CHAPTER 8:

CAPITAL BUDGETING DECISIONS—PART II

Multiple Choice

c

1. Which of the following groups of capital budgeting techniques uses the

time value of money?

a. Book rate of return, payback, and profitability index.

b. IRR, payback, and NPV.

c. IRR, NPV, and profitability index.

d. IRR, book rate of return, and profitability index.

b

2. Discounted cash flow techniques for analyzing capital budgeting

decisions are NOT normally applied to projects

a. requiring no investment after the first year of life.

b. having useful lives shorter than one year.

c. that are essential to the business.

d. involving replacement of existing assets.

d

3. The profitability index

a. does not use present values of cash flows.

b. is generally preferable to any other approach for evaluating

mutually exclusive investment alternatives.

c. produces the same ranking of investment alternatives as does the IRR

criterion.

d. is a discounted cash flow method.

a

4. Companies using MACRS for tax purposes and straight-line depreciation

for financial reporting purposes usually find that the relationship

between the tax basis and book value of their assets is

a. the tax basis is lower than book value.

b. the tax basis is higher than book value.

c. the tax basis is the same as book value.

d. none of the above.

c

5. A company that wants to use MACRS for tax purposes must

a. request permission from the IRS.

b. acquire new assets at or near the middle of the year.

c. ignore salvage value in calculating depreciation.

d. do none of the above.

c

6. The government could encourage increases in investment by

a. increasing tax rates.

b. lengthening the MACRS periods.

c. letting a company expense fixed assets in the year acquired instead

of through annual depreciation charges.

d. taking actions that would increase interest rates.

103

a

7. In choosing from among mutually exclusive investments the manager

should normally select the one with the highest

a. NPV.

b. IRR.

c. profitability index.

d. book rate of return.

a

8. In deciding whether to replace a machine, which of the following is NOT

a sunk cost?

a. The expected resale price of the existing machine.

b. The book value of the existing machine.

c. The original cost of the existing machine.

d. The depreciated cost of the existing machine.

a

9. A company is considering replacing a machine with one that will save

$50,000 per year in cash operating costs and have $20,000 more

depreciation expense per year than the existing machine. The tax rate

is 40%. Buying the new machine will increase annual net cash flows of

the company by

a. $38,000.

b. $30,000.

c. $20,000.

d. $12,000.

c 10. Not-for-profit entities

a. cannot use capital budgeting techniques because profitability is

irrelevant to them.

b. cannot use discounted cash flow techniques because the time value of

money is irrelevant to them.

c. might have serious problems in quantifying the benefits expected

from an investment.

d. should use the IRR method to make investment decisions.

c 11. A major difference between an investment in working capital and one in

depreciable assets is that

a. an investment in working capital is never returned, while most

depreciable assets have some residual value.

b. an investment in working capital is returned in full at the end of a

project's life, while an investment in depreciable assets has no

residual value.

c. an investment in working capital is not tax-deductible when made,

nor taxable when returned, while an investment in depreciable assets

does allow tax deductions.

d. because an investment in working capital is usually returned in full

at the end of the project's life, it is ignored in computing the

amount of the investment required for the project.

d 12. The proper treatment of an investment in receivables and inventory is

to

a. ignore it.

b. add it to the required investment in fixed assets.

c. add it to the required investment in fixed assets and subtract it

from the annual cash flows.

d. add it to the investment in fixed assets and add the present value

of the recovery to the present value of the annual cash flows.

104

a 13. If

of

a.

b.

c.

d.

a company uses a five-year MACRS period to depreciate assets instead

a 10-year life with straight-line depreciation,

the NPV of the investment is higher.

the IRR of the investment is lower.

there is no difference in either NPV or IRR.

total cash flows over the useful life would be lower.

a 14. The NPV and IRR methods give

a. the same decision (accept or reject) for any single investment.

b. the same choice from among mutually exclusive investments.

c. different rankings of projects with unequal lives.

d. the same rankings of projects with different required investments.

d 15. An

a.

b.

c.

d.

investment with a positive NPV also has

a positive profitability index.

