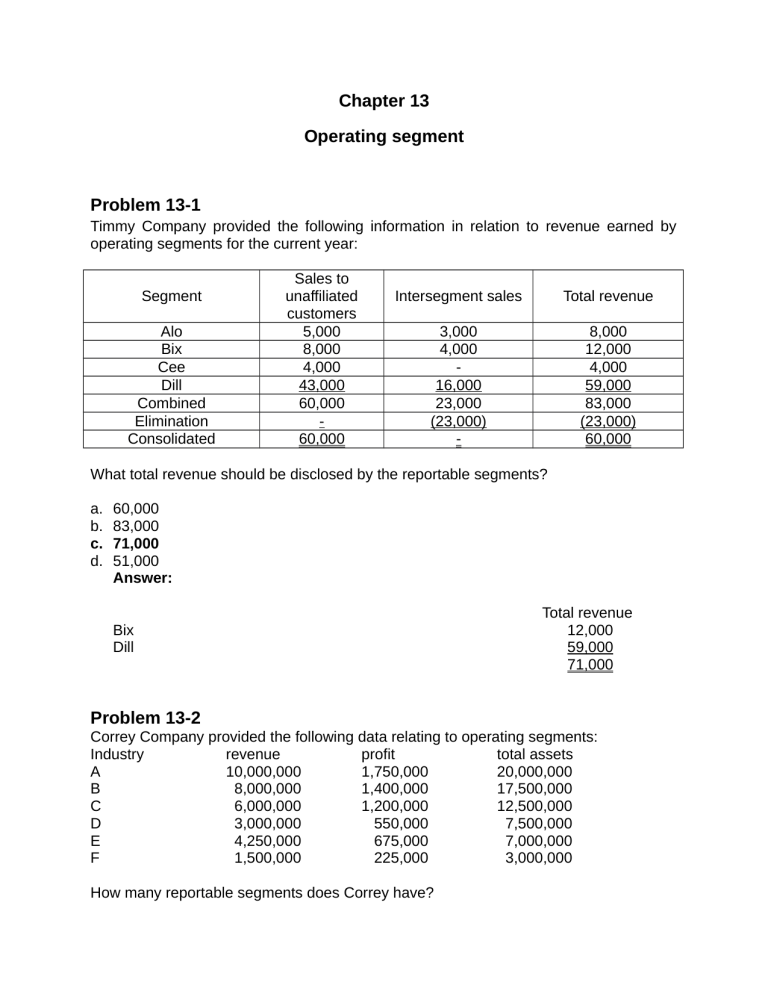

Chapter 13 Operating segment Problem 13-1 Timmy Company provided the following information in relation to revenue earned by operating segments for the current year: Segment Alo Bix Cee Dill Combined Elimination Consolidated Sales to unaffiliated customers 5,000 8,000 4,000 43,000 60,000 60,000 Intersegment sales Total revenue 3,000 4,000 16,000 23,000 (23,000) - 8,000 12,000 4,000 59,000 83,000 (23,000) 60,000 What total revenue should be disclosed by the reportable segments? a. b. c. d. 60,000 83,000 71,000 51,000 Answer: Bix Dill Total revenue 12,000 59,000 71,000 Problem 13-2 Correy Company provided the following data relating to operating segments: Industry revenue profit total assets A 10,000,000 1,750,000 20,000,000 B 8,000,000 1,400,000 17,500,000 C 6,000,000 1,200,000 12,500,000 D 3,000,000 550,000 7,500,000 E 4,250,000 675,000 7,000,000 F 1,500,000 225,000 3,000,000 How many reportable segments does Correy have? a. b. c. d. Three Four Five Six Answer: Revenue 30.53% 24.43% 18.32% 9.16% 12.98% 4.58% 100.00% A B C D E F Profit 30.17% 24.14% 20.69% 9.48% 11.64% 3.88% 100.00% Assets 29.63% 25.93% 18.52% 11.11% 10.37% 4.44% 100.00% A, B, C, D and E reportable because their revenue or operating profit or asset is at least 10% of the combined amount. Problem 13-3 Aurora Company provided the following profit (loss) relating to operating segments: V W X Y Z 3,400,000 1,000,000 (2,000,000) 400,000 ( 200,000) What are the reportable segments based on profit or loss? a. b. c. d. V, W, X and Y V, W and X V and W V, W, X, Y and Z Answer: V W X Y Z 3,400,000 1,000,000 2,000,000 400,000 4,800,000 200,000 2,200,000 The total profit figure is the basis for identifying the reportable segments because it is higher than the total loss figure. Accordingly, those segments with profit or loss of at least 10% of P4,800,000 or P480,000 are reportable. Thus V, W and X are reportable Problem 13-4 Macbeth Company, an entity listed on a recognized stock exchange, reports operating results from a North American division to the chief operating decision maker. The segment information for the current year is as follows: Revenue Profit Assets Number of employees 3,800,000 1,200,000 1,600,000 2,500 The entity’s result for all of the segments in total are: Revenue Profit Assets Number of employees 40,000,000 10,000,000 20,000,000 25,000 Which piece of information determines that the North American division is a reportable segment? a. b. c. d. Revenue Profit Assets Number of employees Answer: 1,200,000/10,000,000 12% Problem 13-5 Aris Company provided the following information in relation to operating for the current year: Sales to unaffiliated customers Intersegment sales of products similar to those sold to unaffiliated customers Interest earned on loans to other industry segments 20,000,000 5,000,000 1,000,000 The entity and all of its division are engaged solely in manufacturing operations. Under the revenue test, what is the minimum revenue of a reportable segment? a. b. c. d. 2,500,000 2,600,000 2,100,000 2,000,000 Answer: Sales to unaffiliated customers Intersegment sales Interest earned on loans Total segment revenue Revenue criterion (10% x 26,000,000) 20,000,000 5,000,000 1,000,000 26,000,000 2,600,000 Problem 13-6 Grum Company is subject to the requirements of segments reporting. In the income statement for the current year, the intersegment sales of P10,000,000, expenses of P47,000,000 and net income of P3,000,000. Expenses included payroll costs of P15,000,000. The combined total assets of all operating segments at year-end amounted to P45,000,000. 