206-Pre-Depa

advertisement

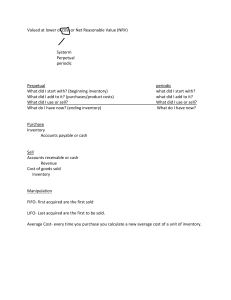

1. The Juice Company may obtain the funds by not taking discounts and thus increasing its accounts payable. The term of credits are 2/20, net 40. The cost of trade credit of this funds is____________ None of the choices 72% 36.72% 40% 30% 2. These are examples of spontaneous financing, except: Notes payable- trade Utilities payable Accrued salaries Short-term bank loans Accounts payable 3. It is an interest rate that is calculated in the context of accounts payable management. None of the choices Cost of capital Discount Interest Simple Interest Cost of trade credit 4. Which one of the following statements is correct concerning the accounts payable period? An increase in the accounts payable period will increase the operating cycle, all else equal. Managers generally prefer a shorter accounts payable period than a longer one The accounts payable period is equal to the net cost of purchases divided by the average accounts payable. Increasing the accounts payable turnover rate increases the accounts payable period. 5. The juice company may obtain the funds by not taking discounts and thus increasing its accounts payable. The terms of credits are 1/10, net 40. The cost of trade credit of this funds is _______ 12.12% 6. Cash management includes the following, except: Investing idle cash Disbursing restricted cash Cash Planning Managing cash flows 7. These are the objectives of cash management, except: To meet current obligations To meet contingencies To maximize funds committed to cash balance To meet installment commitments under long term contracts To make advantage of speculative gains 8. Statement 1. Cash management must aim to reduce the required level of cash but minimize the risk of being unable to discharge claims against the company as they arise. Statement 2. If cash balance is too high there is opportunity cost of not properly invested to earn profits. Statement 3. The cost of excess cash and danger of cash deficiency should be matched to determine the optimum level of cash balances. All statements are true Only two statements are true Only one statement is true All statements are false 9. Statement 1. Marketable securities are liquid instruments that can be quickly converted into cash at a reasonable price. Statement 2. Cash is the most liquid account in the current assets. Statement 3. If the liquidity is high, the profitability is low. Only one statement is true All statements are false All statements are true Only two statements are true 10. Statement 1. Cash management is concerned with minimizing unproductive balances, investing permanently cash advantageously and to making the best possible arrangement to meeting planned on the firm's cash. Statement 2. Cash is the most significant and the least productive asset that a firm holds. Statement 3. There are general motives of holding cash, namely: Transaction and contingency motive. Only one statement is true All statements are true All statements are false Only two statements are true 11. Roles and functions in cash management include the following, except: Payable management Receivable management Capital management Inventory management 12. Statement 1. Cash management must aim to reduce the required level of cash but minimize the risk of being unable to discharge claims against the company as they arise. Statement 2. If cash balance is too high there is opportunity cost of not properly invested to earn profits. Statement 3. The cost of excess cash and danger of cash deficiency should be matched to determine the optimum level of cash balances. All statements are true Only two statements are true Only one statement is true All statements are false 13. Rank the order of priority based on the three primary criteria for selecting appropriate marketable securities to meet firm's anticipated short-term cash needs: 1. Liquidity; 2. Yield; 3. Safety 3, 1 and 2 14. These types of inventory control systems tract inventory using physical inventory counts. Merchandise Inventory System None of the choices Perpetual Inventory System Periodic Inventory System 15. This indicates the effectiveness of the inventory management practices of the firm. Payable turnover Age of inventory Inventory turnover Receivable turnover 16. This allows for uncertainty of estimates used in model and possibility of non-uniform usage. Safety stock 17. Inventory maintenance costs include the following, except: Cost of capital 18. EEE COMPANY buys 5,000 microchips annually for its computer manufacturing business. The chips come in lots of 50 per box. The cost of placing an order is P9,000, while the cost of receiving, including handling charges, is P18,000. Annual carrying costs are 3% of the purchase price of P25,000 per chip. What is the total inventory costs based on the EOQ? P450,000 P337,500 P225,000 P675,000 None of the choices 19. A costs that pertains to storage, handling, loss in value due to obsolescence and physical deterioration, taxes, insurance, financing Carrying costs 20. Statement 1. Carrying costs increase with increases in average inventory levels and therefore argue in favor of low levels of inventory in order to hold these costs down Statement 2. Ordering costs decrease with increases in average inventory levels and therefore the firm wants to carry high levels of inventory so that it does not have to reorder inventory as often as it would if it carried low levels of inventory. Both statements are true 21. Which of the following are the costs of maintaining inventory? 