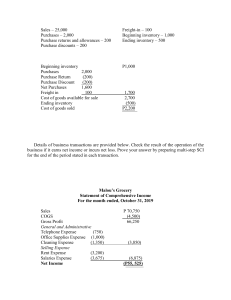

Final Study Guide 1.) During the current year, merchandise is sold for $31,850,000. The cost of goods sold is $24,206,000. A.) What is the amount of the gross profit? 7,644,000 B.) Compute the gross profit percentage (gross profit divided by sales). 31.59% 2.) For the fiscal year, Nike reported sales of $40,339,000. Its gross profit was $9,047,000. What was the amount of Nike’s cost of goods sold? 31292000 3.) For the fiscal year, sales were $919,350,000 and the cost of goods sold was $114,800,000. What was the amount of the gross profit? 804550000 4.) The Wheatland Company purchased merchandise on Account from a supplier for $30,000, terms 1/10, n/30. What is the amount of cash required for the payment within the discount period? 29,700 5.) Journalize the entries for the following transactions: A.) Sold merchandise for cash, $116,300. The cost of gods sold was $72,000 Cash 116,300 Sales COGs Inventory 116,300 72,000 72,000 B.) Sold merchandise on account, $755,000. The cost of goods sold was $400,000 Accounts receivable 755,000 Sales COGs 755,000 400,000 Inventory 400,000 C.) Sold merchandise to customers who used Mastercard and Visa, $1,950,000. The cost of goods sold was $1,250,000 Cash 1,950,000 Sales COGs 1,950,000 1,250,000 Inventory 1,250,000 D.) Sold merchandise to customers who used American Express, $330,000. The cost of goods sold was $230,000 Cash 330,000 Sales COGs Inventory 330,000 230,000 230,000 E.) Paid $81,500 to National Clearing House Credit Co. for service fees for processing MasterCard, Visa, and American Express sales. Credit Card Fees 81,500 Cash 81,500 6.) After the amount due on a sale of $28,000, terms 2/10, n/30, is received from a customer within the discount period, the seller consults to the return of the entire shipment for a cash refund. The cost of the merchandise returned was $16,000. A.) What is the amount of the refund owed to the customer? 27,440 7.) The following expenses were incurred by a retail business during the year. In which expense section of the income statement should each be reported: selling, administrative, or other? A.) Advertising expense - selling B.) Depreciation expense on store equipment - Selling C.) Insurance expense on office equipment - admin D.) Interest expense on notes payable - Other E.) Rent expense on office building - Admin F.) Salaries of office personnel - Admin G.) Salary of sales manager - Selling H.) Sales supplies used – Selling 8.) On March 31, 2020, the balances of the accounts appear in the ledger for White House Black Market, are as follows: Administrative Expense $216,000 Cost of Goods Sold $1,520,000 Interest Expense 4,000 Inventory $392,000 Sales $2,564,000 Selling Expense $286,000 Prepare a multiple-step Income Statement for the year ended March 31, 2020. White House Black Market Income Statement Years ended March 31, 2020 Sales 2,564,000 COGs 1,520,000 1,044,000 Gross Profit Selling Expense 286,000 Admin Expense 216,000 Total Operating Expenses (502,000) Operating Income Interest Expense 542,000 (4,000) (4,000) Total Non-Operating Net Income 538,000 9.) Summary operating data for Custom Clothing & Accessory Company during the year ended May 31, 2018, are as follows: Cost of Goods Sold $6,100,000 Administrative Expense $740,000 Interest Expense $25,000 Rent Revenue $60,000 Sales $9,332,500 Selling Expense $1,250,000 Prepare a single-step Income Statement for the year ended May 31, 2018. Custom Clothing & Accessory Company Income Statement Year Ending May 31, 2018 Revenues Sales Rent Revenue 9,332,500 60,000 9,392,500 Expenses COGs 6,100,000 Selling Expense 1,250,000 Admin Expense 740,000 Interest Expense 25,000 8,115,000 1,277,500 10.) Beginning inventory, purchases, and sales data for portable game players are as follows: Inventory Apr. 1 Purchases 4,000 units at $40 Sales Apr. 2 2,500 Apr. 15 4,500 units at $44 Apr. 19 5,000 Apr. 30 2,000 units at $46 Assuming that the perpetual inventory system is used, costing by the FI-FO method, determine the cost of goods sold for each and the inventory balance after each sale. Purchases Date Quantity Cost of Goods Sold Inventory Unit Total Cost Cost Unit Total Unit Total Cost Cost Quantity Cost Cost Quantity Apr 1 4,000 40 160,000 Apr 2 4000 2500 40 40 160,000 100,000 2000 2000 5000 40 40 40 80,000 80,000 200,000 92,000 5000 40 200,000 2,500 40 100,000 Apr 15 Apr 19 4,500 5000 Apr 30 40 198,000 200,000 2000 Balances 44 46 290,000 200,000 11.) Beginning inventory, purchases, and sales data for portable game players are as follows: Inventory Apr. 1 Purchases 4,000 units at $40 Sales Apr. 2 2,500 Apr. 15 4,500 units at $44 Apr. 19 5,000 Apr. 30 2,000 units at $46 Assuming that the perpetual inventory system is used, costing by the LI-FO method, determine the cost of goods sold for each and the inventory balance after each sale. Purchases Date Quantity Cost of Goods Sold Unit Total Unit Total Unit Total Cost Cost Quantity Cost Cost Quantity Cost Cost 4,000 40 160,000 4,000 2,500 198,000 2000 40 40 40 160,000 100,000 80,000 Apr 1 2 2,500 40 100,000 4,500 15 19 5,000 30 44 40 200,000 2000 40 80,000 5,000 40 200,000 2,000 Balances Inventory 46 92,000 2000 40 80,000 3,000 40 120,000 290,000 200,000 12.) On the basis of the following data, determine the value of the inventory at the lower cost or market value. Apply lower of cost or market to each inventory item. Product Inventory Quantity Cost per Unit Market Value per Unit A 400 $175 $150 B 350 $185 $230 C 900 $45 $60 D 125 $285 $280 E 999 $28 $34 Product Cost Market LCM A 70,000 60,000 60,000 B 64,750 80,500 64,750 C 40,500 54,000 40,500 D 35,625 35,000 35,000 E 27,972 33,966 27,972 13.) The following three identical units of Item Beta are purchased during June: Dates Item Beta Units Cost 2 Purchase 1 $50 12 Purchase 1 $60 23 Purchase 1 $70 Total 3 Average cost per unit Assume that one unit is sold on June 27 for $110. $180 $60 ($180 / 3 units) Determine the gross profit for June and the ending inventory for June 30 using Gross Profit Ending Inventory First in- First out 60 130 Last in- First out 40 110 Weighted Average 50 120 14.) Fonda Motorcycle Shop sells motorcycles, ATVs, and other related supplies and accessories. During the taking of its physical inventory on December 31, 2021, Fonda incorrectly counted its inventory as $452,500 instead of the correct amount of $425,500. A.) State the effects of the error on the December 31, 2021, balance sheet of Fonda Motorcycle Shop. The balance would be at a -27,000 for the balance sheet due to the incorrect amount B.) State the effects on the income statement of Fonda Motorcycle Shop for the year ended December 31, 2021. There would be no effect on the income statement because inventory is not on the income statement. C.) If uncorrected, what would be the effects of the error on the 2022 income statement? The cost of goods sold would be undervalued, which would be bad overall. D.) If uncorrected, what would be the effect of the error on the December 31, 2022, balance sheet? The inventory would be off, if everything was correctly counted, then there would be an extra 27,000 in inventory if no correction is made 15.) A former chairman, CFO, and controller of Donnkenny, Ink., an apparel company that makes sportswear for Pierre Cardin and Victoria Jones, plead guilty to financial statement fraud. These managers used false journal entries to record fictional sales, hid inventory in public warehouses so that it could be recorded as “sold,” and required sales orders to be backdated so that the sale could be moved back to an earlier period. The combined effect of these actions caused $25 million out of $40 million in quarterly sales to be phony. A.) Why might control procedures listed in this chapter be insufficient in stopping this type of fraud? B.) How could this type of fraud be stopped? A third party auditor can check on inventory and sales so there is no bias 16.) The procedures used for over-the-counter receipts are as follows. At the close of each day’s business, the sales clerks count the cash in their respective cash drawers, after which they determine the amount recorded by the cash register and prepare the memo cash form, noting any discrepancies. An employee from the cashier’s office counts the cash, compares the total with the memo, and takes the cash to the cashier’s office. A.) Indicate the weak link in internal control. The beginning amount of the cash drawer is never stated, there for a cashier can not input sales and pocket the money B.) How can the weakness be corrected? Having a manager count the amount of cash in a drawer so the cashier can not hide money 17.) The actual cash received from cash sales was $83,452, the amount indicated by the cash register total was $83,480. Journalize the entry to record the cash receipts and cash sales. Cash Cash Short & Over Cash Sales 83,452 28 83,480 18.) The actual cash received from the cash sales was $315,280, and the amount indicated by the register total was $315,150. Journalize the entry to record the cash receipts and cash sales. Cash Cash Short & Over Cash Sales 315,280 130 315,150 19.) The actual cash received from the cash sales was $425,880, and the amount indicated by the register total was $425,800. Journalize the entry to record the cash receipts and cash sales. Cash Cash Short & Over Cash Sales 425,880 80 425,800 20.) The following procedures were recently installed by Raspberry Creek Company: A.) After necessary approvals have been obtained for the payment of a voucher, the treasurer signs and mails the check. The treasurer then stamps the voucher and supporting documentation as paid and returns the voucher and supporting documentation to the accounts payable clerk for filling. B.) The accounts payable clerk prepares a voucher for each disbursement. The voucher along with the supporting documentation is forwarded to the treasurer’s office for approval. C.) Along with petty cash expense receipts for postage, office supplies, ect., several postdated employee checks are in the petty cash fund. D.) At the end of the day, cash register clerks are required to use their own funds to make up any cash shortages in their registers. E.) At the end of the day, all cash receipts are placed in the bank’s night depository. F.) At the end of each day, an accounting clerk compares the duplicate copy of the daily cash deposit slip with the deposit receipt obtained from the bank. G.) All mail is opened by the mail clerk, who forwards all cash remittances to the cashier. The cashier prepares a listing if the cash receipts and forwards a copy of the list to the accounts receivable clerk for recording in the accounts. H.) The bank reconciliation is prepared by the cashier, who works under the supervision of the treasurer. Indicate whether each of the procedures of internal control over cash represents a strength or a weakness. A B C D E F G H Strength Strength Weakness Weakness Strength Strength Weakness Weakness