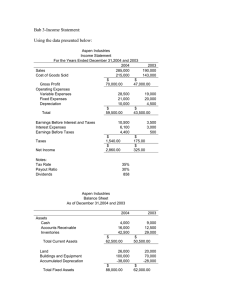

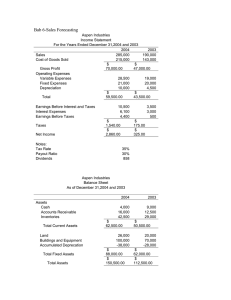

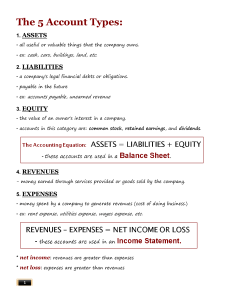

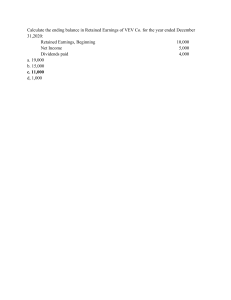

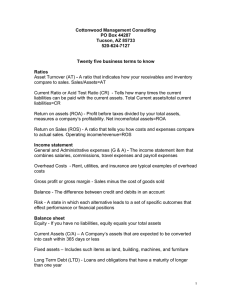

Accounting Notes Chapter 1: Four Basic Financial Statements - Four financial statements are normally prepared by profit-making organizations for use by shareholders, creditors, and other external decision makers: - Statement of Financial Position - Reports the economic resources it owns and the sources of financing for those resources. - Statement of Earnings (the main component of the statement of comprehensive income) Reports its ability to sell goods for more than their cost to acquire and sell. - Statement of Changes in Equity - reports additional contributions from or payments to shareholders, and the amount of earnings the company reinvested for future growth. - Statement of Cash Flows - Reports its ability to generate cash and how it was use The Statement of Financial Position - The purpose of the statement of financial position (balance sheet) is to report the financial position (amount of assets, liabilities, and shareholders’ equity) of an accounting entity at a particular point in time. - The heading of the statement of financial position identifies four significant items related to the statement: - Name of the accounting entity. - Title of the statement. - Specific date of the statement. - Unit of measure. - Accounting Entity - The organization for which financial data are to be collected and reported. - Statement of financial position has three major captions: - Assets, liabilities, and shareholders’ equity. - The basic accounting equation explains their relationship: Assets - Economic resources controlled by the entity as a result of past business events. - Liabilities and shareholders’ equity are the sources of financing for the company’s economic resources. - Assets may be listed on the statement of financial position in either increasing or decreasing order of their convertibility to cash. - Most Canadian companies list their assets beginning with the most-liquid asset, cash, and ending with the least-liquid assets. Liabilities - Indicate the amount of financing provided by creditors. They are the company’s debts or obligations. - Similarly, liabilities may be listed by either increasing or decreasing order of maturity. Shareholders’ Equity - Indicates the amount of financing provided by owners of the business and reinvested earnings. - Contributed Capital - The investment of cash and other assets in the business by the shareholders is called . - Retained Earnings - The amount of earnings (profits) reinvested in the business (and thus not distributed to shareholders in the form of dividends). Most financial statements include the monetary unit sign (in Canada, $) beside the first amount in a group of items (e.g. the cash amount in the assets). - It is common to place a single underline below the last item in a group before a total or subtotal (e.g., Other assets). - A double underline is placed below group totals (e.g., Total assets). - The same conventions are followed in all four basic financial statements. The Statement of Earnings (also called income statement, statement of operations, statement of comprehensive income) - Reports the accountant’s primary measure of performance of a business, revenues less expenses during the accounting period. - While the term profit is used widely for this measure of performance, accountants prefer to use the technical terms net income or net earnings. Revenues - Companies earn revenue from the sale of goods or services to customers. Revenues normally are amounts expected to be received for goods or services that have been delivered to a customer, whether or not the customer has paid for the goods or services. Expenses - Represent the monetary value of resources the entity used up, or consumed, to earn revenues during the period. Net Earnings (also called the “bottom line”) - The excess of total revenues over total expenses incurred to generate revenue during a specific period. The Statement of Cash Flows - Divides a company's cash inflows (receipts) and outflows (payments) into three primary categories of cash flows in a typical business: - - Cash flows from operating, investing, and financing activities. Reported revenues do not always equal cash collected because some sales may be on credit. Expenses reported on the statement of earnings may not be equal to cash paid out during the period because expenses may be incurred in one period and paid for in another. Net earnings (revenues minus expenses) does not usually equal the amount of cash received minus the amount paid during the period. Therefore, because the statement of earnings does not provide information concerning cash flows, the statement of cash flows is prepared to report inflows and outflows of cash. The statement of cash flows equation describes the causes of the change in cash reported on the statement of financial position from the end of the last period to the end of the current period: Cash Flows from Operating Activities (CFO) - Cash flows that are directly related to generating earnings. Cash Flows from Investing Activities (CFI) - Cash flows related to the acquisition or sale of the company’s property, plant, and equipment, and investments. Cash Flows from Financing Activities (CFF) - Directly related to the financing of the company itself. They involve both receipts and payments of cash from/to investors and creditors (except for