1. What is the minimum amount of sales to a major customer? a. b. c. d. 5,000,000 4,000,000 6,000,000 4,500,000 Answer: 10% x 45,000,000 4,500,000 2. What is the minimum amount of external revenue to be disclosed by reportable segments? a. 22,500,000 b. 30,000,000 c. 33,750,000 d. 37,500,000 Answer: 75% x 45,000,000 33,750,000 Problem 13-7 Graf Company discloses supplemental operating segment information. The following information is available for the current year: Segment X Y Z Sales 5,000,000 4,000,000 3,000,000 Traceable expenses 3,000,000 2,500,000 1,500,000 Additional expenses Indirect segment expenses General corporate expenses Interest expense Income tax expense 1,800,000 1,200,000 600,000 400,000 The interest expense and income tax expense are regularly reviewed by the chief operating decision maker as a measure of profit or loss. Appropriate common expenses are allocated to segments based on the ratio of a segment’s sales to total sales. What is Segment Z’s operating profit? a. b. c. d. 900,000 950,000 800,000 500,000 Answer: Sales 3,000,000 Traceable expenses (1,500,000) Indirect expenses (25% x 1,800,000) ( 450,000) General Corporate expenses (25% x 1,200,000) ( 300,000) Interest expense (25% x 600,000) ( 150,000) Income tax expense (25% x 400,000) ( 100,000) 500,000 Problem 13-8 Clay Company has three lines of business, each of which was determined to be reportable segment. Sales aggregated P7,500,000 in the current year, of which Segment One contributed 40%. Traceable costs were P1,750,000 for Segment One out of a total of P5,000,000 for the entity as a whole. The entity allocates common costs of P1,500,000 based on the ratio of a segment’s income before common costs to the total income before common costs. What amount should be reported as operating profit for Segment One? a. 1,250,000 b. 1,000,000 c. 650,000 d. 500,000 Answer: Segment 1 Sales 3,000,000 Traceable costs (1,750,000) Profit before common cost 1,250,000 Common cost (1,250,000/2,500,000 x1,500,000) ( 750,000) Segment profit 500,000 Total revenue 7,500,000 (5,000,000) 2,500,000 (1,500,000) 1,000,000 Problem 13-9 Hyde Company has three reportable segments. Common costs are appropriately allocated on the basis of sales. In the current year, Segment A had sales of P3,000,000, which was 25% of Hyde’s total sales, and had traceable costs of P1,900,000. In the current year, the entity incurred segment costs of P500,000 that were not directly traceable to any of the divisions. Segment A incurred interest expense of P300,000 in the current year. Interest expense is included in the measure of profit or loss. What amount should be reported as Segment A’s profit for the current year? a. b. c. d. 875,000 900,000 975,000 675,000 Answer: Sales – Segment A Expenses: Traceable cost Allocated indirect cost (25% x 500,000) Interest expense Segment profit 3,000,000 1,900,000 125,000 300,000 2,325,000 675,000 Problem 13-10 Eagle Company operates in several different industries. Total sales for the entity totaled P14,000,000, and total common costs amounted to P6,500,000 for the current year. For internal reporting purposes, the entity allocates common costs based on the ratio of a segment’s sales to total sales. Segment 1 2 3 4 5 Contribution to total sales 25% 12% 31% 23% 9% Costs specific to the segment 1,100,000 1,000,000 1,300,000 880,000 400,000 What is the operating profit of Segment 1? a. 3,500,000 b. 1,875,000 c. 2,400,000 d. 775,000 Answer: Sales – Segment 1 (25% x 14,000,000) Specific cost – Segment 1 Allocated common costs (25% x 6,500,000) Operating profit 3,500,000 (1,100,000) (1,625,000) 775,000 Problem 13-11 Colt Company has four manufacturing divisions, each of which has been determined to be a reportable segment. Common costs are appropriately allocated on the basis of each division’s sales in relation to Colt’s aggregate sales. Colt’s Delta division accounted for 40% of Colt’s total sales in the current year. For the current year, Delta division had sales of P8,000,000 and traceable costs of P4,800,000. In addition, the Delta division incurred interest expense of P640,000. In the