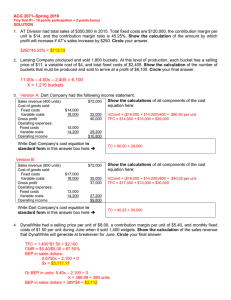

ACCT 404 MANAGEMENT ACCOUNTING LESSON 1 Cost-Volume-Profit (CVP) Analysis Course Instructor Teddy Ossei Kwakye, PhD Senior Lecturer in Accounting Department of Accounting tokwakye@ug.edu.gh Learning outcomes • Define cost-volume-profit (CVP) analysis, identify and explain the different approaches to CVP analysis, and explain how organisations use CVP information in decision making. • Calculate break-even point sales units and revenue for companies selling one product or service. • Determine the sales volume and revenue to achieve desired profit of firms selling one product or service and include taxes in CVP analysis. • Determine the break-even point sales and revenue of firms selling more than one product or service. • Explain the concept and importance of margin of safety and degree of operating leverage to organisations and identify the assumptions and limitations of CVP analysis. LO1 LO2 LO3 LO4 LO5 Slide 2 acct404_CVPAnalysis_teddyok_BSc Learning Outcome 1 Define cost-volume-profit (CVP) analysis, identify and explain the different approaches to CVP analysis, and explain how organisations use CVP information in decision making. Slide 3 acct404_CVPAnalysis_teddyok_BSc CVP analysis [slide 1 of 2] CVP analysis LO1 A method for analyzing how operating decisions and marketing decisions affect profit based on an understanding of the relationship between variable costs, fixed costs, unit selling price, and the output level. It is based on an explicit model of the relationships among the three factors – costs, sales, and profits – and how they change in a predictable way as the volume of activity changes. It uses cost behaviour theory and variable (or marginal) costing Slide 4 acct404_CVPAnalysis_teddyok_BSc CVP analysis [slide 2 of 2] Applications (or uses) of CVP analysis LO1 Ascertaining the break-even point sales units and revenue for firms. Determining the level of sales units and revenue to achieve a target profit. Setting the selling prices of products and services. Determining the amount of revenue required to avoid losses. Establishing whether fixed costs expose firms to an unacceptable level of risk. Performing strategic ‘what if’ analysis to influence current operations and predict future operations. It helps managers to respond to changing market factors from an informed background. Slide 5 acct404_CVPAnalysis_teddyok_BSc Approaches to CVP analysis [slide 1 of 7] LO1 This approach is premised on the basic profit equation. CVP model or equation approach SP(Q) = TFC + VC(Q) + P • SP - Selling price; Q - Units of output sold; TFC - Total fixed cost; VC - Variable cost per unit; P - Profit Slide 6 acct404_CVPAnalysis_teddyok_BSc Approaches to CVP analysis [slide 2 of 7] LO1 Contribution margin • the excess of sales over all variable cost associated with sales output, to cover fixed costs and add to profit i.e., the profit before fixed cost. • Contribution margin = Total sales – Total variable cost Contribution margin approach Contribution margin per unit • the difference between per unit selling price and per unit variable cost. • It measures the increase in profit for a unit increase in sales revenue. • Contribution margin per unit = Selling price – Variable cost per unit Slide 7 acct404_CVPAnalysis_teddyok_BSc Approaches to CVP analysis [slide 3 of 7] LO1 Contribution margin ratio or percentage •the ratio of contribution margin to sales revenue or the ratio of unit contribution margin per unit to selling price, expressed as ratio or percentage. •It shows the proportion of sales or selling price that contributes to the recovery of fixed cost •it is a measure of the profit contribution per sales cedis. Contribution margin approach Uses of contribution margin ratio or percentage •identifies the amount of increase (or decrease) in profits caused by a given increase (or decrease) in sales revenue. •may be used to determine the contribution margin associated with a particular sales revenue. •Variable cost to sales ratio can be deduced from contribution margin ratio or percentage. Slide 8 acct404_CVPAnalysis_teddyok_BSc Approaches to CVP analysis [slide 4 of 7] LO1 This approach substitutes contribution margin into the CVP equation Contribution margin approach CM(Q) – TFC = P • CM – Contribution margin per unit; Q – Units of output sold; TFC – Total fixed cost; P – profit TCM – TFC = P • TCM – Total contribution margin; TFC – Total fixed cost; P - Profit Slide 9 acct404_CVPAnalysis_teddyok_BSc Approaches to CVP analysis [slide 5 of 7] LO1 Graphical approach: CVP graph • Shows