suppliers). Relationships Among the Statements: - Net earnings from the statement of earnings results in an increase in ending retained earnings on the statement of changes in equity. - Ending retained earnings from the statement of changes in equity is one of the three components of shareholders’ equity on the statement of financial position. - The change in cash on the statement of cash flows added to the cash balance at the beginning of the year equals the balance of cash at the end of the year, which appears on the statement of financial position. Notes to Financial Statements - Notes provide supplemental information about the financial condition of a company, without which the financial statements cannot be fully understood. There are three basic types of notes: - The first type provides descriptions of the accounting rules applied in the company’s statements. - The second presents additional detail about a line on the financial statements. - The third type of note presents additional financial disclosures about items not listed on the statements themselves. Responsibilities for the Accounting Communication Process - Effective communication means that the recipient understands what the sender intends to convey. Understandability is the foundation of effective communication. - Decision makers also need to understand the measurement rules applied in computing the numbers on the statements. Accounting Standards Board (AcSB) - The private-sector body given primary responsibility to set the detailed rules that become accepted accounting standards in Canada. - The AcSB is responsible for establishing standards of accounting and reporting by publicly accountable enterprises, private enterprises, government organizations, and not-for-profit organizations. - These standards or recommendations, which are published in the CPA Canada Handbook, have expanded over time because of the increasing diversity and complexity of business practices. - For Canadian publicly accountable enterprises, the AcSB has determined that they must prepare their financial statements in accordance with International Financial Reporting Standards. - IFRS are a single set of globally accepted high-quality standards, produced by the International Accounting Standards Board (IASB), which is an independent standard-setting board responsible for the development and publication of IFRS. - An older set of International Accounting Standards (IAS) were issued by the Board of the International Accounting Standards Committee, and they complement the accounting standards issued by the IAS. Why Accounting Standards are Important - Companies, their managers, and their owners are most directly affected by the information presented in the financial statements. - Companies incur the cost of preparing the statements and bear the major economic consequences of their publication. These economic consequences include, among others, the following: - Changes to the selling price of a company’s shares. - Changes to the amount of bonuses received by management and employees. - The loss of competitive advantage over other companies. Ethics - Standards of conduct for judging right from wrong, honest from dishonest behaviour, and fair from unfair practices. - Intentional misreporting of financial statements is both unethical and illegal. - Many situations are less clear-cut and require that individuals weigh one moral principle (e.g., honesty) against another (e.g., loyalty to a friend). - When facing an ethical dilemma the following three-step process should be followed: - Identify the effects of the decision on both parties, those who will benefit from the situation (often the manager or employee involved) and those who will be harmed (other employees, owners, creditors, the environment). - Identify alternative courses of action. - Choose the alternative that you would like to see reported on the news. That is usually the ethical choice. Companies take three important steps to assure investors that the company’s records are accurate: - Develop and maintain a system of internal controls over both the records and the assets of a company. - Hire outside independent auditors to attest to the fairness of the statement presentations. - Form a committee/board of directors to oversee the integrity of these safeguards. Independent Auditor - Examines the financial reports to ensure that they represent what they claim and conform to generally accepted accounting principles. - In performing an audit, the independent auditor examines the underlying transactions and the accounting methods used to account for these transactions. Employment in the Accounting Profession Today - Accountants are usually engaged in professional practice or employed by businesses, government entities, and not-for-profit organizations. - Practice of Public Accounting - Audit or assurance services, management consulting and advisory services and tax services. - Employment by Organizations - External reporting, tax planning, control of assets etc. - Employment by Public and Not-for-Profit Sectors - Charitable organizations, hospitals and universities. Chapter 2: To understand amounts appearing on a company's statement of financial position we need to answer these questions: - What type of business activities cause changes in amounts reported on the statement of financial position from one period to the next? - How do specific activities affect each of these amounts? - How do companies keep track of these amounts? Objective of External Financial Reporting - To provide