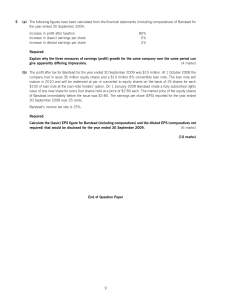

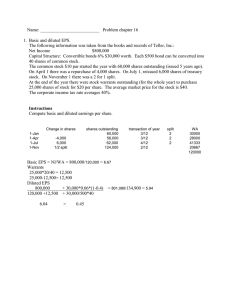

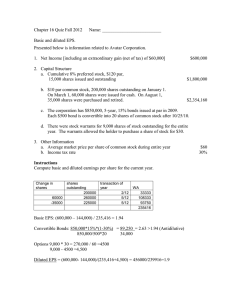

Test Bank, Intermediate Accounting, 14th ed. 197 CHAPTER 19 Earnings Per Share MULTIPLE CHOICE QUESTIONS Theory/Definitional Questions 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 Companies required to supply EPS disclosures Treatment of noncumulative preferred dividends not declared The earnings per share computation reported on the income statement Treatment of dividends on cumulative, nonconvertible preferred stock Items considered when computing diluted EPS Treatment of a stock dividend issued in mid year Diluted EPS is based on assumptions about future transactions Treatment of convertible securities under diluted EPS True/false statements regarding EPS Dilution of options and warrants under treasury stock method Reporting earnings per share information Using the if-converted method with diluted EPS Assumptions of if-converted method of EPS computation Use of the treasury stock method when computing dilutive EPS Computing EPS for a company having different issues of convertible securities and/or stock options and warrants Weighted-average number of shares (midyear events) EPS figures are reported on the income statement Purpose of reporting diluted earnings per share Treatment of interest expense on dilutive convertible debt Computing diluted EPS for a company with a complex capital structure Current GAAP for companies with complex capital structures Current and former GAAP for earnings per share U.S. GAAP vs. international standards Basic EPS and APB Opinion No. 15 Stock options, warrants and rights and EPS calculation Incremental EPS for multiple potential dilutive securities Presentation of EPS for discontinued operations, extraordinary items, and cumulative effect of accounting change 198 Chapter 19 Earnings Per Share Computational Questions 28 Computation of weighted-average number of shares 29 Computation of basic EPS 30 Computation of basic EPS 31 Computation of basic EPS 32 Computation of basic EPS 33 Computation of weighted-average shares for diluted EPS 34 Computation of diluted EPS 35 Computation of diluted EPS 36 Computation of weighted-average shares for diluted EPS 37 Computation of diluted loss per share 38 Computation of shares used for basic and dilutive EPS 39 Computation of weighted-average number of shares for EPS 40 Computation of diluted EPS 41 Computation of diluted EPS 42 Computation of diluted EPS 43 Effect of treasury stock method and warrants on number of shares used 44 Computation of diluted EPS 45 Computation of basic EPS 46 Computation of weighted-average number of shares for diluted EPS 47 Computation of diluted EPS 48 Computation of shares to compute diluted EPS 49 Effect of stock rights on EPS calculation 50 Effect of stock rights on EPS calculation 51 Effect of stock rights on EPS calculation PROBLEMS 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Computation of weighted-average shares and comparative EPS Computation of basic EPS with extraordinary items Computation of dilutive EPS Computation of basic, dilutive EPS Computation of basic, dilutive EPS Computation of weighted-average shares Computation of simple, dilutive EPS Computation of simple, dilutive EPS Computation of basic, dilutive EPS/loss PS Computation of simple, dilutive EPS EPS for complex capital structure Exclusion of nonpublic companies from EPS reporting EPS and stock price maximization Interpreting the price/earnings ratio MULTIPLE CHOICE QUESTIONS Test Bank, Intermediate Accounting, 14th ed. 199 c LO2 1. Earnings per share disclosures are required only for a. companies with complex capital structures. b. companies that change their capital structures during the reporting period. c. public companies. d. private companies. c LO3 2. In computing the earnings per share of common stock, noncumulative preferred dividends not declared should be a. deducted from the net income for the year. b. added to the net income for the year. c. ignored. d. deducted from the net income for the year, net of tax. a LO8 3. Which earnings per share computation should be reported on the face of the income statement? Basic EPS Diluted EPS a. Yes Yes b. Yes No c. No Yes d. No No b LO3 4. When computing earnings per share on common stock, dividends on cumulative, nonconvertible preferred stock should be a. deducted from net income only if the dividends were declared or paid in the current period. b. deducted from net income regardless of whether the dividends were not paid or declared in the period. c. deducted from net income only if net income is greater than the dividends. d. ignored. c LO5 5. In calculating diluted earnings per share, which of the following should not be considered? a. The weighted average number of common shares outstanding b. The amount of dividends declared on cumulative preferred shares c. The amount of cash dividends declared on common shares d. The number of common shares resulting from the assumed conversion of debentures outstanding 200 Chapter 19 Earnings Per Share c LO3 6. What is the correct treatment of a stock dividend issued in mid year when computing the weighted-average number of common shares outstanding for earnings per share purposes? a. The stock dividend should be weighted by the length of time that the additional number of shares are outstanding during the period. b. The stock dividend should be included in the weighted-average number of common shares outstanding only if the additional shares result in a decrease of 3 percent or more in earnings per share. c. The stock dividend should be weighted as if the additional shares were issued at the beginning of the year. d. The stock dividend should be ignored since no additional capital was received. a 7. The EPS computation that is forward-looking and based on assumptions about future transactions is a. diluted EPS. b. basic EPS. c. continuing operations EPS. d. extraordinary EPS. LO2 a LO4 b LO6 8. When computing diluted earnings per share, stock options are a. recognized only if they are dilutive. b. recognized only if they are antidilutive. c. recognized only if they were exercised. d. ignored. 