Accounting Quiz: Revenue, Foreign Currency, Branch, Liquidation

advertisement

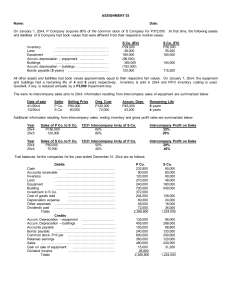

REV 3 Long Quiz Problem Chapter 12 Revenue Recognition: Contract with Customers Other Issues (1-5) On January 1, 20x9, Blesilda Prudencio Company enters into a contract to transfer Product X and Product Y to Virginia and Nanette Co. for P200,000. The contract specifies that payment of Product X will not occur until Product Y is also delivered. In other words, payment will not occur until both Product X and Product Y are transferred to Virginia and Nanette. Blesilda Prudencio determines that standalone prices are P60,000 for Product X and P140,000 for Product Y. Blesilda Prudencio delivers Product X to Virginia and Nanette on February 1, 20x8. On March 1, 20x9, Blesilda Prudencio delivers Product Y to Virginia and Nanette. 1. On January 1, 20x9, the amount of ACCOUNTS RECEIVABLE to be recorded: a. P200,000 b. P60,000 c. P140,000 d. None 2. On February 1, 20x9, the amount of ACCOUNTS RECEIVABLE to be recorded: a. P200,000 b. P60,000 c. P140,000 d. None 3. On March 1, 20x9, the amount of ACCOUNTS RECEIVABLE to be recorded: a. P200,000 b. P60,000 c. P140,000 d. None 4. On February 1, 20x9, the amount of REVENUE to be recorded: a. P200,000 b. P60,000 c. P140,000 d. None 5. On March 1, 20x9, the amount of REVENUE to be recorded: a. P200,000 b. P60,000 c. P140,000 d. None Chapter 7 Foreign Currency Transactions (6-10) JJ restaurants purchased green rice, a special variety of rice, from a foreign country for 100,000 FCs on Nov 1, 20x4. Payment is due on January 30, 20x5.On Nov 1, 20x4, the company also entered into a 90-day forward contract to purchase 100,000 FC. The forward contract is not designated as a hedge. The rates were as follows: Date Spot Rate Forward rate for March 1 November 1, 20x4 P .120 P .126 (90 days) December 31, 20x4 .124 .129 (30 days) January 30, 20x5 .127 6. The entries on January 30, 20x5, include a: a. Credit to Foreign Currency Units, P12,600. b. Debit to Foreign Currency Payable to Exchange Broker, P12,700 c. Debit to Pesos Payable to Exchange Broker, P12,600 d. Debit to Financial Expense, P400. 7. The entries on January 30, 20x5, include a: a. Credit to Cash, P12,600. b. Debit to Pesos Payable to Exchange Broker, P12,000. c. Credit to Foreign Currency Receivable from Exchange Broker, P12,600. d. Credit to Premium on Forward Contract, P600. 8. The entries on January 30, 20x5, include a: a. Debit to Pesos Payable to Exchange Broker, P12,700. b. Credit to Foreign Currency Transaction Gain, P100. c. Credit to Foreign Currency Receivable from Exchange Broker, P12,600. d. Debit to Foreign Currency Units, P12,700. 9. The entries on December 31, 20x4, include a: a. Debit to Financial Expense, P300. b. Debit to Foreign Currency Receivable from Exchange Broker, P12,600. c. Debit to Foreign Currency Receivable from Exchange Broker, P12,600. 300 d. Credit to Foreign Currency Payable to Exchange Broker 10. The entry on November 1, 20x4 to record the forward contract includes a: a. Credit to Premium on Forward Contract, P600. b. Debit to Foreign Currency Receivable from Exchange Broker, 100,000. c. Debit to Foreign Currency Receivable from Exchange Broker, P12,600. d. Credit to Pesos Payable to Exchange Broker, P12,600. Chapter 13 Home Office and Branch Office Accounting: General Procedures Betzler the home office shipped merchandise to the Malate branch that cost P250,000 at a billed priced of P300,000. One-fourth of the merchandise remained unsold at the end of 20x4. The home office records the shipments to the branch at the P300,000 billed price at the time shipments are made. Freight-in of P2,000 on the shipments from the home office was paid by the branch. 11. The home office should make an adjusting entry for freight-in as follows: a. A year-end adjusting entry debiting the branch account for P500. b. A year-end adjusting entry debiting the branch account for P2,000. c. A year-end adjusting entry crediting the branch account for P500. d. No year-end adjusting entry for the freight charge Chapter 11 (12-14) Comita Nocom and Ellen Riofrio Pasta Inn charges an initial fee of P800,000 for a franchise, withP160,000 paid when the agreement is signed on January 1, 20x5 and the balance in four annual payments starting December 31, 20x5. The present value of the annual payments, discounted at 10% is P507,200. The franchisee has the right to purchase P60,000 of kitchen equipment and supplies forP50,000. An additional part of the initial fee is for advertising to be provided by Comita Nocom and Ellen Riofrio Pasta Inn during the next five years. The value of the advertising is P1,000 a month. Franchise commences operations on January 20, 20x5. 12. The amount of unearned franchise fee on December 31, 20x5: a. P70,000 b. P60,000 c. P10,000 d. P132,800 13. The amount of revenue from franchise fee on 20x5: a. P657,200 b. P800,000 c. P597,200 d. P667,200 14. What entry should Carmita Nocom and Ellen Riofrio Pasta Inn make for the franchise fees on January 1, 20x5? a. Cash 160,000 Note Receivable 507,200 Franchise Revenue 597,200 pero nd Unearned interest income/ Discount on N/R 132,800 balance? Unearned franchise revenue 70,000 b. Cash 160,000 Note Receivable 507,200 Unearned franchise revenue c. Cash Note Receivable 160,000 507,200 667,200 Franchise Revenue Unearned franchise revenue 597,200 70,000 d. Cash 160,000 Note Receivable 507,200 Unearned franchise revenue 700,000 Chapter 11 (15-16) Information relating to regular sales and consignment sales of EE Products for the year ended June 30, 20x4 follows: Regular Sales Consignment Sales Total Sales P 120,000 P 30,000 P 150,000 Cost of Sales 84,000 26,000 110,000 Operating expenses ? 1,760 16,910 You ascertain that merchandise costing P6,500 are in the possession of consignees and are included in the cost of consigned merchandise sold. Operating expenses of P15,150 (more than half of which are fixed) are to be allocated to regular sales and to consignment sales based on volume. The P1,760 operating expenses relating to consignment sales include a commission of 5% and P260 Costs incurred by consignees relating to the entire shipment of merchandise worth P26,000. 15. The net income on regular sales is: a. P17,380 b. P30,280 c. P23,880 d. None of the above 16. The net income on consignment sales is: a. P8,740 b. P2,240 c. P5,710 5,775 d. None of the above Chapter 13 Home Office and Branch Office Accounting: General Procedures (17-20) Rome Corporation has one branch office, name Timber Branch. Rome is performing the end-of-theperiod reconciliation. The following items are unsettled at the end of the accounting period (you may assume that the item has been reflected in the accounts of the underlined entity): Rome has agreed to remove P750 of excess freight charges charged to Timber when Rome shipped twice as much inventory as timber requested Timber mailed a check for P11,000 to Rome as a payment for merchandise shipped from Rome to Timber. Rome has not yet received the check. Timber returned defective merchandise to Rome. The merchandise was billed to Timber at P4,000 when its actual cost was P3,000. Advertising expense attribute to the branch office was paid for by the home office in the amount of 5,000 17. Which of the following statements is correct? a. P11,000 of cash in transit and is decreased for the 750 of excess freight charges. b. P5,000 of cash in transit of advertising expense and decreased for the P750 of excess freight charges. c. P11,000 of cash payment to Rome and is decreased by P4,000 for the billed cost of defective merchandise inventory. d. freight charges and increased by the P5,000 of the advertising expenditure. 18. Which of the following statements is correct? a. The Timber Branch decreased for the P750 of excess freight charges. P11,000 of cash in transit and is b. P11,000 of cash in transit and is decreased for the P750 of excess freight charges. c. decreased by P4,000 for the billed cost of defective merchandise inventory. d. P11,000 of cash in transit and is decreased for the P5,000 of allocated advertising cost. 19. If the adjusted balances for the Timber Branch Account and the Rome Home Office account is a. b. c. d. 20. If the a. b. c. d. P515,000 P510,250 P514,000 P504,000 adjusted balances for the Timber Branch Account and the Rome Home Office account is P516,000 P496,750 P505,000 P595,750 Chapter 9 Joint Arrangement (21-24) Vat Company acquired a 30 percent interest in the voting stock of Zel Company for P331,000 on January 1, 20x1, when Zel's stockholders' equity consisted of capital stock of 600,000 and retained earnings of P400,000. At the time of Vat's investment, Zel's assets and liabilities were recorded at their fair values, except for inventories that were undervalued by P30,000 and a building with a 10-year remaining useful life that was overvalued by P120,000. Zel has income for 20x1 of P100,000 and pays dividends of P50,000. Assume undervalued inventories are sold in 20x1. Using equity method. 