1. Carrying costs 2. Ordering costs 3. Stock out costs 4. Excess costs Items 1,2 and 3 22. Which of the following are the inventory control systems? 1. JIT System 2. 3 Bin System 3. XYZ System 4. Outsourcing System 5. Computerized Inventory All of the above items except item 3 23. A system wherein the material, or the products are produced and required just a few hours before they are put to use. Just In-Time System ABC Inventory control system Three bin system Outsourcing system 24. The receivables merely serve as collateral in the event of default Factoring Pledging Assigning Discounting 25. Lender only acts as supplier of funds so if borrower defaults, borrower suffers bad-debt loss, not lender Assigning and Pledging Pledging and Factoring None of the Choices Assigning and Factoring 26. It refers to those decision variables that influence the amount of trade credit Credit Transactions Credit Terms Credit Policy Credit Standards 27. Statement 1. In liberal policy, sales increases and as a result, profit and bad debts also increases and hence the firm faces no problem of liquidity Statement 2. In Stringent policy, sales increases and as a result, profit and bad debts also increases and hence the firm faces no problem of profitability Only statement 1 is true Both statements 1 and 2 are true Both statements 1 and 2 are false Only statements 2 is true 28. Statement 1. Opportunity cost is the profit lost when one alternative is selected over another. Statement 2. An administrative cost is an expense incurred in controlling and directing an organization, but not directly identifiable with financing, marketing, or production operations. Both statements 1 and 2 are false Both statements 1 and 2 are true Only statement 1 is true Only statement 2 is true 29. A lender's opinion of a borrower's general trustworthiness, credibility and personality Capacity Condition Collateral Character Capital 30. Statement 1. In pledging of receivables, lender advances money to borrower up to some predetermined percentage of accounts receivable and then collects directly from customer account. Statement 2. In factoring of receivables, bank or other lender makes loan of some percentage of value of receivables but does not take possession of them. Statement 3. In assigning of receivables, lender buys accounts receivables outright from borrower at discount from face value and assumes burden of collecting receivables. All statements are false Only two statements are false Only one statement is false All statements are true 31. It refers to those decision variables that influence the amount of trade credit Credit Transactions Credit Terms Credit Policy Credit Standards 32. A lender's opinion of a borrower's general trustworthiness, credibility and personality Capacity Condition Collateral Character Capital 33. The amount of money invested by the business owner or management team Character Collateral Capacity Condition Capital 34. It is a promise from a third party (usually a bank) for payment in the event that certain conditions are met. Letter of credit 35. A lien on specifically identified personal property (assets other than real estate) backing a loan Chattel Mortgage 36. It is a promise from a third party (usually a bank) for payment in the event that certain conditions are met. Letter of credit 37. A lien on specifically identified personal property (assets other than real estate) backing a loan Chattel Mortgage 38. Which of the following would be consistent with a conservative approach to financing working capital? Financing short-term needs with long-term debt. 39. All else equal, which one of the following will decrease the cash cycle? increasing the operating cycle increasing the credit period granted to a customer decreasing the accounts payable period increasing the inventory turnover rate decreasing the accounts receivable turnover rate 40. How will the total amount of a company's working capital change when a P10,000 account receivable is collected? The total remains the same Can not be determined The total decreases by P10,000 The total increases by P10,000 41. Which one of the following will decrease the operating cycle? increasing the inventory period decreasing the accounts payable period increasing the accounts receivable turnover rate increasing the accounts payable period Increasing the cash cycle 42. How will a company's liquidity change when it pays the accounts payable from customers? Its Liquidity Decreases 43. Which one of the following actions should a manager take if he or she wants to decrease the operating cycle? decrease the period of time for which credit is granted to customers 44. The amounts needed to compute a company's working capital come from which of the following financial statements? Balance sheet 45. Which of the following statements is true? Collecting an accounts receivable is a use of cash All of the choices Accepting the credit offered by a supplier is a source of cash Increasing the use of trade credit offered by a supplier is a use of cash Cash is decreased when new debt is issued to purchase holiday merchandise. 