a profitability index of one.

a profitability index less than one.

a profitability index greater than one.

b 16. Classifying an asset in a MACRS life category is based on

a. useful life estimated by the company.

b. asset depreciation range (ADR) guidelines.

c. the cost of the asset.

d. any of the above factors.

d 17. Which of the following makes investments more desirable than they had

been?

a. An increase in the income tax rate.

b. An increase in interest rates.

c. An increase in the number of years over which assets must be

depreciated.

d. None of the above.

c 18. Which of the following statements is true?

a. All revenue is taxed.

b. All expenses are tax-deductible.

c. Some revenues and expenses have no tax effects.

d. Income taxes are based solely on revenues and expenses.

b 19. The profitability index is the ratio of

a. total cash inflows to the cost of the investment.

b. the present value of cash inflows to the cost of the investment.

c. the NPV of the investment to the cost of the investment.

d. the IRR to the company's cost of capital.

c 20. With respect to income taxes, the principal

straight-line depreciation is that

a. total taxes will be lower under MACRS.

b. taxes will be constant from year to year

c. taxes will be lower in the earlier years

d. taxes will decline in future years under

a 21. If

a.

b.

c.

d.

advantage of MACRS over

under MACRS.

under MACRS.

MACRS.

the profitability index is less than one,

the IRR is less than cost of capital.

the IRR is the same as cost of capital.

the IRR is greater than cost of capital.

none of the above is true.

105

c 22. Which of the following combinations is possible?

Profitability Index

NPV

IRR

------------------- -------- ------------------------a. greater than 1

positive equals cost of capital

b. greater than 1

negative less than cost of capital

c. less than 1

negative less than cost of capital

d. less than 1

positive less than cost of capital

d 23. Which of the following combinations is NOT possible?

Profitability Index

NPV

IRR

------------------- -------- -------------------------a. greater than 1

positive more than cost of capital

b. equals 1

zero

equals cost of capital

c. less than 1

negative less than cost of capital

d. less than 1

positive less than cost of capital

b 24. In

a.

b.

c.

d.

capital budgeting, sensitivity analysis is used

to determine whether an investment is profitable.

to see how a decision would be affected by changes in variables.

to test the relationship of the IRR and NPV.

to evaluate mutually exclusive investments.

b 25. A unique feature of the analysis of a replacement decision is that

a. the analysis considers total rather than differential costs.

b. the amount used as the cost of the investment is not likely to equal

the price to be paid for the new asset.

c. the time value of money is ignored.

d. such decisions seldom involve cash flows.

a 26. Because of idle capacity, a company is considering two assets for sale.

They are identical in all respects except that asset A has a higher tax

basis than asset B. Only one need be sold now and the market price is

the same for both assets. Which of the following is true?

a. The cash flow is greater from selling asset A.

b. The cash flow is greater from selling asset B.

c. The cash flow is the same no matter which one is sold.

d. It is not possible to determine how the cash flows from sales of the

assets will differ.

a 27. If

to

a.

b.

c.

d.

the tax law were changed so that owners of apartment buildings had

depreciate them over 50 years instead of the current 31.5 years,

rents would rise.

rents would fall because annual depreciation charges would fall.

rents would stay about the same.

more people would invest in apartment buildings.

b 28. Which statement could express the results of a sensitivity analysis of

an investment decision?

a. The NPV of the project is $50,000.

b. A 5% decline in volume will make the project unprofitable.

c. This project ranks third out of the five available.

d. This project does not meet the cutoff rate of return.