21. a. b. c. d. P331,000 P316,000 P338,800 P353,800 a. b. c. d. P338,800 P315,000 P300,000 P330,000 a. b. c. d. P22,800 Nil P30,000 P15,000 22. ssets at December 31, 20x1? 23. Chapter 15 Corporate Liquidation (24-28) On June 1, 20x5, the books of Dremer Corporation show assets with books values and realizable values as follows: Book value Realizable value Cash 1,850 1,850 Accounts Receivable net 21,200 17,000 Note Receivable 15,000 15,000 Inventory 41,000 20,000 Investment in Calandir Stock 5,800 15,000 Land and Building Stock 98,500 92,800 Equipment net 43,000 8,000 TOTALS 226,350 169,650 Accounts payable (50,000 secured by inventory and equipment) Wages payable Other accrued liabilities Accrued Interest on Notes Payable Accrued Interest on Mortgage Payable Notes payable (secured by Calandir Stock) Mortgage Payable (secured by Land and Building) TOTAL BOOK VALUE 90,625 3,775 10,000 375 600 10,000 70,000 185,375 24. The estimated gain (loss) on liquidation a. (56,700) b. 51,000 c. 52,500 d. 45,700 25. The estimated payment to fully secured creditors a. 70,600 b. 90,625 c. 108,975 d. 80,975 26. a. (3,825) b. 40,975 c. 3,975 d. 51,175 27. The estimated amount available to unsecured creditors (with and without priority)/ total free assets: a. 90,625 b. 76,400 c. 72,625 d. 80,625 28. The estimated amount available to unsecured creditors without priority (net free assets): a. 90,625 b. 80,625 c. 76,400 d. 72,625 Chapter 14 Home Office and Branch Office Accounting: Special Procedures (29-31) Alamo Company has two merchandise outlets, its main store and its Bonomo branch. All purchases are made by the main store and shipped to the branch at cost plus 10%. On January 1, 20x4, the main store and Bonomo inventories were P17,000 and P4,950, respectively. During 20x4, the main store purchased merchandise costing P50,000 and shipped 40% of it to Bonomo. At December 31, 20x4Bonomo made the following closing entry: Sales 40,000 Inventory 6,050 Shipments from main store 22,000 Expenses 13,100 Inventory 4,950 Main store 6,000 29. If the main store inventory at December 31, 20x4 is P14,000, the combined cost of goods sold that a. b. c. d. 30. If the P54,000 P33,000 P52,000 P74,000 main store inventory at December 31, 20x4 is P14,000, the combined main store and branch : a. P18,950 b. P19500 c. P20,050 d. P21,500 31. What was the actual branch income for 20x4 on a cost basis assuming generally accepted accounting principles a. P8,550 b. P6,000 c. P8,100 d. P7,900 Chapter 10 Revenue Recognition: Contract with Customers Long-Term Construction (32-34) Gorman Construction Co. began operations in 20x4. Construction activity for 20x4 is shown below. Gorman uses the overtime/ cost recovery method. Contract 1 2 3 Billings Contract Price P 3,200,000 3,600,000 3,300,000 Collections Through 12/31/x4 P 3,150,000 1,500,000 1,900,000 Estimated Through 12/31/x4 P2,600,000 1,000,000 1,800,000 Costs to 12/31/x4 P 2,150,000 820,000 2,250,000 Costs to Complete P 1,880,000 1,200,000 32. Which of the following should be shown on the balance sheet at December 31, 20x4 related to Contract 1? a. Gross profit, P1,000,000. b. Gross profit, P1,050,000. c. Gross profit, P600,000. d. Gross profit, P450,000. 33. Which of the following should be shown on the balance sheet at December 31, 20x4 related to Contract 2? a. Contract assets, P680,000. b. Contract assets, P820,000. c. Contract liabilities, P680,000. d. Contract liabilities, P1,500,000. 34. Which of the following should be shown on the balance sheet at December 31, 20x4 related to Contract 3? e. Contract assets, P350,000. f. Contract assets, P200,000. g. Contract liabilities, P2,250,000. h. Contract liabilities, P2,100,000. Chapter 14 Home Office and Branch Office Accounting: Special Procedures (35-36) The Stone Corporation has one remote location operating as a branch, Rock Branch. Stones make shipments of merchandise to Rock at cost plus ten percent. For the current accounting period, Rock Branch has P2,000 of branch profit and has P5,000 of inventory on hand at cost which was originally received from Stone. 35. following: a. Credit the Rock Branch account for P2,000 of branch profit and eliminate the P5,000 of ending inventory b. Credit the Rock Branch account for P2,000 of branch profit and combine the P5,000 of branch inventory with its own ending inventory. c. Debit the Rock Branch account for P2,000 of branch profit , credit the Rock Branch Profit account for the P2,000 branch profit and eliminate the P5,000 of branch ending inventory d. Debit the Rock Branch account for P2,000 of branch profit , credit the Rock Branch Profit account for the P2,000 branch profit and combine the P5,000 of branch ending inventory. 36. Which of the following statements concerning stone and Rock is correct? a. Stone will have both a Rock Branch account and Shipments from Stone account on its home office books. b. Stone will have both a Stone Home Office account and Shipments from Stone account on its branch office books. c. Rock will have both a Stone Home Office account and Shipments from Stone account on its branch office books. d. Rock will have both a Stone Home Office account and Shipments from Stone account on its branch office books. Chapter 9 Joint Arrangement (37-38) December 31 October 1 P 500 1,500 800 200 P3,000 P 250 1,550 600 200 P2,600 P 300 1,000 500 1,200 P3,000 P 200 1,000 500 900 P2,600 Debits Current assets Plant assets- net Expenses (including COGS) Dividends (paid in July) Credits Current Liabilities Capital stock (no change during the year) Retained earnings, January 1 Sales and liabilities. Using the equity method 37. Compute the correct ba a. P625,000 b. P700,000 c. P600,00 d. Nil 38. a. P300,000 b. P200,000 c. P25,000 d. Nil Chapter 10 Revenue Recognition: Contract with Customers Long-Term Construction (39-40) Horner Construction Co. uses the overtime/ percentage-of-completion method. In 20x4, Horner began work on a contract P5,500,000; it was completed in 20x5. The following cost data pertain to this contract: Cost incurred Estimated costs to complete at the end of the year Year Ended December 31 20x4 20x5 P 1,950,000 P 1,400,000 1,300,000 - 39. The amount of gross profit to be recognized on the income statement for the year ended December 31, 20x5 is: a. P2,150,000 b. P900,000 c. P860,000 d. P800,000 40. If the point-in-time/ cost recovery method (zero-profit approach) of accounting was used, the amount of gross profit to be recognized for years 20x4 and 20x5 would be: a. 20x4 20x5 P 2,250,000 P0 b. 20x4 20x5 P0 P 2,150,00 c. 20x4 20x5 P 2,150,000 (P 100,000) Problems (1-7) On January 1, 20x1, ABC Co. acquired 80% interest in XYZ, Inc. The business combination resulted to goodwill of 3,000. On this date, XYZ s equity comprised of 50,000 share capital and 24,000 retained earnings. NCI was XYZ, Inc. Inventory Equipment (4 yrs. Remaining life) Accumulated depreciation Total Carrying amounts 23,000 50,000 (10,000) 63,000 Fair values 31,000 60,000 (12,000) 79,000 Fair value Adjustment (FVA) 8,000 10,000 (2,000) 16,000 During 20x1, the following intercompany transactions occurred: a) ABC Co. sold goods costing 12,000 to XYZ, Inc., for cash, at a markup of 40% on selling price. A quarter of these goods are held in inventory by XYZ, Inc. by year-end. b) ABC Co. acquired inventory from XYZ, Inc. for 12,000 cash. XYZ, Inc. uses a normal markup of 25% above its cost. ABC's ending inventory included 4,000 from this purchase. The year-end individual financial statements are shown below: Statement of Financial Position As at December 31, 20x1 ABC Co. ASSETS Cash 41,000 Accounts Receivable 75,000 Inventory 97,000 Investment in subsidiary (at cost) 75,000 Equipment 200,000 Accumulated depreciation (60,000) TOTAL ASSETS 428,000 LIABILITIES AND EQUITY Accounts payable Bonds payable Total liabilities Share capital Share premium Retained earnings Total equity TOTAL LIABILITIES AND EQUITY 67,750 22,000 10,400 50,000 (20,000) 130,150 43,000 30,000 73,000 30,000 30,000 170,000 65,000 120,000 355,000 428,000 50,000 50,150 100,150 130,150 Statement of profit or loss For the year ended December 31, 20x1 ABC Co. Sales 330,000 Cost of goods sold (185,000) Gross profit 145,000 Depreciation expense (40,000) Distribution costs (32,000) Interest expense (3,000) PROFIT FOR THE YEAR 70,000 1. The consolidated ending inventory a. 99,400 b. 107,400 c. 104,600 XYZ, Inc. XYZ, Inc. 150,750 (96,600) 54,150 (10,000) (18,000) 26,150 d. 115,400 2. The consolidated cost of sales a. 281,600 b. 249,600 c. 320,000 d. 260,400 3. The intercompany sales to be eliminated is a. 32,000 b. 24,000 c. 21,600 d. 20,000 4. The amount of goodwill at year-end is a. Zero b. 10,000 c. Cannot be determined d. 3,000 5. The unrealized gross profit in ending inventory is a. 8,000 b. 2,400 c. 2,800 d. 2,000 6. The non-controlling interest in net assets a. 12,280 b. 21,070 c. Zero d. 15,250 7. The consolidated retained earnings on Dec. 31, 20x1 is: a. 130,280 b. 196,300 c. 120,000 d. 170,150 (8-10) Wizard Corporation sells inventory on June 20 to a German Company for 86,000 FCUs (Foreign Currency Units). Payment occurs on August 10. The exchange rate on June 20 is 1 FCU = P1.016 and 1 FCU = P1.022 on August 10. 