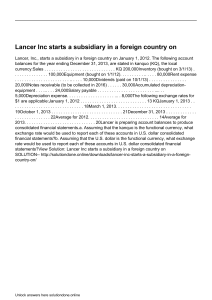

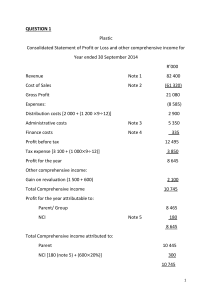

lOMoARcPSD|17139938 ACCO 30023 Accounting for Business Combinations Midterm Reviewer ACCOUNTANCY (Our Lady of Fatima University) Studocu is not sponsored or endorsed by any college or university Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) THEORIES: Select the best answer for each of the following. 1. Statement 1 (S1): In an acquisition of assets for assets, the ownership structure of the acquirer changes. Statement 2 (S2): There is an increase in the total capitalization of an acquirer when the acquirer issues stock for acquiree assets. A. B. C. D. S1 - True; S2 – True S1 - True; S2 - False S1 - False; S2 - True S1 - False: S2 – False 2. Which of the following is not a business combination? A. Statutory amalgamation B. Joint venture C. A company's purchase of 100% of another company's net assets D. A company's purchase of 80% of another company’s voting shares 3. Which of the following is not a reason why a private enterprise may be acquired as a bargain purchase? A. It is a family business and the next generation does not want to continue the business. B. The owner has health problems and does not have a successor. C. The business only has equity financing and has no debt financing. D. The owner is no longer interested in the business 4. When the acquisition price of on acquired firm is less than the fair value of the identifiable net assets, all of the following recorded at fair value except A. Assumed labilities B. Current assets C. Long-lived assets D. Each of the above is recorded at fair value 5. Enchanted Corporation and Delicate Company, both publicly owned companies, are planning a merger, with Enchanted being the survivor. Which of the following is a requirement of the merger? A. The Securities and Exchange Commission must approve the merger. B. The common stockholders of Delicate must receive common stock of Enchanted. C. The creditors of Delicate must approve the merger. D. The boards of directors of both Enchanted and Delicate must approve the merger. 6. According to IFRS 10, these refer to financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity. A. Separate financial statements B. General purpose financial statements C. Consolidated financial statements D. Group financial statements Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) 7. According to IFRS 10, an investor controls an investee if and only if the investor has all of the following elements except: A. Power over the investee B. Exposure, or rights, to variable returns from its involvement with the investee C. The ability to use its power over the investee to affect the amount of the investor's returns. D. Holds protective rights as an investor. 8. An entity acquired an investment in a subsidiary with the view to dispose of the investment within six months. The investment in the subsidiary has been classified as held for sale. How should the investment in the subsidiary be treated in the financial statements? A. Acquisition accounting should be used. B. The subsidiary should not be consolidated but IFRS 5 should be used. C. The subsidiary should be derecognized. D. Equity accounting should be used. 9. An investor has a power over the investee when: A. It has existing rights that give it the current ability to direct the relevant activities. B. It is exposed, or has rights, to variable returns from its involvement with the investee. C. It has the practical ability to affect the returns through its power over the investee. D. None of the above. 10. Control is presumed to exist when the parent owns directly or indirectly through subsidiaries A. More than half of the preference and ordinary shares of an entity. B. More than half of voting power of an entity. C. More than half of the ordinary shares of an entity. D. More than half of the equity of an entity. 