9. Of the following, select the incorrect statement concerning earnings per share. a. During periods when all income is paid out as dividends, earnings per share and dividends per share under a simple capital structure would be identical. b. Under a simple capital structure, no adjustment to shares outstanding is necessary for a stock split on the last day of the fiscal period. c. During a period, changes in stock issued or reacquired by a company may affect earnings per share. d. During a loss period, the amount of loss attributed to each share of common stock should be computed. Test Bank, Intermediate Accounting, 14th ed. c LO4 201 10. In applying the treasury stock method of computing diluted earnings per share, when is it appropriate to use the average market price of common stock during the year as the assumed repurchase price? a. Always b. Never c. When the average market price is higher than the exercise price d. When the average market price is lower than the exercise price d LO8 11. Earnings per share information should be reported for all of the following except a. continuing operations. b. extraordinary gain. c. net income. d. cash flows from operating activities. b LO5 12. When using the if-converted method to compute diluted earnings per share, convertible securities should be a. included only if antidilutive. b. included only if dilutive. c. included whether dilutive or not. d. not included. a LO5 13. The if-converted method of computing EPS data assumes conversion of convertible securities at the a. beginning of the earliest period reported (or at time of issuance, if later). b. beginning of the earliest period reported (regardless of time of issuance). c. middle of the earliest period reported (regardless of time of issuance). d. ending of the earliest period reported (regardless of time of issuance). a 14. When computing dilutive EPS, the treasury stock method can be used for all of the following except a. convertible preferred stock. b. stock warrants. c. stock options. d. stock rights. LO4 202 Chapter 19 Earnings Per Share a 15. For a company having several different issues of convertible securities and/or stock options and warrants, the FASB requires selection of the combination of securities producing a. the lowest possible earnings per share. b. the highest possible earnings per share. c. the earnings per share figure midway between the lowest possible and the highest possible earnings per share. d. any earnings per share figure between the lowest possible and the highest possible earnings per share. LO7 a LO3 16. For purposes of computing the weighted-average number of shares outstanding during the year, a midyear event that must be treated as occurring at the beginning of the year is the a. declaration and issuance of a stock dividend. b. purchase of treasury stock. c. sale of additional common stock. d. issuance of stock warrants. c 17. Where in the financial statements should basic and complex EPS figures for income from continuing operations be reported? a. In the accompanying notes b. In management’s discussion and analysis c. On the income statement d. On the statement of cash flows LO8 d LO2 18. The main purpose of reporting diluted earnings per share is to a. provide a comparison figure for debt holders. b. indicate earnings shareholders will receive in future periods. c. distinguish between companies with a complex capital structure and companies with a simple capital structure. d. show the maximum possible dilution of earnings. b 19. In determining earnings per share, interest expense, net of applicable income taxes, on convertible debt which is dilutive should be a. ignored for diluted earnings per share. b. added back to net income for diluted earnings per share. LO5 Test Bank, Intermediate Accounting, 14th ed. 203 c. deducted from net income for diluted earnings per share. d. none of the above. d LO2 b LO1 20. When computing diluted EPS for a company with a complex capital structure, what is the denominator in the computation? a. Number of common shares outstanding at year-end b. Weighted-average number of common shares outstanding c. Weighted-average number of common shares outstanding plus all other potentially antidilutive securities d. Weighted-average number of common shares outstanding plus all other potentially dilutive securities 21. Under current GAAP, a company with a complex capital structure and potential earnings per share dilution must present a. primary and fully diluted earnings per share. b. basic and diluted earnings per share. c. basic and primary earnings per share. d. basic earnings per share and cash flow per share. c LO1 22. Under current GAAP, common stock equivalents a. are considered in calculating basic earnings per share. b. are considered in calculating primary earnings per share. c. are not considered in calculating basic earnings per share. d. are not considered in calculating fully diluted earnings per share. c LO1 23. Current U.S. GAAP for earnings per share a. are not consistent with the standards for earnings per share promulgated by the Accounting Standards Board of the United Kingdom. b. are not consistent with the standards for earnings per share promulgated by the International Accounting Standards Committee (IASC). c. are consistent both with the U.K. and the International Accounting Standards Committee standards for earnings per share. d. are unique and are not consistent with the standards promulgated by the U.K. Accounting Standards Board, the International Accounting Standards Committee, or any other standard setting body in the world. 