106

c 29. XYZ Co. is adopting just-in-time principles. When evaluating an

investment project that would reduce inventory, how should XYZ treat

the reduction?

a. Ignore it.

b. Decrease the cost of the investment and decrease cash flows at the

end of the project's life.

c. Decrease the cost of the investment.

d. Decrease the cost of the investment and increase the cash flow at

the end of the project's life.

b 30. Which of the following combinations of capital budgeting techniques

includes only discounted cash flow techniques?

a. Book rate of return, payback, and profitability index.

b. NPV, IRR, and profitability index.

c. IRR, payback, and NPV.

d. Profitability index, NPV, and payback.

d 31. An

a.

b.

c.

d.

investment whose profitability index is 1.00

has an IRR equal to the prevailing interest rate.

returns to the company only the cash outlay for the investment.

has a payback period equal to its useful life.

has an NPV of zero.

a 32. In connection with a capital budgeting project, an investment in

working capital is normally recovered

a. at the end of the project's life.

b. in the first year of the project's life.

c. evenly through the project's life.

d. when the company goes out of business.

b 33. For investments that have only costs (no revenues or cost savings), an

appropriate decision rule is to accept the project that has the

a. longest payback period.

b. lowest present value of cash outflows.

c. higher present value of future cash outflows.

d. lowest internal rate of return.

b 34. The cash inflow from the return of an investment in working capital is

a. adjusted for taxes due.

b. discounted to present value.

c. ignored if any depreciable assets also involved in the project have

no expected residual value.

d. not real.

d 35. NPV is appropriate to use to analyze which decision relating to a

joint-products company?

a. Whether or not to sell facilities now used for additional processing

of one of the joint products.

b. Whether or not to acquire facilities needed for additional

processing of one of the joint products.

c. Whether or not to sell facilities now used to operate the joint

process.

d. All of the above.

107

d 36. If X Co. expects to get a one-year bank loan to help cover the initial

financing of capital project Q, the analysis of Q should

a. offset the loan against any investment in inventory or receivables

required by the project.

b. show the loan as an increase in the investment.

c. show the loan as a cash outflow in the second year of the project's

life.

d. ignore the loan.

d 37. A project that has a negative NPV

a. has a payback period longer than its life.

b. has a negative profitability index.

c. must be rejected.

d. doesn't necessarily fit any of the above descriptions.

c 38. A company evaluates a project using straight-line depreciation over its

10-year estimated useful life and then reevaluates it using a 7-year

MACRS class life. The second analysis will show

a. a lower IRR for the project.

b. the same NPV and IRR for the project.

c. a higher NPV for the project.

d. lower total cash flows over the 10 years.

a 39. Assuming that a project has already been evaluated using the following

techniques, the evaluation under which technique is least likely to be

affected by an increase in the estimated residual value of the project?

a. Payback period.

b. IRR.

c. NPV.

d. PI.

d 40. Qualitative factors can influence managers to

a. accept an investment project having negative NPV.

b. reject an investment project having an IRR greater than the

company's cutoff rate.

c. raise the "ranking" of an investment project.

d. take any of the above courses of action.

a 41. The replacement decision is

a. an example of a decision among mutually exclusive alternatives.

b. best arrived at by using the total-project rather than the

differential approach.

c. devoid of qualitative issues.

d. none of the above.

c 42. Acme is considering the sale of a machine with a book value of $160,000

and 3 years remaining in its useful life. Straight-line depreciation of

$50,000 annually is available. The machine has a current market value

of $200,000. What is the cash flow from selling the machine if the tax

rate is 40%?

a. $50,000

b. $160,000

c. $184,000

d. $200,000

108

c 43. Hoff is considering the sale of a machine with a book value of $160,000

and 3 years remaining in its useful life. Straight-line depreciation of

$50,000 annually is available. The machine has a current market value

of $100,000. What is the cash flow from selling the machine if the tax

rate is 40%?

a. $50,000

b. $100,000

c. $124,000

d. $160,000

a 44. Altoona Company is considering replacing a machine with a book value of

$200,000, a remaining useful life of 4 years, and annual straight-line

depreciation of $50,000. The existing machine has a current market

value of $175,000. The replacement machine would cost $320,000, have a

4 year life, and save $100,000 per year in cash operating costs. If the

replacement machine would be depreciated using the straight-line method

and the tax rate is 40%, what would be the increase in annual income

taxes if the company replaces the machine?

a. $28,000

b. $40,000

c. $42,000

d. $64,000

b 45. An investment opportunity costing $300,000 is expected to yield net

cash flows of $100,000 annually for five years. The profitability index

of the investment at a cutoff rate of 14% would be

a. 3.0.

