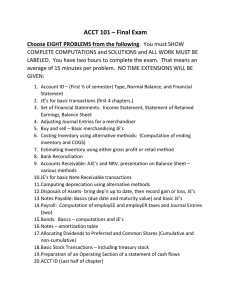

PRACTICAL ACCOUNTING 1 Submitted by: Dizon, Russel Canlas, Marianne Flores, Peejay Lagroma, Stefhanie Villa, Ma. Louella Fatima STATEMENT OF FINANCIAL POSITION 1.) The general ledger trial balance of Darwin Company included the following accounts on December 31, 2013: Inventory, including inventory expected in the ordinary course of operations to be sold beyond 12 months amounting to P700,000 Accounts receivable 1,000,000 1,200,000 Prepaid insurance 100,000 Financial assets held for trading 200,000 Financial asset at fair value through other comprehensive income 800,000 Cash 300,000 Deferred tax asset 150,000 Bank overdraft 250,000 What amount should be reported as total current asset on December 31, 2013? a. 2,800,000 b. 2,550,000 c. 3,600,000 d. 2,100,000 2.) Violago Company provided the following account balances on December 31, 2013: Accounts receivable Financial assets at fair value through profit or loss 1,600,000 500,000 Financial assets at amortized cost 1,300,000 Cash 1,100,000 Inventory 3,000,000 Equipment and furniture 2,500,000 Accumulated depreciation 1,500,000 Patent 400,000 Prepaid expenses 100,000 Equipment classified as held for sale 2,000,000 In the December 31, 2013 statement of financial position, what total Amount should be reported as current assets? a. 6,300,000 b. 8,300,000 c. 8,200,000 d. 9,600,000 3.) Pamela Company provided the following adjusted account balances on December 31, 2013: Wages payable 250,000 Cash 200,000 Mortgage payable 1,500,000 Dividends payable 150,000 Prepaid rent 100,000 Inventory 800,000 Sinking fund 500,000 Short-term investments 300,000 Investment in associate 2,000,000 Taxes payable 220,000 Accounts payable 240,000 Accounts receivable 350,000 What total amount should be reported as current assets on December 31, 2013? a. 2,250,000 b. 1,750,000 c. 3,750,000 d. 4,250,000 4.) Petite Company provided the following data on December 31, 2013: Cash 5,000,000 Financial assets at fair value (including long term investment of P500,000 in ordinary shares of Ayala Company) 2,000,000 Inventories (including goods received on consignment of P200,000) 800,000 Prepaid expenses (including a deposit of P50,000 made on inventories to be delivered in 18 months) 150,000 Property, plant and equipment (excluding P300,000 of equipment still in use, but fully depreciated) 10,000,000 Goodwill (based on estimate by the president) Total assets Cash in general checking account Cash in fund to be used to retire bonds in 2015 Cash held to pay value added tax 1,000,000 18,950,000 3,500,000 1,000,000 500,000 Total cash 5,000,000 What total amount should be reported as current assets on December 31, 2013? a. 6,250,000 b. 6,200,000 c. 7,200,000 d. 7,250,000 5.) Cara Company provided the following information: 1/1/2013 Current assets 12/31/2013 240,000 Property, plant and equipment 1,600,000 Current liabilities ? Noncurrent liabilities 580,000 ? 1,700,000 130,000 ? All assets and liabilities of the entity are reported at year-end. Working capital of P92,000 remained unchanged from 2012 to 2013. Net income in 2013 was P64,000. No dividends were declared during 2013 and there were no other changes in owner’s equity. What amount should be reported as noncurrent liabilities on December 31, 2013? a. 340,000 b. 432,000 c. 580,000 d. 616,000 6.) Rice Company was incorporated on January 1, 2013, with P5,000,000 from the issuance of share capital and borrowed funds of P1,500,000. During the first year, net income was P2,500,000. On December 15, the entity paid a P500,000 cash dividend. No additional activities affected shareholders’ equity in 2013. On December 31, 2013, what amount should be reported as total assets? a. 6,500,000 b. 9,300,000 c. 8,800,000 d. 6,800,000 7.) Mirr Company was incorporated on January 1, 2013, with proceeds from the Issuance of P7,500,000 in share capital and borrowed funds of P1,100,000. During the first year, revenue from sales and consulting amounted to P8,200,000, and operating costs and expenses totaled P6,400,000. On December 15, 2013, the entity declared a P300,000 dividend, payable to shareholders’ equity in 2013. The liabilities increased to P2,000,000 by December 31, 2013. On December 31, 2013, what amount should be reported as total assets? a. 11,000,000 b. 11,300,000 c. 10,100,000 d. 12,100,000 8.) Gold Company provided the following trial balance on December 31, 2013: Cash overdraft Accounts receivable 100,000 350,000 Inventory 580,000 Prepaid expenses 120,000 Land classified as held for sale Property, plant and equipment, net 1,000,000 950,000 Accounts payable and accrues expenses 320,000 Ordinary share capital 250,000 Share premium 1,500,000 Retained earnings 830,000 3,000,000 3,000,000 Checks amounting to P300,ooo were written to vendors and recorded on December 29, 2013, resulting in cash overdraft of P100,000. The checks were mailed January 15, 2014. Land classified as held for sale was sold for cash on January 31, 2014. The entity issued the financial statement on March 31, 2014. On December 31, 2013, what total amount should be reported as current assets? a. 2,250,000 b. 2,050,000 c. 1,950,000 d. 1,250,000 9.) Arabian Company reported the following current assets on December31, 2013: Cash 4,300,000 Accounts receivable 7,500,000 Inventory 4,000,000 Deferred tax asset 1,200,000 An analysis of the accounts receivable disclosed that accounts receivable comprised the following: Trade accounts receivable 5,000,000 Allowance for doubtful accounts ( 500,000) Selling price of Arabian Company’s unsold goods sent to Tar Company on consignment at 150% of cost and excluded from Arabian’s ending inventory 3,000,000 7,500,000 On December 31, 2013, what amount should be reported as total current assets? a. 16,000,000 b. 15,300,000 c. 15,800,000 d. 14,800,000 10.) Caticlan Company provided the following data on December 31, 2013: Cash, including sinking fund of P500,000 Notes receivable Note receivable discounted Accounts receivable – unassigned 2,000,000 1,200,000 700,000 3,000,000 Accounts receivable – assigned Equity of assignee in accounts receivable assigned 800,000 500,000 Inventory, including P600,000 cost of goods in transit Purchased FOB destination. The goods were Received on January 3, 2014/ 2,800,000 Allowance for doubtful accounts 100,000 What total amount of current assets should be reported in the statement of financial position on December 31, 2013? a. 7,900,000 b. 8,000,000 c. 7,400,000 d. 7,700,000 11.) On December 31, 2013, Ivan Company showed the following current assets: Cash 500,000 Accounts receivable 2,500,000 Inventory 2,000,000 Prepaid expenses 100,000 Total current assets 5,100,000 Cash on hand including customer’s postdated check of P20,000 and employee IOU of P10,000 130,000 Cash in bank per bank statement (outstanding Checks on December 31, 2013, P70,000) Total cash 370,000 500,000 Customer’s debit balances, net of customers deposit of P50,000 1,900,000 Allowance for doubtful accounts ( 150,000) Sales price of goods invoiced to customers at 150% of cost on December 29, 2013 but delivered on January 5, 2014 and excluded from reported Inventory 750,000 Total accounts receivable 2,500,000 What total amount of current assets should be reported on December 31, 2013? a. 4,900,000 b. 4,830,000 c. 4,780,000 d. 4,630,000 12.) East Company reported the following current assets at year-end: Cash 3,200,000 Accounts receivable 2,000,000 Inventory 2,800,000 Deferred charges 200,000 8,200,000 That accounts receivable consisted of the following items: Customers’ accounts Employees’ account-current Advances to subsidiary Allowance for uncollectible accounts Claim against shipper for goods lost in transit 1,420,000 240,000 260,000 (120,000) 200,000 2,000,000 What amount should be reported as total current assets? a. 7,740,000 b. 7,780,000 c. 7,940,000 d. 8,200,000 13.) Daet Company provided the following account balances and related Information on December 31, 2013: Cash and cash equivalents 3,700,000 Accounts receivable 1,500,000 Allowance for doubtful accounts ( 200,000) Inventory 2,000,000 Prepaid insurance 300,000 7,300,000 Cash in bank, net of bank overdraft of P300,000 maintained in a separate bank 1,000,000 Cash set aside by the Board of Directors for the purchase of a plant site Petty cash 2,000,000 10,000 Cash withheld from wages for income tax of employees General cash Total cash and cash equivalents 190,000 500,000 3,700,000 The accounts receivable included past due account in the amount of P100,000. The amount is deemed uncollectible and should be written off. The inventory included goods held on consignment amounting to P150,000 And goods of P200,000 purchased and received on December 31, 2013. Neither of these items have been recorded as purchase. The prepaid insurance included cash surrender value of life insurance of P50,000. What total amount should be reported as current assets on December 31, 2013? a. 5,400,000 b. 5,100,000 c. 5,300,000 d. 5,200,000 14.) Mill Company provided the following account balances on December 31, 2013 Accounts payable 1,500,000 Bond payable , due 2014 2,500,000 Discount on bonds payable 300,000 Dividends payable 800,000 Note payable, due 2015 What total amount of current liabilities should be reported? a. 4,500,000 2,000,000 b. 5,100,000 c. 6,500,000 d. 7,800,000 15.) Gar Company reported the following liability account balances on December 31, 2013: Accounts payable 1,900,000 Bonds payable 3,400,000 Premium on bonds payable 200,000 Deferred tax liability 400,000 Dividends payable 500,000 Income tax payable 900,000 Note payable, due January 31, 2014 600,000 The deferred tax liability is based on temporary differences that will reverse in 2015. In the December 31, 2013 statement of financial position, what total amount should be reported as current liabilities? a. 7,100,000 b. 4,300,000 c. 3,900,000 d. 4,100,000 16.) Brite Company had the following liabilities on December 31, 2013: Accounts payable Unsecured note payable, 8%, due July 1, 2014 550,000 4,000,000 Accrued expenses 350,000 Contingent liability 450,000 Deferred tax liability 250,000 Senior bonds payable, 7%, due March 31, 2014 5,000,000 What amount should be reported as current liabilities? a. 10,350,000 b. 10,150,000 c. 9,900,000 d. 4,900,000 17.) Burma Company disclosed the following liabilities: Accounts payable, after deducting debit balances In suppliers’ accounts amounting to P100,000 Accrued expenses 4,000,000 1,500,000 Credit balances of customer’s accounts Stock dividend payable 500,000 1,000,000 Claims for increase in wages and allowances by Employees of the entity, covered in a pending lawsuit Estimated expenses in redeeming prize coupons What amount should be reported as current liabilities? a. 6,700,000 b. 6,600,000 c. 7,100,000 400,000 600,000 d. 7,700,000 18.) Gumamela Company provided the following data on December 31, 2013: Trade accounts payable, including cost of goods received on consignment of P150,000 1,350,000 Accrued taxes payable 125,000 Customers’ deposit 100,000 Gumamela Company as guarantor 200,000 Bank overdraft 55,000 Accrued electric and power