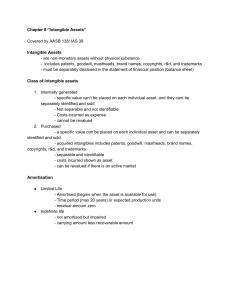

PAS 38: INTANGIBLE ASSETS CRITERIA FOR RECOGNITION Identifiability In order to meet the definition of an intangible asset, expenditure on an item must be separately identifiable in order to distinguish it from goodwill. An asset meets the identifiability criterion when it • Is capable of being separated from the entity and sold, transferred, licensed, or rented either individually or in combination with a related contract, asset, or liability • Arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or other rights or obligations Control An entity controls an asset if it has the power to obtain the future economic benefits flowing from the underlying resource and to restrict the access of others to those benefits. Usually this control would flow from legally enforceable rights. However, legal enforceability is not necessary if control can be enforced in some other way. For example, one method of control is keeping something secret through employee confidentiality. Control needs to be looked at carefully. An entity may be able to identify skills in its workforce and to measure the costs of providing those skills to its staff (via training). However, the entity usually does not have control over the expected economic benefits arising from the skilled staff, as they can leave their employment. Even if the skills are protected in some way such that departing staff are not permitted to use them elsewhere, the entity has lost the future benefit of the skills imbued in the departing staff member. Similarly, the purchase of customer lists or expenditure on advertising, while identifiable, does not provide control to an entity over the expected future benefits. Customers are not forced to buy from the entity and can go elsewhere. Future Economic Benefit Future economic benefit may include revenue from the sale of products, services, or processes, but also includes cost savings or other benefits from use of an asset. Use of intellectual property can reduce operating costs rather than produce revenue. RECOGNITION AND MEASUREMENT An item may be recognized as an intangible asset when it meets the definition of an intangible asset (see previous) and meets these recognition criteria • It is probable that the expected future economic benefits that are attributable to the asset will flow to the entity. • The cost of the asset can be measured reliably. Initially, intangible assets shall be measured at cost. The cost of separately acquired intangible assets comprises • Purchase price, including any import duties and nonrefundable purchase taxes, less discounts and rebates. • Directly attributable costs of preparing the asset for use. Directly attributable costs can include employee benefits, professional fees, and costs of testing. Costs that cannot be included are • Costs of introducing new products or services, such as advertising • Costs of conducting new business • Administration costs • Costs incurred while an asset that is ready for use is awaiting deployment • Costs of redeployment of an asset • Initial operating losses incurred from operation If payment for an intangible asset is deferred beyond normal credit terms, then the cost is the cash price and the balance is treated as a finance charge over the period of the finance. If intangible assets are acquired as part of a business combination, as defined in PFRS 3, their cost is their fair value at the acquisition date. The probability of future economic benefit is reflected in their fair value, and, therefore, the probability of future economic benefit required for recognition is presumed. In a business combination, such intangible assets are to berecognized separately from goodwill. Assessing the fair value of an intangible asset in a business combination can be difficult; obvious techniques are the use of comparable market transactions or quoted prices. Sometimes there may be a range of values to which probabilities can be assigned. Such uncertainty enters into the measurement of the asset rather than demonstrating an inability to measure the value. If an intangible asset has a finite life, then it is presumed to have a reliably measurable fair value. In some circumstances, it may not be possible to reliably measure the fair value of an intangible asset in a business combination because it is inseparable or there is no history or evidence of exchange transactions for the asset, and any fair value estimates would be based on immeasurable variables. If an intangible asset is acquired in exchange for another asset, then the acquired asset is measured at its fair value unless the exchange lacks commercial substance or the fair value cannot be reliably measured, in which case the acquired asset should be measured at the carrying amount of the asset given up, where carrying amount is equal to cost less accumulated depreciation and impairment losses. For impairment losses, reference should be made to PAS 36. In this context, any compensation received for impairment or loss of an asset shall be included in the income statement. INTERNALLY GENERATED INTANGIBLE ASSETS With internally generated intangible assets, problems arise in identifying whether there is an identifiable asset that will generate