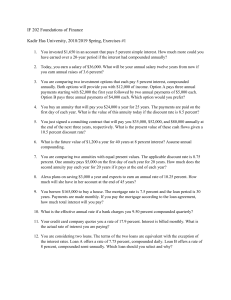

ch6 Student: _______________________________________________________________________________________ Multiple Choice Questions 1. An annuity is a(n): A. B. C. D. E. level stream of perpetual cash flows. level stream of cash flows occurring for a fixed period of time. increasing stream of perpetual cash flows. increasing stream of cash flows occurring for a fixed period of time. decreasing stream of cash flows occurring for a fixed period of time. 2. Which one of the following is the annuity present value factor? A. (1 + Present value factor) / r B. (1 Present value factor) / r C. Present value factor + (1 / r) D. (Present value factor r) + (1 / r) E. r (1 + Present value factor) 3. What is a consol? A. B. C. D. E. a type of annuity issued by an insurance company a name used in Canada for a perpetuity an annuity stream of payments received as an inheritance a decreasing stream of perpetual payments an increasing stream of perpetual payments 4. How is an annuity due defined? A. B. C. D. E. a stream of cash flows occurring for less than one year an annuity stream of payments that are disbursed rather than received an annuity stream of payments that are received rather than disbursed a set of equal cash flows occurring at the end of each period a set of equal cash flows occurring at the beginning of each period 5. An annuity stream where the payments occur forever is called a(n): A. B. C. D. E. annuity due. indemnity. perpetuity. amortized cash flow stream. ordinary annuity. 6. What is the interest rate that is expressed in terms of the interest payment made each period called? A. B. C. D. E. stated interest compound interest effective annual periodic interest daily interest 7. What is the interest rate that is expressed as if it were compounded once per year called? A. B. C. D. E. stated interest compound interest effective annual periodic interest daily interest 8. What is the interest rate charged per period multiplied by the number of periods per year called? A. B. C. D. E. effective annual annual percentage periodic interest compound interest daily interest 9. A loan where the borrower receives money today and repays a single lump sum on a future date is called a(n) _____ loan. A. B. C. D. E. amortized continuous balloon pure discount interest-only 10. A loan where the borrower pays interest each period and repays the entire principal of the loan at some point in the future is called a(n) _____ loan. A. B. C. D. E. amortized continuous balloon pure discount interest-only 11. A loan where the borrower pays interest each period, and repays some or all of the principal of the loan over time is called a(n) _____ loan. A. B. C. D. E. 12. amortized continuous balloon pure discount interest-only A loan where the borrower pays interest each period, repays part of the principal of the loan over time, and repays the remainder of the principal at the end of the loan, is called a(n) _____ loan. A. B. C. D. E. amortized continuous balloon pure discount interest-only 13. You are comparing two annuities which offer monthly payments of $500 for ten years and pay 0.5 percent interest per month. Annuity A will pay you on the first of each month while annuity B will pay you on the last day of each month. Which one of the following statements is correct concerning these two annuities? A. B. C. D. E. Both annuities are of equal value today. Annuity B is an annuity due. Annuity A has a higher future value than annuity B. Annuity B has a higher present value than annuity A. Both annuities have the same future value as of ten years from today. 14. You are comparing two investment options that pay 7 percent interest annually. Both options will provide you with $20,000 of income. Option A pays five annual payments starting with $8,000 the first year followed by four annual payments of $3,000 each. Option B pays five annual payments of $4,000 each. Which one of the following statements is correct given these two investment options? A. B. C. D. E. Both options are of equal value given that they both provide $20,000 of income. Option A is the better choice. Option B has a higher present value than option A. Option B is a perpetuity. Option A is preferable because it is an annuity due. 15. You are considering two projects with the following cash flows: Which of the following statements are true concerning these two projects? I. Both projects have the same future value at the end of year 4, given a positive rate of return. II. Both projects have the same future value given a zero rate of return. III. Both projects have the same future value at any point in time, given a positive rate of return. IV. Project B has a higher future value than project A, given a positive rate of return. A. B. C. D. E. II only IV only I and III only II and IV only I, II, and III only 16. How does a perpetuity differ from an annuity? A. B. C. D. E. perpetuity payments vary with the rate of inflation perpetuity payments vary with the market rate of interest perpetuity payments are variable while annuity payments are constant perpetuity payments never cease annuity payments are smaller in amount 17. Which one of the following statements concerning the annual percentage rate is correct? A. The annual percentage rate considers interest on interest. B. The rate of interest you actually pay on a loan is called the annual percentage rate. C. The effective annual rate is lower than the annual percentage rate when an interest rate is compounded quarterly. D. When firms advertise the annual percentage rate they are violating U.S. truth-in-lending laws. E. The annual percentage rate equals the effective annual rate when the rate on an account is designated as simple interest. 18. Which one of the following statements concerning interest rates is correct? A. B. C. D. The stated rate is the same as the effective annual rate. The effective annual rate is the rate that applies if interest is compounded annually. The annual percentage rate increases as the number of compounding periods per year increases. Borrowers prefer more frequent compounding on their loan accounts given a stated annual percentage rate. E. For any positive rate of interest, the effective annual rate will always exceed the annual percentage rate. 19. Which of the following statements concerning the effective annual rate are correct? I. When making financial decisions, you should compare effective annual rates rather than annual percentage rates. II. The more frequently interest is compounded, the higher the effective annual rate given a fixed annual percentage rate. III. A quoted rate of 6 percent compounded continuously has a higher effective annual rate than if the rate were compounded daily. IV. When choosing which loan to accept, you should select the offer with the highest effective annual rate. A. B. C. D. E. I and II only I and IV only I, II, and III only II, III, and IV only I, II, III, and IV 20. The highest effective annual rate that can be derived from an annual percentage rate of 9 percent is computed as: A. .09e B. e.09 C. e D. 1. q. (1 + .09). e.09 1. E. (1 + .09)q. 21. A pure discount loan is a(n): A. B. C. D. E. example of a present value problem. loan that is interest-free. loan that grants you a discount if you pay your payments on time. loan that requires all interest to be paid at the time the loan is made. loan that discounts the payments if you pay them in advance. 22. The principle amount of an interest-only loan is: A. B. C. D. E. never repaid. repaid in equal increments and included in each loan payment. repaid in full at the end of the loan period. repaid in equal annual payments even when the loan interest is repaid monthly. repaid in increasing increments and included in each loan payment. 23. An amortized loan: A. requires the principle amount to be repaid in even increments over the life of the loan. B. may have equal or increasing amounts applied to the principle from each loan payment. C. requires that all interest be repaid on a monthly basis while the principle is repaid at the end of the loan term. D. requires that all payments be equal in amount and include both principle and interest. E. repays both the principle and the interest in one lump sum at the end of the loan term. 24. Your parents are giving you $500 a month for five years while you attend college to earn both a bachelor's and a master's degree. At a 7 percent discount rate, what are these payments worth to you when you first enter college? A. B. C. D. E. $22,681.13 $24,601.18 $25,251.00 $27,209.17 $30,000.00 25. You just won the lottery! As your prize you will receive $1,500 a month for twenty years. If you can earn 9 percent on your money, what is this prize worth to you today? A. B. C. D. E. $152,087.19 $156,098.29 $157,408.16 $164,313.82 $166,717.43 26. Angela is able to pay $230 a month for 6 years on a car loan. If the interest rate is 7.9 percent, how much can she afford to borrow to buy a car? A. B. C. D. E. $13,154.54 $13,408.17 $13,528.28 $13,666.67 $13,809.19 27. You are the beneficiary of a life insurance policy. The insurance company informs you that you have two options for receiving the insurance proceeds. You can receive a lump sum of $150,000 today or receive payments of $1,627.89 a month for 10 years. You can earn 7.5 percent on your money. Which option should you take and why? A. B. C. D. E. You should accept the payments because they are worth $151,291.91 to you today. You should accept the payments because they are worth $153,417.68 to you today. You should accept the payments because they are worth $154,311.12 to you today. You should accept the $150,000 because the payments are only worth $137,141.17 to you today. You should accept the $150,000 because the payments are only worth $134,808.17 to you today. 28. Your employer contributes $50 a week to your retirement plan. Assume that you work for your employer for another 12 years and that the applicable discount rate is 8 percent. Given these assumptions, what is this employee benefit worth to you today? A. B. C. D. E. $20,046.80 $21,212.12 $21,406.14 $22,989.76 $23,521.79 29. You have a sub-contracting job with a local manufacturing firm. Your agreement calls for annual payments of $82,000 for the next 3 years. At a discount rate of 9.5 percent, what is this job worth to you today? A. B. C. D. E. $162,556.16 $205,730.36 $209,408.37 $211,417.06 $213,918.01 30. Swenson & Swenson just decided to save $2,200 a month for the next 6 years as a safety net for recessionary periods. The money will be set aside in a separate savings account which pays 5.5 percent interest compounded monthly. They deposit the first $2,200 today. If the company had wanted to deposit an equivalent lump sum today, how much would they have had to deposit? A. B. C. D. E. 31. $130,297.18 $134,656.34 $135,273.51 $137,778.92 $138,001.14 You need some money today and the only friend you have that has any is your miserly friend. He agrees to loan you the money you need, if you make payments of $15 a month for the next nine months. In keeping with his reputation, he requires that the first payment be paid today. He also charges you 2 percent interest per month. How much money are you borrowing? A. B. C. D. E. $120.67 $122.43 $124.88 $126.49 $135.00 32. You buy an annuity which will pay you $7,800 a year for 15 years. The payments are paid on the first day of each year. What is the value of this annuity today if the discount rate is 12 percent? A. B. C. D. E. $53,124.74 $59,499.71 $62,407.18 $64,311.21 $65,258.58 33. You are scheduled to receive annual payments of $15,000 for each of the next 13 years. The discount rate is 9 percent. What is the difference in the present value if you receive these payments at the beginning of each year rather than at the end of each year? A. B. C. D. E. $9,211.07 $9,698.17 $9,704.38 $9,876.47 $10,107.32 34. You are comparing two annuities with equal present values. The applicable discount rate is 11.25 percent. One annuity pays $6,000 on the first day of each year for 25 years. How much does the second annuity pay each year for 25 years if it pays at the end of each year? A. B. C. D. E. $6,350 $6,408 $6,675 $6,921 $7,100 35. Betsy receives $600 on the first of each month. Jen receives $600 on the last day of each month. Both Betsy and Jen will receive payments for four