bills 60,000 Reserve for contingencies 150,000 What amount should be reported as total current liabilities? a. 1,840,000 b. 1,740,000 c. 1,650,000 d. 1,540,000 19.) Charice Company provided the following on December 31, 2013: Accounts payable amounted to P500,000 and accrued expenses totaled P300,000 on December 31, 2013. On December 15, 2013, the entity declared a cash dividend of P7 per share on 100,000 outstanding shares, payable on January 15, 2014. On July 1, 2013, the entity issued P500,000,000, 8% bonds for P4,400,000 to yield 10%. The bonds mature on June 30, 2018, and pay interest annually every June 30. The pretax financial income was P8,500,000 and taxable income was P6,000,000. The difference is due to P1,000,000 permanent difference and P1,500,000 of taxable temporary difference to reverse in 2014. The income tax rate is 30%. The entity made estimated income tax payments during the year of P1,000,000. What amount should be reported as total current liabilities on December 31, 2013? a. 3,500,000 b. 2,700,000 c. 2,300,000 d. 2,500,000 20.) Mazda Company reported the following liability balances on December 31, 2013: 10% note payable issued on October 1, 2012, maturing October 1, 2014 2,000,000 12% note payables issued on March 1, 2012, maturing On March 1, 2014 4,000,000 The 2013 financial statements were issued on March 31, 2014. Under the loan agreement for the 10% note payable, the entity has discretion to refinance the obligation for at least twelve months after December 31, 2013. On March 1, 2014, the entire P4,000,000 balance of the 12% note payable was refinanced through issuance of a long-term obligation payable lump sum. What amount of the notes payable should be classified as current on December 31, 2013? a. 6,000,000 b. 4,000,000 c. 2,000,000 d. 0 21.) On December 31, 2013, Ace Company had P40,000,000 note payable due on February 28, 2014. On December 31, 2013, the entiy arranged a line credit with City Bank which allows the entity to borrow up to P35,000,000 at one percent above the prime rate for three years. On February 15, 2014, the entity borrowed P25,000,000 from City Bank and used P5,000,000 additional cash to liquidate P30,000,000 note payable. The financial statement were issued on March 31, 2014. What amount of the note payable should be reported as current liability on December 31, 2013? a. 40,000,000 b. 10,000,000 c. d. 5,000,000 0 22.) Jam Company had P2,000,000 note payable that is due on February 28,2014. The entity borrowed P1,600,000 on February 25, 2014 which was a five year term and used the proceeds to pay down the note and used other cash to pay the balance. How much of the P2,000,000 note is classified as noncurrent in the December 31,2013 financial statements that were issued on March 31, 2014? a. 2,000,000 b. 1,600,000 c. 400,000 d. 0 23.) Kumaykay Company provided the following schedule of liabilities on December 31, 2013: Accounts payable 6,500,000 Bank note payable – 10% 3,000,000 Bank note payable – 11% 5,000,000 Interest payable Mortgage note payable – 10% Bonds payable 150,000 2,000,000 4,000,000 The P3,000,000, 10% note was issued March 1, 2013, payable on demand. Interest is payable every six months. The one-year P5,000,000, 11% note was issued January 15, 2013. On December 31, 2013, the entity negotiated a written agreement with the bank to replace the note with a 2year, P5,000,000, 10% note to be issued January 15, 2014. The 10% mortgage note was issued October 1, 2010, with a term of 10 years. Terms of the note give the holder the right to demand immediate payment if the entity fails to make a monthly interest payment within 10 days from the date the payment is due. On December 31, 2013, the entity is three months behind in making its required interest payment. The bonds payable are ten-year, 8% bonds, issued June 30, 2004. Interest is payable semiannually on June 30 and December 31. What amount should be reported as total current liabilities on December 31, 2013? a. 15,650,000 b. 11,650,000 c. 20,650,000 d. 13,650,000 24.) Manchester Company provided the following information on December 31,2013: Employee income taxes withheld 900,000 Cash balance at First State Bank 2,500,000 Cash overdraft at Harbor Bank 1,300,000 Accounts receivable with credit balance 750,000 Estimated expenses of meeting warranties 500,000 Estimated damages as a result of unsatisfactory Performance on a contract Accounts payable 1,500,000 3,000,000 Deferred serial bonds, issued at par and bearing interest at 12%, Payable in semiannual installments of P500,000 due April 1 and October 1 of each year, the last bond to be paid on October 1, 2019. Interest is also paid semiannually. 5,000,000 What amount should be reported in the December 31, 2013 statement of financial position as total current liabilities? a. 8,100,000 b. 7,950,000 c. 9,100,000 d. 7,350,000 25.) The unadjusted current assets and shareholders’ equity of United Company on December 31, 2013 are as follows: Cash 600,000 Financial assets at fair value (including cost of P300,000 of United Company’s shares) 1,000,000 Trade accounts receivable 3,500,000 Inventory 1,500,000 Share capital 5,000,000 Share premium Retained earnings 2,000,000 500,000 What amount should be reported as total shareholders’ equity? a. 7,200,000 b. 7,500,000 c. 7,800,000 d. 5,200,000 26.) The adjusted trial balance of Kalinga Company on December 31, 2013 included the following accounts: Share capital 15,000,000 Share premium 5,000,000 Treasury shares, at cost 2,000,000 Actuarial loss recognized through other comprehensive income 1,000,000 Retained earnings unappropriated 6,000,000 Retained earnings appropriated 3,000,000 Revaluation surplus 4,000,000 Cumulative translation adjustment – credit 1,500,000 What amount should be reported as total shareholders’ equity? a. 31,500,000 b. 32,500,000 c. 28,500,000 d. 25,500,000 27.) Silver Company provided the following information on December 31, 2013: Share premium Accounts payable Preference share capital, at par Ordinary share capital, at par Sales 1,000,000 1,100,000 2,000,000 3,000,000 10,000,000 Total expenses 7,800,000 Treasury shares – ordinary 500,000 Dividends 700,000 Retained earnings – January 1 1,000,000 What total shareholders’ equity should be reported on dece, 31, 2013? a. 8,000,000 b. 8,500,000 c. 5,800,000 d. 8,700,000 28.) Mont Company reported net assets totaling P8,750,000 on December 31, 2013. The assets included the following: Treasury shares of Mont Company at cost 250,000 Idle machinery 100,000 Trademark 150,000 Allowance for inventory writedown 200,000 What amount should be reported as net assets on December 31, 2013? a. 8,500,000 b. 8,400,000 c. 8,300,000 d. 8,200,000 29.) Peach Company reported total assets of P4,375,000 at year-end. The total assets included the following: Treasury shares of Peach Company at cost Unamortized patent 120,000 56,000 Cash surrender value of life insurance Cumulative translation loss What amount should be reported as total assets at year-end? a. 4,208,500 b. 4,213,000 c. 4,250,500 d. 4,225,000 68,500 42,000 30.) Kabugao Company provided the following on December 31, 2013: Cash in bank, net of bank overdraft of P500,000 5,000,000 Petty cash (unreplenished petty cash expenses, P10,000) Notes receivable 50,000 4,000,000 Accounts receivable, net of accounts with credit balances Of P1,500,000 6,000,000 Inventory 3,500,000 Bond sinking fund 3,000,000 Total current assets 21,550,000 Accounts payable, net of accounts with debit balances of P1,000,000 7,000,000 Notes payable 4,000,000 Bond payable due June 30, 2014 3,000,000 Accrued expenses 2,000,000 Total current liabilities 16,000,000 1. What amount should be reported as total current assets on December 31, 2013? a. 19,040,000 b. 20,040,000 c. 20,050,000 d. 24,040,000 2. What amount should be reported as total current liabilities on December 31, 2013? a. 19,000,000 b. 16,000,000 c. 15,500,000 d. 15,000,000 31.) The following trial balance of Trey Company on December 31, 2013 has been adjusted except for income tax expense: Cash 600,000 Accounts receivable, net allowance of P100,000 1,650,000 Prepaid taxes 300,000 Accounts payable 140,000 Share capital 500,000 Share premium 680,000 Retained earnings Foreign currency translation adjustment 630,000 400,000 Revenue Expenses 3,600,000 2,600,000 5,550,000 5,550,000 During 2013, estimated tax payments of P300,000 were change to prepaid taxes. The entity has not yet recorded income tax expense. There were no differences between financial and taxable income. The tax rate is 30%. Included in accounts receivable is P500,000 due from a customer. Special terms granted to this customer require payment in equal semiannual installments of P125,000 every April 1 and October 1. 1. In the December 31, 2013 statement of financial position, what amount should be reported as total current assets? a. 2,000,000 b. 2,200,000 c. 2,300,000 d. 2,500,000 2. In the December 31, 2013 statement of financial position, what amount should be reported as total retained earnings? a. 1,680,000 b. 1,200,000 c. 1,330,000 d. 1,630,000 32.) The following trial balance of Mint Company on December 31, 2013 has just been adjusted except for income tax expense: Cash Accounts receivable, net Cost in excess of billings on long-term contracts 600,000 3,500,000 1,600,000 Billings in excess of cost on long-term contracts Prepaid taxes Property, plant and equipment Note payable – noncurrent, net Share capital Share premium Retained earnings unappropriated 700,000 450,000 1,510,000 1,620,000 750,000 2,030,000 900,000 Retained earnings appropriated 160,000 Earnings from long-term contracts Cost and expenses 6,680,000 5,180,000 12,840,000 12,840,000 The entity used the percentage of completion method to account for long-term construction contracts for financial statement and income tax purposes. All receivables on these contracts are considered to be collectible within 12 months. During 2013, estimated tax payments of P450,000 were charged to prepaid taxes. The entity has not recorded income tax expense. There were no temporary or permanent differences. The tax rate is 30%. In December 31, 2013 statement of financial position, what amount should be reported as 1. Total retained earnings? a. 1,950,000 b. 2,110,000 c. 2,400,000 d. 2,560,000 2. Total noncurrent liabilities? a. 1,620,000 b. 1,780,000 c. 2,230,000 d. 2,480,000 3. Total current assets? a. 5,000,000 b. 4,100,000 c. 5,700,000 d. 6,225,000 33.) Multinational Company provided the following balances on December 31, 2013: Accounts payable 500,000 Accrued taxes 100,000 Ordinary share capital 5,000,000 Dividends – ordinary share 1,000,000 Dividends – preference share 500,000 Mortgage payable (P500,000 due in six months) 4,000,000 Note payable, due in January 31, 2015 2,000,000 Share premium Preference share capital Premium on note payable Income summary – credit balance 500,000 3,000,000 200,000 4,000,000 Retained earnings – January 1 2,500,000 Unamortized issue cost on note payable Unearned rent income 50,000 150,000 1. What is the total amount of noncurrent liabilities on December 31, 2013? a. 5,700,000 b. 6,200,000 