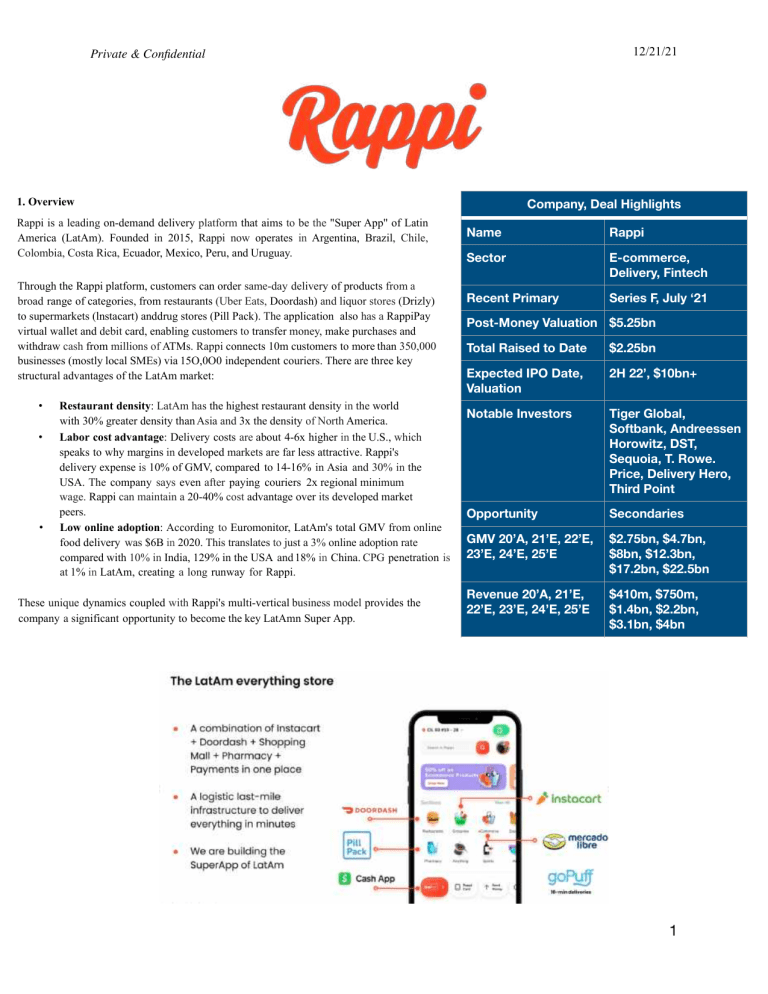

12/21/21 Private & Con dential 1. Overview Rappi is a leading on-demand delivery platform that aims to be the "Super App" of Latin America (LatAm). Founded in 2015, Rappi now operates in Argentina, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Peru, and Uruguay. Through the Rappi platform, customers can order same-day delivery of products from a broad range of categories, from restaurants (Uber Eats, Doordash) and liquor stores (Drizly) to supermarkets (lnstacart) anddrug stores (Pill Pack). The application also has a RappiPay virtual wallet and debit card, enabling customers to transfer money, make purchases and withdraw cash from millions of ATMs. Rappi connects 10m customers to more than 350,000 businesses (mostly local SMEs) via 15O,0O0 independent couriers. There are three key structural advantages of the LatAm market: • • • Restaurant density: LatAm has the highest restaurant density in the world with 30% greater density than Asia and 3x the density of North America. Labor cost advantage: Delivery costs are about 4-6x higher in the U.S., which speaks to why margins in developed markets are far less attractive. Rappi's delivery expense is 10% of GMV, compared to 14-16% in Asia and 30% in the USA. The company says even after paying couriers 2x regional minimum wage. Rappi can maintain a 20-40% cost advantage over its developed market peers. Low online adoption: According to Euromonitor, LatAm's total GMV from online food delivery was $6B in 2020. This translates to just a 3% online adoption rate compared with 10% in India, 129% in the USA and 18% in China. CPG penetration is at 1% in LatAm, creating a long runway for Rappi. These unique dynamics coupled with Rappi's multi-vertical business model provides the company a significant opportunity to become the key LatAmn Super App. Company, Deal Highlights Name Rappi Sector E-commerce, Delivery, Fintech Recent Primary Series F, July ‘21 Post-Money Valuation $5.25bn Total Raised to Date $2.25bn Expected IPO Date, Valuation 2H 22’, $10bn+ Notable Investors Tiger Global, Softbank, Andreessen Horowitz, DST, Sequoia, T. Rowe. Price, Delivery Hero, Third Point Opportunity Secondaries GMV 20’A, 21’E, 22’E, 23’E, 24’E, 25’E $2.75bn, $4.7bn, $8bn, $12.3bn, $17.2bn, $22.5bn Revenue 20’A, 21’E, 22’E, 23’E, 24’E, 25’E $410m, $750m, $1.4bn, $2.2bn, $3.1bn, $4bn fi 1 12/21/21 Private & Con dential LatAm E-Commerce Market Opportunity 2. Company Highlights • • Rapidly increasing market dominance: Rappi has grown its footprint to nine countries and over 100 cities in LatAm. Rappi has maintained the status of #1 or #2 player in the most important markets. Revenue & GMV growth at scale: As Rappi has scaled across key regions and verticals in LatAm, the company has maintained impressive revenue and GMV growth. o The company has grown revenue from $6.5M in 2017 to $410M in 2020 (and on track to fi 2 Private & Con dential 12/21/21 deliver $750M this year). The company has grown GMV from $69M in 2017 to $2.7B in 2020 (and on track to deliver $4.7B this year). Consistent growth in client penetration: Rappi has consistently shown remarkable growth in key client metrics. o Rappi has reached 10m new users and is expected to reach 12.4m by year-end. o Active users have increased on the platform especially after the rollout of Rappi Prime (similar to Amazon Prime's annual membership). Rappi Prime members have grown from 470k in January 2020 to 1.1m in January 2021. o Rappi has 5.5m monthly active users (MAU) and 1.82m daily active users (DAU) implying a DAU/MAU ratio of 33%, significantly higher than the industry benchmark of 8%. Clear runway for top-line expansion: Online adoption in LatAm remains muted at low singledigitpercentages. In comparison, we see 10%. 