8. What is the debit to cash when Wizard collects the Accounts Receivable on August 10? a. 87,376 b. 86,000 c. 87,892 9. What is the amount recorded on Wizard s financial records for the sale on June 20? a. 87,376 b. 86,000 c. 87,892 10. What is the amount on Exchange Gain or Loss recorded on Wizard s financial records on August 10? a. 516 gain b. 516 loss (11-12) On September 30, 20x1, ABC Co. acquired all of the identifiable assets and assumed all of the liabilities of XYZ, Inc. by paying cash of P1,000,000. On this date, the identifiable assets acquired and liabilities assumed have fair values of P1,600,000 and P900,000, respectively. ABC engaged an independent valuer to appraise a building acquired from XYZ. However, the valuation report was not received by the time ABC authorized for issue its financial statements for the year ended December 31, 20x1. As such, the building was assigned a provisional amount of P700,000. Also, the building was tentatively assigned an estimated useful life of 10 years from acquisition date. ABC uses the straight line method of depreciation and On July 1, 20x2, ABC finally received the valuation report from the independent valuer which shows that the fair value of the building as of September 30, 20x1 is 2,000,000 and remaining useful from that date is 5 years. 11. The adjusted fair value of net identifiable assets acquired a. 1,600,000 b. 500,000 c. 700,000 d. 900,000 12. The amount of goodwill on September 30, 20x1 is a. 1,000,000 b. 300,000 c. 50,000 d. 700,000 (13-14) On September 30, 20x1, ABC Co. acquired all of the identifiable assets and assumed all of the liabilities of XYZ, Inc. by paying cash of P1,000,000. On this date, the identifiable assets acquired and liabilities assumed have fair values of P1,600,000 and P900,000, respectively. On July 1, 20x2, ABC obtained new information that XYZ has an unrecorded patent, which was not identified on September 30, 20x1. It was believed that the unrecorded patent had a fair value of P1,000,000 and a remaining useful life of 4 years as of September 30, 20x1. 13. The adjusted goodwill is a. 100,000 b. 200,000 c. 500,000 d. 300,000 14. The adjusted fair value of net identifiable assets acquired is a. 900,000 b. 500,000 c. 800,000 d. 100,000 (15-17) On January 1, 20x1, ABC Co., acquired 30% ownership interest in XYZ Inc. for P100,000. Because the investment gave ABC significant influence over XYZ, the investment was accounted for under the equity method in accordance with PAS 28 Investment in Associates and Joint Ventures. From 20x1 to the end of 20x3, ABC recognized P50,000 net share in the profits of the associate and P10,000 share in dividends. Therefore, the carrying amount of the investment in associate account on January 1, 20x3, is P140,000. On January 1, 20x4, ABC acquired additional 60% ownership interest in XYZ Inc. for P800,000. As of this date, ABC has identified the following: 1. The previously held 30% interest has a fair value of P180,000. 3. ABC elected to measure non-controlling interests at the nonidentifiable net assets. 15. The gain on remeasurement on January 1, 20x4 is a. 80,000 b. Zero c. 40,000 d. 100,000 16. What amount of goodwill is a. 40,000 b. Zero c. 100,000 d. 80,000 17. The balance of the Investment in Subsidiary account on January 1, 20x4 is a. 800,000 b. 980,000 c. 1,080,000 d. 1,000,000 (18-21) Kennedy Company acquired all of the outstanding common stock of Hastie Company of Canada for 350,000 foreign currency units (FCUs) on January 1, 20x4, when the exchange rate for the foreign currency units (FCUs) was P0.70. The fair value of the net assets of Hastie was equal to their book value of 450,000 foreign currency units (FCUs) on the date of acquisition. Any excess cost over fair value was attributed to an unrecorded patent with a remaining life of five years. The functional currency of Hastie is the FCU. For the year ended December 31, 2009, Hastie's translated net income was P25,000. The average exchange rate for the FC during 20x4 was P0.68, and the 20x4 year-end exchange rate was P0.65 18. Amortization of the patent, translated, for 20x4 would be a. 13,600 b. 7,000 c. 10,000 d. 6,800 19. The peso amount allocated to the patent at January 1, 20x4. a. 35,000 b. 60,000 c. 100,000 d. 50,000 20. Kennedy s share of Hastie s net income for 20x4 would be: a. 18,200 b. 25,000 c. 50,000 d. 6,800 21. Compute the amount of the patent reported on the consolidated balance sheet at December 31, 20x4. a. 55,000 b. 40,000 c. 50,000 d. 26,000 (22-27) On January 1, 20x1, ABC Co. acquired 80% interest in XYZ, Inc. by issuing 5,000 shares with total fair value of P75,000. Non-controlling interest was measured at a fair value of P18,750. [(P75,000 / 80%) x 20% = 18,750]. Share capital Retained earnings Total equity (at carrying amounts) 50,000 24,000 74,000 On January 1, 20x1 following: XYZ, Inc. Inventory Equipment (4 yrs. Remaining life) Accumulated depreciation Total approximate their fair values except for the Carrying amounts 23,000 50,000 (10,000) 63,000 Fair values 31,000 60,000 (12,000) 79,000 Fair value Adjustment (FVA) 8,000 10,000 (2,000) 16,000 The remaining useful life of the equipment is 4 years. No dividends were declared by either entity in 20x1. There were no intercompany transactions and no impairment in goodwill. The year-end individual financial statements of the entities are shown below: Statement of Financial Position As at December 31, 20x1 ABC Co. ASSETS Cash Accounts Receivable Inventory Investment in subsidiary (at cost) Equipment Accumulated depreciation TOTAL ASSETS LIABILITIES AND EQUITY Accounts payable Bonds payable Total liabilities Share capital Share premium Retained earnings Total equity TOTAL LIABILITIES AND EQUITY 23,000 75,000 105,000 75,000 200,000 (60,000) 418,000 50,000 (20,000) 124,000 43,000 30,000 73,000 30,000 30,000 170,000 65,000 110,000 345,000 418,000 50,000 44,000 94,000 124,000 Statement of profit or loss For the year ended December 31, 20x1 ABC Co. Sales 300,000 Cost of goods sold (165,000) Gross profit 135,000 Depreciation expense (40,000) Distribution costs (32,000) Interest expense (3,000) PROFIT FOR THE YEAR 60,000 22. The consolidated total liabilities: a. 120,00 b. 103,000 c. 30,000 d. 73,000 23. The consolidated total equity a. 353,000 b. 403,000 373,550 c. 353,500 d. 373,750 24. Profit or loss attributable to parent XYZ, Inc. 57,000 22,000 15,000 XYZ, Inc. 120,000 (72,000) 48,000 (10,000) (18,000) 20,000 a. b. c. d. 68,000 70,000 76,000 72,000 25. The consolidated profit or loss a. 70,000 b. 52,000 c. 90,000 d. 60,000 26. Profit or loss attributable to NCI a. 2,000 b. 28,000 c. 5,000 d. 20,000 27. The consolidated total assets a. 551,750 b. 470,750 c. 476,750 d. 473,000 (28-32) Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20x4. On December 31, 20x5, Mortar received P390,000 from Granite for an equipment Mortar had purchased on January 1, 20x2, for P400,000. The equipment is expected to have a 10-year useful life and no salvage value. 