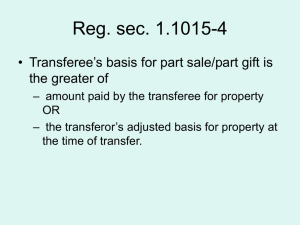

Real Estate Taxation Unit 1: Choice of Business Entity Choice of Business entity ● State law entities ○ ● Tax Entities What are the general types of state-law entities that are important in real estate transactions? a. Partnership i. General ii. Limited iii. LLP b. LLC c. Corporation d. 2. What non-tax factors should a taxpayer consider when choosing a state-law entity to hold his/her property? a. Liability 3. What are the four main types of tax entities that real estate ivestors should consider? a. Corporate Tax entity, C-Corp b. S-Corp c. Partnership d. Sole proprietorship (disregarded entity) 4. Check the box regs allow you to choose how you would like the state entity to be taxed as a tax entity. 5. On February 1, Year 1, Ali, Bobbi and Cris formed a limited liability company (ABC LLC), which acquired 3 acres of land. ABC LLC intends to build ann apartment building on the land. 4. What type of tax entity is ABC LLC? a. C-Corp, S Corp, Partnership b. CTB if you have entity that is not a per se corp, and that entity has more than 1 member, you get to choose whether you want to be a partnership or C-Corp. c. If you don’t choose, you will be a partnership. d. If only 1 member, option is disregarded entity (default) or elect corporation. e. If you have a foregin entity, if its not 5. Why might you advise Ali, Bobbi and Cris to treat ABC LLC as a tax partnership? a. Tell them to elect a tax partnership because it is a flow through entity. i. Better tax benefits b. Inform that a C-corp is subject to double taxation. c. Hold income at Corp at 21% d. Individual rate at 37% e. Tax Act introduced qualified business income deduction (QBI) i. Certain flow through entities receive an additional deduction and reduces tax rate. Always want to start with what a person’s gross income is. Section 61(a). “Gains derived from dealings in property” AR-AB = Gain/loss (Sec. 1001(a)) 1. UNIT II ASSIGNMENT Basis, Realization, and Recognition I.A. Introductory Concepts, Purchases and Sales, Taxable Exchanges Code: §§ 61(a); 83(a); 109; 1001(a)-(c); 1011(a); 1012(a); 1019 I.B. Gifts, Spouses Code: §§ 102; 1015(a); 1041(a)-(c) I.C. Transfers at Death Code: §§ 102; 691(a)(1)-(3); 1014(a), (b)(1), (c), (e); 2032(a), (c) Problem 1(a) In Year 1, A purchases unimproved land for $100 in cash. At the end of year 1, the land is worth $105. In year 10, A transfers the land to B in exchange for $80 in cash and stock worth $35. How much gain does A recognize in Year 1 with respect to the land? No realization event during year 1. AR -AB 115-100 = 15 ● No gain or loss recognized ● There is no realization event. A realization event is ● Benefit of realization event is you get to defer the gain. ● A realization event might not be a good thing if: ○ When you have loss ● Why are we not taxing? ○ May not have cash In Year 1, A purchases unimproved land for $100 in cash. At the end of year 1, the land is worth $105. In year 10, A transfers the land to B in exchange for $80 in cash and stock worth $35. How much gain does A recognize in Year 10 with respect to the land? ● $15 gain. ● Realized gains are recognized gains. Treas. Reg 1.1001-1(a) ● Gen rule. Except as otherwise provided in subtitle A of the code, the gain or loss realized from conversion of prop to cash Haig-Simons Definition of Income ● Income=Consumption + Change in Value of property rights. ● Income = 0 + (105-100) = $5 of gain under this definition. An exchange is considered to be a realization event if it Problem 2 ● Cottage savings case ● If you are determining whether they are of the same value, you ask. ○ Are these legally distinct embodiments ● 1.1001-3 ○ When do significant modifications of debt result in come Problem 3 ● A: X corp stock; paid $200; FMV $250 ● B: Y Corp Stock; paid $300; FMV $260 ● A and B exchange stock. ● First ask ○ Has there been a realization event? ■ Yes because there is an exchange for x corp stock and y corp stock. ■ Therefore, gain/loss may be triggered. ● ● A pays $250 cash to buy Y stock A exchanges X Corp stock for Y Corp Stock ○ Tax consequences to A ■ AR-AB ■ 260-200 = 60 gain. ■ Y corp stock ■ A’s basis in new Y stock is $260 amd not 260 because you already have paid tax on it ■ When you have exchange, basis will be FMV of property received. ○ B tax consequences ■ B disposing y Stock ● 250 - 300 ● ● ● ● ● B has a $50 loss B’s basis in x stock ○ 250 because it is an exchange. ○ If you don’t know what FMV, then you would look at person paid for property received. Philadelphia park case ○ Tell’s you what basis in property is when you deal with an exchange ○ Def Basis when exchanging property ○ Default rule: FMV of property received ○ Second rule: FMV of property that gave up ○ Third rule: TP’s basis in property that gave up. Hypo ○ A: X corp stock; paid 200; fmv 250 ○ B: y corp stock; paid $300; $260 ○ A is an employee of B. A buys Y corp stock from B for $250 cash. Stock worth 260 ○ What is A’s basis in Y corp stock? ■ 260 to prevent a double tax on stock. ■ Tax cost basis. ○ --------------------------------------------------------------------------------------------------------------------------------------UNIT II ASSIGNMENT Basis, Realization, and Recognition I.A. Introductory Concepts, Purchases and Sales, Taxable Exchanges Code: §§ 61(a); 83(a); 109; 1001(a)-(c); 1011(a); 1012(a); 1019 Treasury Regulations: § 1.61-2(d)(2)(i); 1.1001-1(a); 1.1001-2(a)(1)-(3), (4)(i)-(iii), (b), (c) (Exs. 1, 2, 7, 8); 1.1012-1(a) Textbook : pp. 1; 115 – 119 (Philadelphia Parks); 120; 871 – 872. Other Materials: ● Haig-Simons Definition of Income ● Cottage Savings Ass’n v. Comm’r Problems: 1 – 5 I.B. Gifts, Spouses Code: §§ 102; 1015(a); 1041(a)-(c) Treasury Regulations: § 1.1001-1(e); 1.1015-1(a)(1)-(2); 1.1015-4 Textbook: pp. 128 – 130. Problems: 6 – 7 I.C. Transfers at Death Code: §§ 102; 691(a)(1)-(3); 1014(a), (b)(1), (c), (e); 2032(a), (c) Treasury Regulations: §§ 1.1014-1(a); 1.1014-2(a)(1); 1.1014-3(a) Textbook: pp. 131 - 133 Problems: 8 UNIT II Problems Basis, Realization and Recognition 1. In Year 1, A purchases unimproved land for $100 in cash. At the end of year 1, the land is worth $105. In year 10, A transfers the land to B in exchange for $80 in cash and stock worth $35. 1. When and in what amounts does A recognize gain with respect to the land? i. 1001 ii. AR-AB= G/L 2. 3. 4. 5. 6. iii. Except as otherwise provided in this subtitle, the entire amount of the gain or loss, determined under this section, on the sale or exchange of property shall be recognized 2. Think about the definition of income given by Haig- Simons. As of the end of year 1, how would A be taxed on the profits from her land investment under a tax system based on the Haig-Simons definition? i. Income = consumption + change in value of property rights T, a bank, holds a portfolio of mortgage loans whose value is substantially below T’s cost. T exchanges the portfolio of loans for a loan portfolio held by another bank. The portfolios given and received in exchange have been carefully selected to be as nearly identical as possible in principal amounts, interest rates, maturity dates, nature of the property securing the loans, and other factors affecting value and performance. Banking regulators have ruled that gain or loss need not be recognized on such an exchange for financial accounting purposes. Can T nevertheless properly claim a tax deduction for loss realized on the exchange? A owns stock of X Corp. that she purchased 5 years ago for $200 in cash. B owns stock of Y Corp, purchased 2 years ago for $300. A and B swap when the X stock is worth $250 and the Y stock is worth $260. What are the tax consequences of the exchange to A? (Refer to Philadelphia Park case). 1. Basis when exchanging properties: i. Default rule: FMV of property received ii. Second rule: FMV of property that gave up iii. Third rule: taxpayer’s basis in property that gave up 2. T owes $100 as the principal amount of an enforceable borrowing. Having already expended all of her money, T transfers shares of X stock worth $100 to the lender in satisfaction of the debt. T received the X stock from her employer as a bonus several years ago when the stock was worth $60. What are the tax consequences to T? 1. When you receive $60 of stock, that becomes $60 of ordinary income. Compensation income. 2. Sec 83 - if you receive property in exchange for services and property not subject to forfeiture and not restricted. 3. You take FMV of property received - amount paid for that property = compensation income. 4. AR-AB=G/l 5. 100 (FMV of Property) - 60 (tax cost basis) = 40 gain 6. Reg 1.1001-2(a)(1) 7. Reg 1.61-2(d)(2)(1) A purchases 100 acres of vacant land for $100,000. A leases it to the Nordic Cross Country Ski Club for $10,000 a year, which is a market rate of rent. The lease is for 10 years. In the 5th year the Club builds a warming hut, whose value is $5,000. The hut will pass to A at the termination of the lease. In the 12th year, A sells the land and the hut to B for $115,000. What are the tax consequences to A? 1. HS Income = consumption + Change in wealth 2. Change in wealth argument could be year 5 when hut was built 3. Change in wealth could be year 10 when lease ends 4. Change in wealth could be year 12- convert into cash. 5. Sec 109 says that for tax purposes, change in wealth will be when property is sold. 6. Income in year 12 7. To prevent landlord from avoiding income on hut we have Sec 1019 8. 109 and 1019 go hand in hand 9. 1019 - property on which lessee has made improvements - no basis shall be increased or decreased based on improvement to the land. 10. 115k-100k=15k A makes a gift to B of an undeveloped parcel of real property, Blackacre, which A had purchased several years ago for $500. Determine the tax consequences to A and B in the following alternative situations: 1. Blackacre is worth $1000 at the time of the gift. No gift tax is paid. Three months later, B sells Blackacre for $1600. i. B 1. How much g/l does B recognize? a. None - section 102 b. Can’t exclude income unless you can find provision. 2. B’s basis will be donor’s basis 3. B’s basis will be 500 - 1015(a) ii. AR-AB=G/L iii. 1600-500=1100 iv. When property received by gift, holding period can be tacked on by previous owner. v. A consequences 1. No income tax consequences from gift. vi. HYPO 1. Y1: a purchased blackacre for $500 2. CY: Blackacre FMV = 1000 a. A sells to B for 700 cash 3. 1.1001-1(e)(1) a. Transferor will receive amount of gain up to their basis. 4. What does discount mean in sibling context? It is a gift 5. This will be a part sale/part gift transaction. 6. A purchased Blackacre several years ago for $500. B pays A $700 cash for Blackacre, which has a FMV of $1,000 at the time of the purchase. How much recognized gain or loss does Taxpayer A have as a result of this part sale/part gift? a. $200 gain b. AR-AB=G/L c. 700-500=200 d. Part sale/part gift- not fully exempt, transferor will recognize 7. What is taxpayer B’s basis in blackacre? a. 700 basis because that is how much b paid b. Compare cost basis and donor’s transfer basis i. Take the bigger number ii. 700 v 500 8. A purchased Blackacre several years ago for $500. B pays A $400 cash for Blackacre (instead of $700). Blackacre has a FMV of $1,000 at the time of the purchase. How much recognized gain or loss does Taxpayer A have as a result of this transaction? a. 0 gain/loss b. Why 0? c. 400-500 = 100 loss d. HOWEVER, you don’t recognize loss in part sale and part gift. 9. What is Taxpayer B’s basis in Blackacre? a. 500, you take greater amount when comparing basis 2. Blackacre is worth $300 at the time of the gift. No gift tax is paid. Three months later, B sells Blackacre for, in the alternative, $200 or $400. (A’s basis = $500). i. What is B’s Basis? 1. 500 2. Based on 1015 donor basis (carryover basis) 3. General rule does not apply because at the time that B acquires property, there is an inherent loss. 4. Basis is greater than FMV and sells at a loss, 1015 says don’t use carryover use FMV at time of gift. 5. Since loss on property, 6. FMV at time of gift: 300 7. When b sells property, B receives 200 8. 