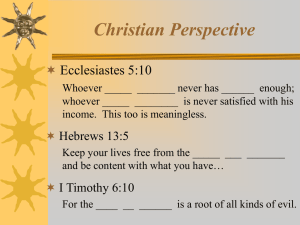

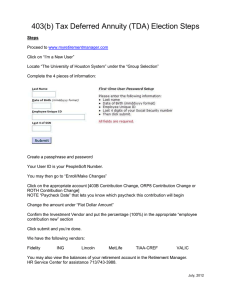

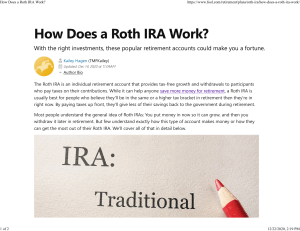

Professional Practice and Personal Finance ***Disclaimer*** Although the author believes all of the provided information to be accurate, correct, current and up to date, he makes no claims to be factual correct. He is not a CPA, lawyer, financial planner, or tax professional and as such all information given is generic and not intended for specific personal advice or recommendations for any product, investment vehicle, strategy, insurance or coverage of any kind. Please seek the consultation of a competent professional for any specific questions prior to making any financial or business decisions. Now that we’ve covered what this isn't; what is this presentation. It is my synthesis of opinions, both mine and others, experiences, and understanding of ideas related to the professional entry to practice and personal financial decisions of both new grads and seasoned CRNA;s. I have certain inherent biases that are part of my opinion. I have tried ruthlessly to include information about products and services that I may not agree with, but believe imperative to know about. (One liners for motivation) I. Employment and Income A. Employment i. Do not burn bridges ii. Very small community of CRNA’s and MDA’s iii. Every interaction can be an interview a) My children's rotation experience B. Contract i. Responsibilities for coverage a) Call; Night/Weekend/Service OB/GYN b) 24 Hrs? / 72 Hrs? Solo Practice/ BU Call System c) In house call; Home call, beeper. Maximum response time, 30 minutes? d) Vacation; Who covers your call. Do you pay them, system, self billed ii. Type of facility a) Ambulatory Surgery Center b) Dental office c) Pain clinic d) Teaching Hopsital/Private Hospital UTMC/UA is a combined type. UTMC is teaching hospital while UA is a private group with a contract for all anesthesia services. CRNA’s are employees of UHS, Inc, the company that owns UTMC. CRNA’s get benefits through UHS, and medical directed by UA. UA also buys us additional benefits. Decreases Nursing administration over control of CNRA’s. e) Practice Type Solo CRNA Only ACT Equal Group Participation MDA Only f) Practice Restrictions Imposed by Hopsital or Supervising MDA No OB No Heads/Hearts Can be political or no cases done of that kind iii. Compensation (Biggest Wealth Building Tool) a) W-2 (UTMC) Employee Paid a wage +- Call System Benefits typically provided b) 1099 (contractor) Typically higher wage Does not typically have health insurance or other benefits They do NOT pay half of Employment Taxes Greater options for business tax code and deductions c) Self Billing You bill directly for your services May receive small stipend from facility d) Locum Tennens Can be a mixture of any payment type based on contract, but typicall the contract has a finite start and end date. Could be for vacation coverage of Solo CRNA/MDA, or short term OR coverage. iv. Benefits a) Health insurance b) Life insurance c) LTD/STD * d) PTO/Vacation/Continuing Ed time and money e) ESL f) Retirement * 401k (roth) 403b (roth) 457 (b)(f) HSA SEP IRA II. Personal Finance A. Taxes i. Why do they matter? a) Typically largest expense every month. ii. Minimize tax bill, How? a) Easiest way is to make less money. Progressive Tax System All things being equal, More taxable* income = More taxes Lower taxable income by pretax deductions, health insurance, FSA Tax deferred plans, 401k, 403b, 457 (b) (f), HSA, Traditional IRA iii. What type of taxes are we concerned with? a) Federal income tax Tax paid on wages-Progressive tax system b) Employment Taxes-FICA (Federal Insurance Contribution Act) Medicare; self explanatory 1.45% Paid by both Employee and Employer; Total 2.9% if self employed Can have a surchage 0.9% o employee for higher incomes >200k OASDI (Old Age Survivors Disability Insurance); Basically what people call SS 6.2% Paid by both Employee and Employer; Total 12.4 if self employed Taxed on first $127,200.00; Adjusted each year iv. But if work too many hours I will make less money b/c of taxes a) WRONG-Progressive Tax System-Higher percentage as income increases b) Adjusted gross income c) All income minus deductions Standard