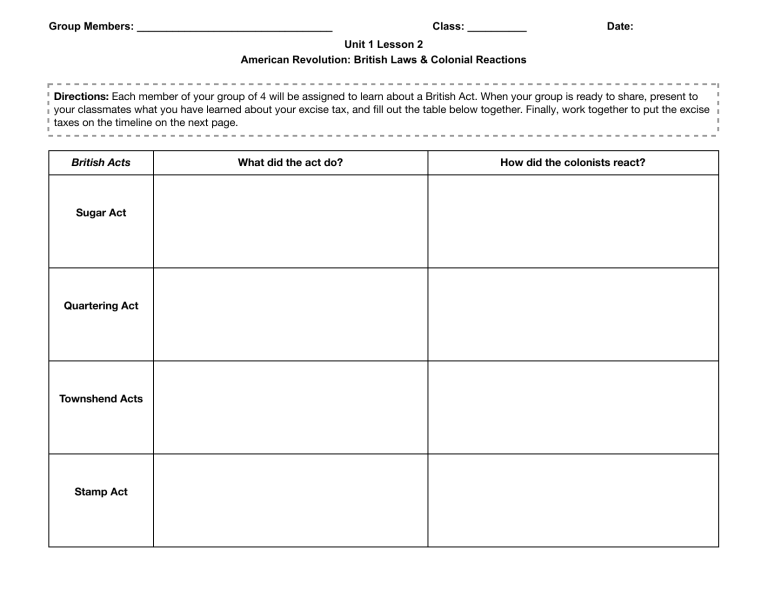

Group Members: _________________________________ Class: __________ Date: Unit 1 Lesson 2 American Revolution: British Laws & Colonial Reactions Directions: Each member of your group of 4 will be assigned to learn about a British Act. When your group is ready to share, present to your classmates what you have learned about your excise tax, and fill out the table below together. Finally, work together to put the excise taxes on the timeline on the next page. British Acts Sugar Act Quartering Act Townshend Acts Stamp Act What did the act do? How did the colonists react? Sugar Act Document A Source Information: Great Britain: Parliament - The Sugar Act: 1764 Whereas it is quickly necessary that new provisions and regulations should be established for improving the revenue of this kingdom, for settling the expenses of defending, protecting, and securing the American colonies; we, your Majesty's most dutiful and loyal subjects, the commons of Great Britain, in parliament being desirous to make a plan towards raising the said revenue in America....That from and after the twenty ninth day of September, one thousand seven hundred and sixty four, there shall be taxed, raised, imposed (charged), collected, and paid, unto his Majesty: ● for and upon all white sugars or molasses imported into America ● for and upon indigo, and coffee of foreign produce or manufacture ● for and upon wines (except French wine;) ● for and upon all wrought silks, bengals, and stuffs, mixed with silk or herbs of the manufacture of Persia, China, or East India ● calico painted, dyed, printed, or stained there; and for and upon all foreign linen cloth Analysis Questions: 1) Sourcing: This is a primary source OR secondary source. 2) Close Reading: According to lines 1 - 3, what claims did Parliament make about why they were raising and collecting these taxes? 3) Close Reading: What was being taxed? Sugar Act Document B Source Information: This is an excerpt from “Thought from an American Citizien in Williamsburg, Virginia” written by Richard Bland. It was published in The Colonel Dismounted in 1764. If then the People of this Colony are free born and have a Right to the Liberties and Privileges of English Subjects, they must necessarily have a legal Constitution, that is, a government composed, in Part, of the Representatives of the People, who may enact laws for the INTERNAL Government of the Colony, and suitable to its various circumstances and Occasions; and without such a Representative, I am bold enough to say, no Law can be made. . . . if the Parliament should impose Laws upon us, we ought to have representation in that parliament... Part of our Birthright as Englishmen is being governed by Laws made with our own Consent, this is being violated at the present terms by a parliament we have no representation in Analysis Questions: 1) Sourcing: This is a primary source OR secondary source. 2) Close Reading: What reasons does the author provide for not agreeing with the recent British taxes imposed on the American colony? Quartering Act Document C Source Information: “The Quarteing Act,” published by Jamestown-Yorktown Foundation in 2015 During the French and Indian War, British military commanders in North America often found it difficult to persuade the assemblies of some uncooperative colonies to pay for the costs of housing and supplying food for the soldiers sent over to fight the French. Once the war had ended, the king’s advisors decided that some British troops should remain in North America, to defend colonists from further attacks by Native Americans. The Quartering Act act of 1765 required colonial governments to provide and pay for feeding and sheltering any troops stationed in their colony. If enough barracks were not made available, then soldiers could be housed in inns, stables, outbuildings, uninhabited houses, or private homes that sold wine or alcohol. American colonists resented and opposed the Quartering Act of 1765 because they were being taxed by the colonial governments to pay for provisions and barracks for the army… Many American colonists saw the Quartering Act as one more way Parliament was attempting to tax them without their consent. Many suspected that the real purpose of keeping a small standing army in America – stationed in cities, not on the frontier – was not for defense, but to enforce new British policies and taxes such as the Stamp Act and Sugar Act. They felt threatened by the constant presence of a standing army, fearing that the army might randomly attack or harass them. Analysis Questions: 1) Sourcing: This is a primary source OR secondary source. 