c. 5,500,000 d. 5,650,000 2. What is the amount of retained earnings on December 31, 2013? a. 6,500,000 b. 2,500,000 c. 1,000,000 d. 5,000,000 3. What is the total shareholders’ equity on December 31, 2013? a. 15,000,000 b. 13,500,000 c. 9,500,000 d. 8,500,000 34.) Aroma Company provided the following information on December 31, 2013: Cash Accounts receivable, net allowance of P50,000 Inventory Prepaid expenses Property, plant and equipment Accumulated depreciation 300,000 800,000 1,650,000 250,000 8,800,000 800,000 Accounts payable 1,250,000 Accrued expenses 250,000 Bonds payable 4,000,000 Share capital 5,000,000 Retained earnings 500,000 A P500,000 note payable to bank, due on June 30, 2014, was deducted from the balances on deposit in the same bank. The entity recorded checks of P200,000 in payment of accounts payable on December 31, 2013. These checks were still on hand on January 20, 2014. An advance payment of P100,000 from a customer for goods to be delivered in 2014 was deducted from accounts receivable. What is the working capital on December 31, 2013? a. 1,500,000 b. 3,800,000 c. 1,400,000 d. 2,000,000 35.) Alena Company provided the following information at year-end: Property, plant and equipment Accounts receivable 35,000,000 20,000,000 Prepaid insurance 2,500,000 Short-term note payable 3,000,000 Cash 5,000,000 Bonds payable 40,000,000 Total assets 101,500,000 Land 20,000,000 Accounts payable 8,000,000 Allowance for doubtful accounts 1,000,000 Merchandise inventory 13,000,000 Financial asset at fair value through other comprehensive income 7,000,000 Wages payable 2,000,000 Total liabilities 56,000,000 Premium on bonds payable What is the working capital? a. 46,500,000 b. 33,500,000 c. 26,500,000 d. 35,500,000 3,000,000 36.) Moon Company provided the following data on December 31, 2013: Cash in general checking account 500,000 Sinking fund to be used to retire bonds in 2016 1,200,000 Cash held to pay value added taxes 300,000 Notes receivable – due February 2015 2,200,000 Accounts receivable 2,100,000 Inventory 1,500,000 Prepaid insurance 300,000 Vacant land held as investment 5,000,000 Equipment classified as help for sale 300,000 Accounts payable 1,400,000 Note payable – due July 2014 800,000 Note payable – due January 2015 300,000 Bonds payable – maturity 2016 4,600,000 Salaries payable 400,000 Value added taxes payable 300,000 What is the amount of working capital? a. 4,900,000 b. 2,000,000 c. 2,260,000 d. 1,700,000 37.) The following trial balance of Shaw Company on December 31, 2013 has been adjusted except income tax expense: Cash 675,000 Accounts receivable (net) 2,695,000 Inventory 2,185,000 Property, plant and equipment (net) 10,245,000 Accounts payable and accrued liabilities 1,800,000 Income tax payable 1,500,000 Deferred tax liability 750,000 Share capital 2,500,000 Share premium 3,000,000 Retained earnings, January 1 3,350,000 Net sales and other revenue 15,000,000 Costs and expenses 10,000,000 Income tax expense 2,100,000 27,900,000 27,900,000 The accounts receivable included P1,000,000 due from a customer and payable in quarterly installments of P125,000. The last payment is due December 30, 2015. During the year, estimated tax payment of P600,000 was charged to income tax expense. The income tax rate is 30% on all types of income. On December 31, 2013, what amount should be reported as: 1. Total current assets? a. 6,030,000 b. 5,555,000 c. 5,530,000 d. 5,055,000 2. Total current liabilities? a. 2,700,000 b. 3,300,000 c. 4,050,000 d. 3,450,000 3. Retained earnings? a. 8,350,000 b. 7,750,000 c. 6,850,000 d. 6,250,000 38.) The current sections of the unadjusted statement of financial position of Camarines Company on December 31, 2013 were as follows: Cash 2,000,000 Accounts receivable 3,000,000 Merchandise inventory Prepaid expenses 1,900,000 100,000 Total current assets 7,000,000 Trade accounts payable, net of a debit balance of P500,000 2,450,000 Interest payable Income tax payable Money claims of the union, pending final decision Mortgage payable, due in four annual installments Total current liabilities 150,000 300,000 500,000 2,000,000 5,400,000 A review showed that the cash balance of 2,000,000 included a customer’s check amounting to P100,000 returned by the bank marked NSF, an employee IOU of P50,000, and P200,000 deposited with the court for a case under litigation. The cash in bank portion of P1,650,000 is the balance per bank statement. On December 31, 2013, outstanding checks amounted to P250,000. The accounts receivable included the following: Customer’s debit balance 1,600,000 Advances to subsidiary 400,000 Advances to suppliers 200,000 Receivable from officers 300,000 Allowance for doubtful accounts (100,000) Selling price of merchandise invoiced at 120% of cost, not yet delivered and excluded from ending inventory 600,000 Total accounts receivable 3,000,000 What amount should be reported as total current assets on December 31, 2013? a. 6,050,000 b. 6,350,000 c. 5,550,000 d. 6,100,000 NOTES TO FINANCIAL STATEMENTS 1.) During 2013, Jane Company engaged in the following transactions: Key management personnel compensation 2,000,000 Sales to affiliated entities 3,000,000 What total amount should be included as related party disclosures in Jane Company’s 2013 financial statements? a. 5,000,000 b. 3,000,000 c. 2,000,000 d. 0 2.) Gibson Company is part of a major industrial group and is known to accurately disclose related party transactions in its financial statements. Renumeration and other payments made to the entity’s chief executive office during 2013 were: Annual salary 2,000,000 Share option and other share-based payments 1,000,000 Contribution to retirement benefit plan 500,000 Reimbursement of travel expenses for business trips 1,200,000 What total amount should be disclosed as “compensation” to key management personnel? a. 3,500,000 b. 4,700,000 c. 3,000,000 d. 2,500,000 3.) Dean Company acquired 100% Morey Company prior to 2013. During 2013, the individual entities included in their financial statements the following: Dean Morey Key officers’ salaries 750,000 Officers’ expenses 200,000 100,000 1,250,000 500,000 Loans to officers Intercompany sales 1,500,000 500,000 What total amount should be reported as related party disclosures in the notes to Dean Company’s 2013 consolidate financial statement? a. 1,500,000 b. 1,550,000 c. 1,750,000 d. 3,000,000 4.) The audit of Anne Company for the year ended December 31, 2013 was completed on March 1, 2014. The financial statements were signed by the managing director on March 15, 2014 and approved by the shareholders on March 31, 2014. The next events have occurred. On January 15, 2014, a customer owing P200,000 to Anne Company filed for bankruptcy. The financial statements included an allowance for doubtful accounts pertaining to this customer only of P100,000 Anne Company’s issued share capital comprised 100,000 ordinary shares with P100,000 par value. The entity issued additional 25,000 shares on March 1, 2014 at par value. Specialized equipment costing P525,000 purchased on September 1, 2013 was destroyed by fire on December 15, 2013. Anne Company has booked a receivable of P400,000 from the insurance entity. After the insurance entity completed its investigation on February 1, 2014, it was discovered that the fire took place due to negligence of the machine operator. As a result, the insurer’s liability was zero on this claim. What total amount should be reported as “adjusting events” on December 31, 2013? a. 1,300,000 b. 1,200,000 c. 3,800,000 d. 3,700,000 5.) The end of reporting period of Norway Company is December 31, 2013 and the financial statements are authorized for issue on March 15, 2014. On December 31, 2013, Norway Company had a receivable of P400,000 from a customer that is due 60 days after the end of reporting period. On January 15, 2014, a receiver was appointed for the said customer. The receiver informed Norway that the P400,000 would be paid in full by June 30, 2014. Norway Company measured its investments in listed shares as held for trading at fair value through profit or loss. On December 31, 2013, these investments were recorded at the market value of P5,000,000. During the period up to February 15, 2014, there was a steady decline in the market value of all the shares in portfolio, and on February 15, 2014, the market value had fallen to P2,000,000. Norway Company had reported a contingent liability on December 31, 2013 related to a court case in which Norway Company was defendant. The case was not heard until the first of February 2014. On February 11, 2014, the judge handed down a decision against Norway Company. The judge determined that Norway Company was liable to pay damages and costs totaling P3,000,000. On December 31, 2013, Norway Company had a receivable from a large customer in the amount of P3,500,000. On January 31, 2014, Norway Company was advised in writing by the liquidator of the said customer that the customer was insolvent and that only 10% of the receivable will be paid on April 30, 2014. What should be reported as “adjusting events” on December 31, 2013? a. 6,150,000 b. 9,150,000 c. 9,550,000 d. 6,500,000 6.) Ginger Company is completing the preparation of its draft financial statements for the year ended December 31, 2013. The financial statements are authorized for issue on March 31, 2014. On March 15, 2014, a dividend of P1,750,000 was declared and a contractual profit share payment of P350,000 was made, both based on the profit for the year ended December 31, 2013. On February 1, 2014, a customer went into liquidation having owed the entity P340,000 for the past 5 months. No allowance had been made against this debt in the draft financial statements. On March 20, 2014, a manufacturing plant was destroyed by fire resulting in a financial loss of P2,600,000. What total amount should be recognized as profit or loss for the year ended December 31, 2013 ro reflect adjusting events after the end of reporting period? a. 1,750,000 b. 3,290,000 c. 2,600,000 d. 690,000 7.) Elysee Company’s draft financial statements showed the profit before tax for the year ended December 31, 2013 at P9,000,000. The board of directors authorized the financial statements for issue on March 20, 2014. A fire occurred at one of Elysse’s sites on January 15, 2014 with the resulting damage costing P7,000,000, only P4,000,000, of which is covered by insurance. The repairs will take place and be paid for in April 2014. The 4,000,000 claim from the insurance entity will however be received on February 14, 2014. What amount should be reported as profit before tax in Elysee’s financial statements? a. 13,000,000 b. 9,000,000 c. 2,000,000 d. 6,000,000 8.) Caress Company carried a provision of P2,000,000 in its draft financial statements on December 31, 2013 in relation to an unresolved court case. On January 31, 2014, when the financial statements on December 31, 2013 had not yet been authorized for issue, the case was settled and the court decided the final total damages payable by Caress to be P2,800,000. What amount should be adjusted on December 31, 2013 in relation to this event? a. 2,800,000 b. 2,000,000 c. 800,000 d. 0 9.) During 2013, Marian Company was sued by a competitor for P5,000,000 for infringement of patent. Based on the advice of the entity’s legal counsel, the entity accrued the sum of P3,000,000 as a provision in its financial statements for the year ended December 31, 2013. Subsequently, on March 15, 2014. The Supreme Court decided in favor of the party alleging infringement of the patent and ordered the defendant to pay the aggrieved party a sum of P3,500,000. The financial statements were prepared by the entity’s management of February 15, 2014 and approved by the board of directors on March 31, 2014. What amount should be recognized as accrued liability on December 31, 2013? a. 5,000,000 b. 3,500,000 c. 3,000,000 d. 1,500,000 10.) Caroline Company provided the following events that occurred after December 31, 2013: 1/15/2014 customer. P3,000,000 of accounts receivable was written off due to the bankruptcy of a major 2/14/2014 lost at sea A shipping vessel of the entity with carrying amount of P5,000,000 was completely because of a hurricane. 