Financial Ratios: Liquidity, Leverage, Activity, Profitability

advertisement

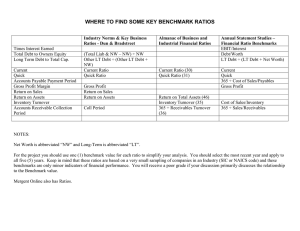

Financial Ratios Liquidity Ratios • Current ratio : • • • • Usually a minimum is 2.0 However, it varies between industries and economic conditions. A high ratio (e.g., > 5) indicates assets are not efficiently used. A low ratio (below industry average) indicates liquidity problems Liquidity Ratios • Acid Test Ratio: • Since inventory is more difficult to liquidate, it is removed here • Again, it varies between industries and economic conditions. 4 Leverage Ratio • ‘Gearing’ Ratio: Debt-to-Assets Ratio = Total Debt Total Assets • Shows how much funding comes from debt. • For example, if Company XYZ had $10 million of debt on its balance sheet and $15 million of assets, then Company XYZ's debt ratio is: Debt Ratio = $10,000,000 / $15,000,000 = 0.67 or 67% This means that for every dollar of Company XYZ assets, Company XYZ had $0.67 of debt. A ratio above 1.0 indicates that the company has more debt than assets. Activity Ratios • These ratios show how effectively a company is using its resources. Some of these ratios are: Inventory Turnover = Cost of Goods Sold Inventory • Result indicates how many times per year we sell all inventory. • The higher the number the better • If the result above is (for example) 3, that means we ‘turnover’ our inventory 3 times per year. That is, every 4 month we get new inventory 6 Activity Ratios Asset Turnover • A measure of how well the company is using its assets to generate sales. • The higher the number the better Asset Turnover = Net Sales Total Assets 7 Activity Ratios Accounts Receivable Turnover • A measure of how well the company is getting its accounts receivable from the market. • The higher the number the better Accounts Receivable Turnover = Net Sales Accounts Receivable • Again, a number of ‘3’ means we are renewing (turning over) our Accounts Receivable 4 times a year 8 Profitability Ratio Profit Margin • A ratio of Net Income versus Sales • The higher the number the better Profit Margin = Net Income Net Sales • Usually a value of 8 – 10% is acceptable. For some businesses it can be around 2 – 3% • Net sales is calculated by subtracting any returns or refunds from gross sales. Net income equals total revenues minus total expenses and is usually the last number reported on the income statement.