financial information about the reporting entity that is useful to existing and potential investors, lenders, and other creditors in making decisions about providing resources to the entity. Qualitative Characteristics of Useful Accounting Information: - Fundamental characteristics: Relevance, faithful representation. - Enhancing characteristics: Comparability, verifiability, timeliness, understandability. Elements to Be Measured and Reported: - Assets, liabilities, shareholders’ equity, investments by owners, distribution to owners. - Revenues, expenses, gains and losses . - Comprehensive income. Concepts for Measuring and Reporting Information: - Assumptions: Separate entity, stable monetary unit, continuity (going concern), periodicity. - Principles: Mixed-attribute measurement, revenue recognition, full disclosure. - Constraints: cost. To fulfill the primary objective of providing useful information, the conceptual framework provides guidance on the essential characteristics that determine the usefulness of accounting information. There are two fundamental qualitative characteristics; relevance and faithful representation. - Relevance - Makes a difference in a decision, predictive value, feedback/confirmatory value - Faithful representation - Complete, neutral, reasonably free from error or bias. - These two fundamental characteristics are supported by four enhancing qualitative characteristics: Comparability, verifiability, timeliness, and understandability. - Comparability - Across companies. - Verifiability - Similar results under independent measures. - Timeliness - Information must be available before it loses its usefulness. - Understandability - Allows reasonably informed users to see the significance of the information. - Accounting information that embodies the best balance of these characteristics will be of high quality to external decision makers. Cost Constraint - Information should be produced only if the perceived benefits of increased decision usefulness exceed the expected costs of providing that information. Recognition and Measurement Concepts: - Separate Entity Assumption - Activities of the business are separate from activities of owners. - Stable Monetary Unit Assumption - Accounting measurements will be in the national monetary unit (i.e., $ in Canada) without any adjustments for changes in purchasing power (i.e., inflation). - Continuity (going concern) Assumption - The business is assumed to continue to operate into the foreseeable future. - Historical Cost Principle - Cash equivalent cost given up is the basis for the initial recording of elements. Assets - Economic resources controlled by an entity as a result of past transactions or events and from which future economic benefits may be obtained. These are the resources that the entity has and can use in its future operations. Current Assets - Assets that will be used or turned into cash, normally within one year. Examples include: - Cash. - Short-term investments. - Accounts receivable. - Inventories. - Prepaid expenses (i.e., expenses paid in advance of use). Non-current Assets - Assets that are considered to be long-term because they will be used or turned into cash over a period longer than the next year. Examples include: - Property, plant, and equipment (at historical cost less accumulated depreciation). - Financial assets. - Goodwill. - Intangible assets. Liabilities - Present debts or obligations of the entity to transfer an economic resource as a result of past events. They represent future outflows of assets (mainly cash) or services to the creditors that provided the corporation with the resources needed to conduct its business. Current Liabilities - Short-term obligations that will be settled within the coming year by providing cash, goods, other current assets or services. Examples include: - Accounts payable. - Short-term debt (or borrowings). - Income taxes payable. - Accrued liabilities. - Provisions. Non-current Liabilities - All of the entity’s obligations not classified as current liabilities. - Long-term debt (or borrowings). - Provisions. Shareholders’ Equity (owners’ equity) - The financing provided to the corporation by both its owners and the operations of the business. - Typically, the shareholders’ equity of a corporation includes the following: 1. Contributed capital. 2. Retained earnings (accumulated earnings that have not been declared as dividends) 3. Other components. Contributed Capital - Financing provided by shareholders. - Shareholders invest in the business by providing cash and sometimes other assets, and receive shares as evidence of ownership. Earned Capital (Retained Earnings) - Financing provided by operations. - Most companies that operate profitably retain part of their earnings for reinvestment in their business. The other part is distributed as dividends to shareholders. - Retained Earnings - Earnings that are not distributed to shareholders but instead are reinvested in the business by management. Accounting focuses on specific events that have an economic impact on the entity. Transaction - Any event that is recorded as a part of the accounting process. - The first step in translating the results of business events to financial statement amounts is determining which events to include. - Only economic resources and debts resulting from past transactions are recorded on the statement of financial position. Transactions include two types of events: external events and internal events. - External Events - These are exchanges of assets, goods, or