200-300=100 loss 9. No one gets to take the 200 loss, it disappears 10. How do you avoid this and are able to recognize the loss? a. A could have sold the property to an unrelated party and then given money to B ii. B sells for 400 1. We have inherent loss since 2. When you have inherent loss but sell for gain 3. B would not have gain nor loss. iii. A makes a gift to B of an undeveloped parcel of real property, Blackacre, which A had purchased several years ago for $500. Blackacre is worth $300 at the time of the gift. No gift tax is paid. This time, B sells Blackacre for $800. What is B’s basis in Blackacre? 1. B’s basis in the gift is $500 2. There is still inherent loss but in order to use FMV as basis, it is only available if you sell it at a loss 3. Here it sold it at a gain, therefore use FMV/ 7. H purchases stock in 2010 for $140,000. In 2020, he gives his wife W the stock when its value is $170,000. W subsequently sells the stock for $210,000. What does H report? What does W report? 1. Tax consequences when Husband transfers to wife i. none ii. 1041 iii. Transfers between spouses, no gain loss recognized by either 2. What is wife’s basis? i. Transfer basis - 140K ii. AR-AB= G/L iii. 210-140=70K gain 8. Suppose instead that in 2020 H divorced W and as part of the settlement, H was required to transfer the stock to W. At that time, the stock had a value of $100,000. W subsequently sells the stock for $80,000. What does H report? What does W report? 1. Does 1041 apply to divorced spouses? i. yes , incident to divorce if transfer occurs within 1 year of divorce. ii. Carryover basis of 140 k basis 2. H reports? i. 9. D bought X stock for $100 and held the stock until he died this year. The stock, worth $120 when D died, was bequeathed to B by D’s will. Ten months after D’s death, the stock is distributed to B and B immediately sells it for $140. To whom is the profit on the stock taxed? 1. What happens if transfer is at date of death? 2. Sec 102 3. Sec 1014 - basis in property received from inheritance, will be FMV at the date of death. Generally results in a step up in basis. 4. 120 Basis 5. 140-120=20 gain --------------------------------------------------------------------------------------------------------------------------------------------------- UNIT III ASSIGNMENT Cost Recovery (Depreciation and Amortization) A. Theory and Stakes, Property Qualifying for Cost Recovery Code: §§ 167(a), (c); 168(a), (i)(8); 248; 709; 263. Treasury Regulations: § 1.167(a)-1; -2; -4(a); -5 Textbook: pp. 394 – 400 (a review – read, if necessary) Additional Materials (TWEN): Rev. Rul. 2001-60; Rev. Rul. 68-232; Geneva Drive-In Theatre Problems: I & II B. Intangibles Code: §§ 167(g)(1), (2), (6); 178; 197 Treasury Regulations: § 1.162-11(a); 1.167(a)-3; 1.167(a)-14(c)(4); Skim § 1.197-2(a)-(g)(1) C. Tangible Personal Property and Real Property Code: §§ 168(a)-(e)(2) [skim (e)(3)], (g)(1)-(3), (7); (i)(1)-(2), (k)(1)-(2)(A), (E)(ii), (F)(i), (6), (7); 179(a)-(c), (d)(1)-(3); 1016(a)(1) & (2). Cost Recovery ● Benefit of immediate expensing ● Property qualifying for cost recovery UNIT III Problems Cost Recovery (Depreciation & Amortization) I. Theory and Stakes T is a taxpayer who is in the 40% tax bracket at all relevant times. On January 1 of this year, T buys machinery for a purchase price of $2,000,000 that will be useful in T’s business for 5 years. The salvage value of the machinery, that is, the estimated fair market value of the machinery at the end of its useful life, is negligible. 1. May T deduct the full cost of this machinery upon acquisition, i.e., today? Why or why not? ■ No, because T is buying a depreciable asset. ■ Section 263 says that anything that has a value of more than 1 year then you have to capitalize and you cannot deduct immediately and you have to give it basis. 2. If T were entitled to deduct the full cost of the asset today, how much would she currently save in taxes? ■ T’s tax savings would be 800K ■ Amount of deduction * marginal tax rate ■ 2M*40% = 800k tax saving 3. If she were required to wait until the end of year 5 to deduct any portion of her cost, how much would she save in taxes? ■ 2M*40% = 800k 4. If she were required to recover her cost in the asset by deducting a ratable portion each year she used it in her business, how much would she save in taxes? ■ Y1-y5 ■ 400k deduction each year for 5 years ■ 400k*5 year = 2M * 40% = 800k 5. Which method should T prefer and why? Do you need more information? ■ Time value of money ■ Dollar today worth more than dollar in future Section 167 - tells us what we can depreciate Section 168 - how we calculate depreciation for tangible property How do i know something is depreciable? Section 167 Requirements ● Trade or business or investment property ● Property with determinable basis (subject to wear and tear) ● Property with determinable useful life II. Property Qualifying for Cost Recovery Which of the following are depreciable? 1. Land bought for farming. In its natural state, the land was covered with water. The taxpayer drained the land, exposing a rich organic topsoil that is ideal for farming but will oxidize over time. The topsoil is expected to last for 20 years, water which time the land will not be usable for growing crops and will have a nominal value. ■ Expenditure for land ● Land not depreciable, not subject to wear and tear and no useful life ● Reg 1.167(a)-2) ■ When dealing with land and it may have a useful life for only 20 years, you cannot depreciate it because it will always exist ■ Expenditure for drainage expenses ● RR 2001-60 - golf course, 2 different types of greens, modern greens are depreciable because they had to put grass over pipes ■ Test - if you would have to destroy the land preparation in order to fix depreciable assets then you can depreciate it. ■ Are the drainage expenses associated with a depreciable asset? 2. Expenditures incurred in organizing a corporation. ■ Get immediate deduction unless expenses produce value that extends beyond the taxable year ■ IRC 248 ■ Can deduct 5000 over 180 months ■ Hypo - on 1/1/Y1 spend 35,000 to org a corp and the corp begins business immediately ● ● ● Immediate deduction: lesser of 5000 or expenses Deduct 5000 in Y1 Amortize remaining expenses over 180 months ○ 30,000/180 months - 167/month ○ 167/month in y 1 = 200 in y1 ○ Total year 1 deduction = 7000 3. A commercial office building and the underlying land, purchased subject to a 10-year lease at a rent equal to the current fair rental value of the building and land. ■ Land ● Land not depreciable ■ Building ● Depreciable but question ■ Lease ● Reg 1.167(a)-5 ○ the basis for depreciation cannot exceed an amount which bears the same proportion to the lump sum as the value of the depreciable property at the time of acquisition bears to the value of the entire property at that time. ● Must have some basis in lease in order to depreciate it ● If you are buying property subject to lease in which you get rent equal to FMV, you have a 0 basis. That is because you’re giving up right to use land in exchange for those assignments ■ We’re going to divide 100k between land and building ■ 4. A owns undeveloped land that he leased to B for 10 years. B built a building on the land. Under the terms of the land lease, the building reverts to A upon expiration of the lease. (See Geneva Drive-In case; § 168(i)(8); § 1.167(a)-4(a)). ■ Land ● Not depreciable ■ Building (B built) ● Leasehold improvement ● Who gets to depreciate? ○ Geneva ■ While lessee owns the property, it can take depreciation ■ When property reverts back to owner, it may be possible for landowner to take deductions ○ Lessee holds for 5 years - reg 1.167(a)-4(a) ○ 168(i)(8) ■ (8) Treatment of leasehold improvements ■ (A) In general In the case of any building erected (or improvements made) on leased property, if such building or improvement is property to which this section applies, the depreciation deduction shall be determined under the provisions of this section. ■ (B) Treatment of lessor improvements which are abandoned at termination of leaseAn improvement— ● (i) which is made by the lessor of leased property for the lessee of such property, and ● (ii) which is irrevocably disposed of or abandoned by the lessor at the termination of the lease by such lessee, shall be treated for purposes of determining gain or loss under this title as disposed of by the lessor when so disposed of or abandoned. ● Lessee for 5 years will depreciate with nirmal depreciation rules ● Any depreciation that was not recovered, you will treat as disposed of for zero dollar minus basis = loss ● Landlord - gets to take depreciation, in year 10, landlord gets deduction and starts over when he receives at 10 year, 27.5 ○ But depreciation deduction because he paid nothing for it ○ 109 - no gross income from receiving ○ 1019 says you have zero basis 5. Assume in (4) that the land and improvements are worth $1,000, while the land alone is worth $800 without the building. T buys the land from A subject to the land lease (i.e., T’s purchase of the land includes A’s position as lessor under the land lease) and, in addition, T buys A’s right to reversion of the building. T paid $877. The annual ground rents under the land lease are $80, the fair rental value of the land apart from the building improvement. ■ L&I FMV: 100 ■ Land FMV: 800 ■ T buys land subject to land lease and buys A’s right to reversion of building for 877 ■ Annual ground rents under the land lease: $80 ■ What does 77 dollars represent? Represents the value of the leasehold improvements ■ At the time when building reverts back to buyer thats when new owner gets to depreciate the building. ■ Court tells purchaser that even though you bought today, you cannot deduct until you receive property 6. A tract of farm land purchased for investment. The land is subject to a lease that will expire in 10 years. The fair rental value of the land is $100 per year and the fair market value of the land, unencumbered by the lease, is $1,000. Assume that the annual rent under the lease is $120 and the purchase price is $1,122 ($1,000 plus the present value of $20 per year for 10 years at 10 percent). (Compare § 171(a)). ■ Farm land (with lease) purchase price - 1122 ■ Land FMV - 1000 ■ Fair rental value of land - 100/year ■ Annual rent - 120/year ■ When rent is higher than market rent, there is a basis ■ Can we depreciate our basis in the lease? ■ Is a lease is a depreciable asset? 167(c)(2) - no basis even though higher than market rent. ■ 122 will go to property subject to lease and increase basis by 122 Depreciation ● 02042020 Presenter C. Real Estate Investments - “tax partnerships” win ● Why are tax partnerships (flow throughs) the preferred structure for investors? ● Because they can combine limited liability (state/foreing law LPs) with tax benefits: ○ One-level of tax passing through income, gains, losses, credits, to investors for tax purposes (no double taxation) ○ Significant flexibility under entity governing and operating agreements (and typically respected for tax purposes) to allocated income/expenses to specific investors (for groups of investors) ○ Contributions to / distributions from entities are typically tax free ○ Self employment taxes ● If investors need to make distributions, flow through is still best option. 301.7701-2(b) PART IIB: INTANGIBLE ASSETS SECTION 197 - HOW YOU RECOVER COST OF INTANGIBLE ASSETS Code: §§ 167(g)(1), (2), (6); 178; 197 Treasury Regulations: § 1.162-11(a); 1.167(a)-3; 1.167(a)-14(c)(4); Skim § 1.197-2(a)-(g)(1) Textbook: 422 – 426 Additional Materials (TWEN): None Problems: III Intangible assets Purchase a business for 200,000 1. Machine 2. Patent (5 years) 3. Goodwill Basis of each asset ● Machine: 100,000 ● Section 167→ reg 1.167(a)-3 (pre-sec. 197) Result Section 197 ● Provides 15-year straight line amortization rule ○ Amortization being in month intangible acquired ○ Ex: acquire sec 197 property for 180,000 on march 15: ■ 180,000/180=1000/month ■ Year 1: 10 months * 1000 month = 10,000 amortization in y1 ■ Year 2- year 14: 12000/year ■ Year 15: 2000 (remaining basis) ○ Only applies to section 197 property (sec. 197(c)) ■ Excludes self created intangibles ■ Has to be held for a trade or business ○ Anti churning rules 197(f)(9) - NOT TESTED ■ Purpose of these rules is to prevent manipulation of self created rule ● If you fall under 197 you do straight line amortization ● 197(f)(1)(B)- in case of intangible that is a covenant not to compete, ○ You have to dispose of all assets that you acquired when you acquired covenant not to compete ● HYPO: acquire a business that includes ○ 5 year patent ○ Goodwill ○ Copyright ○ In year 5: ■ Amortize ■ Pater: 40,000 ■ Goodwill: 50K ■ Copyright 50K ○ Result: ■ Goodwill: 50K + 20K = 70K new basis ■ Copyright: 50K + 20K = 70 new basis III. Intangibles 1. On September 1 of this year, T purchased Business B consisting of the following assets, all of which will be used in her existing business (Business A). In each case, describe how T should recover her investment in these assets: 1. Goodwill or going concern value. (See Reg. § 1.197-2(b)(1) & (2)). 