3/11/2014 A court case involving the entity as the defendant was settled and the entity was obligated to pay the plaintiff P1,500,000. The entity previously has not recognize a liability for the suit because entity would lose the case. management deemed it possible that then 3/15/2014 One of the entity’s factories with a carrying amount of P4,000,000 was completed razed by forest fire that erupted in its vicinity. The management completed the draft of the financial statements for 2013 on February 10, 2014. On March 20, 2014, the board of directors authorized the financial statements for issue. The entity announced its profit and other selected information on March 22, 2014. The financial statements were approved by shareholders on April 2, 2014 and filed with the SEC the very next day. What total amount should be reported as “adjusting events” on December 31, 2013? a. 9,500,000 b. 8,500,000 c. 9,000,000 d. 4,500,000 NOTES TO FINANCIAL STATEMENTS 11.) During 2013, Jane Company engaged in the following transactions: Key management personnel compensation 2,000,000 Sales to affiliated entities 3,000,000 What total amount should be included as related party disclosures in Jane Company’s 2013 financial statements? e. 5,000,000 f. 3,000,000 g. 2,000,000 h. 0 12.) Gibson Company is part of a major industrial group and is known to accurately disclose related party transactions in its financial statements. Renumeration and other payments made to the entity’s chief executive office during 2013 were: Annual salary 2,000,000 Share option and other share-based payments 1,000,000 Contribution to retirement benefit plan 500,000 Reimbursement of travel expenses for business trips 1,200,000 What total amount should be disclosed as “compensation” to key management personnel? e. 3,500,000 f. 4,700,000 g. 3,000,000 h. 2,500,000 13.) Dean Company acquired 100% Morey Company prior to 2013. During 2013, the individual entities included in their financial statements the following: Dean Morey Key officers’ salaries 750,000 Officers’ expenses 200,000 100,000 1,250,000 500,000 Loans to officers Intercompany sales 500,000 1,500,000 What total amount should be reported as related party disclosures in the notes to Dean Company’s 2013 consolidate financial statement? e. 1,500,000 f. 1,550,000 g. 1,750,000 h. 3,000,000 14.) The audit of Anne Company for the year ended December 31, 2013 was completed on March 1, 2014. The financial statements were signed by the managing director on March 15, 2014 and approved by the shareholders on March 31, 2014. The next events have occurred. On January 15, 2014, a customer owing P200,000 to Anne Company filed for bankruptcy. The financial statements included an allowance for doubtful accounts pertaining to this customer only of P100,000 Anne Company’s issued share capital comprised 100,000 ordinary shares with P100,000 par value. The entity issued additional 25,000 shares on March 1, 2014 at par value. Specialized equipment costing P525,000 purchased on September 1, 2013 was destroyed by fire on December 15, 2013. Anne Company has booked a receivable of P400,000 from the insurance entity. After the insurance entity completed its investigation on February 1, 2014, it was discovered that the fire took place due to negligence of the machine operator. As a result, the insurer’s liability was zero on this claim. What total amount should be reported as “adjusting events” on December 31, 2013? e. 1,300,000 f. 1,200,000 g. 3,800,000 h. 3,700,000 15.) The end of reporting period of Norway Company is December 31, 2013 and the financial statements are authorized for issue on March 15, 2014. On December 31, 2013, Norway Company had a receivable of P400,000 from a customer that is due 60 days after the end of reporting period. On January 15, 2014, a receiver was appointed for the said customer. The receiver informed Norway that the P400,000 would be paid in full by June 30, 2014. Norway Company measured its investments in listed shares as held for trading at fair value through profit or loss. On December 31, 2013, these investments were recorded at the market value of P5,000,000. During the period up to February 15, 2014, there was a steady decline in the market value of all the shares in portfolio, and on February 15, 2014, the market value had fallen to P2,000,000. Norway Company had reported a contingent liability on December 31, 2013 related to a court case in which Norway Company was defendant. The case was not heard until the first of February 2014. On February 11, 2014, the judge handed down a decision against Norway Company. The judge determined that Norway Company was liable to pay damages and costs totaling P3,000,000. On December 31, 2013, Norway Company had a receivable from a large customer in the amount of P3,500,000. On January 31, 2014, Norway Company was advised in writing by the liquidator of the said customer that the customer was insolvent and that only 10% of the receivable will be paid on April 30, 2014. What should be reported as “adjusting events” on December 31, 2013? e. 6,150,000 f. 9,150,000 g. 9,550,000 h. 6,500,000 16.) Ginger Company is completing the preparation of its draft financial statements for the year ended December 31, 2013. The financial statements are authorized for issue on March 31, 2014. On March 15, 2014, a dividend of P1,750,000 was declared and a contractual profit share payment of P350,000 was made, both based on the profit for the year ended December 31, 2013. On February 1, 2014, a customer went into liquidation having owed the entity P340,000 for the past 5 months. No allowance had been made against this debt in the draft financial statements. On March 20, 2014, a manufacturing plant was destroyed by fire resulting in a financial loss of P2,600,000. What total amount should be recognized as profit or loss for the year ended December 31, 2013 ro reflect adjusting events after the end of reporting period? e. 1,750,000 f. 3,290,000 g. 2,600,000 h. 690,000 17.) Elysee Company’s draft financial statements showed the profit before tax for the year ended December 31, 2013 at P9,000,000. The board of directors authorized the financial statements for issue on March 20, 2014. A fire occurred at one of Elysse’s sites on January 15, 2014 with the resulting damage costing P7,000,000, only P4,000,000, of which is covered by insurance. The repairs will take place and be paid for in April 2014. The 4,000,000 claim from the insurance entity will however be received on February 14, 2014. What amount should be reported as profit before tax in Elysee’s financial statements? e. 13,000,000 f. 9,000,000 g. 2,000,000 h. 6,000,000 18.) Caress Company carried a provision of P2,000,000 in its draft financial statements on December 31, 2013 in relation to an unresolved court case. On January 31, 2014, when the financial statements on December 31, 2013 had not yet been authorized for issue, the case was settled and the court decided the final total damages payable by Caress to be P2,800,000. What amount should be adjusted on December 31, 2013 in relation to this event? e. 2,800,000 f. 2,000,000 g. h. 800,000 0 19.) During 2013, Marian Company was sued by a competitor for P5,000,000 for infringement of patent. Based on the advice of the entity’s legal counsel, the entity accrued the sum of P3,000,000 as a provision in its financial statements for the year ended December 31, 2013. Subsequently, on March 15, 2014. The Supreme Court decided in favor of the party alleging infringement of the patent and ordered the defendant to pay the aggrieved party a sum of P3,500,000. The financial statements were prepared by the entity’s management of February 15, 2014 and approved by the board of directors on March 31, 2014. What amount should be recognized as accrued liability on December 31, 2013? e. 5,000,000 f. 3,500,000 g. 3,000,000 h. 1,500,000 20.) Caroline Company provided the following events that occurred after December 31, 2013: 1/15/2014 customer. P3,000,000 of accounts receivable was written off due to the bankruptcy of a major 2/14/2014 lost at sea A shipping vessel of the entity with carrying amount of P5,000,000 was completely because of a hurricane. 3/11/2014 A court case involving the entity as the defendant was settled and the entity was obligated to pay the plaintiff P1,500,000. The entity previously has not recognize a liability for the suit because management deemed it possible that then entity would lose the case. 3/15/2014 One of the entity’s factories with a carrying amount of P4,000,000 was completed razed by forest fire that erupted in its vicinity. The management completed the draft of the financial statements for 2013 on February 10, 2014. On March 20, 2014, the board of directors authorized the financial statements for issue. The entity announced its profit and other selected information on March 22, 2014. The financial statements were approved by shareholders on April 2, 2014 and filed with the SEC the very next day. What total amount should be reported as “adjusting events” on December 31, 2013? e. 9,500,000 f. 8,500,000 g. 9,000,000 h. 4,500,000 STATEMENT OF COMPREHENSIVE INCOME 1.) Brock Company reported operating expenses in two categories, namely distribution and genereal and administrative. The adjusted trial balance at year-end included the following expense and loss accounts for current year? Accounting and legal fees 1,200,000 Advertising 1,500,000 Freight out 800,000 Interest Loss on sale of long-term investment 700,000 300,000 Officers’ salaries 2,250,000 Rent for office space 2,200,000 Sales salaries and commissions One-half of the rented premises is occupied by the sales department. What amount should be reported as total distribution costs? 