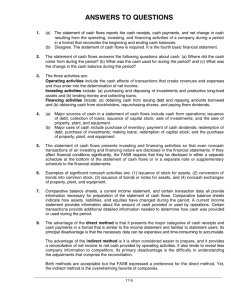

STATEMENT OF CASH FLOWS STATEMENT OF CASH FLOWS A statement of cash flows is a component of financial statements which summarizes the operating, investing and financing activities of an entity (information about cash receipts and cash payments made during a given period of time). The statement of cash flows is intended to provide information about the change in an entity’s cash and cash equivalents. Cash comprises cash on hand and demand deposits. Cash equivalents are short-term highly liquid investments that are readily convertible to known amount of cash and which are subject to an insignificant risk of change in value. CLASSIFICATION OF CASH FLOWS Operating activities are the cash flows derived primarily from the principal revenue producing activities of the entity. Examples of cash flows from operating activities are: a. Cash receipts from sale of goods and rendering of services b. Cash receipts from royalties, rental, fees, commissions and other revenues c. Cash payments to suppliers for goods and services d. Cash payments for selling, administrative and other expenses e. Cash receipts and cash payments of an insurance enterprise for premiums and claims, annuities and other policy benefits f. Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities g. Cash receipts and payments for securities held for dealing or trading purposes STATEMENT OF CASH FLOWS CLASSIFICATION OF CASH FLOWS Investing activities are the cash flows derived from the acquisition and disposal of long-term assets and other investments not included in cash equivalents. Examples of cash flows from investing activities are: a. Cash payments to acquire property, plant and equipment, intangibles and other long-term assets b. Cash receipts from sales of property, plant and equipment, intangibles and other long-term assets c. Cash payments to acquire equity or debt instruments of other entities and interests in joint ventures (current and long-term investments) d. Cash receipts from sales of equity or debt instruments of other entities and interests in joint ventures e. Cash advances and loans to other parties (other than advances and loans made by financial institutions) f. Cash receipts from repayment of advances and loans made to other parties g. Cash payments for futures contract, forward contract, option contract and swap contract h. Cash receipts from futures contract, forward contract, option contract and swap contract STATEMENT OF CASH FLOWS CLASSIFICATION OF CASH FLOWS Financing activities are the cash flows derived from the equity capital and borrowings of the entity. Financing activities include the cash flows from transactions involving nontrade liabilities and equity of an entity. Cash flows from financing activities result from transactions: a. between the entity and the owners – equity financing b. Between the entity and the creditors – debt financing Examples of cash flows from financing activities are: a. Cash receipts from issuing shares or other equity instruments (e.g. issuance of ordinary and preference shares) b. Cash payments to owners to acquire or redeem the entity’s shares (e.g. payment for treasury shares) c. Cash receipts from issuing debentures, loans, notes, bonds, mortgages and other short or long-term borrowings (nontrade) d. Cash payments for amounts borrowed e. Cash payments by a lessee for the reduction of the outstanding principal lease liability IMPORTANT NOTE: Cash payments to settle obligations involving trade accounts and notes payable, income tax payable, accrued expenses and similar items are operating activities, NOT financing activities. STATEMENT OF CASH FLOWS Noncash transactions The statement of cash flows is strictly a cash concept. Accordingly, investing and financing activities that do not require the use of cash or cash equivalents shall be excluded from the statement of cash flows. The following noncash transactions are disclosed separately (either in the Notes to FS or in a separate schedule): a. b. c. d. Acquisition of asset by assuming directly related liability Acquisition of asset by means of issuing share capital Conversion of bonds payable to share capital Conversion of preference share to ordinary share Interest Interest paid and interest received shall be classified as operating cash flows because they form part of the determination of net income or loss for the period (PAS 7, par. 33). Alternative treatments: 1. Interest paid may be classified as financing cash flow because it is a cost of obtaining financial resources. 