1. 197(d)(1)(A) - goodwill is a type of 197 asset 2. How many years to recover asset? 15 years 3. Going concern value - additional value that attaches as an integral part of an ongoing business 4. 197- 15 year straight line amortization rule 1. Amortization begins in month intangible acquired 2. EX: acquire sec 197(c) property: 180k on march 15: a. 180k/180 months = 1000/month b. Y1=10 months X 1000/month = 10,000 amortization in Y1 c. Y2-Y14= 12,000 per year (1000 X 12 months) d. Year 15= 200 (remaining basis) 2. A covenant not to compete in which X promised not to compete with T for 5 years. (See § 197(f)). 1. 197(f)(1)(B)- 197(d)(1)(E) -197 applies however a bit confusing because its only for 5 years. 197 says you have to recover over 15 years. in no event shall such covenant or other arrangement be treated as disposed of (or becoming worthless) before the disposition of the entire interest described in such subsection in connection with which such covenant (or other arrangement) was entered into. ( so basically you cant treat as disposed 2. What if, rather than acquiring the covenant as part of the purchase of Business B’s assets, X had been T’s employee for the past 30 years and has now decided to go out on his own? T paid X $150,000 in a lump sum for X’s covenant not to compete (i.e., did not acquire the covenant as part of the purchase of Business B’s assets). 1. Section 167 applies because a. Paid 150,000, use the useful life so divide by 5 years = 30k/year for 5 years. 3. A customer list or a subscriber list, each of which can be predictably expected to be worthless in five years. 197 assets because any information from customer list or subscriber list. You can only acquire 4. A leasehold in real property with 10 years remaining on the lease. (See § 197(e)(5); 1.162-11(a); 178). 1. 167 because it is an exception under 197(e)(5), 2. What if lease also had an option? 178, the term of lease shall be treated as included all renewal options if less than 75% of such cost is attributable to period of term 2. On January 1 of this year T purchases for $100,000 all of the substantial rights to a patent with a remaining useful life of 10 years. How should T recover her cost? (Compare § 174). 1. Y1 - Y5 reduce by 100,000/180 months(15 yrs) * 12 months = 66,667 2. Basis in patent = 100K - 33333= 67K in year 5 3. What if sell patent for 50K cash 1. AR-AB=50k-67k=17K loss 4. 197(f)(1)(B) 5. What if we separately acquired the patent and not as part of a business? 1. In order to be part of 197 you have to acquire as part of business 2. Therefore, 167 applies and do not amortize over 15 years. 3. 1.167(a)-14(c)(4) 4. Deduct ratably over 10 years OR 5. Income forecast method: 1. Dep 6. 174 1. Allows to make a deduction of R&D upfront 3. Same as (1) except that the purchase price is $40,000 plus T’s promise to pay the seller 40% of the annual net profits derived from the patent. What is T’s basis in the patent? 1. This year, the patent earns $25,000 and T pays the seller $10,000 as his share for the year. How should T recover her cost in the patent? 1. T should recover her costs in the 2. 197 1. 40,000 payment made in Y1 - basis 2. Additional 10,000 paid in y2 a. 1.197-2(f)(2) b. Payment is properly included in basis c. Will amortize by amount of years left d. Here since y2 divide by 13 years 3. Take 40K and amortize over 15 years 3. 4. 1.196-2(j) 1. Says that if principal purpose of transaction is to avoid 197, IRS will be able to change results to get back to 197 2. If one of the principal purposes of a transaction is to achieve a tax result that is inconsistent with the purposes of section 196, the comm will recast the transaction for federal tax purposes as appropriate to achieve tax results that are consistent with the purposes of section 197. Bonus depreciation - 168 k ● 100% cost recovery for eligible property placed in service in 2018-2022 ● Deduction phases out after 2022 ● 2023 = 80% ● 2024 - 60% ● 2025 - 40% ● 2026 - 20% Part IV 6/1/y1: amber purchase equipment ● Purchase price: 100K ● Useful life: 3 years ● Salvage value: 40,000 ● Amber does not elect out of 168(k) ○ Can deduct entire cost for eligible property placed in service ○ Deduction phases out in after 2022 ● How do we know if qualify? ○ Have to have qualified property under 168(k)(2) ■ Property depreciated under MACRS with recovery period of 20 years or less ■ Computer software ■ Other property listed in section 168(k) ● Amber’s basis at end of y1 is zero because What if amber wants to use 179 1. 179 a. Dollar limitation: 1M 179(b)(1) b. Asset limitation: 2,500,000 179(b)(2) c. Income from trade or business: 179(b)(3) d. Must have tangible personal property that is subject to 168 e. f. Property has to be acquired by purchase, not inheritance and purchasing it for use in active trade or business g. Well how much cost can amber deduct? i. Cannot deduct more than 1M ii. Asset limitation: 2.5M iii. Income from T/B: sec 179(b)(3) has to be at least equal to or greater than amount trying to deduct 2. How much can amber deduct under 179? a. Amber can deduct up to 1M On June 1 of this year (“year 1”), Amber purchases equipment (which has a 6-year class life) for use in her real estate business. Amber pays $2,700,000 for the equipment and expects to use it in her business for three years, at the end of which time she expects to sell the equipment for $40,000. Amber acquires no other depreciable property during year 1. Amber would like to maximize her depreciation deductions to the extent permitted by law. How much of her $2,700,000 cost can Amber recover in Year 1? ● She can recover all under 168k How much of her $2,700,000 cost can Amber expense in Year 1 under §179? ● Asset limitation - 2.7M-2.5M - 200k ● 1M-200K=800K ● If more than 2.5 we’re going to reduce limitation dollar for dollar. 200k What is Amber’s basis in the equipment after she takes the appropriate deduction under §179? ● Amber’s basis is 1.9M because 2.7M - 800K of deduction. = 1.9M 1(c) 6/1/y1 amber purchase equipment ● Purchase price: 100K ● Useful life: 3 years ● Salvage value: 40,000 ● Elects out of section 168(k) and section 179 Section 168 MACRS depreciation: ● 100k depreciation basis ● 5 year recovery period ● Double declining balance (300%) method ● Half-year convention 1(d) 6/1/y1: amber purchases equipment for 100k 6/1/y3: amber sells equipment for 50k ● Y1 depreciation: 20k depreciation ● Y2 depreciation: 32k depreciation ● Y3 depreciation: 19.2k depreciation CRANE CASE ● FMV of inherited property: 262K ● Nonrecourse debt: 262K ● Initial Basis: 262K (sec 1014) ● Adjusted basis 262K initial basis - 28k depreciation deductions = 234k ● Sells property: 2500 cash + debt relief (255K) = 257500 ● FMV of property > non recourse debt ● What if FMV is equal? ○ RR 77-110 ■ 200 cash + 1800 non recourse debt ■ FMV: 200 ■ IRS held that debt will not be held in basis. ○ If NRD less than or equal to, you will get basis credit. ● ○ IF NRD greater than FMV, you dont get basis credit ● In Y1, T purchased depreciable property (Blackacre) from S for $200. What is T’s basis in Blackacre if T funds the purchase in the following alternative ways (T is personally liable for all borrowings): IRC 168 (MACRS) Depreciation ● ● ● ● ● ● ● Section 167 requirements ○ Not personal use, have useful life, etc Must be tangible personal or real property (except computer software can count) 168(a) is not elective, whereas bonus depreciation is Class lives are on TWEN. Also in 168(i) or Rev. Proc. 87-56 or 168(e)(3)(C). On exam, be careful about what figure you are using. Life, recovery period, etc? Tangible personal property default method is double declining balance method ○ Like straight line, but doubled. Math: basis * 2/5 ○ When straight line method would give bigger deduction, switch to straight line ■ Almost always the year after the halfway point ○ Also a 150% method for some property ○ Real property is required to use the straight line method ○ Alternative depreciation system (ADS) in 168(g)- can elect it ■ Straight line, same convention, longer recovery period Applicable convention ○ Applies in year acquired, disposed of, or in the last year of depreciation ○ Mid-month applies to real property; mid-quarter if last 3 quarter of year (d)(3) ■ Half year convention ■ Mid month convention ■ Mid quarter convention ● Ex: i place equipment in service on september 1, y1. ● ● Depreciation of entire: 1000 ● Depreciation in Y1: 1000 x 1.5/4 = 375 Applicable recovery period ○ ○ Recovery period ■ Class life 168(i) ■ Class property - 168(e) ■ Recovery period - 168(c) ● Problem 2 ● ● ● ● ● Mid-quarter convention because more than 40% tangible personal property (TPP) placed into service in last quarter. This applies to all TPP placed in service this year. For June equipment, take 2.5/4. For December equipment, take 0.5/4. Look at Table A-3 for 5 year property. Less accelerated? Yes, can use 150%, straight line, or ADS Hypo I have a property with a 100k adjusted basis and a 5 years recovery period ● Straight line rule- 10,000 x 1/5 years = 2,000 year - 20% ● Double declining balance rule = 2 x 20% = 40 % or 2/5 ● Basis on 1/1/y2 = 10,000 initial - 4000 DD = 6000 ● Depreciation in y2 = 6000 X 40% = 2400 Problem 3 ● ● ● ● ● ● ● ● T purchases hotel building for 415K on 10/22/y1 7/1/Y3 T sells building for 450,000, 50k to land. Allocate price. Land basis is $25K. Building basis is $390K. Can only use IRC 168 because real property Recovery period is 39 years, under 168(e)(2)(A) Using mid-month convention, because real property Using straight line method Y1: $390K x 1/39 x 2.5/12 = $2,083 ⅖ because purchased on oct 22 ● Y2: $390K x 1/39 = $10K ● Y3: $390K x 1/39 x 6.5/12 = $5,417 6.5 b/c purchased on 7/1 ● Gain for building is $400K – ($390K - $17,500) = $27,500 ● Gain for land is $50K - $25K = $25K Problem 1(a) ● Recourse loan. T’s basis is cost basis of $200 under IRC 1012 Problem 1(b) ● Basis is still $200. Treat entire amount as cost because recourse loan Problem 1(c) ● Crane says $200 Problem 1(d) ● Still $200, does not matter who the creditor is Notes ● ● ● ● The point of above problems: If recourse debt, you get basis credit for the debt Inherited property basis is FMV on date of death. IRC 1014, Crane. Crane says include the loan in your basis regardless of whether recourse or not. Crane- FMV greater than debt, so definitely going to pay it off, so might as well be recourse, so we treat it as recourse, and you get basis credit. Problem 2(a) ● Non-recourse UNIT IV ASSIGNMENT Effect of Debt on Basis and Dispositions; Cancellation of Indebtedness A. Effect of Debt on Basis Code: §§ 108(e)(5); 1012(a) Treasury Regulations: § 1.168-2(d)(3) (Proposed Reg.) B. Disposition of Encumbered Property; Cancellation of Indebtedness Code: §§ 61(a)(12); 108(a), (b), (c), (d)(1)-(5), (e)(5), (h); 1017(a), (b)(1), (b)(3)(A)-(B), (c)(2), (d). Treasury Regulations: § 1.1001-2: 1.1015-4 UNIT IV Problems Effect of Debt on Basis and Dispositions; Cancellation of Indebtedness --------------------------------------------------------------------------------------------------------------------------------------------------1. In Y1, T purchased depreciable property (Blackacre) from S for $200. What is T’s basis in Blackacre if T funds the purchase in the following alternative ways (T is personally liable for all borrowings): 1. by paying the seller $200 in cash from T’s own pocket and then borrowing $100 from a bank on an unsecured basis i. T’s basis is cost basis of $200 under IRC 1012 2. by paying $100 from his own pocket and paying the seller another $100 that T borrowed from the bank on an unsecured basis; i. Basis is still $200. Treat entire amount as cost because recourse loan 3. by assuming an existing mortgage of $100 encumberingz the property and paying $100; i. Crane says $200 4. by paying the seller $100 cash, executing a note for the $100 balance, and giving the seller a purchase money mortgage. i. Still $200, does not matter who the creditor is 5. 