1,400,000 a. 4,800,000 b. 4,000,000 c. 3,700,000 d. 3,600,000 2.) Lee Company reported the following data for the current year: Legal and audit fees 1,700,000 Rent for office space 2,400,000 Interest on inventory loan 2,100,000 Loss on abandoned data processing equipment 350,000 The office space is used equally by the sales and accounting departments. What amount should be classified as general and administrative expenses? a. 2,900,000 b. 3,250,000 c. 4,100,000 d. 5,000,000 3.) Griff Company reported the following data for the current year: Accounting and legal fees 250,000 Freight in 1,750,000 Freight out 1,600,000 Officers’ salaries 1,500,000 Insurance 850,000 Sales representative salaries 2,150,000 What amount should be reported as administrative expenses? a. 2,600,000 b. 5,500,000 c. 6,350,000 d. 8,100,000 4.) Dell Company provided the following information for the current year: Purchases Purchase discounts 5,300,000 100,000 Beginning inventory 1,600,000 Ending inventory 2,150,000 Freight out 400,000 What is the cost of goods sold for the current year? a. 4,650,000 b. 4,750,000 c. 5,050,000 d. 5,850,000 5.) Bart Company provided the following information for the current year: Disbursement for purchases 5,800,000 Increase in trade accounts payable 500,000 Decrease in merchandise inventory 200,000 What is the cost of goods sold for the current year? a. 6,500,000 b. 6,100,000 c. 5,500,000 d. 5,100,000 6.) Vigor Company provided the following information for the current year: Net accounts receivable at January 1 Net accounts receivable at December 31 Accounts receivable turnover 900,000 1,000,000 5 to 1 Inventory at January 1 1,100,000 Inventory at December 31 1,200,000 Inventory turnover 4 to 1 What is the gross margin for the current year? a. 150,000 b. 200,000 c. 300,000 d. 400,000 7.) Hiligaynon Company provided the following information for the current year: Beginning inventory 400,000 Freight in 300,000 Purchase returns 900,000 Ending inventory 500,000 Selling expenses 1,250,000 Sales discount 250,000 The cost of goods sold is six times the selling expenses. What is the amount of gross purchase? a. 6,500,000 b. 6,700,000 c. 8,000,000 d. 8,200,000 8.) Bicolano Company provided the following information for the current year: Inventory, January 1 2,000,000 Purchases 7,500,000 Purchase returns and allowances 500,000 Sales returns and allowances 750,000 Inventory on December 31 Gross profit rate on net sales What is the amount of gross sales for the current year? a. 7,750,000 b. 8,500,000 c. 7,000,000 d. 9,125,000 2,800,000 20% 9.) Kay Company provided the following information for the current year: Increase in raw materials inventory Decrease in goods in process inventory Decrease in finished goods inventory 150,000 200,000 350,000 Raw materials purchased 4,300,000 Direct labor payroll 2,000,000 Factory overhead 3,000,000 Freight out 450,000 Freight in 250,000 What is the cost of goods sold for the current year? a. 9,950,000 b. 9,550,000 c. 9,250,000 d. 9,150,000 10.) Sheraton Company reported the following information for the current year: Ending goods in process Depreciation on factory building 1,000,000 320,000 Beginning raw materials Direct labor Factory supervisor’s salary Depreciation on headquarters building Beginning goods in process 400,000 1,980,000 560,000 210,000 760,000 Ending raw materials 340,000 Indirect labor 360,000 Purchases of raw materials 2,300,000 What is the cost of goods manufactured for the current year? a. 5,340,000 b. 5,580,000 c. 5,550,000 d. 5,820,000 11.) year: Argentina Company incurred the following costs and expenses during the current Raw materials purchases 4,000,000 Direct labor 1,500,000 Indirect labor – factory 800,000 Factory repairs and maintenance 200,000 Taxes on factory building 100,000 Depreciation – factory building 300,000 Taxes on salesroom and general office 150,000 Depreciation – sales equipment 50,000 Advertising 400,000 Sales salaries 500,000 Office salaries 700,000 Utilities (60% applicable to factory) 500,000 Beginning Ending Raw materials 300,000 450,000 Work in process 400,000 350,000 Finished goods 500,000 700,000 What is the cost of goods manufactured for the current year? a. 6,900,000 b. 7,200,000 c. 7,100,000 d. 7,300,000 12.) Vane Company provided the following trial balance of income statement accounts for the current year: Debit Credit Sales 5,750,000 Cost of sales 2,400,000 Administrative expenses 700,000 Loss on sale of equipment 100,000 Sales commissions 500,000 Interest revenue 250,000 Freight out 150,000 Loss on early retirement of long-term debt 200,000 Uncollectible accounts expense 150,000 4,200,000 6,000,000 Finished goods inventory: January 1 4,000,000 December 31 3,600,000 What amount should be reported as cost of goods manufactured? a. 2,000,000 b. 2,150,000 c. 2,800,000 d. 2,950,000 13.) Mercury Company showed cost of goods sold of P4,320,000 in its statement of comprehensive income after the first year of operations. The total manufacturing costs comprised 50% materials used, 30% direct labor incurred, and 20% manufacturing overhead. Goods in process at year-end were 10% of the total manufacturing cost. Finished goods at year-end amounted to 20% of the cost of goods manufactured. What is the amount of the direct labor cost incurred? a. 1,800,000 b. 2,400,000 c. 3,000,000 d. 5,400,000 14.) Tactful Company reported that the operating expenses other than interest expense for the current year amount to 40% of cost of sales but only 20% of sales. Interest expense if 5% of sales. The amount of purchases is 120% of cost of sales. Ending inventory is twice as much as the beginning inventory. The income after tax of 30% for the current year is P560,000. What is the amount of sales for the current year? a. 2,080,000 b. 1,485,000 c. 2,285,000 d. 3,200,000 15.) Jericho Company showed net income of P480,000 in its income statement for the current year. Selling expenses were equal to 15% of sales and also 25% of cost of sales. All other expenses were 13% of sales. What is the gross profit for the current year? a. 4,000,000 b. 2,400,000 c. 1,600,000 d. 2,000,000 16.) The financial records of Ronalyn Company were destroyed by fire at the end of the current year. However, certain statistical data related to the income statement are available. Interest expense Cost of goods sold Sales discount 20,000 2,000,000 100,000 The beginning inventory was P400,000 and decreased 20% during the year. Administrative expense are 25% of cost of goods sold but only 10% of gross sales. Four-fifths of the operating expenses relate to sale activities. Ignoring income tax, what is the net income for the current year? a. 380,000 b. 480,000 c. 330,000 d. 400,000 17.) Thorpe Company reported net income of P7,410,000 for the current year. The auditor raised questions about the following amounts that had been included in net income: Unrealized loss on foreign currency translation Gain in early retirement of bonds payable ( 540,000) 2,200,000 Adjustment of prior of prior year for error in depreciation (net of tax effect) Loss from fire ( 750,000) (1,400,000) What amount should be reported as adjusted net income? a. 6,500,000 b. 6,610,000 c. 8,160,000 d. 8,700,000 18.) Pearl Company reported income before tax of P5,000,000 for the current year. The auditor questioned the following amounts that had been included in income before tax: Equity earnings of Cinn Company – 40% interest Dividend received from Cinn Company 1,600,000 320,000 Adjustment of profit of prior year For arithmetical error in depreciation What amount should be reported as income before tax? a. 3,400,000 b. 4,680,000 c. 4,800,000 d. 6,080,000 (1,400,000) 19.) Witt Company incurred the following during the current year: a. P350,000 from major strike by employees. b. P300,000 from condemnation of asset. c. P250,000 from the abandonment of equipment used in the business. In the income statement, what is the total amount of infrequent losses that should be reported as extraordinary? a. 900,000 b. 600,000 c. 650,000 d. 0 20.) Ocean Company’s comprehensive insurance policy allows its assets to be replaced at current value. The policy has a P250,000 deductible clause. One of the entity’s waterfront warehouse was destroyed in a winter storm. Such storms occur approximately every four years. The entity incurred P100,000 of cost in dismantling the warehouse and plans to replace it. The following data relate to the warehouse: Current carrying amount 1,500,000 Replacement cost 5,500,000 What amount of gain should be reported as a component of income from continuing operations? a. 5,150,000 b. 3,900,000 c. 3,650,000 d. 0 21.) Bangladesh Company provided the following information for the current year: Sales 50,000,000 Cost of goods sold 30,000,000 Distribution costs 5,000,000 General and administrative expenses 4,000,000 Interest expense 2,000,000 Gain on early extinguishment of long-term debit Correction of inventory error, net of income tax – credit 500,000 1,000,000 Investment income – equity method 3,000,000 Gain on expropriation 2,000,000 Income tax expense 5,000,000 Dividends declared 2,500,000 What is the income from continuing operations? a. 9,000,000 b. 8,000,000 c. 9,500,000 d. 7,000,000 22.) Rosebud Company provided the following information for the current year: Sales 5,000,000 Cost of goods sold 2,800,000 Foreign translation adjustment – credit 400,000 Selling expenses 700,000 Unusual and infrequent error 400,000 Correction of inventory error 200,000 General and administrative expenses 600,000 Income tax expense 150,000 Gain on sale of investment 50,000 Proceeds from sale of land at cost 800,000 Dividends 300,000 What amount should be reported as income from continuing operations? a. 1,200,000 b. 1,350,000 c. 1,600,000 d. 2,000,000 23.) Corazon Company provided the following information for the current year: Sales Sales returns and allowances 7,000,000 100,000 Cost of goods sold 2,800,000 Utilities expense 1,000,000 Interest revenue 150,000 Income tax expense 800,000 Casualty loss due to earthquake 50,000 Finance cost 200,000 Salaries expense 600,000 Loss on sale of investment 50,000 What amount should be reported as income from continuing operations? a. 1,550,000 b. 1,600,000 c. 2,350,000 d. 1,400,000 24.) Igloo Company provided the following information for the current year: Uncollectible accounts expense 2,000,000 Freight out 3,500,000 Cost of sales 40,000,000 Loss on sale of equipment 1,500,000 Loss from typhoon 3,000,000 Sales 90,000,000 Interest income 4,000,000 Administrative expense 10,000,000 Finished goods inventory, January 1 Sales commissions 60,000,000 7,000,000 Finished goods inventory, December 31 Income tax rate What amount should be reported as income from continuing operations? a. 30,000,000 b. 19,500,000 c. 27,000,000 d. 18,900,000 55,000,000 30% 25.) Remy Company had the following events and transactions during 2013: Depreciation for 2011 was understated by P300,000. A litigation settlement resulted in a loss of P250,000. The Inventory on December 31, 2011 was over stated by P200,000. The entity disposed of a recreational division at a loss of P500,000. The income tax rate is 30%. What is the effect of these events on the income from continuing operations for 2013? a. 175,000 b. 385,000 c. 665,000 d. 525,000 26.) Sky Company reported the following date for the current year: Income from continuing operations 450,000 Net income 405,000 