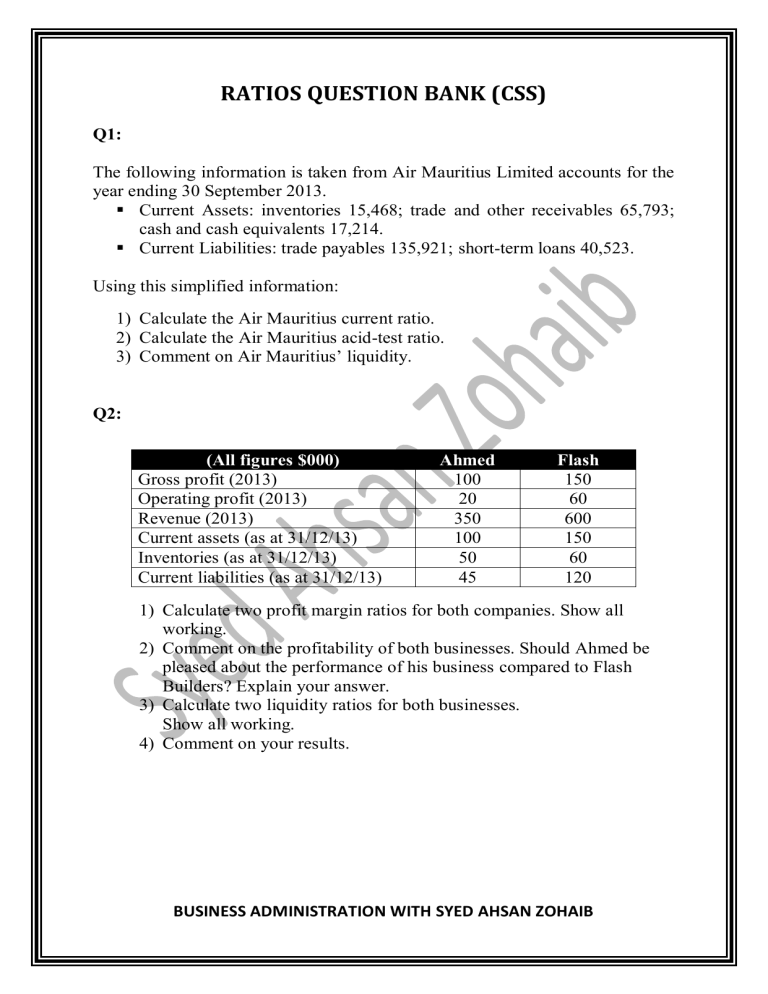

RATIOS QUESTION BANK (CSS) Q1: The following information is taken from Air Mauritius Limited accounts for the year ending 30 September 2013. Current Assets: inventories 15,468; trade and other receivables 65,793; cash and cash equivalents 17,214. Current Liabilities: trade payables 135,921; short-term loans 40,523. Using this simplified information: 1) Calculate the Air Mauritius current ratio. 2) Calculate the Air Mauritius acid-test ratio. 3) Comment on Air Mauritius’ liquidity. Q2: (All figures $000) Gross profit (2013) Operating profit (2013) Revenue (2013) Current assets (as at 31/12/13) Inventories (as at 31/12/13) Current liabilities (as at 31/12/13) Ahmed 100 20 350 100 50 45 Flash 150 60 600 150 60 120 1) Calculate two profit margin ratios for both companies. Show all working. 2) Comment on the profitability of both businesses. Should Ahmed be pleased about the performance of his business compared to Flash Builders? Explain your answer. 3) Calculate two liquidity ratios for both businesses. Show all working. 4) Comment on your results. BUSINESS ADMINISTRATION WITH SYED AHSAN ZOHAIB RATIOS QUESTION BANK (CSS) Q3: $m Value of inventories (31 December 2013) Company X Company Y 73 150 Cost of Sales sales revenue 2013 580 750 1,120 1,460 Capital Nonemployed current liabilities 1,575 2,050 500 1,025 Trade accounts receivable (31 December 2013) 112 319 Both of these companies operates in the same industry – furniture manufacture. 1) Calculate for both companies: days’ sales in trade receivables ratio inventory turnover ratio gearing ratio Q4: Using the following data taken from the published accounts of two public limited companies, calculate as many of the profitability ratios, financial efficiency ratios and liquidity ratios for 2013 as you have information for. (All figures in $ million.) Company Capital employed Noncurrent liabilities Current Current assets liabilities A 3,000 1,500 1,200 1,400 B 200 50 70 70 Gross Operating profit profit 1,10 0 75 Revenue Inventories 750 4,000 400 25 300 35 1) Using your results, compare the performance, efficiency and liquidity of these two businesses, which operate in the same industry. 2) Assess the limitation of the ratio analysis you have just undertaken. BUSINESS ADMINISTRATION WITH SYED AHSAN ZOHAIB RATIOS QUESTION BANK (CSS) Q5: Look at the extracts from the published accounts for Karachi Paper Products plc and answer the questions that follow. $m Revenue Cost of goods sold Operating profit Profit for the year Inventories Trade accounts receivable Current assets Current liabilities Dividends Non-current liabilities Capital employed Number of shares issued Share price Year ending 31 October 2018 400 120 35 30 58 80 Year ending 31 October 2019 330 100 33 29 36 70 125 140 20 150 300 80m At 31 October 2018 = $4.00 120 120 15 120 260 80m At 31 October 2019 = $3.60 2018 2019 Current ratio Acid-test ratio Days’ sales in receivable P/E ratio Gearing ratio Gross profit margin Operating profit margin ROCE Dividend yield 1) Calculate the ratios from the Karachi Paper Products data provided and complete the table. BUSINESS ADMINISTRATION WITH SYED AHSAN ZOHAIB