future economic benefit and in reliably determining its cost. Goodwill The Standard proscribes the recognition of internally generated goodwill as an asset. The rationale behind this is that any expenditure incurred does not result in an asset that is an identifiable resource—it is not separable, nor does it arise from contractual or other legal rights—or that is controlled by the entity. In addition, any costs incurred are unlikely to be specifically identifiable as generating the goodwill. The position that the difference between a valuation of a business and the carrying amount of its individual assets and liabilities may be capitalized as goodwill falls down insofar as that difference cannot be categorized as the cost and therefore cannot be recognized as an asset. Other Internally Generated Intangible Assets The Standard sets out rules for the recognition of other internally generated intangible assets and broadly defines such expenditures as research and development. It proscribes the recognition of internally generated brands, mastheads, publishing titles, customer lists, and similar items, because expenditure thereon, like expenditure on internally generated goodwill, cannot be distinguished from the cost of developing the business as a whole and is therefore not separately identifiable. In order to determine whether an internally generated intangible asset qualifies for recognition, its generation is divided into a research phase and a development phase. If the two phases cannot be distinguished, then the entire expenditure is classified as research. Expenditure on research (or the research phase of an internal project) is to be written off as an expense as and when incurred, as it is not possible to demonstrate that an asset exists that will generate future economic benefit. Examples include • Activities aimed at obtaining new knowledge • The search for, evaluation, and selection of applications of research findings or knowledge • The search for alternatives for materials, devices, products, systems, or processes • The formulation, design, evaluation, and selection of possible alternatives for new or improved materials, devices, products, systems, or processes Development expenditure may be recognized as an intangible asset when, and only when, all of the following can be demonstrated: • The technical feasibility of completing the asset so that it will be available for use or sale • The intention to complete the asset and use or sell it • The ability to use or sell the asset • How the asset will generate probable future economic benefit, including demonstrating a market for the asset’s output, or for the asset itself, or the asset’s usefulness • The availability of sufficient technical, financial, and other resources to complete the development and to use or sell the asset • The ability to reliably measure the expenditure attributable to the asset during its development Examples of activities that may fail to be recognized as intangible assets include • The design, construction, and testing of preuse prototypes or models • The design of tools and jigs involving new technology • The design, construction, and operation of a pilot plant that is not capable of commercial production • The design, construction, and testing of a chosen alternative for new or improved materials, devices, products, systems, or processes RECOGNITION OF AN EXPENSE The Standard requires that all expenditure on an intangible item be written off as an expense unless it meets the recognition criteria or it is acquired as part of a business combination and cannot be separately identified, in which case it is subsumed as part of goodwill and treated in accordance with PFRS 3. Examples include • Expenditure on start-up activities (start-up costs) or on opening a new facility or business (preoperative expenses) • Expenditure on training • Expenditure on advertising and promotional activities (including mail order catalogues) • Expenditure on relocating or reorganizing part or all of an entity WEB SITE DEVELOPMENT COSTS The advent of the Internet has created new ways of performing tasks that were unknown in the past. Most entities have their own Web site that serves as an introduction of the entity and its products and services to the world at large. A Web site has many of the characteristics of both tangible and intangible assets. With virtually every entity incurring costs on setting up its own Web site, there was a real need to examine this issue from an accounting perspective. An interpretation was issued that addressed Web site costs: SIC 32, Intangible Assets—Web site Costs. SIC 32 lays down guidance on the treatment of Web site costs consistent with the criteria for capitalization of costs established by PAS 38. According to SIC 32, a Web site that has been developed for the purposes of promoting and advertising an entity’s products and services does not meet the criteria for capitalization of costs under PAS 38. Thus costs incurred in setting up such a Web site should be expensed. MEASUREMENT AFTER RECOGNITION The Standard states that, after recognition, intangible assets may be measured using either a cost model or a revaluation model. However, if the revaluation model is used, then all assets