Selling and administrative expenses 2,250,000 Income before income tax 900,000 What amount should be reported as income or loss from discontinued operations? a. 450,000 income b. 360,000 income c. 90,000 loss d. 45,000 loss 27.) Alladin Company provided the following for the current year: Net income 3,500,000 Unrealized gain on derivative contract 250,000 Foreign currency translation adujstment – debit Revaluation surplus 50,000 1,000,000 What is the comprehensive income for the current year? a. 3,700,000 b. 4,700,000 c. 4,800,000 d. 4,500,000 28.) Brass Company provided the following data for the current year: Income from continuing operations 8,000,000 Actuarial loss recognized in other comprehensive income Dividend paid Casualty loss (not included in income) What is the profit for the current year? a. 8,000,000 b. 7,500,000 c. 5,500,000 2,000,000 700,000 500,000 d. 6,800,000 29.) Rose Company, an investment entity, provided the following income and expenses for the current year: Dividend income from investments 9,200,000 Distribution income from trusts Interest income on deposits 500,000 700,000 Income from bank treasury bills 100,000 Unrealized gain on derivative account 400,000 Income from dealing in securities and derivatives held for trading 600,000 Writedown of securities and derivatives held for trading 150,000 Other income 250,000 Finance cost 300,000 Administrative staff costs 3,800,000 Sundry administrative costs 1,200,000 Income tax expense 1, 700,000 What is the comprehensive income of the current year? a. 4,200,000 b. 4,600,000 c. 3,800,000 d. 9,200,000 30.) Sales Dahlia Company provided the following information for the current year: 9,500,000 Interest revenue 250,000 Gain sale of equipment Revaluation surplus during the year Share of profit of associate Cost of goods sold 100,000 1,200,000 350,000 6,000,000 Finance cost 150,000 Distribution costs 500,000 Administrative expenses 300,000 Translation loss in foreign operation 200,000 Income tax expense 950,000 What is the net income for the current year? a. 2,300,000 b. 3,300,000 c. 4,200,000 d. 2,100,000 31.) Lotus Company provided the following date for the current year: Sales Share of profit of associate 9,750,000 450,000 Decrease in inventory of finished goods 250,000 Raw materials and consumables used 3,500,000 Employee benefit expense 1,500,000 Translation gain on foreign operation 300,000 Impairment loss 800,000 Finance cot 350,000 Other operating expenses 900,000 Income tax expenses 900,000 Unrealized gain on internet swap 200,000 What is the net income for the current year? a. 2,900,000 b. 2,500,000 c. 2,000,000 d. 1,850,000 32.) Mount Isarog Company provided the following data for the current year: Retained earnings, January 1 3,000,000 Dividends 1,000,000 Sales 8,350,000 Dividend income 100,000 Inventory, January 1 1,040,000 Purchases 3,720,000 Salaries 1,540,000 Contribution to employees’ pension fund 280,000 Delivery 205,000 Miscellaneous expense 125,000 Doubtful accounts expense 10,000 Depreciation expense 85,000 Loss on sale of securities 40,000 Loss on inventory writedown 150,000 Income tax 753,000 Inventory on December 31 was valued at P700,000(P850,000 less P150,000 writedown of obsolete inventory). 1. What is the cost of goods sold? a. 4,760,000 b. 4,060,000 c. 3,910,000 d. 4,210,000 2. What is the income from continuing operations? a. 2,105,000 b. 1,370,000 c. 1,520,009 d. 1 410,000 3. What is the balance of retained earnings on December? a. 4,370,000 b. 3,370,000 c. 4,520,000 d. 3,520,000 33.) While preparing the 2013 financial statements, Dek Company discovered computational errors in the 2012 and 2011 depreciation expense. These errors resulted in overstatement of each year’s income by P100,000, net of income tax. The following amounts were reported in the previously issued financial statements: Retained earnings, January 1 Net income 2012 2011 2,800,000 2,000,000 600,000 800,000 The net income for 2013 is correctly reported at P700,000. What is the correct balance of retained earnings on December 31, 2103? a. 3,900,000 b. 4,100,000 c. 4,300,000 d. 4,000,000 NONCURRENT ASSET HELD FOR SALE DISCONTINUED OPERATION 1.) Dana Company accounts for noncurrent assets using the cost model. On October 1, 2013, the entity classified a noncurrent asset as held for sale. At that date, the asset’s carrying amount was P3,200,000, its fair value was estimated at P2,200,000 and the cost of disposal at P200,000. On December 15,2013, the asset was sold for net proceeds of P1,850,000. What amount should be included as an impairment loss in the statement of comprehensive income for the year ended December 31, 2013? a. 1,000,000 b. 1,200,000 c. 1,350,000 d. 0 2.) Arlene Company accounts for noncurrent assets using the cost model. On October 30, 2013, the entity classified a noncurrent asset as held for sale. At that date, the asset’s carrying amount was P1,500,000, its fair value was estimated at P1,100,000 and the cost of disposal at P150,000. On November 20, 2013, the asset was sold for net proceeds of P800,000. What amount should be included as loss on disposal in the statement of comprehensive income for the year ended December 31, 2013? a. 550,000 b. 700,000 c. 150,000 d. 0 3.) Coral Company accounts for noncurrent assets using the cost model. On July 31, 2013, the entity classified a noncurrent asset as held for sale. At that date, the asset’s carrying amount was P1,450,000, the fair value was estimated at P2,150,000 and the cost of disposal at 150,000. The asset was sold on January 31, 2014 for P2,120,000. At what amount should the asset be measured in the statement of financial position on December 31, 2013? a. 2,000,000 b. 2,150,000 c. 2,120,000 d. 1,450,000 4.) Lynx Company is planning to dispose of a collection of assets. The entity designated these assets as a disposal group. The carrying amount of these assets immediately before classification as held for sale was P2,000,000. Upon being classified as held for sale, the assets were revalued to P1,800,000. The entity feels that it would cost P100,000 to sell the disposal group. What is the carrying amount of the disposal group after classification as held for sale? a. 2,000,000 b. 1,800,000 c. 1,700,000 d. 1,900,000 5.) On April 1, 2013, Brandy Company has a machine with a cost of P1,000,000 and accumulated depreciation of P750,000. On April 1, 2013, the entity classified the machine as “held for sale” and decided to sell the machine within 1 year. On April 1, 2013, the machine had an estimated selling price of P100,000 and a remaining useful life of 2 years. It is estimated that selling cost associated with the disposal of the machine will be P10,000. On December 31, 2013, the estimated selling price of the machine had increased to P150,000 with estimated selling cost of P20,000. What amount should be recognize as gain on reversal of impairment on December 31, 2013? a. 93, 750 b. 73,750 c. 60,000 d. 40,000 6.) On January 1, 2013, Villa Company classified as held for sale a noncurrent asset with a carrying amount of P5,000,000. On this date, the asset is expected to be sold for P4,600,000. Reasonable disposal cost to be incurred on sale is expected at P200,000. By December 31, 2013, the asset had not been sold and management after considering its option decided to place back the noncurrent asset into operations. On that date, the entity estimated that the noncurrent asset is expected to be sold at P4,300,000 with disposal cost of P50,000. The carrying amount of the noncurrent asset is P4,000,000 on December 31, 2013 if the noncurrent asset is not classified as held for sale. What is the carrying amount of the asset that should be reported in the statement of financial position on December 31, 2013? a. 5,000,000 b. 4,000,000 c. 4,400,000 d. 4,250,000 7.) Clara Company purchased equipment for P5,000,000 on January 1, 2013 with a useful life of 10 years and no residual value. On January 1, 2015, the entity classified the asset as held for sale. The fair value of the equipment on January 1, 2015 is P3,300,000 and the cost of disposal is P100,000. On December 31, 2015, the fair value of the equipment is P3,800,000 and the cost of disposal is P200,000. On December 31,2015, the entity believed that the criteria for classification as held for sale can no longer be met. Accordingly, the entity decided not to sell the asset but to continue to use it. 1. What is the measurement of the equipment that ceases as held for sale on December 31, 2013? a. 3,200,000 b. 4,000,000 c. 3,500,000 d. 3,600,000 2. What amount should be recognized as profit or loss as a result of the reclassification in 2015? a. 800,000 b. 300,000 c. 400,000 d. 0 8.) Booker Company committed to sell its comic book division (a component of the business) on September 1, 2013. The carrying amount of the division was P4,000,000 and its fair value was P3,500,000. The disposal date is expected to be June 1, 2014. The division reported an operating loss of P200,000 for the year ended December 31, 2013. Ignoring income tax, what amount should be reported as loss from discontinue operation in 2013? a. 500,000 b. 200,000 c. 700,000 d. 0 9.) Enron Company decided on August 1, 2013 to dispose of a component of its business, the component was sold on November 30, 2013. The income for 2013 included income of P5,000,000 from operating the discontinued segment from January 1 to the sale date. The entity incurred a loss on the November 30 sale of P4,500,000. Ignoring income tax, what amount should be reported in the 2013 income statement as income or loss under “discontinued operation” ? a. 4,500,000 loss b. 5,000,000 income c. 500,000 loss d. 500,000 income 10.) Xavier Company has three segment s, A, B and C. Segment C, the closing division, is deemed inconsistent with the long-term direction of the entity. Management has decided to dispose of Segment C. On November 15, 2013, the board of directors of Xavier Company voted to approve the disposal and an announcement was made. On that date the carrying amount of Segment C’s net asset was P90,000,000 and the fair value less cost of disposal was P70,000,000. Segment C’s revenue and expenses for 2013, respectively, were P50,000,000 and P32,000,000, including an interest of P5,000,000 attributable to Segment C. There was no further impairment of assets between November 15 and December 31, 2013. Before income tax, what is the income or loss from discontinued operation to be reported in the 2013 income statement? a. 13,000,000 income b. 18,000,000 income c. 30,000,000 income d. 2,000,000 loss 11.) On September 30, 2013, when the carrying amount of the net assets of a business segment was P70,000,000, Young company signed a legally binding contract to sell the business segment. The sale is expected to be completed by January 31, 2014 at a selling price of P60,000,000. In addition, prior to January 31, 2014, the sale contract obliges Young Company to terminate the employment of certain employees of the business segment incurring an expected termination cost of P2,000,000 to be paid on June 30, 2014. The segment revenue and expenses for 2013 were P40,000,000 and