6. 7. 8. The point of above problems: If recourse debt, you get basis credit for the debt Inherited property basis is FMV on date of death. IRC 1014, Crane. Crane says include the loan in your basis regardless of whether recourse or not. Crane- FMV greater than debt, so definitely going to pay it off, so might as well be recourse, so we treat it as recourse, and you get basis credit. 2. T is contemplating purchasing a building whose expected economic life is 20 years and whose value is in the range of $190 to $205. Several alternative forms of the purchase transaction are described below. What would T’s basis for the building be under each of them? 1. The purchase price is $200, payable $100 in cash and $100 by T giving the seller a purchase money mortgage in that amount. T is not personally liable on the mortgage note. It bears interest at an adequate stated rate and interest is payable annually. No principal is due on the mortgage for 20 years at the end of which time the principal is payable in full. th 1. If T prepays the mortgage during the 9 year of the mortgage term, would the prepayment have any tax consequences? 1. No change, basis will still be $200. 2. The purchase price is $100 plus T’s agreement to pay the seller 50% of the profits from the building’s operations over the next 5 years. The FMV of T’s deferred payment obligation is $100. (See Prop Reg 1.168-2(d)(3)). 1. Albany car wheel company - TP purchases company, pays own cash and assumes liability and obligation of company to pay severance(contingent liability). TP is trying to argue that because he can estimate how much he is going to pay, he tries to include in basis. Court said no because it is too con. If debt assumed is too contingent we will not include in basis up front. 2. Here, Initial basis: 0 with respect to severance obligation. 3. Now, when you need to pay, when payment is made, no adjustments will be made to basis, instead you will be allowed to immediately deduct payment. 4. IRS Says that if you had a contingent liability, at the time you make payment, your basis will be increased by that amount and will be depreciated for the remaining amount of years. 5. What if in year 3, T makes a payment to S: 1. IRS says increase your basis by this $50 payment. 2. We look at what month they acquired it 3. $100 unadjusted basis (y1) 4. Minus $5 depreciation deductions taken for y1 and y2 5. Add $50 payment 6. $145 readjusted basis a. $145 basis * 1/37 years remaining = 3.92 depreciation in y3. 6. 3. The purchase price is $200, there is no down payment and the entire price is paid by a purchase money mortgage to the seller on which T has no personal liability. For 20 years, interest on the mortgage is payable annually at an adequate rate, but no principal need be paid. The principal is payable in a lump sum at the end of this 20-year period. 1. It is $200 basis because it is a PMM. it is nonrecourse debt, within the FMV range. 2. FMV is 195-205 4. The purchase price is $500, payable $100 in cash and $400 by a purchase money mortgage on which T has no personal liability. 1. Would it make any difference to your answer in part (e) if the $400 mortgage debt had been a recourse liability (one on which T had personal liability)? 1. Yes, it would make a differemce. $500 basis because there is recourse. 2. 3 options on how to treat this 1. $400 nonrecourse debt > 195-205 FMV a. 1st option - getting 0 basis credit i. Only arises if we arent going to respect sale and treat payment as an option ii. Does not apply b. RR 77-110 - will give credit of $100 for actual cash paid. i. Ignore NRD because exceeds FMV (IRS Position) c. 3rd option - we can give 200 basis credit = to FMV i. Respect some of the nonrecourse debt. ii. 3rd circuit T purchases property with a purchase price of $2,000. He pays $1,000 in cash and pays the remaining $1,000 by taking out a $1,000 recourse mortgage on the property. What is T’s basis in the property? $2000 because it’s recourse debt. T purchases property with a purchase price of $1,400. He pays $500 in cash and pays the remaining $900 by taking out a $900 non-recourse mortgage on the property. The fair market value of the property is $1,000. What is T’s basis in the property? $1400 because NR mortgage less than FMV therefore when NRD less than FMV we respect sale price. T purchases property with a purchase price of $2,000. He pays $500 in cash and pays the remaining $1,500 by taking out a $1,500 non-recourse mortgage on the property. The fair market value of the property is $1,000. What is T’s basis in the property? $500 because NRD > FMV of property 3. During year 1, T purchases a building (but not the underlying land) for $100 of which $50 is paid in cash and $50 is borrowed under a non-recourse mortgage note from a lender who is unrelated to T and the seller. During year 5, after T has been allowed depreciation deductions of $20 on the building, T borrows nd an additional $120 without recourse from another unrelated lender, giving a 2 mortgage on the building as security. What are the tax consequences of the year 5 loan? a. FMV is at least 170 in Y5 b. AR-AB=G/L c. 170 - 80=90b gain d. 4. During Years 1 thru 6, T in Problem 3 is allowed depreciation deductions of $25 and repays $20 of principal on the second loan. The principal balance on the first mortgage, however, continues to be $50. What tax consequences will follow if T disposes of the building at the beginning of year 7 in one of the following transactions? (See Reg. § 1.1001-2) 1. T sells the building to B who pays T $25 in cash and takes the property subject to both of the mortgages on it. 1. Y1 - 100 → 75 appreciation to y7 2. FMV in y7: 175 3. Appreciation 75 4. Depreciation deduction - 25 5. Basis in y7: 100 (initial) - DD = 75 basis 6. T’s amount realized = AR-AB=G/L 1. 25+50+100 - 75 = 100 gain 2. T gives the property to her son, who takes the property subject to the mortgages. 1. AR-AB= G/L 2. 150-75=75 3. Greater of gift or sale price 4. Donee will receive that basis 3. The mortgagees foreclose on the building, and the property is sold in a foreclosure sale for $100, of which $50 is paid in full satisfaction of the first mortgage and $50 is paid to the holder of the nd 2 mortgage in satisfaction of one half of its claim. 1. What do we do here? How much gain does TP have when disposing? 1. Use full debt relief realized when lookin at FMV 2. AR = 150 ( full amount of debt relief) a. 100 on second loan b. 50 on first loan 3. AB - 75 basis 4. 150-75 = 75 gain 5. During year 1, T purchases land for $1,000 of which $200 is paid in cash and $800 is borrowed under a nonrecourse mortgage note from a lender who is unrelated to T and the seller. The fair market value of the land at the time of purchase was $400. What is T’s initial basis in the land? ● 200 because nonrecourse is more than the FMV of the land. Therefore when it’s like this your basis is based on what you paid for it. A few years later T sells the land in exchange for $700 cash and the buyer taking the land subject to the $800 liability. How much gain or loss does T realize from the sale? ● T will realize 500 gain because 700-200=500. ● 800 does not count because since 800 didn’t apply to basis, it shouldn’t apply to gain. ● Reg 1001.1-2(a)(3) Cancellation Of Debt Income Section 61(a)(11) - gross income Section 108 - exceptions Sec 108(b)(2) - Reduction in Tax Attributes Sec 108(b)(5) - option to first reduce basis depreciable property !08 Exceptions ● Bankruptcy exception ● Insolvency exception ○ EX: T has $100 assets and $110 liabilities, T pays $30 to fully discharge $50 of debt ○ COD Income - $20 ○ Insolvency - $10 ○ Exclude $10 from Gross income; $10 included in GI ● Qualified farm indebtedness ● Qualified RP business indebtedness ● Qualified principal residence indebtedness 5. T purchases a tract of undeveloped land for investment for $200, paying $50 of the price in cash and borrowing the remaining $150 from a lender unrelated to T or the seller. T is personally liable on the mortgage note. A few years later, the land’s value drops substantially because of changes in the community that destroy the prospects for developing the land. What tax consequences result to T in the following alternative transactions? Recourse debt because T is personally liable. 1. Recourse Debt 1. FMV<Debt 2. 200<150 2. T’s basis is 200 3. 2. T defaults on the mortgage, whose principal balance is still $150 and the mortgagee forecloses, realizing only $100 in the foreclosure sale. T pays the mortgagee $50 in satisfaction of its deficiency claim. 1. What is AR when he disposes of property by giving it back to creditor? 1. Only discharged of 100 when giving back 2. The AR is the amount you actually give up. 2. When you have recourse debt and discharge of debt, you have two different transaction. 3. Same as (a), except that the parties settle by T paying the mortgagee $30 in full satisfaction of the deficiency claim. 1. 50 debt - 30 paid = 20 2. 50(debt)-30paid = 20 Cancellation Of Debt 61(a)(11) 3. 108(b)(2) - not taxed because wihting 4. If liabilities are greater than assets you dont have to report income. 5. 108(a)(1)(A) Bankruptcy exception 6. 108(a)(1)(b) insolvency exception 7. (1)(D) qualified real property busines indebtedness 8. (1)E) qualified principal residence indebtedness 4. Same as (b), except that instead of $30 in cash, T delivers to the mortgagee shares of publicly traded stock that are worth $30 but have an A/B to T of $10, and T is hopelessly insolvent. 1. AR-AB 2. Amount realized is the amount that he is satisfying 3. 30-10 = 20 capital gain 4. Not taxed because within 108 insolvency exception 5. Same as (b), except T is a fully solvent real estate developer who bought the land, not for investment but to build a shopping center. T’s other assets at the time of discharge consist of cash, bulldozers, backhoes and other heavy construction equipment, land held for future development and a building T uses to conduct its business operations (including storage and maintenance of equipment). 1. Payment of $100 debt = 100 AR - 200 AB = <100 loss> 2. Payment of $50 of debt: 50 debt - 30 Paid (FMV) of stock = 20 COD income 3. 108(a)(1)(D) qualified real property business exception 4. Requirements 1. Cannot be a C corp, 2. Qualified real property indebtedness a. Debt incurred or assumed by a TP in connection with Real prop used in trade or business. It has to be depreciable real property 3. Have to have depreciable real property a. Such as buildings 4. What is FMV of RP, compare it to debt on RP a. Debt-FMV = max amount you can exclude under exception 5. All requirements met, therefore can benefit from exception 6. 20 of COD income would be excluded under (1)(D) exception. 7. 6. T purchases equipment for $200 in cash, $150 of which is borrowed from a bank, which is given a nonrecourse chattel mortgage on the equipment to secure the debt. Over the next few years, T is properly allowed cost recovery allowances totaling $75. At the time of the following alternative events T’s adjusted basis in the equipment is $125 and the principal balance of the note is still $150. What are the tax consequences to T in each case? 1. NRD 150 2. FMV 100 3. AR: 125 2. When the equipment is worth $100, the mortgagee forecloses and repossesses the equipment. What if the mortgage were recourse rather than non-recourse and the $50 balance of debt was cancelled? 1. AR-AB=G/L 2. 150-125= 25 3. It is 150 because it NRD. The full amount of the debt relief. 4. 100 - 125 = 25 5. 50 - 0 = 50 cancellation of debt 3. When the equipment is worth $175, the lender compromises the $150 non-recourse note for $120. Following the compromise, T holds the equipment free and clear. 