years. At a 7 percent discount rate, what is the difference in the present value of these two sets of payments? A. B. C. D. E. $135.40 $137.46 $138.09 $141.41 $146.16 36. What is the future value of $3,400 a year for 6 years at a 9 percent rate of interest? A. B. C. D. E. $22,051.60 $23,876.49 $24,011.77 $25,579.34 $27,881.48 37. What is the future value of $1,650 a year for 9 years at a 7 percent rate of interest? A. B. C. D. E. $17,409.08 $19,763.68 $21,254.45 $23,136.19 $25,222.22 38. Marcia plans on saving $6,000 a year and expects to earn an annual rate of 11.5 percent. How much will she have in her account at the end of 40 years? A. B. C. D. E. $4,007,098 $4,467,914 $5,911,408 $6,221,009 $6,347,238 39. Christie adds $2,000 to her savings account on the first day of each year. Todd adds $2,000 to his savings account on the last day of each year. They both earn a 7 percent rate of return. What is the difference in their savings account balances at the end of 25 years? A. B. C. D. E. $8,854.86 $9,003.48 $9,126.39 $9,130.07 $9,041.14 40. You borrow $14,500 to buy a car. The terms of the loan call for monthly payments for 6 years at a 6.9 percent rate of interest. What is the amount of each payment? A. B. C. D. E. $238.87 $240.27 $246.51 $249.08 $252.50 41. You borrow $187,500 to buy a house. The mortgage rate is 7.25 percent and the loan period is 25 years. Payments are made monthly. If you pay for the house according to the loan agreement, how much total interest will you pay? A. B. C. D. $186,408 $219,079 $227,001 $264,319 E. $291,406 42. The Home Improvement Center (HIC) has an employment contract with the newly hired CEO. The contract requires a lump sum payment of $32.4 million be paid to the CEO upon the successful completion of her first five years of service. HIC wants to set aside an equal amount of money at the end of each year to cover this anticipated cash outflow and will earn 7.25 percent on the funds. How much must HIC set aside each year for this purpose? A. B. C. D. E. $5,227,064 $5,606,026 $5,668,987 $6,778,958 $7,270,433 43. Pat retires at age 58 and expects to live to age 90. On the day she retires, she has $287,409 in her retirement savings account. She is conservative and expects to earn 5.25 percent on her money during her retirement years. How much can she withdraw from her retirement savings each month if she plans to die on the day she spends her last penny? A. B. C. D. E. $1,359.79 $1,364.18 $1,540.01 $1,546.75 $1,702.11 44. The Chelsey Group purchased a piece of property for $4.8 million. They paid a down payment of 25 percent in cash and financed the balance. The loan terms require monthly payments for 25 years at an annual percentage rate of 8.65 percent compounded monthly. What is the amount of each mortgage payment? A. B. C. D. E. $27,804.13 $27,989.62 $28,406.23 $29,142.91 $29,352.98 45. You estimate that you will have $31,870 in student loans by the time you graduate. The interest rate is 5.45 percent. If you want to have this debt paid in full within four years, how much must you pay each month? A. B. C. D. E. $737.11 $738.82 $739.34 $740.46 $741.09 46. You are buying a previously owned car today at a price of $4,950. You are paying $750 down in cash and financing the balance for 42 months at 8.45 percent. What is the amount of each loan payment? A. B. C. D. E. $108.54 $115.05 $115.86 $135.60 $136.55 47. The Helping Hand Insurance Company wants to sell you an annuity which will pay you $2,750 per quarter for 20 years. You want to earn a minimum rate of return of 6.25 percent. What is the most you are willing to pay as a lump sum today to buy this annuity? A. B. C. D. E. $125,085.43 $127,039.89 $179,544.36 $193,573.08 $198,747.27 48. Your car dealer is willing to lease you a new car for $199 a month for 72 months. Payments are due on the first day of each month starting with the day you sign the lease contract. If your cost of money is 5.45 percent, what is the current value of the lease? A. B. C. D. E. $11,708.18 $11,297.60 $12,197.74 $12,253.14 $13,008.31 49. Your favorite grandmother left you an inheritance in the form of a trust. The trust agreement states that you are to receive $10,000 on the first day of each year, starting immediately and continuing for 25 years. What is the value of this inheritance today if the applicable discount rate is 7.5 percent? A. B. C. D. E. $107,006.67 $111,469.46 $114,141.41 $117,208.42 $119,829.67 50. You just received an insurance settlement offer related to an accident you had four years ago. The offer gives you a choice of one of the following three offers: Option A: $6,500 on the first day of each year for 40 years Option B: $610 on the first day of each month for 25 years Option C: $75,000 as a lump sum payment today You can earn 8.75 percent on your investments. You do not care if you personally receive the funds or if they are paid to your heirs should you die within the settlement period. Which one of the following statements is correct given this information? A. Option C is the best choice since you can earn 8.75 percent on the entire lump sum starting immediately. B. Option B is the best choice since it offers the largest number of payments. C. Option A is the best choice since it has the largest present value. D. Option B is the best choice since it has the largest present value. E. You are indifferent to the three options as they are all equal in value to you. 51. Priestly Engineers wants to save $145,000 to buy some new equipment two years from now. The plan is to set aside an equal amount of money on the first day of each quarter starting today. The firm can earn a 5.5 percent rate of return. How much does the firm have to save each quarter to achieve their goal? A. B. C. D. E. $17,084.43 $17,036.35 $17,270.60 $17,308.67 $17,421.18 52. Starting today, Stephen is going to contribute $200 on the first of each month to his retirement account. His employer will contribute an additional 50 percent of the amount Stephen contributes. If both Stephen and his employer continue to do this and he can earn a monthly rate of 0.75 percent, how much will Stephen have in his retirement account 40 years from now? A. B. C. D. E. $936,264 $943,286 $1,404,396 $1,414,929 $1,672,413 53. You are considering an annuity which costs $250,000 today. The annuity pays $30,000 a year at an annual interest rate of 6.25 percent. What is the length of the annuity time period? A. B. C. D. E. 11.11 years 11.67 years 12.14 years 12.38 years 12.49 years 54. Today, you signed loan papers agreeing to borrow $35,000 at 9.75 percent compounded monthly. The loan payment is $700 a month. How many loan payments must you make before the loan is paid in full? A. B. C. D. E. 55. 62.00 63.25 63.48 63.74 64.42 Huntington Manor would like to buy some additional land and build a new assisted living center. The anticipated total cost is $12.4 million. The CEO of the firm is quite conservative and will only do this when the company has sufficient funds to pay cash for the entire construction project. Management has decided to save $235,000 a month for this purpose. The firm earns 7 percent compounded monthly on the funds it saves. How long does the company have to wait before expanding its operations? A. B. C. D. E. 30.32 months 31.23 months 46.14 months 49.68 months 54.00 months 56. Today, you are retiring. You have a total of $387,419 in your retirement savings and have the funds invested such that you expect to earn an average of 6.8 percent, compounded monthly, on this money throughout your retirement years. You want to withdraw $3,000 at the beginning of every month, starting today. How long will it be until you run out of money? A. B. C. D. E. 225.05 months 228.47 months 230.19 months 232.14 months 233.33 months 57. Slow Poke Corp. is notoriously known as a slow-payer. The firm currently needs to borrow $36,000 and only one company will even deal with them. The terms of the loan call for daily payments of $55. The first payment is due today. The interest rate is 24 percent compounded daily. What is the time period of this loan? A. B. C. D. E. 2.34 years 2.48 years 2.54 years 2.67 years 2.82 years 58. Jonathan's Apple Orchard is considering a project which has an initial cash requirement of $218,700. The project will yield cash flows of $3,725 monthly for 72 months. What is the rate of return on this project? A. B. C. D. E. 6.97 percent 7.04 percent 7.28 percent 7.41 percent 7.56 percent 59. Your insurance agent is trying to sell you an annuity that costs $165,000 today. By buying this annuity, your agent promises that you will receive payments of $775 a month for the next 40 years. What is the rate of return on this investment? A. B. C. D. E. 4.28 percent 4.39 percent 4.52 percent 4.67 percent 4.81 percent 60. You have been investing $165 a month for the last 12 years. Today, your investment account is worth $60,508.29. What is your average rate of return on your investments? A. B. C. D. E. 13.77 percent 13.80 percent 13.84 percent 13.89 percent 14.03 percent 61. Susan Sunshine has been investing $160,000 a year for the past 9 years into Sunshine in a Can, Inc. Today, as the sole shareholder, she sold Sunshine in a Can, Inc. for $2.6 million. What is her rate of return on this investment? A. B. C. D. E. 14.13 percent 14.24 percent 14.29 percent 14.37 percent 14.42 percent 62. Your grandmother helped you start saving $10 a month beginning on your 6th birthday. She always made you make your deposit on the first day of each month just to "start the month out right". Today, you turn 21 and have $2,994.21 in your account. What is the rate of return on your savings? A. B. C. D. E. 6.18 percent 6.21 percent 6.25 percent 6.28 percent 6.31 percent 63. Today, you turn 21. Your birthday wish is that you will be a millionaire by your 41st birthday. In an attempt to reach this goal, you decide to save $30 a day, every day until you turn 41. You open an investment account and deposit your first $30 today. What rate of return must you earn to achieve your goal? A. B. C. D. E. 12.65 percent 12.71 percent 12.78 percent 12.82 percent 12.85 percent 64. You just settled an insurance claim. The settlement calls for increasing payments over a 5-year period. The first payment will be paid one year from now in the amount of $30,000. The following payments will increase by 6 percent annually. What is the value of this settlement to you today if you can earn 8.5 percent on your investments? A. B. C. D. E. $126,408.28 $129,417.11 $132,023.05 $141,414.14 $152,008.16 65. Your grandmother left you an inheritance that will provide an annual income for 25 years. You will receive the first payment one year from now in the amount of $10,000. Every year after that, the payment amount will increase by 5 percent. What is your inheritance worth to you today if you can earn 12 percent on your investments? A. B. C. D. E. $114,400.49 $116,666.67 $121,121.21 $123,464.12 $126,908.17 66. You just won a national sweepstakes! For your prize, you opted to receive never-ending payments. The first payment will be $10,000 and will be paid one year from today. Every year thereafter until forever, the payments will increase by 4 percent annually. What is the present value of your prize at a discount rate of 10 percent? A. B. C. D. E. $166,666.67 $172,500.00 $183,333.33 $191,406.15 $200,000.00 67. A wealthy benefactor just donated some money to the local college. This gift was established to provide scholarships for worthy students. The first scholarships will be granted one year from now for a total of $50,000. Annually thereafter the scholarship amount will be increased by 5 percent to help offset the effects of inflation. The scholarship fund will last indefinitely. What is the value of this gift today at a discount rate of 7.5 percent? A. B. C. D. E. $1,500,000 $1,666,667 $1,750,000 $1,885,000 $2,000,000 68. Chadwicke & Co. is considering acquiring S&K Industries. Chadwicke & Co. believes that S&K Industries can generate cash flows of $245,000, $270,000, and $315,000 over the next three years, respectively. After that time, they feel the business will be worthless. Chadwicke & Co. has determined that a 15 percent rate of return is applicable to this potential acquisition. What is Chadwicke & Co. willing to pay today to acquire S&K Industries? A. B. C. D. E. $622,570 $623,480 $624,320 $624,510 $625,000 69. You are considering two savings options. Both options offer a 6 percent rate of return. The first option is to save $1,500, $2,500, and $3,500 a year over the next three years, respectively. The other option is to save one lump sum amount today. If you want to have the same balance in your savings account at the end of the three years, regardless of the savings method you select, how much do you need to save today if you select the lump sum option? A. B. C. D. E. $6,211.16 $6,578.75 $7,013.47 $7,063.33 $7,500.00 70. You are considering two insurance settlement offers. The first offer includes annual payments of $15,000, $22,500, and $25,000 over the next three years, respectively. The other offer is the payment of one lump sum amount today. You are trying to decide which offer to accept given the fact that your discount rate is 6.5 percent. What is the minimum amount that you will accept today if you are to select the lump sum offer? A. B. C. D. E. $51,006.01 $52,398.29 $52,473.15 $54,618.07 $55,318.09 71. You are considering changing jobs. Your goal is to work for three years and then return to school full-time in pursuit of an advanced degree. A potential employer just offered you an annual salary of $36,000, $39,000, and $42,000 a year for the next three years, respectively. The offer also includes a starting bonus of $1,000 payable immediately. What is this offer worth to you today at a discount rate of 7.5 percent? A. B. C. D. E. $94,925.29 $98,206.13 $102,044.69 $104,879.92 $107,311.16 72. You are considering a project which will provide cash inflows of $2,100, $4,000, and $5,500 per year over the next three years, respectively. What is the present value of these cash flows, given a 13 percent discount rate? A. B. C. D. E. $7,487.78 $7,711.42 $8,050.00 $8,213.09 $8,802.77 73. You just signed a contract that will pay you $13,000, $18,000, and $25,000 annually over the next three years, respectively. What is the present value of these cash flows given a 15 percent discount rate? A. B. C. D. $41,352.84 $42,607.11 $42,908.17 $43,333.33 E. $46,827.94 74. You have some property for sale and have received two offers. The first offer is for $197,500 today in cash. The second offer is the payment of $45,000 today and an additional $200,000 two years from today. If the applicable discount rate is 12.50 percent, which offer should you accept and why? A. B. C. D. E. You should accept the $197,500 today because it has the higher net present value. You should accept the $197,500 today because it has the lower future value. You should accept the second offer because you will receive $245,000 total. You should accept the second offer because you will receive about $5,525 more in today's dollars. You should accept the second offer because it has a present value of $202,778. 75. Your local travel agent is advertising an upscale winter vacation package for travel two years from now to Antarctica. The package requires that you pay $15,000 today, $25,000 one year from today, and a final payment of $65,000 on the day you depart two years from today. What is the cost of this vacation in today's dollars if the discount rate is 9 percent? A. B. C. D. E. $92,644.98 $94,607.78 $95,250.00 $97,411.18 $99,987.47 76. One year ago, Dover Supply deposited $5,200 in an investment account for the purpose of buying new equipment four years from today. Today, they are adding another $5,200 to this account. The company plans on making a final deposit of $12,000 to the account one year from today. How much will be available when they are ready to buy the equipment, assuming they earn a 6.5 percent rate of return? A. B. C. D. E. $22,109.16 $25,277.78 $25,409.18 $26,581.67 $28,309.47 77. Marcia will receive $6,350 this year, $7,280 next year, and $8,470 the following year. The cash flows occur at the end of each year. What is the future value of these cash flows at the end of year 3 if the interest rate is 8 percent? A. B. C. D. E. $22,008.19 $22,116.23 $23,739.04 $24,258.58 $24,611.87 78. You plan on saving $6,500 this year, nothing next year, and $6,500 the following year. You will deposit these amounts into your investment account at the end of the year. What will your investment account be worth at the end of year three if you can earn 11.75 percent on your funds? A. $14,617.24 B. C. D. E. $15,213.80 $15,916.78 $16,334.77 $17,001.42 79. Suzette is going to receive $25,000 today as the result of an insurance settlement. In addition, she will receive $30,000 one year from today and $50,000 two years from today. She plans on saving all of this money and investing it for her retirement. If Suzette can earn an average of 12 percent on her investments, how much will she have in her account if she retires 20 years from today? A. B. C. D. E. $789,320.06 $807,446.41 $884,038.47 $930,178.26 $1,012,860.78 80. Stevenson Interiors has a $67,500 liability they must pay four years from today. The company is opening a savings account so that the entire amount will be available when this debt needs to be paid. The plan is to make an initial deposit today and then deposit an additional $10,000 a year for the next four years, starting one year from today. The account pays a 5 percent rate of return. How much does the firm need to deposit today? A. B. C. D. E. $18,299.95 $20,072.91 $21,400.33 $24,398.75 $31,076.56 81. The government has imposed a fine on the Shady Trader. The fine calls for annual payments of $650,000, $900,000, and $1.2 million respectively over the next three years. The first payment is due one year from today. The government plans to invest the funds until the final payment is collected and then donate the entire amount, including the investment earnings, to a national securities training center. The government will earn 4.25 percent on the funds held. How much will the national securities training center receive three years from today? A. B. C. D. E. $2,844,674.06 $2,866,875.00 $2,884,549.69 $2,965,572.71 $3,115,737.67 82. Mrs. Black established a trust fund that provides $65,000 in scholarships each year for needy students. The trust fund earns a fixed 5.5 percent rate of return. How much money did Mrs. Black contribute to the fund assuming that only the interest income is distributed? A. B. C. D. E. $41,935.48 $61,904.76 $68,575.00 $1,300,000.00 $1,181,818.18 83. A preferred stock pays an annual dividend of $3.75. What is one share of this stock worth today if the rate of return is 8 percent? A. B. C. D. E. $.30 $4.05 $8.00 $46.88 $52.50 84. You would like to establish a trust fund that will provide $300,000 a year forever for your heirs. The trust fund is going to be invested very conservatively so the expected rate of return is only 4.5 percent. How much money must you deposit today to fund this gift for your heirs? A. B. C. D. E. $3.14 million $3.22 million $6.00 million $6.67 million $6.97 million 85. You just paid $425,000 for an insurance annuity that will pay you and your heirs $15,000 a year forever. What rate of return are you earning on this policy? A. B. C. D. E. 3.31 percent 3.33 percent 3.42 percent 3.47 percent 3.53 percent 86. Your father won a lottery years ago. The value of his winnings at the time was $225,000. He invested this money such that it will provide annual payments of $12,000 a year to his heirs forever. What is the rate of return? A. B. C. D. E. 1.88 percent 2.85 percent 5.33 percent 5.49 percent 6.02 percent 87. The preferred stock of Western Mines has a 4.62 percent dividend yield. The stock is currently priced at $38.50 per share. What is the amount of the annual dividend? A. B. C. D. E. $1.78 $1.84 $2.10 $2.13 $2.34 88. Your credit card company charges you 1.45 percent per month. What is the annual percentage rate on your account? A. B. C. D. E. 16.67 percent 16.79 percent 17.40 percent 18.00 percent 18.86 percent 89. What is the annual percentage rate on a loan with a stated rate of 1.75 percent per quarter? A. B. C. D. E. 6.50 percent 7.00 percent 7.19 percent 8.00 percent 8.13 percent 90. You are paying an effective annual rate of 19.56 percent on your credit card. The interest is compounded monthly. What is the annual percentage rate on this account? A. B. C. D. E. 17.50 percent 18.00 percent 18.25 percent 18.64 percent 19.00 percent 91. What is the effective annual rate if a bank charges you 8.48 percent compounded quarterly? A. B. C. D. E. 8.20 percent 8.48 percent 8.75 percent 9.02 percent 9.46 percent 92. Your credit card company quotes you a rate of 18.9 percent. Interest is billed monthly. What is the actual rate of interest you are paying? A. B. C. D. E. 19.48 percent 19.67 percent 20.63 percent 20.87 percent 21.21 percent 93. Tight-Wad Rosie loans money at an annual rate of 22 percent and compounds interest daily. What is the actual rate she is charging on her loans? A. B. C. D. E. 94. 24.49 percent 24.60 percent 25.54 percent 26.78 percent 26.99 percent You are considering two loans. The terms of the two loans are equivalent with the exception of the interest rates. Loan A offers a rate of 8.10 percent compounded daily. Loan B offers a rate of 8.25 percent compounded semi-annually. Loan _____ is the better offer because______. A. B. C. D. E. A; the effective annual rate is 8.41 percent A; the annual percentage rate is 8.41 percent B; the annual percentage rate is 8.32 percent B; the interest is compounded less frequently B; the effective annual rate is 8.42 percent 95. You have $3,500 that you want to use to open a savings account. You have found five different accounts that are acceptable to you. All you have to do now is determine which account you want to use such that you can earn the highest rate of interest possible. Which account should you use based upon the annual percentage rates quoted by each bank? account A: 3.25 percent, compounded annually account B: 3.18 percent, compounded monthly account C: 3.20 percent, compounded semi-annually account D: 3.15 percent, compounded continuously account E: 3.15 percent, compounded quarterly A. B. C. D. E. account A account B account C account D account E 96. What is the effective annual rate of 17.9 percent compounded continuously? A. B. C. D. E. 18.86 percent 18.98 percent 19.37 percent 19.44 percent 19.60 percent 97. What is the effective annual rate of 10.35 percent compounded continuously? A. B. C. D. E. 10.67 percent 10.84 percent 10.90 percent 10.97 percent 11.02 percent 98. Newtown Bank wants to appear competitive based on quoted loan rates and thus must offer an 8.7 percent annual percentage rate on its loans. What is the maximum rate the bank can actually earn based on the quoted rate? A. B. C. D. E. 8.89 percent 8.94 percent 8.98 percent 9.02 percent 9.09 percent 99. You are going to loan your friend $1,500 for one year at a 6 percent rate of interest. How much additional interest can you earn if you compound the rate continuously rather than annually? A. B. C. D. E. $1.97 $2.75 $3.14 $3.36 $4.20 100. You are borrowing money today at a 7.9 percent interest rate. You will repay the principle plus all the interest in one lump sum of $7,500 four years from today. How much are you borrowing? A. B. C. D. E. $5,250.00 $5,233.50 $5,533.19 $5,611.08 $6,000.00 101. This morning you borrowed $6,000 at 8.45 percent annual interest. You are to repay the loan principle plus all of the loan interest in one lump sum three years from today. How much will you have to repay? A. B. C. D. E. $7,653.14 $7,680.29 $7,711.21 $7,450.89 $7,682.20 102. On this date last year, you borrowed $12,500. You have to repay the loan principle plus all of the interest five years from today. The payment that is required at that time is $17,500. What is the interest rate on this loan? A. B. C. D. E. 5.77 percent 7.87 percent 8.25 percent 8.40 percent 9.89 percent 103. The Corner Drug Store just borrowed $250,000 from the bank. The loan terms require annual interest payments with the entire principle payable after six years. The interest rate is 9.45 percent. How much will The Corner Drug Store owe the bank in year five of the loan? A. B. C. D. E. $23,625.00 $32,750.00 $44,367.21 $56,479.75 $65,025.31 104. On the day you enter college you borrow $12,000 from your local bank. The terms of the loan include an interest rate of 5.45 percent. The terms stipulate that the principle is due in full one year after you graduate. Interest is to be paid annually at the end of each year. Assume that you complete college in four years. How much will you pay the bank one year after you graduate? A. B. C. D. E. $2,806.27 $3,419.59 $12,000.00 $12,654.00 $15,646.39 105. On the day you enter college you borrow $18,000 from your local bank. The terms of the loan include an interest rate of 5.75 percent. The terms stipulate that the principle is due in full one year after you graduate. Interest is to be paid annually at the end of each year. Assume that you complete college in four years. How much total interest will you pay on this loan? A. B. C. D. E. $1,035 $4,140 $4,051 $4,181 $5,175 106. On November 1, you take out a mortgage in the amount of $189,500 at an 8.5 percent interest rate compounded monthly. Payments are to be made at the end of each month for thirty years. How much of the first loan payment is interest? (Assume that each month is equal to 1/12 of a year.) A. B. C. D. E. $536.92 $1,342.29 $2,684.58 $4,974.38 $6,316.67 107. On March 1, you borrow $239,000 to buy a house. The mortgage rate is 7.75 percent. The loan is to be repaid in equal monthly payments over 20 years. The first payment is due on April 1. How much of the third payment applies to the principle balance? (Assume that each month is equal to 1/12 of a year.) A. B. C. D. E. $418.53 $421.23 $423.95 $1,540.84 $1,543.54 Essay Questions 108. Explain the difference between the effective annual rate (EAR) and the annual percentage rate (APR). 