current year, Colt incurred costs of P800,000 that were not directly traceable to any of the divisions. It is an entity policy that interest expense is included in the measure of profit or loss that is reviewed by the chief operating decision maker. What amount should be disclosed as Delta’s profit for the current year? a. b. c. d. 3,200,000 3,000,000 2,880,000 2,240,000 Answer: Sales – Delta’s Traceable costs Interest expense Incurred cost (40% x 800,000) Profit 8,000,000 (4,800,000) ( 640,000) ( 320,000) 2,240,000 Problem 13-12 Taylor Company assesses performance and makes operating decisions using the following information for the reportable segments: Total revenue Total profit or loss 9,000,000 1,500,000 The total profit and loss included intersegment profit of P300,000. In addition, the entity had P100,000 of common costs for the reportable segments that are not allocated in reports provided to the chief operating decision maker. For purposes of segment reporting, what amount should be reported as segment profit? a. b. c. d. 1,400,000 1,200,000 1,800,000 1,500,000 Answer: Total profit or loss Common cost Segment profit 1,500,000 ( 100,000) 1,400,000 Problem 13-13 Diversity Company had total assets of P65,000,000 at year-end and provided the following condensed income statement for the current year: Sales Expenses Income before income tax Income tax expense Net income 45,000,000 (33,000,000) 12,000,000 ( 3,800,000) 8,200,000 The entity has two reportable segments and has developed the following related information: Sales Segment expenses Segment assets Segment A Segment B Others 25,000,000 18,000,000 35,000,000 15,000,000 9,000,000 18,000,000 5,000,000 4,000,000 7,000,000 The total assets of P65,000,000 include general corporate assets of P5,000,000. The total segment expenses of P33,000,000 include general corporate expenses of P2,000,000. The chief operating decision maker does not allocate income tax as a measure of profit or loss. Required: 1. Prepare the necessary disclosures for Diversity Company in relation to operating segments. 2. Prepare the reconciliations between segment information and amount shown in the entity’s financial statements. Answer: Disclosure of profit or loss and assets Sales Profit or loss Total assets Segment A Segment B Others Total 25,000,000 7,000,000 35,000,000 15,000,000 6,000,000 18,000,000 5,000,000 1,000,000 7,000,000 45,000,000 14,000,000 60,000,000 Reconciliation Revenue Revenue of reportable segments Revenue of nonreportable segments Entity revenue shown in income statement 40,000,000 5,000,000 45,000,000 Profit and loss Profit or loss of reportable segments Profit or loss of nonreportable segments Corporate expenses Unallocated income tax expense Entity net income shown in income statement 13,000,000 1,000,000 ( 2,000,000) ( 3,800,000) 8,200,000 Total assets Total assets of reportable segments Total assets of nonreportable segments General corporate assets Entity total assets shown in statement of financial position 53,000,000 7,000,000 5,000,000 65,000,000 Problem 13-14 Congo Company does business in several different industries. The condensed income statement for the entire entity for the current year is as follows: Sales Costs of goods sold Gross income Expenses Depreciation Income tax expense Net income 60,000,000 (28,000,000) 32,000,000 (14,000,000) ( 4,000,000) ( 4,000,000) 10,000,000 The entity has two major reportable segments, X and Y. an analysis reveals that P1,000,000 of the total depreciation expense and P2,000,000 of the expenses are related to general corporate activities. The chief operating decision maker allocates income tax expense to reportable segments as a measure of profit or loss. The expenses and sales are directly allocable to segment activities according to the following percentages: Segment X Sales Costs of goods sold Expenses Depreciation Income tax expense 40% 35 40 40 50 Segment Y 45% 50 40 45 40 Others 15% 15 20 15 10 Required: 1. Prepare a schedule that reports the segment profit or loss. 2. Prepare the disclosures required for operating segments. 