11. Which of the statements is true? I. At the date of consolidation, the debit differential consists solely of one item—in this example that one item is an expense. II. There are no intercompany transactions at the date of consolidation III. The subsidiary’s stock and the related stockholders’ equity accounts must be eliminated because the stock of the subsidiary is held entirely within the consolidated entity and none represents claims by outsiders. IV. The investment account must be eliminated because, from a single entity viewpoint, a company cannot hold an investment in itself. A. B. C. D. I, III, IV I, II, IV II, III, IV I, II, III Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) 12. A majority-owned subsidiary that is in legal reorganization should normally be accounted for using: A. B. C. D. consolidated financial statements. the equity method. the market value method. the cost method 13. In a business combination accounted for as an acquisition, registration costs related to common stock issued by the parent company are: A. expensed as incurred. B. deducted from other contributed capital. C. included in the investment cost. D. deducted from the investment cost 14. On the consolidated balance sheet, consolidated stockholders' equity is: A. equal to the sum of the parent and subsidiary stockholders' equity. B. greater than the parent's stockholders' equity. C. less than the parent's stockholders' equity. D. equal to the parent's stockholders' equity. 15. Which of the following is a limitation of consolidated financial statements? Select one: A. Consolidated statements provide no benefit for the stockholders and creditors of the parent company. B. Consolidated statements of highly diversified companies cannot be compared with industry standards. C. Consolidated statements are beneficial only when the consolidated companies operate within the same industry. D. Consolidated statements are beneficial only when the consolidated companies operate in different industries. 16. Which one of the following accounts would not appear in the consolidated financial statements at the end of the first fiscal period of the combination? A. Additional Paid-In Capital B. Investment in Subsidiary C. Goodwill D. Common Stock 17. Consolidated net income using the equity method for an acquisition combination is computed as follows: A. Parent company’s income from its own operations plus the equity from subsidiary’s income recorded by the parent. B. Combined revenues less combined expenses less equity in subsidiary’s income less amortization of fair-value allocations in excess of book value. C. Parent’s revenues less expenses for its own operations plus the equity from subsidiary’s income recorded by parent. D. All of the above. Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) 18. When a company applies the initial method in accounting for its investment in a subsidiary and the subsidiary reports income in excess of dividends paid, what entry would be made for a consolidation worksheet? A. Dr. Retained Earnings, Cr. Investment in Subsidiary B. Dr. Retained Earnings, Cr. Additional Paid-In Capital C. Dr. Investment in Subsidiary, Cr. Retained Earnings D. Dr. Investment in Subsidiary, Cr. Equity in Subsidiary’s Income 19. When a company applies the initial value method in accounting for its investment in a subsidiary and the subsidiary reports income less than dividends paid, what entry would be made for a consolidation worksheet? A. Dr. Retained Earnings, Cr. Investment in Subsidiary B. Dr. Retained Earnings, Cr. Additional Paid-In Capital C. Dr. Investment in Subsidiary, Cr. Retained Earnings D. Dr. Investment in Subsidiary, Cr. Equity in Subsidiary’s Income 20. Under the initial value method, when accounting for an investment in a subsidiary, A. Dividends received by the subsidiary decrease the investment account. B. The investment account remains at initial value. C. Income reported by the subsidiary increases the investment account. D. The investment account is adjusted to fair value at year-end. PROBLEMS: Select the best answer for each of the following. 