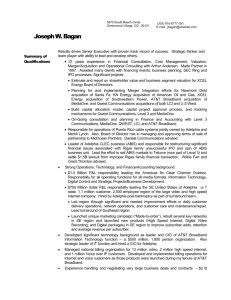

Historical background and business profile of Adelphia: In 1952 John and Gus Rigas acquired their first television cable franchise for $300 from a local hardware owner. This franchise was able to produce better television reception from an antenna located on top of a local hill than any of its competitors. This acquisition was a big investment for the town of Coudersport, Pennsylvania, which had a population of less than three thousand. As the Rigas Company grew through acquisitions, the Rigases decided that they needed to change the name of the company to Adelphia, which is Greek for brothers. As Adelphia became larger and the Rigases' children grew up, other family members, including three sons, became involved in the strategic decision-making and planning process at Adelphia. Key players: Timothy Rigas was a graduate of Wharton Business School with a bachelor's degree in economics. He was the former CFO and chairman of the board of directors audit committee from 1992 to 2001. He resigned from the board directors in May 2002 after the accusations of accounting fraud became public. In July 2004 he was found guilty of conspiracy, bank fraud, and securities fraud. Michael Rigas, a graduate of Harvard and Harvard Law School, resigned from the Adelphia board in May 2002. He also resigned as the executive vice president of operations. Michael Rigas was found guilty of fraud and sentenced to ten months of home confinement in March 2006. James Rigas attended Harvard and Stanford Law School. He was the executive vice president of strategic planning. He resigned from his position and from the board in May 2002 and did not face any criminal charges. Corporate governance structure and Board of Directors: Rigas family would make management decisions at the dinner table rather than in the board room or an executive's office." The Rigas family controlled the company by issuing to investors only as a shares that were worth one vote each while retaining all the class B stock that had ten votes with each share. Of the nine board members, five were immediate family members. The other four members were friends and/or business associates of John Rigas. As a result, the decisions of the board of directors were always stacked in favor of the Rigases. Main tricks: 1. Obtained $2.3 billion in loans from Adelphia in the form of off-balance sheet transactions (use of Adelphia's cash to pay for personal expenditures) 2. $167 million loan given to the family in the form of bonds that had not been paid back. 3. The Rigas family set up a "cash-management system, which in- cluded money obtained from revenue for the cable systems as well as from family-run businesses and proceeds from company loans. This was the account used to pay for the personal expenses of the Rigas family. As a result, the Rigas family now had unlimited access to Adelphia's resources without any check and control system in place 4. Adelphia's statement of cash flows was artificially inflated by recording service call expenses as capital investments. Adelphia filed a lawsuit against its two major suppliers of thgtart converter boxes, Scientific Atlanta and Motorola. Adelphia claimed that these two suppliers willingly aided Adelphia in committing fraud by helping Adelphia inflate earnings through a fraudulent marketing campaign. Adelphia would pay the two suppliers an additional $26 per box beyond the original price. The suppliers would then pay Adelphia $26 per box in marketing "support." There was no action taken by Adelphia to warrant the $26 per box fee, yet Adelphia would use the additional $26 paid by the suppliers to inflate earnings. Adelphia would record the amount paid to the suppliers as a capital expense, which could be spread out over a number of years, and the amount received by the suppliers would be recorded as a contra-expense, which would ultimately increase Adelphia's carnings for that current quarter 5. June 2004, former vice president and assistant treasurer Michael Mulcahey admitted that Adelphia maintained two sets of books but that there was nothing illegal with the practice. An external" set of books was used to present information to banks and other investors. The internal sets of books showed the actual performance of the company but contained more detait that required by outside interests. Mulcahey claimed that Adelphia's external auditor, Deloitte & Touche, could have access to the internal books if it requested it. Yet Jim Brown, former vice president of finance at Adelphia, testified in court that at the end of every quarter, there would be a meeting at the corporate office to compare the subsidiaries' performance to the financial tests needed to evaluate the covenants of the loans. If the loans were no longer in compli- ance with the covenants, the numbers would be manipulated to ensure they were in compliance. TIMELINE February 2001: Cohen finds out that that based on their purchasing pattern of Adelphia stock, the family was in debt by more than $1 billion. March 2001: Cohen finds out about off-balance sheet transactions. May 2001: John Rigas resignes as chairman of the board and chief executive officer of Adelphia. Erland Kailbourne becomes CEO. June 2002: Adelphia filed for Chapter 11 bankruptcy protection July 2004: John and Tim Rigas were found guilty of eighteen counts of conspiracy and fraud June 2005: John Rigas was sentenced to fifteen years in prison. Tim Rigas was sentenced to twenty years in prison. The SEC also filed civil charges against Adelphia's external auditor, Deloitte & Touche, for its negligence in identifying the fraud committed by the Rigas family. The fines were estimated to cost Deloitte & Touche approximately $50 million and a guarantee that corrections would be made within the firm to ensure that the actions would not occur again October 8, 2005: John and Timothy Rigas were indicted for tax evasion November 2005: Adelphia's former executive vice president, Michael Rigas, pleaded guilty to securities fraud by filing false financial information with the Securities and Exchange Commission. B y accepting the plea bargain, Michael Rigas avoided jail time of up to three years. In May 2006 Michael Rigas was sentenced to two years' probation with the first ten months to be served as home confinement, and he was ordered to pay a fine of $2,000 for his actions. November 2006 former vice president and assistant treasurer Michael Mulcahey was barred from ever serving again as an officer or as a director for a publicly traded company.

![-----Original Message----- From: Dean Keenhold [ ]](http://s2.studylib.net/store/data/015586969_1-ed410adfa543e5e848eada99da572ed4-300x300.png)