2. Interest received may be classified as investing cash flow because it is a return on investment Interest paid and interest received are usually classified as operating cash flows for financial institutions. Cash flows from interest paid and interest received shall be classified in a consistent manner from period to period as either operating, investing or financing activities. STATEMENT OF CASH FLOWS Dividends Dividend received shall be classified as operating cash flow because it enters into the determination of net income (PAS 7, par. 33). Dividend paid shall be classified as financing cash flow because it is a cost of obtaining financial resources (PAS 7, par. 33). Alternative treatments: 1. Dividend received may be classified as investing cash flow because it is a return on investment. 2. Dividend paid may be classified as operating cash flow in order to assist users to determine the ability of the entity to pay dividends out of operating cash flows. The classification of dividend received and dividend paid as either operating, investing or financing activity shall be made on a consistent basis from period to period. Income taxes Cash flows arising from income taxes shall be separately disclosed as cash flows from operating activities unless they can be specifically identified with investing and financing activities. STATEMENT OF CASH FLOWS Direct Method – Operating activities This method shows in detail the major classes of gross cash receipts and gross cash payments which are listed one by one where the difference is presented as the net cash flow from operating activities. The direct method resembles the “cash basis” income statement which requires the conversion of some income and expense items from accrual to cash basis form. Indirect Method – Operating activities The net income or loss is adjusted for the effects of transactions of a noncash nature, any deferrals or accruals of past or future operating cash receipts and payments, and items of income or expense associated with investing and financing activities. Adjustment Guidelines (Accrual net income or loss to Cash Basis) 1. All increases in trade noncash current assets and decreases in trade noncash current liabilities are deducted from net income. 2. All decreases in trade noncash current assets and increases in trade noncash current liabilities are added to net income. 3. Depreciation, amortization and other noncash expenses are added back to net income to eliminate their effects on net income. 4. Any gain on disposal of property or gain on early retirement of nontrade liabilities shall be deducted from net income. 5. Any loss on disposal of property or loss on early retirement of nontrade liabilities shall be added back to net income. 6. Other noncash income or gain is deducted from net income and other noncash expense or loss is added to net income to eliminate their effects on net income. Practical computational guidelines on trade noncash current assets and trade noncash current liabilities 1. For trade noncash current assets = prior year balance minus current year balance 2. For trade noncash current liabilities = current year balance minus prior year balance STATEMENT OF CASH FLOWS Problem 1 COUZ FLAWS Co. reported the following income statement for the current year: Sales Cost of goods sold: Inventory, Jan 1 Purchases Goods available for sale Inventory, Dec 31 Gross income Expenses: Salaries Rent Insurance Doubtful accounts Other expenses Depreciation Net income 4,500,000 750,000 2,850,000 3,600,000 ( 600,000) 3,000,000 1,500,000 600,000 250,000 20,000 30,000 100,000 50,000 1,050,000 450,000 Additional information: Accounts receivable Allowance for doubtful accounts Inventory Prepaid insurance Accounts payable Salaries payable Equipment Accumulated depreciation Dec 31 540,000 40,000 600,000 15,000 280,000 50,000 1,200,000 290,000 Jan 1 440,000 20,000 750,000 10,000 160,000 80,000 1,200,000 240,000 During the year, the entity recognized doubtful accounts expense of P30,000 and wrote off uncollectible accounts of P10,000. REQUIRED: Determine the cash flow from operating activities using the direct method and indirect method. STATEMENT OF CASH FLOWS Problem 1 (Answers) Direct method – operating activities Accounts receivable – Jan 1 Sales Accounts written off Accounts receivable – Dec 31 Cash received from customers 440,000 4,500,000 ( 10,000) ( 540,000) 4,390,000 Accounts payable – Jan 1 Purchases Accounts payable – Dec 31 Cash payments to creditors 160,000 2,850,000 ( 280,000) 2,730,000 Accrued salaries – Jan 1 Salaries expense Accrued salaries – Dec 31 Salaries paid 80,000 600,000 ( 50,000) 630,000 Prepaid insurance – Dec 31 Insurance expense Prepaid insurance – Jan 1 Insurance paid 15,000 20,000 ( 10,000) 25,000 Rent 250,000 Other expenses 100,000 Cash received from customers Cash payments to creditors Salaries paid Insurance paid Rent Other expenses Net cash provided by operating activities 4,390,000 (2,730,000) ( 630,000) ( 25,000) ( 250,000) ( 100,000) 655,000 Indirect method – operating activities Net income Depreciation Increase in net accounts receivable Decrease inventory Increase in prepaid insurance Increase in accounts