28. In the preparation of the 20x5 consolidated financial statements, equipment will be: a. Debited for P15,000 b. Debited for P1,000 c. Debited for P10,000 d. Debited for P25,000 29. In the preparation of the 20x6 consolidated financial statements, accumulated depreciation will be: a. Debited for P160,000 in the eliminating balance b. Credited for P160,000 in the eliminating balance c. Debited for P135,000 in the eliminating balance d. Credited for P135,000 in the eliminating balance 30. In the preparation of the 20x6 consolidated financial statements, equipment will be: a. Debited for P15,000 b. Debited for P1,000 c. Debited for P10,000 d. Debited for P25,000 31. The gain on sale of equipment recorded by Mortar for 20x5 is: a. P65,000 b. P40,000 c. P110,000 d. P150,000 32. In the preparation of the 20x6 consolidated financial statements, depreciation expense will be: a. Debited for P15,000 in the eliminating balance b. Credited for P25,000 in the eliminating balance c. Debited for P25,000 in the eliminating balance d. Credited for P15,000 in the eliminating balance 33. On March 1, 20x4 Wilson Corporation sold goods for a peso equivalent of P31,000 to a foreign supplier. The transaction is denominated in foreign curreny (FC). The payment is received on May 10. The exchange rates were: March 1: 1 FC = P0.31 March 10: 1 FC = P0.34 What entry is required to revalue foreign currency payable to peso equivalent value on May 10? a. Accounts Receivable 3,000 Foreign Currency Transaction Gain 3,000 b. Sales 93 Foreign Currency Transaction Gain 93 c. Accounts Receivable Foreign Currency Transaction Gain 93 d. Foreign Currency Transaction Gain Accounts Receivable 3,000 93 3,000 34. Greco, In. a Philippine corporation, bought machine parts from Franco Company of foreign country on March 1, 20x4, for -end was March 31, 20x4, when the spot rate was P0.5495. (transaction) gain or loss for the years ended March 31, 20x4 and 20x5? a. 20x4 P-0b. 20x4 P350 loss 20x5 P-020x5 P-0- c. 20x4 P350 loss 20x5 P350 loss 20x4 P-0- 20x5 P350 loss d. 35. On 12/12/x6, a domestic exporter sold inventory for foreign company for P100,000 FCUs (foreign currency units). On that date, the direct spot rate was P0.20. At 12/31/x6, the direct spot rate was P0.24. On 1/22/x7, which the direct spot rate was P0.21, the domestic exporter received full payment of P100,000 FCUs. In the importer a. 2,400 gain b. 4,000 loss c. 2,400 loss d. 4,000 gain what should be reported as an FX gain or loss? 36. BR Corporation had a realized foreign exchange loss of P13,000 for the year ended December 31, 20x2, and must also determine whether the following items will require year-end adjustment. BR had a P7,000 credit resulting from the restatement in pesos of the accounts of its wholly owned foreign subsidiary for the year ended December 31, 20x2. BR has an account payable to an unrelated foreign supplier payable in the supplier s local currency. The peso equivalent of the payable was P60,000 on the October 31, 20x2 invoice date P64,000 on December 31, 20x2. The invoice is payable on January 30, 20x3. What amount of the net foreign exchange loss in computing net income should be reported in BR s 20x2 consolidated statement of income? a. Functional Currency - LCU Functional Currency Peso P17,000 P17,000 b. Functional Currency - LCU Functional Currency Peso P10,000 P10,000 Functional Currency - LCU P10,000 Functional Currency Peso P17,000 Functional Currency - LCU P17,000 Functional Currency Peso P10,000 c. . d. 37. A wholly owned foreign subsidiary of NN Inc. has certain expense accounts for the year ended December 31, 20x4 stated in local currency units (LCU) as follows: LCU Deprecation of equipment (related assets were purchases on January 1, 20x2 Provisions for Uncollectible Accounts 120,000 80,000 Rent 200,000 The exchange rate at various dates were as follows: January 1, 20x2 December 30, 20x4 Average, 20x4 Peso Equivalent of 1 LCU P0.50 0.40 0.44 What total peso amount should be included in NN Inc. s 20x4 consolidated income statement to reflect these expenses? a. Functional Currency - LCU Functional Currency Peso P176,000 P183,200 b. Functional Currency - LCU P183,200 Functional Currency Peso P183,200 Functional Currency - LCU P183,200 Functional Currency Peso P183,200 Functional Currency - LCU P176,000 Functional Currency Peso P176,000 c. d. 38. The balance in Newsprint Corp. s foreign exchange loss account was P10,000 on December 31, 20x4, before any necessary year-end adjustment relating to the following: (1) Newsprint had a P15,000 debit resulting from the restatement in dollars of the accounts of its wholly owned foreign subsidiary for the year ended December 31, 20x4. (2) Newsprint had an account payable to an unrelated foreign supplier, payable in the supplier's local currency unit (LCU) on January 15, 20x5. The peso equivalent of the payable was P50,000 on the December 1, 20x4, invoice date and P53,000 on December 31, 20x4. In Newsprint's 20x4 consolidated income statement, what amount should be included as foreign exchange loss in computing net income, if the LCU is the functional currency and the translation method is appropriate? a. 13,000 b. 10,000 c. 17,000 d. 15,000 39. Kettle Company purchased equipment for 375,000 FCUs (foreign currency units) from a supplier in a foreign country on July 3, 20x4. Payment in FCU is due on Sept. 3, 20x4. The exchange rates to purchase one FCU is as follows: Spot-rate 30-day-rate 60-day-rate JULY 3 1.58 1.57 1.56 AUG. 31 (year-end) 1.55 1.53 1.49 SEPT. 3 1.54 - On its August 31, 20x4, income statement, what amount should Kettle report as a foreign exchange transaction gain: a. 11,250 b. 12,500 c. 25,00 d. 1,250 40. Greco, In. a Philippine corporation, bought machine parts from Franco Company of foreign country on March 1, 20x4, for -end was March 31, 20x4, when the spot rate was P0.5495. (transaction) gain or loss for the years ended March 31, 20x4 and 20x5? a. 20x4 P3,500 loss / 20x5 P3,500 loss b. 20x4 P350 loss / 20x5 P350 loss MIDTERM AFAR Theories 1. The amount of the adjustment to the non-controlling interest in consolidated in net assets is equal to the nona. b. c. d. Unrealized intercompany gain at the beginning of the period. Realized intercompany gain at the beginning of the period. Realized intercompany gain at the end of the period. Unrealized intercompany gain at the end of the period. 2. a. Always the currency of the country in which the company has its headquarters. b. c. The currency in which transactions are denominated. d. The currency in which the entity primarily generated and expends cash. 3. As part of the consolidation process for a partially-held foreign subsidiary, the elimination entry to distribute the excess of cost over book value will include a credit to Cumulative Translation Adjustment- Parent a. for the amount of excess attributable to identifiable net assets multiplied by the difference between historical and current exchange rates b. for the amount of excess attributable to identifiable net assets multiplied by the difference between average and current exchange rates c. for the Parent's portion of the excess attributable to identifiable net assets multiplied by the difference between historical and current exchange rates d. for the Parent's portion of the excess attributable to identifiable net assets multiplied by the difference between average and current exchange rates 4. What is a basic premise of the acquisition method regarding accounting for a non-controlling interest? a. Consolidated financial statements should not report a non-controlling interest balance because these outside owners do not hold stock in the parent company. b. Consolidated financial statements should be primarily for the benefit of the parent company's stockholders. c. Consolidated financial statements should be produced only if both the parent and the subsidiary are in the same basic industry. d. A subsidiary is an invisible part of a business combination and should be included in its entirety regardless of the degree of ownership. 