109. Assume you are the advertising manager of your local bank. Which rate do you prefer to advertise on monthly-compounded loans, the effective annual rate (EAR) or the annual percentage rate (APR)? Which rate do you prefer to advertise on quarterly-compounded savings accounts, the EAR or the APR? Explain. As a consumer, which rate do you prefer and why? 110. You are considering two annuities, both of which pay a total of $10,000 over the life of the annuity. Annuity A pays $1,000 at the end of each year for the next 10 years. Annuity B pays $500 at the end of each year for the next 20 years. Which annuity has the greater value today? Is there any circumstance where the two annuities would have equal values as of today? Explain. 111. There are three factors that affect the present value of an annuity. Explain what these three factors are and discuss how an increase in each factor will impact the present value of the annuity. 112. Bill owns a perpetuity which pays $5,000 at the end of each year. He comes to you and offers to sell you all of the payments to be received after the 25th year for a price of $10,000. At an interest rate of 8 percent, should you accept his offer? What does this suggest to you about the value of a perpetuity? ch6 KEY Multiple Choice Questions 1. An annuity is a(n): A. B. C. D. E. level stream of perpetual cash flows. level stream of cash flows occurring for a fixed period of time. increasing stream of perpetual cash flows. increasing stream of cash flows occurring for a fixed period of time. decreasing stream of cash flows occurring for a fixed period of time. Ross - Chapter 006 #1 SECTION: 6.2 TOPIC: ANNUITY TYPE: DEFINITIONS 2. Which one of the following is the annuity present value factor? A. (1 + Present value factor) / r B. (1 Present value factor) / r C. Present value factor + (1 / r) D. (Present value factor r) + (1 / r) E. r (1 + Present value factor) Ross - Chapter 006 #2 SECTION: 6.2 TOPIC: PRESENT VALUE FACTOR FOR ANNUITIES TYPE: DEFINITIONS 3. What is a consol? A. B. C. D. E. a type of annuity issued by an insurance company a name used in Canada for a perpetuity an annuity stream of payments received as an inheritance a decreasing stream of perpetual payments an increasing stream of perpetual payments Ross - Chapter 006 #3 SECTION: 6.2 TOPIC: CONSOL TYPE: DEFINITIONS 4. How is an annuity due defined? A. B. C. D. E. a stream of cash flows occurring for less than one year an annuity stream of payments that are disbursed rather than received an annuity stream of payments that are received rather than disbursed a set of equal cash flows occurring at the end of each period a set of equal cash flows occurring at the beginning of each period Ross - Chapter 006 #4 SECTION: 6.2 TOPIC: ANNUITIES DUE TYPE: DEFINITIONS 5. An annuity stream where the payments occur forever is called a(n): A. B. C. D. E. annuity due. indemnity. perpetuity. amortized cash flow stream. ordinary annuity. Ross - Chapter 006 #5 SECTION: 6.2 TOPIC: PERPETUITY TYPE: DEFINITIONS 6. What is the interest rate that is expressed in terms of the interest payment made each period called? A. B. C. D. E. stated interest compound interest effective annual periodic interest daily interest Ross - Chapter 006 #6 SECTION: 6.3 TOPIC: STATED INTEREST RATES TYPE: DEFINITIONS 7. What is the interest rate that is expressed as if it were compounded once per year called? A. B. C. D. E. stated interest compound interest effective annual periodic interest daily interest Ross - Chapter 006 #7 SECTION: 6.3 TOPIC: EFFECTIVE ANNUAL RATE TYPE: DEFINITIONS 8. What is the interest rate charged per period multiplied by the number of periods per year called? A. B. C. D. E. effective annual annual percentage periodic interest compound interest daily interest Ross - Chapter 006 #8 SECTION: 6.3 TOPIC: ANNUAL PERCENTAGE RATE TYPE: DEFINITIONS 9. A loan where the borrower receives money today and repays a single lump sum on a future date is called a(n) _____ loan. A. amortized B. continuous C. balloon D. pure discount E. interest-only Ross - Chapter 006 #9 SECTION: 6.4 TOPIC: PURE DISCOUNT LOAN TYPE: DEFINITIONS 10. A loan where the borrower pays interest each period and repays the entire principal of the loan at some point in the future is called a(n) _____ loan. A. B. C. D. E. amortized continuous balloon pure discount interest-only Ross - Chapter 006 #10 SECTION: 6.4 TOPIC: INTEREST-ONLY LOAN TYPE: DEFINITIONS 11. A loan where the borrower pays interest each period, and repays some or all of the principal of the loan over time is called a(n) _____ loan. A. B. C. D. E. amortized continuous balloon pure discount interest-only Ross - Chapter 006 #11 SECTION: 6.4 TOPIC: AMORTIZED LOAN TYPE: DEFINITIONS 12. A loan where the borrower pays interest each period, repays part of the principal of the loan over time, and repays the remainder of the principal at the end of the loan, is called a(n) _____ loan. A. B. C. D. E. amortized continuous balloon pure discount interest-only Ross - Chapter 006 #12 SECTION: 6.4 TOPIC: BALLOON LOAN TYPE: DEFINITIONS 13. You are comparing two annuities which offer monthly payments of $500 for ten years and pay 0.5 percent interest per month. Annuity A will pay you on the first of each month while annuity B will pay you on the last day of each month. Which one of the following statements is correct concerning these two annuities? A. Both annuities are of equal value today. B. C. D. E. Annuity B is an annuity due. Annuity A has a higher future value than annuity B. Annuity B has a higher present value than annuity A. Both annuities have the same future value as of ten years from today. Ross - Chapter 006 #13 SECTION: 6.2 TOPIC: ORDINARY ANNUITY VERSUS ANNUITY DUE TYPE: CONCEPTS 14. You are comparing two investment options that pay 7 percent interest annually. Both options will provide you with $20,000 of income. Option A pays five annual payments starting with $8,000 the first year followed by four annual payments of $3,000 each. Option B pays five annual payments of $4,000 each. Which one of the following statements is correct given these two investment options? A. B. C. D. E. Both options are of equal value given that they both provide $20,000 of income. Option A is the better choice. Option B has a higher present value than option A. Option B is a perpetuity. Option A is preferable because it is an annuity due. Ross - Chapter 006 #14 SECTION: 6.1 AND 6.2 TOPIC: UNEVEN CASH FLOWS AND PRESENT VALUE TYPE: CONCEPTS 15. You are considering two projects with the following cash flows: Which of the following statements are true concerning these two projects? I. Both projects have the same future value at the end of year 4, given a positive rate of return. II. Both projects have the same future value given a zero rate of return. III. Both projects have the same future value at any point in time, given a positive rate of return. IV. Project B has a higher future value than project A, given a positive rate of return. A. B. C. D. E. II only IV only I and III only II and IV only I, II, and III only Ross - Chapter 006 #15 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND FUTURE VALUE TYPE: CONCEPTS 16. How does a perpetuity differ from an annuity? A. perpetuity payments vary with the rate of inflation B. perpetuity payments vary with the market rate of interest C. perpetuity payments are variable while annuity payments are constant D. perpetuity payments never cease E. annuity payments are smaller in amount Ross - Chapter 006 #16 SECTION: 6.2 TOPIC: PERPETUITY VERSUS ANNUITY TYPE: CONCEPTS 17. Which one of the following statements concerning the annual percentage rate is correct? A. The annual percentage rate considers interest on interest. B. The rate of interest you actually pay on a loan is called the annual percentage rate. C. The effective annual rate is lower than the annual percentage rate when an interest rate is compounded quarterly. D. When firms advertise the annual percentage rate they are violating U.S. truth-in-lending laws. E. The annual percentage rate equals the effective annual rate when the rate on an account is designated as simple interest. Ross - Chapter 006 #17 SECTION: 6.3 TOPIC: ANNUAL PERCENTAGE RATE TYPE: CONCEPTS 18. Which one of the following statements concerning interest rates is correct? A. B. C. D. The stated rate is the same as the effective annual rate. The effective annual rate is the rate that applies if interest is compounded annually. The annual percentage rate increases as the number of compounding periods per year increases. Borrowers prefer more frequent compounding on their loan accounts given a stated annual percentage rate. E. For any positive rate of interest, the effective annual rate will always exceed the annual percentage rate. Ross - Chapter 006 #18 SECTION: 6.3 TOPIC: INTEREST RATES TYPE: CONCEPTS 19. Which of the following statements concerning the effective annual rate are correct? I. When making financial decisions, you should compare effective annual rates rather than annual percentage rates. II. The more frequently interest is compounded, the higher the effective annual rate given a fixed annual percentage rate. III. A quoted rate of 6 percent compounded continuously has a higher effective annual rate than if the rate were compounded daily. IV. When choosing which loan to accept, you should select the offer with the highest effective annual rate. A. B. C. D. E. I and II only I and IV only I, II, and III only II, III, and IV only I, II, III, and IV Ross - Chapter 006 #19 SECTION: 6.3 TOPIC: EFFECTIVE ANNUAL RATE TYPE: CONCEPTS 20. The highest effective annual rate that can be derived from an annual percentage rate of 9 percent is computed as: A. .09e B. e.09 1. q. C. e (1 + .09). D. e.09 1. E. (1 + .09)q. Ross - Chapter 006 #20 SECTION: 6.3 TOPIC: CONTINUOUS COMPOUNDING TYPE: CONCEPTS 21. A pure discount loan is a(n): A. B. C. D. E. example of a present value problem. loan that is interest-free. loan that grants you a discount if you pay your payments on time. loan that requires all interest to be paid at the time the loan is made. loan that discounts the payments if you pay them in advance. Ross - Chapter 006 #21 SECTION: 6.4 TOPIC: PURE DISCOUNT LOAN TYPE: CONCEPTS 22. The principle amount of an interest-only loan is: A. B. C. D. E. never repaid. repaid in equal increments and included in each loan payment. repaid in full at the end of the loan period. repaid in equal annual payments even when the loan interest is repaid monthly. repaid in increasing increments and included in each loan payment. Ross - Chapter 006 #22 SECTION: 6.4 TOPIC: INTEREST-ONLY LOAN TYPE: CONCEPTS 23. An amortized loan: A. requires the principle amount to be repaid in even increments over the life of the loan. B. may have equal or increasing amounts applied to the principle