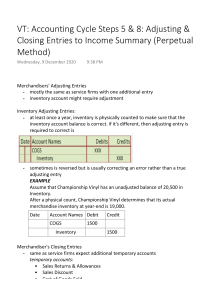

MBADM 811 – Exam 1 Study Guide Background information – be able to explain: Who are the users of financial information (stakeholders in the company) Roles of the SEC and FASB What GAAP is The characteristics of useful financial information under GAAP Financial statements – understand and recognize: Elements included in each financial statement (balance sheet, income statement, SE statement, cash flow statement) Relationships among the financial statements Structure of a classified balance sheet and a multi-step (classified) income statement o Know the order in which the line items are presented Be able to calculate net income, given transactions, account names, and/or income statement line items Accounting equation Be able to calculate amounts of missing elements of the accounting equation, given related information Accounts Identify given accounts as assets, liabilities, or stockholders’ equity Calculate the balance in an account, given the debits and credits for the accounting period Retained earnings Be able to calculate retained earnings, given other elements of the financial statements Transaction analysis For common transactions, analyze which areas of the accounting equation (and balance sheet) increase or decrease Understand and recognize the two transactions that are recorded when inventory is sold Debits and credits Know the accounting meaning of debit and credit Know the normal balance of specific accounts (whether an account increases on the debit or credit side) o Conversely, know whether the account decreases on the debit or the credit side Journal entries Know how a journal entry is structured Be able to recognize and interpret a journal entry for a given transaction T-accounts Be able to interpret T-account notation Given numerical information, be able to calculate the balance or the missing increase or decrease in an account Accounting cycle Know the general order of steps in the accounting cycle Understand the structure and purpose of the three trial balances in the accounting cycle Accrual vs. cash accounting Given a transaction, determine the amount of revenue or expense recognized on the income statement for the relevant accounting period Determine the amount of cash flows from transactions Understand the difference between accrual and cash accounting Adjusting journal entries Understand and recognize when and why adjusting entries are needed Understand the effects of adjusting entries on accounts and financial statements Determine the appropriate accounts and amounts to debit or credit in an adjusting entry in a given circumstance Determine which areas of the accounting equation are affected when an adjusting entry is not recorded Closing process Understand and explain the purpose of closing the temporary accounts Be able to interpret and recognize closing journal entries Understand how net income is added to retained earnings via closing entries