payable Decrease in accrued salaries Net cash provided by operating activities 450,000 50,000 ( 80,000) 150,000 ( 5,000) 120,000 ( 30,000) 655,000 NOTE: Depreciation is added back since it is a noncash expense. Changes in trade assets are inversely related to cash flows while changes in trade liabilities are directly related to cash flows. STATEMENT OF CASH FLOWS Problem 2 COUZ FLAWS Co. provided the following comparative statement of financial position: 2020 Assets Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Property, plant & equipment, net Accumulated depreciation Total Liabilities and equity Accounts payable Accrued expenses Share capital Retained earnings Total 2019 750,000 1,750,000 2,550,000 100,000 5,300,000 (1,150,000) 9,300,000 950,000 1,100,000 1,800,000 150,000 4,300,000 ( 800,000) 7,500,000 1,250,000 50,000 4,750,000 3,250,000 9,300,000 1,000,000 200,000 4,250,000 2,050,000 7,500,000 Additional information: 1. The statement of retained earnings for 2020 showed net income of P1,500,000 and cash dividend paid of P300,000. 2. During the current year, the entity purchased equipment for cash and issued share capital for cash REQUIRED: Prepare a statement of cash flows for the current year using the indirect method. STATEMENT OF CASH FLOWS Problem 2 (Answer) COUZ FLAWS Co. Statement of Cash Flows For the year ended December 31, 2020 Cash flows from operating activities: Net income Depreciation Increase in accounts receivable Increase in inventory Decrease in prepaid expense Increase in accounts payable Decrease in accrued expenses Net cash provided by operating activities 1,500,000 350,000 ( 650,000) ( 750,000) 50,000 250,000 ( 150,000) 600,000 Cash flows from investing activities: Purchase of equipment (1,000,000) Cash flows from financing activities: Issuance of share capital Payment of cash dividend Net cash provided by financing activities Decrease in cash and cash equivalents Cash and cash equivalents – Jan 1 Cash and cash equivalents – Dec 31 500,000 ( 300,000) 200,000 ( 200,000) 950,000 750,000 NOTE: Depreciation is added back since it is a noncash expense. Changes in trade assets are inversely related to cash flows while changes in trade liabilities are directly related to cash flows. STATEMENT OF CASH FLOWS Problem 3 COUZ FLAWS Co. provided the following comparative statement of financial position and income statement as at and for the year ended 12/31/20: 2020 Assets Cash and cash equivalents Accounts receivable Inventory Prepaid insurance Property, plant & equipment, net Accumulated depreciation Total Liabilities and Equity Accounts payable Salaries payable Income tax payable Accrued interest payable Bonds payable Share capital Retained earnings Treasury shares Total 2019 120,000 370,000 1,090,000 80,000 4,300,000 ( 840,000) 5,120,000 150,000 210,000 860,000 90,000 3,620,000 ( 720,000) 4,210,000 400,000 70,000 35,000 5,000 600,000 3,050,000 1,100,000 ( 140,000) 5,120,000 345,000 40,000 15,000 3,050,000 760,000 ___ 4,210,000 Sales Cost of sales: Inventory – Jan 1 Purchases Goods available for sale Inventory – Dec 31 Gross income Gain on sale of equipment Total income Expenses: Salaries Insurance Rent Depreciation Bad debt written off Interest expense Income before income tax Income Tax Net income 4,450,000 860,000 2,630,000 3,490,000 (1,090,000) 640,000 100,000 350,000 260,000 20,000 40,000 2,400,000 2,050,000 60,000 2,110,000 1,410,000 700,000 ( 200,000) 500,000 Additional information: 1. Cash dividends of P160,000 were declared and paid during the year. 2. Equipment costing P190,000 and with accumulated depreciation of P140,000 was sold for P110,000 cash. STATEMENT OF CASH FLOWS: Problem 3 (cont.) 3. New equipment was purchased for cash. 4. Bonds payable were issued for cash at the face amount of P600,000. 5. The treasury shares were purchased at cost of P140,000. REQUIRED: 1. Cash flows from operating activities 2. Cash flows from investing activities 3. Cash flows from financing activities ANSWERS (Requirement No. 1) Income before tax Depreciation Interest expense Gain on sale Increase in accounts receivable Increase in inventory Decrease in prepaid expenses Increase in accounts payable Increase in salaries payable Interest paid Income taxes paid Net cash provided by operating activities ANSWERS (Requirement No. 2) Purchase of equipment * Proceeds from sale of equipment Net cash used in investing activities 700,000 260,000 40,000 ( 60,000) (160,000) (230,000) 10,000 55,000 30,000 ( 35,000) (180,000) 430,000 (870,000) 110,000 (760,000 *Increase in PPE (P4,300,000 – P3,620,000) Cost of equipment sold Cost of equipment purchased for cash 680,000 190,000 870,000 ANSWERS (Requirement No. 3) Proceeds from issuance of bonds Purchase of treasury shares Payment of cash dividends Net cash provided by financing activities 600,000 (140,000) (160,000) (760,000) Direct method: Operating