in the same class are to be treated alike unless there is no active market for those assets. “Classes of intangible assets” refers to groupings of similar items, such as patents and trademarks, concession rights, or brands. Assets in each class must be treated alike in order to avoid mixes of costs and values. If the cost model is selected, then after initial recognition, an intangible asset shall be carried at cost less accumulated amortization and impairment losses. If the revaluation model is selected, the intangible asset shall be carried at its fair value less subsequent accumulated amortization and impairment losses. Fair values are to be determined from an active market and are to be reassessed with regularity sufficient to ensure that, at the end of the reporting period, the carrying amount does not differ materially from its fair value. A revaluation increase is to be recognized in other comprehensive income and accumulated in equity unless it reverses a previously recognized impairment loss, in which case it shall be recognized in profit or loss. If, in subsequent years, revaluation decreases on the same asset occur, such decreases are recognized in other comprehensive income to the extent of any credit balance in the revaluation surplus in respect of that asset. Otherwise the reduction is recognized in profit or loss. Any revaluation reserve in respect of a particular intangible asset is transferred to retained earnings when it is realized. This could be on disposal, although it is permitted to treat the additional amortization resulting from the revaluation as a realization of that surplus and transfer this amount from revaluation reserve to retained earnings. Under no circumstances can the revaluation reserve, or part thereof, be credited to profit or loss. USEFUL LIFE The useful life of an intangible asset must be assessed on recognition as either indefinite or finite. If the assessment determines the life to be finite, then the length of life or number of units to be produced must be determined also. An indefinite useful life may be determined when there is no foreseeable limit to the period over which the entity will continue to receive economic benefit from the asset. All relevant factors must be considered in this assessment and may include • Expected usage by the entity and whether it could be used by new management teams • Product life cycles • Rates of technical or commercial change • Industry stability • Likely actions by competitors • Legal restrictions • Whether the useful life is dependent on the useful lives of other assets “Indefinite” does not mean “infinite.” Additionally, assessments should not be made based on levels of future expenditure over and above that which would normally be required to maintain the asset at its initial standard of performance. AMORTIZATION The depreciable amount of an intangible asset with a finite useful life is to be allocated over its useful life. The depreciable amount is the cost of the asset (or other amount substituted for cost, e.g., in a revaluation model) less its residual value. Amortization shall commence when the asset is ready for use and shall cease when it is derecognized or is reclassified as held for sale under PFRS 5. The residual value is to be assumed to be zero unless there is a commitment by a third party to acquire the asset at the end of its useful life or there is an active market for the asset and the residual value can be determined by reference to that market, and it is probable that an active market will continue to exist at the end of the asset’s useful life. Therefore, an asset with a residual value at anything other than zero assumes that the entity will dispose of the asset prior to the end of the asset’s economic life. The Standard requires that the residual value be reassessed at each balance sheet date. Any changes are to be treated as changes in accounting estimates. In practice, this is unlikely to have any impact in view of the basic presumption of a zero residual value. Similarly, the useful life is to be reassessed annually. Any changes are also to be treated as changes in accounting estimates. Intangible assets with indefinite useful lives are not to be amortized. However, the asset must be tested for impairment annually and whenever there is an indication that it may be impaired. PAS 36 provides guidance on impairment. Additionally, the determination of an indefinite useful life must be reassessed at each balance sheet date. If the assessment changes, it is to be treated as a change in accounting estimate. Accounting for Specific Intangible Assets Patent A patent gives the holder exclusive right to use, manufacture, and sell a product or a process without interference or infringement by others. Acquired Same with PPE - (Cost depends on manner of acquisition) Internally generated Expensed – R&D costs related to the development of the product, process, or idea that is subsequently patented Capitalized – Costs to secure the patent right Amortization Over its legal life (20 years) or its useful life, whichever is shorter. Trademark A trademark or trade name is a word, phrase, or symbol that distinguishes or identifies a particular entity or product. Measurement Same with patents