from each loan payment. C. requires that all interest be repaid on a monthly basis while the principle is repaid at the end of the loan term. D. requires that all payments be equal in amount and include both principle and interest. E. repays both the principle and the interest in one lump sum at the end of the loan term. Ross - Chapter 006 #23 SECTION: 6.4 TOPIC: AMORTIZED LOAN TYPE: CONCEPTS 24. Your parents are giving you $500 a month for five years while you attend college to earn both a bachelor's and a master's degree. At a 7 percent discount rate, what are these payments worth to you when you first enter college? A. B. C. D. E. $22,681.13 $24,601.18 $25,251.00 $27,209.17 $30,000.00 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #24 SECTION: 6.2 TOPIC: ORDINARY ANNUITY AND PRESENT VALUE TYPE: PROBLEMS 25. You just won the lottery! As your prize you will receive $1,500 a month for twenty years. If you can earn 9 percent on your money, what is this prize worth to you today? A. B. C. D. E. $152,087.19 $156,098.29 $157,408.16 $164,313.82 $166,717.43 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #25 SECTION: 6.2 TOPIC: ORDINARY ANNUITY AND PRESENT VALUE TYPE: PROBLEMS 26. Angela is able to pay $230 a month for 6 years on a car loan. If the interest rate is 7.9 percent, how much can she afford to borrow to buy a car? A. B. C. D. E. $13,154.54 $13,408.17 $13,528.28 $13,666.67 $13,809.19 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #26 SECTION: 6.2 TOPIC: ORDINARY ANNUITY AND PRESENT VALUE TYPE: PROBLEMS 27. You are the beneficiary of a life insurance policy. The insurance company informs you that you have two options for receiving the insurance proceeds. You can receive a lump sum of $150,000 today or receive payments of $1,627.89 a month for 10 years. You can earn 7.5 percent on your money. Which option should you take and why? A. B. C. D. E. You should accept the payments because they are worth $151,291.91 to you today. You should accept the payments because they are worth $153,417.68 to you today. You should accept the payments because they are worth $154,311.12 to you today. You should accept the $150,000 because the payments are only worth $137,141.17 to you today. You should accept the $150,000 because the payments are only worth $134,808.17 to you today. AACSB TOPIC: ANALYTIC Ross - Chapter 006 #27 SECTION: 6.2 TOPIC: ORDINARY ANNUITY AND PRESENT VALUE TYPE: PROBLEMS 28. Your employer contributes $50 a week to your retirement plan. Assume that you work for your employer for another 12 years and that the applicable discount rate is 8 percent. Given these assumptions, what is this employee benefit worth to you today? A. B. C. D. E. $20,046.80 $21,212.12 $21,406.14 $22,989.76 $23,521.79 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #28 SECTION: 6.2 TOPIC: ORDINARY ANNUITY AND PRESENT VALUE TYPE: PROBLEMS 29. You have a sub-contracting job with a local manufacturing firm. Your agreement calls for annual payments of $82,000 for the next 3 years. At a discount rate of 9.5 percent, what is this job worth to you today? A. B. C. D. E. $162,556.16 $205,730.36 $209,408.37 $211,417.06 $213,918.01 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #29 SECTION: 6.2 TOPIC: ORDINARY ANNUITY AND PRESENT VALUE TYPE: PROBLEMS 30. Swenson & Swenson just decided to save $2,200 a month for the next 6 years as a safety net for recessionary periods. The money will be set aside in a separate savings account which pays 5.5 percent interest compounded monthly. They deposit the first $2,200 today. If the company had wanted to deposit an equivalent lump sum today, how much would they have had to deposit? A. $130,297.18 B. C. D. E. $134,656.34 $135,273.51 $137,778.92 $138,001.14 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #30 SECTION: 6.2 TOPIC: ANNUITY DUE AND PRESENT VALUE TYPE: PROBLEMS 31. You need some money today and the only friend you have that has any is your miserly friend. He agrees to loan you the money you need, if you make payments of $15 a month for the next nine months. In keeping with his reputation, he requires that the first payment be paid today. He also charges you 2 percent interest per month. How much money are you borrowing? A. B. C. D. E. $120.67 $122.43 $124.88 $126.49 $135.00 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #31 SECTION: 6.2 TOPIC: ANNUITY DUE AND PRESENT VALUE TYPE: PROBLEMS 32. You buy an annuity which will pay you $7,800 a year for 15 years. The payments are paid on the first day of each year. What is the value of this annuity today if the discount rate is 12 percent? A. B. C. D. $53,124.74 $59,499.71 $62,407.18 $64,311.21 E. $65,258.58 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #32 SECTION: 6.2 TOPIC: ANNUITY DUE AND PRESENT VALUE TYPE: PROBLEMS 33. You are scheduled to receive annual payments of $15,000 for each of the next 13 years. The discount rate is 9 percent. What is the difference in the present value if you receive these payments at the beginning of each year rather than at the end of each year? A. B. C. D. E. $9,211.07 $9,698.17 $9,704.38 $9,876.47 $10,107.32 Difference = $122,410.88 Note: The difference = .09 $112,303.56 = $10,107.32 $112,303.5589 = $10,107.32 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #33 SECTION: 6.2 TOPIC: ORDINARY ANNUITY VERSUS ANNUITY DUE TYPE: PROBLEMS 34. You are comparing two annuities with equal present values. The applicable discount rate is 11.25 percent. One annuity pays $6,000 on the first day of each year for 25 years. How much does the second annuity pay each year for 25 years if it pays at the end of each year? A. B. C. D. E. $6,350 $6,408 $6,675 $6,921 $7,100 Because each payment is received one year later, then the cash flow has to equal: $6,000 = $6,675 (1 + .1125) AACSB TOPIC: ANALYTIC Ross - Chapter 006 #34 SECTION: 6.2 TOPIC: ORDINARY ANNUITY VERSUS ANNUITY DUE TYPE: PROBLEMS 35. Betsy receives $600 on the first of each month. Jen receives $600 on the last day of each month. Both Betsy and Jen will receive payments for four years. At a 7 percent discount rate, what is the difference in the present value of these two sets of payments? A. B. C. D. E. $135.40 $137.46 $138.09 $141.41 $146.16 Difference = $25,202.28 $25,056.12 = $146.16 Note: Difference AACSB TOPIC: ANALYTIC Ross - Chapter 006 #35 SECTION: 6.2 TOPIC: ORDINARY ANNUITY VERSUS ANNUITY DUE TYPE: PROBLEMS 36. What is the future value of $3,400 a year for 6 years at a 9 percent rate of interest? A. B. C. D. E. $22,051.60 $23,876.49 $24,011.77 $25,579.34 $27,881.48 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #36 SECTION: 6.2 TOPIC: ORDINARY ANNUITY AND FUTURE VALUE TYPE: PROBLEMS 37. What is the future value of $1,650 a year for 9 years at a 7 percent rate of interest? A. B. C. D. E. $17,409.08 $19,763.68 $21,254.45 $23,136.19 $25,222.22 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #37 SECTION: 6.2 TOPIC: ORDINARY ANNUITY AND FUTURE VALUE TYPE: PROBLEMS 38. Marcia plans on saving $6,000 a year and expects to earn an annual rate of 11.5 percent. How much will she have in her account at the end of 40 years? A. B. C. D. E. $4,007,098 $4,467,914 $5,911,408 $6,221,009 $6,347,238 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #38 SECTION: 6.2 TOPIC: ORDINARY ANNUITY AND FUTURE VALUE TYPE: PROBLEMS 39. Christie adds $2,000 to her savings account on the first day of each year. Todd adds $2,000 to his savings account on the last day of each year. They both earn a 7 percent rate of return. What is the difference in their savings account balances at the end of 25 years? A. B. C. D. E. $8,854.86 $9,003.48 $9,126.39 $9,130.07 $9,041.14 Difference = $135,352.94 $126,498.08 = $8,854.86 Note: Difference = $126,498.08 .07 = $8,854.8656 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #39 SECTION: 6.2 TOPIC: ANNUITY DUE VERSUS ORDINARY ANNUITY TYPE: PROBLEMS 40. You borrow $14,500 to buy a car. The terms of the loan call for monthly payments for 6 years at a 6.9 percent rate of interest. What is the amount of each payment? A. B. C. D. E. $238.87 $240.27 $246.51 $249.08 $252.50 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #40 SECTION: 6.2 TOPIC: ORDINARY ANNUITY PAYMENTS TYPE: PROBLEMS 41. You borrow $187,500 to buy a house. The mortgage rate is 7.25 percent and the loan period is 25 years. Payments are made monthly. If you pay for the house according to the loan agreement, how much total interest will you pay? A. $186,408 B. C. D. E. $219,079 $227,001 $264,319 $291,406 Total interest = ($1,355.262871 25 12) $187,500 = $219,079 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #41 SECTION: 6.2 AND 6.4 TOPIC: ORDINARY ANNUITY PAYMENTS AND COST OF INTEREST TYPE: PROBLEMS 42. The Home Improvement Center (HIC) has an employment contract with the newly hired CEO. The contract requires a lump sum payment of $32.4 million be paid to the CEO upon the successful completion of her first five years of service. HIC wants to set aside an equal amount of money at the end of each year to cover this anticipated cash outflow and will earn 7.25 percent on the funds. How much must HIC set aside each year for this purpose? A. B. C. D. E. $5,227,064 $5,606,026 $5,668,987 $6,778,958 $7,270,433 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #42 SECTION: 6.2 TOPIC: ORDINARY ANNUITY PAYMENTS AND FUTURE VALUE TYPE: PROBLEMS 43. Pat retires at age 58 and expects to live to age 90. On the day she retires, she has $287,409 in her retirement savings account. She is conservative and expects to earn 5.25 percent on her money during her retirement years. How much can she withdraw from her retirement savings each month if she plans to die on the day she spends her last penny? A. B. C. D. E. $1,359.79 $1,364.18 $1,540.01 $1,546.75 $1,702.11 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #43 SECTION: 6.2 TOPIC: ORDINARY ANNUITY PAYMENTS AND PRESENT VALUE TYPE: PROBLEMS 44. The Chelsey Group purchased a piece of property for $4.8 million. They paid a down payment of 25 percent in cash and financed the balance. The loan terms require monthly payments for 25 years at an annual percentage rate of 8.65 percent compounded monthly. What is the amount of each mortgage payment? A. B. C. D. E. $27,804.13 $27,989.62 $28,406.23 $29,142.91 $29,352.98 Amount financed = $4,800,000 (1 .25) = $3,600,000 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #44 SECTION: 6.2 TOPIC: ORDINARY ANNUITY PAYMENTS AND PRESENT VALUE TYPE: PROBLEMS 45. You estimate that you will have $31,870 in student loans by the time you graduate. The interest rate is 5.45 percent. If you want to have this debt paid in full within four years, how much must you pay each month? A. B. C. D. E. $737.11 $738.82 $739.34 $740.46 $741.09 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #45 SECTION: 6.2 TOPIC: ORDINARY ANNUITY PAYMENTS AND PRESENT VALUE TYPE: PROBLEMS 46. You are buying a previously owned car today at a price of $4,950. You are paying $750 down in cash and financing the balance for 42 months at 8.45 percent. What is the amount of each loan payment? A. B. C. D. E. $108.54 $115.05 $115.86 $135.60 $136.55 Amount financed = $4,950 $750 = $4,200 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #46 SECTION: 6.2 TOPIC: ORDINARY ANNUITY PAYMENTS AND PRESENT VALUE TYPE: PROBLEMS 47. The Helping Hand Insurance Company wants to sell you an annuity which will pay you $2,750 per quarter for 20 years. You want to earn a minimum rate of return of 6.25 percent. What is the most you are willing to pay as a lump sum today to buy this annuity? A. B. C. D. E. $125,085.43 $127,039.89 $179,544.36 $193,573.08 $198,747.27 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #47 SECTION: 6.2 TOPIC: ORDINARY ANNUITY PAYMENTS AND PRESENT VALUE TYPE: PROBLEMS 48. Your car dealer is willing to lease you a new car for $199 a month for 72 months. Payments are due on the first day of each month starting with the day you sign the lease contract. If your cost of money is 5.45 percent, what is the current value of the lease? A. B. C. D. E. $11,708.18 $11,297.60 $12,197.74 $12,253.14 $13,008.31 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #48 SECTION: 6.2 TOPIC: ANNUITY DUE PAYMENTS AND PRESENT VALUE TYPE: PROBLEMS 49. Your favorite grandmother left you an inheritance in the form of a trust. The trust agreement states that you are to receive $10,000 on the first day of each year, starting immediately and continuing for 25 years. What is the value of this inheritance today if the applicable discount rate is 7.5 percent? A. B. C. D. E. $107,006.67 $111,469.46 $114,141.41 $117,208.42 $119,829.67 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #49 SECTION: 6.2 TOPIC: ANNUITY DUE PAYMENTS AND PRESENT VALUE TYPE: PROBLEMS 50. You just received an insurance settlement offer related to an accident you had four years ago. The offer gives you a choice of one of the following three offers: Option A: $6,500 on the first day of each year for 40 years Option B: $610 on the first day of each month for 25 years Option C: $75,000 as a lump sum payment today You can earn 8.75 percent on your investments. You do not care if you personally receive the funds or if they are paid to your heirs should you die within the settlement period. Which one of the following statements is correct given this information? A. Option C is the best choice since you can earn 8.75 percent on the entire lump sum starting immediately. B. Option B is the best choice since it offers the largest number of payments. C. Option A is the best choice since it has the largest present value. D. Option B is the best choice since it has the largest present value. E. You are indifferent to the three options as they are all equal in value to you. Option A has a present value of $77,966.27. Option B has a present value of $74,737.30. Option C has a present value of $75,000. Option A is the best choice since it has the largest present value. AACSB TOPIC: ANALYTIC Ross - Chapter 006 #50 SECTION: 6.2 TOPIC: ANNUITY DUE PAYMENTS AND PRESENT VALUE TYPE: PROBLEMS 51. Priestly Engineers wants to save $145,000 to buy some new equipment two years from now. The plan is to set aside an equal amount of money on the first day of each quarter starting today. The firm can earn a 5.5 percent rate of return. How much does the firm have to save each quarter to achieve their goal? A. B. C. D. E. $17,084.43 $17,036.35 $17,270.60 $17,308.67 $17,421.18 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #51 SECTION: 6.2 TOPIC: ANNUITY DUE PAYMENTS AND FUTURE VALUE TYPE: PROBLEMS 52. Starting today, Stephen is going to contribute $200 on the first of each month to his retirement account. His employer will contribute an additional 50 percent of the amount Stephen contributes. If both Stephen and his employer continue to do this and he can earn a monthly rate of 0.75 percent, how much will Stephen have in his retirement account 40 years from now? A. B. C. D. E. $936,264 $943,286 $1,404,396 $1,414,929 $1,672,413 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #52 SECTION: 6.2 TOPIC: ANNUITY DUE PAYMENTS AND FUTURE VALUE TYPE: PROBLEMS 53. You are considering an annuity which costs $250,000 today. The annuity pays $30,000 a year at an annual interest rate of 6.25 percent. What is the length of the annuity time period? A. B. C. D. E. 11.11 years 11.67 years 12.14 years 12.38 years 12.49 years AACSB TOPIC: ANALYTIC Ross - Chapter 006 #53 SECTION: 6.2 TOPIC: ORDINARY ANNUITY TIME PERIODS AND PRESENT VALUE TYPE: PROBLEMS 54. Today, you signed loan papers agreeing to borrow $35,000 at 9.75 percent compounded monthly. The loan payment is $700 a month. How many loan payments must you make before the loan is paid in full? A. B. C. D. E. 62.00 63.25 63.48 63.74 64.42 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #54 SECTION: 6.2 TOPIC: ORDINARY ANNUITY TIME PERIODS AND PRESENT VALUE TYPE: PROBLEMS 55. Huntington Manor would like to buy some additional land and build a new assisted living center. The anticipated total cost is $12.4 million. The CEO of the firm is quite conservative and will only do this when the company has sufficient funds to pay cash for the entire construction project. Management has decided to save $235,000 a month for this purpose. The firm earns 7 percent compounded monthly on the funds it saves. How long does the company have to wait before expanding its operations? A. B. C. D. E. 30.32 months 31.23 months 46.14 months 49.68 months 54.00 months AACSB TOPIC: ANALYTIC Ross - Chapter 006 #55 SECTION: 6.2 TOPIC: ORDINARY ANNUITY TIME PERIODS AND FUTURE VALUE TYPE: PROBLEMS 56. Today, you are retiring. You have a total of $387,419 in your retirement savings and have the funds invested such that you expect to earn an average of 6.8 percent, compounded monthly, on this money throughout your retirement years. You want to withdraw $3,000 at the beginning of every month, starting today. How long will it be until you run out of money? A. B. C. D. E. 225.05 months 228.47 months 230.19 months 232.14 months 233.33 months AACSB TOPIC: ANALYTIC Ross - Chapter 006 #56 SECTION: 6.2 TOPIC: ANNUITY DUE TIME PERIODS AND PRESENT VALUE TYPE: PROBLEMS 57. Slow Poke Corp. is notoriously known as a slow-payer. The firm currently needs to borrow $36,000 and only one company will even deal with them. The terms of the loan call for daily payments of $55. The first payment is due today. The interest rate is 24 percent compounded daily. What is the time period of this loan? A. B. C. D. E. 2.34 years 2.48 years 2.54 years 2.67 years 2.82 years AACSB TOPIC: ANALYTIC Ross - Chapter 006 #57 SECTION: 6.2 TOPIC: ANNUITY DUE TIME PERIODS TYPE: PROBLEMS 58. Jonathan's Apple Orchard is considering a project which has an initial cash requirement of $218,700. The project will yield cash flows of $3,725 monthly for 72 months. What is the rate of return on this project? A. B. C. D. E. 6.97 percent 7.04 percent 7.28 percent 7.41 percent 7.56 percent ; This cannot be solved directly, so it's easiest to just use the calculator method to get an answer. You can then use the calculator answer as the rate in the formula just to verify that your answer is correct. AACSB TOPIC: ANALYTIC Ross - Chapter 006 #58 SECTION: 6.2 TOPIC: ORDINARY ANNUITY INTEREST RATE TYPE: PROBLEMS 59. Your insurance agent is trying to sell you an annuity that costs $165,000 today. By buying this annuity, your agent promises that you will receive payments of $775 a month for the next 40 years. What is the rate of return on this investment? A. B. C. D. E. 4.28 percent 4.39 percent 4.52 percent 4.67 percent 4.81 percent This cannot be solved directly, so it's easiest to just use the calculator method to get an answer. You can then use the calculator answer as the rate in the formula just to verify that your answer is correct. AACSB TOPIC: ANALYTIC Ross - Chapter 006 #59 SECTION: 6.2 TOPIC: ORDINARY ANNUITY INTEREST RATE TYPE: PROBLEMS 60. You have been investing $165 a month for the last 12 years. Today, your investment account is worth $60,508.29. What is your average rate of return on your investments? A. B. C. D. E. 13.77 percent 13.80 percent 13.84 percent 13.89 percent 14.03 percent This cannot be solved directly, so it's easiest to just use the calculator method to get an answer. You can then use the calculator answer as the rate in the formula just to verify that your answer is correct. AACSB TOPIC: ANALYTIC Ross - Chapter 006 #60 SECTION: 6.2 TOPIC: ORDINARY ANNUITY INTEREST RATE TYPE: PROBLEMS 61. Susan Sunshine has been investing $160,000 a year for the past 9 years into Sunshine in a Can, Inc. Today, as the sole shareholder, she sold Sunshine in a Can, Inc. for $2.6 million. What is her rate of return on this investment? A. B. C. D. E. 14.13 percent 14.24 percent 14.29 percent 14.37 percent 14.42 percent This cannot be solved directly, so it's easiest to just use the calculator method to get an answer. You can then use the calculator answer as the rate in the formula just to verify that your answer is correct. AACSB TOPIC: ANALYTIC Ross - Chapter 006 #61 SECTION: 6.2 TOPIC: ORDINARY ANNUITY INTEREST RATE TYPE: PROBLEMS 62. Your grandmother helped you start saving $10 a month beginning on your 6th birthday. She always made you make your deposit on the first day of each month just to "start the month out right". Today, you turn 21 and have $2,994.21 in your account. What is the rate of return on your savings? A. B. C. D. E. 6.18 percent 6.21 percent 6.25 percent 6.28 percent 6.31 percent This cannot be solved directly, so it's easiest to just use the calculator method to get an answer. You can then use the calculator answer as the rate in the formula just to verify that your answer is correct. To more decimal places, the answer is 6.2799899 percent. AACSB TOPIC: ANALYTIC Ross - Chapter 006 #62 SECTION: 6.2 TOPIC: ANNUITY DUE INTEREST RATE TYPE: PROBLEMS 63. Today, you turn 21. Your birthday wish is that you will be a millionaire by your 41st birthday. In an attempt to reach this goal, you decide to save $30 a day, every day until you turn 41. You open an investment account and deposit your first $30 today. What rate of return must you earn to achieve your goal? A. B. C. D. E. 12.65 percent 12.71 percent 12.78 percent 12.82 percent 12.85 percent This cannot be solved directly, so it's easiest to just use the calculator method to get an answer. You can then use the calculator answer as the rate in the formula just to verify that your answer is correct. To more decimal places, the answer is 12.65031578 percent. AACSB TOPIC: ANALYTIC Ross - Chapter 006 #63 SECTION: 6.2 TOPIC: ANNUITY DUE INTEREST RATE TYPE: PROBLEMS 64. You just settled an insurance claim. The settlement calls for increasing payments over a 5-year period. The first payment will be paid one year from now in the amount of $30,000. The following payments will increase by 6 percent annually. What is the value of this settlement to you today if you can earn 8.5 percent on your investments? A. B. C. D. E. $126,408.28 $129,417.11 $132,023.05 $141,414.14 $152,008.16 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #64 SECTION: 6.2 TOPIC: GROWING ANNUITY PRESENT VALUE TYPE: PROBLEMS 65. Your grandmother left you an inheritance that will provide an annual income for 25 years. You will receive the first payment one year from now in the amount of $10,000. Every year after that, the payment amount will increase by 5 percent. What is your inheritance worth to you today if you can earn 12 percent on your investments? A. B. C. D. E. $114,400.49 $116,666.67 $121,121.21 $123,464.12 $126,908.17 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #65 SECTION: 6.2 TOPIC: GROWING ANNUITY PRESENT VALUE TYPE: PROBLEMS 66. You just won a national sweepstakes! For your prize, you opted to receive never-ending payments. The first payment will be $10,000 and will be paid one year from today. Every year thereafter until forever, the payments will increase by 4 percent annually. What is the present value of your prize at a discount rate of 10 percent? A. B. C. D. E. $166,666.67 $172,500.00 $183,333.33 $191,406.15 $200,000.00 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #66 SECTION: 6.2 TOPIC: GROWING PERPETUITY PRESENT VALUE TYPE: PROBLEMS 67. A wealthy benefactor just donated some money to the local college. This gift was established to provide scholarships for worthy students. The first scholarships will be granted one year from now for a total of $50,000. Annually thereafter the scholarship amount will be increased by 5 percent to help offset the effects of inflation. The scholarship fund will last indefinitely. What is the value of this gift today at a discount rate of 7.5 percent? A. B. C. D. $1,500,000 $1,666,667 $1,750,000 $1,885,000 E. $2,000,000 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #67 SECTION: 6.2 TOPIC: GROWING PERPETUITY PRESENT VALUE TYPE: PROBLEMS 68. Chadwicke & Co. is considering acquiring S&K Industries. Chadwicke & Co. believes that S&K Industries can generate cash flows of $245,000, $270,000, and $315,000 over the next three years, respectively. After that time, they feel the business will be worthless. Chadwicke & Co. has determined that a 15 percent rate of return is applicable to this potential acquisition. What is Chadwicke & Co. willing to pay today to acquire S&K Industries? A. B. C. D. E. $622,570 $623,480 $624,320 $624,510 $625,000 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #68 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND PRESENT VALUE TYPE: PROBLEMS 69. You are considering two savings options. Both options offer a 6 percent rate of return. The first option is to save $1,500, $2,500, and $3,500 a year over the next three