1. Blank Space Co. is acquiring Love Story Inc. Love Story has the following intangible asset: a. Patent on a product that is deemed to have no useful life, P100,000. b. Customer list with an observable fair value of P80,000. c. A 5-year operating lease with favorable terms with a discounted present value of P25,000. d. Identifiable R & D of P150,000. e. Goodwill of 300,000. f. Franchise of P80,000. g. Right of use machinery, held for production, P500,000. Blank Space Co. will record how much for acquired Intangible Assets from the purchase of Love Story Inc.? A. P160,000 B. P185,000 C. P310,000 D. P335,000 2. On January 2, 2021, Gorgeous Company purchased the net asset of Lover Company by paying P500,000 cash and issuing 100,000 shares of stocks at P3,000,000 fair market value. The par value of Gorgeous Company's shares is P24 per share. Book value and fair value data on the Statement of Financial Positions on January 2, 2021 are as follows: Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) Gorgeous incurred and paid legal and brokerage fees of P50,000 for business combination; share issue costs of P30,000 and P20,000 indirect acquisition costs. It is determinable that contingency fee of P150,000 (estimated fair value) would be paid within the year. How much is the Goodwill or Gain on Bargain Purchase? A. P1,126,000 B. P1,276,000 C. P1,326,000 D. P1,376,000 3. Using the information in No. 2, assuming that Gorgeous Company is an SME, how much is the Goodwill or Gain on Bargain Purchase? A. P1,126,000 B. P1,276,000 C. P1,326,000 D. P1,376,000 4. On January 1, 2020, Drei Co. acquired all of the identifiable assets and assumed all liabilities of Cerise, Inc. by paying P4,800,000. On this date, identifiable assets and liabilities assumed have fair value of P7,680,000 and P4,320,000, respectively. Terms of the agreement are as follows: a. 20% of the price shall be paid on January 1, 2020 and the balance on December 31, 2021 (the prevailing market rate on the same date is 10%). b. the acquirer shall also transfer its piece of land with book and fair value of P2,400,000 and P1,440,000, respectively. Included in the liabilities assumed is an estimated warranty liability. The carrying amount and fair value of this warranty liability amounted to P576,000 and P468,000, respectively. The acquiree guarantees that the warranty liability would only be settled for P480,000. How much is the consideration transferred? A. P2,400,000 B. P4,133,376 C. P4,800,000 D. P5,573,376 Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) 5. Using the information in No. 4, how much is the goodwill on the business combination? A. P2,105,376 B. P2,201,376 C. P2,213,376 D. None of the above 6. Del Valle Company paid P150,000 for its 75% interest in Enrile Company. Del Valle elected to value NCI at fair value. Enrile’s net identifiable assets approximated their fair values at acquisition date. The acquisition resulted in a goodwill attributable to NCI of P10,000. Since the acquisition date, Enrile has made accumulated profits of P200,000. There have been no changes in Enrile’s share capital since acquisition date. The group determined that goodwill has been impaired by P8,000. Since the acquisition date, Enrile has made accumulated profits of P200,000. There have been no changes in Enrile’s share capital since acquisition date. The group determined that goodwill has been impaired by P8,000. A summary of the individual statements of financial positions of the entities as at the end of reporting period is shown below: Del Valle Company Total Assets Enrile Company P 1,000,000 P 500,000 Total Liabilities 200,000 120,000 Share capital 300,000 100,000 Retained earnings 500,000 280,000 P 1,000,000 P 500,000 Total Liabilities and equity How much is the fair value assigned to NCI at the date of acquisition? A. P55,000 B. P76,000 C. P98,000 D. P112,000 7. Using the information in No. 6, how much is the goodwill at the end of reporting period? A. P9,000 B. P13,000 C. P15,000 D. P17,000 8. Using the information in No. 6, how much is the NCI in net assets? A. P89,000 B. P103,000 C. P95,000 D. P112,000 Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) 9. Using the information in No. 6, how much is the consolidated retained earnings? A. P556,000 B. P628,000 C. P644,000 D. P702,000 10. Using the information in No. 6, how much is the consolidated total assets? A. P1,402,000 B. P1,387,000 C. P1,367,000 D. P1,298,000 11. On January 1, 2021, Siri Company purchased 90% of the outstanding shares of Alexa Company for P16,000,000. Siri Company also paid P500,000 as direct costs attributable to the acquisition. Siri Company was also obligated to pay additional P4,000,000 to the stockholders of Alexa company at the end of the year if Alexa Company maintained existing profitability and