COMMENTS FOR TAX REFORM Dear Sir,

advertisement

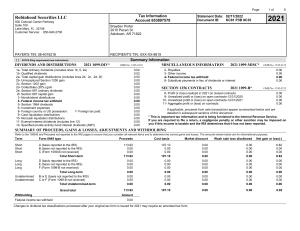

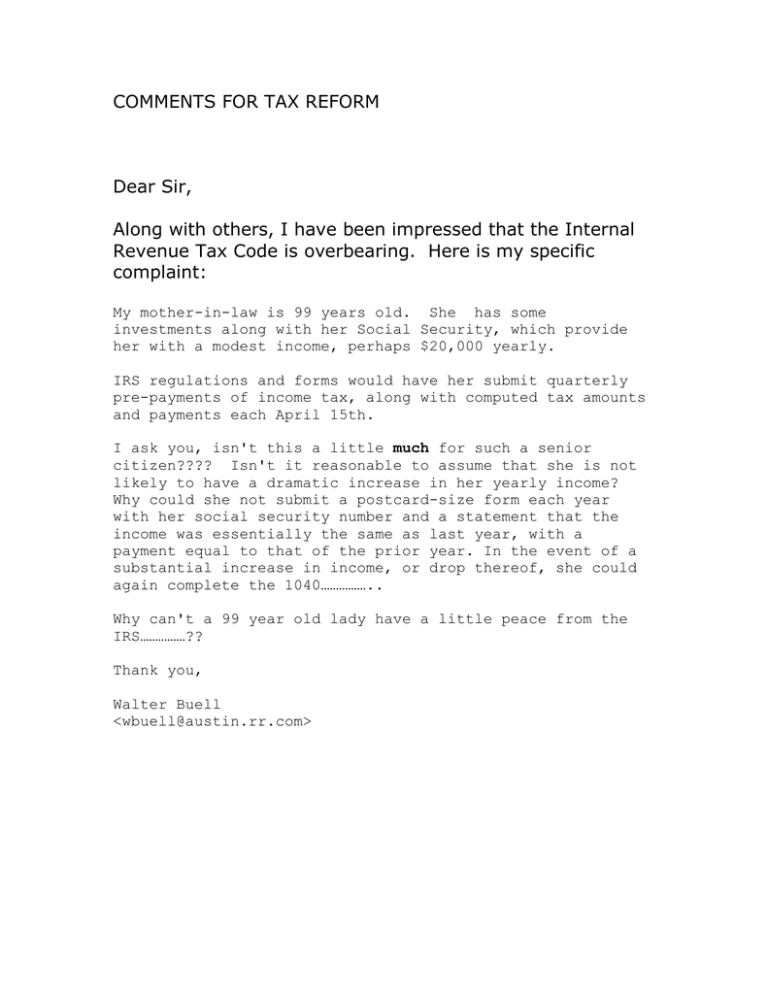

COMMENTS FOR TAX REFORM Dear Sir, Along with others, I have been impressed that the Internal Revenue Tax Code is overbearing. Here is my specific complaint: My mother-in-law is 99 years old. She has some investments along with her Social Security, which provide her with a modest income, perhaps $20,000 yearly. IRS regulations and forms would have her submit quarterly pre-payments of income tax, along with computed tax amounts and payments each April 15th. I ask you, isn't this a little much for such a senior citizen???? Isn't it reasonable to assume that she is not likely to have a dramatic increase in her yearly income? Why could she not submit a postcard-size form each year with her social security number and a statement that the income was essentially the same as last year, with a payment equal to that of the prior year. In the event of a substantial increase in income, or drop thereof, she could again complete the 1040…………….. Why can't a 99 year old lady have a little peace from the IRS……………?? Thank you, Walter Buell <wbuell@austin.rr.com>

![-----Original Message----- From: Pitman Buck [ ]](http://s2.studylib.net/store/data/015588101_1-8341f4e78372efe89d0546692b0e70b5-300x300.png)