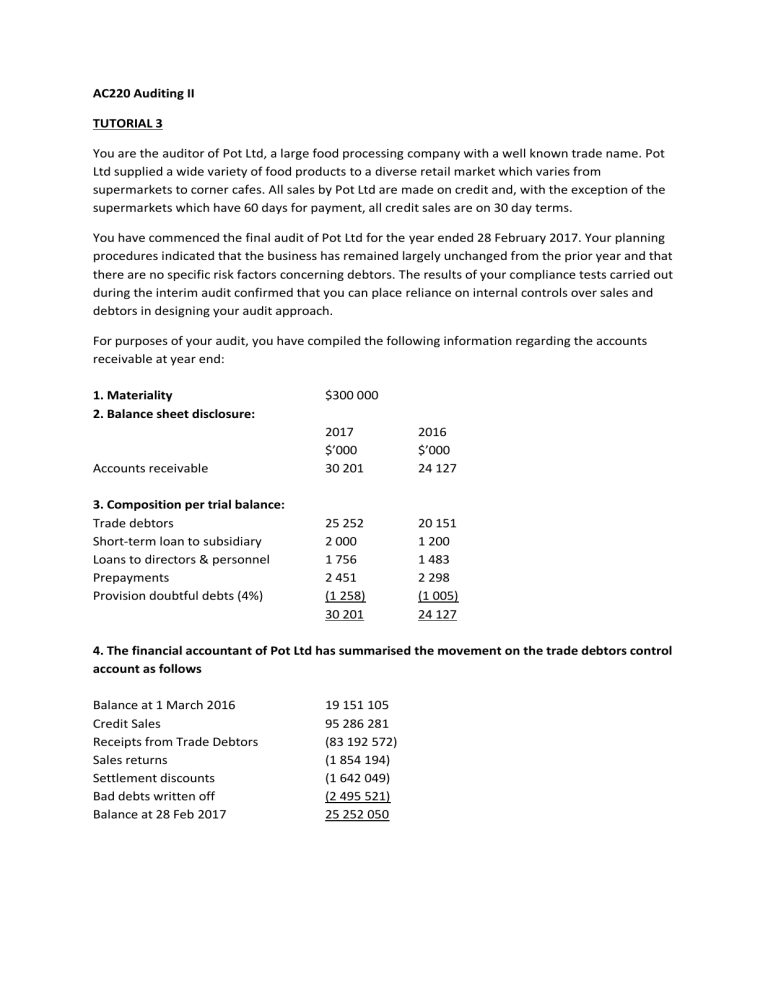

AC220 Auditing II TUTORIAL 3 You are the auditor of Pot Ltd, a large food processing company with a well known trade name. Pot Ltd supplied a wide variety of food products to a diverse retail market which varies from supermarkets to corner cafes. All sales by Pot Ltd are made on credit and, with the exception of the supermarkets which have 60 days for payment, all credit sales are on 30 day terms. You have commenced the final audit of Pot Ltd for the year ended 28 February 2017. Your planning procedures indicated that the business has remained largely unchanged from the prior year and that there are no specific risk factors concerning debtors. The results of your compliance tests carried out during the interim audit confirmed that you can place reliance on internal controls over sales and debtors in designing your audit approach. For purposes of your audit, you have compiled the following information regarding the accounts receivable at year end: 1. Materiality 2. Balance sheet disclosure: Accounts receivable 3. Composition per trial balance: Trade debtors Short-term loan to subsidiary Loans to directors & personnel Prepayments Provision doubtful debts (4%) $300 000 2017 $’000 30 201 2016 $’000 24 127 25 252 2 000 1 756 2 451 (1 258) 30 201 20 151 1 200 1 483 2 298 (1 005) 24 127 4. The financial accountant of Pot Ltd has summarised the movement on the trade debtors control account as follows Balance at 1 March 2016 Credit Sales Receipts from Trade Debtors Sales returns Settlement discounts Bad debts written off Balance at 28 Feb 2017 19 151 105 95 286 281 (83 192 572) (1 854 194) (1 642 049) (2 495 521) 25 252 050 5. List of trade debtors and age analysis of each market segment Balance 28/02/2017 $'000 Current month $'000 30 Days 60 Days 90 Days 120 days $'000 $'000 $'000 $'000 Supermarkets PicknChoose Marche & Bon KO 5150 3398 4236 1458 1121 1723 1390 987 1378 1997 793 1135 305 497 Chain Stores 20 Chain stores 7104 2797 2105 1294 658 251 Cafes 350 cafes 6364 2367 2203 752 626 416 Credit balances Total -1000 25252 -1000 8466 8063 5971 2086 667 Debtors REQUIRED: a) State with reasons how you would select the specific debtors balances for your year end circularisation of the trade debtors of Pot Ltd. (8) b) Describe how you maintain control over the circularization process. (10) c) Critically review the provision of doubtful debts made by Pot Ltd at 28 February 2017 (13) d) List any other issues, arising from information provided, that you believe will require further audit attention. (9) Total 40 Marks