Legal life Legal protection for an indefinite number of renewals for a period of 10 years (Sec. 145 RA 8293) each. Amortization Limited life - Amortized over the life of the trademark Indefinite life - not amortized Franchise A franchise is a contractual arrangement under which the franchisor grants the franchisee the right to sell certain products or services, to use certain trademarks or trade names, or to perform certain functions, usually within a designated geographical area. Fees related to franchise Initial – capitalized; amount depends on the manner of payment Periodic – expensed when incurred Amortization Limited life - Amortized over the life of the franchise Indefinite life - not amortized Goodwill An asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized. (PFRS 3 Appendix) Determination of Goodwill Specific attributes approach The attributes and components of goodwill are identified and valued accordingly. Indirect valuation approach Goodwill is the difference between the purchase price and the fair value of identifiable net assets acquired. Excess earnings approach 1. Purchase of average earnings. Average earnings Less normal earnings (FV of NA x Normal rate of return) Excess earnings x number of years Goodwill Pxx xx xx x Pxx 2. Capitalization of average excess earnings Average earnings Less normal earnings (FV of NA x Normal rate of return) Excess earnings / Capitalization rate Goodwill Pxx xx xx % Pxx 3. Capitalization of average earnings Average earnings / Capitalization rate Net assets, including goodwill Less net assets, excluding goodwill Goodwill Pxx % xx xx Pxx 4. Present value of average excess earnings Average earnings Less normal earnings (FV of NA x Normal rate of return) Excess earnings x PVF using an appropriate rate Goodwill Pxx xx xx xx Pxx Illustrative Theories and Problems 1. Intangible assets are a. Identifiable non-monetary assets without physical substance. b. Properties held to earn rentals or for capital appreciation or both. c. Assets held for sale in the ordinary course of business. d. Tangible items that are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes; and are expected to be used during more than one period. 2. The critical attributes of an intangible asset include a. Identifiability (separable or arising from contractual or other legal rights) b. Control (power to obtain benefits from the asset) c. Future economic benefits (such as revenues or reduced future costs) d. All of the above. 3. An intangible asset shall be recognized if, and only if it is probable that the expected future economic benefits that are attributable to the asset will flow to the entity and the cost of the asset can be measured reliably. The probability recognition criterion is always considered to be satisfied for intangible assets acquired a. Separately. b. In a business combination. c. Either a or b d. Neither a nor b 4. Expenditures that do not satisfy the recognition criteria are recognized as a. In general, expense when they are incurred. b. In business combinations, part of the amount attributed to the goodwill recognized at the acquisition date. c. Either a or b d. Neither a nor b 5. PAS 38 defines ‘Research’ as a. The original and planned investigation undertaken with the prospect of gaining new scientific or technical knowledge and understanding. b. The application of research findings or other knowledge to a plan or design for the production of new or substantially improved materials, devices, products, processes, systems or services before the start of commercial production or use. c. The search for mineral resources, including minerals, oil, natural gas and similar nonregenerative resources after the entity has obtained legal rights to explore in a specific area. d. The determination of the technical feasibility and commercial viability of extracting the mineral resource. 6. Which statement is correct regarding initial recognition of research and development costs? a. Research costs may be capitalized. b. All development costs should be capitalized. c. If an entity cannot distinguish the research phase of an internal project to create an intangible asset from the development phase, the entity treats the expenditure for that project as if it were incurred in the development phase only. d. A research and development project acquired in a business combination is recognized as an asset. 7. Development costs are capitalized if, and only if, an entity can demonstrate: I. The technical feasibility of completing the intangible asset so that it will be available for use or sale. II. Its intention to complete the intangible asset and use or sell it. III. Its ability to use or sell the intangible asset. IV. How the intangible asset will generate probable future economic benefits. V. The availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset. VI. Its ability to measure reliably the expenditure attributable to the intangible asset during its development. a. I, II, III, IV, V and VI. b. I, II, IV and VI only. c. I, II, III, IV and V only. d. I, IV and VI only. 8. Snape Corp. is engaged in a research and development project to produce a new product. In the year ended December 31, 2019, the company spent P1,200,000 on research and concluded