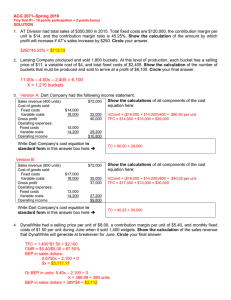

E2Cost volume profit Analysis CVP ANALYSIS - is a profit planning tool that deals with profit’s relationship with costs and sales volume. Traditional Income Statement Sales Less: Cost of goods sold Gross Margin/Profit Less: Operating expenses Operating Profit (pre Tax profit) Tax Rate After tax profit PXX XX PXX XX PXX XX% PXX 100% (XX%) (XX%) Contribution Income Statement Sales (Sales Volume X Selling Price) Less: Variable cost (Sales Volume X VC per unit) Contribution Margin (Sales Volume X CM per unit) Less: Fixed Cost Operating Profit (pre Tax profit) Tax Rate After tax profit Total Percentage PXX 100% XX (XX%) PXX (XX%) XX PXX XX% PXX *Traditional Income Statement is used primarily for external reporting while Contribution Income Statement is used primarily by management. Usage of CVP Analysis in Managerial Decisions Product pricing Accepting/rejecting sales orders What product lines to promote? What level of output is required to achieve a set level of net profit? Feasibility of profit plan Technology usage CONTRIBUTION MARGIN (CM) is a measure of company’s ability to cover variable costs with revenues. It is also known as marginal income, profit contribution, contribution to fixed cost or incremental contribution. CM = Sales – Variable Costs Unit CM = Unit Selling Price – Unit Variable Costs CM Ratio = CM ÷ Sales = Unit CM ÷ Unit Selling Price = Δ CM ÷ Δ Sales CM Ratio is also known as marginal ratio or profit-volume (P/V) ratio. BREAK-EVEN POINT (BEP) is the sales level at which profit is zero (i.e., total revenues = total costs). BEP(units) = Fixed Costs ÷ Unit CM BEP (peso sales) = Fixed Costs ÷ CM Ratio BEP Ratio = BEP ÷ Sales Sales (units) with Target Profit = (Fixed Costs + Target Profit*) ÷ Unit CM Sales (peso sales) with Target Profit = (Fixed Costs + Target Profit*) ÷ CM Ratio Sales (peso sales) with Target Profit Ratio = Fixed Costs ÷ (CM Ratio – Profit Ratio) * Target Profit must be expressed before tax: Pre-tax Profit = After-tax Profit ÷ (100% - tax rate) MARGIN of SAFETY is the maximum amount by which sales could decrease without incurring a loss. Margin of Safety (MS) = Sales – Breakeven Sales = Profit ÷ CM Ratio MS Ratio = MS ÷ Sales = Profit Ratio ÷ CM Ratio = 100% - BEP Ratio Like BEP, safety margin can also be expressed in units or in peso sales. INDIFFERENCE POINT is the level of volume at which total costs, and hence profits, are the same between two alternatives under consideration. Alternative A Alternative B . (Unit CM x Q) – Fixed Costs = (Unit CM x Q) – Fixed Costs Fixed Costs + (Unit VC x Q) = Fixed Costs + (Unit VC x Q) Legend: Q – number of units (indifference point) SALES MIX (a.k.a. product mix) is the proportion of different products that comprise the company’s total sales. Overall BEP (units) = Fixed Costs ÷ Weighted Average Unit CM Overall BEP (peso sales) = Fixed Costs ÷ Weighted Average CM Ratio DEGREE of OPERATING LEVERAGE (DOL) measures how sensitive the profit is to sales volume increases and decreases. It is also known as operating leverage factor. DOL = Contribution Margin ÷ Profit before tax = 1 ÷ MS Ratio Δ% in Sales x DOL = Δ% in profit before tax CVP analysis assumptions and limitations Behavior of both sales and costs (variable and fixed) is linear and predictable throughout the entire relevant range of activity and within a specified time span. Fixed costs, unit variable costs, selling price and sales mix must behave as constants. There are no changes in inventory levels (i.e., production equals sales). Volume is the only factor affecting sales, variable costs and