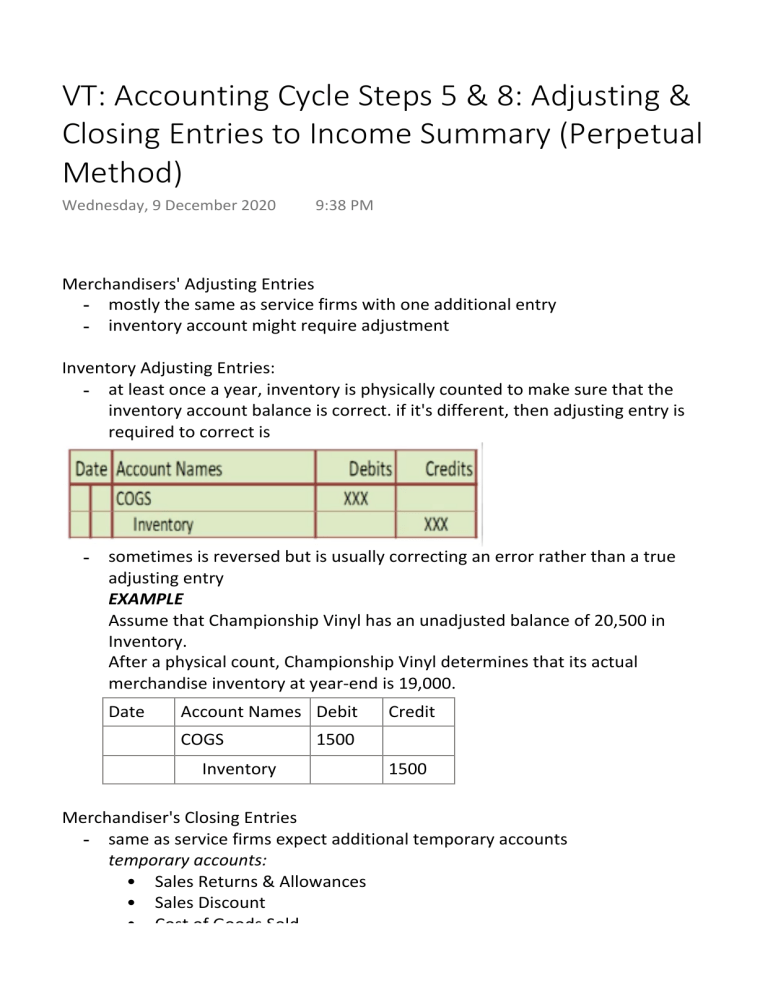

VT: Accounting Cycle Steps 5 & 8: Adjusting & Closing Entries to Income Summary (Perpetual Method) Wednesday, 9 December 2020 9:38 PM Merchandisers' Adjusting Entries - mostly the same as service firms with one additional entry - inventory account might require adjustment Inventory Adjusting Entries: - at least once a year, inventory is physically counted to make sure that the inventory account balance is correct. if it's different, then adjusting entry is required to correct is - sometimes is reversed but is usually correcting an error rather than a true adjusting entry EXAMPLE Assume that Championship Vinyl has an unadjusted balance of 20,500 in Inventory. After a physical count, Championship Vinyl determines that its actual merchandise inventory at year-end is 19,000. Date Account Names Debit COGS Inventory Credit 1500 1500 Merchandiser's Closing Entries - same as service firms expect additional temporary accounts temporary accounts: • Sales Returns & Allowances • Sales Discount • Cost of Goods Sold these accounts all have normal debit balances so they are closed with credits and are included in the expense closing entries. CLOSE REVENUES TO INCOME SUMMARY • Sales Returns & Allowances • Sales Discount • Cost of Goods Sold these accounts all have normal debit balances so they are closed with credits and are included in the expense closing entries. CLOSE REVENUES TO INCOME SUMMARY CLOSE EXPENSES TO INCOME SUMMARY CLOSE INCOME SUMMARY TO RETAINED EARNINGS CLOSE DIVIDENDS TO RETAINED EARNINGS