1. RR 91-131 2. RR 82 - 202 3. Pay 120 4. 150-120 = 30 cancellation of debt 5. 108(e)(5) 1. Tells us if you purchase money debt reduction, for a solvent debtor then you can exclude COD income from income and in exchange will reduce TP’s basis in that asset. 2. Basis was 125, reduce by 30 COD income = 95 income 4. Same as (b) except that the note evidences purchase money debt (the original purchase of the equipment was seller financed). 1. What if the seller of the equipment had sold T’s note to X and X compromises the $150 note for $120? 1. UNIT V Problems Characterization A. Capital Gains and Losses, Net Investment Income Tax Code: §§ 1(c), (f)(1), (h) & (i); 64; 65; 165(a), (c), (f); 1211; 1212(b); 1221(a); 1222; 1223(1), (2); 1231(a), (b)(1), (c)(1)-(2); 1245(a); 1250(a)(1), (b)(1); 1441. Skim §§ 1236, 1237. Treasury Regulations: None B. Options Code: §§ 1234(a), (b); 1234A Ordinary income/ordinary loss IRC 64, 65 Net Capital Gain = Net LTCG - Net STCL Section 1221 - capital asset defined Section 1222 - STCG: gain from the S/E of capital asset held for not more than 1 year LTCG: gain from S/E of capital asset held for MORE than 1 year Net capital gain = Ney LTCG - STCL Tax Rates ● 1(c): ordinary income tax rates (but incomplete & adjusted for inflation) ● 1(h): preferential tax rates ○ Category 1: 0/15/20% rate ■ Adjusted net capital gain / residual basket ○ Category 2: 25% rate ■ Unrecaptured section 1250 gain ○ Category 3: 28% rate ■ Collectibles and Sec. 1202 gain Determining Tax Rate ● Compute taxable income w/o regard to character ● Determine Net CG ● Apply ordinary rate schedule to everything other than NCG ● Determine the tax rate for NCG per section 1(h) Losses-Section 165 ● General rule: losses are deductible ● Exceptions: individual’s deduction for losses are limited ○ Losses incurred in trade/business ○ Losses incurred in any transaction entered into for profit (though not connected to business) ○ Casualty losses (fire, storm, shipwreck, other casualty) Capital Losses ● Section 1211(b) ○ Deduct all capital loss to extent of capital gain ○ Deduct 3000 of excess against ordinary income ○ Carry forward excess indefinitely 1. T, an unmarried taxpayer, is in business for herself as a doctor. This year, T has $500,000 of taxable income without regard to the transaction listed below. The character of this $500,000 is entirely derived from ordinary income transactions (e.g., fees for services). On June 1 of this year, T also engages in the sales transactions described in the questions below. For each question, where relevant, determine the rate at which each item of gain or loss will be taxed as set forth in §1(c) (as amended by §1(i) and §1(h)). [NOTE: see JCX excerpt for inflation adjustments per §1(f)]. Additionally, determine the amount of any loss carryovers. Do NOT compute T’s actual tax liability and disregard §1411. 1. T has the following gains and losses from sales: 1. T sold shares of IBM stock that T had held for investment for 3 years at a gain of $40,000. Long term 1. 40k LTCG - 5000 LTCL = 35L net LTCG 2. T also sold shares of AT&T stock that T had held for investment for 2 years at a loss of $5,000. Long term capital loss 3. T also sold shares of Microsoft stock that T had held for investment for 10 months at a gain of $16,000. Short term capital 1. 16000 - 1000= 15000 net STCG 4. T also sold shares of Intel stock that T had held for investment for one month at a loss of $1,000. Short terms 5. How much Net Capital Gain 1. Net LTCG - NET STCL 2. 350000 - 0 = 35K 6. What will this amount fall under 1. 500k OI + 15 NSTCG = 515 K OI 7. What would the 35K go to? 1. 0/15/20 - residual basket. Taxed at 20% because we exceed 39% because we exceed 429000 2. Assume the same facts as (a) except that T also received $1,000 of dividend income this year from the shares of each corporation ($4,000 in total). 1. Total taxable income: 500k OI + 35K Net LTCG + 15k net STCG + 4000 dividend income = 554000 taxable income 3. (C)Assume the same facts as in part (a) (but no dividends), except that the loss on the AT&T stock in (a) was $50,000. 1. How would your answer to part (c) above change if T sold the AT&T stock at a loss of $50,000 and T also sold a painting that T had been holding for investment for four years at a gain of $15,000? 1. Net longs: 40,000 LTCG - 50,000 LTCL + 15000 LTCG = 5000 net LTCG 2. Net shorts: 16000 STCG - 1000 STCL = 15000 net STCG 4. How would your answer to part (a) above change if, in addition to the stock sales described in part (a), T had also sold an undeveloped parcel of land that T had been using in her business over the past several years? The land was sold by T for $30,000 at a time when T’s basis in the land was $20,000. 1. Land sold: 30,000 AR; Basis 20,000; used in business 2. Land 30k AR - 20 k AB = 10k gain 1. 10,000 net section 1231 gain 2. 10,000 LTCG 3. Section 1231- property used in a trade or business 1. Property is used in T/B 2. Property is depreciable property or real property 3. Held for more than 1 year and 4. Which is not inventory or copyright or literary/music composition or publication of US government 5. Net Section 1231 gain: LTCG and LTCL 6. Net section 1231 Loss: ORdinary income and ordrinary losses 4. Net longs: 40,000 LTCG - 5000 LTCL + 10000LTCG land = 45000 Net LTCG 5. Net shorts: 16000 STCG - 1000 STCL = 15000 net STCG 6. NCG: 45,000 Net LTCG - 0 STCL = 45000 NCG 7. HYPO 1. TP has the following 1231 gain/losses in Y6: a. 13000 Section 1231 gain b. <3000> Section 1231 Loss 2. TP Net section 1231 Transaction in prior 5 years a. Y1: <5000> net section 1231 loss b. Y2: Net Section 1231 gain or loss c. Y3: $0 net section 1231 gain or loss d. Y4: <3000> net section 1231 loss e. Y5: Net Section 1231 gain or loss 8. Alternatively, assume that T’s basis in the land at the time of the sale had been $90,000. 1. 30,000 AR - 90,000 AB = <60,000> net section 1231 loss 2. <60,000> ordinary loss 3. Basis: 90,000, Loss: 60,000 4. Net longs: 40,000 LTCG - 5000 LTCL = 35000 Net LTCg 5. Net Shorts: 16,000 STCG - 1000 LTCL - 15000 Net STCG 6. NCG: 35,000 Net LTCG - 0 STCL = 35,000 Net CG 7. 35,000 Taxed at 20% 8. 15000 Taxed as ordinary income 9. 500,000 - 60,000 land = 440,000 treated as ordinary income 5. How would your answer to (a) have changed if in addition to the stock sales described in part (a), T had also sold some machinery that T had been using in her business over the past several years? The machinery had been purchased by T for $100,000. Up to and including the time of sale, T had properly taken $60,000 of depreciation deductions with respect to the machinery (no §179 election had been made by T and §168(k) had not been applicable). T sold the machinery for $125,000. 1. Land: 125,000 AR - 40,000 AB = 85,000 Gain 1. 85,000 Total gain 2. 25,000 gain attributable to appreciation 3. 60,000 attributable to depreciation deductions 4. Section 1245 applies 2. Section 1245 1. Applies to section 1245 Property 2. Recharacterizes ordinary income: a. The lower of i. Recomputed basis - Adjusted basis OR ii. Amount realized - adjusted basis 3. Here, Lower of 1. 100,000 (40K AB + 60k) Recomputed basis - 40,000 = 60,000 OR 2. 125,000 AR - 40,000 = 85,000 3. 60,000 ordinary income (section 1245 Recapture) 4. 25,000 Gain remaining, Net section 1231 gain & LTCG 4. Net longs: 40,000 LTCG - 5000 LTCL + 25,000 LTCG (from machinery) = 60,000 net LTCG 5. Net shorts: 16,000 - 100 STCL = 15000 NET STCG 6. NCG: 60,000 Net LTCG - 0 Net STCL = 60,000 NCG 7. End Result: 1. 500,000 salary _ 60,000 section 1245 recapture + 15000 Net STCG = 575,00 ordinary income 2. 60,000 NCG @ 20% 6. How would your answer to part (a) above have changed if, in addition to the stock sales described in part (a), T had also sold an office building that T had been using in her business over the past several years? T had purchased the property for $415,000 of which $25,000 was allocable to the underlying land. Up to and including the time of sale, T had properly taken $20,000 of depreciation deductions with respect to the office building. T sold the property for $450,000 of which $50,000 is allocable to the land. 1. Land: 50,000 AR - 25,000 AB - 25,000 Gain 2. Building: 400,000 AR - 370,000 = 30,000 gain 3. Characterization of Gains/losses 1. 15,000 STCG (stock sales) 2. 25,000 LTCG (stock saleS) 3. 25,000 Section 1231 Gain (land sale) 4. 30,000 Section 1231 Gain (building Sale) 4. 55,000 Net Section 1231 Gain 1. 25,000 Land gain & 25,000 LTCG 2. 30,000 Building Gain & 30,000 LTCg 5. Net Longs: 40,000 LTCG - 5000 LTCL + 25,000 LTCG + 35,000= 90,000 Net LTCG 6. Net Shorts: 16k - 1k = 15,000 Net STCG 7. Hypo: 1. 2. A is an unmarried taxpayer who earned $400,000 of taxable income from her services (i.e., Ordinary income) this year. She also earned $600,000 of net investment income this year. All of her investment income was long-term capital gain that A earned from sales of stock in her investment portfolio. What is the total rate of tax that A will incur on her investment income? (Consider §1411. Assume A earned no other income this year and has no other applicable deductions, ie, her modified AGI for purposes of §1411 is $1M). 1. 600,000 NCG @ 20% (Sec 1(h)) 2. Section 1411 1. 3.8% sutax applies to lesser of 1. Net investment income OR 2. Modified AGI - Threshold amount 3. 600,000 Net investment income 1. Lesser of: 1. 600,000 net investment income OR 2. 800,000 (1,000,000 AGI - 200,000 Threshold) 3. 3.8% x 600,000 4. Total rate of tax on investment income - 23.8% 2. 4. How would your answer change if the $600,000 was all short-term capital gain instead of longterm capital gain? 1. Total rate of tax on investment income = 40.8% 2. 600,000 Net STCG @ 37% 3. Section 1411 @ 3.8% 3. S, an unmarried taxpayer, earned $140,000 in wages and had $80,000 of net investment income representing interest from a bond portfolio in Year 1. (Assume no other applicable income or deductions). How much tax will S incur under §1411 for Year 1? 1. 80,000 interest income & ordinary income 2. 20,000 x 3.8% = 760,000 Tax under sec 1411 1. Lesser of 1. 80,000 net investment income OR 2. 220,000 AGI - 200,000 Threshold = 20,000 4. In each of the following alternative situations, determine whether the properties being sold are capital assets in T’s hands: 1. T’s full-time occupation is trading in securities. She spends her days researching stocks and bonds, talking on the phone with brokers, and keeping records of her trades. Last year, she made 253 purchases of stocks and bonds and 362 sales. (What is it about the nature of her activities that distinguishes “traders” in securities from retailers, e.g., a local grocer whose inventory sales produce ordinary income? Compare the result under § 475(f)(1) and (d)(3)). 1. Section 1221(a)(1) 1. (a) In generalFor purposes of this subtitle, the term “capital asset” means property held by the taxpayer (whether or not connected with his trade or business), but does not include— a. (1) stock in trade of the taxpayer or other property of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the taxable year, or property held by the taxpayer primarily for sale to customers in the ordinary course of his trade or business; b. (2) property, used in his trade or business, of a character which is subject to the allowance for depreciation provided in section 167, or real property used in his trade or business; 2. Section 475 Election 1. Mark to market regime 2. Ordinary treatment (Sec 475(d)(3)) 2. T is a public school shop teacher. Last spring, he bought a residential lot. Over the summer, he and 2 other teachers, who worked as T’s employees, built a house on the lot. T sold the house and lot in October. T has never done anything like this before, and although he sold the property at a profit, he has no definite plans for building any more houses. 1. Sec 1221(a)(1) 1. Property held primarily for sale in the ordinary course of a TP’s trade or business 2. Bramblett Case a. Nature and purpose of acquisition of property and duration of ownership b. Extent and nature of TP’s efforts to sell the property c. Number, extent continuity and substantiality of sales d. Extent of subdividing developing and advertising increase sale e. Use of a business office for the sale of property f. Character and degree of supervision or control exercised by taxpayer over an y rep selling the property g. Time and effort TP habitually devoted to the sales 2. Bramblett Case 1. 