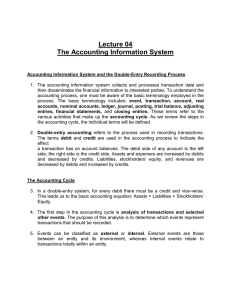

FASB is the common abbreviation for the Board that currently establishes financial accounting and reporting standards in the U.S. (Enter the acronym.) Information that best explains companies' stock price performance is reported in the Income Statement Which of the following represents the net income earned by a corporation and not yet paid to shareholders? Retained Earnings A transaction is initially recorded in the journal, and then subsequently posted to the general ledger A(n) account is maintained for each financial statement item, whereas a(n) general ledger contains all of the accounts of the company. A list of all accounts and their balances at a particular date showing that debits equal credits is referred to as a trial balance Which of the following contains a list of transactions affecting each account and the account's balance? General Ledger Journal - record a chronological listing of every transaction for a company. The process of transferring information from the journal to the ledger is referred to as posting Reporting revenues only when cash is received and expenses only when cash is paid is called the cash basis of accounting. In an adjusting entry for expenses incurred but not yet paid a liability is increasing since cash will be paid in the future due to the expense incurred Reason: - Adjusting entries for accruals relate to entries that record revenues and expenses earned or incurred during the period prior to when the cash changes hands. Accrual adjustments include increasing assets and revenue or increasing expenses and liabilities. No cash is involved in adjusting entries. The adjusting entry for an accrued revenue always includes: (Select all that apply.) 1) a debit to an asset account – Accounts Receivable 2) a credit to a revenue account – Service Revenue