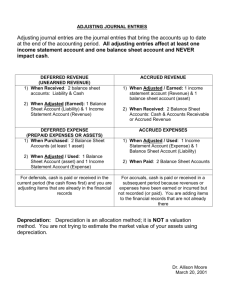

1. Which among the following is the last step in the accounting cycle? A. Preparation of reversing entries B. Preparation of financial statements C. Journalizing and posting of closing entries D. Preparation of the post-closing trial balance 2. Arrange the following steps in their correct order: I. Financial statements are prepared. II. Adjusting entries are recorded. III. Nominal accounts are closed. A. I, II and III B. II, I and III C. III, II and I D. II, III, I 3. Adjusting entries are needed because an entity A. Uses the accrual basis of accounting B. Has earned revenue during the period by selling products from its central operations C. Has expenses D. Uses the cash basis of accounting rather than the accrual basis 4. Adjusting entries involve A. Only real accounts B. Only nominal accounts C. Only capital accounts D. At least one real and one nominal account 5. Which of the following least resembles a typical adjusting entry? A. Debit asset, credit revenue C. Debit revenue, credit liability B. Debit expense, credit liability D. Debit asset, credit liability 6. Accruals are A. Adjusting entries where cash flow precedes revenue or expense recognition B. Adjusting entries where revenue or expense recognition precedes cash flow C. Adjusting entries where cash flow and revenue or expense recognition are simultaneous D. Adjusting entries where revenue or expenses are recognized in the absence of cash flow evidence 7. Which of the following is an example of an adjusting entry? A. Recording the purchase of supplies on account B. Recording depreciation of a truck C. Recording the billing of customers for services rendered D. Recording the payment of wages to employees 8. An unearned revenue can be best be described as an amount A. Collected and currently matched with expense B. Collected and not currently matched with expense C. Not collected and currently matched with expense D. Not collected and not currently matched with expense 9. Total net income over the life of an entity is A. Higher under the cash basis than under the accrual basis B. Lower under the cash basis than under the accrual basis C. The same under the cash basis as under the accrual basis D. Not susceptible to measurement 10. Closing entries A. Are optional B. Affect only the real accounts C. Permit an entity to analyze routine and repetitive transactions the same way all the time D. Remove the balances from the entity’s temporary accounts 11. After the accounts have been closed A. All the accounts have zero balances B. The asset, liability, and stockholder’s equity accounts have zero balances C. The revenue, expenses, income summary, and retained earnings have zero balances D. The revenue, expenses, and income summary accounts have zero balances 12. Income summary is a A. Mixed account B. Nominal account C. Capital account D. Real account 13. The manufacturing summary account A. Summarizes all revenues and expenses B. Is a substitute for the income summary C. Summarizes all accounts that enter into the computation of cost of goods manufactured D. Summarizes all accounts that enter into the computation of cost of goods sold 14. Reversing entries apply to A. All adjusting entries B. All deferrals C. All accruals D. All closing entries 15. Adjusting entries that are reversed include those for prepaid or unearned items that A. Create an asset or a liability account B. Were originally entered in a revenue or expense account C. Were originally entered in an asset or liability account D. Create an asset or a liability account and were originally entered in a revenue or expense account 16. An entity initially records prepayment in real accounts and makes reversing entries when appropriate. Which of the following year-end adjusting entries should be reversed? A. The entry to record depreciation expense for the period B. The entry to record the portion of service fees received in advance that is earned by year-end C. The entry to record supplies used during the period D. The entry to record service fees earned by year-end but not billed 17. An entity initially records prepayment in nominal accounts. Which of the following yearend adjusting entries may be reversed? A. The entry to record inventory at year-end B. The entry to record the portion of rental received in advance that is unearned at year-end C. The entry to record the portion of supplies previously acquired that is consumed as of year-end D. The entry to record the portion of interest paid in advance that expired at year-end 18. Which of the following is not true of a worksheet? A. The worksheet is included as part of the published financial statements B. The worksheet provides a place where adjusting entries can be made informally before they are journalized and posted C. The worksheet provides a balancing mechanism that helps to uncover accounting errors D. The worksheet helps facilitate the preparation of financial statements 19. In preparing a 10-column worksheet A. The beginning inventory is extended as a credit in the income statement columns B. The beginning inventory is extended as a credit in the statement of financial position columns C. The ending inventory is extended as a debit in the income statement columns and as a credit in the statement of financial position columns D. The ending inventory is extended as a credit in the income statement columns and as a debit in the statement of financial position columns 20. The balancing figure in the worksheet is net loss of A. The total of the credits exceeds the total debits in the income statement columns B. In the statement of financial position columns, the total of the debits exceeds the total of the credits C. The total of the credits is the same as the total of the debits in the income statement columns D. In the statement of financial position columns, the total of the credits exceeds the total of the debits 21. In preparing a worksheet and the entity is profitable in the current period, the total of the statement of financial position credit column will be A. Larger than the total of the statement of financial position debit column B. Smaller than the total of the statement of financial position debit column C. Larger than the total of the income statement debit column D. Larger than the total of the income statement credit column 22. Which of the following is a “source document” and which source document requires an entity in the books? A. Chart of accounts B. General Journal C. Purchase order D. Sales invoice 23. Which among the rules on debit and credit below is not correct? A. The normal balance of any account appears on the side for recording increases. B. Assets and expenses are debited when increased, and liabilities, revenues and equity are credited when increased. C. The debit is always on the left side of the accounting double entry. D. Debit means increase, and credit means decrease. 24. Debits A. Increase assets and decrease expenses, liabilities, revenue, and equity B. Increase assets and expenses and decrease liabilities, revenue and equity C. Increase assets and equity and decrease liabilities, expenses and revenue D. Decrease assets and expenses and increase liabilities, revenue and equity 25. Which of the choices that follow is not a “book of original entry”? A. Sales journal B. Voucher register C. General Journal D. General ledger 26. Journalizing is performed in what phase of the accounting process? A. Reporting B. Recording C. Classifying D. Summarizing 27. General ledger serves what phase of the accounting process? A. Reporting B. Recording C. Classifying D. Summarizing 28. An accounting record into which the essential facts and figures in connection with all transactions are initially recorded and in chronological order is called A. Account B. Trial balance C. Ledger D. Journal 29. Which of the following accounting tool exemplifies the ledger? A. T-account B. General journal C. Trial balance D. Voucher It helps localize accounting errors within a period of time. A. Account B. Trial balance C. Ledger D. Journal 30.