or Itemized Student loan interest* Teacher expenses Moving expenses HSA/Trad IRA* Education Costs * v. That number puts and your filing status you into a marginal tax bracket a) 2017; 10, 15, 25, 28, 33, 35, 39.6% b) 2018; 10, 12, 22, 24, 32, 35, 37% vi. Progressive Chart-Not all money is taxed at the highest rate, tiered system vii. Effective tax rate is the total tax paid divided by gross income a) That will change based on your increasing taxable income b) You will not make less, by earning more! (**% Take home will change**) viii. Your year end tax liability is then determined by Subtracting what your paid, by what you owe(Tax Table Calculation), minus any credits. Ie EIC*, Child Tax Credit*, Credit for Disbaled Elderly* B. The P in Personal Finance is key. No 2 people are the same. i. B^*&#T (Budget) is not a dirty word a) A tool to make your money behave b) Simply tracking your expenses, post hoc budgeting, can have an impact c) Simple or complex back of napkin excel YNAB quicken Mint.com Personal Capitol ii. Do not save what is leftover after spending, spend what is leftover after saving a) Savings goals LT >5 yrs-Emergency Fund, Retirement Accounts, Home MT 1-5 yrs-Car, Maintenace, Emergency Fund ST-Yearly-Emergency Fund, Taxes, Insurance Premiums, Vacations, X-mas b) Bills Discretionary-you decide monthly how miuch to spend Groceries, Gasoline, restaurants, entertainment, kids sports stuff, school lunch, education supplies DR envelipe system, cash in envelope at each paycheck, forgot cash digital envelopes, (GoodBudget.com) auto syncs, wife and I both know “Fixed” Monthly bill is same or similar and recurring, (*you don’t control*) Mortgage, student loans, car debt, personal loans, CC **cable, utilities, netflix, subscriptions** III. A. Income and Asset Protection (Why?, biggest wealth builing tool)(Insurance) Know your practice regulations, restrcitions, standards of care. Local, hospital, state abd federal practice guidlijes, and restrictions. You are your best defense. What skills are you proficient in? What skills have you not practiced in 5 years, 10 years. Do not put yourself in harms way. Legal right vs compentence can be argued. ii. Insurancea) Malpractice Insurance Group or Solo coverage Limits b) Life Insurance Term Set length, 10-30 yrs, guaranteed value relatively inexpensive can cancel at anytime Whole life, aka cash value, ordinary life, universal lifestyle Names keep changing d/t a negative association generates cash value Investment vehicle built into a life insurance policy can be expensive can be a cash tax shelter in some instances c) STD Pays out after 1 week for first 90-180 days? usually expensive and pays out relatively small amount, and you don't know when you will need it, could be paying into for years, (Except Pregnancy) Emergency fund self insured d) LTD Pays out after 90-180 days until 5 years? General LTD Own Occ pays out for predentermined number of years, can be until age 70+ Expensive, but does not force you back into a non Anesthesia career, and allows you to work in addition. e) Auto/Home Insurance CRNA’s may be seen as “deeper” than normal pockets , Target f) Umbrella coverage Increases total liability coverage for any claim made against yourself +- Target g) LLC or limited partnership vs sole proprietor Business structure can protect personal property from litigation IV. Retirement-Nest Egg a) Elusive pot of gold at the end of the rainbow ii. Magic Formula a) Income – Expenses = Leftover b) Make more, Spend Less, Invest the Rest Income ++ Call Team, Side hustle, Locum Change employer, self employ Significant other returns to workforce Expenses – AVOID lifestyle inflation (Dr. Itis) No need to finance a 60k automobile for 6 years just for graduating Used vs new car, depreciation Sweet spot for used 2-3 yrs old New car sweet spot must own for 10 years Don’t need to buy or build a McMansion 15 vs 30 year mortgage interest rates longevity, typical home ownership 7 years Moving costs Closing costs Realtor fees Upgrading Your home location affects your expenses exponentially-1st 3 easy Geographic Arbitrage State and local income taxes (local income taxes!!) State and local sales tax city and county realestate taxes Neighborhood HOA Dues Greencare lawn service public vs private school Type of car in driveway Type of furnishings kids your kids hang out with, vacations, gaming systems walmart vs trek bicycle kohls vs American eagle iii. What to do with the diffence? a) Invest it!! (and start early) The power of compounding-5000$ yearly Susan age 25-35, 50k Bill age 35-65, 150k Chris age 25-65. 