services by one party for assets, services, or promises to pay (liabilities) by one or more other parties. - Internal events - These include certain events that are not exchanges between the business and other parties but, nevertheless, have a direct and measurable effect on the accounting entity. Account - A standardized record that organizations use to accumulate the monetary effects of transactions on each financial statement item. - The cumulative result of all transactions that affect a specific account, or its ending balance, is then reported on the appropriate financial statement. To facilitate the recording of transactions, each company establishes a chart of accounts; a list of accounts and their unique numeric codes. - The chart of accounts is organized by financial statement element, with asset accounts listed first (by order of liquidity), followed by liabilities (by order of time to maturity), shareholders’ equity, revenue, and expense accounts, in that order. Elements of the Statement of Financial Position: - Assets - Economic resources with probable future benefits owned or controlled by the entity. Measured by the historical cost principle. - Liabilities - Probable debts or obligations (claims to a company’s resources) that result from a company’s past transactions and will be paid with assets or services. - Entities that a company owes money to are called creditors. - Shareholders’ Equity - The financing provided by the owners and by business operations. Often referred to as contributed capital. Dual Effects Concept - Every transaction has at least two effects on the basic accounting equation. - Most transactions with external parties involve an exchange by which the business entity both receives something and gives up something in return. The accounting equation must remain in balance after each transaction. - A = L + SE Balancing the Accounting Equation: - Step 1: Ask: What was received and what was given? - Identify the accounts affected by their titles (e.g., cash and accounts payable). - Make sure that at least two accounts change. - Classify each by type of account. Was each account an asset (A), a liability (L), or shareholders’ equity (SE)? - Determine the direction of the effect. - Did the account increase (+) or decrease (−)? Step 2: Verify: Is the accounting equation in balance? - A = L + SE The Accounting Cycle: T-Account - A shorthand term for the entire ledger account. The T-account has a left side, called the debit side, and a right side, called the credit side. A journal entry might look like this: - - By themselves, journal entries do not provide the ending balances in accounts. After the journal entries have been recorded, the bookkeeper posts (transfers) the monetary values to each account affected by the transaction to determine the new account balances. In most computerized accounting systems, this happens automatically upon recording the journal entries. Statement of Financial Position - Usually, businesses will create a trial balance spreadsheet first for internal purposes before preparing and reporting financial statements for external users. - A trial balance lists the titles of the T-accounts in the first column, usually in financial statement order with their ending debit or credit balances in the next two columns. - Debit balances are indicated in the left column and credit balances are indicated in the right column. Then the two columns are totalled to provide a check on the equality of the debits and credit. Classified Statement of Financial Position - In a classified statement of financial position assets and liabilities are classified into two categories – current and noncurrent. - Current assets are those to be used or transformed into cash within the upcoming 12 months whereas noncurrent assets are those that will last longer than one year. - Current liabilities are those obligations to be paid or settled within the next 12 months with current assets. Ratio Analysis in Decision Making - Users of financial information compute a number of ratios when analyzing a company’s past performance and financial condition as input in predicting its future potential. - The change in ratios over time and how they compare to the ratios of the company’s competitors or industry averages provide valuable information about a company’s strategies for its operating, investing, and financing activities. The Current Ratio: Does the company currently have the resources to pay its short-term debt? Ratio And Comparisons - Analysts use the current ratio as an indicator of the amount of current assets available to satisfy current liabilities. It is computed as follows: - Current Ratio = Current Assets / Current Liabilities - Quick Ratio/Acid Test Ratio = (Cash & Cash Equivalents + Net Accounts Receivable + Marketable Securities)/Current liabilities - A more conservative measure of current assets available to pay current liabilities. Chapter 3: Operating Cycle (cash-to-cash cycle) - The time it takes for a company to pay cash to suppliers, sell those goods and services to customers, and collect cash from customers. The Periodicity Assumption -To meet the needs of decision makers, we report financial information for relatively short time periods (monthly, quarterly, annually). - Two types of issues arise in reporting periodic net earnings to users: - Recognition Issues - When should the transactions and their effects of operating activities be recognized, classified, and recorded? - Measurement Issues - What amounts should be recognized and