cash flows Cash received from customers Cash payments to suppliers Salaries paid Insurance paid Rent paid Interest paid Income taxes paid Net cash provided by operating activities 4,270,000 (2,575,000) ( 610,000) ( 90,000) ( 350,000) ( 35,000) ( 180,000) 430,000 NOTE (indirect method): Depreciation is added to net income since it is a noncash expense. Interest expense is an operating cash flow, unless otherwise elected by the entity to present the same under financing cash flows. Gain is added back to net income to properly adjust the latter. STATEMENT OF CASH FLOWS Problem 4 COUZ FLAWS Co. showed the following comparative statement of Financial position: Cash and cash equivalents Accounts receivable, net of allowance Inventory Investment in Hall Company shares Land Property, plant and equipment Accumulated depreciation Goodwill Total 2020 2,350,000 600,000 1,000,000 2,200,000 2,000,000 5,000,000 (1,050,000) 400,000 12,500,000 2019 350,000 700,000 850,000 2,000,000 1,500,000 4,000,000 (800,000) 400,000 9,000,000 Accounts payable Notes payable - long term Bonds payable Share capital, P100 par Share premium Retained earnings Treasury shares Total 600,000 500,000 1,600,000 5,250,000 2,700,000 1,850,000 12,500,000 550,000 2,100,000 4,000,000 1,750,000 1,300,000 (700,000) 9,000,000 Additional information: 1. The net income for the current year was P3,050,000. 2. Cash dividend paid amounted to P2,500,000. 3. The entity sold equipment costing P200,000 with carrying amount of P50,000. for P70,000 cash. 4. The entity issued 10,000 shares of capital for cash at P150 per share. 5. The entity sold all of its treasury shares for P900,000 cash. 6. Individuals holding bonds with face amount of P500,000 exercised their conversion privilege. Each of the 500 bonds was converted into 5 shares of capital. 7. The entity purchased equipment for P1,200,000. 8. Land with a fair value of P500,000 was purchased through the issuance of long term note. REQUIRED: Statement of Cash Flows for the current year. STATEMENT OF CASH FLOWS Problem 4 (Answer) COUZ FLAWS Co. Statement of Cash Flows For the year ended December 31, 2020 Cash flows from operating activities: Net income Depreciation Investment income Gain on sale Decrease in accounts receivable Increase in inventory Increase in accounts payable Net cash provided by operating activities Supporting computations and explanations: 3,050,000 400,000 (200,000) (20,000) 100,000 (150,000) 50,000 3,230,000 Cash flows from investing activities: Purchase of equipment Proceeds from sale of equipment Net cash used in investing activities (1,200,000) 70,000 (1,130,000) Cash flows from financing activities: Proceeds from issuance of shares Proceeds from sale of treasury shares Payment of dividends Net cash used in financing activities 1,500,000 900,000 (2,500,000) (100,000) Increase in cash and cash equivalents Cash and cash equivalents – Jan 1 Cash and cash equivalents – Dec 31 2,000,000 350,000 2,350,000 Increase in PPE (P5,000,000 – P4,000,000) Cost of equipment sold Cost of equipment purchased for cash 1,000,000 200,000 1,200,000 The increase in the investment account is presumed to have resulted from the fluctuation in the fair value of investment (investment income). Since it does not have actual cash effect, the investment income is deducted from net income to reflect the cash basis income during the period. Depreciation is a noncash expense, hence, added back to net income. Gain on sale is adjusted back to net income to properly reflect operating cash flows. The proceeds from sale (carrying amount of the asset sold plus the gain) is presented as a cash inflow under the investing activities. Changes in trade assets are inversely related to cash flows while changes in trade liabilities are directly related to cash flows. STATEMENT OF CASH FLOWS Problem 5 COUZ FLAWS Co. provided the following data for the current year: Cash balance, beginning of the year Cash flows from financing activities Total shareholders’ equity, end of the year 1,300,000 1,000,000 2,300,000 What amount of cash was reported at the end of the current year? ANSWER: Cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net decrease in cash during the year Cash balance, beginning of the year Cash balance, end of the year 400,000.00 (1,500,000.00) 1,000,000.00 (100,000.00) 1,300,000.00 1,200,000 Cash flows from operating activities Cash flows from investing activities Total shareholders’ equity, beginning of the year 400,000 (1,500,000) 2,000,000 STATEMENT OF CASH FLOWS Problem 6 COUZ FLAWS Co. provided the following data for the preparation of the statement of cash flows for the current year: Dividends declared and paid Cash flows from investing activities Cash flows from financing activities 800,000 (2,500,000) ( 800,000) Cash Other assets Liabilities Share capital Retained earnings Dec 31 2,100,000 21,000,000 10,500,000 