years, respectively. The other option is to save one lump sum amount today. If you want to have the same balance in your savings account at the end of the three years, regardless of the savings method you select, how much do you need to save today if you select the lump sum option? A. B. C. D. E. $6,211.16 $6,578.75 $7,013.47 $7,063.33 $7,500.00 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #69 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND PRESENT VALUE TYPE: PROBLEMS 70. You are considering two insurance settlement offers. The first offer includes annual payments of $15,000, $22,500, and $25,000 over the next three years, respectively. The other offer is the payment of one lump sum amount today. You are trying to decide which offer to accept given the fact that your discount rate is 6.5 percent. What is the minimum amount that you will accept today if you are to select the lump sum offer? A. B. C. D. E. $51,006.01 $52,398.29 $52,473.15 $54,618.07 $55,318.09 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #70 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND PRESENT VALUE TYPE: PROBLEMS 71. You are considering changing jobs. Your goal is to work for three years and then return to school full-time in pursuit of an advanced degree. A potential employer just offered you an annual salary of $36,000, $39,000, and $42,000 a year for the next three years, respectively. The offer also includes a starting bonus of $1,000 payable immediately. What is this offer worth to you today at a discount rate of 7.5 percent? A. B. C. D. E. $94,925.29 $98,206.13 $102,044.69 $104,879.92 $107,311.16 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #71 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND PRESENT VALUE TYPE: PROBLEMS 72. You are considering a project which will provide cash inflows of $2,100, $4,000, and $5,500 per year over the next three years, respectively. What is the present value of these cash flows, given a 13 percent discount rate? A. B. C. D. E. $7,487.78 $7,711.42 $8,050.00 $8,213.09 $8,802.77 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #72 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND PRESENT VALUE TYPE: PROBLEMS 73. You just signed a contract that will pay you $13,000, $18,000, and $25,000 annually over the next three years, respectively. What is the present value of these cash flows given a 15 percent discount rate? A. B. C. D. E. $41,352.84 $42,607.11 $42,908.17 $43,333.33 $46,827.94 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #73 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND PRESENT VALUE TYPE: PROBLEMS 74. You have some property for sale and have received two offers. The first offer is for $197,500 today in cash. The second offer is the payment of $45,000 today and an additional $200,000 two years from today. If the applicable discount rate is 12.50 percent, which offer should you accept and why? A. B. C. D. E. You should accept the $197,500 today because it has the higher net present value. You should accept the $197,500 today because it has the lower future value. You should accept the second offer because you will receive $245,000 total. You should accept the second offer because you will receive about $5,525 more in today's dollars. You should accept the second offer because it has a present value of $202,778. AACSB TOPIC: ANALYTIC Ross - Chapter 006 #74 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND PRESENT VALUE TYPE: PROBLEMS 75. Your local travel agent is advertising an upscale winter vacation package for travel two years from now to Antarctica. The package requires that you pay $15,000 today, $25,000 one year from today, and a final payment of $65,000 on the day you depart two years from today. What is the cost of this vacation in today's dollars if the discount rate is 9 percent? A. B. C. D. E. $92,644.98 $94,607.78 $95,250.00 $97,411.18 $99,987.47 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #75 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND PRESENT VALUE TYPE: PROBLEMS 76. One year ago, Dover Supply deposited $5,200 in an investment account for the purpose of buying new equipment four years from today. Today, they are adding another $5,200 to this account. The company plans on making a final deposit of $12,000 to the account one year from today. How much will be available when they are ready to buy the equipment, assuming they earn a 6.5 percent rate of return? A. B. C. D. E. $22,109.16 $25,277.78 $25,409.18 $26,581.67 $28,309.47 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #76 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND FUTURE VALUE TYPE: PROBLEMS 77. Marcia will receive $6,350 this year, $7,280 next year, and $8,470 the following year. The cash flows occur at the end of each year. What is the future value of these cash flows at the end of year 3 if the interest rate is 8 percent? A. B. C. D. E. $22,008.19 $22,116.23 $23,739.04 $24,258.58 $24,611.87 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #77 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND FUTURE VALUE TYPE: PROBLEMS 78. You plan on saving $6,500 this year, nothing next year, and $6,500 the following year. You will deposit these amounts into your investment account at the end of the year. What will your investment account be worth at the end of year three if you can earn 11.75 percent on your funds? A. B. C. D. E. $14,617.24 $15,213.80 $15,916.78 $16,334.77 $17,001.42 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #78 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND FUTURE VALUE TYPE: PROBLEMS 79. Suzette is going to receive $25,000 today as the result of an insurance settlement. In addition, she will receive $30,000 one year from today and $50,000 two years from today. She plans on saving all of this money and investing it for her retirement. If Suzette can earn an average of 12 percent on her investments, how much will she have in her account if she retires 20 years from today? A. B. C. D. E. $789,320.06 $807,446.41 $884,038.47 $930,178.26 $1,012,860.78 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #79 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND FUTURE VALUE TYPE: PROBLEMS 80. Stevenson Interiors has a $67,500 liability they must pay four years from today. The company is opening a savings account so that the entire amount will be available when this debt needs to be paid. The plan is to make an initial deposit today and then deposit an additional $10,000 a year for the next four years, starting one year from today. The account pays a 5 percent rate of return. How much does the firm need to deposit today? A. B. C. D. E. $18,299.95 $20,072.91 $21,400.33 $24,398.75 $31,076.56 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #80 SECTION: 6.1 TOPIC: PRESENT VALUE, PAYMENTS AND FUTURE VALUE TYPE: PROBLEMS 81. The government has imposed a fine on the Shady Trader. The fine calls for annual payments of $650,000, $900,000, and $1.2 million respectively over the next three years. The first payment is due one year from today. The government plans to invest the funds until the final payment is collected and then donate the entire amount, including the investment earnings, to a national securities training center. The government will earn 4.25 percent on the funds held. How much will the national securities training center receive three years from today? A. B. C. D. E. $2,844,674.06 $2,866,875.00 $2,884,549.69 $2,965,572.71 $3,115,737.67 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #81 SECTION: 6.1 TOPIC: UNEVEN CASH FLOWS AND FUTURE VALUE TYPE: PROBLEMS 82. Mrs. Black established a trust fund that provides $65,000 in scholarships each year for needy students. The trust fund earns a fixed 5.5 percent rate of return. How much money did Mrs. Black contribute to the fund assuming that only the interest income is distributed? A. B. C. D. E. $41,935.48 $61,904.76 $68,575.00 $1,300,000.00 $1,181,818.18 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #82 SECTION: 6.2 TOPIC: PERPETUITY PRESENT VALUE TYPE: PROBLEMS 83. A preferred stock pays an annual dividend of $3.75. What is one share of this stock worth today if the rate of return is 8 percent? A. B. C. D. E. $.30 $4.05 $8.00 $46.88 $52.50 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #83 SECTION: 6.2 TOPIC: PERPETUITY PRESENT VALUE TYPE: PROBLEMS 84. You would like to establish a trust fund that will provide $300,000 a year forever for your heirs. The trust fund is going to be invested very conservatively so the expected rate of return is only 4.5 percent. How much money must you deposit today to fund this gift for your heirs? A. B. C. D. E. $3.14 million $3.22 million $6.00 million $6.67 million $6.97 million AACSB TOPIC: ANALYTIC Ross - Chapter 006 #84 SECTION: 6.2 TOPIC: PERPETUITY PRESENT VALUE TYPE: PROBLEMS 85. You just paid $425,000 for an insurance annuity that will pay you and your heirs $15,000 a year forever. What rate of return are you earning on this policy? A. B. C. D. E. 3.31 percent 3.33 percent 3.42 percent 3.47 percent 3.53 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #85 SECTION: 6.2 TOPIC: PERPETUITY DISCOUNT RATE TYPE: PROBLEMS 86. Your father won a lottery years ago. The value of his winnings at the time was $225,000. He invested this money such that it will provide annual payments of $12,000 a year to his heirs forever. What is the rate of return? A. B. C. D. E. 1.88 percent 2.85 percent 5.33 percent 5.49 percent 6.02 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #86 SECTION: 6.2 TOPIC: PERPETUITY DISCOUNT RATE TYPE: PROBLEMS 87. The preferred stock of Western Mines has a 4.62 percent dividend yield. The stock is currently priced at $38.50 per share. What is the amount of the annual dividend? A. B. C. D. E. $1.78 $1.84 $2.10 $2.13 $2.34 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #87 SECTION: 6.2 TOPIC: PERPETUITY PAYMENT TYPE: PROBLEMS 88. Your credit card company charges you 1.45 percent per month. What is the annual percentage rate on your account? A. B. C. D. E. 16.67 percent 16.79 percent 17.40 percent 18.00 percent 18.86 percent APR = .0145 12 = .174 = 17.4 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #88 SECTION: 6.3 TOPIC: ANNUAL PERCENTAGE RATE TYPE: PROBLEMS 89. What is the annual percentage rate on a loan with a stated rate of 1.75 percent per quarter? A. B. C. D. 6.50 percent 7.00 percent 7.19 percent 8.00 percent E. 8.13 percent APR = .0175 4 = .0700 = 7.00 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #89 SECTION: 6.3 TOPIC: ANNUAL PERCENTAGE RATE TYPE: PROBLEMS 90. You are paying an effective annual rate of 19.56 percent on your credit card. The interest is compounded monthly. What is the annual percentage rate on this account? A. B. C. D. E. 17.50 percent 18.00 percent 18.25 percent 18.64 percent 19.00 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #90 SECTION: 6.3 TOPIC: ANNUAL PERCENTAGE RATE TYPE: PROBLEMS 91. What is the effective annual rate if a bank charges you 8.48 percent compounded quarterly? A. B. C. D. E. 8.20 percent 8.48 percent 8.75 percent 9.02 percent 9.46 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #91 SECTION: 6.3 TOPIC: EFFECTIVE ANNUAL RATE TYPE: PROBLEMS 92. Your credit card company quotes you a rate of 18.9 percent. Interest is billed monthly. What is the actual rate of interest you are paying? A. B. C. D. E. 19.48 percent 19.67 percent 20.63 percent 20.87 percent 21.21 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #92 SECTION: 6.3 TOPIC: EFFECTIVE ANNUAL RATE TYPE: PROBLEMS 93. Tight-Wad Rosie loans money at an annual rate of 22 percent and compounds interest daily. What is the actual rate she is charging on her loans? A. B. C. D. E. 24.49 percent 24.60 percent 25.54 percent 26.78 percent 26.99 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #93 SECTION: 6.3 TOPIC: EFFECTIVE ANNUAL RATE TYPE: PROBLEMS 94. You are considering two loans. The terms of the two loans are equivalent with the exception of the interest rates. Loan A offers a rate of 8.10 percent compounded daily. Loan B offers a rate of 8.25 percent compounded semi-annually. Loan _____ is the better offer because______. A. B. C. D. E. A; the effective annual rate is 8.41 percent A; the annual percentage rate is 8.41 percent B; the annual percentage rate is 8.32 percent B; the interest is compounded