that there were sufficient grounds to carry the project on to its development stage and a further P750,000 had been spent on development. At that date management had decided that they were not sufficiently confident in the ultimate profitability of the project and wrote off all the expenditure to date to the income statement. In 2020 further direct development costs have been incurred of P800,000 and the development work is now almost complete with only an estimated P100,000 of costs to be incurred in the future. Production is expected to commence within the next few months. Unfortunately, the total trading profit from sales of the new product is not expected to be as good as market research data originally forecasted and is estimated at only P1,500,000. Assuming the other criteria given in PAS 38 are met, how much should be capitalized as of December 31, 2020? a. P1,650,000 c. P900,000 b. P1,550,000 d. P800,000 9. When an internally generated asset meets the recognition criteria, the appropriate treatment for costs previously expensed is: a. Reinstatement. b. No adjustment as these amounts may not be reinstated. c. Include in the cost of the development of the asset. d. Capitalize into the cost of the asset and adjust the opening balance of retained earnings 10. Coron Company incurred the following costs during the current year: Quality control during commercial production, including routine testing of products Laboratory research aimed at discovery of new knowledge Testing for evaluation of new products P58,000 68,000 24,000 Modification of the formulation of a plastic product Engineering follow-through in an early phase of commercial production Adaptation of an existing capability to a particular requirement or customer's need as a part of continuing commercial activity Trouble-shooting in connection with breakdowns during commercial production Searching for applications of new research findings 26,000 15,000 13,000 9,000 19,000 What is the total amount Coron should report as research and development expense? a. P137,000 c P198,000 b. P169,000 d. P213,000 11. Siargao Company provided the following information relevant to the research and development expenditures for the current year: Current period depreciation on the building housing R and D activities P1,500,000 Cost of market research study 1,000,000 Current period depreciation on a machine used in R and D activities 500,000 Salary of R and D director 1,200,000 Salary of Vice-President who spends ¼ of his time overseeing R and D activities 2,400,000 Pension costs for salary of R and D director 50,000 Pension costs for salary of Vice-President 100,000 The R and D expense for the current period should be a. P3,875,000 c. P4,875,000 b. P5,750,000 d. P3,800,000 12. Which of the following describes a patent? a. It gives the holder exclusive right to use, manufacture, and sell a product or a process without interference or infringement by others. b. A word, phrase, or symbol that distinguishes or identifies a particular entity or product. c. The exclusive and assignable legal right, given to the originator for a fixed number of years, to print, publish, perform, film, or record literary, artistic, or musical material. d. A contractual arrangement under which the franchisor grants the franchisee the right to sell certain products or services, to use certain trademarks or trade names, or to perform certain functions, usually within a designated geographical area. 13. Taal Company purchased a patent from the inventor, who asked P110,000 for it. Taal paid for the patent as follows: cash, P40,000; issuance of 1,000 shares of its own ordinary shares, par P10 (market value, P20 per share); and a note payable due at the end of three years, face amount, P50,000, noninterest-bearing. The current interest rate for this type of financing is 12 percent. Taal Company should record the cost of the patent at a. P110,000 c. P95,590 b. P 98,800 d. P85,590 14. A patent should be amortized over a. Twenty years. b. Its useful life. c. Its useful life or twenty years, whichever is longer. d. Its useful life or twenty years, whichever is shorter. 15. Legal fees incurred by a company in defending its patent rights should be expensed when the outcome of the litigation is Successful Unsuccessful a. Yes Yes b. Yes No c. No No d. No Yes 16. Haikyu Enterprises Inc. developed a new machine for manufacturing baseballs. Because the machine is considered very valuable, the company had it patented. The following expenditures were incurred in developing and patenting the machine. Purchases of special equipment to be used solely for development of the new machine Research salaries and fringe benefits for engineers and scientists Cost of testing prototype Legal costs for filing for patent Fees paid to government patent office P1,820,000 171,000 236,000 127,000 25,000 Drawings required by patent office to be filed with patent application 47,000 Haikyu elected to amortize the patent over its legal life. At the beginning of the second year, Haikyu Enterprises paid P240,000 to successfully defend the patent in an infringement suit. At the beginning of the fourth year Haikyu determined that the remaining estimated useful life of the patent was five years. The carrying