CHAPTER 3 INTERPRETING AND FORECASTING FINANCIAL STATEMENTS Objectives •

advertisement

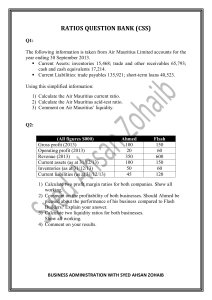

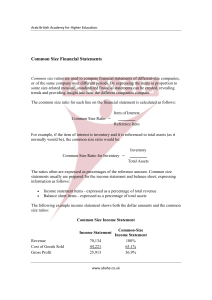

CHAPTER 3 INTERPRETING AND FORECASTING FINANCIAL STATEMENTS • • • • 3.1 3.2 3.3 3.4 3.5 3.6 3.7 3.8 3.9 3.10 3.11 Objectives To contrast the economic and accounting models of the firm. To show how accounting information can be useful to the financial decision maker when used with care. To understand the purpose and process of financial planning. To understand why firms need working capital and how to manage it so as to maximize shareholder value. Outline Functions of Financial Statements Review of Financial Statements Market Values Versus Book Values Accounting versus Economic Measures of Income Returns to Shareholders versus Return on Book Equity Analysis Using Financial Ratios The Financial Planning Process Constructing a Financial Planning Model Growth and the Need for External Financing Working Capital Management Liquidity and Cash Budgeting Summary Financial statements serve three important economic functions: • They provide information to the owners and creditors of the firm about the company’s current status and past financial performance. • They provide a convenient way for owners and creditors to set performance targets and impose restrictions on the managers of the firm. • They provide convenient templates for financial planning. The basic accounting statements reviewed are the income statement, the balance sheet, and the statement of cash flows. The income statement reports the results of operations over the period, and is based on the model of revenues minus costs (including depreciation and taxes) equals net income or earnings. The balance sheet shows the assets (both current and long-term (fixed) assets) on the one hand, and the claims against these (i.e., the liabilities and equity), on the other. The statement of cash flows gives a summary of cash flows from operating, investing, and financing activities for the period. A firm’s accounting balance sheet differs from an economic balance sheet because: • It omits some economically significant assets and liabilities and • It does not report all assets and liabilities at their current market values. Analysts use financial ratios as one mode of analysis to better understand the company’s strengths and weaknesses, whether its fortunes are improving, and what its prospects are. These ratios are often compared with the ratios of a comparable set of companies and to ratios of recent past periods. The five types of ratios are profitability, turnover, financial leverage, liquidity, and market value ratios. Finally, it is helpful to organize the analysis of these ratios in a way that reveals the logical connections among them and their relation to the underlying operations of the firm. The purpose of financial planning is to assemble the firm’s separate divisional plans into a consistent whole, to establish concrete targets for measuring success, and to create incentives for achieving the firm’s goals. The tangible outcome of the financial planning process is a set of “blueprints” in the form of projected financial statements and budgets. The longer the time horizon, the less detailed the financial plan In the short run, financial planning is concerned primarily with the management of working capital. The need for working capital arises because for many firms, cash needed to conduct its production and selling activities starts to flow out before cash flows in. The longer this time lag, which is called the length of the cash flow cycle, the more the amount of working capital the firm needs. A firm’s need for working capital is measured as the sum of cash equivalents, prepaid expenses, receivables, and inventories minus the sum of customer advances, payables, and accrued expenses. The main principle behind the efficient management of a firm’s working capital is to minimize the amount of the firm’s investment in low-earning current assets such as receivables and inventories and maximize the use of low-cost financing through current liabilities such as customer advances and accounts payable. Cash management is important because even a profitable firm can go bankrupt if it becomes illiquid.