profit. Time value of money is ignored. Margin of Safety 1. Dani Company has sales of P 100,000, fixed costs of P 50,000, and a profit of P 10,000. What is Dani Company’s margin of safety? a. P 10,000 b. P 16,667 c. P 33,333 d. P 83,333 2. Viconia Company had a 25 percent margin of safety. Its after-tax return on sales is 6 percent. The company’s income is subject to tax rate of 40 percent. If fixed costs amount to P320,000, how much peso sales did Viconia make for the year? A. P1,066,667 C. P1,280,000 B. P1,000,000 D. P 800,000 3. Romero, Inc. had the following economic data for 2021: Net sales Contribution margin Margin of safety P400,000 160,000 40,000 What is Romero’s breakeven point in 2021? A. P360,000 C. P320,000 B. P288,000 D. P 80,000 4. The following information pertains to Joshua Corporation for the year ending December 31, 2021: Budgeted sales P1,000,000 Breakeven sales 700,000 Budgeted contribution margin 600,000 Cashflow breakeven 200,000 The margin of safety for the Joshua Corporation is: A. B. C. D. P300,000 P400,000 P500,000 P800,000 Indifference point 5. Machine XX has fixed costs of P 225,000 and a variable cost of P 20. Machine YY has fixed costs of P 300,000 and a variable cost of P 14. What is the indifference point in units? a. 11,250 b. 12,500 c. 21,429 d. Cannot be determined from given information 6. Duke, Inc. owns and operates a chain of food centers. The management is considering installing machines that will make popcorn on the premises. These machines are available in two different sizes with the following details: Annual capacity Costs: Annual machine rental Popcorn cost per box Cost of each box Other variable cost per box Economy Regular 20,000 P60,000.00 3.90 0.80 6.60 50,000 P82,500.00 3.90 0.80 4.20 The level of output in boxes at which the Economy and the Regular would earn the same profit (loss) is a. b. c. d. 20,000 boxes 9,375 boxes 15,000 boxes 12,500 boxes 7. Mellow, Inc. sells its single product for P40 per unit. Mellow purchases the product for P20. The salespeople receive a salary plus a commission of 5% of sales. Last year the corporation’s net income was P100,800. The corporation is subject to 30% income tax rate. The fixed costs of the company are: Advertising Rent Salaries Other fixed costs Total P124,000 60,000 180,000 32,000 P396,000 The company is considering changing the compensation plan for sales personnel. If the organization increases the commission to 10% of revenues and reduces salaries by P80,000, what revenues must the organization have to raise in order to earn the same net income as last year? a. b. c. d. P1,600,000 P1,350,000 P1,150,000 P1,630,000 Solution: 1. B Sales Variable Cost Contribution Margin Fixed Cost Profit P100,000 100% 40,000 40% 60,000 60% 50,000 P 10,000 Margin of Safety = Profit/CM ratio = P10,000/60% = P16,667 Or MOS = Sales – BEP (Peso Sales) = P100,000 – P83,333 = P16,667 (BEP = P50,000/60% = P83,333) 2. A Margin of safety ratio = Profit ratio/CM Ratio CMR = Before-tax return on sales/MSR = (0.06 ÷ 0.60) ÷ 0.25 = 0.40 or 40% BES = 320,000 ÷ 0.40 = P 800,000 Sales = P800,000/.75 = P1,066,667 3. A BEP = Sales – Margin of Safety = P400,000 – P40,000 = P360,000 4. A MOS = Sales – Breakeven Sales = P1,000,000 – P700,000 = P300,000 5. B XX FC + (VC X Q) P225,000 + P20X P20X – P14X P6X = P75,000 X = 12500 units = = = YY FC + (VC X Q) P300,000 + P14X P300,000 – P 225,000 6. B Economy Regular P60,000 + (P11.30X) = P82,500 + (P8.9X) P11.30X – P8.9X = P82,500 – P60,000 P2.4X = P22,500 X = 9,375 7. A Indifference Point = Decrease in Fixed Cost/Increase in Variable Cost =P80,000/.05 =P1,600,000