4 individuals form PS and corporation 2. PS buys land 3. PS Sells land to corp 4. Corp develops land and sells it to ultimate buyers 3. HYPO 1. T holds about 40 tracts of land 2. Makes about 6 sales a year 3. This year, T sells undeveloped tract of land at a gain 4. HYPO 1. I buy land for 100,000, hold it for 10 years and sell it for 200,000 2. Gain = 200,000 AR - 100,000 AB = 100,000 a. Appreciation b. Improvements 5. Section 1237 1. Safe harbor, not treated as professional developer 5. ● ● ● ● 2. Requirements a. You are not a developer who has made a lot of sales b. You cannot ake any substantial improvements to the property c. You have to hold onto the property for at least 5 years 3. SEction 1237(b) limitation 6. HERE 1. T’s occupation is a teacher 2. Last year, T bought a lot 3. T and 2 employees build a house on the lot 4. T sells the house and lot this year 5. This is the first time T has done this. 6. Section 1237 Safe harbor On January 1 of Year 1, B pays S $100 for an option to purchase a tract of undeveloped land for $1,000 at any time during year 1 or year 2. What are the tax consequences to the parties if, alternatively: (See §§ 1234, 1234A, Rev. Rul. 78-182): Call option Possible FMV of land = 1100 B: option basis = 100 S: no tax consequences 1. B exercises the option during Year 2. 1. B Tax consequences 1. Basis in land: 1,100 2. RR 78-182 2. S tax consequences 1. 1100 AR - ? AB = G/L 2. B sells the option to A for $75 during year 1, and A exercises the option in Year 2. 1. B tax consequences 1. <25 loss> 2. 75 AR - 100 AB = 25 loss 2. A tax consequences 1. Y1 75 basis in option 2. Y2: 1075 basis in land 3. S tax consequences 1. 1100 AR - ?AB = G/L 3. B neither transfers nor exercises the option, which expires at the end of Year 2. 1. B tax consequences 1. <100 loss> 2. Possibly LTCL 2. S tax consequences 1. 100 LTCG 2. Section 1234A Problem 3 Wages: 140,000 Net Investment Income: 80,000 (interest income) How much tax under 1411? UNIT V ASSIGNMENT Characterization Code: §§ 1(c), (f)(1), (h) & (i); 64; 65; 165(a), (c), (f); 1211; 1212(b); 1221(a); 1222; 1223(1), (2); 1231(a), (b)(1), (c)(1)-(2); 1245(a); 1250(a)(1), (b)(1); 1441. Skim §§ 1236, 1237. Capital asset means property held by the taxpayer Bramblett Factors ● Nature and purpose of acquisition of property and duration of ownership ● Extent and nature of TP’s efforts to sell the property ● Number, extent continuity and substantiality of sales ● Extent of subdividing developing and advertising increase sale ● Use of a business office for the sale of property ● Character and degree of supervision or control exercised by taxpayer over an y rep selling the property ● Time and effort TP habitually devoted to the sales 1. T, an unmarried taxpayer, is in business for herself as a doctor. This year, T has $500,000 of taxable income without regard to the transaction listed below. The character of this $500,000 is entirely derived from ordinary income transactions (e.g., fees for services). On June 1 of this year, T also engages in the sales transactions described in the questions below. For each question, where relevant, determine the rate at which each item of gain or loss will be taxed as set forth in §1(c) (as amended by §1(i) and §1(h)). [NOTE: see JCX excerpt for inflation adjustments per §1(f)]. Additionally, determine the amount of any loss carryovers. Do NOT compute T’s actual tax liability and disregard §1411. 1. T has the following gains and losses from sales: 1. T sold shares of IBM stock that T had held for investment for 3 years at a gain of $40,000. 2. T also sold shares of AT&T stock that T had held for investment for 2 years at a loss of $5,000. 3. T also sold shares of Microsoft stock that T had held for investment for 10 months at a gain of $16,000. 4. T also sold shares of Intel stock that T had held for investment for one month at a loss of $1,000. 2. Assume the same facts as (a) except that T also received $1,000 of dividend income this year from the shares of each corporation ($4,000 in total). 3. Assume the same facts as in part (a) (but no dividends), except that the loss on the AT&T stock in (a) was $50,000. 1. How would your answer to part (c) above change if T sold the AT&T stock at a loss of $50,000 and T also sold a painting that T had been holding for investment for four years at a gain of $15,000? 1. 40k LTCG - 50k LTCL +15000 LTCG = 5k LTCG 4. How would your answer to part (a) above change if, in addition to the stock sales described in part (a), T had also sold an undeveloped parcel of land that T had been using in her business over the past several years? The land was sold by T for $30,000 at a time when T’s basis in the land was $20,000. 1. Alternatively, assume that T’s basis in the land at the time of the sale had been $90,000. 5. How would your answer to (a) have changed if in addition to the stock sales described in part (a), T had also sold some machinery that T had been using in her business over the past several years? The machinery had been purchased by T for $100,000. Up to and including the time of sale, T had properly taken $60,000 of depreciation deductions with respect to the machinery (no §179 election had been made by T and §168(k) had not been applicable). T sold the machinery for $125,000. 6. How would your answer to part (a) above have changed if, in addition to the stock sales described in part (a), T had also sold an office building that T had been using in her business over the past several years? T had purchased the property for $415,000 of which $25,000 was allocable to the underlying land. Up to and including the time of sale, T had properly taken $20,000 of depreciation deductions with respect to the office building. T sold the property for $450,000 of which $50,000 is allocable to the land. 2. A is an unmarried taxpayer who earned $400,000 of taxable income from her services (i.e., Ordinary income) this year. She also earned $600,000 of net investment income this year. All of her investment income was long-term capital gain that A earned from sales of stock in her investment portfolio. What is the total rate of tax that A will incur on her investment income? (Consider §1411. Assume A earned no other income this year and has no other applicable deductions, ie, her modified AGI for purposes of §1411 is $1M). 1. How would your answer change if the $600,000 was all short-term capital gain instead of longterm capital gain? 3. S, an unmarried taxpayer, earned $140,000 in wages and had $80,000 of net investment income representing interest from a bond portfolio in Year 1. (Assume no other applicable income or deductions). How much tax will S incur under §1411 for Year 1? 4. In each of the following alternative situations, determine whether the properties being sold are capital assets in T’s hands: 1. T’s full-time occupation is trading in securities. She spends her days researching stocks and bonds, talking on the phone with brokers, and keeping records of her trades. Last year, she made 253 purchases of stocks and bonds and 362 sales. (What is it about the nature of her activities that distinguishes “traders” in securities from retailers, e.g., a local grocer whose inventory sales produce ordinary income? Compare the result under § 475(f)(1) and (d)(3)). 1. Has the option to make a 475 election 1. Applies specifically to traders and allows to elect mark to market regime 2. If she makes election she has ordinary treatment 2. Hypo - T holds about 40 tracts of lands, makes about 6 sales a year. This year, T sells undeveloped tract of land at a gain 1. Consider bramblett 2. Would be considered a developer because they routinely involved in this type of business. 3. If she had 1 sale a year then you could argue that this isnt a developer this is an investor. 4. At least 6 sales a year is enough to bring you to developer status 3. T is a public school shop teacher. Last spring, he bought a residential lot. Over the summer, he and 2 other teachers, who worked as T’s employees, built a house on the lot. T sold the house and lot in October. T has never done anything like this before, and although he sold the property at a profit, he has no definite plans for building any more houses. 1. Is this section 1221 2. TP will argue that they are an investor and not a developer therefore capital treatment. 3. Govt will argue it is a ordinary because it is not used in a trade or business only used 4. Purpose of acquiring the property was to acquire and flip 5. Not a trade or business 6. Gov will argue ordinary treatment what did this gain result from. Did profit result in services from improving the land. Because if it did then it looks like an ordinary type of gain. 4. Factors to consider whether someone is an investor or a developer. 1. Bramblett case 1. 4 individuals form partnership and corporation 2. Partnership buys land 3. PS sells land to corporation 4. Corp develops land and sells it to ultimate buyers 5. Can we attribute corporation’s development behavior to PS? a. Court said no. b. It will receive capital treatment because PS was deemed an investor. c. IRS believes not a capital treatment. d. As long as same people own 2 diff entities, then those separate entities will be respected so long as you have separate activities. 6. This case started showing people that they can buy with 1 entity and hold so it can appreciate it. When they are ready to develop they will sell to 2nd entity with same owners. Any gain that occurred because of development will receive capital treatment 5. Hypo 1. I buy land for 100k, hold it for 10 years, and sell it for 200. 2. Gain - 200k/A/R - 100k A/B - 100,000 1. Appreciation 2. Improvements 3. What if i do improvements? 1. 50k in appreciation 2. 50k in improvement 3. 50k of appreciation will be protected from ordinary income treatment. Section 1237 ● Safe harbor → not treated as professional developer ● Requirements ○ You are not a developer who has made a lot of sales ○ You cannot make any substantial improvements to the property ○ You have to hold onto the property for at least 5 years ● 1237(b) limitation 5. On January 1 of Year 1, B pays S $100 for an option to purchase a tract of undeveloped land for $1,000 at any time during year 1 or year 2. What are the tax consequences to the parties if, alternatively: (See §§ 1234, 1234A, Rev. Rul. 78-182): 1. B exercises the option during Year 2. 2. B sells the option to A for $75 during year 1, and A exercises the option in Year 2. 3. B neither transfers nor exercises the option, which expires at the end of Year 2. UNIT VI ASSIGNMENT Treatment of Losses A. General Limitation on Losses Code: §§ 165(a)-(c), (f), (g)(1), (g)(2); 267(a)(1), (b)-(d); 1091; 1211; 1221(a)(1), (a)(4). Treasury Regulations: §§ 1.165-1(b), -4(a), -5(a)-(d)(1), (f), (i). B. At Risk and Passive Loss Limitations Code: §§ 465 [excluding §465(c)(4)-(7)]; 469(a)-(h), (j), 1411(a), (c)(1), (2). C. Excess Business Loss Limitation Code: § 461(l)(1)-(3), (6). Deductible Losses - Section 165 ● Trade/business losses ● Investment losses ● Very limited personal losses Definition of a Loss ● 165(a): there shall be allowed as a deduction any loss sustained during the taxable year and not compensated for by insurance or otherwise ● Treas reg 1.165-1(b) ○ To be allowed as a deduction under 165(a), a loss must be evidence by closed and completed transaction fixed by identifiable events ● Reg 1.165-4(a) ○ No deduction shall be allowed under section 165(a) solely on account of a decline in the value of stock owned by the TP Section 165(g)(1) ● Any security which is a capital asset become worthless the loss shall be treated as a loss from the sale/exchange on the last day of the taxable year of a capital asset ● UNIT VI Problems Treatment of Losses 1. W purchases 100 shares of the stock of X Corp. for $500. What are the tax consequences of each of the following alternatives? 