P45,000,000 respectively. Before income tax, what amount should be reported as loss from discontinued operation for 2013? a. 17,000,000 b. 12,000,000 c. 15,000,000 d. 7,000,000 12.) Zebra Company is a diversified entity with nationwide interests in commercial real estate development, banking, mining and food distribution. The food distribution division was deemed to be inconsistent with the long-term direction of the entity. On October 1, 2013the board of directors voted to approved the disposal of this division. The sale is expected to occur in August 2014. The food distribution had the following revenue and expenses in 2013: January 1 to September 30, revenue of P35,000,000 and expenses of P27,000,000; October 1 to December 31, revenue of P15,000,000 and expenses of P10,000,000. The carrying amount of the division’s value less cost of disposal was P58,000,000. The sale contract requires Zebra to terminate certain employees incurring an expected termination cost of P4,000,000 to be paid by December 15, 2014. The income tax rate is 30%. In the income statement for the year ended December 31, 2013, what amount should be reported as income from discontinued operation? a. 7,700,000 b. 8,300,000 c. 9,000,000 d. 6,300,000 13.) Flame Company has two divisions, North and South both qualified as business components. In 2013, the entity decided to dispose of the assets and liabilities of division South and it is probable that the disposal will be completed early next year. The revenue and expenses of Flame Company for 2013 and 2012 are as follows: 2013 Sales- North 4,600,000 5,000,000 Total nontax expenses-North 4,100,000 4,400,000 Sales-South 5,100,000 3,500,000 Total nontax expenses-South 4,500,000 3,900,000 2012 During the later part of 2013, the entity disposed of a portion of division South and recognized a pretax loss of P2,000,000 on the disposal. The income tax rate is 30%. What amount should be reported as loss from discontinued operation in 2013? a. 2,000,000 b. 2,400,000 c. 1,400,000 d. 1,680,000 14.) Jazz Company operates two restaurants, one in Boracay and Dakak. The operations and cash flows of each of the two restaurants are clearly distinguishable. During 2013, the entity decided to close the restaurant in Dakak and sell the property. It is probable that the disposal will be completed early next year. The revenue and expenses for 2013 and for the preceding two years are as follows: 2013 Sales-Boracay 60,000 Cost of goods sold-Boracay 18,000 Other expenses-Boracay Sales-Dakak 52,000 2011 48,000 40,000 26,000 14,000 23,000 Cost of goods sold-Dakak 20,000 Other expenses-Boracay 2012 22,000 13,000 30,000 14,000 17,000 12,000 19,000 16,000 15,000 The other expenses do not include income tax expense. During the later part of 2013, the entity sold some of the kitchen equipment of the Dakak restaurant and recognized a pretax gain of P15,000 on the disposal. The income tax rate is 30%. What amount should be reported an income or loss from discontinued operation for 2013? a. 8,000 loss b. 7,000 gain c. 5,600 loss d. 4,900 gain 15.) In 2013, Isuzu Company decided to discontinue its Electronics Division, a separately identifiable component of Isuzu’s business. On December 31, 2013, the division has not been completely sold. However negotiations for the final and complete sale are progressing in a positive manner and it is probable that hthe disposal will be complete within a year. Analysis of the records for the year disclosed the following relative to the Electronics Division: Operating loss for the year 8,000,000 Loss on disposal of some Electronic Division assets During 2013 500,000 Expected operating loss in 2014 preceding final disposal 1,000,000 Expected gain in 2014 on disposal of division 2,000,000 What amount should be reported as pretax loss from discontinued operation in 2013? a. 8,000,000 b. 8,500,000 c. 9,500,000 d. 7,500,000 16.) Mati Company, a parent entity, approved on December 1, 2013 a plan to sell its subsidiary. The sale is expected to be completed on March 31, 2014. The year –end of the entity is December 31, 2013 and the financial statements were approved on March 1, 2014. The subsidiary had net assets with carrying amount of P15,000,000 including goodwill of P1,500,000 from January 1 to March 1, 2014 and is expected to make a further loss of P2,000,000 up to the date of sale. At the date of approval of the financial statements; the entity was in negotiation for the sale of the subsidiary but no contract had been signed. The entity expects to sell the subsidiary for P9,000,000 and to incur cost of selling of P500,000. The value in use of the subsidiary was estimated to be P10,000,000. In the December 31, 2013 statement of financial position, what is the measurement of the subsidiary which is considered as a “disposal group classified as held for sale”? a. 15,000,000 b. 10,000,000 c. 9,000,000 d. 8,500,000 17.) Purple Company has correctly classified its packaging operation as a disposal group held for sale and as discontinued operation. For the year ended December 31, 2013, this disposal group incurred trading loss after tax of P2,000,000 and the loss on remeasuring it to fair value less cost of disposal was P1,500,000. What total amount of the disposal group’s losses should be included in profit or loss for the year ended December 31, 2013? a. 3,500,000 b. 2,000,000 c. 1,500,000 d. 0 ACCOUNTING CHANGES 1.) During 2013, Orca Company decided to change from the FIFO method of inventory valuation to the weighted average method. Inventory balances under each method were as follows: FIFO Weighted average January 1 7,100,000 7,700,000 December 31 7,900,000 8,300,000 Ignoring income tax, in the 2013 statement of retained earnings, what amount should be reported as the cumulative effect of this accounting change? a. 1,000,000 addition b. 1,000,000 deduction c. 600,000 addition d. 600,000 deduction 2.) Goudard Company had used the FIFO method of inventory valuation since it began operations in 2010. The entity decided to change to the weighted average method for determining inventory costs at the beginning of 2013. The following schedule shows year-end inventory balances under the FIFO and weighted average method: Year FIFO 2010 4,500,000 2011 7,800,000 2012 8,300,000 Weighted average 5,400,000 7,100,000 7,800,000 What amount , before income tax should be reported in the 2013 statement of retained earnings as the cumulative effect of the change in accounting policy? a. 500,000 decrease b. 300,000 decrease c. 500,000 increase d. 300,000 increase 3.) On January 1,2013, Folk Company change from the average cost method to the FIFO method to account for its inventory. Ending inventory for each method was as follows: 2012 2013 Average cost 500,000 900,000 FIFO cost 700,000 1,400,000 The income statement information calculated by the average cost method was as follows: 2012 2013 Sales 10,000,000 13,000,000 Cost of goods sold 7,000,000 9,000,000 Operating expenses 1,500,000 2,000,000 Income before tax 1,500,000 Tax expense 450,000 2,000,000 600,000 The entity accurate tax expense on December 31 of each year and pays the tax in April of the following year. The income tax rate is 30%. What is the net income to be reported in 2013 after the change to the FIFO inventory method? a. 1,610,000 b. 2,300,000 c. 1,750,000 d. 1,890,000 4.) Bank Company used the cost recovery method of accounting since it began operations in 2010. In 2013, management decided to adopt the percentage of completion method. 2010 Revenue from completed contracts 40,000,000 Cost of completed contracts Income from operations Casualty loss 0 Income 12,000,000 2011 25,000,000 2012 42,000,000 18,000,000 29,000,000 28,000,000 7,000,000 13,000,000 12,000,000 0 7,000,000 0 13,000,000 Analysis of the accounting records disclosed the following income by contracts using percentage of completetion method. 2010 Contract 1 2011 2012 7,000,000 Contract 2 5,000,000 Contract 3 2,000,000 8,000,000 3,000,000 Contract 4 6,000,000 7,000,000 1,000,000 Contract (1,000,000) 5 Ignoring income tax, what is the cumulative effect of changes in accounting policy that should be reported in the statement of retained earnings for 2013? a. 6,000,000 b. 8,000,000 c. 7,000,000 d. 0 5.) During 2013, Build Company changed from the cost recovery method to the percentage of completion method. The tax rate is 40%. Gross profit figures are as follows: 2011 Cost recovery method 1,400,000 Percentage of completion 2,100,000 How should this accounting change be reported in 2013? a. 1,200,000 increase in profit or loss b. 780,000 increase in profit or loss 2012 2013 950,000 1,250,000 1,600,000 1,900,000 c. 1,200,000 increase in retained earnings d. 780,000 increase in retained earnings 6.) Rodrigo Company had purchased an equipment on January 1, 2010 for P2,400,000. The entity used the straight line depreciation based on a ten-year useful life with no residual value. During 2013, the entity decided that the equipment would be used only three more years. What entry should be made on January 1, 2013 to reflect this accounting change? a. No entry b. Debit other comprehensive income and credit accumulated depreciation for P480,000. c. Debit retained earnings and credit accumulated depreciation for P480,000. d. Debit depreciation and credit accumulated depreciation for P560,000. 7.) Blue Company purchased a machine on January 1, 2010 for P6,000,000. At the date of acquisition, the machine had a life of six years with no residual value. The machine is being depreciated on a straight line basis. On January 1, 2013, the entity determined that the machine had a useful life of eight years from the date of acquisition with no residual value. What is the depreciation of the machine for 2013? a. 750,000 b. 600,000 c. 375,000 d. 500,000 8.) On January 1,2010, Flax Company purchased a machine for P5,280,000 and depreciated it by the straight line method using an estimated useful life of eight years with no residual value. On January 1, 2013, the entity determined that the machine had a useful life of six years from the date of acquisition and the residual value was P480,000. An accounting change was made in 2013 to reflect these additional data. What is the accumulated depreciation for the machine on December 31, 2013? a. 2,920,000 b. 3,080,000 c. 3,200,000 d. 3,520,000 9.) On January 1, 2011, Milan Company purchased an equipment for P6,000,000. The equipment had been depreciated using the straight line with residual value of P600,000 and useful life of 20 years. On January 1, 2013, the entity determined that the remaining useful life is 10 years and the residual value is P800,000. What is the depreciation for 2013? a. 270,000 b. 546,000 c. 466,000 d. 582,000 10.) On January 1, 2009, Roma Company purchased equipment for P4,000,000. The equipment has a useful life of 10 years and a residual value of P400,000. On January 1, 2013, the entity determined that the useful life of the equipment was 12 years from the date of acquisition and the residual value was P460,000. What is the depreciation of the equipment for 2013? a. 175,000 b. 262,500 c. 360,000 d. 300,000 