204 Chapter 19 Earnings Per Share d LO1 24. Under Accounting Principles Board Opinion No. 15, the historical or basic earnings per share figure for companies with complex capital structures was a. always reported as part of primary earnings per share, but not fully diluted earnings per share. b. always reported as part of fully diluted earnings per share, but not primary earnings per share. c. always disclosed as a separate amount in addition to primary and fully diluted earnings per share. d. never disclosed either in primary or fully diluted earnings per share. c LO7 25. In calculating earning per share, stock options warrants, and rights are a. always dilutive. b. never dilutive. c. dilutive if the exercise price is less than the average market price of the common stock. d. dilutive if the exercise price is more than the average market price of the common stock. b LO7 26. For companies with a complex capital structure, a convertible security is potentially dilutive if a. its incremental EPS is greater than basic EPS after considering any stock options, rights, and warrants. b. its incremental EPS is less than basic EPS after considering any stock options, rights, and warrants. c. its incremental EPS is equal to basic EPS after considering any stock options, rights, and warrants. d. its incremental EPS is less than 1.00 after considering any stock options, rights, and warrants. c LO8 27. An entity that reports a discontinued operation, an extraordinary item, or a cumulative effect of an accounting change shall present basic and diluted earnings per share amounts for those line items a. only on the face of the income statement. b. only in the notes to the financial statements. c. either on the face of the income statement or in the notes to the financial statements. d. only if management chooses to do so as these amounts are note required to be disclosed either in the financial statements or the notes thereto. Test Bank, Intermediate Accounting, 14th ed. c LO3 d LO3 205 28. On December 31, 2002, Superior, Inc. had 600,000 shares of common stock issued and outstanding. Superior issued a 10 percent stock dividend on July 1, 2003. On October 1, 2003, Superior reacquired 48,000 shares of its common stock and recorded the purchase using the cost method of accounting for treasury stock. What number of shares should be used in computing basic earnings per share for the year ended December 31, 2003? a. 612,000 b. 618,000 c. 648,000 d. 660,000 29. At December 31, 2002, the Murdock Company had 150,000 shares of common stock issued and outstanding. On April 1, 2003, an additional 30,000 shares of common stock were issued. Murdock's net income for the year ended December 31, 2003, was $517,500. During 2003, Murdock declared and paid $300,000 in cash dividends on its nonconvertible preferred stock. The basic earnings per common share, rounded to the nearest penny, for the year ended December 31, 2003, should be a. $3.00. b. $2.00. c. $1.45. d. $1.26. d LO3 30. At December 31, 2003 and 2003, Lapham Corp. had 200,000 shares of common stock and 20,000 shares of 5 percent, $100 par value cumulative preferred stock outstanding. No dividends were declared on either the preferred or common stock in 2003 or 2002. Net income for 2003 was $1,000,000. For 2003, basic earnings per common share amounted to a. $5.00. b. $4.75. c. $4.50. d. $4.00. c LO3 31. The Thomas Company's net income for the year ended December 31 was $30,000. During the year, Thomas declared and paid $3,000 in cash dividends on preferred stock and $5,250 in cash dividends on common stock. At December 31, 36,000 shares of common stock were outstanding, 206 Chapter 19 Earnings Per Share 30,000 of which had been issued and outstanding throughout the year and 6,000 of which were issued on July 1. There were no other common stock transactions during the year, and there is no potential dilution of earnings per share. What should be the year’s basic earnings per common share of Thomas, rounded to the nearest penny? a. $0.66 b. $0.75 c. $0.82 d. $0.91 b LO3 d LO4 32. Bay Area Supplies had 60,000 shares of common stock outstanding at January 1. On May 1, Bay Areas Supplies issued 31,500 shares of common stock. Outstanding all year were 30,000 shares of nonconvertible preferred stock on which a dividend of $4 per share was paid in December. Net income for the year was $290,100. Bay Area Supplies should report basic earnings per share for the year of a. $1.86. b. $2.10. c. $2.84. d. $3.17. 33. Landrover, Inc. had 150,000 shares of common stock issued and outstanding at December 31, 2002. On July 1, 2003, an additional 25,000 shares of common stock were issued for cash. Landrover also had unexercised stock options to purchase 20,000 shares of common stock at $15 per share outstanding at the beginning and end of 2003. The market price of Landrover's common stock was $20 throughout 2003. What number of shares should be used in computing diluted earnings per share for the year ended December 31, 2003? a. 182,500 b. 180,000 c. 177,500 d. 167,500 Test Bank, Intermediate Accounting, 14th ed. 207 b LO4 34. Glendale Enterprises had 200,000 shares of common stock issued and outstanding at December 31, 2002. On July 1, 2003, Glendale issued a 10 percent stock dividend. Unexercised stock options to purchase 40,000 shares of common stock (adjusted for the 2003 stock dividend) at $20 per share were outstanding at the beginning and end of 2003. The market price of Glendale's common stock (which was not affected by the stock dividend) was $25 per share during 2003. Net income for the year ended December 31, 2003, was $1,100,000. What should be Glendale's 2003 diluted earnings per common share, rounded to the nearest penny? a. $4.23 b. $4.82 c. $5.00 d. $5.05 b LO5 35. On January 2, 2002, Worley Co. issued at par $50,000 of 4 percent bonds convertible, in total, into 5,000 shares of Worley's common stock. No bonds were converted during 2002. Throughout 2002 Worley had 5,000 shares of common stock outstanding. Worley's 2002 net income was $5,000. Worley's income tax rate is 40 percent. No potentially dilutive securities other than the convertible bonds were outstanding during 2002. Worley's diluted earnings per share for 2002 would be a. $0.58. b. $0.62. c. $0.70. d. $1.16. 208 Chapter 19 Earnings Per Share d 36. At December 31, 2002, Dayplanner Inc. had 250,000 shares of common stock outstanding. On October 1, 2003, an additional 60,000 shares of common stock were issued for cash. Dayplanner also had 2,000,000 of 8 percent convertible bonds outstanding at December 31, 2003, which are convertible into 50,000 shares of common stock. The bonds are dilutive in the 2003 earnings per share computation. No bonds were issued or converted into common stock during 2003. What is the number of shares that should be used in computing diluted earnings per share for the year ended December 31, 2003? a. 265,000 b. 300,000 c. 310,000 d. 315,000 LO5 b LO6 c LO5 37. The JVB Corporation had 200,000 shares of common stock and 10,000 shares of cumulative, $6 preferred stock outstanding during 2003. The preferred stock is convertible at the rate of three shares of common per share of preferred. For 2003, the company had a $60,000 net loss from operations and declared no dividends. JVB should report 2003 diluted loss per share of (rounded to the nearest cent) a. $(0.30). b. $(0.52). c. $(0.58). d. $(0.60). 