance for doubtful accounts. b. net income. c. net realizable value of accounts receivable. d. working capital. 7. When a specific customer's account is written off by a company using the allowance method, the effect on net income and the net realizable value of the accounts receivable is Net Realizable Value Net Income of Accounts Receivable Page |4 a. b. c. d. None Decrease Increase Decrease None Decrease Increase None 8. When the allowance method of recognizing bad debt expense is used, the entries at the time of collection of a small account previously written off would a. increase net income. b. increase the allowance for doubtful accounts. c. decrease net income. d. decrease the allowance for doubtful accounts. 9. A method of estimating bad debts that focuses on the balance sheet rather than the income statement is the allowance method based on a. direct write-off. b. aging the trade receivable accounts. c. credit sales. d. specific accounts determined to be uncollectible. 10. The entry Accounts Receivable xxx Allowance for Uncollectible Accounts xxx would be made when a. a customer pays its account balance. b. a customer defaults on its account. c. a previously defaulted customer pays its outstanding balance. d. estimated uncollectible receivables are too low. “Do not be wise in your own eyes; fear the LORD and shun evil. “ (Proverbs 3:7) - END – 1. At January 1, 20x1, Judy Co. had a credit balance of ₱260,000 in its allowance for uncollectible accounts. Based on past experience, 2% of Judy 's credit sales have been uncollectible. During 20x1, Judy wrote off ₱325,000 of uncollectible accounts. Credit sales for 20x1 were ₱9,000,000. In its December 31, 20x1, balance sheet, what amount should Judy report as allowance for uncollectible accounts? Page |5 a. 115,000 b. 180,000 c. 245,000 d. 440,000 2. On the December 31, 20x6, balance sheet of Esther Co., the current receivables consisted of the following: Trade accounts receivable Allowance for uncollectible accounts Claim against shipper for goods lost in transit (November 20x6) Selling price of unsold goods sent by Esther on consignment at 130% of cost (not included in Esther's ending inventory) Security deposit on lease of warehouse used for storing some inventories 93,000 (2,000) 3,000 26,000 30,000 150,00 0 Total At December 31, 20x6, the correct total of Esther's current net receivables was a. 94,000 b. 120,000 c. 124,000 d. 150,000 3. The following information is from the records of Prosser, Inc. for the year ended December 31, 2002. Allowance for Doubtful Accounts, January 1, 2002 .. Sales, 2002 ....................................... Sales Returns and Allowances, 2002 ................ ₱ 6,000 (cr) 2,920,000 32,000 If the basis for estimating bad debts is 1 percent of net sales, the correct amount of doubtful accounts expense for 2002 is a. ₱22,800. b. ₱23,200. c. ₱28,880. d. ₱34,880. 4. An analysis and aging of the accounts receivable of Shriner Company at December 31 revealed the following data: Accounts Receivable .................................. Allowance for Doubtful Accounts (before ₱450,000 25,000 (cr) Page |6 adjustment) .. Required ending balance of allowance ............... 32,000 (cr) The net realizable value of the accounts receivable at December 31 should be a. ₱450,000. b. ₱443,000. c. ₱425,000. d. ₱418,000. 5. Maple Company provides for doubtful accounts expense at the rate of 3 percent of credit sales. The following data are available for last year: Allowance for Doubtful Accounts, January 1 ........ Accounts written off as uncollectible during the year ............................................ Collection of accounts written off in prior years . (customer credit was re-established) .............. Credit sales, year-ended December 31 .............. ₱ 54,000 (cr) 60,000 15,000 3,000,000 The allowance for doubtful accounts balance at December 31, after adjusting entries, should be a. ₱45,000. b. ₱84,000. c. ₱90,000. d. ₱99,000. 