3. Prepare the reconciliations between segment information and amounts shown in the entity’s financial statements. Answer: Segment X Sales 24,000 Cost of goods sold ( 9,800) Gross income 14,200 Segment expenses ( 4,800) Depreciation ( 1,200) Income tax expense ( 2,000) Segment profit or loss 6,200 Segment Y 27,000 (14,000) 13,000 ( 4,800) ( 1,350) ( 1,600) 5,250 Others 9,000 (4,200) 4,800 (2,400) ( 450) ( 400) 1,550 Total 60,000 (28,000) 32,000 (12,000) ( 3,000) ( 4,000) 13,000 Segment Y 27,000 5,250 1,350 Others 9,000 1,550 450 Total 60,000 13,000 3,000 Disclosure of segment profit or loss Sales Profit or loss Depreciation Segment X 24,000 6,200 1,200 Reconciliation Revenue Revenue of reportable segments Revenue of nonreportable segments Entity revenue shown in income statement 51,000,000 9,000,000 60,000,000 Profit and loss Profit or loss of reportable segments Profit or loss of nonreportable segments Unallocated depreciation General corporate expenses Entity net income shown in income statement 11,450,000 1,550,000 ( 1,000,000) ( 2,000,000) 10,000,000 Problem 13-15 Easy Company provided the following statement of financial position at year-end and income statement for the current year: Current assets Property, plant and equipment Goodwill Investment in associate 130,000 500,000 100,000 70,000 Total assets 800,000 Current liabilities Noncurrent liabilities Share capital Retained earnings 90,000 60,000 400,000 250,000 Total liabilities and equity 800,000 Revenue Cost of goods sold Gross profit Other income Distribution cost Administrative expenses Other expenses Finance cost Share in profit of associate 1,800,000 (1,200,000) ( ( ( ( 600,000 60,000 200,000) 100,000) 50,000) 60,000) 10,000 Income before tax Income tax expense ( Net income 170,000 The entity is organized for management purposes into three major operating segments, namely furniture, stationery and computer products. There are other smaller operating segments. Furniture Stationery Computer products Other segments 260,000 90,000) External sales Intersegment sales 800,000 500,000 400,000 100,000 200,000 150,000 50,000 The costs of goods sold, distribution cost, administrative expenses and finance cost can be allocated as 50% to furniture, 25% to stationery, 20% to computer products, and 5% to other segments. The cost of sales related to intersegment sales amounted to P24,000,000 to be allocated as 50% to furniture, 40% to stationery, and 10% to computer products The segment assets and liabilities are as follows: Furniture Stationery Computer products others Current Asset Property, Plant and Equipment Goodwill 80,000 40,000 5,000 2,000 300,000 60,000 100,000 30,000 85,000 10,000 3,000 - Total asset 440,000 170,000 100,000 5,000 45,000 30,000 8,000 1,000 30,000 20,000 7,000 2,000 Total liabilities 75,000 50,000 15,000 3,000 Current Liabilities Noncurrent Liabilities The remaining assets and liabilities are general corporate assets and liabilities are general corporate assets and liabilities identified with the entity as a whole. The other income and other expenses are not allocated to the operating segments as a measure of profit or loss. The chief operating decision maker does not allocate income tax expense to reportable segments as a measure of profit or loss. Required: 1. Determine the profit or loss for all the operating segments. 2. Prepare the disclosure required for operating segments. 