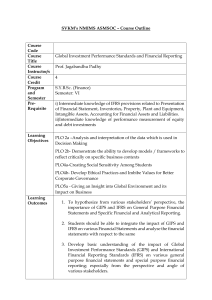

Introduction It is an introductory course on Financial Accounting. Accounting is the language of business. Planning, controlling and reporting in business uses accounting and hence understanding business, require understanding of accounting. Financial Accounting is used for reporting results of the business to external stakeholders. This course aims at developing reasonable skills to understand, evaluate and use financial information aimed at both managers and external stakeholders. Accounting is based on a sound methodology. Understanding this methodology is an essential for understanding accounts and business information. Emphasis in this course is on achieving conceptual clarity in accounting. Since, fiscal year 2016-17 onwards India is implementing Indian version of International Financial Reporting Standers (IFRS) called IndAS in a phased manner. This course is proposed based on IndAS and referred to IFRS as and when required. Learning Outcomes/Course Objectives At the end of the course, the students would be able to: Understand the construction of financial statements and measurement of revenues, expenses, assets and liabilities. Understand the basics of financial statement analysis techniques. Textbooks and Learning Materials Text Book(s) Financial Accounting for Management (Fourth Edition), Tata McGraw Hill Education Pvt Ltd. New Delhi by N Ramachandran and Ram Kumar Kakani (RK) Reference Book(s) Accounting Text and Cases, (13th Edition), Robert N Anthony, David F Hawkins and Kenneth A Merchant, McGraw Hill Financial Accounting: A Managerial Perspective (Fourth Edition), (2011) PHI Learning Private Limited, New Delhi by R Narayanaswamy Modern Managerial Accounting and Control by Sunder Ram Korivi, Himalaya Publishing House Financial accounting by Weygandt, Jerry J., Paul D. Kimmel, and Donald E. Kieso. John Wiley & Sons. Additional Reading(s) International GAAP 2012: Generally Accepted Accounting Practice under International Financial Reporting Standards (IFRS) [Paperback], Ernst & Young (Editor), Wiley Publications Other Resources (Journals, Internet Websites) (if any) Page 1 of 3 Journals: 1. 2. 3. 4. The Chartered Accountant by ICAI Accounting Review Journal of Business Finance and Accounting Journal of Accounting Research Web Resources: http://www.ifrs.org/Home.htm - International accounting Standards Committee www.icai.org Evaluation Components/Assessment of Student Learning Assessment Tool Percentage END-TERM EXAMINATION 50% Assignments Quizzes & Class Participation 25% 25% Page 2 of 3 Session Plan Session 1 Topic: Introduction to Financial Accounting Financial Statements: Balance Sheet / Statement of Financial Position Read: RK Chapter 1, 2 Session 2 Topic: Financial Statements: Profit and Loss Account / Income Statement Read: RK Chapter 2, 3 Session 3 Topic: Financial Statements (Both): Balance Sheet & Profit and Loss Account Read: RK Chapter 2 & 3 Session 4 Topic: a. Accounting recording process b. Issues pertaining to Asset reporting, Inventory valuation & Revenue Recognition Read: RK Chapter 5, 8 Session 5 Topic: Financial Statements: Understanding and Analysis of Cash Flow Statement Read: RK Chapter 4 Session 6 Topic: Financial Statements: Understanding and Analysis of Cash Flow Statement Read: RK Chapter 4 Session 7 Topic: Financial Statement Analysis : Horizontal, Vertical, Trend and Ratio Analysis Read: RK Chapter 7 Session 8 Topic: Financial Statement Analysis : Ratio Analysis Read: RK Chapter 7 Page 3 of 3