recorded for the transactions? Classified Statement of Earnings - Includes a number of sections and subtotals to aid the user in identifying the company’s earnings from operations for the year, and to highlight the effect of other items on net earnings. - Most manufacturing and merchandising companies use the following basic structure: Net Sales - Cost of sales = Gross profit - Operating expenses = Earnings from operations +/- Non-operating revenues/expenses and gains/losses = Earnings before income taxes - Income tax expense = Earnings from continuing operations +/- Earnings/loss from discontinued operations = Net earnings - The statement of earnings includes three major sections: 1. Results of continuing operations 2. Results of discontinued operations 3. Earnings per share - All companies report information for sections 1 and three, while some companies report information in section 2, depending on their circumstances. - The bottom line, net earnings, is the sum of sections 1 and 2. Continuing Operations - This section of the statement of earnings presents the results of normal or continuing operations. - Revenues are defined as increases in assets or settlements of liabilities from ongoing operations of the business. Operating revenues result from the sale of goods or services. - Expenses are decreases in assets or increases in liabilities from ongoing operations, and are incurred to generate revenues during the period. Primary Operating Expenses - For merchandising companies: - Cost of Sales - The cost of products sold to customers. In companies with a manufacturing or merchandising focus, the cost of sales (also called cost of goods sold) is usually the most significant expense. The difference between sales, net of sales discounts, returns, and allowances, and cost of sales is known as gross profit (or gross margin). - Operating Expenses - The usual expenses, other than cost of sales, that are incurred in operating a business during a specific accounting period. The expenses reported will depend on the nature of the company’s operations. - Earnings from Operations - Also called operating income, equals net sales less cost of sales and operating expenses. - Cost of Sales → Sales and Marketing Expenses → Distribution Expenses → General and administrative expenses. Non-Operating Items - Not all activities affecting a statement of earnings are central to continuing operations. Any revenues, expenses, gains, or losses that result from these other activities are not included as part of earnings from operations, but instead categorized as other income or expenses. These typically include: - Interest income, financing costs, gains or losses on disposal of assets. - These non-operating items that are subject to income taxes are added to or subtracted from earnings from operations to obtain the earnings before income taxes (or pretax earnings. Income Tax Expense - The last expense listed on the statement of earnings. - All for-profit corporations are required to compute income taxes owed to federal, provincial, and foreign governments. - Income tax expense is calculated as a percentage of earnings before income taxes, reflecting the difference between income, which includes revenue and gains, and expenses and losses. - It is determined by using applicable tax rates. Discontinued Operations - Companies may dispose of a major line of business or geographical area of operations during the accounting period, or decide to discontinue a specific operation in the near future. - The net earnings or loss from that component, as well as any gain or loss on subsequent disposal, are disclosed separately on the statement of earnings as discontinued operations. - Because of their non-recurring nature, the financial results of discontinued operations are not useful in predicting future recurring net earnings. Earnings per Share - Corporations are required to disclose earnings per share on the statement of earnings or in the notes to the financial statements. - This ratio is widely used in evaluating the operating performance and profitability of a company. - Simple earnings per share can be calculated as net earnings divided by the average number of shares outstanding during the period. - The calculation of the ratio is actually more complex and beyond the scope of this course. How Are Transactions from Operating Activities Recognized and Measured? - Many local retailers and other small businesses use cash basis accounting, in which revenues are recorded when cash is received and expenses are recorded when cash is paid, regardless of when revenues are earned or the expenses are incurred. - A cash basis is often quite adequate for these small businesses, which usually do not have to report to external users. Cash Basis Accounting - Financial statements created under cash basis accounting normally postpone or accelerate recognition of revenues and expenses long after or before goods and services are produced and delivered (when cash is received or paid). - The cash basis also does not necessarily reflect all assets and liabilities of a company on a particular date. - Cash basis financial statements are not very useful to external decision makers. - IFRS therefore require accrual basis accounting for financial reporting purposes. Accrual Accounting - In accrual basis accounting, revenues and expenses are recognized when the transaction that causes them occurs, not necessarily when cash is received or paid. - Revenues are recognized when they are earned and expenses when they are incurred. - The