2,000,000 10,600,000 Jan 1 1,200,000 22,700,000 11,700,000 2,000,000 10,200,000 What amount should be reported as cash flows from operating activities? ANSWER: Cash balance, end of the year Cash balance, beginning of the year Net increase in cash during the year Net cash used in investing activities Net cash used financing activities Net cash provided by operating activities 2,100,000 1,200,000 900,000 2,500,000 800,000 4,200,000 IMPORTANT NOTES: The net increase in cash during the period pertains to the net effect of the operating, investing and financing cash flows for the year. Accordingly, the known net cash provided from an activity is deducted from the net change in cash and the known net cash used in an activity is added to the net change in cash to determine the net cash flow from the other activity. STATEMENT OF CASH FLOWS Problem 7 COUZ FLAWS Co. provided the following data for the current year: Cash Retained earnings Cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Dividends declared and paid Net income Dec 31 1,500,000 7,000,000 ? (4,800,000) 1,800,000 2,000,000 3,600,000 Jan 1 1,000,000 5,400,000 What amount should be reported as cash flows from operating activities? ANSWER: Cash balance, end of the year Cash balance, beginning of the year Net increase in cash during the year Net cash used in investing activities Net cash provided by financing activities Net cash provided by operating activities 1,500,000 1,000,000 500,000 4,800,000 (1,800,000) 3,500,000 IMPORTANT NOTES: The net increase in cash during the period pertains to the net effect of the operating, investing and financing cash flows for the year. Accordingly, the known net cash provided from an activity is deducted from the net change in cash and the known net cash used in an activity is added to the net change in cash to determine the net cash flow from the other activity. STATEMENT OF CASH FLOWS Problem 8 COUZ FLAWS Co. reported net income of P5,000,000 for the current year. Depreciation expense was P1,900,000. The following working capital accounts changed during the year: Accounts receivable Nontrading equity investment Inventory Nontrade note payable Accounts payable 1,100,000 increase 1,600,000 increase 730,000 increase 1,500,000 increase 1,220,000 increase What amount should be reported as cash flows from operating activities (use indirect method)? ANSWER: Net income for the year Depreciation Increase in accounts receivable Increase in inventory Increase in accounts payable Cash flows provided by operating activities 5,000,000 1,900,000 (1,100,000) (730,000) 1,220,000 6,290,000 NOTE: Depreciation is added back since it is a noncash expense. Changes in trade assets are inversely related to cash flows while changes in trade liabilities are directly related to cash flows. STATEMENT OF CASH FLOWS Problem 9 COUZ FLAWS Co. reported net income of P750,000 for the current year. The entity provided the following account balances for the preparation of statement of cash flows for the current year: Jan 1 Dec 31 Accounts receivable 115,000 145,000 Allowance for doubtful accounts 4,000 5,000 Prepaid rent expense 62,000 41,000 Accounts payable 97,000 112,000 What amount should be reported as cash flows from operating activities during the current year? ANSWER: Net income for the year Increase in accounts receivable, net Decrease in prepaid rent Increase in accounts payable Cash flows provided by operating activities 750,000 (29,000) 21,000 15,000 757,000 IMPORTANT NOTES: The allowance for doubtful accounts is deducted from the gross accounts receivable in determining the increase (decrease) in the latter. Changes in trade assets are inversely related to cash flows while changes in trade liabilities are directly related to cash flows. STATEMENT OF CASH FLOWS Problem 10 COUZ FLAWS Co. reported net income of P 1,500,000 for the current year. The entity provided the following changes in several accounts during the current year: Investment in NO-FERA Co. shares carried on the equity basis Accumulated depreciation, caused by major repair to project equipment Premium on bonds payable Deferred tax liability 55,000 increase 21,000 decrease 14,000 decrease 18,000 increase What amount should be reported as cash flows from operating activities during the current year? ANSWER: Net income for the year Investment income Amortization of premium on bonds payable Increase in deferred tax liability Cash flows provided by operating activities 1,500,000 (55,000) (14,000) 18,000 1,449,000 IMPORTANT NOTES: Investment income is deducted from net income since it does not result in any cash flow to the entity. Amortization is a noncash expense. Accordingly, it is added back to net income to properly reflect the cash flows from operations. Increase in deferred tax liability decreases the income tax payments during the period. Hence, the increase is added