200k Who has more money at age 65?? Let your money work for you b) Where to invest it? Retirement vehicles (varying rules and limits on contributions and withdrawals) 401k (roth) 403b (roth) 457 (b)(f) HSA SEP IRA Tradition IRA Roth IRA Non Retirement Vehicles Debt (increase cashflow) Business opportunity (passive income?) Rental property Savings Account HY After tax Brokerage Account Too many choices whichh one is best Debt vs 401k? Student loan vs downpayment on house? Emergency Fund vs Vacation? Oppurtunity Costs Everything is a trade off. Everything needs balance. You can tackle mutiple targets at a atime. Not an all or none. c) Typical Retirement assets will have a sugnificant portion in stocks bonds and mutual funds. (not an endorsement, but an observation), d/t that some basic understanding is needed. Stocks-(equities) Partial ownership in publically or privsately traded company You pay a brokerage fee (commission) to the broker who brokers the deal (Purchases the equity) on your behalf. No ongoing fee associated with stock unless you sell, or have a taxable event. Since it is one company the risk of that invenstment is higher, not a lot of diversification Bonds-(Debts) You are loaning money to a company, government or entity with the promise to pay a set interest rate plus the face value of the bond (loan) on a due date. The debtor may default and not pay you back. Different bonds have different credit ratings ranking their risk, junck vs US Treasury bonds, the greater the risk of default, the greater the interest rate. Mutual Funds-(Groups of Stocks or Bonds, or mixtures of varyign percentages. Larger diversifcation d/t multiple companies being in the mix. Risk pooling. Some Mutual funds have a 1 time sales charge (Commision) Active vs Passive Mutual Funds Active Funds have managers who try to coninutaly beat the market average by adding and removign stocks from their mix. Typical Expense ratios 1-1.5%, 100-150 basis points (bips) Passive funds have managers who seek to mirror a market index and do not “actively” buy and sell stocks consistently Typical expense ratio 0.05-0.5%, 5-55 basis points (bips) If the active fund manager can beat the market, aren’t they worth the extra money? Most cant. They get paid whether they do or dont perform better. Layer on more fees with a CFP or a Registered investment advisor charging a %AUM That % cost difference can be devastating. 20 yrs, 1500$ month 8% = $ 2.23M, 7% = $ 1.82M, 1% costs you $400k 6% = $ 1.5M, 2% costs you $700k Why pay someone an extra 1% on top of mutual fund fees to manage your retirement accounts. d) Major Cost of market fluctuations arise from buying and selling at less than oppurtune times. Nobody can predict the future, but selling off after a sudden market drop locks in a loss, and makes it difficult, if not impossible to ride the recovery that has accompanied every recess/decline/crash in history. Your ideal asset allocation must take into account your risk tolerance and timeline. More time and risk tolerance usually means more aggressive, (heavier on equities), more volatile but higher overall return. Total stock Marker index is 7-8% annually Less time or risk tolerance usually means more conservative, (heavier on bonds), less volatile but less overall return, Total bond Market index 1-3% annually. iv. Be willing to adapt to an ever changing environment. Just when you get everything in asset allocation and retirement planning just as yiu want, something will change. Job change Spouse change, death, divorce, long term care needs Major tax law changes , 2018 Market conditions can change, buy, sell, hold the course. Market volatility and your comfort level getting more aggressive or conservative V. Nobody will ever care for your career, money or goals more than you will. Take the initiative, learn all that you can and enjoy the benefits you have all worked so hard to achieve.