2) Close Reading: What did the Quartering Act of 1765 require? 3) Close Reading: Why did the King’s advisors decide that some British troops should remain in North America? 4) Close Reading: What did some colonists suspect the real purpose of keeping a small standing army in America? Quartering Act Document Analysis: Benjamin Franklin, Letter to Henry Home, Lord Kames, 25 February 1767, excerpts on the Quartering Act and the resurgent “Tension between the two Countries” Document D Source Information: This is a letter written by Benjamin Franklin to Henry Home and Lord Kames on February 25, 1767. I have mentioned that the tension between Britain and America is like to be revived. It is on this Occasion: In the same session of Parliament with the Stamp Act, an Act was passed to regulate the Quartering of Soldiers in America… The Reasons given by the Governor of New York for their Refusal are: Firstly, That they understand the Act to mean the furnishing such things to Soldiers only while war time and not to great regiments of Soldiers to be fixed as at present in the colony during peacetime - the Burden in the second case being greater than the Inhabitants can bear for it is so costly. Secondly, that it would put it in the Power of the Captain General of the British Army to oppress the colonists at pleasure...But there is supposed to be another Reason, at bottom, which they suggest though they do not plainly express it, that it is of the nature of an internal tax laid on them by Parliament, which has no right so to do without representation for the colonies in parliament. In the meantime, every Act of Oppression will sour their Tempers, ...and hasten their final Revolt: For the Seeds of Liberty are universally sown there, and nothing can eradicate them... Analysis Questions: 1) Sourcing: This is a primary source OR secondary source. 2) Close Reading: Did all of the colonies agree to pay for the quartering of soldiers? Explain. 3) Corroboration: Does this primary source support the colonists feelings about the Quartering Act as stated in Quartering Act Document 1? Cite textual evidence from both sources to support your claims. Townshend Acts Document E Source Information: Great Britain: Parliament — The Townshend Act, November 20, 1767 WHEREAS it is [reasonable] that revenue should be raised in your Majesty's dominions in America, for making a more certain and adequate provision for [paying] the charge of the administration of justice, and the support of civil government...and towards further [paying for] the expenses of defending, protecting, and securing, the said dominions;... …there shall be raised, levied, collected, and paid, unto his Majesty, for and upon the respective goods hereinafter mentioned, which shall be imported from Great Britain into any colony or plantation in America: ● ● ● ● ● ● ● For every hundred pounds imported of crown, plate, flint, and white glass, four shillings and eight pence For every hundred pounds imported of green glass, one shilling and twopence For every hundred pounds imported of red lead, two shillings For every hundred pounds of white lead, two shillings For every hundred pounds of painters colours, two shillings For every pound of tea, three pence For every ream (500 sheets) of paper, twelve shillings Analysis Questions: 1) Sourcing: This is a primary source OR secondary source. 2) Close Reading: According to lines 1 - 3, why are these taxes being imposed? 