12% and 18% penetration in India, the U.S. and China respectively. Sources of growth are offline to online migration, category expansion and higher frequency of purchase. User frequency grows with maturity: Typically, on-demand is one of the most competitive markets with low loyalty. In comparison to global peers, Rappi’s customer spend data is significantly higher. Rappi's cohort data shows that purchase frequency increases from an average of 2x/month from year 1 to over 11x/month by year 5 compared to Grab at 3.6x, Coupang at 3.6x, and DoorDash at 1.6x. Rappi's power users purchase as much as 20 to 30x per month. Structural advantage: Rappi has one of the lowest delivery expenses of all on demand apps as a percentage of GMV. Rappi can generate above-average delivery margins per order as a result of its low delivery expense and high average order value (AOV}, a significant structural advantage over Western peers that we explain below. o • • • • 3. Rappi’s Product Rappi's core offering is on-demand services for grocery delivery (Instacart). food delivery (Doordash, Uber Eats), mobile money transfers (Cash App), e-commerce (Mercado Libre), pharmacy (Pill Pack) and 10-minute deliveries from dark stores (traditional retail stores that have been converted to local fulfillment centers). The vast majority of Rappi’s net revenue is generated from commissions earned from merchants selling via its marketplace. Monetization • Commissions: Rappi charges the merchants commissions to sell via the marketplace. (81% of net revenue) • Delivery fees: For each order, consumers pay a fixed delivery fee to Rappi. Then, Rappi pays the couriers. (2% of net revenue, due to delivery costs outweighing fees for the time being) • Advertising revenue: Restaurants and FMCG (fast-moving consumer goods) companies pay advertising fees to the platform for priority listings. (10% of net revenue) • Subscription revenue: Rappi has a subscription membership called Rappi Prime, which provides customers free delivery on orders. (11% of net revenue) 4. Product Growth Rappi reaching critical mass in its core markets in food and product delivery has enabled it to expand beyond food and CPG delivery into verticals such as e-commerce, travel, and merchant advertising. These markets are complimentary to Rappi’s existing services and will expand Rappi’s addressable market through more user scenarios, large cohorts and higher AOV. We highlight key initiatives below: fi 3 Private & Con dential 12/21/21 1. Advertising: CPGs in LatAm spend roughly $80B a year on marketing. Rappi has become an attractive avenue for ad spend generating approximately $95m in highly profitable (70%+ margins) ARR. Rappi’s restaurant ads and placements are beginning to scale at a rapid pace and will continue to improve the company’s economics. Additionally, the company expects that RappiAds Paid Media will improve contribution margins by roughly 15% in December 2021. 2. Rappi Pay and Bank: Although still in its early stages of development and growth, Rappi is well-positioned to offer robust payment offerings to its customers via virtual debit and credit cards. The company has already received 1.5m applications and issued 350k cards. The card creates a feedback loop for Rappi’s ecosystem as it reduces transaction fees, creates higher customer retention, and opens the door to additional financials products. 3. E-Commerce: With a population of over 650m and significant mobile adoption (70%), the LatAm region is still behind other regions in e-commerce penetration at 6%. In comparison, China, with similar mobile adoption metrics, boasts a 25% penetration in e-commerce. We see this as a clear expansion opportunity for Rappi as e-commerce currently represents just 2% of the company’s net revenue. 