how the levels of revenues and total costs change over different levels of output. • Where revenue line falls below (above) the cost line, losses (profits) results. Slide 10 acct404_CVPAnalysis_teddyok_BSc Approaches to CVP analysis [slide 6 of 7] LO1 Graphical approach: Contribution margin graph • It is like the traditional CVP graph except that it makes it possible to read contribution at different levels of activity Slide 11 acct404_CVPAnalysis_teddyok_BSc Approaches to CVP analysis [slide 7 of 7] LO1 Graphical approach: Profitvolume graph • It illustrates how the level of profits changes over different levels of output or volume of sales. • It highlights the total amount of profit or loss at different sales volumes. Slide 12 acct404_CVPAnalysis_teddyok_BSc Learning Outcome 2 Calculate break-even point sales units and revenue for companies selling one product or service. Slide 13 acct404_CVPAnalysis_teddyok_BSc Break-even point analysis [slide 1 of 2] LO2 Break-even point (BEP) • The volume of sales at which the total revenues and costs are equal, and the firms’ operations breaks even. • The organisation makes no profit or loss, i.e., profit is zero. • The firm’s total contribution margin from sales is equal to the total fixed cost. • BEP can be expressed in both sales units and sales amount (value). • BEP sales increases when: • fixed costs increases. • variable costs increases. • sales price decreases. Slide 14 acct404_CVPAnalysis_teddyok_BSc Break-even point analysis [slide 2 of 2] Using CVP model BEP sales in units (QBE) QBE = TFC ÷ (SP – VC) LO2 Using contribution margin BEP sales in amount or value (TSBE) BEP sales in units (QBE) Multiply BEP sales in unit (QBE) by the selling price (SP) per unit QBE = TFC ÷ CM BEP sales in amount or value (TSBE) Multiply BEP (QBE) sales in units by the selling price per unit, or Determine the contribution margin ratio or percentage (CMR) TSBE = QBE * SP •TSBE = TFC ÷ CMR Slide 15 acct404_CVPAnalysis_teddyok_BSc Example: Break-even point analysis [slide 1 of 2] LO2 Studio Emerald Enterprise is a photo-finishing store and has provided the following data for the month of March in 2022. They charge GHS0.60 per unit for developing prints. During March, they developed 12,000 prints at a variable cost of goods sold of GHS0.30 per unit. Their variable selling cost was GHS0.06 per print. The total fixed cost of Studio Emerald Enterprise in the month of March was GHS1,500 and they desire a before tax profit of GHS1,800. Slide 16 acct404_CVPAnalysis_teddyok_BSc Example: Break-even point analysis [slide 2 of 2] Solution CVP model • QBE = TFC ÷ (SP – VC) Contribution margin • CM = SP – VC = 1,500 ÷ [0.60 – (0.30 + 0.06)] = 6,250 prints • TSBE = QBE * SP LO2 = 0.60 – (0.30+0.06) = 0.24 • QBE = TFC ÷ CM = 6,250 * 0.60 = GHS3,750 = 1,500 ÷ 0.24 = 6,250 prints • TSBE = TFC ÷ CMR = 1,500 ÷ 0.4 = GHS3,750 Slide 17 acct404_CVPAnalysis_teddyok_BSc Learning Outcome 3 Determine the sales volume and revenue to achieve desired profit of firms selling one product or service and include taxes in CVP analysis Slide 18 acct404_CVPAnalysis_teddyok_BSc Profit planning [slide 1 of 2] LO3 Profit planning • Involves the determination of sales volume or output level by managers to achieve a targeted profit assuming operating costs remain constant. • It entails revenue planning, cost planning, and accounting for the effect of income taxes (when planning for the desired profit after tax). • When planning for a targeted profit, before tax profit must be used, • after-tax profit must be grossed up as: • Before-tax profit = After-tax profit ÷ (1 – tax rate) Slide 19 acct404_CVPAnalysis_teddyok_BSc Profit planning [slide 2 of 2] LO3 Using CVP model Using contribution margin Sales in units to achieve desired profit (QDP) Sales in units to achieve desired profit (QDP) QDP = (TFC + DP) ÷ (SP – VC) Sales revenue to achieve desired profit (TSDP) Multiply QDP by the selling price (SP) per unit TSDP = QDP * SP QDP = (TFC + DP) ÷ CM Sales revenue to achieve desired profit (TSDP) Multiply QDP sales in units by the selling price per unit, or Determine the contribution margin ratio or percentage (CMR) •TSDP = (TFC + DP) ÷ CMR Slide 20 acct404_CVPAnalysis_teddyok_BSc Example: Profit planning [slide 1 of 2] LO3 Studio Emerald Enterprise is a photo-finishing store and has provided the following data for the month of March in 2022. They charge GHS0.60 per unit for developing prints. During March, they developed 12,000 prints at a variable cost of goods sold of GHS0.30 per unit. Their variable selling cost was GHS0.06 per print. The