Securing Financial Future Your

advertisement

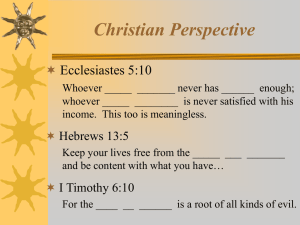

Securing Your Financial Future Amount American Workers Have Saved for Retirement (65% are confident they will have enough money for retirement) $250,000 or more 11% $100,000 -249,999 12% $50,000 - $99,999 Less than $25,000 12% 52% $25,000 - $49,999 13% SOURCE: Employee Benefit Research Institute Christian Perspective Ecclesiastes 5:10 Whoever loves money never has money enough; whoever loves wealth is never satisfied with his income. This too is meaningless. Hebrews 13:5 Keep your lives free from the love of money and be content with what you have… I Timothy 6:10 For the love of money is a root of all kinds of evil. Christian Perspective I Corinthians 16:2 (Paul speaking) On the first day of each week, each one of you should set aside a sum of money in keeping with his income, saving it up, … Proverbs 13:11 Dishonest money dwindles away, but he who gathers money little by little makes it grow. Proverbs 13:22 A good man leaves an inheritance for his children's children, … 401K, 403B, 457, SEP Retirement Plans Company sponsored retirement savings plans (supported by multiple types of mutual funds) – 401K offered by “for profit” companies – 403B offered by “non profit” companies – 457 offered by government agencies – SEP available for self-employed individuals In many cases, these retirement savings plans are replacing company sponsored pension plans 401K, 403B, 457, SEP Retirement Plans (cont’d) Maximum contribution is 15% of earned income Tax favored (tax advantaged) – Additions are made with “before- tax” dollars – All interest/dividends are tax deferred Most companies will match the first 1-5% of each employee’s contribution All balances must be rolled over to an IRA when you leave a job (to avoid taxes and 10% tax penalties) Individual Retirement Accounts Traditional IRA – – – – – All contributions are made with “before-tax” dollars All mutual fund gains are tax differed All future withdrawals are fully taxable You must begin withdrawing money at age 70 ½ Main use: Store (roll over) 401K/403B funds from previous jobs (and thus defer taxes) Roth IRA – – – – (very similar to a 401K or 403B plans) (introduced in 1997) All contributions are made with “after-tax” dollars All mutual fund gains are tax free All withdrawals are tax free (after age 59 ½ ) You do not have to begin withdrawing money at 70 ½ Retirement Strategy Begin investing 10% your first day at work – You will never miss what you never had – You will not have to make tough decisions later Recommended Investment Strategy – First, invest in a 401K up to the matching percent – Second, invest in a Roth IRA up to the maximum amount allowed per year ($4,000 in 2005). – Third, go back and invest in your 401K up to the maximum allowed per year ($14,000 in 2005) Retirement Savings Example Your first job pays $30,000 per year and you get a raise of $3,000 per year thereafter. You contribute 10% each month (payroll deduction) Your employer matches the first 3% contribution You contribute 10% for 45 years (ages 22–67) Your final retirement “nest egg” will be: 401K + Roth IRA = Total $ 700,000 + $ 800,000 = $1,500,000 ( 5% - pessimistic) $ 900,000 + $1,100,000 = $2,000,000 ( 6% - conservative) $1,500,000 + $1,800,000 = $3,300,000 ( 8% - avg. last 30 yrs) $2,600,000 + $3,100,000 = $5,700,000 (10% - optimistic) Summary Every person is eligible to invest in their future You will secure your financial future if you follow one simple rule…. Invest 10% beginning day one of your career Don’t borrow from your 401K or 403B plan! College is still the best option if you want: – More initial career options – Higher starting salary – More career advancement opportunities