back to net income. STATEMENT OF CASH FLOWS Problem 11 COUZ FLAWS Co. provided the following information: Accounts receivable, Jan 1, net of allowance of P100,000 Accounts receivable, Dec 31, net of allowance of P300,000 Sales for the current year – all on credit Uncollectible accounts written off during the year Recovery of accounts return off during the year Bad debt expense for the year Cash expenses for the year Net income for the year 1,200,000 1,600,000 8,000,000 70,000 20,000 250,000 5,250,000 2,500,000 What amount should be reported as cash flows from operating activities during the current year? ANSWER: Beginning balance Sales on account Recovery Accounts Receivable 1,300,000 Ending balance 8,000,000 Accounts written off 20,000 Collections 9,320,000 Collections from customers Cash expenses for the year Net cash provided by operating activities 1,900,000 70,000 7,350,000 9,320,000 7,350,000 (5,250,000) 2,100,000 Alternative computations (indirect method): Net income Increase in accounts receivable (P1,600,000 - P1,200,000) Net cash provided by operating activities 2,500,000 (400,000) 2,100,000 STATEMENT OF CASH FLOWS Problem 12 COUZ FLAWS Co. provided the following information at year end: 2020 2019 Accounts receivable 620,000 680,000 Inventory 1,960,000 1,840,000 Accounts payable 380,000 520,000 Accrued expenses 500,000 340,000 The income statement for the current year showed: Net income 2,120,000 Depreciation 240,000 Amortization of patent 80,000 Gain on sale of land 200,000 What amount should be reported as cash flows from operating activities during the current year? ANSWER: Net income for the year Depreciation Amortization of patent Gain on sale of land Decrease in accounts receivable Increase in inventory Decrease in accounts payable Increase in accued expenses Net cash provided by operating activities 2,120,000 240,000 80,000 (200,000) 60,000 (120,000) (140,000) 160,000 2,200,000 IMPORTANT NOTES: Depreciation and amortization are noncash expense items, hence, added back to net income. Gain on sale is deducted from net income. The cash effect of the sale must be reflected under investing activities. Changes in trade assets are inversely related to cash flows while changes in trade liabilities are directly related to cash flows. STATEMENT OF CASH FLOWS Problem 13 COUZ FLAWS Co. provided the following account balances: Dec 31 Accounts receivable 800,000 Inventory 300,000 Accounts payable 500,000 Jan 1 750,000 450,000 700,000 The income statement for the current year showed: Revenues 9,800,000 Cost of sales (4,000,000) Other expense (1,300,000) Depreciation expense (1,000,000) Loss on sale of equipment ( 100,000) Net income 3,400,000 What amount should be reported as cash flows from operating activities during the current year? ANSWER: IMPORTANT NOTES: Net income for the year 3,400,000 Depreciation is a noncash expense, hence, added back to net Depreciation 1,000,000 income. Loss on sale of equipment 100,000 Loss on sale is added back to net income. The cash effect of the sale Increase in accounts receivable (50,000) must be reflected under investing activities. Decrease in inventory 150,000 Decrease in accounts payable (200,000) Changes in trade assets are inversely related to cash flows while Net cash provided by operating activities 4,400,000 changes in trade liabilities are directly related to cash flows. STATEMENT OF CASH FLOWS Problem 14 COUZ FLAWS Co. provided the following information for the current year: Purchase of inventory Purchase of land, with the vendor financing P1,000,000 for 2 years Purchase of plant for cash Sale of plant: Carrying amount Cash proceeds Buyback of ordinary shares 1,950,000 3,500,000 2,500,000 500,000 400,000 700,000 What amount of investing net cash flows should be reported in the statement of cash flows for the current year? ANSWER: Sale of plant assets Purchase of land (cash portion only) Purchase of plant assets Net cash used in investing activities 400,000 (2,500,000) (2,500,000) (4,600,000) NOTE: The purchase of inventory is an operating cash outflow while the buyback of ordinary shares is a financing cash outflow. STATEMENT OF CASH FLOWS Problem 15 COUZ FLAWS Co. provided the following information at the end of each year: 2020 2019 Borrowings 2,500,000 800,000 Share capital 3,500,000 2,000,000 Retained earnings 950,000 750,000 Borrowings of P300,000 were repaid during 2020 and new borrowings include P200,000 vendor financing arising on the acquisition of a property. The movement in retained earnings comprised profit for 2020 of P900,000 net of dividends of P700,000. The movement in share capital arose from issuance of shares for cash during the year. What amount should be reported as financing net cash flows for the current year? ANSWER: Proceeds from issuance of shares Proceeds from new borrowings Payment of borrowings Payment of dividends Net