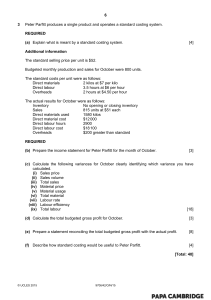

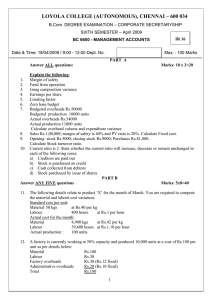

Strategic Cost Management & Performance Evaluation Course Material

advertisement