total fixed cost of Studio Emerald Enterprise in the month of March was GHS1,500 and they desire: (a) a before tax profit of GHS1,800, and (b) an after-tax profit of GHS1,800 (tax rate is 25%) Slide 21 acct404_CVPAnalysis_teddyok_BSc Example: Profit planning [slide 2 of 3] LO3 Solution CVP model • QDP = (TFC + PP) ÷ (SP – VC) Contribution margin • QDP = (TFC + DP) ÷ CM = (1,500 + 1,800) ÷ (0.60 – 0.36) = 13,750 prints • TSDP = QPP * SP = (1,500 + 1,800) ÷ 0.24 = 13,750 prints • TSDP = (TFC + DP) ÷ CMR = 13,750 * GH¢0.60 = GH¢8,250 = (1,500 + 1,800) ÷ 0.4 = GH¢8,250 Slide 22 acct404_CVPAnalysis_teddyok_BSc Example: Profit planning [slide 3 of 3] LO3 Solution Before-tax profit = after-tax profit ÷ (1 – tax rate) = 1,800 ÷ (1 – 0.25) = GH¢2,400 CVP model Contribution approach QDP = (1,500 + 2,400) ÷ (0.60 – 0.36) QDP = (1,500 + 2,400) ÷ 0.24 = 16,250 prints = 16,250 prints TSDP TSDP = 16,250 * GH¢0.60 = GH¢9,750 Slide 23 = (1,500 + 2,400) ÷ 0.4 = GH¢9,750 acct404_CVPAnalysis_teddyok_BSc Learning Outcome 4 Determine the break-even point sales and revenue of firms selling more than one product or service Slide 24 acct404_CVPAnalysis_teddyok_BSc CVP analysis for multiple products [slide 1 of 2] LO4 Best approached using the contribution margin approach Assume a constant sales mix for the products or services. Sales mix is the relative proportion of the different products sold or services provided that constitutes the total revenue or sales of firms. The contribution margin used is weighted on the quantities of each product or service included in the ‘bag’ of products or services the weighted average contribution margin per unit (WACM) is used if it is assumed that the sales mix will remain constant in units Slide 25 the weighted average contribution margin ratio (WACMR) is used if it is assumed that sales mix will remain constant in amount or value acct404_CVPAnalysis_teddyok_BSc CVP analysis for multiple products [slide 2 of 2] LO4 Weighted average contribution margin • Sum of the total contribution margin for each of the products or services (ΣTCM) divided by the sum of sales units for each of the products or services (ΣQ), i.e., ΣTCM ÷ ΣQ or • Sum of the product of sales mix of each product or service (Smix) and the corresponding contribution margin per unit (CM) of all the product, i.e., Σ(Smix * CM) Weighted average contribution margin ratio • Weighted average contribution margin per unit (WACM) divided by weighted average revenue (WAR), where WAR = Sum of the product of the sales mix of each product or service (Smix) and the corresponding selling price per unit (SP) of all the products. i.e., WACM ÷ Σ(Smix * SP) or • Sum of the product of the sales mix of each product or service (Smix) and the corresponding contribution margin ratio (CMR) of all the products, or i.e., Σ(Smix * CMR) Slide 26 acct404_CVPAnalysis_teddyok_BSc Break even point for multiple products [slide 1 of 2] LO4 Calculate the BEP for all the products or services in total as: BEP sales for multiple products • In sales units: QBE = TFC ÷ WACM • In sales value or amount: TSBE = TFC ÷ WACMR Determine the BEP for each product or service based on the sales mix by multiplying the sales mix by total BEP calculated i.e., Smix * QBE or Smix * TSBE Slide 27 acct404_CVPAnalysis_teddyok_BSc Break even point for multiple Products [slide 2 of 2] LO4 Graphical approach • It is similar to the profit-volume graph for single products • Profit/loss and cumulative sales from each of the products are plotted on the graph • Cumulative sales are determined in order of contribution margin to sales ratio • Profit/loss of each product is determined by deducting fixed cost from the cumulative contributions of each product Slide 28 acct404_CVPAnalysis_teddyok_BSc Example: BEP for multiple products [slide 1 of 2] LO4 Unilever (Ghana) Ltd sells three types of soap – Sunlight, Lux and Geisha – and planning their operations for the quarter ended 30th June 2021. Unilever expects to sell the products for GHS30, GHS32 and GHS40 per bar respectively, with a variable costs per bar of GHS24, GHS24 and GHS36 respectively. During the quarter ended 31st March 2021, sales revenue from Sunlight was GHS750,000, Lux was GHS600,000 and Geisha was GHS150,000. The total fixed costs for the period are expected to be GHS168,000, and it is assumed that Unilever’s sales will remain constant in sales amount for the three products. Slide 29 acct404_CVPAnalysis_teddyok_BSc Example: BEP for multiple products [slide 2 of 2] LO4 Solution • Sales mix (Smix) Sunlight : Lux : Geisha = 0.5 : 0.4 : 0.1 (the