cash provided by financing activities 1,500,000 1,800,000 (300,000) (700,000) 2,300,000 Borrowings, 12/31/20 Add: Payments made in 2020 Total Increase resulting from noncash transactions Borrowings, 12/31/2019 Proceeds from new borrowings 2,500,000 300,000 2,800,000 (200,000) (800,000) 1,800,000 NOTE: The increase in borrowings resulting from the vendor financing on the acquisition of property is a noncash transaction, hence, not considered in the determination of cash flows. STATEMENT OF CASH FLOWS Problem 16 COUZ FLAWS Co. provided the following data for the current year: (a) Purchased a building for P1,200,000. Paid P400,000 and signed a mortgage with the seller for the remaining P800,000. (b) Executed a debt – equity swap and replaced a P600,000 loan by the giving the lender ordinary shares worth P600,000 on the date the swap was executed. (c) Purchased land for P1,000,000. Paid P350,000 and issued ordinary shares worth P650,000. (d) Borrowed P550,000 under a long – term loan agreement. Used the cash from the loan proceeds to purchase additional inventory of P150,000, to pay cash dividends of P300,000 and to increase the cash balance of P100,000. Questions: 1. What amount should be reported as net cash used in investing activities? 2. What amount should be reported as net cash provided by financing activities? ANSWERS: Purchase of building (cash paid only) Purchase of land (cash paid only) Net cash used in investing activities (400,000) (350,000) (750,000) Proceeds from long-term loan Payment of dividends Net cash provided by financing activities NOTE: The increase in building and land supported by a mortgage and issuance of shares, respectively, are noncash transactions. The debt-equity swap transaction is also a non-cash transaction. The purchase of inventory is an operating cash flow. 550,000 (300,000) 250,000 STATEMENT OF CASH FLOWS Problem 17 COUZ FLAWS Co. reported net income of P3,000,000 for the current year. The following changes occurred in several accounts: Equipment Accumulated depreciation Notes 250,000 increase 400,000 increase 300,000 increase (a) During the year, the entity sold equipment costing P250,000 with accumulated depreciation of P120,000 at a gain of P50,000. (b) In December, the entity purchased equipment costing P500,000 with P200,000 cash and a 12% note payable of P300,000. Questions: 1. What is the depreciation expense for the year? 2. What amount should be reported as net cash used in investing activities? 3. What amount should be reported as net cash provided by operating ting activities? ANSWERS: Net increase in accumulated depreciation Accumulated depreciation on asset sold Depreciation expense for the year 400,000 120,000 520,000 Proceeds from sale of equipment* Purchase of equipment Net cash used in investing activities 180,000 (200,000) (20,000) Net income for the year Depreciation expense Gain on sale of equipment Net cash provided by operating activities *Proceeds from sale of equipment: (CA of P130,000 plus gain of P50,000) NOTE: The increase in notes payable is a noncash transaction. The proceeds from sale of equipment is equal to the carrying amount at the time of sale plus the gain on sale. 3,000,000 520,000 (50,000) 3,470,000 180,000 STATEMENT OF CASH FLOWS Problem 17 COUZ FLAWS Co. provided the following data for the current year: Gain on sale of equipment Proceeds from sale of equipment Purchase of ABC bonds, face amount P2,000,000 Amortization of bond discount Dividends declared Dividends paid Proceeds from sale of treasury shares with carrying amount of P650,000 100,000 200,000 1,800,000 150,000 4,500,000 4,000,000 750,000 Questions: 1. What is the net cash used in financing activities? 2. What is the net cash used in investing activities? ANSWERS: Proceeds from sale of treasury shares Payment of dividends Net cash used in financing activities 750,000 (4,000,000) (3,250,000) Proceeds from sale of equipment Purchase of Ace bonds Net cash used in investing activities NOTE: The gain on sale of equipment ( - ) and amortization of bond discount ( + ) are adjustments related to operating cash flows. The dividends paid is used to reflect the actual cash effect of dividends on the cash flows during the year. 200,000 (1,800,000) (1,600,000) STATEMENT OF CASH FLOWS Problem 18 COUZ FLAWS Co. reported net income of P3,400,000 for the current year. The net income included depreciation of P840,000 and a gain on sale of equipment of P170,000. The equipment had an original cost of P4,000,000 and accumulated depreciation of P2,400,000. All of the following accounts increased during the current year: Patent Prepaid rent Financial asset, at fair value through other comprehensive income (OCI) Bonds payable 450,000 680,000 100,000 500,000 What amount should be reported as net cash flows from investing activities? ANSWERS: Proceeds from sale of equipment* Purchase of