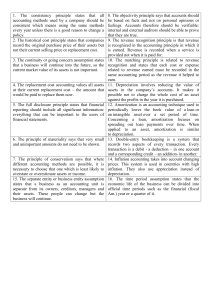

BAT4M1 ACCOUNTING LOBERTO UNIT 3 – CAPITAL ASSETS KNOWLEDGE (16 Marks) 1. Match the items below with each appropriate code letter. A. Gain on disposal B. Loss on disposal C. Trademark D. Natural resources E. Goodwill F. Amortization G. Intangible assets H. Research costs ___ 1. Process of allocating the cost of an intangible asset to expense over its useful life. ___ 2. Occurs if proceeds of disposal exceed the net book value. ___ 3. Examples are franchises and licences. ___ 4. Capital assets that are replaceable only by an act of nature. ___ 5. Can be identified only with a business as a whole. ___ 6. A symbol that identifies a particular enterprise or product. ___ 7. When net book value of asset is greater than the proceeds received from its sale. ___ 8. Must be expensed when incurred. 2. Identify the following expenditures as capital expenditures or operating expenditures. (a) Replacement of worn-out gears on factory machinery. (b) Construction of a new wing on an office building. (c) Painting the exterior of a building. (d) Oil change on a company truck. (e) Replacing a 486-computer chip with a Pentium chip, which increases productive capacity. No extension of useful life expected. (f) Overhaul of a truck motor. One year extension in useful life is expected. (g) Purchased a wastebasket at a cost of $10.00. (h) Painting and lettering of a used truck upon acquisition of the truck. BAT4M1 THINKING (16 Marks) 1. ACCOUNTING LOBERTO Kelso Word Processing Service uses the straight-line method of amortization. The company's fiscal year end is December 31. The following transactions and events occurred during the first three years. 2000 July 1 - Purchased an IBM computer from the Computer Centre for $7,000 cash, and shipping costs of $250. Nov.3 - Incurred ordinary repairs on computer of $440. Dec.31 - Recorded 2000 amortization on the basis of a four-year life and estimated residual value of $1,250. 2001 Dec.31 - Recorded 2001 amortization. 2002 – Jan.1 - Paid $1,800 for a major upgrade of the computer. This expenditure is expected to increase the operating efficiency and capacity of the computer. INSTRUCTIONS Prepare the necessary entries. 2. Net sales were $1,000,000 and net income was $100,000 in second year of operation for Juan's Used Furniture Shop. Total assets in the first year were $200,000 and in the second year $3,000,000. Determine the Asset Turnover and the Return on Assets for Juan's Used Furniture Shop. Show all calculations. BAT4M1 COMMUNICATION (20 Marks) 1. ACCOUNTING LOBERTO Danson Company purchased a machine on January 1, 2001. In addition to the purchase price paid, the following additional costs were incurred: (a) purchase of a second machine, (b) transportation and insurance costs while the machinery was in transit from the seller (FOB shipping point), (c) personnel training costs for initial operation of the machinery, (d) installation costs necessary to secure the machinery to the building flooring, (e) major overhaul to extend the life of the machinery, (f) lubrication of the machinery gearing before the machinery was placed into service, (g) lubrication of the machinery gearing after the machinery was placed into service, and (h) annual city operating licence. Indicate whether the items (a) through (h) are capital or operating expenditures in the spaces provided: C = Capital, 2. O = Operating, N = Neither. (a)__________ (b)___________ (c)___________ (d)___________ (e)__________ (f)___________ (g)___________ (h)___________ Indicate in the blank spaces below, the appropriate group heading for financial reporting purposes. Use the following codes to identify your answer: PPE - Property, Plant, and Equipment NR - Natural Resources I - Intangibles O - Other N/A - Not on the balance sheet ___ 1. Goodwill ___ 7. Timberlands ___ 2. Land Improvements ___ 8. Franchises ___ 3. Development costs for a patented product ___ 9. Licences ___ 4. Accumulated Amortization ___ 10. Equipment ___ 5. Trademarks ___ 11. Amortization Expense ___ 6. Research costs ___ 12. Land BAT4M1 APPLICATION (10 Marks) 1. ACCOUNTING LOBERTO Tolbert Company purchased equipment on January 1, 2001 for $60,000. It is estimated that the equipment will have a $5,000 residual value at the end of its 5-year useful life. It is also estimated that the equipment will produce 100,000 units over its 5-year life. INSTRUCTIONS - Answer the following independent questions. a) Calculate the amount of amortization expense for the year ended December 31, 2001, using the straight-line method of amortization. b) If 16,000 units of product are produced in 2001 and 24,000 units are produced in 2002, what is the book value of the equipment at December 31, 2002? The company uses the units-of-activity amortization method. 2. A capital asset acquired on October 1, 2001, at a cost of $400,000 has an estimated useful life of 10 years. The residual value is estimated to be $30,000 at the end of the asset's useful life. The company has a December 31 year end. INSTRUCTIONS Determine the amortization expense for December 31, 2001 and 2002 using the straight-line method.