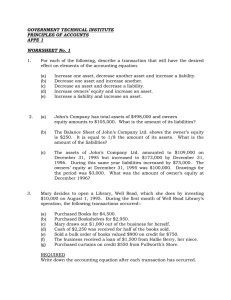

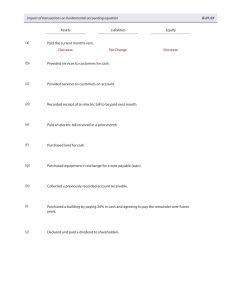

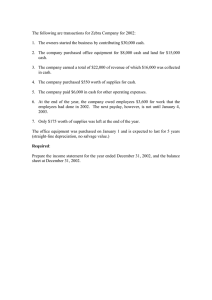

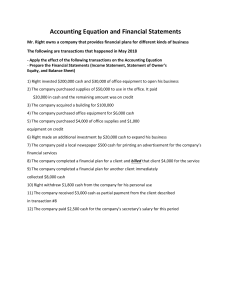

ACT1100 SEMESTER I WORKSHEET No. 1 1. 2. 3. For each of the following, describe a transaction that will have the desired effect on elements of the accounting equation. (a) (b) (c) (d) (e) Increase one asset, decrease another asset and increase a liability. Decrease one asset and increase another. Decrease an asset and decrease a liability. Increase owners’ equity and increase an asset. Increase a liability and increase an asset. (a) John’s Company has total assets of $498,000 and owners equity amounts to $105,000. What is the amount of its liabilities? (b) The Balance Sheet of John’s Company Ltd. shows the owner’s equity is $250. It is equal to 1/8 the amount of its assets. What is the amount of the liabilities? (c) The assets of John’s Company Ltd. amounted to $109,000 on December 31, 1995 but increased to $173,000 by December 31, 1996. During this same year liabilities increased by $75,000. The owners’ equity at December 31, 1995 was $100,000. Drawings for the period was $3,000. What was the amount of owner’s equity at December 1996? Mary decides to open a Library, Well Read, which she does by investing $10,000 on August 1, 1995. During the first month of Well Read Library’s operation, the following transactions occurred:(a) (b) (c) (d) (e) (f) (g) Purchased Books for $4,500. Purchased Bookshelves for $2,950. Mary draws out $1,000 out of the business for herself. Cash of $2,250 was received for half of the books sold. Sold a bulk order of books valued $900 on credit for $750. The business received a loan of $1,500 from Hallie Berry, her niece. Purchased curtains on credit $550 from Fullworth’s Store. REQUIRED Write down the accounting equation after each transaction has occurred. 1 4. For each of the following transactions listed below indicate the effect of each transaction on the current liabilities, profits and current assets of the business. (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) (x) Purchase of machinery $75,000 by way of loan which is repayable over a five (5) year period. Paid $5,000 cash for repairs to building. Cash of $6,795 was withdrawn for private use from the business. Purchase stock on credit $12,000. $15,000 cash was borrowed from the bank. Stock costing $5,000 was sold for $3,500 cash. Sold a van for $1,275 cash. Insurance paid $1,095 cash. Bought a new car $105,000 by cash. Stock purchased for $35,000 cash. 5. Enter these transactions in the appropriate accounts. Oct. 1. 3. 6. 10. 12. 14. 15. 16. 17. 18. 20. 21. 22. 26. 6. Purchased goods for cash $10,400. Purchased goods by cheque $26,200. Purchased goods on credit from Allan $31,100. Returned some faulty goods to Allan received credit note $6,200. Sold goods for cash $21,000. Sold goods to Brown who paid a cheque $6,400. Sold goods to Clive on credit $30,400. Purchased goods from David on credit $29,900 Received a credit note from Allan who had over charged $1,000. Sold goods for cash $13,200. Sold goods on credit to Ray $20,000. Purchased an office desk from Frank on credit $8,000. Purchased goods on credit from David $20,600. Paid David the amount owing by cheque $50,500. The following debtors and creditors existed at 31st October. Dr. Grant $100 Reid Pearson $262 Richard $300 Cr. $150 S. Singh, a dealer in antiques had the following transactions during the month of November. 2 1. 2. 3. 6. 8. 10. 13. 14. 15. 16. 17. 18. 19. Bought antiques for cash at auction $500. Sold antiques to Pearson on credit $320. Bought antiques on credit from Reid $132. Returned faulty antiques to Reid $16. Sold antiques for cash $100. Sold antiques to Grant on credit $70. Pearson paid, on account $100. Gave a credit note to Grant for error in the invoice $3. Bought antiques for cash $120. Sold antiques on credit to Quincy $135. Sold antiques for cash $30. Richard paid the amount due by him. Sold for cash antique chest used for storage of documents $100. REQUIRED: Enter the above transactions in the appropriate accounts. 7. Bill Cashing sets up practice as an architect, investing $10,000 of his own money into the business and effecting a transfer of that sum from his personal account to his business account at the Midland Bank Ltd. The transfer is effected on January 1, 1990, the date on which he formally commenced. The following transactions took place. January 1 January 1 January 1 January 3 January 4 January 7 January 10 January 11 January 17 January 20 January January January January 30 30 30 30 Paid Office rent for January $200. Purchased Office equipment on account from Equipit Ltd. $1,000. Purchased office supplies on account from W. Brown for $150. Hired a junior out of school $100 Survey a property for A. Bond and sent out an invoice for $150. Decided to transfer his own car to the business at a value of $2,000. Bought petrol for $10. Took a client to lunch at a cost of $20 and was asked to prepare plans for a new factory for which work he estimated he would earn $1,200. Conducted another property survey for A. Bond and invoiced him for $60. Took another prospective client to lunch at a cost of $30 and found that he would not be able to undertake work for that client. Paid the office junior his monthly wage $70. Sent a cheque to Equipit Ltd. for $1,000. Sent a cheque to W. Brown for office supplies $150. Banked a cheque received for A. Bond for $50. 3 REQUIRED: Entered these transactions in Bill Cashing’s accounting records and test the arithmetical accuracy of your work by preparing a trial balance when you have completed the entries needed to be made. 8. Harold Davies is the proprietor of a small building firm. He does not understand the term “balance sheet” and asks you to explain to him whether the following items should be on his balance sheet. Indicate the nature of the items (e.g. current asset, long-term liability, not applicable etc.) and give the reason for your answer. (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) (x) stock of sand and cement air compressor purchased for cash air compressor hired for three (3) weeks wages paid to labourer lorry used for transporting materials diesel fuel in lorry fuel tank washing machine bought for Mrs. Davies bank overdraft petty cash in hand $2,000 owing to an uncle who says Harold need not repay until five years have elapsed. 4