3) Close Reading: What was being taxed? Townshend Acts. Document F Source Information: These excerpts are from “Letter 2” from December 7, 1767 from a collection of 12 Letters from A Farmer in Pennsylvania, (1767-1768) by John Dickinson. Dickinson was a Pennsylvania political leader who served in the Stamp Act Congress of 1765. Later in his career, he served in the Continental Congress, and later still, in the Constitutional Convention. In the following statement, Dickinson condemned some of the new taxes being imposed by Parliament. There is another late act of parliament, which appears to me to be unconstitutional, and as destructive to the liberty of these colonies, as that mentioned in my last letter; that is, the act for granting the duties on paper, glass, &c. [the Townshend Act]. The parliament unquestionably possesses a legal authority to regulate the trade of Great Britain and all her colonies. I have looked over every statute (law) relating to these colonies, from their first settlement of this time; and I find every one of them founded on this principle, till the Stamp Act administration…All before, are calculated to regulate trade...The raising of revenues...was never intended…Never did the British parliament, (until the passage of the Stamp Act) think of imposing duties in America for the purpose of raising a revenue…….. Analysis Questions: 1) Sourcing: This is a primary source OR secondary source. 2) Sourcing: Who wrote this document? What was his purpose? 3) Close Reading: How are the Townshend Acts different from other acts from British Parliament? Stamp Act Document G Source Information: This summary of the 1765 Stamp Act was published by the Colonial Williamsburg Museum in 2017. The Stamp Act was passed by the British Parliament on March 22, 1765. The new tax was imposed on all American colonists and required them to pay a tax on every piece of printed paper they used. Ship's papers, legal documents, licenses, newspapers, other publications, and even playing cards were taxed. The money collected by the Stamp Act was to be used to help pay the costs of defending and protecting the American frontier near the Appalachian Mountains (10,000 troops were to be stationed on the American frontier for this purpose). The actual cost of the Stamp Act was relatively small. What made the law so offensive to the colonists was not so much its immediate cost but the standard it seemed to set. In the past, taxes and duties on colonial trade had always been viewed as measures to regulate commerce, not to raise money. The Stamp Act, however, was viewed as a direct attempt by England to raise money in the colonies without the approval of the colonial legislatures. If this new tax were allowed to pass without resistance, the colonists reasoned, the door would be open for far more troublesome taxation in the future. Analysis Questions: 1) Sourcing: This is a primary source OR secondary source. 2) Close Reading: What was taxed by the Stamp Act? 3) Contextualization: According to this source, what motivated Great Britain to collect these taxes? Stamp Act Document H Source Information: I AM sorry to be obliged to inform my Readers, that as The STAMP ACT, is feared to be obligatory [mandatory] upon us after the First of November (Tomorrow) ...the Publisher of this Paper unable to bear the tax burden, has thought it expedient [urgent] TO STOP publishing this paper awhile, in order to think about, whether any Methods can be found to break the taxing Chains put on us, and escape the insupportable economic Slavery... 1) Sourcing: This is a primary source OR secondary source. 2) Contextualization: How might the author’s perspective as a newspaper publisher bias this source? ★ Document G ★ Source Information: This excerpt is from "Considerations ...," a pamphlet written by Thomas Whately, Whately was an advisor to George Grenville, British Chancellor of the Exchequer (1763-1765) and the author of the Stamp Act. In this pamphlet, Whately explained why the British were justified in levying taxes on their American colonists. We are not yet recovered from a War undertaken solely for their [the Americans'] Protection ... a War undertaken for their defense only ... they should contribute to the Preservation of the Advantages they have received.... 1) Sourcing: This is a primary source OR secondary source. 2) Sourcing: How did Thomas Whately justify the Stamp Act?