5. Which of the following terms describes the change in currency values to one another as a result of decisions made by politicians? a. Floating exchange rate b. Exchange rate c. Fixed exchange rate 6. An exchange rate of P1.32 : 1 FC a. Means that each peso is worth 1.32 FC. b. Implies that the peso has strengthened vis-à-vis the FC. c. Implies that the FC has strengthened vis-à-vis the peso. d. Can also be expressed as P1: 0.76 FC. 7. In determining controlling interest in consolidated income in the consolidation financial statements, unrealized intercompany profit on inventory acquired by a parent from its subsidiary should: a. b. Not be elimination c. Be eliminated to the extent of the non-controlling interest in the subsidiary. d. Be eliminated in full. 8. When an offer is made to acquire a company and the acquire management supports the offer, the offer is called which of the following? a. Friendly takeover b. Tender offer c. Hostile takeover d. Defensive measure 9. A parent buys 32 percent of a subsidiary in one year and then buys an additional 40 percent in the next year. In a step acquisition of this type, the original 32 percent acquisition should be a. Maintained at its initial value b. Adjusted to fair value at the date of the second acquisition with a resulting gain or loss recorded c. Adjusted to its equity method balance at the date of the second acquisition d. Adjusted to fair value at the date of the second acquisition with a resulting adjustment to additional paid-in capital 10. A defensive maneuver where a company buys a stock from a potential acquirer at a premium over the marker price is called which of the following? a. White knight b. Shark repellent c. Greenmail d. Sale of the crown jewels 11. The business enterprise that enter into a business combination are termed the: a. Merging companies b. Combiner companies c. Joining companies d. Constituent companies 12. What is the date called when a foreign currency transaction is paid through the exchange of currency? a. Origination date b. Settlement date c. Balance sheet date d. Transaction date 13. Alpha purchased an 80% interest in Beta on June 30, 20x4. porting periods end December 31. Which of the following represents the controlling interest in consolidated net income for 20x4? a. -December 31 income b. -December 31 income c. ry 1-December 31 income d. -December 31 income 14. In a mid- he purchased income a. b. c. Consolidated net income d. Sub 15. In comparing the translation and the remeasurement process, which of the following is true? a. The reported balance of the inventory is normally the same under both methods b. The reported balance of equipment is normally the same under both methods c. The reported balance of depreciation expense is normally the same under both methods d. The reported balance of sales is normally the same under both methods 16. The amount of intercompany profit eliminated is the same under total elimination and partial elimination in the case of (1) upstream sales where the selling affiliate is a less than wholly owned subsidiary. (2) all downstream sales. (3) horizontal sales where the selling affiliate is a wholly owned subsidiary/ a. 1 b. 2 c. 3 d. Both 2 and 3 17. a. b. c. d. 000 of goodwill? Event's goodwill is an identifiable asset and should be included as part of Raj's purchase price discrepancy (PPD). Event's goodwill is an identifiable asset but should not be included as art of Raj's PPD. Event's goodwill is not an identifiable asset but should be included as part of Raj's PPD. . 18. Company A makes a hostile take-over bid for Company B. In response, Company B makes a counter-offer to a. b. c. d. Selling the crown jewels A Hostile Defense Poison Pill Pac-man defense 19. Under PFRS 3, when a gain is recognized in consolidating financial information? a. When any bargain purchase is created. b. In a combination created in the middle of a fiscal year. c. In an acquisition when the value of all assets and liabilities cannot be determined. d. When the amount of a bargain purchase exceeds the value of the applicable liability held by the acquired company. 20. How should accounting fees for an acquisition be treated? a. Expensed in the period of acquisition. b. Capitalized as part of the acquisition cost. c. Deferred and amortized. d. Deferred until the company is disposed of or wound-up. 21. Polly Inc. owns 80% of Saffron, Inc. During 20x4, Polly sold goods with a 40% gross profit to Saffron. Saffron sold all of these goods in 20x4. For 20x4 consolidated financial statements, how should the summation of Polly and Saffron income statement items be adjusted? a. Sales and cost of goods sold should be reduced by the intercompany sales. b. Sales and cost of goods sold should be reduced by 80% of the Intercompany sales. c. Net income should be reduced by 80% of the gross profit on intercompany sales. d. No adjustment is necessary. 22. Which of the following does NOT constitute a Business Combination under IFRS 3? a. b. c. A Corp enters into a Joint Venture with B Corp. d. A Corp purchases the net assets B. Corp. 23. In the year an 80% owned subsidiary sells equipment to its parent company at a gain, the non-controlling interest in consolidated income is calculated by multiplying the nonnet income a. Minus the net amount of unrealized gain on the intercompany sale b. Minus the intercompany gain considered realized in the current period c. Plus the intercompany gain considered realized in the current period d. Plus the net amount of unrealized gain on the intercompany sale 24. In years subsequent to the year a 90% owned subsidiary sells equipment to its parent company at a gain, the noncontrolling interest in consolidated income is computed by multiplying the non-controlling interest percentage by the a. Minus the net amount of unrealized gain on the intercompany sale b. Minus the intercompany gain considered realized in the current period c. Plus the intercompany gain considered realized in the current period d. Plus the net amount of unrealized gain on the intercompany sale 25. Which of the following statements is NOT accurate with regard to a purchase or sale denominated in a foreign currency? a. The amount recorded in the financial records will be the estimated value of the foreign currency paid or received. b. The amount recorded in the financial records is the number of foreign currency units exchanged. c. The account titles would be the same as a similar transaction undertaken with a Philippine company. d. 26. Which of the following is NOT a reason why a private enterprise may be acquired as a bargain purchase? a. It is a family business and the next generation does not want to continue the business. b. The business only has equity financing and has no debit financing. c. The owner has health problems and does not have a successor. d. The owner is no longer interested in the business. 27. What is the most common valuation method used for intangible assets a. Market-based b. Amortized cost c. Income-based d. Cost-based 28. JJ Company acquired 85% of MR Company on April 1. On its December 31, consolidated income statement, how e April 1. a. -acquisition portion as non-controlling interest in net income. b. Deduct 15 percent of the net combined revenues and expenses relating to the pre-acquisition period from consolidated net income. c. Exclude 100 percent of the pre-acquisition revenues and 100 percent of the pre-acquisition expenses from their respective consolidated totals. d. Exclude 15 percent of the pre-acquisition revenues and 15 percent of the pre-acquisition expenses from consolidated expenses. 29. Which one of the following is a characteristic of a business combination that should be accounted for as an acquisition? a. The transaction may be considered to be the uniting of the ownership interests of the companies involved b. The two companies may be about the same size and it is difficult to determine the acquired company and the acquiring company c. The combination must involve the exchange of equity securities only d. The acquired subsidiary must be smaller in size than the acquiring parent e. The transaction establishes an acquisition fair value basis for the company being acquired 30. What is the appropriate accounting treatment for the value assigned to in-process research and development acquired in a business combination? a. Expense until future economic benefits become certain and then capitalize as an asset b. Expenses if there is no alternative use for the assets used in the research and development and technological feasibility has yet to be reached c. Expense upon acquisition d. Capitalize as an asset 31. May foreign currency transaction gains or losses be recognized on the following transactions denominated in a foreign currency: a. Purchase of merchandise? Purchase of merchandise? No Yes b. Purchase of merchandise? No Purchase of merchandise? No Purchase of merchandise? Yes Sale of merchandise? Yes Purchase of merchandise? Yes Sale of merchandise? No c. d. 32. In reference to the downstream or upstream sale of depreciable assets, which of the following statements is correct? a. The initial effect of unrealized gains and losses from downstream sales of depreciable assets is different from the sale of non-depreciable assets. b. Gains, but not losses, appear in the parent-company accounts in the year of sale and must be eliminated by the parent company in determining its investment income under the equity method of accounting. c. Gains and losses appear in the parent-company accounts in the year of sale and must be eliminated by the parent company determining its investment income under the equity method of accounting d. Upstream sales from the subsidiary to the parent company always result in unrealized gains or losses 33. The material sale of inventory items by a parent company to an affiliated company: a. Does not require a working paper adjustment if the merchandise was transferred at cost b. Affects consolidated net income under a periodic inventory system but not under a perpetual inventory system c. g. d. Does not result in consolidated income until the merchandise is sold to outside parties. 