38. Zacor Incorporated has 2,500,000 shares of common stock outstanding on December 31, 2002. An additional 500,000 shares of common stock were issued April 1, 2003, and 250,000 more on July 1, 2003. On October 1, 2003, Zacor issued 5,000, $1,000 face value, 7 percent convertible bonds. Each bond is convertible into 40 shares of common stock. No bonds were converted into common stock in 2003. What is the number of shares to be used in computing basic earnings per share and diluted earnings per share, respectively? a. 2,875,000 and 2,925,000 b. 2,875,000 and 3,075,000 c. 3,000,000 and 3,050,000 Test Bank, Intermediate Accounting, 14th ed. 209 d. 3,000,000 and 3,200,000 b LO3 39. Shoemaker Company had 1,000 common shares issued and outstanding at January 1. During the year, Shoemaker also had the common stock transactions listed below. April 1 Issued 300 previously unissued shares May 1 Split the stock 2-for-1 June 30 Purchased 100 shares for the treasury July 30 Distributed a 20 percent stock dividend December 31 Split the stock 3-for-1 Given this information, what is the weighted-average number of shares that Shoemaker should use for earnings per share purposes? a. 2,880 b. 8,640 c. 8,820 d. 9,720 c LO5 40. During its fiscal year, Richards' Distributing had net income of $100,000 (no extraordinary items) and 50,000 shares of common stock and 10,000 shares of preferred stock outstanding. Richards declared and paid dividends of $.50 per share to common and $6.00 per share to preferred. The preferred stock is convertible into common stock on a share-for-share basis. For the year, Richards Distributing should report diluted earnings (loss) per share of a. $(0.80). b. $1.00. c. $1.67. d. $2.67. c 41. At December 31, 2002, the Roberts Company had 700,000 shares of common 210 Chapter 19 Earnings Per Share LO5 stock outstanding. On September 1, 2003, an additional 300,000 shares of common stock were issued. In addition, Roberts had $20,000,000 of 8 percent convertible bonds outstanding at December 31, 2002, which are convertible into 400,000 shares of common stock. No bonds were converted into common stock in 2003. The net income for the year ended December 31, 2003, was $6,000,000. Assuming the income tax rate was 40 percent, what should be the diluted earnings per share for the year ended December 31, 2003? a. $5.00 b. $5.53 c. $5.80 d. $8.30 c 42. The 2003 net income of Atwater Inc. was $200,000 and 100,000 shares of its common stock were outstanding during the entire year. In addition, there were outstanding options to purchase 10,000 shares of common stock at $10 per share. These options were granted in 2000 and none had been exercised by December 31, 2003. Market prices of Atwater's common stock during 2003 were January 1.................................................... $20 per share December 31.............................................. $40 per share Average Price............................................. $25 per share LO4 The amount that should be shown as Atwater's diluted earnings per share for 2003 (rounded to the nearest cent) is a. $2.00. b. $1.95. c. $1.89. d. $1.86. d LO4 43. Warrants exercisable at $20 each to obtain 20,000 shares of common stock were outstanding during a period when the average and year-end market price of the common stock was $25. Application of the treasury stock method for the assumed exercise of these warrants in computing diluted earnings per share will increase the weighted-average number of outstanding common shares by a. 20,000. b. 16,667. c. 16,000. d. 4,000. Test Bank, Intermediate Accounting, 14th ed. b LO6 211 44. The following information relates to the capital structure of Metcalf Corp.: 12/31/02 12/31/03 Outstanding shares: Common stock.............................................. 180,000 180,000 Preferred stock, convertible into 60,000 shares of common......................................... 60,000 60,000 10% convertible bonds, convertible into 40,000 shares of common............................ $2,000,000 $2,000,000 During 2003 Metcalf paid $90,000 in dividends on the preferred stock. Metcalf's net income for 2003 was $1,960,000 and the income tax rate was 40 percent. For the year ended December 31, 2003, the diluted earnings per share is a. $7.29. b. $7.43. c. $8.17. d. $8.29. a LO5 45. At December 31, 2002, Lefton, Inc. had 600,000 shares of common stock outstanding. On April 1, 2003, an additional 180,000 shares of common stock were issued for cash. Lefton also had $5,000,000 of 8% convertible bonds outstanding at December 31, 2003, which are convertible into 150,000 shares of common stock. The bonds are dilutive in the 2003 EPS computation. No bonds were issued or converted into common stock during 2003. What is the number of shares that should be used in computing basic earnings per share for 2003? a. 735,000 b. 780,000 c. 885,000 d. 910,000 212 Chapter 19 Earnings Per Share c LO5 46. At December 31, 2002, Lefton, Inc. had 600,000 shares of common stock outstanding. On April 1, 2000, an additional 180,000 shares of common stock were issued for cash. Lefton also had $5,000,000 of 8% convertible bonds outstanding at December 31, 2003, which are convertible into 150,000 shares of common stock. The bonds are dilutive in the 2000 EPS computation. No bonds were issued or converted into common stock during 2003. What is the number of shares that should be used in computing diluted earnings per share for 2003? a. 735,000 b. 780,000 c. 885,000 d. 910,000 b 47. Datatec, Inc., had 400,000 shares of $20 par common stock and 40,000 shares of $100 par, 6% cumulative, convertible preferred stock outstanding for the entire year ended December 31, 2003. Each share of the preferred stock is convertible into 5 shares of common stock. Datatec's net income for 2003 was $1,680,000. For the year ended December 31, 2003, the diluted earnings per share is a. $2.40. b. $2.80. c. $3.60. d. $4.20. LO5 b LO5 48. On December 31, 2001, Feterik Company had 7,000 shares of common stock issued and outstanding. On April 1, 2002, an additional 1,000 shares of common stock were issued and on July 1, 500 more shares were issued. On October 1, 2002, Feterik issued 10, $1,000 maturity value, 8% convertible bonds. Each bond