revenue recognition principle and the matching process determine when revenues and expenses are to be recorded under accrual basis accounting. Revenue Recognition Principle - Specifies both the timing and amount of revenue to be recognized during an accounting period. It requires that a company recognize revenue when goods and services are transferred to customers in an amount it expects to receive. - Revenue is earned when the business delivers goods or services, although cash can be received from customers in a period before delivery, in the same period as delivery, or in a period after delivery. - Cash is received before the goods are delivered: - - Cash is received after the goods are delivered: If cash is received in the same period as the goods or services are delivered, simply debit cash and credit sales revenue in one transaction. Matching Process - Requires that expenses are recorded when incurred in earning revenue; all of the resources consumed in earning revenue during a specific period must be recognized in that same period (matching costs with benefits). - The costs of generating revenue include expenses incurred, such as: - Salaries to employees who worked during the period (wages expense) - Utilities for the electricity used during the period (utilities expense) - Inventory items that are sold during the period (cost of sales) - Facilities rented during the period (rent expense) - Use of buildings and equipment for production purposes during the period (depreciation expense) Recording Expenses v.s. Cash Payments: - As with revenues and cash receipts, expenses are recorded as incurred, regardless of when cash is paid. - Cash may be paid before, during, or after an expense is incurred. - An entry is made on the date the expense is incurred and another one on the date of the cash payment, if it’s at a different time. - If cash is paid before the expense is incurred to generate revenue: - Companies purchase many assets that are used to generate revenues in future periods (eg. insurance for future coverage, paying rent for future use, acquiring supplies/equipment for future use). - When revenues are generated in the future, the company records an expense for the portion of the cost of the assets used. - If cash is paid in the same period as the expense is incurred to generate revenue: - Expenses are sometimes incurred and paid for in the period in which they arise (eg. paying for repairs on sewing machines the day of the service). - If cash is paid after the cost is incurred to generate revenue: - Although rent and supplies are typically purchased before they are used, many costs are paid after goods or services have been received and used (eg. using electric and gas utilities that are not paid for until the following period, using borrowed funds and incurring interest expenses, owing wages to employees who worked in the current period). Transaction Analysis Rules: - Assets increase in dr, liabilities increase in cr, shareholders’ equity increase in cr, revenues increase in cr, expenses increase in dr. - Revenues increase net earnings, retained earnings, and shareholders equity. - Recording revenue results in either increasing an asset or decreasing a liability. - Expenses decrease net earnings, thus decreasing retained earnings and shareholders’ equity. - Recording an expense results in either decreasing an asset or increasing a liability. How a Statement of Earnings is Prepared and Analyzed (Income Statement): - Determine that debits=credits for the period by generating a trial balance. - Accounts are listed in a specific order: assets, liabilities, and shareholders’ equity accounts are reported on the statement of financial position (balance sheet), followed by revenues/gains and expenses/losses that are reported on the statement of earnings. - The ending account balances that did not change as a result of the transactions are taken from the beginning trial balance from the period. - The accounts that did change due to transactions are taken from the T-accounts. - There may also be new accounts that are added from the previous list of accounts. - End-of-period adjustments have to be made to reflect all revenues earned and expenses incurred during the period. - After the adjustments are made, the amount of income tax expense and net earnings will be reported in the statement of earnings. Operating Cash Flow: Key Ratio Analysis: - - Total Asset Turnover Ratio - Useful in determining how effective management is at generating sales from assets (resources). - TATR = Sales/Average Total Assets - Average Total Assets = (Beginning Total Assets + Ending Total Assets ) /2 - Measures the sales generated per dollar of assets. - A high total asset turnover ratio signifies efficient management of assets; a low total asset turnover ratio signifies less-efficient management. - Stronger operating performance improves the total asset turnover ratio. - Creditors and security analysts use this ratio to assess a company’s effectiveness at controlling current and noncurrent assets. Return On Assets - Useful measure in addressing how well management uses the total invested capital provided by debt holders and shareholders during the period. - ROA = (Net Earnings + Interest Expense(no tax)) / Average Total Assets - Measures how much the firm earned from the use of its assets. - It is the broadest measure of profitability and management effectiveness, independent of financing strategy. - Allows investors to compare management’s investment performance against alternative