4. Grocery: Rappi operates a grocery marketplace that provides last-mile delivery but holds no inventory. The offering has turned into a dominant grocery product for LatAm. To strengthen economics and the user experience, Rappi has begun vertically integrating the grocery business via the Dark Store. There is a clear structural advantage by creating more opportunities to work directly with suppliers. 5. Dark Stores: As of Q2 2021, Rappi’s platform consists of 57 dark stores, with a target of 450 by year-end. The dark stores enable the 10-minute delivery guarantee which significantly increases repurchase rates and improves unit economics on these orders due to logistics and procurement efficiencies. 5. Strategic Initiatives In order to continue driving top line growth and user penetration (Rappi is targeting $3bn in net revenue by 2024, driven primarily by an increase in contribution per order and growth in active buyers from 7m to 14.6m), Rappi will be focusing on the following near-term strategic initiatives: 1. Continued expansion in Mexico & Brazil as the two largest market opportunities in LatAm. 2. Growth of 10-minute delivery, which has a superior user experience and unit economics. Rappi plans to expand to 450 dark stores by year-end, targeting high frequency and high order value customers to drive further margin expansion. 3. Rappi's fintech vertical will continue to grow and gain significance. Rappi will continue to deepenits relationship with current banking partners (Banorte in Mexico. Davivienda in Colombia, and Interbank in Peru). Fintech Vertical fi 4 12/21/21 Private & Con dential 10-minute Delivery, Turbo Stores fi 5 Private & Con dential 12/21/21 fi 6 Private & Con dential 12/21/21 6. Pathway To Profitability Notes - Large profitability drivers coming from launch of dark stores and Rappi financial - AOV steadily increasing Y/Y while delivery costs are decreasing - Lower transaction and bank fees with more people using Rappi pay - AOV steadily increasing with bigger flywheel of services and products/offerings - cross selling - CPG Ads business, Online Ad business is starting to take off and scale, adding to UE, more companies starting to market digitally - Restaurant Paid Ads also scaling, further boost UE - Rappi Ads Paid Media will increase CM by +15% in December 21’E - Courier per/h rev increasing while cost per order going down, due to algorithm improvements and steady rollout into new markets - $(30.5)m EBIDA/month 2020 to $(17.3)m EBITDA/month in 2021, what happened, how does this project to 2022 profitability expectations of $10.2m EBITDA/month… - UE contribution went from $0.61 in December 2020 to $1.14 in December 2021 - Gross revenues per order growing, growth in commissions, CPG and Restaurant Ad business taking off, prime subscription business, while you have delivery costs actually falling (Rappi cites technology improvements and newly implemented algorithm as cause for efficiency gains per courier per hour) so overall they have a proven growth model of gross revenues per order increasing while delivery costs flat to actually decreasing from 19’ to 21’. All cost line items below delivery costs have started to flatten out in 21’ vs’ 20’ and 19’ given scale and optimization. Line items like transaction and banks fees are to fall further as Rappi fintech ecosystem will bring those fees down, all other items flat to decreasing from 19’ to 21’ - Large gross revenue drivers coming from CPG Ad and Restaurant Paid Ad business - Rappi prime growth of 1.1m users in Jan’21 to 2m in Dec 21’ - 10 minute deliveries/Dark stores - UE and CM from dark store vertical is projected to be much more profitable than traditional Rappi, with 450+ dark stores EOY 21’ from 57 at BOY, dark store CM in 21’ is $2.68, net rev