1. The stock declines in value to, alternatively, $100 or $0. i. No tax consequences 2. W sells the stock to her husband, H, for $100, its fair market value. Five months later, H sells the stock to an unrelated person for $125. i. 100 AR - 500 AB = <400 realized loss> ii. Loss disallowed 1. Section 1041 2. Section 267 3. Section 1041 applies a. W: does not recognized loss b. H: 500 basis iii. Sale from H to 3rd party for 125 1. 125 AR - 500 AB = <375> realized loss 2. Loss deductible under sec 165 3. W sells the stock to her brother, B, for $100, its fair market value, and five months later, B sells the stock to an unrelated person for, alternatively $75 or $125. i. Sale from W to B 1. 75 AR - 100 AB = <25 realized loss> 2. Loss disallowed under 267 a. W: does not recognize the loss b. B: 100 basis cost ii. Sale from B to 3rd party for $75 1. 75 AR - 100 AB = 25 realized loss 2. 25 loss recognized 3. Total decline in value in W & B hands: 500 initial FMV - 75 final FMV (selling price) = 425 decline in FMV iii. Sale from B to 3rd Party for 125 1. 125 AR - 100 AB = 25 realized gain 2. Change in FMV: 500 initial FMV - 125 Final FMV = 375 decline in FMV 3. 0 gain recognized 267(d) iv. Section 267(d) 1. Gain shall be recognized to the extent that it exceeds so much of such loss as is properly allocable to the property sold or otherwise disposed of by the TP 2. 4. W sells her X Stock to Y Corp for $100. In the aggregate, W and all persons related to her own less than one percent of X’s outstanding stock. Assume the stock of Y Corp is held 100 percent by H (W’s husband). i. Sale from W to C for 100 1. 100 AR - 500 AB = <400> realized loss 2. 267 applies, loss disallowed 5. W sells the X stock to C, the wife of W’s brother, for $100, its fair market value, and C sells it back to W 20 days later for $105. i. W to C for $100 1. 100 AR - 500 AB = <400> realized loss 2. 400 loss recognized ii. C to X for $105 1. Section 1091 applies 2. 400 loss disallowed iii. 1091(a) 1. No loss allowed if acquired within 30 days iv. 1091(d) 1. The basis shall be the basis of the stock of securities so sold or disposed of increased or decreased as the case may be by the difference v. W’s basis in stock 1. 500 initial basis 2. + 5 or the difference (105 repurchase price - 100 from initial sale) 3. $505 basis in stock vi. C’s tax consequences 1. 105 AR - 100 AB = 5 gain 2. 400 loss disallowed 6. W sells her 100 X shares for $100 in a transaction effected on a stock exchange, and W’s brother, B, buys 100 X shares in an exchange transaction for $105 20 days later. i. Sale by W for 100 1. 100 AR - 500 AB = <400> loss 2. Section 1091 is N/A 3. Mcwilliams case 7. Demolition of buildings i. 280B - in the case of demolition of buildings 1. No deduction otherwise allowableunder this chapter shall be allwoed to the owner or lessee of such structure for a. Any amount expended for such demolition or b. Any loss sustained on account of such demolition AN 2. Amounts described in paragraph 1 shall be treated as properly chargeable to capital account with respect to the land on which the demolition structure was located More loss limitations ● 465 - at risk rules ○ Focus is on NRD ○ Must economically bear the risk of loss to take the loss deduction ● 469 - passive activity loss rules ○ Passive activity loss (PAL) ○ Focus is on active v passive investors ○ Must materially participate in the activity to the loss deduction 469 ● Active Basket ● Portfolio income Basket: ● Passive basket Sec. 465 ● Only take a loss to the extent “at risk” ○ TP’s cash i the activity ○ Adjusted basis of property contributed to the activity ○ Amount borrowed with respect to such activity if either personally liable for repayment OR to extent TP has pledged property that does not already secure the debt Sec 469 ● Passive activity means any activity - which involves the conduct of any trade or business AND in which the TP does not materially participate ● A TP shall be treated as materially participating in an activity only if the TP is involved in the operations of the activity on a basis which is -○ Regular ○ Continuous and ○ Substantial ● Section 469(c)(2) ○ Except as provided in paragrpah (7) the term passive activity means any rental activity ○ Exception if real estate professional and materially participate 2. T, an individual, is a doctor. For Year 1, T has net income from his medical practice of $90,000 and investment income from marketable debt securities (taxable interest) of $50,000. On January 18 of Year 1, T purchased a small office building in an arm's length transaction for $500,000. T paid $40,000 in cash from unborrowed funds and issued a nonrecourse note, secured by the property, to the seller for the remaining $460,000. The note bears adequate stated interest payable annually; principal is due in one payment in 5 years. The building generates $65,000 in annual rental income. Assume the annual cost recovery deduction is $30,000. T pays $49,000 in interest on the note, $10,000 in real property taxes, and $16,000 in maintenance annually. Also, T spends $30,000 during Year 1 on repairs (not subject to capitalization) needed to put the building into top shape for renting. T pays for these repairs on the last day of the year by borrowing an additional $30,000 from the seller of the building and increasing the first nonrecourse mortgage on the building to $490,000. T hires a rental and management agent for the building and is not personally involved in its management. How much must T include in his gross income for Year 1 in respect of the building activity? What deductions is T allowed in Year 1 in respect of the building activity? (Regs. §§ 1.469-1T(d)(1), (e)(3)(i)-(ii); -2T(d)(1)-(5), (6)(i), (6)(iii)). The numbers are tabulated here: Rental Income $65 Expenses: Maintenance Expenses $16 Real Property Taxes $10 Depreciation $30 Repairs $30 Interest on Mortgage $49 Total Expenses $135 ● Active Basket: 90,000 medical income (salary) ● Portfolio basket: 50,000 investment income ● Passive basket: <50,000> rental loss, suspended under 469 Cannot deduct any of the 70,000 loss this year The factual assumptions of Questions (3) and (4) may be summarized as follows: Q3 Q4 A/R $1200 $800 A/B 900 900 Gain (Loss) 300 (100) §465 (20) - §469 (40) (40) Passive Activity #2 (100) 90 3. An individual, T, sells a building held for rental to an unrelated buyer for $1.2 million. For the year of the sale, T has no income or expenses relating to the building apart from gain or loss on the sale. T's adjusted basis for the building is $900,000, losses previously suspended under §465(a) are $20,000, and losses previously suspended under § 469 are $40,000. T also has $100,000 of passive losses from Activity # 2. What are the consequences of the sale? (§ 1231; a. Section 465 suspended loss for 20,000: allowed under prop. Reg. 1.465 - 12 b. Section 469 - loss of $60 i. Passive basket: <60 loss> ii. Reg 1.469-2T iii. Passive basket 1. 300 income (1.2 M - 900k= 300k) 2. - 60 loss (40+20 previously suspended) 3. - 100 loss 4. = 140 net gain Reg. § 1.469-2T(c)(2)(i), (3)(i), (4); Prop. Reg. § 1.465-12(a); Prop. Reg. § 1.465-66) 4. Same as Question (3), except the selling price for the building is $800,000; there is no § 465 suspension; the previously suspended § 469 losses are $40,000; and Activity # 2 yields passive income for the year of $90,000. (See Reg. § 1.469 2T(d)(5)(i)(A)). 1. Total sec 469 loss: 140 2. Passive basket: i. 90 income (act #2) ii. -140 loss) iii. 50 net Loss 5. T and X, who are unrelated, are the partners of a general partnership engaged in the constructing and selling of single family homes. For a particular year, T's distributive share of the partnership's net profits from this business is $25,000. T also is a limited partner in an equipment leasing partnership that sustains a loss of $60,000 for the same year. T's distributive share of this loss is $25,000. What is T's passive activity loss for the taxable year? Assume alternatively: 1. 2. T and X each spend 110 hours during the year on the construction activity. The partnership has no employees or contractors who work on its construction projects. (Reg.§ 1.469-5T(a)-(d)); (Reg. § 1.469-2T(f)(1)-(3)). 6. T, who has substantial salary income and income from portfolio investments, purchased a motel at the beginning of Year 1, financing the purchase with a small down payment and a mortgage loan on which T has personal liability. Sometimes customers stay for as much as three nights (over a long weekend), but only rarely do they stay for as long as four nights. T incurs losses of $10,000 and $15,000, respectively, from the motel in Years 1 & 2, but has an $8,000 profit in year 3. What is the application of § 469 to the losses if: 1. T's husband works full-time (2,000 hours) as manager of the motel from the time of T's purchase. i. Not per se passive ii. Losses are not passive losses - not limited by sec 469 2. The motel is managed during Year 1 by T's son, who proves to be so incompetent that T's husband takes over as full-time (2,000 hours) manager at the beginning of Year 2? (See Reg. § 1.469-1T(e)(3)(i)-(ii); § 469(f)(1); § 469(c)(7)). i. Y1: passive activity 1. <10,000> passive activity loss carryforward ii. Y2: 1. Active activity -<15000 loss is not passive> 2. <10,000> PAL carryforward iii. Y3: 1. Active activity 2. <8000> becomes deductible 3. <2000> PAL Carryforward 3. Assume instead that the motel is managed during all years by T’s son and is profitable. Is the income earned from the motel by T subject to the net investment income tax (assuming the dollar thresholds are met)? (See § 1411(c)). i. 3.8 surtax on lesser of 1. Net investment income OR 2. Modified AGI Excess business loss limitation ● Section 461(f) ● Only applies to non-corporate taxpayers ● Only applies in tax year: 2018-2025 ● Limitation applies after application of at risk and PAL rules ● Only applies if have and “excess business” loss ○ Aggregate deduction for tax year attributable to trade/business ○ MINUS ■ Aggregate income /gain attributable to T/B + 500,000 M/Filing jointly(250,000 single) ● Disallowed loss are treated as NOL carryover in subsequent uear ● CARES Act 7. Win owns two separate unincorporated businesses and files a joint return for the year with his spouse. Win has a gaming business that has $600,000 of income and $200,000 of deductions for the year, but his restaurant business has $500,000 of income and $1.5 million of deductions for the year. 1. To what extent may Win deduct his losses? i. Excess business loss 1. 1.7 M deduction - (1.1M income + 500,000) = 100,000 2. What happens to any nondeductible losses in (a), above? 3. What result in (a), above, if Win does not materially participate in the restaurant business? i. Restaurant business 1. 1M loss: sec 469 disallows ii. Gaming business: 1. NO loss disallowed (do not have an excess business loss) 4. What result in (a), above, if in addition Win owns a real estate business that has $300,000 of income and $200,000 of deductions for the year? i. NO excess business loss: 1.9M deductions - 1.9 M (1.4M income + 500k) = 0 UNIT VII ASSIGNMENT Like Kind Exchanges Code: §§ 1001(c); 1031 (other than (e) and (g)); 1223(1); 1245(b)(4) Treasury Regulations: §§ 1.1031(a)-1; 1.1031(a)-2(a); 1.1031-1(b)-1 (Example (1)); 1.1031(d)-1 Disposition of property Gen Rule: Gain or loss recognized unless otherwise specified UNIT VII Problems Like Kind Exchanges 1. T owns a tract of undeveloped land, Blackacre, which he holds for investment, with a basis of $50 and a fair market value of $75. X owns a tract of land, Whiteacre, which is also held for investment and is also worth $75, but has an adjusted basis to X of $80. In each of the following alternatives, what amounts of gain or loss are recognized by T and X and what bases do they have for the property received? ○ T and X exchange properties, and each holds the property received for investment. ■ T Tax consequence 1. 75 AR - 50 = 25 gain 2. T’s basis in whiteacre: 75 gain ■ X’s tax consequences in absence of 1031 1. 75 AR - 80 <5 loss> 2. X’s basis: 75 ■ T’s consequences with 1031 1. 