investment options. - Firms with higher ROA are doing a better job of selecting new investment, all other things being equal. Chapter 4: The Accounting Cycle - The process used by entities to analyze and record transactions, adjust the records to provide reliable account balances at the end of the period, prepare financial statements, and prepare the records for the next cycle. - During the accounting period, transactions that result in exchanges of benefits and obligations between the company and other external parties are analyzed and recorded in the general journal in chronological order (journal entries), and the related accounts are updated in the general ledger (T-accounts). - The end-of-period steps focus primarily on adjustments to record revenues and expenses in the proper period and to update the statement of financial position accounts for reporting purposes. Adjusting Entries - Recorded at the end of every accounting period, so that: - Revenues are recorded when earned (the revenue recognition principle). - Expenses are recorded when incurred to generate revenue during the same period (the matching process). - Assets are reported at amounts that represent the probable future benefits remaining at the end of the period. - Liabilities are reported at amounts that represent the probable future sacrifices of assets or services owed at the end of the period. - Companies wait until the end of the accounting period to adjust their accounts, because adjusting the records daily would be very costly and time consuming. - Adjusting entries are required every time a company wants to prepare financial statements for external users. Four Types of Adjustments: - Deferrals - Receipts of assets or payments of cash in advance of revenue or expense recognition. - Accruals - Revenues earned or expenses incurred that have not been previously recorded. Adjustment Process: 1. Was revenue earned or an expense incurred that is not yet recorded? - If yes, the revenue or expense account must be increased in the adjusting entry. 2. Was the related cash received or paid in the past or will it be received or paid in the future? - If cash was received in the past, a deferred revenue account was recorded in the past. Now, reduce the liability account that was recorded when cash was received, because the entire liability or part of it has been settled since then. - If cash will be received in the future, increase the receivable account to record what is owed by others to the company. - If cash was paid in the past, a deferred expense account was recorded in the past. Now, reduce the asset account that was recorded in the past because the entire asset or part of it has been used since then. - If cash will be paid in the future, increase the payable account to record what is owed by the company to others. 3. Compute the amount of revenue earned or expense incurred and record the adjusting entry. - Sometimes the amount is given or known. Other times, it must be computed or, sometimes, estimated. Unadjusted Trial Balance - A listing of individual accounts, usually in financial statement order (A, L, SE, R, E). - Ending debit or credit balances are listed in two separate columns. - Total debit account balances should equal total credit account balances. - If not, errors have occurred in preparing balanced journal entries, posting the correct dollar effects of a transaction, calculating ending balances in accounts, or in copying ending balances from the ledger to the trial balance. Deferred Revenues - When a customer pays for goods or services before the company delivers them, the company records the amount of cash received in a deferred revenue account. - Deferred revenue is a liability representing the company’s promise to perform or deliver the goods or services in the future. - Recognition of the revenue is deferred until the company meets its obligation. Accrued Revenues - Sometimes, companies perform services or provide goods before customers pay. Because the cash that is owed for these goods has not yet been received, the revenue that was earned cannot be recorded. - Revenues that have been recognized but have not yet been realized in cash and recorded at the end of the accounting period are called accrued revenues. Deferred Expenses - Assets represent resources with probable future benefits to the company. Many assets are used over time to generate revenues. - At the end of every period, an adjustment must be made to record the amount of the asset that was used during the period. Accrued Expenses - Numerous expenses are incurred in the current period without being paid until the next period. - They accumulate overtime but are not recognized until the end of the period in an adjusting entry. Property, Plant, and Equipment: - Increases when assets are acquired, and decreases when they are sold. These assets are used overtime to generate revenue. Thus, a part of their cost should be expensed in the same period (the matching process). - They depreciate over time as they are used. - Depreciation - An allocation of an asset’s cost over its estimated useful life to the organization. - To keep track of the asset’s historical cost, the amount that has been used is not subtracted directly from the asset account. Instead, it is accumulated in a new kind of account, called a contra account. - Contra Account - An account that is an offset to, or reduction of, the primary account. It is directly related to another account, but has a balance on the opposite side of the T-account. - As a contra account