34. Goodwill arising from business combination is: a. Never amortized b. Amortized over 40 years or its useful life, whichever is higher c. Amortized over 40 years or its useful life, whichever is shorter d. Charged to Retained Earnings after the acquisition is completed 35. What is push-down accounting? a. Inventory transfers made from a parent company to a subsidiary b. -value allocations as well as subsequent amortization c. The adjustments required for consolidation when a parent has applied the equity method of accounting for internal reporting purposes d. A requirement that a subsidiary must use the same accounting principles as a parent company 36. In years subsequent to the upstream intercompany sale of non-depreciable assets, the necessary consolidated workpaper entry under the cost method is to debit the a. Non-controlling interest and Retained Earnings (Parent) accounts, and credit the non-depreciable asset b. Retained Earnings (Parent) account and credit the non-depreciable asset c. Non-depreciable asset, and credit the Non-controlling interest and Investment in Subsidiary accounts d. No entries are necessary 37. Which of the following statements is true for the translation process (as opposed to remeasurement)? a. Equipment is translated at the historical exchange rate in effect at the date of its purchase b. monetary liabilities caused by exchange rate fluctuations c. A translation adjustment can affect consolidated net income d. exchange rate fluctuations. 38. A parent company regularly sells merchandise to its 80%-owned subsidiary. Which of the following statements describes the computation of non-controlling interest income? a. unrealized profits in the ending inventory) x 20% b. c. unrealized profits in the beginning inventory) x 20% d. its in the beginning inventory unrealized profits in the ending inventory 39. Which of the following is the BEST theoretical justification for consolidated financial statements? a. In form and substance the companies are separate b. In form and substance the companies are one entity c. In form the companies are one entity; in substance they are separate d. In form the companies are separate; in substance they are one entity 40. Business combinations that result in one dominant company in an industry are said to have formed which of the following? a. Oligopoly b. Monopoly c. Pure competition d. Free market Finals (AFAR) 1. On September 30, 20x4, Jaja Inc. was awarded to contract to build a 1,000-room hotel for P120 million. Among others, the parties agreed to the following: Ten percent mobilization fee (deductible from "final billing") payable within ten days from the signing of the contract retention of ten percent on all billings (to be paid within the final billing upon completion and acceptance of the project); and Progress billings are to be paid within 2 weeks upon acceptance. By the end of 20x4, the company had presented one progress billing, corresponding 10% completion, which was evaluated and accepted by the client on December 29, 20x4 for payment in January of next year. In 20x4, assuming use of the percentage-of-completion method of accounting, Jaja Inc. received cash a total fee of: Group of answer choices P13,200,000 P11,880,000 P12,000,000 P 1,200,000 2. On August 5, 20x5, Famous Furniture shipped 20 dining sets on consignment to Furniture Outlet, Inc. The cost of each dining set was P350 each. The cost of shipping the dining sets amounted to P1,800 and was paid for by Famous Furniture. On December 30, 20x5, the consignee reported the sale of 15 dining sets at P850 each. The consignee remitted payment for the amount due after deducting a 6% commission, advertising expense of P300, and installation and setup costs of P390. The total profit on units sold for the consignor is Group of answer choices P11,295 P4,695 P6,045 P9,945 3. Geri Corporation sells cosmetics through a network of independent distributors. Geri shipped cosmetics to its distributors and is considering whether it should record P300,000 of revenue upon shipment of a new line of cosmetics. Geri expects the distributors to be able to sell the cosmetics, but is uncertain because it has little experience with selling cosmetics of this type. Geri is committed to accepting the cosmetics back from the distributors if the cosmetics are not sold. How much revenue should Geri recognize upon delivery to its distributors? Group of answer choices None P300,000 incomplete data P25,000 4. For 20x6, Pyna reported P500,000 of net income from its own separate operations. This amount excludes income relating to Syna, its 80%-owned created subsidiary, which reported P100,000 of net income and declared P55,000 of dividends in 20x6. What is the consolidated net income under the economic unit concept? Group of answer choices P644,000 P544,000 P580,000 P536,000 P600,000 5. For the year ended 12/31/x6, the adjusted financial statements of a home office and its branch show net income of P700,000 and P100,000, respectively. At the end of 20x5, the home office adjusted the Intracompany Profit Deferred account by debiting it for P40,000, leaving a balance of P10,000. The combined net income for 20x6 is Group of answer choices P800,000 None of the above. P690,000 P660,000 P700,000 6. NN Company consigns sign pens to retailers, debiting Accounts Receivable for the retail sales price of the sign pens consigned and crediting Sales. All costs relating to the consigned sign pens are debited to expenses of the current accounting period. Net remittances of the consignees are credited to Accounts Receivable. In December, 800 sign pens costing P60 each and retailing for P100 a unit were consigned to SS Store. Freight cost of P800 was debited to Freight Expense by the consignor. On December 31, SS Store remitted P35,505 to NN Company in full settlement of the balance due. Accounts Receivable was credited for this amount. The consignee deducted a commission of P10 on each sign pens sold and P45 for delivery expense. The number of sign pens sold by SS Store is: Group of answer choices None of the above 355 395 400 7. Maxwell is a partner and has an annual salary of 30,000 per year, but he actually draws P3,000 per month. The other partner in the partnership has an annual salary of P40,000 and draws P4,000 per month. What is the total annual salary that should be used to allocate annual net income among the partners? Group of answer choices P50,000 P84,000 P70,000 P14,000 8.P Company purchased land from its 80% owned subsidiary at a cost of P100,000 greater than it subsidiary's book value. Two years later P sold the land to an outside entity for P50,000 more than its cost. In its current year consolidated income statement P and its subsidiary should report a gain on the sale of land of: Group of answer choices P50,000 P130,000 P120,000 P150,000 9. Dobby Corporation was forced into bankruptcy and is in the process of liquidating assets and paying claims. Unsecured claims will be paid at the rate of thirty cents on the peso. Carson holds a note receivable from Dobby for P75,000 collateralized by an asset with a book value of P50,000 and a liquidation value of P25,000. The amount to be realized by Carson on this note is: Group of answer choices P50,000 P40,000 P75,000 P25,000 10. An entity acquired all the share capital of a foreign entity at a consideration of 9 million baht on June 30, 20x4. The fair value of the net assets of the foreign entity at that date was 6 million baht. The functional currency of the entity is the peso. The financial year-end of the entity is December 31, 20x4. The exchange rates at June 30, 20x4, and December 31, 20x4, were 1.5 baht = P1 and 2 baht = P1 