is convertible into 40 shares of common stock. No bonds were converted into common stock in 2002. Assuming there are no antidilutive securities, what is the number of shares Feterik should use to compute diluted earnings per share for the year ended December 31, 2002? a. 7,950 b. 8,100 c. 8,150 d. 8,400 Test Bank, Intermediate Accounting, 14th ed. 213 The following information relates to questions 49-51: James Corporation currently has stock rights outstanding for 2,000 common shares. The exercise price of these shares is $20. The options were issued in January of 2000. The average market price of the related common stock during the year 2000 was $25. The average market price of the related common stock during 2001 was $21 and during 2002 was $19. The company’s fiscal year ends on December 31 of each year. d LO7 49. How should these stock rights be treated in earnings per share calculations for the year ending December 31, 2000? a. The stock options are antidilutive and should not be included either in basic and diluted earnings per share. b. The stock options are dilutive and should be included both in basic and diluted earnings per share. c. The stock options are dilutive and should be included both in basic and diluted earnings per share in the amount of 400 shares. d. The stock options are dilutive and should be included only in diluted earnings per share in the amount of 400 shares. b 50. How should these stock rights be treated in the earnings per share calculation for the year ending December 31, 2002? a. The stock options are antidilutive and should not be included either in basic or diluted earnings per share. b. The stock options are dilutive and should be included in diluted earnings per share in the amount of 95 shares. c. The stock options are dilutive and should be included in diluted earnings per share in the amount of 2,000 shares. d. The stock options are dilutive and should be included in diluted earnings per share in the amount of 400 shares. LO7 a LO7 51. How should these stock rights be treated in the earnings per share calculation for the year ending December 31, 2003? a. The stock options are antidilutive and should not be included with in basic or diluted earnings per share. b. The stock options are dilutive and should be included in diluted earnings per share in the amount of 105 shares. c. The stock options are dilutive and should be included in diluted earnings per share in the amount of 2,000 shares. 214 Chapter 19 Earnings Per Share d. The stock options are dilutive and should be included in diluted earnings per share in the amount of 400 shares. PROBLEMS Problem 1 On December 31, 2001, Jamfest Travel Inc. had 450,000 shares of no-par common stock issued and outstanding. All shares were sold for $7.50. On June 30, 2002, the firm issued an additional 135,000 shares for $7 per share. The 2002 income was $319,200. On September 1, 2003, a 15 percent stock dividend was issued to all common shareholders. On October 1, 2003, 60,000 shares were reacquired as treasury shares. Net income in 2003 was $278,063. (1) Compute the weighted-average number of common shares outstanding for 2002 and 2003 that should be shown on comparative statements at the end of 2003. (2) Compute the basic earnings per share in 2002 and 2003 to be reported on comparative statements at the end of 2003. Solution 1 LO3 (1) 2002: 450,000 x 12/12 x 1.15 = 517,500 135,000 x 6/12 x 1.15 = 77,625 595,125 shares 2003: 585,000 x 12/12 x 1.15 = 672,750 (60,000) x 3/12 = (15,000) 657,750 (2) 2002: ($319,200 / 595,125) = $.54 (rounded) 2003: ($278,063 / 657,750) = $.42 (rounded) Problem 2 The income statement of Micro Computers, Inc. showed the following information on December 31, 2003. Income before income tax..................................................... $1,472,000 Income tax expense............................................................... 441,600 Income from continuing operations....................................... $1,030,400 Extraordinary loss (net of tax savings).................................. (100,000) Net income............................................................................. $ 930,400 Compute earnings per share figures for common stock under the assumption that Micro Computer Inc. has (1) 320,000 shares of $24 par value common stock outstanding. (2) 9,600 shares of $100, par 8% cumulative preferred stock, and 240,000 shares of no-par common stock. Dividends are not in arrears. Note: Assumption (1) is independent of (2). Solution 2 LO3 (1) EPS--continuing operations EPS--extraordinary items EPS $3.22 * (.31)** $2.91 (rounded) *$1,030,400/320,000 = $3.22 **$(100,000)/320,000 = $(.31) (2) EPS--continuing operations EPS--extraordinary items EPS $3.97* (.42)** $3.55 *[$1,030,400 - ($8.00 x 9,600)] / 240,000 = ($1,030,400 - $76,800) / 240,000 = $3.97 **(100,000) / 240,000 = $(.42) Problem 3 During 2003, the Ellis Corporation had 370,000 shares of $20 par common stock outstanding. On January 1, 2003, 2,000, 8 percent bonds were issued with a maturity value of $1,000 each. To enhance the bond sale, the company offered a conversion of 50 shares of common stock for each bond at the option of the purchaser. Net income for 2003 was $464,000. The income tax rate was 30 percent. Compute the diluted earnings per share of common stock. Solution 3 LO5 Diluted EPS = ($464,000 + $160,000 - $48,000) / (370,000 + 100,000) = $576,000 / 470,000 = $1.23 (rounded) Problem 4 During 2003, Wright Corp. had outstanding 125,000 shares of common stock and 7,500 shares of noncumulative, 8 percent, $50 par preferred stock. Each preferred share is convertible into 8 shares of common stock. In 2003, net income was $231,500. (1) Compute basic and diluted earnings per share for 2003 assuming no dividends were declared or paid. (2) Compute basic and diluted earnings per share for 2003 assuming dividends were declared and paid on the preferred stock. Solution 4 LO3 (1) BEPS DEPS (2) BEPS DEPS = ($231,500 / 125,000) = $1.85 (rounded) = $231,500 / [125,000 + (8 x 7,500)] = $231,500 / 185,000 = $1.25 (rounded) = ($231,500 - 30,000) / 125,000 = $1.61 (rounded) = $231,500 / (125,000 + 60,000) = $231,500 / 185,000 = $1.25 (rounded) Problem 5 On December 31, 2003, Masters Inc. had outstanding 180,000 shares of common stock. Net income for 2003 was $285,000. Outstanding options (granted July 1, 2003) to purchase 15,000 shares of common stock at $20 per share had not been exercised by December 31, 2003. During 2003, market prices for the common stock were: July 1, 2003...................................................................... December 31, 2003.......................................................... Average market................................................................ (1) Compute the basic earnings per common share in 2003. (2) Compute the diluted earnings per common share in 2003. $18 per share $32 per share $25 per share Solution 5 LO4 (1) BEPS = $285,000 / 180,000 = $1.58 (rounded) (2) DEPS = $285,000 / [180,000 + ½ (15,000 - 12,000*)] = $285,000 / 181,500 = $1.57 (rounded) * $300,000/$25 = 12,000 shares Problem 6 Data Controls Inc. had 250,000 shares of common stock outstanding at the end of 2001. During 2002 and 2003, the following transactions took place. 2002 March 1 July 24 October 1 December 1 Sold 24,000 shares Issued a 20 percent stock dividend Sold 16,000 shares Purchased 15,000 shares to be held in treasury 2003 June 1 September 1 3-for-1 stock split Sold 60,000 shares Data Controls Inc. has a simple capital structure. Compute the weighted average number of shares for 2002 and 2003 to be used in the earnings per share computation for comparative financial statements at the end of 2003. Solution 6 LO3 2002 January 1 March 1 October 1 December 1 2003 January 1 September 1 250,000 x 12/12 x 1.20 x 3 = 24,000 x 10/12 x 1.20 x 3 = 16,000 x 3/12 x 3 = (15,000) x 1/12 x 3 = 329,800* x 12/12 x 3 = 60,000 x 4/12 = 900,000 72,000 12,000 (3,750) 980,250 989,400 20,000 1,009,400 *2002 January 1 March 1 July 24 October 1 December 1 Issuance 20% stock dividend Issuance Treasury stock 250,000 24,000 54,800 16,000 (15,000) 329,800 Problem 7 The following is a partial balance sheet for Anderson Corp. for the year ended December 31, 2002. 9 percent Convertible Bonds (issued at par)................................... $1,800,000 Common Stock, 180,000 shares issued and outstanding, $50 par. $9,000,000 (a) (b) (c) (d) Each $1,000 convertible bond can be converted into 80 shares of common stock. On September 1, 2003, one-third of the convertible debt was converted into common stock. Anderson reported net income of $1,550,000 in 2003. The income tax rate was 30 percent. No other stock transactions took place during 2003. (1) Compute basic earnings per share for 2003. (2) Compute diluted earnings per share for 2003. Solution 7 LO6 (1) BEPS = $1,550,000 / [180,000 + (4/12 x 48,000)] = $1,550,000 / 196,000 = $7.91 (rounded) Conversion (600 bonds x 80) = 48,000 shares (2) DEPS = $1,550,000 + ($144,000 x 0.7) / 196,000 + 128,000 = $1,650,800 / 324,000 = $5.10 Interest Avoided $1,200,000 x 9% x 12/12 = $ 600,000 x 9% x 8/12 = Equivalent Shares 1,200 bonds x 12/12 x 80 = 600 bonds x 80 x 8/12 = $108,000 36,000 $144,000 96,000 32,000 128,000 Problem 8 The Stanley Corp. provides the following data for 2003. Transactions in common stock: January 1, 2003, beginning balance............................... 300,000 shares April 1, 2003, issuance.................................................... 100,000 shares 8% $100 par nonconvertible cumulative preferred stock....... Issued at par $100,000 6% $100 par convertible cumulative preferred stock............. Issued at $105 Convertible into 20,000 shares $200,000 Stock options.......................................................................... Option price...................................................................... Average market................................................................ Year-end market............................................................... 60,000 shares $25 $35 $40 The net income for 2003 is $2,300,000. The company's tax rate is 30 percent. No conversions or options were exercised during 2003. (1) Compute basic earnings per share. (2) Compute diluted earnings per share. Solution 8 LO9 (1) BEPS (2) DEPS = ($2,300,000 - $8,000 - $12,000) / [300,000 + 9/12 (100,000)] = $2,280,000 / 375,000 = $6.08 = ($2,300,000 - $8,000) / (375,000 + 20,000 + 60,000 - 42,857) = $2,292,000 / 412,143 = $5.56 Options = 60,000 x $25 = $1,500,000 $1,500,000/$35 = 42,857 Problem 9 At December 31, 2002, Rollins Inc. had 400,000 shares of common stock outstanding. The company also had 40,000 shares of $7 convertible preferred stock. Each share is convertible into 4 shares of common stock. (Dividends were declared and paid.) Transactions during 2003: July 1, 2003 July 8, 2003 September 1, 2003 October 1, 2003 Sold 200,000 shares Declared 100% stock dividend Sold 120,000 shares Purchased 60,000 shares to be held in treasury Rollins Inc. reported a loss of $670,000 for 2003. (1) Compute basic earnings (loss) per share. (2) Compute diluted earnings (loss) per share. Solution 9 LO6 Weighted-average computation: January 1, 2003 400,000 x 12/12 x 2 = 800,000 July 1, 2003 200,000 x 6/12 x 2 = 200,000 September 1, 2003 120,000 x 4/12 = 40,000 October 1, 2003 (60,000) x 3/12 = (15,000) 1,025,000 (1) BEPS = [$(670,000) - $280,000] / 1,025,000 = ($950,000) / 1,025,000 = $(.93) (2) DEPS = $(670,000) / (1,025,000 + 160,000) = $(670,000) / 1,185,000 = $(.57) * *The convertible preferred stock is antidilutive. Rollins would report a loss per common share of $.93 for 2000. Problem 10 During all of 2002, Dawson Manufacturing Company had 950,000 shares of common stock outstanding. On June 30, 2002, the company issued 10,000 7 percent convertible bonds at par. The maturity value of each bond is $1,000. Each bond is convertible into 20 shares of common stock. None were converted during 2002. Dawson also had 60,000 stock warrants outstanding for all of 2002. The option price is $10 per share. The market price of the common stock was $40 on December 31, 2002, and the average market price for 2002 was $30. Dawson reported a net income of $3,650,000 for 2002. Assume the company had a 40 percent income tax rate. (1) Compute the basic earnings per share. (2) Compute diluted earnings per share. Solution 10 LO9 (1) BEPS = $3,650,000 / 950,000 = $3.84 (rounded) (2) DEPS = ($3,650,000 + 350,000 - 140,000) / [950,000 + 6/12 (200,000) + (60,000 - 20,000)] = $3,860,000 / 1,090,000 = $3.54 (rounded) Bonds--dilutive: ($10,000,000 x .07 x .60) / (10,000 x 20) = $2.10 $2.10 < $3.84 Incremental shares = 10,000 x 20 = 200,000 