patent Purchase of financial asset at FVOCI Net cash provided by investing activities 1,770,000 (450,000) (100,000) 1,220,000 *Proceeds from sale computations: Carrying amount of equipment Gain on sale Proceeds from sale of equipment NOTE: The gain on sale of equipment ( - ) and depreciation ( + ) are adjustments related to operating cash flows. The increase in prepaid rent, it being a trade asset, is part of operating cash flows. The increase in bonds payable is a financing cash flow. 1,600,000 170,000 1,770,000 STATEMENT OF CASH FLOWS Problem 19 COUZ FLAWS Co. provided the following data for the current year: Purchase of real estate for cash Cash was borrowed from bank to purchase real estate Sale of investment securities for cash Dividends paid Issuance of ordinary shares for cash Purchase of patent for cash Payment of bank loan Increase in customers’ deposits Issuance of bonds payable for cash 5,500,000 5,500,000 5,000,000 6,000,000 2,500,000 1,250,000 1,500,000 200,000 3,000,000 Questions: 1. What is the net cash provided by financing activities? 2. What is the net cash used in investing activities? ANSWERS: Proceeds from bank loan Proceeds from issuance of shares Proceeds from issuance of bonds payable Payment of dividends Payment of bank loan Net cash provided by financing activities 5,500,000 2,500,000 3,000,000 (6,000,000) (1,500,000) 3,500,000 Proceeds from sale of investment securities Purchase of real estate Purchase of patent Net cash used in investing activities 5,000,000 (5,500,000) (1,250,000) (1,750,000) STATEMENT OF CASH FLOWS Problem 20 COUZ FLAWS Co. used the direct method to prepare the statement of cash flows. The entity had the following cash flows during the current year: Cash receipts from issuance of ordinary shares Cash receipts from customers Cash receipts from dividends on long-term investments Cash receipts from repayment of loans made to another entity Cash payments for wages and other operating expenses Cash payment for insurance Cash payment for dividends Cash payment for taxes Cash payment to purchase land Cash balance – beginning 4,000,000 2,000,000 300,000 2,200,000 1,200,000 100,000 200,000 400,000 800,000 3,500,000 ANSWERS: Cash receipts from customers Cash receipts from dividends on long-term investments Cash payments for wages and other operating expenses Cash payment for insurance Cash payment for taxes Net cash provided by operating activities 2,000,000 300,000 (1,200,000) (100,000) (400,000) 600,000 Cash receipts from repayment of loans made to another entity Cash payment to purchase land Net cash provided by investing activities 2,200,000 (800,000) 1,400,000 Questions: 1. What is the net cash provided by operating activities? 2. What is the net cash provided by investing activities? 3. What is the net cash provided by financing activities? 4. What is the cash balance at year-end Cash receipts from issuance of ordinary shares Cash payment for dividends Net cash provided by financing activities 4,000,000 (200,000) 3,800,000 Cash balance as at the start of the year Net increase in cash during the period Cash balance as at end of the year 3,500,000 5,800,000 9,300,000 Note: Receipt of dividends are operating cash flows, unless otherwise elected by the entity to present the same under investing cash flows. STATEMENT OF CASH FLOWS Problem 21 COUZ FLAWS Co. used the direct method to prepare the statement of cash flows. The entity had the following cash flows during the current year: Dividend received 500,000 Dividends paid 1,000,000 Questions: Cash received from customers 9,000,000 1. What is the net cash provided by operating Proceeds from issuance of shares 1,500,000 activities? Interest received 200,000 2. What is the net cash provided by investing Proceeds from sale of long-term investments 2,000,000 activities? Cash paid to suppliers and employees 6,000,000 3. What is the net cash provided by financing Interest paid on long-term debt 400,000 activities? Income taxes paid 300,000 4. What is the cash balance at year-end Cash balance – beginning 1,800,000 ANSWERS: Cash received from customers Dividends received Interest received Cash paid to suppliers and employees Interest paid on long-term debit Income taxes paid Net cash provided by operating activities Proceeds from sale of long-term investments (investing activity) 9,000,000 500,000 200,000 (6,000,000) (400,000) (300,000) 3,000,000 2,000,000 Proceeds from issuance of shares Dividends paid Net cash provided by financing activities 1,500,000 (1,000,000) 500,000 Cash balance as at the start of the year Net increase in cash during the period Cash balance as at end of the year 1,800,000 5,500,000 7,300,000 Note: Dividends and interest received and interest payments are operating cash flows, unless otherwise elected by the entity to present the same under investing cash flows and financing cash flows, respectively.