amount of the patent at the end of fourth year is a. P135,320 c. P1,649,680 b. P131,100 d. P 39,800 17. An entity purchases a trademark and incurs the following costs in connection with the trademark: One-time trademark purchase price P100,000 Nonrefundable taxes 5,000 Training sales personnel on the use of the new trademark 7,000 Research expenditures associated with the purchase of the new trademark 24,000 Legal costs incurred to register the trademark 10,500 Salaries of the administrative personnel 12,000 Assuming that the trademark meets all of the applicable initial asset recognition criteria, the entity should recognized an asset in the amount of a. P100,000 c. P146,500 b. P115,500 d. P158,500 18. Hinata Corp. acquired a fast food franchise for a P50,000 cash down payment and in addition gave a P150,00, oneyear, noninterest-bearing note payable. The implicit interest rate is 12 percent. Hinata also agreed to pay the franchiser P100,000 per year for the next 10 years for promotional campaigns, accounting, and related services by the franchiser. Hinata should record the cost of the franchise as: a. P183,935 c. P 933,935 b. P950,000 d. P1,183,935 19. Copyrights should be amortized over a. Their legal life. b. The life of the creator plus fifty years. c. Twenty years. d. Their useful life or legal life, whichever is shorter. 20. On January 1, 2020, Karasuno Corp. acquired a copyright on a book of photographs from the estate of a world renowned photographer who died in late December 2019, for a price of P500,000. Karasuno’s CEO knows that copyrights normally cover the lifetime of the artist plus 50 years, but she has heard of a recent court case that extended the legal life by an additional 20 years. Other similar books sold by Karasuno for deceased photographers typically remain popular for only 10 years. The carrying amount of the copyright at December 31, 2020 should be a. P500,000 c. P492,857 b. P490,000 d. P450,000 21. RGW Industries purchased the net assets of SP Company for P1,300,000. A schedule of the net assets of SP Company, as recorded on SP Company's books at the time of the acquisition, is as follows: Assets Cash P 31,000 Receivables 250,000 Inventory 302,000 Land, buildings, and equipment (net) 350,000 Total assets P933,000 Liabilities Current liabilities Long-term debt Total liabilities P 90,000 185,000 P275,000 Net assets (book value) P658,000 The following schedule shows the differences between the recorded costs and market values of the assets of SP Company at the date of the acquisition: Cost Market Inventory Land, buildings, & equipment Patents Purchased in-process research & development Existing work force Totals Liabilities P302,000 350,000 -0-0-0P652,000 P275,000 P400,000 390,000 40,000 300,000 90,000 P1,220,000 P 275,000 Determine the amount of goodwill to be recognized on the acquisition. a. P642,000 c. P 74,000 b. P464,000 d. P164,000 SOLUTION: Purchase price Less FV of net assets: Cash Receivables Inventory PPE Patents In-process R&D Total Liabilities Goodwill P1,300,000 P 31,000 250,000 400,000 390,000 40,000 300,000 1,411,000 ( 275,000) 1,136,000 P 164,000 22. The reason goodwill is sometimes referred to as a master valuation account is because a. It represents the purchase price of a business that is about to be sold. b. It is the difference between the fair value of the net identifiable assets as compared with the purchase price of the acquired business. c. The value of a business is computed without consideration of goodwill and then goodwill is added to arrive at a master valuation. d. It is the only account in the financial statements that is based on value, all other accounts are recorded at an amount other than their value. 23. Tadashi Company engaged your services to compute the goodwill in the purchase of Tsukishima Company which provided the following: Net income Net assets 2017 P1,400,000 P 6,000,000 2018 1,600,000 8,000,000 2019 2,000,000 8,800,000 2020 2,200,000 9,200,000 Total P 7,200,000 P32,000,000 It is agreed that goodwill is measured by capitalizing excess earnings at 25% with normal return on average net assets at 15%. How much is the purchase price for Tsukishima Company? a. P11,600,000 c. P10,400,000 b. P11,200,000 d. P11,000,000 24. The owners of Bokuto Company are planning to sell the business to new interests. The cumulative net earnings for the past 5 years was P9,500,000. The current value of net assets of Bokuto Company was P20,000,000. Goodwill is determined by capitalizing average earnings at 8%. What is the amount of goodwill? a. P1,900,000 c. P1,700,000 b. P3,750,000 d. P1,250,000 25. We purchased all the outstanding ordinary shares of Fukuradani Travel Corporation. Fukuradani has one asset whose value exceeds its book value by P10,000. Fukuradani's Equity is P80,000. We agreed with Fukuradani that its excess earnings would last for 10 years and we were granted a 10% return on our investment. Fukuradani's average income for negotiation purposes is P40,000 and the industry average rate of return is 30% on market value of net assets. Using the "present value of excess earnings" approach to the calculation of goodwill, what is the purchase price paid for Fukuradani? a. P335,782 c. P169,880 b. P220,000 d. P 79,880