3. Prepare the necessary reconciliations between the segment information and amounts shown in the entity’s financial statements. Answer: Segment profit or loss External sales Intersegment sales Total revenue Cost of sales – external Cost of sales – internal Gross profit Distribution cost Administrativ e expense Finance cost Segment profit or loss Furniture Stationery Computer Others Total 800,000 500,000 400,000 100,000 1,800,000 200,000 150,000 50,000 - 400,000 1,000,000 (600,000) 650,000 (300,000) 450,000 (240,000) 100,000 (60,000) 2,200,000 (1,200,000) (120,000) (96,000) (24,000) - (240,000) 280,000 (100,000) 254,000 (50,000) 186,000 (40,000) 40,000 (10,000) 760,000 (200,000) (50,000) (25,000) (20,000) (5,000) (100,000) (30,000) 100,000 (15,000) 164,000 (12,000) 114,000 (3,000) 22,000 (60,000) 400,000 Furniture Stationery Computer Others Total 800,000 500,000 400,000 100,000 1,800,000 200,000 150,000 50,000 - 400,000 100,000 164,000 114,000 22,000 400,000 Minimum disclosures External sales Intersegmen t sales Profit or loss Finance cost Total assets Total liabilities 30,000 440,000 75,000 15,000 170,000 50,000 12,000 100,000 15,000 3,000 5,000 3,000 60,000 715,000 143,000 Reconciliation Revenue Sales of reportable segments Sales of nonreportable segments Elimination of intersegment sales Entity sale in income statement 2,100,000 100,000 ( 400,000) 1,800,000 Profit and loss Profit or loss of reportable segments Profit or loss of nonreportable segments Elimination of intersegment profit Share in profit of associate Unallocated items: Other income Other expenses Income tax expense Entity net income in income statement 378,000 22,000 (160,000) 10,000 Intersegment sales Cost of sales – intersegment sales Intersegment gross profit 400,000 (240,000) 160,000 60,000 (50,000) (90,000) 170,000 Total assets Total assets of reportable segments Total assets of nonreportable segments Investment in associate General corporate assets Entity total assets 710,000 5,000 70,000 15,000 800,000 Total liabilities Total liabilities of reportable segments Total liabilities of nonreportable segments General corporate liabilities Entity total liabilities 140,000 3,000 7,000 150,000 Problem 13-16 Revlon Company provided the following data for the current year. Segments 1 2 3 4 5 6 7 Others Revenue Profit (loss) 620,000 100,000 340,000 190,000 180,000 70,000 120,000 380,000 200,000 20,000 70,000 ( 30,000) ( 25,000) 10,000 ( 20,000) ( 25,000) Assets 400,000 80,000 300,000 140,000 180,000 120,000 140,000 140,000 The “others category includes five operating segments, none of which has revenue or assets greater than P80,000 and none with an operating profit. Operating Segments 1 and 2 produce very similar products and use very similar production processes, but serve different customer types and use quite different product distribution system. These differences are due in part to the fact that Segment 2 operates in a regulated environment while Segment 1 does not. Operating Segments 6 and 7 have similar products, production processes, product distribution systems, but are organized as separate division since they serve substantially different types of customers. Neither Segments 6 and 7 operate in a regulated environment. Required: 1. Determine the reportable segments without regard to aggregation criteria. 2. If the 75% overall size test for reportable segments is not yet met, identify additional reportable segments. 3. What are the reportable segments after considering all factors? Answer: Segments 1 2 3 4 5 6 7 Others Revenue Profit (loss) 620,000 100,000 340,000 190,000 180,000 70,000 120,000 380,000 200,000 20,000 70,000 ( 30,000) ( 25,000) 10,000 ( 20,000) ( 25,000) Assets 400,000 80,000 300,000 140,000 180,000 120,000 140,000 140,000 Total 2,000,000 200,000 1,500,000 1. The information above shows that any operating segment with revenue equal to or greater than P200,000 is a reportable segment (segments 1 and 3). Any segment with identifiable assets greater than P150,000 is a reportable segments 1, 3, and 5). The total profit for all segments with profit totals P300,000. As a result, any segment with an operating profit or loss equal to or greater than an absolute amount of P30,000 is a reportable segment (segments 1, 3 and 4). Thus, Segments 1, 3, 4 and 5 are reportable segments. 