less frequently B; the effective annual rate is 8.42 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #94 SECTION: 6.3 TOPIC: EFFECTIVE ANNUAL RATE TYPE: PROBLEMS 95. You have $3,500 that you want to use to open a savings account. You have found five different accounts that are acceptable to you. All you have to do now is determine which account you want to use such that you can earn the highest rate of interest possible. Which account should you use based upon the annual percentage rates quoted by each bank? account A: 3.25 percent, compounded annually account B: 3.18 percent, compounded monthly account C: 3.20 percent, compounded semi-annually account D: 3.15 percent, compounded continuously account E: 3.15 percent, compounded quarterly A. B. C. D. E. account A account B account C account D account E x Using e on a financial calculator: EAR = 3.20 percent On the Texas Instruments BA II Plus, the input is: nd x .0315, 2 , e , 1, = .0320 = 3.20 percent Account A offers the highest effective annual rate at 3.25 percent. AACSB TOPIC: ANALYTIC Ross - Chapter 006 #95 SECTION: 6.3 TOPIC: EFFECTIVE ANNUAL RATE TYPE: PROBLEMS 96. What is the effective annual rate of 17.9 percent compounded continuously? A. B. C. D. E. 18.86 percent 18.98 percent 19.37 percent 19.44 percent 19.60 percent x Using e on a financial calculator: EAR = 19.60 percent On the Texas Instruments BA II Plus, the input is: nd x .179, 2 , e , 1, = .1960 = 19.60 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #96 SECTION: 6.3 TOPIC: CONTINUOUS COMPOUNDING TYPE: PROBLEMS 97. What is the effective annual rate of 10.35 percent compounded continuously? A. B. C. D. E. 10.67 percent 10.84 percent 10.90 percent 10.97 percent 11.02 percent x Using e on a financial calculator: EAR = 10.90 percent On the Texas Instruments BA II Plus, the input is: nd x .1035, 2 , e , 1, = .1090 = 10.90 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #97 SECTION: 6.3 TOPIC: CONTINUOUS COMPOUNDING TYPE: PROBLEMS 98. Newtown Bank wants to appear competitive based on quoted loan rates and thus must offer an 8.7 percent annual percentage rate on its loans. What is the maximum rate the bank can actually earn based on the quoted rate? A. B. C. D. E. 8.89 percent 8.94 percent 8.98 percent 9.02 percent 9.09 percent x Using e on a financial calculator: EAR = 9.09 percent On the Texas Instruments BA II Plus, the input is: nd x .087, 2 , e , 1, = .0909 = 9.09 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #98 SECTION: 6.3 TOPIC: CONTINUOUS COMPOUNDING TYPE: PROBLEMS 99. You are going to loan your friend $1,500 for one year at a 6 percent rate of interest. How much additional interest can you earn if you compound the rate continuously rather than annually? A. B. C. D. $1.97 $2.75 $3.14 $3.36 E. $4.20 x Using e on a financial calculator: EAR = 6.18365 percent On the Texas Instruments BA II Plus, the input is: nd x .06, 2 , e , 1, = .0618365 = 6.18365 percent Additional interest = $1,500 (.0618365 .06) = $2.75 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #99 SECTION: 6.3 TOPIC: CONTINUOUS COMPOUNDING VERSUS ANNUAL COMPOUNDING TYPE: PROBLEMS 100. You are borrowing money today at a 7.9 percent interest rate. You will repay the principle plus all the interest in one lump sum of $7,500 four years from today. How much are you borrowing? A. B. C. D. E. $5,250.00 $5,233.50 $5,533.19 $5,611.08 $6,000.00 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #100 SECTION: 6.4 TOPIC: PURE DISCOUNT LOAN TYPE: PROBLEMS 101. This morning you borrowed $6,000 at 8.45 percent annual interest. You are to repay the loan principle plus all of the loan interest in one lump sum three years from today. How much will you have to repay? A. B. C. D. E. $7,653.14 $7,680.29 $7,711.21 $7,450.89 $7,682.20 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #101 SECTION: 6.4 TOPIC: PURE DISCOUNT LOAN TYPE: PROBLEMS 102. On this date last year, you borrowed $12,500. You have to repay the loan principle plus all of the interest five years from today. The payment that is required at that time is $17,500. What is the interest rate on this loan? A. B. C. D. E. 5.77 percent 7.87 percent 8.25 percent 8.40 percent 9.89 percent AACSB TOPIC: ANALYTIC Ross - Chapter 006 #102 SECTION: 6.4 TOPIC: PURE DISCOUNT LOAN TYPE: PROBLEMS 103. The Corner Drug Store just borrowed $250,000 from the bank. The loan terms require annual interest payments with the entire principle payable after six years. The interest rate is 9.45 percent. How much will The Corner Drug Store owe the bank in year five of the loan? A. B. C. D. E. $23,625.00 $32,750.00 $44,367.21 $56,479.75 $65,025.31 Payment in year 6 = $250,000 .0945 = $23,625.00 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #103 SECTION: 6.4 TOPIC: INTEREST ONLY LOAN TYPE: PROBLEMS 104. On the day you enter college you borrow $12,000 from your local bank. The terms of the loan include an interest rate of 5.45 percent. The terms stipulate that the principle is due in full one year after you graduate. Interest is to be paid annually at the end of each year. Assume that you complete college in four years. How much will you pay the bank one year after you graduate? A. B. C. D. E. $2,806.27 $3,419.59 $12,000.00 $12,654.00 $15,646.39 Payment in year 5 = $12,000 (1 + .0545) = $12,654.00 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #104 SECTION: 6.4 TOPIC: INTEREST ONLY LOAN TYPE: PROBLEMS 105. On the day you enter college you borrow $18,000 from your local bank. The terms of the loan include an interest rate of 5.75 percent. The terms stipulate that the principle is due in full one year after you graduate. Interest is to be paid annually at the end of each year. Assume that you complete college in four years. How much total interest will you pay on this loan? A. B. C. D. E. $1,035 $4,140 $4,051 $4,181 $5,175 Total interest paid = $18,000 .0575 5 = $5,175 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #105 SECTION: 6.4 TOPIC: INTEREST ONLY LOAN TYPE: PROBLEMS 106. On November 1, you take out a mortgage in the amount of $189,500 at an 8.5 percent interest rate compounded monthly. Payments are to be made at the end of each month for thirty years. How much of the first loan payment is interest? (Assume that each month is equal to 1/12 of a year.) A. B. C. D. E. $536.92 $1,342.29 $2,684.58 $4,974.38 $6,316.67 Interest portion of first loan payment = AACSB TOPIC: ANALYTIC Ross - Chapter 006 #106 SECTION: 6.4 TOPIC: AMORTIZED LOAN TYPE: PROBLEMS 107. On March 1, you borrow $239,000 to buy a house. The mortgage rate is 7.75 percent. The loan is to be repaid in equal monthly payments over 20 years. The first payment is due on April 1. How much of the third payment applies to the principle balance? (Assume that each month is equal to 1/12 of a year.) A. B. C. D. E. $418.53 $421.23 $423.95 $1,540.84 $1,543.54 AACSB TOPIC: ANALYTIC Ross - Chapter 006 #107 SECTION: 6.4 TOPIC: AMORTIZED LOAN TYPE: PROBLEMS Essay Questions 108. Explain the difference between the effective annual rate (EAR) and the annual percentage rate (APR). The APR is a stated rate and is computed as (r n), where r is the rate per period and n is the number n of periods per year. The EAR considers compounding and is computed as (1 + r) − 1, where r is the rate per period and n is the number of periods per year. The effective annual rate will always be higher than the annual percentage rate as long as the account is compounded more than once a year and the interest rate is greater than zero. The EAR is the equivalent rate based on annual compounding. AACSB TOPIC: REFLECTIVE THINKING Ross - Chapter 006 #108 SECTION: 6.3 TOPIC: EFFECTIVE ANNUAL RATE VERSUS ANNUAL PERCENTAGE RATE 109. Assume you are the advertising manager of your local bank. Which rate do you prefer to advertise on monthly-compounded loans, the effective annual rate (EAR) or the annual percentage rate (APR)? Which rate do you prefer to advertise on quarterly-compounded savings accounts, the EAR or the APR? Explain. As a consumer, which rate do you prefer and why? A bank prefers to advertise the APR on loans since this rate is lower and the EAR on savings accounts since this rate is higher. As a consumer, the EAR is the relevant rate since the EAR allows you to compare various options. AACSB TOPIC: REFLECTIVE THINKING Ross - Chapter 006 #109 SECTION: 6.3 TOPIC: EFFECTIVE ANNUAL RATE VERSUS ANNUAL PERCENTAGE RATE 110. You are considering two annuities, both of which pay a total of $10,000 over the life of the annuity. Annuity A pays $1,000 at the end of each year for the next 10 years. Annuity B pays $500 at the end of each year for the next 20 years. Which annuity has the greater value today? Is there any circumstance where the two annuities would have equal values as of today? Explain. If the discount rate is a positive, Annuity A will have the greater value today. If the discount rate is zero, then both annuities are worth $10,000 today. AACSB TOPIC: REFLECTIVE THINKING Ross - Chapter 006 #110 SECTION: 6.2 TOPIC: COMPARING ANNUITIES 111. There are three factors that affect the present value of an annuity. Explain what these three factors are and discuss how an increase in each factor will impact the present value of the annuity. The factors are the discount rate, payment amount, and number of payments. An increase in the payment amount or number of payments will increase the present value. An increase in the discount rate will decrease the present value. AACSB TOPIC: REFLECTIVE THINKING Ross - Chapter 006 #111 SECTION: 6.2 TOPIC: PRESENT VALUE OF AN ANNUITY 112. Bill owns a perpetuity which pays $5,000 at the end of each year. He comes to you and offers to sell you all of the payments to be received after the 25th year for a price of $10,000. At an interest rate of 8 percent, should you accept his offer? What does this suggest to you about the value of a perpetuity? The present value of the perpetuity is $62,500 and the present value of the first 25 payments is th $53,373.88. This means that the payments starting with the 26 year and continuing forever are only worth $9,126.12. Thus, you should reject his offer. This illustrates how the bulk of an annuity's value is derived from the payments in the near future. AACSB TOPIC: REFLECTIVE THINKING Ross - Chapter 006 #112 SECTION: 6.2 TOPIC: PERPETUITY PAYMENTS ch6 Summary Category # of Questions AACSB TOPIC: ANALYTIC AACSB TOPIC: REFLECTIVE THINKING Ross - Chapter 006 SECTION: 6.1 SECTION: 6.1 AND 6.2 SECTION: 6.2 SECTION: 6.2 AND 6.4 SECTION: 6.3 SECTION: 6.4 TOPIC: AMORTIZED LOAN TOPIC: ANNUAL PERCENTAGE RATE TOPIC: ANNUITIES DUE TOPIC: ANNUITY TOPIC: ANNUITY DUE AND PRESENT VALUE TOPIC: ANNUITY DUE INTEREST RATE TOPIC: ANNUITY DUE PAYMENTS AND FUTURE VALUE TOPIC: ANNUITY DUE PAYMENTS AND PRESENT VALUE TOPIC: ANNUITY DUE TIME PERIODS TOPIC: ANNUITY DUE TIME PERIODS AND PRESENT VALUE TOPIC: ANNUITY DUE VERSUS ORDINARY ANNUITY TOPIC: BALLOON LOAN TOPIC: COMPARING ANNUITIES TOPIC: CONSOL TOPIC: CONTINUOUS COMPOUNDING TOPIC: CONTINUOUS COMPOUNDING VERSUS ANNUAL COMPOUNDING TOPIC: EFFECTIVE ANNUAL RATE TOPIC: EFFECTIVE ANNUAL RATE VERSUS ANNUAL PERCENTAGE RATE TOPIC: GROWING ANNUITY PRESENT VALUE TOPIC: GROWING PERPETUITY PRESENT VALUE TOPIC: INTEREST ONLY LOAN TOPIC: INTEREST RATES TOPIC: INTEREST-ONLY LOAN TOPIC: ORDINARY ANNUITY AND FUTURE VALUE TOPIC: ORDINARY ANNUITY AND PRESENT VALUE TOPIC: ORDINARY ANNUITY INTEREST RATE TOPIC: ORDINARY ANNUITY PAYMENTS TOPIC: ORDINARY ANNUITY PAYMENTS AND COST OF INTEREST TOPIC: ORDINARY ANNUITY PAYMENTS AND FUTURE VALUE TOPIC: ORDINARY ANNUITY PAYMENTS AND PRESENT VALUE 84 5 112 15 1 59 1 21 15 4 5 1 1 3 2 2 3 1 1 1 1 1 1 4 1 7 2 2 2 3 1 2 3 6 4 1 1 1 5 TOPIC: ORDINARY ANNUITY TIME PERIODS AND FUTURE VALUE TOPIC: ORDINARY ANNUITY TIME PERIODS AND PRESENT VALUE TOPIC: ORDINARY ANNUITY VERSUS ANNUITY DUE TOPIC: PERPETUITY TOPIC: PERPETUITY DISCOUNT RATE TOPIC: PERPETUITY PAYMENT TOPIC: PERPETUITY PAYMENTS TOPIC: PERPETUITY PRESENT VALUE TOPIC: PERPETUITY VERSUS ANNUITY TOPIC: PRESENT VALUE FACTOR FOR ANNUITIES TOPIC: PRESENT VALUE OF AN ANNUITY TOPIC: PRESENT VALUE, PAYMENTS AND FUTURE VALUE TOPIC: PURE DISCOUNT LOAN TOPIC: STATED INTEREST RATES TOPIC: UNEVEN CASH FLOWS AND FUTURE VALUE TOPIC: UNEVEN CASH FLOWS AND PRESENT VALUE TYPE: CONCEPTS TYPE: DEFINITIONS TYPE: PROBLEMS 1 2 4 1 2 1 1 3 1 1 1 1 5 1 6 9 11 12 84