increases, the net amount (the account balance less the contra-account balance) decreases. For property, plant, and equipment, the contra account is called accumulated depreciation. - Since assets have dr balances, accumulated depreciation has a cr balance. - On the statement of financial position, the amount that is reported for property, plant, and equipment is its carrying amount (book value or net book value), which equals the ending balance in the property, plant, and equipment account minus the ending balance in the accumulated depreciation account. Materiality and Adjusting Entries: - Materiality - Describes the relative significance of financial statement information in influencing economic decisions made by financial statement users. - Materiality suggests that minor items would not influence the decisions of financial statement users are to be treated in the most cost-beneficial way in compliance with accounting standards. - It’s a qualitative factor in the conceptual framework providing scope for accountants to apply the pervasive constraint that benefit to users must outweigh the cost of reporting accounting information when they record the effects of transactions and prepare financial disclosure. Preparing Financial Statements: Statement of Earnings - Prepared first, because net earnings is a component of retained earnings, which is reported on the statement of changes in equity. - The earnings per share ratio is reported on the statement of earnings. - It is widely used in evaluating the operating performance and profitability of a company and is the only ratio required to be disclosed on the statement or in the notes to the financial statements. Statement of Changes in Equity - The final amount from the statement of earnings, net earnings, is carried forward to the retained earnings column of the statement of changes in equity. - Net earnings is an increase in retained earnings. - Dividends declared during the period are deducted to arrive at the ending balance. The issuance of additional shares is added to the beginning balance of contributed capital. Statement of Financial Position - The ending balances under the contributed capital, retained earnings, and other components headings of the statement of changes in equity are included on the statement of financial position. - Assets are listed in order of liquidity, while liabilities are listed in order of time to maturity. - Current assets are those used or turned into cash within one year. Current liabilities are obligations to be settled within one year. Net Profit Margin Ratio - Compares net earnings to the revenues generated during the period. - Useful is determining how effective management is at controlling revenues and expenses to generate more earnings. - NPMR = Net Earnings / Net Sales (Sales less any returns or other reductions) - Measures how much profit is earned as a percentage of revenues generated during the period. - A rising net profit margin ratio signals more efficient management of sales and expenses. - Financial analysts expect well-run businesses to maintain or improve their NPMR overtime. Return on Equity - Relates net earnings to shareholders’ investment in the business. - Determines how well management used shareholder investment to generate net earnings during the period. - ROE = Net Earnings / Average Shareholders’ equity - Average Shareholders’ Equity = (Beginning Shareholders Equity + Ending Shareholders Equity) / 2 - Measures how much the firm earned as a percentage of shareholders’ investment. - In the long run, firms with higher ROE are expected to have higher share prices than firms with lower ROE, all other things being equal. - Managers, analysts, and creditors use this ratio to assess the effectiveness of the company’s overall business strategy (operating, investing, and financing strategies). End of the Accounting Cycle: - Statement of financial position accounts are permanent accounts and are not reduced to zero at the end of the accounting period. The ending balance for the current accounting period becomes the beginning account balance for the next accounting period. - However, revenue, expense, gain, loss, and dividend accounts are used to accumulate transaction effects for the current accounting period only. They are called nominal (temporary) accounts. - At the end of each period, the balances in the temporary accounts are transferred, or closed, to the retained earnings account by recording closing entries. Closing Entries - Has two purposes: 1. To transfer the balances in the temporary accounts to retained earnings. 2. To establish a zero balance in each of the temporary accounts to start the accumulation in the next accounting period. Steps for Closing Entries: - Prepare an entry to close the revenue and gain accounts, which have credit balances and are closed by debiting the total amount to income summary. - Prepare an entry to close the expense and loss accounts, which have debit balances and are closed by crediting the total amount to income summary. - Prepare an entry to close the dividends declared account to the retained earnings account. - The balance of the income summary account reflects the net earnings/loss and is then closed to the retained earnings account. Post-Closing Trial Balance - After all temporary accounts have been closed, we prepare a post-closing trial balance. Only assets, liabilities, and shareholders’ equity accounts will appear. All revenue, expense, gain, and loss accounts will have a zero balance. Debits should equal credits.