Debt investments

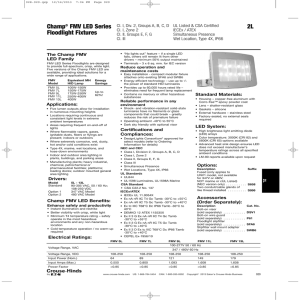

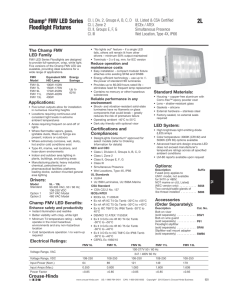

advertisement

Chapter 13 notes Debt investments First the debt investment account is debited and periodically interest revenue is recognized when paid. When the investment is sold, gain/loss is recognized. Stock investments 1. Holding of less than 20% ownership, Cost method is used a. Stock investment account is debited at acquisition b. Recognize dividends revenue when received. 2. Holding between 20% and 50% ownership, Equity method is used a. Stock investment account is debited at acquisition b. In subsequent periods, recognize a proportionally portion of net income of the investee company as investment income and increase the stock investment account with the same amount c. received. 3. In subsequent periods, reduce stock investment account by the amount of dividends Holding more than 50% ownership, Equity method is used (same as number 2 above) a. All financial statements are prepared in consolidated form Categories of Securities 1. Trading securities a. Short term investment. Recorded at cost at acquisition b. At fiscal year end, compare cost with FMV of portfolio and recognize gain/loss in the income statement. Portfolio is reported at FMV in the balance sheet c. Could be stock or bonds 2. Available for sale securities a. Could be short or long term b. At fiscal year end, compare cost with FMV of portfolio (short and long term separately) and record gain/loss in the stockholder’s equity section. Portfolio is reported at FMV in the balance sheet c. Could be stock or bonds 3. Held-to-maturity securities a. Long term debt investment b. Recorded at cost and no FMV adjustment is necessary