it is highly probable that Alexa Company would achieve this expectation. The fair value of the contingent consideration is P4,000,000. NCI is measured at proportionate share. Cash & CE Accounts Receivables Inventory Plant & Equipment Other Assets Total Assets Siri Company Book Value P 18,000,000 6,500,000 9,500,000 20,000,000 1,200,000 P 55,200,000 Alexa Company Book Value FV P 1,500,000 P 1,500,000 3,500,000 3,300,000 5,000,000 4,600,000 10,000,000 12,000,000 800,000 500,000 P 20,800,000 P 21,900,000 Compute for the NCI. A. P1,880,000 B. P1,990,000 C. P1,050,000 D. P1,060,000 12. Using the data in No. 11, how much is the goodwill? A. P1, 780,000 B. P3,080,000 C. P2,090,000 D. P1,980,000 13. On January 1, 2021, Ferreira Company issued 300,000 shares of its P18 par ordinary share for all Lorenzo Company’s common stock. The shares have a market price of P20 per share. Data below presents the shareholder’s equity before the consolidation: Ordinary Share Ordinary Share Premium Retained Earnings Ferreira Company Lorenzo Company P3,000,000 P1,500,000 1,300,000 150,000 2,500,000 850,000 P6,800,000 P2,500,000 Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) Ferreira Company incurred finder’s fee amounting to P30,000 and share issuance costs of P35,000. At the date of acquisition, the total consolidated equity should be reported at: A. P12,855,000 B. P12,900,000 C. P12,735,000 D. P10,355,000 14. On January 1, 2021, Yuchengco Company acquired 75% interest in Arellano Company for P2,500,000 cash. Yuchengco Company incurred transaction costs of P250,000 for legal, accounting and consultancy fees in negotiating the business combination. NCI is measured at proportionate share in Arellano Company’s identifiable net assets. The carrying amounts and fair values of Arellano Company’s assets and liabilities at the acquisition date were as follows: Cash in bank Accounts Receivable Inventory Equipment (net) Goodwill Total Assets Payables Carrying Amount P 25,000 425,000 1,300,000 2,500,000 250,000 P4,500,000 Fair Value P 25,000 300,000 875,000 2,750,000 50,000 P4,000,000 P1,000,000 P1,000,000 How much is the goodwill (gain on bargain purchase)? A. 278,500 B. 140,000 C. 264,500 D. 287,500 15. On September 4, 2022, Cantavieja Corporation paid P560,000 in acquiring 4,000 shares of Laurel Company. At the same date, the 1,000 shares of Laurel Company had a market price of P140 per share. Cantavieja Corporation and Laurel Company presents its condensed financial statements as of September 4, 2022 below: Assets Liabilities Ordinary Shares, P100 par Retained earnings Total Cantavieja Corporation P3,800,000 1,350,000 1,500,000 950,000 P3,800,000 Downloaded by PO POPOL (tyuytni@gmail.com) Laurel Company P850,000 250,000 500,000 100,000 P850,000 lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) On September 4, 2022, Cantavieja Corporation paid P560,000 in acquiring 4,000 shares of Laurel Company. At the same date, the 1,000 shares of Laurel Company had a market price of P140 per share. In the consolidated statement of financial position on September 4, 2022, the total assets and total equity must be: A. Total Assets - P4,170,000, Total Liabilities - P2,550,000 B. Total Assets - P4,650,000, Total Liabilities - P3,190,000 C. Total Assets - P4,750,000, Total Liabilities - P3,050,000 D. Total Assets - P4,190,000, Total Liabilities - P2,590,000 16. On January 1, 2018, Tender Corporation acquired 100% of Juicy Co. On that date, both Tender Corporation and Juicy Company’s equipment has a 10-year remaining useful life. Tender Corp. uses the equity method to record its investment in Juicy Co. Tender Corporation Juicy Company Book Value Fair Value Book Value Fair Value January 1, 2018 P320,000 P420,000 P272,000 P400,000 December 31, 2020 394,000 545,200 190,400 357,000 What is the consolidated balance for the Equipment account as of December 31, 2020? A. P674,000 B. P712,400 C. P612,400 D. P546,000 17. On January 1, 2019, Lucario Company purchased 80% of the common stock of Blue Company for P320,000. On this date, Blue Company had common stock, other paidin capital, and retained earnings of P40,000, P120,000, and P200,000, respectively. Lucario Company’s common stock amounted to P500,000 and retained earnings of P200,000. On the same