Interest avoided = $10,000,000 x 7% x 6/12 = $350,000 Tax savings on interest = $350,000 x 0.40 = $140,000 Stock options--dilutive Proceeds $10 x 60,000 = $600,000 $600,000 / $30 = 20,000 shares Incremental shares = 60,000 - 20,000 = 40,000 Problem 11 At December 21, 2002, EMD Company had 500,000 shares of common stock outstanding. EMD sold 50,000 shares on October 1, 2003. Net income for 2003 was $2,417,875; the income tax rate was 30%. In addition, EMD had the following debt and equity securities on its books on December 31, 2002: (a) 18,000 shares of $100 par, 12% cumulative preferred stock. (b) 28,000 shares of $100 par, 10% cumulative preferred stock, par $100, sold at 110. Each share of preferred stock is convertible into 2 shares of common stock. (c) $2,000,000 face value of 9% bonds sold at par. (d) $3,000,000 face value of 7% convertible bonds sold to yield 8%. Unamortized bond discount is $100,000 at December 31, 2002. Each $1,000 bond is convertible into 20 shares of common stock. Options to purchase 10,000 shares of common stock were issued May 1, 2003. Exercise price is $30 per share; market value at date of option was $29; average market value May 1 to December 31, 2003, was $40. Compute the earnings per share amounts for the year ended December 31, 2003. Solution 11 LO9 1. Computation of basic earnings per share: Net income.................................................................. Less: Dividends on cumulative preferred stock: 18,000 x $100 x .12............................................$216,000 28,000 x $100 x .10............................................ 496,000 Net income identified with common stock.......................... $1,921,875 Weighted average number of shares: Jan. 1 to Oct. 1 (500,000 x ¾).................................... 375,000 Oct. 1 to Dec. 31 (550,000 x ¼)................................. 137,500 Total.................................................................... 512,500 Basic earnings per share.................................................... $3.75 2. Computation of diluted earnings per share: Test for dilution of convertible securities: $2,417,875 280,000 Net Income Number of Incremental 7% Convertible bonds.......................... 10% Convertible preferred stock.......... Impact $168,000 * 280,000 Shares 60,000 56,000 EPS $2.80 5.00 $3,000,000 x .08 x .70 = $168,000; effective interest is amount charged to interest expense, not interest paid. Since only the convertible bonds are less than the basic earnings per share of $3.75, only the convertible bonds are potentially dilutive. * Net Description Income Basic earnings per share $1,921,875 May 1, 2003, options as if exercised May 1, 2003: Number of shares assumed issued: 10,000 Number of treasury shares (10,000 x $30) $40 (7,500) $1,921,875 7% convertible bonds 168,000 Diluted earnings per share $2,089,875 Number of Shares 2,500 Part of Year 8/12 Weighted Average 512,500 EPS $3.75 1,667 514,167 $3.74 60,000 574,167 $3.64 Problem 12 Statement of Financial Accounting Standards No. 128, “Earnings Per Share,” requires that earnings per share figures be presented only by companies with publicly held common stock or potential common stock. List arguments for and against the exclusion of nonpublic companies from the requirement of reporting earnings per share. Solution 12 LO8 Perhaps the major argument for not requiring earnings per share for nonpublic enterprises relates to the issue of standards overload. Authoritative accounting pronouncements have increased both in quantity and complexity. Managers of small companies believe that the cost of complying with complex standards exceeds the value of the benefits derived from the information disclosed under these standards. Small firms having limited resources cannot afford the enormous cost of complying with complex and costly standards that require information of questionable value. A major argument for requiring earnings per share information even for nonpublic companies is the fact that many enterprises exempted from the requirement are neither small nor closely held. Many nonpublic enterprises are large and complex entities whose financial reports are widely distributed. Such enterprises may be in direct competition with enterprises whose securities are traded in public markets. Suspension of the requirement for reporting earnings per share for some enterprises in an industry, but not for others, is not sustainable solely on the basis of differences in form of ownership. Arguments regarding the cost and benefits of pronouncements are problematical because costs of applying a standard may be identified, but valuing the benefits derived is difficult. The increasing complexity of business transactions suggests that the statement reader should be provided with as much information as possible in order to make an informed decision about the financial condition of the enterprise and the integrity and stewardship of management. If the standards relating to earnings per share and other matters are complex, it is only because the standards are reflecting the complexity of the transactions. Problem 13 You are an independent CPA and have just acquired a new client, A. Dunn Manufacturing Company. The president of the company recently read an article advising a firm’s management team to seek to maximize the long-run value of the firm’s stock. The article mentioned profit maximization, earnings per share, and the role of these two factors in stock price maximization. The president wants your advice on how the choice of inventory cost flow methods (e.g., FIFO vs. LIFO) relates to profit maximization, earnings per share, and stock price maximization. Solution 13 LO8 The objective of a firm is not to maximize earnings per share or the accounting definition of profit. The correct objective is to maximize shareholder wealth, which is the price per share that is equivalent to the discounted cash flows of the firm. Maximizing earnings per share may actually result in a reduction in cash flows. For example, earnings per share during a period of rising prices would be higher for a firm that adopts FIFO inventory accounting rather than LIFO. FIFO matches older, lower costs against current revenues, resulting in a higher net income and higher earnings per share. LIFO would produce lower net income and earnings per share because more