per order for dark stores is $5.77 vs CM on traditional Rappi of $1.14 and net revenue per order of $3.44. - Finally the fintech vertical, CM expense line items like bank fees will be brought significantly down, benefits of ecosystem from fintech blending into delivery services. - Steadily improving UE, launch of much higher margin generating dark stores, CPG and Restaurant spend drivers, prime subscription drivers, and increased ecosystem engagement and lower fees/transaction costs from fintech vertical and integration are all strong drivers of profitability.. Cross-selling to lower frequency/higher margin products within platform too also big driver, same super-app evolution story as Meituan (see below). 7. Rappi’s Mirroring Meituan’s Playbook to Become a Super-App Rappi’s goal is to become the super-app of LATM. They are following the same playbook that Meituan did in China. Rappi enjoys high density and low labor costs, two important structural advantages compared to its western peers. Rappi would remain as the top 3 players in all operating countries with 50%+ GMV growth through category expansion and higher adoption; margin improvement through lower delivery cost and operating leverage fi 7 Private & Con dential 12/21/21 - Over the last few years, Rappi has been expanding beyond food and CPG delivery into e-commerce, travel and merchant advertising: verticals that are complementary to Rappi’s existing services and can expand Rappi’s TAM in the long run through more user scenarios, larger cohorts and higher AOV. This strategy of using high frequency, low margin verticals to gain mindshare and then cross-selling into low frequency but high margin verticals is similar to how Meituan became a one-stop platform in China: • Expanded their customer base and transaction frequencies by introducing more services with strong cross-selling capabilities. • Unlocking value for merchants through online marketing, payment systems and supply chain finance • Investing in its intra-city on-demand delivery network and algorithm to improve operating efficiency - Cross-selling from high frequency, low margin verticals to low frequency but high margin verticals is an effective strategy to gain market share. Through food delivery, Meituan captured users, and could then cross-sell the high margin hotel business to the same group of sticky users. As a result, 70%+ of its hotel booking customers came from its existing food delivery customers. Today, food delivery makes up 57% of Meituan's revenue but only 34% of its gross margin, whereas travel contributes 19% of revenue and 51% of its gross profit. Meituan’s main advantage was its strong execution and ability to dominate new cities. The company used a team of 30,000 sales and business development representatives to establish relationships with merchants, on-board them, and provide them with SaaS solutions that helped them run their business while also bringing them into the Meituan ecosystem. Rappi is still in the early days of building out this kind of ecosystem. The majority of Rappi’s current revenue—about 75%—comes from food and CPG delivery. Nevertheless, it is the only company in Latin America that has a super-app or multi-vertical DNA. In other words, it is a pure horizontal player, while all its competitors are vertical players with aspirations to go horizontal. fi 8 Private & Con dential 12/21/21 8. Competitive Landscape Rappi's largest competitors include iFood in Brazil, Uber Eats in Mexico and Pedidos Ya in Argentina.These are all well-funded companies that have ambitious plans for growth. fi 9 Private & Con dential 12/21/21 Local network effects and scale advantages tend to create meaningful performance gaps between the second and third players in these markets, As a result, on-demand