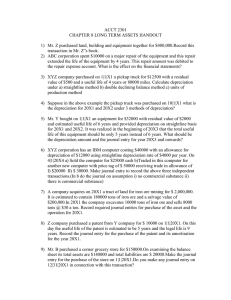

Partnership Formation & Operations: Accounting Textbook Chapter

advertisement