b. 1.14.

c. 0.33.

d. 14%.

d 46. A project has a NPV of $30,000 when the cutoff rate is 10%. The annual

cash flows are $41,010 on an investment of $100,000. The profitability

index for this project is

a. 1.367.

b. 3.333.

c. 2.438.

d. 1.300.

c 47. A project has an IRR in excess of the cost of capital. The

profitability index for this project would be

a. less than zero.

b. between zero and one.

c. greater than one.

d. cannot be determined without more information.

b 48. A project has an IRR less than the cost of capital. The profitability

index for this project would be

a. less than zero.

b. between zero and one.

c. greater than one.

d. cannot be determined without more information.

109

b 49. Portage Press Company is considering replacing a machine with a book

value of $200,000, a remaining useful life of 5 years, and annual

straight-line depreciation of $40,000. The existing machine has a

current market value of $200,000. The replacement machine would cost

$300,000, have a 5-year life, and save $100,000 per year in cash

operating costs. If the replacement machine would be depreciated using

the straight-line method and the tax rate is 40%, what would be the

increase in annual net cash flow if the company replaces the machine?

a. $60,000

b. $68,000

c. $76,000

d. $84,000

b 50. Winneconne Company is considering replacing a machine with a book value

of $400,000, a remaining useful life of 5 years, and annual straightline depreciation of $80,000. The existing machine has a current market

value of $400,000. The replacement machine would cost $550,000, have a

5-year life, and save $75,000 per year in cash operating costs. If the

replacement machine would be depreciated using the straight-line method

and the tax rate is 40%, what would be the net investment required to

replace the existing machine?

a. $90,000

b. $150,000

c. $330,000

d. $550,000

True-False

T

1. The higher the IRR on an investment project, the higher its

profitability index.

F

2. If the payback period of an investment project is shorter than its

life, the project's profitability index is greater than 1.

F

3. If a company has decided that a certain task must be performed and

three machines accomplish that task, the machine with the lowest

initial cash outlay should be selected.

T

4. An investment with an IRR greater than cost of capital has a

profitability index greater than 1.

T

5. The only costs and revenues relevant to a replacement decision are

those that will change if a replacement is made.

T

6. Both the incremental and the total-project approaches to analyzing a

replacement decision should yield the same decision.

F

7. Both the IRR and the book rate of return methods of analyzing

investments should yield the same decision.

F

8. If the payback period of an investment is shorter than its life, its

profitability index is greater than l.

T

9. When compared with straight-line depreciation, using MACRS will result

in a larger NPV.

110

F 10. IRR and book rate of return will usually yield the same value for an

investment.

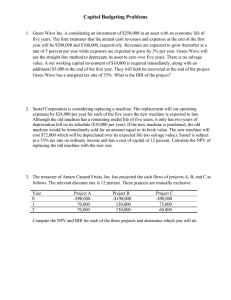

Problems

1. Stockholm Company is considering the sale of a machine with the following

characteristics.

Book value

Remaining useful life

Annual straight-line depreciation

Current market value

$120,000

5 years

$ 24,000

$ 70,000

If the company sells the machine its cash operating expenses will increase

by $30,000 per year due to an operating lease. The tax rate is 40%.

a. Find the cash flow from selling the machine.

b. Calculate the increase in annual net cash outflows as a result of

selling the machine.

SOLUTION:

a. Cash flow from sale:

tax loss)

$90,000

($70,000 + 40% tax savings on the $50,000

b. Increase in annual cash outflows: $27,600

($30,000 pretax cost increase

- $2,400 decrease in income taxes; the $30,000 increase in cash costs is

partially offset by losing a $24,000 depreciation deduction)

2. Pepin Company is considering replacing a machine that has the following

characteristics.

Book value

Remaining useful life

Annual straight-line depreciation

Current market value

$100,000

5 years

$ ???