11.) Acute Company was incorporated on January 1, 2010. In preparing the financial statements for the year ended December 31, 2012, the entity used the following original cost and useful life for the property, plant and equipment: Original cost Building years Useful life 15,000,000 15 Machinery Furniture 10,500,000 3,500,000 10 years 7 years On January 1, 2013, the entity determined that the remaining useful life is 10 years for the building, 7 years for the machinery and 5years for the furniture. The entity used the straight line method of depreciation with no residual value. What is the total depreciation for 2013? a. 2,650,000 b. 3,700,000 c. 2,550,000 d. 3,500,000 12.) On January 1, 2013, Canyon Company decided to decrease the estimated useful life on all existing patents from 10 years to 8 years. Patents were purchased on January 1, 2008 for P3,000,000. The estimated residual value is zero. The entity decided on January 1, 2013, total cost of depreciable assets is P8,000,000 and the accumulated depreciation is P3,400,000. The remaining useful life of depreciation assets on January 1, 2013is 10 years and the residual value is P200,000. What is the total charges against income for 2013 as a result of the accounting changes? a. 940,000 b. 960,000 c. 627,500 d. 647,500 13.) On January 1, 2010, Charisma Company bought a merchandise for P1,500,000. The machine had useful life of six years with no residual value. On January 1, 2013, the entity determined that the machine had useful life of eight years from the date it was acquired with no residual value. The straight line method of depreciation is used. What amount of depreciation should be recorded for 2013? a. 125,000 b. 150,000 c. 187,500 d. 250,000 14.) On January 1, 2011 Brazilia Company purchased for P4,800,000 a machine with a useful life of ten years and a residual value of P200,000. The machine was depreciated by the double declining balance and the carrying amount of the machine was P3,072,000 on December 31, 2012. The entity changed to the straight line method on January 1, 2013. The residual value did not change. What is the depreciation expense on this machine for the year ended December 31, 2013? a. 287,200 b. 384,000 c. 460,000 d. 359,000 15.) On January 1, 2012, Kelvin Company purchased a machine for P2,750,000/ the machine was depreciated using the sum of years’ digits method based on a useful life of 10 years with no residual value. On January 1, 2013, the entity changed to the straight line method of depreciation. The entity can justify the change. What is the depreciation of the machine for 2013? a. 180,000 b. 220,000 c. 250,000 d. 275,000 16.) Xavier Company purchased a machinery of January 1, 2010 for P7,200,000. The machinery has useful life of 10 years with no residual value and was depreciated using the straight line method. In 2013, a decision was made to change the depreciation method from straight line to sum of years’ digits method. The estimates of useful life and residual value remained unchanged, what is the depreciation for 2013? a. 1,260,000 b. 1,440,000 c. 916,360 d. 720,000 17.) On January 1, 2007, Paragon Company paid P6,000,000 to acquire a new barge. In the belief that it was entitled to a refund of purchase taxes on the acquisition of the barge, the entity claimed and was refunded P600,000 by the local government. However, in late 2013 the entity repaid the refund when it became apparent that it had made an error in making the claim to the local government as it had not been entitled to the refund of purchase taxes on acquisition of the barge. The useful life of the barge is 15 years from the date of acquisition. The residual value of the barge is NIL, 18.)In 2013, the period over which the barge is expected to be economically usable increased from 15 to 26 years. However, the entity expects to dispose of the barge after using it for 20 years from the date of acquisition. On December 31, 2013, the entity assessed the residual value of the barge at P800,000. What is the carrying amount of the barge on December 31, 2013? a. 3,600,000 b. 3,400,000 c. 3,460,000 d. 3,420,000 PRIOR PERIOD ERRORS 1.) Effective January 1, 2013. King Company adopted the accounting policy of expensing advertising and promotion costs as they are incurred. Previously, advertising and promotion costs applicable to future periods were recorded in prepaid expenses. The entity can justify the change, which was made for both financial statement and income tax reporting purposes. The prepaid advertising and promotion costs totaled P600,000 on December 31,2013. The income tax rate is 30%. What is the net charge against income for 2013 as a result of the change? a. 600,000 b. 180,000 c. 420,000 d. 0 2.) On January 1, 2012, Aker Company acquired a machine at a cost of P2,000,000. The machine is depreciated on the straight line method over a five-year period with no residual value. Because of a bookkeeping error, no depreciation was recognized in the 2012 financial statements. The oversight was discovered during the preparation of the 2013 financial statements. What is the depreciation expense on the machine for 2013? a. 800,000 b. 400,000 c. 500,000 d. 0 3.) Harbor Company reported the following events during the year ended December 31, 2013: It was decided to write off P800,000 from inventory which was over two years old as it was obsolete. Sales of P600,000 had been omitted from the financial statements for the year ended December 31, 2012. What total amount should be reported as prior period error in the financial statements for the year ended December 31, 2013? a. 1,400,000 b. 600,000 c. 800,000 d. 200,000 4.) Universal Company failed to accrue warranty cost of P100,000 on December 31, 2012. In addition, a change from straight line to accelerated depreciation made at the beginning of 2013 resulted in a cumulative effect of P60,000 on retained earnings. What amount before tax should be reported as prior period error in 2013? a. 100,000 b. 160,000 c. 60,000 d. 0 5.) The draft financial statements for Savior Company for the year ended December 31, 2013 had been prepared. A final review of the draft revealed an overvaluation of the ending inventory of P2,000,000 on December 31, 2013. Further investigation showed that there was an overvaluation of the ending inventory on December 31, 2012 of P1,200,000. What adjustment should be made to the profit for the year ended December 31, 2013 presented as the comparative figure in the 2014 financial statements? a. 2,000,000 decrease b. 1,200,000 decrease c. 800,000 decrease d. 0 6.) Extracts from the statement of financial position of Animus Company showed the following: December 31, 2014 Development costs Amortization December 31, 2014 8,160,000 5,480,000 (1,800,000) (1,200,000) The capitalized development costs relate to a single project that commenced in 2011. It has now been discovered that one of the criteria for capitalization has never been met. What adjustment is required to restate retained earnings on January 1, 2014? a. 6,360,000 b. 1,720,000 c. 4,640,000 d. 0 7.) In reviewing Bituin Company’s draft financial statements for the year ended December 31, 2014, management decided that market conditions were such that the provision for inventory obsolescence on December 31, 2014 should be increased by P3,000,000. If the same basis of calculating inventory obsolescence had been applied on December 31, 2013, the provision would have been P1,800,000 higher than the amount recognized in the statement of financial position. What adjustment should be made to the profit for 2014 and financial statements? Profit for 2014 Profit for 2013 a. 3,000,000 decrease 1,800,000 decrease b. 1,200,000 decrease 1,800,000 decrease c. 3,000,000 decrease 0 d. 3,000,000 decrease 0 8.) Samar Company reported the following events during the year ended December 31, 2014: A counting error relating to the inventory on December 31, 2013 was discovered. This required a reduction in the carrying amount of inventory at that date of P280,000. The provision for uncollectible accounts receivable on December 31, 2013 was P300,000. During 2014, P500,000 was written off the December 31, 2013 accounts receivable. What adjustment is required to restate retained earnings on January 1, 2014? a. 280,000 b. 300,000 c. 580,000 d. 0 9.) After the issuance of the 2013 financial statements, Narra Company discovered a computational error of P150,000 in the calculation of the December 31, 2013 inventory. The error resulted in a P150,000 overstatement in the cost of goods sold for the year ended December 31, 2013. In October 2014, the entity paid the amount of P500,000 in settlement of litigation instituted against it during 2013. Ignore income tax. In the 2014 financial statements, what is the adjustment of the retained earnings on January 1, 2014? a. 150,000 credit b. 350,000 debit c. 500,000 debit d. 650,000 credit 10.) Natasha Company reported net income of P700,000 for 2014. The entity declared and paid dividends of P150,000 in 2014 and P300,000 in 2013. In the financial statements for the year ended December 31, 2013, the entity reported retained earnings of P1,100,000 on January 1, 2013. The profit for 2013 was P600,000. In 2014, after the 2013 financial statements were approved for issue, the entity discovered error in the December 31, 2012 financial statements. The effect of the error was P650,000 overstatement of profit for the year ended December 31, 2012 due to under depreciation. What amount should be reported as retained earnings on December 31, 2014? a. 1,300,000 b. 1,400,000 c. 1,650,000 d. 1,950,000 OPERATING SEGMENT 1.) Correy Company and its division are engaged solely in manufacturing operations. The following data pertain to the industries in which operations were conducted for the current year: Industry Revenue Profit A 10,000,000 1,750,000 20,000,000 B 8,000,000 1,400,000 17,500,000 C 6,000,000 1,200,000 12,500,000 D 3,000,000 550,000 7,500,000 E 4,250,000 675,000 7,000,000 F 1,500,000 225,000 3,000,000 32,750,000 5,800,000 67,500,000 How many reportable segments does Correy have? a. Three b. Four c. Five Assets d. Six 2.) Aroma Company and its divisions are engaged solely in manufacturing. The following data pertain to the industries in which operations were conducted for the current year: Segment profit (loss) V 3,400,000 W 1,000,000 X (2,000,000) Y 400,000 Z ( 200,000) 2,600,000 In the segment information for the current year, what are the reportable segments? a. V, W, X and Y b. V, W and X c. V and W d. V, W, X, Y and Z 3.) Macbeth Company, an entity listed on a recognized stock exchange, reports operating results from its North American division to the chief operating decision maker. The segment information for the current year is as follows: Revenue Profit Assets 3,675,000 970,000 1,700,000 Number of employees The results for all of the operating segments in total are: 2,500 Revenue 39,250,000 Profit 9,600,000 Assets 17,500,000 Number of employees 18,500 Which pieces of information determines for the entity that the North American divisions is a reportable operating segment? a. Revenue b. Profit c. