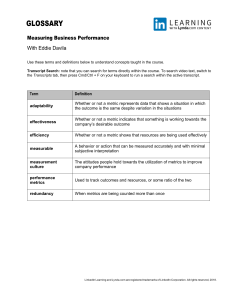

GLOSSARY Financial Modeling and Forecasting Financial Statements With Jim Stice and Kay Stice Use these terms and definitions below to understand concepts taught in the course. Transcript Search: note that you can search for terms directly within the course. To search video text, switch to the Transcripts tab, then press Cmd/Ctrl + F on your keyboard to run a search within the active transcript. Term Definition capital expenditures Capital expenditures, or CapEx, are purchases of long-term operating assets, such as land, buildings, and equipment careful financial model A careful financial model is a numerical plan of a business's activities made in advance that helps a business identify and solve problems before these problems even arise cash burn rate Cash burn rate is a measure of negative cash flow, and is typically quoted in terms of cash spent per month Depreciation Depreciation is an accounting method of spreading the cost (or value) of a tangible or physical asset over its useful life or life expectancy discounted cash flow analysis (DCF) The fundamental model for estimating the value of a business or any other asset fixed cost A fixed cost is a cost that does not change regardless of the amount of goods or services produced or sold long-term asset Long-term assets, such as property, plant, and equipment are not intended to be turned into cash or be consumed within one year of the balance sheet date reversion to the mean A belief that asset prices and historical returns eventually revert to the mean LinkedIn Learning and Lynda.com are registered trademarks of LinkedIn Corporation. All rights reserved, 2019. variable cost A variable cost is a cost that increases in direct proportion to the volume of business LinkedIn Learning and Lynda.com are registered trademarks of LinkedIn Corporation. All rights reserved, 2019.