6. Based on the aging of its accounts receivable at December 31, Pribob Company determined that the net realizable value of the receivables at that date is ₱760,000. Additional information is as follows: Accounts Receivable at December 31 ................ ₱880,000 Allowance for Doubtful Accounts at January 128,000 (cr) 1 ...... Accounts written off as uncollectible during the year ............................................ 88,000 Pribob's doubtful accounts expense for the year ended December (31 is a. ₱80,000. b. ₱96,000. c. ₱120,000. d. ₱160,000. 7. Based on its past collection experience, Ace Company provides for bad debts at the rate of 2 percent of net credit sales. On January 1, 2002, the allowance for doubtful accounts credit balance was ₱10,000. During 2002, Ace wrote off ₱18,000 of uncollectible receivables and recovered Page |7 ₱5,000 on accounts written off in prior years. If net credit sales for 1999 totaled ₱1,000,000, the doubtful accounts expense for 2002 should be a. ₱17,000. b. ₱20,000. c. ₱23,000. d. ₱35,000. 8. Richards Company uses the allowance method of accounting for bad debts. The following summary schedule was prepared from an aging of accounts receivable outstanding on December 31 of the current year. No. of Days Outstanding 0-30 days 31-60 days Over 60 days Probability of Collection .98 .90 .80 Amount ₱500,000 200,000 100,000 The following additional information is available for the current year: Net credit sales for the year .................. Allowance for Doubtful Accounts: Balance, January 1 ............................. Balance before adjustment, December 31 ......... ₱4,000,000 45,000 2,000 (cr) (dr) If Richards determines bad debt expense using 1.5 percent of net credit sales, the net realizable value of accounts receivable on the December 31 balance sheet will be a. ₱738,000. b. ₱740,000. c. ₱742,000. d. ₱750,000. 9. Gekko, Inc. reported the following balances (after adjustment) at the end of 2002 and 2001. 12/31/200 12/31/200 2 1 Total accounts ₱105,000 ₱96,000 receivable ................. Net accounts receivable ................... 102,000 94,500 During 2002, Gekko wrote off customer accounts totaling ₱3,200 and collected ₱800 on accounts written off in previous years. Gekko's doubtful accounts expense for the year ending December 31, 2002 is a. ₱1,500. b. ₱2,400. c. ₱3,000. d. ₱3,900. Page |8 10. Gray Company had an accounts receivable balance of ₱50,000 on December 31, 2001, and ₱75,000 on December 31, 2002. The company wrote off ₱20,000 of accounts receivable during 2002, and collected ₱3,000 on an account written off in 2000. Sales for the year 2002 totaled ₱620,000. All sales were on account. The amount collected from customers on accounts receivable during 2002, including recoveries, was a. ₱575,000. b. ₱578,000. c. ₱600,000. d. ₱595,000. “For the Lord gives wisdom; from his mouth come knowledge and understanding.” (Proverbs 2:6) - END - Page |9 SOLUTIONS: 1. A (260K + (2% x 9M) – 325K = 115K 2. A (93,000 – 2,000 + 3,000) = 94,000 3. C (2,920,000 – 32,000) x 1% = 28,880 4. D (450,000 – 32,000) = 418,000 5. D [54,000 – 60,000 + 15,000 + (3,000,000 x 3%)] = 99,000 6. A Allowance for doubtful accounts Write-offs 88,000 128,000 beg. 80,000 Bad debts expense (squeeze) end. a 120,000 Recoveries a (880,000 – 760,000) = 120,000 7. B (1,000,000 x 2%) = 20,000 8. C Allowance for doubtful accounts Dec. 31 (unadjusted) 2,000 Write-offs - 60,000 - end. Bad debts (4M x 1.5%) Recoveries 58,000 (500,000 + 200,000 + 100,000) = 800,000 – 58,000 = 742,000 9. D Allowance for doubtful accounts Write-offs 3,200 1,500 beg. (96K - 94.5K) 3,900 Bad debts (squeeze) 800 end. (105K - 102K) Recoveries 3,000 10. B Accounts receivable beg. Sales on account Recoveries 50,000 620,000 578,000 Collections, including recoveries 3,000 20,000 Write-offs 75,000 end. P a g e | 10