ratio of the products sales values) • WACMR CM for Sunlight = GH¢6 CM of Lux = GH¢8 CM of Geisha = GH¢4 CMR for Sunlight = 0.2 CMR of Lux = 0.25 CMR of Geisha = 0.1 WACMR = (0.5 * 0.2) + (0.4 * 0.25) + (0.1 * 0.1) = 0.21 • Total break-even sales revenue (TSBE) TSBE = GH¢168,000 ÷ 0.21 = GH¢800,000 • Break-even sales revenue of each soap Sunlight = 0.5 * GH¢800,000 = GH¢400,000 Lux = 0.4 * GH¢800,000 = GH¢320,000 Geisha = 0.1 * GH¢800,000 = GH¢80,000 Slide 30 acct404_CVPAnalysis_teddyok_BSc Profit planning for multiple products [slide 1 of 1] LO4 Calculate the sales for all the products or services in total to achieve the desired profit as: Profit planning for multiple products • In sales units: QDP = (TFC + DP) ÷ WACM • In sales value or amount: TSDP = (TFC + DP) ÷ WACMR Determine the sales for each product or service based on the sales mix by multiplying the sales mix by total sales to achieve the desired profit calculated i.e., Smix * QDP or Smix * TSDP Slide 31 acct404_CVPAnalysis_teddyok_BSc Example: Profit planning for multiple products [slide 1 of 2] LO4 Unilever (Ghana) Ltd sells three types of soap – Sunlight, Lux and Geisha – and planning their operations for the quarter ended 30th June 2018. Unilever expects to sell the products for GHS30, GHS32 and GHS40 per bar respectively, with a variable costs per bar of GHS24, GHS24 and GHS36 respectively. During the quarter ended 31st March 2018, sales revenue from Sunlight was GHS750,000, Lux was GHS600,000 and Geisha was GHS150,000. The total fixed costs for the period are expected to be GHS168,000, and it is assumed that Unilever’s sales will remain constant in sales amount for the three products. Assuming that Unilever wants to achieve a desired before-tax profit of GHS25,200. Determine the sales revenue for each of the soaps for Unilever to achieve the desired profit. Slide 32 acct404_CVPAnalysis_teddyok_BSc Example: Profit planning for multiple products [slide 2 of 2] LO4 Solution • Sales mix (Smix) Sunlight : Lux : Geisha = 0.5 : 0.4 : 0.1 • WACMR WACMR = (0.5 * 0.2) + (0.4 * 0.25) + (0.1 * 0.1) = 0.21 • Sales revenue to achieve the desired profit (TSDP) TSDP = (GH¢168,000 + GH¢25,200) ÷ 0.21 = GH¢920,000 • Sales revenue for each soap to achieve the desired profit Sunlight = 0.5 * GH¢920,000 = GH¢460,000 Lux = 0.4 * GH¢920,000 = GH¢368,000 Geisha = 0.1 * GH¢920,000 = GH¢92,000 Slide 33 acct404_CVPAnalysis_teddyok_BSc Learning Outcome 5 Explain the concept and importance of margin of safety and degree of operating leverage to organisations and identify the assumptions and limitations of CVP analysis Slide 34 acct404_CVPAnalysis_teddyok_BSc Margin of safety [slide 1 of 1] LO5 It shows how far a company is operating from its break-even point and indicates the amount by which sales revenue can drop before reaching break-even point and losses begin to be incurred by an organization The value or amount of sales above the break even point Planned (or actual) sales − breakeven sales (in units or in value) It is a useful measure for comparing the risk of two or more alternative as it measures the amount of ‘cushion’ against losses A higher margin of safety serves as a good cushion and indicates lesser risk for losses. Slide 35 acct404_CVPAnalysis_teddyok_BSc Degree of operating leverage [slide 1 of 1] The extent of fixed costs in the cost structure of an organisation The greater the operating leverage, the greater the operating risk Slide 36 DOL = Total contribution margin ÷ operating profit or DOL = (total fixed cost ÷ profit) + 1 LO5 DOL has an inverse relationship with margin of safety i.e., the smaller the margin of safety, the larger the degree of operating leverage and vice versa acct404_CVPAnalysis_teddyok_BSc Assumptions of CVP analysis [slide 1 of 1] Assumption of CVP analysis LO5 The behaviour of total cost and revenue is linear over the relevant range Costs can be accurately categorised into fixed and variable components. Selling price per unit of the product variable and fixed costs will not change as sales volume varies within the relevant range. The sales volume is the only cost driver. Labour productivity, production technology and market conditions do not change. There are no capacity additions during the period under consideration. In multiproduct organisations, the sales mix remains constant over the relevant range. In manufacturing firms, the levels of all inventory at the beginning and end of the period are the same. Total contribution margin increases proportionately with increases in sales volume. Slide 37 acct404_CVPAnalysis_teddyok_BSc End of Lesson