$ 60,000

The replacement machine would cost $150,000, have a five-year life, and

save $50,000 per year in cash operating costs. It would be depreciated

using the straight-line method. The tax rate is 40%.

a. Find the net investment required to replace the existing machine.

b. Compute the increase in annual income taxes if the company replaces the

machine.

c. Compute the increase in annual net cash flows if the company replaces

the machine.

111

SOLUTION:

a. Net investment:

$74,000

[$150,000 - $60,000 - 40%($100,000 - 60,000)]

b. Increase in income taxes: $16,000

[40% x ($50,000 pretax flow - $30,000

depreciation + $20,000 lost depreciation)]

c. Increase in cash flows:

taxes)

$34,000

($50,000 - $16,000 increase in income

3. Cable Company is considering the purchase of a machine with the following

characteristics.

Cost

Useful life

Expected annual cash cost savings

$100,000

10 years

$30,000

Cable's income tax rate is 40% and its cost of capital is 12%. Cable

expects to use straight-line depreciation for tax purposes.

a. Compute the expected increase in annual net cash flow for this project.

b. Compute the profitability index for the project.

c. How would the profitability index for this project be affected if Cable

were to use MACRS depreciation for tax purposes and the machine fell

into the 7-year MACRS class? (increase

decrease not affected)

Circle the appropriate answer.

SOLUTION:

a. Increase in annual net cash flow:

$10,000)]

b. Profitability index:

1.24

$22,000

[$30,000 - (40% x ($30,000 -

[($22,000 x 5.65)/$100,000]

c. Effect on profitability index: Increase

(PI would increase because the

tax shield of depreciation would occur earlier and so be more valuable

when considering the time value of money.)

4. Frank Co. has the opportunity to introduce a new product. Frank expects

the product to sell for $60 and to have per-unit variable costs of $35 and

annual cash fixed costs of $4,000,000. Expected annual sales volume is

275,000 units. The equipment needed to bring out the new product costs

$6,000,000, has a four-year life and no salvage value, and would be

depreciated on a straight-line basis. Frank's cost of capital is 14% and

its income tax rate is 40%.

a. Compute the annual net cash flows for the investment.

b. Compute the NPV of the project.

c. Suppose that some of the 275,000 units expected to be sold would be to

customers who currently buy another of Frank's products, the X-10,

112

which has a $12 per-unit contribution margin. Find the sales of X-10

that can Frank lose per year and still have the investment in the new

product return at least the 14% cost of capital.

d. Suppose that selling the new product has no complementary effects but

that Frank's production engineers anticipate some production problems

in making the new product and are not confident of the $35 estimate of

per-unit variable costs for the new product. Find the amount by which

Frank's estimate of per-unit variable cost could be in error and the

investment still have a return at least equal to the 14% cost of

capital.

SOLUTION:

a. Annual net cash flows: $2,325,000

[$2,875,000 pretax - 40% x

($2,875,000 - $1,500,000 depreciation)]

pretax income = 275,000 x ($60 - $35) - $4,000,000 = $2,875,000

b. NPV:

$775,050 [($2,325,000 x 2.914) - $6,000,000]

c. Allowable loss of X-10 sales,

[($775,050/2.914)/60%]/12

approximately 36,941 units

d. Allowable error in per-unit VC,

$1.61

{[($775,050/2.914)/60%]/275,000 units}

5. Zenex is considering the purchase of a machine. Data are as follows:

Cost

Useful life

Annual straight-line depreciation

Expected annual savings in cash

operation costs

Additional working capital needed

$240,000

10 years

$

???

$ 80,000

$100,000

Zenex's cutoff rate is 12% and its tax rate is 40%.

a. Compute the annual net cash flows for the investment.

b. Compute the NPV of the project.

c. Compute the profitability index of the project.

SOLUTION:

a. Annual net cash flows:

$24,000 depreciation)]

$57,600

[$80,000 pretax - 40% x ($80,000 -

b. NPV: $17,640 [($57,600 x 5.650) - $240,000 - $100,000 + ($100,000 x

.322)]

c. PI: 1.052

{[($57,600 x 5.650) + ($100,000 x .322)]/($240,000 + $100,000)}

113

6. Darwin Company is considering the sale of a machine with the following

characteristics.