2. The revenue of the reportable segment Segment 1 3 4 5 Total revenue 620,000 340,000 190,000 180,000 1,330,000 Percentage (1,330,000 / 2,000,000) If the total external revenue attributable to reportable segments constitutes less than 75% of the total entity revenue, additional segment shall be identified even if they do not meet the 10%, threshold segments that are below the 10% threshold can be aggregated as one segment if they share a majority of the five factors in identifying a business segment, namely: a. b. c. d. e. Nature of product Nature of production process Class of customer Method of distributing product Regulated environment Since segments 6 and 7 are similar in four of the five criteria, they can be aggregated as one reportable segment. Revenue Profit (loss) Segment assets Segment 6 Segment & 70,000 120,000 10,000 ( 20,000) 120,000 140,000 Total 190,000 ( 10,000) 260,000 With segments 6 and 7 considered as one reportable segment, the total segment revenue increases to P1,520,000 or 76% of the total. The 75% requirement has been met. Revenue of reportable segments before aggregation Revenue of additional reportable segments Total 1,330,000 190,000 1,520,000 Percentage (1,520,000 / 2,000,000) 76% 3. In conclusion, Segments 1, 3, 4, 5, and Segments 6 and 7 (combined) shall be considered reportable segments. Problem 13-17 Universal Company has two different product lines and makes significant sales both in the Philippines and Japan. The entity has compiled the following information Product A Philippines Japan Revenue 1,000,000 Segment profit or loss 250,000 Depreciation 150,000 Property, plant and Equipment 500,000 Segment assets 1,200,000 Segment liabilities 700,000 Capital expenditures 200,000 Product B Philippines Japan 1,500,000 400,000 200,000 4,000,000 500,000 800,000 2,000,000 200,000 500,000 600,000 1,400,000 600,000 400,000 2,500,000 6,000,000 4,000,000 1,000,000 1,500,000 4,000,000 2,000,000 300,000 Required: 1. Universal Company has structured its operations internally into two division based on two products, A and B Prepare the disclosures required in relation to operating segments. 2. Prepare the entity-wide disclosure about geographical areas to conform with the requirement of segment reporting. Answer: 1. Minimum disclosures under PFRS: Revenue Segment profit or loss Depreciation Total assets Total liabilities Capital expenditures Product A 2,500,000 650,000 350,000 2,600,000 1,300,000 600,000 Product B 6,000,000 700,000 1,300,000 10,000,000 6,000,000 1,300,000 Total 8,500,000 1,350,000 1,650,000 12,600,000 7,300,000 1,900,000 2. Entity-wide disclosure about geographical areas: Revenue Noncurrent assets - PPE Philippines 5,000,000 3,000,000 Japan 3,500,000 2,100,000 Total 8,500,000 5,100,000 Problem 13-18 1. If a financial report contains both the consolidated financial statements of a parent and the parent’s separate financial statements, segment information is required in a. b. c. d. The separate financial statements The consolidated financial statements Both the separate and consolidated financial statements. Neither the separate nor the consolidated financial statements 2. When an operating segment is reportable? a. The segment external and internal revenue is 10% or more of the combined external and internal revenue of all operating segments b. The segment profit or loss is 10% or more of the greater between the combined profit of all profitable operating segments and the combined loss of all unprofitable operating segments c. The assets of the segment are 10% or more of the total assets of all operating segments d. Under all of these circumstances. 