markets tend to settle into a duopoly structure at maturity. we expect Rappi to capture a substantial share of the top three markets in LatAm (Columbia, Mexico, and Brazil) and remain competitive in other rapidly growing, but smaller countries in the region. Rappi’s business model requires scale economies and global consolidation that are already underway. |n addition, we're seeing less well-funded companies exit markets where they cannot be a leading provider. Rappi currently faces the toughest competition in Brazil with market leader iFood. However, Rappi and Uber Eats recently won a dispute against iFood regarding the exclusivity agreements the company signed with restaurants. Brazilian regulatory body, CADE (the Administrative Council for Economic Defense) has now forbidden iFood to sign any new exclusivity deals with restaurants as a way to promote competition and better prices for the consumer. We view this as tremendously positive for Rappi’s ability to continue penetrating the largest on-demand market in LatAm. Rappi's key advantage over all the other delivery apps is that it remains the only company in LatAm to have a superapp platform. Although the majority of the Rappi’s revenue is still derived from delivery, the company has taken significant steps to expand horizontally. All of Rappi's competitors have successfully built strong vertical models, but to truly build critical mass and benefit from hyper-local network effects, a multi-vertical approach is necessary (which we saw in China via Meituan). fi 10 Private & Con dential 12/21/21 We value Rappi based on sum of-the parts valuation, considering the differences among its business units. • • « • We value Rappi's delivery vertical on 8.0x 2O22E EV/Revenue, towards the high end of global listed delivery peers' as we factor i n Rappi's superior revenue growth. Despite the significant macro tailwind present in e-commerce penetration within LatAm, we take a conservative approach and value Rappi's e-commerce vertical on 6.5x 2022E EV/Revenue, in-line with the average of gIoDaI listed marketplace peers' We value Rappi's online ad vertical on 9.5x 2022E EV/Revenue, in-line with the average of global listed marketplace peers' We assign zero value to Rappi's payments business given the early phases of its rollout. Our SOTP fair value is at $11.2B, with 74/16/10% of the value from delivery, online ads, and e-commerce respectively. We've taken a particularly conservative approach to showcase the immense opportunity for Rappi fi 11 Private & Con dential 12/21/21 if it can simply execute on its near-term commercialization strategy. Rappi's opportunity to become the Super App of LatAm presents a Meituan-esque upside scenario given the demographic tailwinds of the region and the lack of competition in the multi-vertical approach. 9. Risks LatAm companies generally tend to experience higher business risks and volatility versus developed market peers. We highlight key risk considerations for Rappi: • « • • • Currency Risk: As opposed to developed market currencies, LatAm faces far higher FX volatility. Political Risk: LatAm countries can at times face varied political dynamics. Politics can pose increased business risks by implementing economic controls, creating corrupt business regulations, implementing targeted taxes on nascent industries, and implementing capital controls. Labor Policy Uncertainty Risk: LatAm Labor policy is far more inconsistent and incongruent than in the developed markets. Regulatory Risks: Banking regulators could pose impediments to Rappi's fintech ambitions. Competitive Dynamics: Some countries, such as Brazil, count strong and well-funded local leadersin the space. This could lead to changes in pricing dynamics in a bid to “buy” market share. fi 12