Book value

Remaining useful life

Annual straight-line depreciation

Current market value

$110,000

5 years

$ ???

$120,000

If the company sells the machine its cash operating expenses will increase

by $20,000 per year. The tax rate is 40%.

a. Find the cash flow from selling the machine.

b. Calculate the increase in annual net cash outflows as a result of

selling the machine.

SOLUTION:

a. Cash flow from sale:

gain)

$116,000

($120,000 - 40% tax on the $10,000 tax

b. Increase in annual cash outflows: $20,800

($20,000 pretax cost increase

+ $800 increase in income taxes; the $20,000 increase in cash costs is

more than offset by losing a $22,000 depreciation deduction)

7. Rusk Company is considering replacing a machine that has the following

characteristics.

Book value

Remaining useful life

Annual straight-line depreciation

Current market value

$200,000

4 years

$ ???

$160,000

The replacement machine would cost $300,000, have a four-year life, and

save $37,500 per year in cash operating costs. It would be depreciated

using the straight-line method. The tax rate is 40%.

a. Find the net investment required to replace the existing machine.

b. Compute the increase in annual income taxes if the company replaces the

machine.

c. Compute the increase in annual net cash flows if the company replaces

the machine.

SOLUTION:

a. Net investment:

160,000)]

$124,000

[$300,000 - $160,000 - 40% x ($200,000 -

b. Increase in income taxes: $5,000

[40% x ($37,500 pretax flow - $75,000

depreciation + $50,000 lost depreciation)]

114

c. Increase in cash flows:

taxes)

$32,500

($37,500 - $5,000 increase in income

8. Zmolek Company is considering the purchase of a machine costing $700,000

with a useful life of 10 years. Annual cash cost savings are expected to

be $200,000. Zmolek's income tax rate is 40% and its cost of capital is

12%. Zmolek expects to use straight-line depreciation for tax purposes.

a. Compute the expected increase in annual net cash flow for this project.

b. Compute the profitability index for the project.

SOLUTION:

a. Increase in annual net cash flow:

- $70,000)]

b. Profitability index:

1.19

$148,000

[$200,000 - 40% x ($200,000

[($148,000 x 5.65)/$700,000]

9. Racine Co. has the opportunity to introduce a new product. Racine expects

the project to sell for $200 and to have per-unit variable costs of $130

and annual cash fixed costs of $6,000,000. Expected annual sales volume

is 125,000 units. The equipment needed to bring out the new product costs

$7,200,000, has a four-year life and no salvage value, and would be

depreciated on a straight-line basis. Working capital of $500,000 would

be necessary to support the increased sales. Racine's cost of capital is

12% and its income tax rate is 40%.

a. Compute the NPV of this opportunity.

b. Compute the profitability index of this opportunity.

SOLUTION:

a. NPV:

negative $184,310

Annual cash flow: $2,370,000 = 60% x [125,000 x ($200 - $130)]

- 60% x $6,000,000 + 40% x $7,200,000/4

NPV: [($2,370,000 x 3.037) - $7,200,000 - 500,000 + ($500,000 x .636)]

b. PI: 0.976

[($2,370,000 x 3.037 + 500,000 x .636)/($7,200,000 + 500,000)]

10. Seiler is considering the purchase of a machine. Data are as follows:

Cost

Useful life

Annual straight-line depreciation

Expected annual savings in cash

operation costs

Additional working capital needed

$2,000,000

8 years

$ ???

$

$

115

750,000

500,000

Seiler's cutoff rate is 12% and its tax rate is 40%.

a. Compute the annual net cash flows for the investment.

b. Compute the NPV of the project.

c. Compute the profitability index of the project.

SOLUTION:

a. Annual net cash flows:

depreciation)]

b. NPV: $434,400

.404)]

$550,000

[$750,000 - 40% x ($750,000 - $250,000

[($550,000 x 4.968) - $2,000,000 - $500,000 + ($500,000 x

c. PI: 1.17 {[($550,000 x 4.968) + ($500,000 x .404)]/($2,000,000 +

$500,000)}

116