3. In financial reporting for operating segments, and entity shall disclose all of the following, except a. Types of products and services from which each reportable segment derives revenue b. The title of the chief operating decision maker of each reportable segment. c. Factors used to identify the reportable segments. d. The basis of measurement of segment profit or loss and segment assets. 4. Which statement is not true with respect to a chief operating decision maker? a. The term chief operating decision maker identifies a function and not necessarily a manager with specific title. b. In some cases, the chief operating decision maker could be the chief operating officer. c. The board of directors acting collectively could qualify as the chief operating decision maker. d. The chief internal auditor would generally qualify as chief operating decision maker. 5. What is the quantitative threshold for the revenue that must be disclosed by reportable operating segments? a. The total external and internal revenue of all reportable segments is 75% or more of the entity external revenue. b. The total external revenue of all reportable segments is 75% or more of entity external and internal revenue. c. The total external revenue of all reportable segments is 75% or more of the entity external revenue. d. The total internal revenue of all reportable segments is 75% or more of the entity internal revenue. 6. Two or more operating segments may be aggregated into a single operating segment if all of the following conditions are satisfied, except a. The segments have similar characteristics. b. The segments share a majority of the nature of product or service, nature of production process, class of customer, method of product distribution and regulatory environment. c. The aggregation is consistent with the core principles of segment reporting. d. The segments have dissimilar characteristics. 7. Operating segments that do not meet any of the quantitative thresholds a. Cannot be considered reportable. b. May be considered reportable and separately disclosed if management believes that information about the segment would be useful to the users of the financial statements. c. May be considered reportable and separately disclosed if the information is for internal use. d. May be considered reportable and separately disclosed if this is the practice within the economic environment in which the entity operates 8. Which of the following is a required enterprise-wide disclosure regarding external customers? a. The entity of any external customer considered to be major by management b. The identity of any external customer providing 10% or more of a particular operating segment revenue c. Information on major customers is not required in segment reporting d. The fact that transactions with a particular external customer constitute at least 10% of the total entity revenue 9. IFRS 8 requires that an entity should provide reconciliations of segment information. Which of following is not a required reconciliation? a. The total of the reportable segments’ revenue to the entity’s revenue b. The total of the reportable segments’ profit or loss to the entity’s profit or loss before tax expense and discontinued operating c. The total number of major customers of all segments to the total number of major customers of the entity d. The total of the reportable segments’ assets to the entity’s assets 10. An operating segment is considered reportable when any of the following conditions is met, except a. Segment revenue is 10% or more of the combined revenue of all of the entity’s segments. b. Segment assets are 10% or more of the combined assets of all segments. c. Segment liabilities are 10% or more of the combined liabilities of all segments. d. Segment’s operating profit or operating loss is 10% or more of the combined operating profit of all segments that did not incur an operating loss.