recent, higher costs are matched against current revenues. Nevertheless, FIFO is the wrong choice in a period of rising prices because it minimizes cash flow by maximizing taxes. LIFO should be chosen because it provides higher cash flows as a result of reducing income and thus reducing taxes. Since shareholders are concerned about discounted cash flow, they will assign a higher value to the shares of a company that uses LIFO accounting. Problem 14 The price-earnings ratio frequently is used by analysts and investors for evaluating stock prices because it relates the earnings of the business to the current market price of the stock. The ratio is computed by dividing the market price per share by the earnings per share before extraordinary items. Explain how the price-earnings ratio should be interpreted, including any problems associated with the interpretation of the ratio. Solution 14 LO8 A stock selling at a high price-earnings ratio generally is regarded favorably by analysts. A high ratio shows that investors believe that the firm has good growth opportunities and that the firm’s earnings are relatively safe. The lower risk of the earnings lowers the discount rate used in discounting future earnings to the present thus raising the present value of these discounted future cash flows and raising the stock price as a result. Nonetheless, a firm could have a high priceearnings ratio, not because stock price is high, but because earnings are low. A major problem with the price-earnings ratios is the use of earnings per share in the denominator. Earnings per share reflect the somewhat arbitrary choices of accounting principles used to determine earnings. A firm’s reported earnings could be changed substantially by the adoption of more conservative or less conservative accounting procedures. An additional problem with the price-earnings ratio is that only at the end of the fiscal year are the numerator and denominator measured as of the same date. The price-earnings ratio often is computed during the year using the earnings per share amount from the most recent financial statements or by using a moving quarterly average. CHAPTER 19 -- QUIZ A Name _________________________ Section ________________________ T F 1. When the market price of stock options, warrants, and rights is higher than the current option price, exercise might occur; therefore, there is potential dilution from these securities and they would be included in the computation of diluted earnings per share. T F 2. In order to compute diluted earnings per share when convertible debt exists, adjustments must be made both to net income (numerator) and to the number of shares of common stock outstanding (denominator). T F 3. When a company has only common stock outstanding, but there are convertible securities, stock options, warrants, or other rights outstanding, it is never classified as a company with a simple capital structure. T F 4. The term “complex capital structure” describes a company with outstanding stock options, warrants, convertible securities, etc., which are materially dilutive. T F 5. When earnings per share are diluted as a result of the inclusion of outstanding options and warrants, the average market price of the common stock at the end of the period is used in computing the number of shares assumed to be reacquired. T F 6. Nonconvertible preferred stock is excluded from consideration in the determination of basic earnings per share during periods where dividends on preferred stock are declared. T F 7. Retroactive treatment of common stock dividends and splits is required for all periods' earnings per share data presented in the financial statements. T F 8. If preferred stock dividends are cumulative, the full amount of the annual dividends should be deducted from net income in the determination of basic earnings per share, whether or not the dividends have been declared. T F 9. Any security whose exercise or conversion would increase earnings per share or reduce loss per share are referred to as antidilutive securities. T F 10. When a convertible bond is included in the determination of diluted earnings per share, net income is adjusted by adding back the interest expense, and the number of shares of common stock outstanding is increased by the number of shares that would have been issued upon conversion. 226 CHAPTER 19 -- QUIZ B A. B. C. D. E. F. G. Name _________________________ Section ________________________ Incremental shares Dilutive securities Treasury stock method Basic earnings per share Simple capital structure If-converted method Antidilutive security H. I. J. K. Primary earning per share Convertible securities Complex capital structure Diluted earnings Select the term that best fits each of the following definitions and descriptions. Indicate your answer by placing the appropriate letter in the space provided ____ 1. Securities whose assumed exercise or conversion results in a reduction in earnings per share or an increase in loss per share. ____ 2. Securities, such as bonds and preferred stock, whose terms permit the holder to change the investment into the common stock. ____ 3. Used to adjust the earnings per share computation to consider the impact of the possible conversion of convertible securities. ____ 4. A company having only common or common and preferred stock. ____ 5. A company with potential earnings per share dilution. ____ 6. The number of shares issued upon exercising an option or warrant less the assumed number of shares reacquired after applying the treasury stock method of stock reacquisition. ____ 7. Securities whose assumed conversion or exercise results in an increase in earnings per share or a decrease in a loss per share. ____ 8. The amount of earnings attributable to each share of common stock outstanding, including common stock equivalents. This amount is no longer reported under FASB Statement No. 128. ____ 9. A method of recognizing the use of proceeds that would be obtained upon exercise of options and warrants in computing earnings per share. ____ 10. Net income divided by weighted-average number of shares outstanding. 227 CHAPTER 19 -- QUIZ SOLUTIONS Quiz A 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. T T F T F F T T T F Quiz B 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. B I F E J A G H C D (This page is left blank intentionally.)