respectively. What figure for goodwill should be included in the financial statements for the year ended December 31, 20x4? Group of answer choices P2 million P3 million 3 million baht P1.5 million 11. During the liquidation of Gym, Hob & Ing Partnership, Partner Hob withdrew equipment with a cost to the partnership of P18,000, accumulated depreciation of P8,000, and a current fair value of P13,000. The partners shared net income and losses equally. The net debit to Hob's capital account (including any gain or loss on disposal of the equipment), assuming the noncash asset may be distributed safely to Hob, is: Group of answer choices P12,000 P10,000 P18,000 P13,000 12. Max,Jones and Waters shared profits and losses 20%, 40% and 40% respectively and their partnership capital balance is P10,000, P30,000 and P50,000 respectively. Max has decided to withdraw from the partnership. An appraisal of the business and its property estimates the fair value to be P200,000. Land with a book value of P30,000 has a fair value of P45,000. Max has agreed to receive P20,000 in exchange for her partnership interest. What amount should land be recorded on the partnership books? Group of answer choices P50,000 P20,000 P30,000 P45,000 13. The home office of Glendale Company, which uses the perpetual inventory system, bills shipments of merchandise to the Montrose Branch at a markup of 25% on the billed price. On August 31, 20x4, the credit balance of the home office's Allowance for Overvaluation of Inventories - Montrose Branch ledger account was P60,000. On September 17, 20x4, the home office shipped merchandise to the branch at a billed price of P400,000. The branch reported an ending inventory, at billed price, of P160,000 on September 30, 20x4. Compute the realized gross profit? Group of answer choices P108,000 P 28,000 P 120,000 P 20,000 14. At December 31, 20x5, the following information has been collected by Maxwell Company's office and branch for reconciling the branch and home office accounts. The home office's branch account balance at December 31, 20x5 is P590,000. The branch's home office account balance is P506,700. On December 30, 20x5, the branch sent a check for P40,000 to the home office to settle its account. The check was not delivered to the home office until January 3, 20x6. On December 27, 20x5, the branch returned P15,000 of seasonal merchandise to the home office for the January clearance sale. The merchandise was not received by the home office until January 6, 20x6 The home office allocated general expenses of P28,000 to the branch. The branch had not entered the allocation at the year-end. Branch store insurance premiums of P900 were paid by the home office. The branch recorded the amount at P600. The correct balance of the reciprocal account amounted to: Group of answer choices P534,700 P535,000 P575,000 P507,000 15. Lawrence Company, a Philippine company, ordered parts costing 1,000,000 foreign currencies (FC) from a foreign supplier on July 7 when the spot rate was P.025 per baht. A one-month forward contract was signed on that date to purchase 1,000,000 FC at a rate of P.027. The forward contract is properly designated as a fair value hedge of the 1,000,000 FC firm commitments. On August 7, when the parts are received, the spot rate is P.028. What is the amount of accounts payable that will be paid at this date? Group of answer choices P27,000 P28,000 P25,000 P20,100 P20,000 16. Holmgren Seafoods, Inc. catches and processes salmon and tuna caught off the coast of Maine. In May 20x6, it placed 100 freshly caught wild salmon with a retail price of P75 each in Joe's Fish Shop. Holmgren's contract with the shop stipulates that the shop will earn a 15% commission on each salmon sold. Joe's is responsible for purchasing any fish that remain unsold at the end of a three-day period. During the three-day period, Joe's Fish Shop was able to sell 88 of the 100 salmon. How much revenue should Holmgren recognize with respect to this transaction? Group of answer choices Incomplete data None P7,500 P75 17. Richardson, Peterson, and Wilkerson are forming a partnership. The partners contribute cash and noncash assets valued at P30,000, P50,000, and P25,000, respectively. The partners choose to apply the bonus method where applicable. If the partners agree to establish equal capital account balances when the partnership is formed, how much of a bonus is received by Richardson? Group of answer choices P15,000 P10,000 P 5,000 Richardson does not receive a bonus 18. Belgium Co. is constructing a tunnel for P800 million. Construction began in 20x4 and is estimated to be completed in 20x8 . At December 31, 20x6, Belgium has incurred costs totaling P356 million with P85 million of that incurred in 20x6, P143 million in 20x7, and the remainder during 20x8. Belgium believes that it completed 30% of the tunnel during 20x6, although that may change based on future activity. Belgium Co. uses PAS 11 for its accounting and regards its cost numbers as very uncertain (cost recovery method/zero profit approach). What amount of revenue should Belgium Co. recognize for the year ended December 31, 20x6? Group of answer choices P85 million No revenue should be recognized until the contract is completed in 20x8 . P356 million P240 million 19. SS Corporation had the following foreign currency transactions during 20x4. First, it purchased merchandise from a foreign supplier on January 20, 20x4, for the Philippine peso equivalent of P90,000. The invoice was paid on March 20, 20x4, at the Philippine peso equivalent of P96,000. Second, on July 1, 20x4, SS borrowed the Philippine peso equivalent of P500,000 evidenced by a note that was payable in the lender's local currency on July 1, 20x5. On December 31,20x4, the Philippine peso equivalents of the principal amount and accrued interest were P520,000 and P26,000, respectively. Interest on the note is 10 percent per annum. In SS's 20x4 income statement, what amount should be included as a foreign exchange loss? Group of answer choices P-0P27,000 P6,000 P21,000 20. Sparkman Co. filed a bankruptcy petition and liquidated its noncash assets. Sparkman was paying forty cents on the dollar for unsecured claims. Bailey Co. held a mortgage of P150,000 on land that was sold for P110,000. The total amount of payment that Bailey should have received is calculated to be Group of answer choices P44,000 P126,000 P60,000 P110,000 P134,000 21. Meisner Co. ordered parts costing 100,000 foreign currency units (FCUs) for a foreign supplier on May 12 when the spot rate was P.24 per FCU. A one-month forward contract was signed on that date to purchase 100,000 FCUs at a forward rate of P.25 per FCU. On June 12, when the parts were received and payment was made, the spot rate was P.28 per FCU. At what amount should inventory be reported? Group of answer choices P0 P2,000 P24,200 P25,000 28,000 22. An operator enters into a contract to provide construction services costing P100,000. It has been determined that the fair value of the construction services provided is P110,000. The total cash inflows over the entire life of the contract are fixed by the grantor at P200,000. The finance revenue by using the effective interest rate method in accordance is P10,000 over the entire life of the services concession arrangement. Total cash inflows over the life of the contract Group of answer choices P80,000 P100,000 P200,000 P110,000 23. On January 1, 20x4 , Chamberlain Corporation pays P388,000 for a 60 percent ownership in Neville. Annual excess fair-value amortization of P15,000 results from the acquisition. On December 31, 20x5 , Neville reports revenues of P400,000 and expenses of P300,000 and Chamberlain reports revenues of P700,000 and expenses of P400,000. The parent figures contain no income from the subsidiary. What is consolidated net income attributable to the controlling interest? Group of answer choices P366,000 P400,000 P231,000 P351,000 24. Arnold acquired 60 percent of Dunk Corporation on May 1. At that date, Dunk has plant assets with a book and market value of 2,300,000 and 4,300,000 LCUs respectively. The exchange rates that exist on May 1 and December 31 are P.57 and P.53, respectively. What is the peso amount of plant assets included in the consolidated balance sheet at May 1? Group of answer choices P1,219,000 P2,451,000 P2,279,000 P1,311,000 25. Mint Corporation has several transactions with foreign entities. Each transaction is denominated in the local currency unit of the country in which the