date, the only tangible assets of Blue that were undervalued were inventory and building. Inventory, for which FIFO is used, was worth P5,000 more than cost. The inventory was sold in 2019. Building, which was worth P15,000 more than book value, has a remaining life of 8 years, and straight-line depreciation is used. Any remaining excess is full-goodwill with an impairment for 2019 amounting to P3,000. Blue Company reported net income of P50,000 and paid dividends of P10,000 in 2019, while Lucario Company reported net income amounted to P100,000 and paid dividends of P20,000. How much is the consolidated net income, attributable to Lucario Company? A. P20,000 B. P124,100 C. P8,025 D. P132,125 Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) 18. Using the information in No. 17, how much is the consolidated net income, attributable to the Non-Controlling Interest? A. P20,000 B. P124,100 C. P8,025 D. P132,125 19. Using the information in No. 17, how much is the consolidated Retained Earnings on December 31, 2019? A. P304,100 B. P305,000 C. P344,100 D. P320,000 20. Using the information in No. 17, how much is the ending balance of the NonControlling Interest on December 31, 2019? A. P85,025 B. P88,025 C. P87,025 D. P86,025 Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) ANSWER KEY: THEORIES 1. C. S1 - False; S2 – True 2. B. Joint venture 3. C. The business only has equity financing and has no debt financing. 4. D. Each of the above is recorded at fair value. 5. D. The boards of directors of both Enchanted and Delicate must approve the merger. 6. C. Consolidated financial statements 7. D. Holds protective rights as an investor. 8. B. The subsidiary should not be consolidated but IFRS 5 should be used. 9. A. It has existing rights that give it the current ability to direct the relevant activities. 10. B. More than half of voting power of an entity. 11. C. II, III, IV 12. A. the cost method 13. A. expensed as incurred 14. D. equal to the parent's stockholders' equity. 15. B. Consolidated statements of highly diversified companies cannot be compared with industry standards. 16. B. Investment in Subsidiary 17. C. Parent’s revenues less expenses for its own operations plus the equity from subsidiary’s income recorded by parent. 18. C. Dr. Investment in Subsidiary, Cr. Retained Earnings 19. A. Dr. Retained Earnings, Cr. Investment in Subsidiary 20. B. The investment account remains at initial value. PROBLEMS 1. D. P335,000 Patent Customer List Operating Lease R&D Goodwill Franchise Right of use machinery Total P 80,000.00 25,000.00 150,000.00 80,000.00 P335,000.00 2. B. P1,276,00 Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) Consideration transferred: Cash Issued shares of stock Contingency Fee Less: Fair value of net identifiable assets acquired: Cash Accounts Receivable Inventory PPE, net Liabilities Goodwill P P 500,000 3,000,000 150,000 300,000 980,000 600,000 1,064,000 (570,000) P3,650,000 2,374,000 P1,276,000 3. C. P1,326,000 Consideration transferred: Cash Issued shares of stock Contingency Fee Direct Cost Less: Fair value of net identifiable assets acquired: Cash Accounts Receivable Inventory PPE, net Liabilities Goodwill P P 500,000 3,000,000 150,000 50,000 300,000 980,000 600,000 1,064,000 (570,000) 4. D. P5,573,376 Cash (down payment): P4,800,000 x 20% Balance: PV of an annuity of P1 for 2 periods [0.8264 x (P4,800,000 x 80%)] Land (fair value) Consideration transferred 5. D. P2,201,376 Downloaded by PO POPOL (tyuytni@gmail.com) P 960,000 3,173,376 1,440,000 P5,573,376 P3,700,000 2,374,000 P1,326,000 lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) 6. A. P55,000 Enrile Company Share capital Retained earnings Subsidiary’s net assets at fair value Acquisition date P100,000 80,000 P180,000 Consolidation date P100,000 280,000 P380,000 Goodwill attributable to NCI - acquisition date NCI’s proportionate share in net assets of subsidiary (P180,000 x 25%) Fair value of NCI Net change P200,000 P10,000 45,000 P55,000 7. D. P17,000 Consideration transferred Less: Parent’s proportionate share in the net assets of subsidiary (P180,000 x 75%) Goodwill attributable to owners of parent - acquisition date Less: Parent’s share in goodwill impairment (P8,000 x 75%) Goodwill attributable to owners