46. The Winters Co. has annual sales of P918,700. Cost of goods sold is equal to 55 percent of sales. The firm has an average accounts payable balance of P72,400. How many days on average does it take The Winters Co. to pay its suppliers? 52 days 47. The accounts receivable turnover rate for the Bedford Bedding Co. has gone from an average of 6.7 times to 7.2 times per year. The days in receivables has: Decreased by 4 days 48. Wayne's Wells has sales for the year ofP P48,900 and an average inventory of P8,800. The cost of goods sold is equal to 60 percent of sales and the profit margin is 5 percent. How many days on average does it take the firm to sell an inventory item? 109 days 49. The Sun Lee Co. has a receivables turnover rate of 11.5, a payables turnover rate of 9.8, and an inventory turnover rate of 13.6. What is the length of the firm's cash conversion cycle? 22 days 50. Robert's International currently has an inventory turnover of 15, a receivables turnover of 18, and a payables turnover of 10. How many days are in the cash cycle? 8 days 81 days 22 days 74 days 45 days 51. AAA COMPANY requires 40,000 units of Product Q for the year. The units will be sold evenly during the year. It costs P61.25 to place an order. It costs P10 to carry a unit in inventory for the year. What is the EOQ (in units)? Answer: 7,000 52. The following information relates to the DDD COMPANY: Units required per year 30,000 Cost of placing an order P400 Unit carrying cost per year P600 What is the total inventory costs based on the EOQ? Answer: 120,000 53. On January 1, 2020, XYZ Corp. borrowed money in the bank P2,000,000, 1-year term, with an interest rate of 10% per annum. XYZ pledged it's A/R which amounted to P3,000,000. How much is the maturity value of loan one year after assuming at a simple interest? Answer: 2,200,000 2,000,000 x (100% + 10%) = 2,200,000 54. During a recent year, a company's accounts receivable had an average balance of P60,000 and its sales on credit were P540,000. Using 360 days in the given year, the company's receivable period for the year was __________ days Answer: 55. A company has current assets of Cash of P140,000; Marketable Securities of P160,000; Accounts Receivable of P 180,000; Inventory of P220,000; and Prepaid Expenses of P50,000. The total of its current liabilities is P250,000 and the total amount of its liabilities is P500,000. Given this information, the company's current ratio is A company has current assets of Cash of P140,000; Marketable Securities of P160,000; Accounts Receivable of P 180,000; Inventory of P220,000; and Prepaid Expenses of P50,000. The total of its current liabilities is P250,000 and the total amount of its liabilities is P500,000. Given this information, the company's current ratio is 3:1 (hindi na ako sure for todays bideo) 56. Assume the following data of XYZ Company: Cash sales P 5,500,000 Credit sales 3,500,000 A/R, beg 370,000 A/R, end 330,000 Inventory 2,500,000 Compute the receivable period using 360 days in a year. Answer is _______ days Answer: 57. You are consulted by the President of SAN MIGUEL CORPORATION to analyze the liquidity for the fiscal year ended May 31, 2019. Consider some of the following accounts below at year end: Cash P 10,000,000 Marketable securities 20,000,000 Accounts receivable 50,000,000 Merchandise inventory 120,000,000 Accounts payable 8,000,000 Notes payable-trade 40,000,000 Additional data shows at year end May 31, 2019: Beginning balances of account receivables and merchandise inventory were P40,000,000 and P130,000,000, respectively; Sales were P4,500,000,000 while the cost of sale were 1,250,000,000. What is the inventory turnovers? Answer: __ times Answer: 10 58. You are consulted by the President of Philadelpa Sixer Co. to analyze the liquidity for the fiscal year ended May 31, 2019. Consider some of the following accounts below at year end: Cash P 10,000,000 Marketable securities 20,000,000 Accounts receivable 50,000,000 Merchandise inventory 120,000,000 Accounts payable 8,000,000 Notes payable-trade 40,000,000 Additional data shows at year end May 31, 2019 1. Beginning balances of account receivables and merchandise inventory were: P40,000,000 and P130,000,000, respectively; 2. Sales were P4,500,000,000 while the cost of sale were 1,250,000,000. What is the NET WORKING CAPITAL at May 31,2019? Answer: 150,000,000 59. A company has current assets of Cash of P80,000; Marketable Securities of P120,000; Accounts Receivable of P80,000; Inventory of P60,000; and Prepaid Expenses of P20,000. The total of its current liabilities is P120,000 and the total amount of its liabilities is P290,000. Given this information, the company's quick ratio is: __:1 60. On January 1, 2020, XYZ Corp. borrowed money in the bank P2,000,000, 1-year term, with an interest rate of 12% per annum. XYZ pledged it's A/R which amounted to P3,000,000. How much is the cash proceeds of loan on January 1, 2020 assuming at a discounted interest? P____________ (do not provide space in writing the amount) Answer: 1,760,000