foreign entity is located. On November 2, 20x4, Mint sold confectionary items to a foreign company at a price of LCU 23,000 when the direct exchange rate was 1 LCU = P1.08. The account has not been settled as of December 31, 20x4, when the exchange rate has increased to 1 LCU = P1.10. The foreign exchange gain or loss on Mint's records at year-end for this transaction will be: Group of answer choices P460 gain P387 loss P387 gain P460 loss 26. The Naples Company uses the overtime/percentage-of-completion method and the point-in-time /cost-to-cost method for its long-term construction contracts. On one such contract, Naples expects total revenues of P260,000 and total costs of P200,000. During the first year, Naples incurred costs of P50,000 and billed the customer P30,000 under the contract. At what net amount should Naples' Construction in Progress for this contract be reported at the end of the first year? Group of answer choices P30,000 P65,000 P50,000 P35,000 27. During the liquidation of the partnership of Karr, Rice, and Long. Karr accepts, in partial settlement of his interest, a machine with a cost to the partnership of P150,000 accumulated depreciation of P70,000, and a current fair value of P110,000. The partners share net income and loss equally. The net debit to Karr's account (including any gain or loss on disposal of the machine) is Group of answer choices P 90,000 P15,000 P110,000 P100,000 28. Erlinda Magalona Insurance is an insurer which conducts general insurance business. For the year ended December 31, 20x4, its total gross premiums written on vehicle insurance policies were P3,000,000, of which P300,000 was ceded out to reinsurers. By December 31, 20x3, the unearned premium reserve was P960,000. As of December 31, 20x4, an unearned premium reserve amount of P1,200,000 is considered necessary. On December 31, 20x4, the net premium amounted to: Group of answer choices P2,700,000 Nil P9,000,000 P 900,000 29. Mallard Corporation purchased 25 percent of Drake Company's stock in January, 20x5. At the acquisition date, Drake has inventory with a market value P60,000 greater than book value. On that date, Mallard Corporation gives the ability to have joint control with another entity over Drake Company's. Drake expects to sell the inventory during 20x5. Drake has net income of P100,000 and pays P30,000 of dividends. What amount will Mallard's net income change as a result of its investment in Drake? Group of answer choices P10,000 P2,500 P7,500 P25,000 30. Gilbert is a 90 percent subsidiary of Ferrante. On September 1, 20x5, Gilbert sells Ferrante equipment for P72,000. At that date, the equipment has a cost and accumulated depreciation on Gilbert's financial records of P96,000 and P36,600, respectively. The equipment had a remaining life of six years on Gilbert's books and was assigned a life of five years by Ferrante. Gilbert and Ferrante have income in 20x5 of P243,000 and P523,000, respectively. What is the worksheet elimination to the non-controlling interest account if consolidated financial statements are prepared on December 31, 20x6? Group of answer choices P1,260 debit P1,176 credit P1,176 debit P1,260 credit 31. Bishop has a capital balance of P120,000 in a local partnership, and Cotton has a P90,000 balance. These two partners share profits and losses by a ratio of 60 percent to Bishop and 40 percent to cotton. Lovett invests P60,000 in cash in the partnership for a 20 percent ownership. The goodwill (or revaluation of asset) method will be used. What is Cotton's capital balance after this new investment? Group of answer choices P126,000 P102,000 P 99,600 P112,000 32. Jennifer and Robert are partners who are changing their profit and loss ratios from 60/40 to 45/55. At the date of the change, the partners choose to revalue assets with market value different from book value. One asset revalued is land with a book value of P50,000 and a market value of P120,000. Two years after the profit and loss ratio is changed, the land is sold for P200,000. What is the amount of change to Robert's capital account at the date the land is revalued? Group of answer choices P72,000 P28,000 P30,000 P42,000 33. OC signed a contract to provide office services to PQ for one year from 1 October 20x6 for P500 per month. The contract required PQ to make a single payment to OC for all 12 months at the beginning of the contract. OC received P6,000 on October 1, 20x6. What amount of revenue should OC recognize in its statement of profit or loss for the year ended March 31,20x7? Group of answer choices P3,000 profit Nil P 300 P6,000 profit 34. Diller owns 80% of Lake Company common stock. During October 20X4, Lake sold merchandise to Diller for P300,000. On December 31, 20X4, one-half of this merchandise remained in Diller's inventory. For 20X4, gross profit percentages were 30% for Diller and 40% for Lake. The amount of unrealized profit in the ending inventory on December 31, 20X4 that should be eliminated in consolidation is_______ . Group of answer choices P60,000 P32,000 P80,000 P30,000 35. A, B, and C have capital balances of P80,000, P80,000, and P40,000, respectively. Profits are allocated 40% to A, 40% to B and 20% to C. The partners have decided to dissolve and liquidate the partnership. After paying all creditors the amount available for distribution is P20,000. A, and B are personally solvent. C is personally insolvent. Under the circumstances, A and B will each Group of answer choices receive P10,000. receive P6,000. receive P9,000. receive P8,000. 36. Assume that a partnership had assets with a book value of P240,000 and a market value of P195,000, outside liabilities of P70,000, loans payable to partner Able of P20,000, and capital balances for partners Able, Baker, and Chapman of P70,000, P30,000, and P50,000. How much would Able receive upon liquidation of the partnership assuming profits and losses are allocated equally? Group of answer choices P55,000 P90,000 P75,000 P70,000 37. James Dixon, a partner in an accounting firm, decided to withdraw from the partnership. Dixon's share of the partnership profits and losses was 20%. Upon withdrawing from the partnership, he was paid P74,000 in final settlement for his partnership interest. The total of the partners' capital accounts before recognition of partnership goodwill prior to Dixon's withdrawal was P210,000. After his withdrawal, the remaining partners' capital accounts, excluding their share of goodwill, totaled P160,000. The total agreed-upon goodwill (revaluation of asset) of the firm was: Group of answer choices P250,000 P160,000 P120,000 P140,000 38. On January 2, Ken Company purchased a 30 percent interest in Pod Company for P250,000 such interest gives Ken Company the joint control over Pod Company. On this date, the book value of Pod's stockholders' equity was P500,000. The carrying amounts of Pod's identifiable net assets approximated fair values, except for land, whose fair value exceeded its carrying amount by P200,000. Pod reported net income of P100,000 and paid no dividends. Ken accounts for this investment using the equity method. In its December 31 balance sheet, what amount should Ken report for this investment? Group of answer choices P280,000 P270,000 P220,000 P210,000 39. Elizabeth De Leon Insurance Company has one-year vehicle insurance policy with a premium of P37,500 is written on October 1, 20x4 and the risk covered is up to September 30, 20x5 then for an insurer with a financial year that ends on December 31, the unexpired risk period of this policy at the year-end is from January 1, 20x5 to September 30, 20x5. If the insurer has another similar (second) policy (premium of P50,000) that is written on December 1, 20x4. For the Second Policy, the increased in the unearned premium on December 31, 20x4 (with an insurance rate of 35%). On December 31, 20x4, the unearned premium for the first policy: Group of answer choices P28,048 P37,500 P18,750 Nil 40. Gentry Inc. acquired 100% of Gaspard Farms on January 5, 20x3. During 20x3 , Gentry sold Gaspard Farms for P625,000 goods which had cost P425,000. Gaspard Farms still owned 12% of the goods at the end of the year. In 20x4 , Gentry sold goods with a cost of P800,000 to Gaspard Farms for P1,000,000 and Gaspard Farms still owned 10% of the goods at year-end. For 20x4 cost of goods sold was P1,200,000 for Gaspard Farms and 5,400,000 for Gentry. What was consolidated cost of goods sold for 20x4? Group of answer choices P6,600,000 P6,596,000 P5,620,000 P5,625,000 P5,596,000