75 AR - 50 AB = 25 realized gain, 0 gain recognized 2. T’s basis in whiteacre: 50 a. 50 blackacre basis + 0 cash + 0 gain recognized - 0 loss recognized = 50 basis in whiteacre ○ Same as (a) except that X is a trust created by T several years ago for his children, and 18 months after the exchange, X sells Blackacre for $85. What if, 5 months after X sells Blackacre, T sells Whiteacre for $82? ○ Same as (a) except that X (an individual this time) immediately begins construction of a house on the land received from T and uses the house as her personal residence when it is completed. Problem 1(c) - purpose requirement ● X not using for business or investment purpose ● What happens when X sells? ● ● ● 1031 does not apply X tax consequences ○ 75 AR - 80 AB = 5 loss T’s Tax Consequences ○ 75 AR - 50 AB = 25 gain realized ○ X’s basis in blackacre - $50 ■ 2. T trades unimproved land used in her business for a city building to be used for the same purpose. The land is worth $150,000 and has an adjusted basis to T of $100,000. The building is worth $400,000. To even up the exchange, T also transfers corporate stock worth $250,000 whose adjusted basis to T is $300,000. What are the tax consequences of the exchange to T? What is her basis for the building? ○ Transaction 1 ■ 250000 Ar - 300000 = 50000 loss ○ Transaction 2 ■ 150000 AR - 10000 = 50,000 gain realized ■ 0 recognized ○ T basis in building received ○ 400k basis - 0 money received + 0 gain recognized - 50,000 loss recognized = 350,000 basis in building 3. X, the other party to the exchange in the preceding problem has an adjusted basis of $50,000 (after having taken $300,000 of prior depreciation deductions) for the building transferred to T in the exchange. What are the tax consequences of the exchange to X? ○ ○ ○ 400,000 AR - 50,000 AB = 350,000 gain realized Section 1031(c) X basis in acquired property ■ 405 basis in building - 0 money received + 0 gain recognized - 0 loss recognized = 450,000 total basis 1. Basis in stock = 250,000 2. Basis in land = 200,000 4. X owns an apartment building that he would like to exchange for a building owned by Y. Both buildings are encumbered by mortgages and in any exchange, each party would take subject to the mortgage on the acquired property. Three alternative sets of adjusted basis, value and mortgage figures are given below. With each alternative set of figures, determine the gains and losses that would be recognized if X and Y exchanged properties, straight up in alternatives (a) and (b) and with $10 cash boot paid by Y in alternative (c). What basis would each party take for the property received under each alternative? (See Reg 1.1031(d)-2)) ○ X tax consequences ■ gain/loss ■ AR - 110 ■ AB - 90 ■ G/L: 110 AR - 90 AB - 20 realized gain ■ 0 gain recognized ○ X’s basis in Y’s building ■ 50 exchange basis + 40 debt x assumes = 90 exchange basis ■ <40 debt that Y assumes> ■ 0 gain recognized ■ <0 loss recognized> ■ = $50 basis ○ none ○ Y analysis ■ Gain/Loss: 1. AR - 110 2. AB - 70 3. G/L - 110 AR - 70 AB = 40 realized gain 4. 0 gain recognized because 1031(d) 5. No net benefit ○ Y’s basis in X’s building ■ 30 exchange basis + 40 debt Y assumes = 70 exchange basis ■ <40 debt that X assumes> ■ 0 gain recognized ■ 0 loss recognized ■ =30 basis 4(b) - here X’s building is now worth 80 and mortgage is 50 X tax consequence ● gain/loss ○ Ar - 120 ○ Ab - 90 ○ g/l- 120 AR - 90 AB = 30 realized gain ○ 10 gain recognized ● X basis in y;s building ○ 50 exchange basis + 40 debt x assumes = 90 exchange basis ○ <50 debt relieg> ○ + 10 gain recognized ○ <0 loss recognized ○ 50 basis Y tax consequences ● g/l: ○ AR - 120 ○ AB - 80 ○ G/L 120 AR - 80 AB = 40 realized gain ○ We have a net detriment ○ 0 gain recognized ● Y’s basis in X’s building ○ 30 exchange basis + 50 debt Y assumes = 80 exchange basis ○ <40 debt relief> ○ + 0 gain recognized ○ <0 loss recognized> ○ $40 basis Problem 4(c) X tax consequences Has net detriment ● AR - 110 (70 FMV + 30 Mortg+ $10 cash) ● AB - 90 (50 basis in building + 40 mortgage) ● G/L - 20 realized gain ● We have net detriment because he’s being relieved of debt but assuming 10 debt ● 10 gain recognized X basis in Y building ● 50 exchange basis + 40 debt X assumes = 90 exchange basis ● <30 debt relief ● <10 cash received> ● + 10 gain recognized ● <0 loss recognized> ● = $60 basis Y’s tax consequences - has a net benefit ● ● Gain/loss: ○ 0 gain recognized ○ Realized gain = 110 AR (70 AR + 40 debt relief) = 70 AB (30 basis in Y building + 30 debt assumption + 10 cash) = 40 realized gain Y’s basis in X building ○ 30 exchange basis + 30 debt y assumes + 10 cash = 70 exchange basis ○ <40 debt relief> ○ 0 gain recognized ○ <0 loss recognized> ○ 30 basis Alternative X’s building (a) (b) (c) FMV 70 80 70 A/B 50 50 50 Mortgage 40 50 30 FMV 70 70 70 A/B 30 30 30 Mortgage 40 40 40 Y’s building Cash Boot Paid by Y to X HYPO #1 T ● Wants to sell his farm (FMV 75) ● Wants to acquire apt building (FMV 75) owned by Y ● Prefers like-kind exchange Y ● Wants to sell apt but only for cash X ● Wants to purchase T’s property for cash How to structure the transaction ● Option 1 ○ Step 1: T sells farm to X for cash $10 ● ● ○ Step 2: T then uses the cash to buy the apt from Y Option 2 ○ Step 1: X buys Y’s property for cash ○ Step 2: T and X swap properties ○ 3-cornered exchange (Rev-Rul 77-297) Option 3 ○ 4 party exchange ○ Step 1: T transfers property to qualified intermediary ○ Step 2: QI transfers property to X for cash ○ Step 3: QI uses cash to purchase Y property ○ Step 4: QI transfer the Y property to T Hypo 2 T: ● Transfer property (fmv 75) to X in exchange for X’s promise to deliver property acceptable to T within one year ● If T is unable to deliver the property, X will pay T $75 plus interest from the date of original exchange Deferred like kind exchange ● Starker case ● Section 1031(a)(3) ○ Must identify property to be received as the replacement property within 45 days of which original property relinquished ○ Property muse be received before the earlier of the day which is 180 days after the date on which the TP transfers the property relinquished in the exchange (or the due date of transferor’s return for taxable year when relinquished property is transferred) ● Reg 1.103(k)-1(g) Hypo 3 T: ● T acquires apartment building before he can find someone to acquire his farm Reverse deferred like-kind exchange ● Acquire replacement property before relinquish property ● Rev Proc 2000-37 ○ Y gets rid of property and transfers to exchange accomodation titleholder (EAT) ○ Once T finds buyer for relinquished property & T transfer relinquished property to EAT and EAT gives T the replacement property ○ The relinquished property goes to the buyer that wanted it from EAT. 165 1091(a) in case of loss 1041 267 280B - demolition of buildings Loss limitation 465 469 Same facts as HYPO from the assignment: T, an individual is a doctor. She has net income from medical practice of $90,000; Investment income from marketable debt securities of $50,000, a Building purchased for $500,000 (using $40,000 cash and a $460,000 nonrecourse note borrowed from Citibank) and an additional note this year of $30,000 borrowed from Citibank to pay for the $30,000 of repairs. T also has rental income related to the building of $65,000, and the following expenses related to the building: $16,000 maintenance expenses, $10,000 real property taxes, $30,000 depreciation, $30,000 repairs, and $49,000 interest on mortgage for total expenses of $135,000. How much does T have at risk this year? $540000 50k at risk earlier from problem 460K included - qualified recourse debt $30 k borrowed How much of T's $70,000 loss is suspended under Section 465? It is 0. Here only 20,00 carries forward as passive and 50,000 as at risk. How much of T's $70,000 is deductible this year (under the loss limitations that we have discussed)? Cleared the 465 hurdle but still needs to clear the 469 hurdle. $0 is deductible whenever you have loss that passes 465 hurdle you move to 469 hurdle. If it can clear 469 hurdle then deductible if it can't. To be deductible, ask which basket does the 70,000 loss go? Here it goes to passive because it is rental income. Therefore does not clear the hurdle and cannot deduct anything. Here, 70,000 is carried forward as a passive activity. Section 1031 Requirements ● An exchange of properties ● Held for business or investment purpose ● Real property ● Exchange for like-kind property ○ Reg. 1.1031(a)-1(b) - nature or character Basis in property you acquire is under 1031(d) - exchange basis The same as property exchanged ● - any money received ● +any gain recognized ● - any loss recognized ● -------------------------● Basis in property acquired in like-kind exchange Transaction 1 ● 250000 Ar - 300000 = 50000 loss Transaction 2 ● 150000 AR - 10000 = 50,000 gain realized ● 0 recognized ● T basis in building received ○ 400k basis - 0 money Problem 3 ● ● ● 400,000 AR - 50,000 AB = 350,000 gain realized Section 1031(c) X basis in acquired property ○ 405 basis in building - 0 money received + 0 gain recognized - 0 loss recognized = 450,000 total basis ■ Basis in stock = 250,000 ■ Basis in land = 200,000 HYPO ● A’s property ○ 30 basis ○ 60 fmv ○ 20 mortgage ● B’s property ○ 40 FMV ○ 20 cash ● Like kind exchange ● A’s G/L ○ 60 AR - 30 AB = 30 realized gain ○ Recognize lesser of ___ non like property ○ $20 gain recognized ● A’s Basis in B’s property ○ 30 exchange basis - 20 cash received + 20 gain recognized = 30 basis Reg 1.1031(d)-2 ● Net benefit ○ Treat as boot ○ Reduce net benefit by cash/property that you transfer ● Net detriment ○ Do not reduce net detriment by cash/property received Debt relief (debt x is relieved of) - debt assumed (y building debt) X tax consequences gain/loss AR - 110 AB - 90 G/L: 110 AR - 90 AB - 20 realized gain 0 gain recognized X’s basis in Y’s building 50 exchange basis + 40 debt x assumes = 90 exchange basis <40 debt that Y assumes> + 0 gain recognized + <0 loss recognized> + = $50 basis none Y analysis Gain/Loss: ● AR - 110 ● AB - 70 ● G/L - 110 AR - 70 AB = 40 realized gain ● 0 gain recognized because 1031(d) ● No net benefit Y’s basis in X’s building ● ● ● ● ● 30 exchange basis + 40 debt Y assumes = 70 exchange basis <40 debt that X assumes> 0 gain recognized 0 loss recognized 30 basis 4(b) - here X’s building is now worth 80 and mortgage is 50 X tax consequence ● gain/loss ○ Ar - 120 ○ Ab - 90 ○ g/l- 120 AR - 90 AB = 30 realized gain ○ 10 gain recognized ● X basis in y;s building ○ 50 exchange basis + 40 debt x assumes = 90 exchange basis ○ <50 debt relieg> ○ + 10 gain recognized ○ <0 loss recognized ○ 50 basis Y tax consequences ● g/l: ○ AR - 120 ○ AB - 80 ○ G/L 120 AR - 80 AB = 40 realized gain ○ We have a net detriment ○ 0 gain recognized ● Y’s basis in X’s building ○ 30 exchange basis + 50 debt Y assumes = 80 exchange basis ○ <40 debt relief> ○ + 0 gain recognized ○ <0 loss recognized> ○ $40 basis Problem 4(c) X tax consequences Has net detriment ● AR - 110 (70 FMV + 30 Mortg+ $10 cash) ● AB - 90 (50 basis in building + 40 mortgage) ● G/L - 20 realized gain ● We have net detriment because he’s being relieved of debt but assuming 10 debt ● 10 gain recognized X basis in Y building ● 50 exchange basis + 40 debt X assumes = 90 exchange basis ● <30 debt relief ● <10 cash received> ● + 10 gain recognized ● <0 loss recognized> ● = $60 basis Y’s tax consequences - has a net benefit ● Gain/loss: ○ 0 gain recognized ○ Realized gain = 110 AR (70 AR + 40 debt relief) = 70 AB (30 basis in Y building + 30 debt assumption + 10 cash) = 40 realized gain ● Y’s basis in X building ○ 30 exchange basis + 30 debt y assumes + 10 cash = 70 exchange basis ○ <40 debt relief> ○ 0 gain recognized ○ <0 loss recognized> ○ 30 basis What if T wants to sell his farm (FMV 75) Wants to acquiret Section 1031(a)(3) ● Must identify the property to be received as the replacement property within 45 days of which original property relinquished SOCRATIVE This year, T (who is in the highest tax bracket) sells (i) land used in his business for a gain of $25,000, (ii) a building used in his business for a gain of $30,000 (he had taken $20,000 of depreciation deductions) (iii) a machine used in his business for a loss of $50,000 (he had taken $1,000 of depreciation deductions), and (iv) stock for 40,000. He had held each of these assets for many years prior to the sale. How much of this income will be subject to tax at the 25% tax rate. 20 assuming 40 gain 5 0 55 None