of parent - current year P150,000 (135,000) P15,000 (6,000) P9,000 Fair value of NCI Less: NCI’s proportionate share in the net assets of subsidiary (P180,000 x 25%) Goodwill attributable to NCI - acquisition date Less: NCI’s share in goodwill impairment (P8,000 x 25%) Goodwill attributable to NCI - current year Goodwill attributable to owners of parent - current year Goodwill attributable to NCI - current year Goodwill, net - current year P9,000 8,000 P17,000 8. B. P103,000 Del Valle’s net assets at FV - current year Multiply by: NCI percentage Total Add: Goodwill attributable to NCI - current year Non-controlling interest in net assets - current year P380,000 25% P95,000 8,000 P103,000 9. C. P644,000 Del Valle’s retained earnings - current year Consolidation adjustments Del Valle’s share in the net change in Enrile’s net assets Del Valle’s share in goodwill impairment Consolidated earnings - current year Downloaded by PO POPOL (tyuytni@gmail.com) P500,000 P150,000 (6,000) P144,000 P644,000 P55,000 (45,000) P10,000 (2,000) P8,000 lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) 10. C. P1,367,000 Total Assets of Del Valle P1,000,000 Total Assets of Enrile 500,000 Investment in subsidiary (consideration transferred) (150,000) Goodwill – net 17,000 Consolidated total assets P1,367,000 11. B. P1,990,000 Fair Value of net assets acquired Total liabilities at book value of Alexa Company Total Multiply NCI P21,900,000 (2,000,000) 19,900,000 10% P1,990,000 12. C. P2,090,000 Consideration transferred (P16m + 4m) NCI [(P21.9m-2m) x 10%] Total FVNAA (P21.9m - 2m) Goodwill P20,000,000 1,990,000 P21,990,000 (19,900,000) P2,090,000 13. C. P12,735,000 Shares issued (300,000 shares x 20) Equity, Ferreira Company Less: Finder’s Fee Less: Share issuance costs Total consolidated equity P6,000,000 6,800,000 (30,000) (35,000) P12,735,000 14. D. P287,500 Cash paid NCI (at proportionate share) Total Less: FVNA Goodwill (gain on bargain purchase) P2,500,000 737,500 P3,237,500 (2,950,000 P287,500 15. D. Total Assets - P4,190,000, Total Liabilities - P2,590,000 Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) Cantavieja Co. Assets Laurel Co. Assets Goodwill Cash paid NCI FVNA Less: Cash paid Total Assets P3,800,000 850,000 P560,000 140,000 (600,000) Ordinary Shares, Cantavieja Co. Retained Earnings, Cantavieja Co. NCI Total Equity 100,000 (560,000) P4,190,000 P1,500,000 950,000 140,000 P2,590,000 16. A. P674,000 Tender Corp. Book Value Juicy Co. Book Value Original Acquisition Date – allocation to Juicy Co.’s Equipment (400000 – 272000) Less: Amortization (128000 * 3/10) Consolidated balance of Equipment, 12/31/20 P394,000 190,400 128,000 38,400 P674,000 17. B. P124,100 Consideration Transferred (80%) NCI at FV (320000/80% * 20%) Less: FV of Net Assets Acquired Common Stock APIC Retained Earnings Inventory adj. Building adj. Goodwill Consolidated Net Income Net Income Inventory Building (15000/8 yrs) Impairment – Full Goodwill Dividends (10000 * 80%) CNI, attributable to Lucario Co. From CNI, Lucario Co. From CNI, Blue Co. (40,125 * 80%) CNI, attributable to Lucario Co. P320,000 80,000 40,000 120,000 200,000 5,000 15,000 380,000 P20,000 Lucario Co. P100,000 Blue Co. P50,000 (5,000) (1,875) (3,000) P40,125 (8,000) P92,000 P92,000 32,100 P124,100 Downloaded by PO POPOL (tyuytni@gmail.com) lOMoARcPSD|17139938 POLYTECHNIC UNIVERSITY OF THE PHILIPPINES College of Accountancy and Finance Student Council CAF Review ACCO 30023: ACCOUNTING FOR BUSINESS COMBINATIONS (Midterm Examinations) 18. C. P8,025 CNI, attributable to the Non-Controlling Interest From CNI, Blue Co. Multiply: NCI % CNI, attributable to the Non-Controlling Interest P40,125 20% P8,025 19. A. P304,100 Retained Earnings, beginning CNI – Lucario Company Less: Dividends Consolidated Retained Earnings, 12/31/19 P200,000 124,100 20,000 P304,100 20. D. P86,025 NCI at FV, beginning (320000/80% * 20%) NCI – NI Less: NCI Dividends (10000* 20%) NCI on 12/31/19 P80,000 8,025 2,000 P86,025 ** Nothing Follows ** Review well. Good luck sa real, CAFwa! Reference: Various CPA Review Materials. Checked and Verified: ABC Professor. “Do something that your future self will thank you for.” #CAFReview2021 #CAFwalangIwanan #PUPCAFSC2122 Downloaded by PO POPOL (tyuytni@gmail.com)