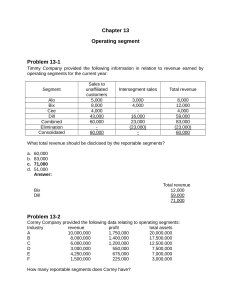

1. All of the following are considered line items in the statement of financial position of an SME, except, a. Biological Assets carried at fair value b. Investments in joint venture c. Investment properties carried at cost d. Total of assets classified as held for sale 2. An operating segment is considered reportable when any of the following conditions is met, except a. Segment revenue is 10% or more of the combined revenue of all of the entity’s segments. b. Segment assets are 10% or more of the combined assets of all segments. c. Segment liabilities are 10% or more of the combined liabilities of all segments. d. Segment’s profit or loss is 10% or more of the combined profit of all segments that did not incur a loss. 3. Everest Company operates in the travel industry and incurs costs unevenly throughout the year. Advertising costs of 2,000,000 were incurred on March 1, 2021 and staff bonuses are paid at year-end based on sales. Staff year-end bonuses are expected to be around 15,000,000 for the year. What total amount of expenses should be included in the quarterly financial report during March 31, 2021? a. 7,000,000 b. 5,500,000 c. 5,750,000 d. 0 4. During 2020, PLBT Company reported the following events: om the financial statements for the year ended December 31, 2019. it was obsolete. What pretax amount should be reported as prior period error in the financial statements for 2020? a. 900,000 b. 2,000,000 c. 2,900,000 d. 1,100,000