Highway Engineering Assignment: Pavement Design & Analysis

advertisement

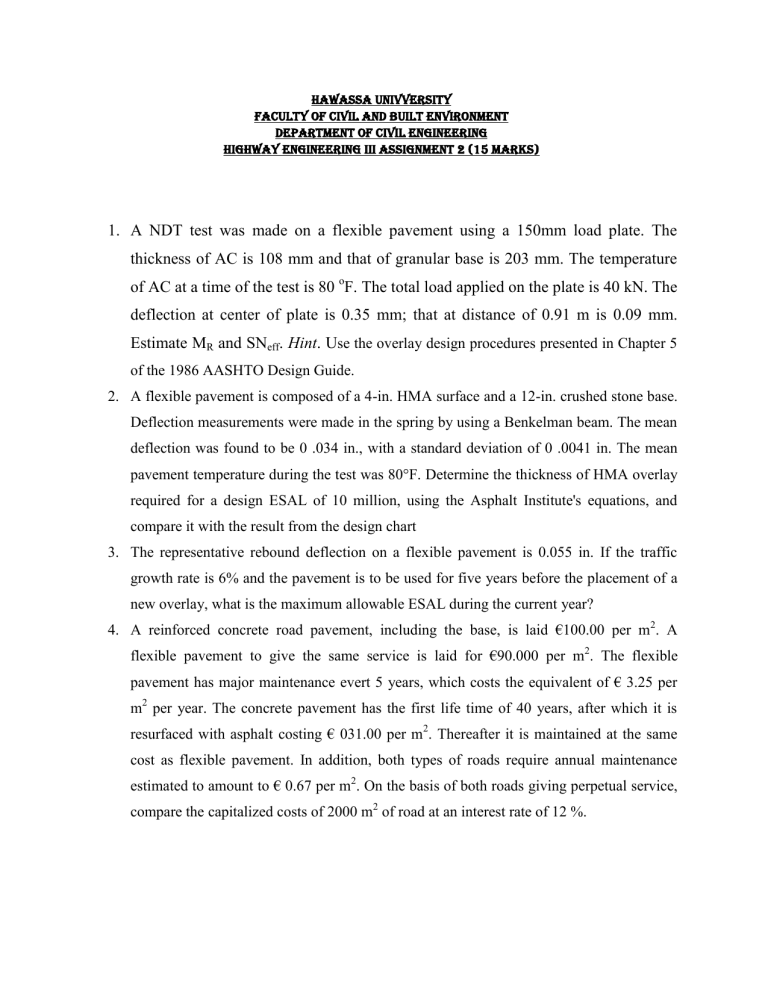

HAWASSA UNIVVERSITY FACULTY OF CIVIL AND BUILT ENVIRONMENT DEPARTMENT OF CIVIL ENGINEERING HIGHWAY ENGINEERING III assignment 2 (15 marks) 1. A NDT test was made on a flexible pavement using a 150mm load plate. The thickness of AC is 108 mm and that of granular base is 203 mm. The temperature of AC at a time of the test is 80 oF. The total load applied on the plate is 40 kN. The deflection at center of plate is 0.35 mm; that at distance of 0.91 m is 0.09 mm. Estimate MR and SNeff. Hint. Use the overlay design procedures presented in Chapter 5 of the 1986 AASHTO Design Guide. 2. A flexible pavement is composed of a 4-in. HMA surface and a 12-in. crushed stone base. Deflection measurements were made in the spring by using a Benkelman beam. The mean deflection was found to be 0 .034 in., with a standard deviation of 0 .0041 in. The mean pavement temperature during the test was 80°F. Determine the thickness of HMA overlay required for a design ESAL of 10 million, using the Asphalt Institute's equations, and compare it with the result from the design chart 3. The representative rebound deflection on a flexible pavement is 0.055 in. If the traffic growth rate is 6% and the pavement is to be used for five years before the placement of a new overlay, what is the maximum allowable ESAL during the current year? 4. A reinforced concrete road pavement, including the base, is laid €100.00 per m2. A flexible pavement to give the same service is laid for €90.000 per m2. The flexible pavement has major maintenance evert 5 years, which costs the equivalent of € 3.25 per m2 per year. The concrete pavement has the first life time of 40 years, after which it is resurfaced with asphalt costing € 031.00 per m2. Thereafter it is maintained at the same cost as flexible pavement. In addition, both types of roads require annual maintenance estimated to amount to € 0.67 per m2. On the basis of both roads giving perpetual service, compare the capitalized costs of 2000 m2 of road at an interest rate of 12 %. 5. A planned highway project will have the following receipts and disbursements as shown in the table below. Using the information given, calculate NPV, EIRR and B-CR at 12% opportunity of cost of capital. Is the project feasible? Why? Costs Year Construction Maintenance Benefits Development Value Maintenance Cost Vehicle Added Savings Operating Cost Savings 2005 15,000 2006 30,000 2007 10,000 2008 1,000 100 10,000 500 1,500 2009 1,000 100 10,500 500 1,500 2010 1,000 100 11,000 500 2,000 2011 1,500 100 12,000 500 2,500 2012 1,500 100 13,000 500 2,500 2013 2,000 100 15,000 500 3,000 2014 2,000 100 17,000 500 3,000 2015 2,500 100 19,000 500 3,000 2016 2,500 100 20,000 500 3,500 2017 3,000 100 22,000 500 3,500 6. A proposed highway project requires an initial investment of 10 million and a supplementary investment of 5 million at the end of the tenth year. The project will have a useful life of 50 years, counting from the date of the initial investment. The interest rate is 6%. The cost of operation and maintenance is 200,000 per year. The benefit of the project is estimated to begin with 1.0 million per year for the first 15 years and also for the remaining 35 years the benefit is supposed to be increased at once to 2.75 million per year and remains constant up to the end the useful life. Based on the information given above, determine the feasibility of the investment by using NPW EUAW, BCR and ROR appraisal techniques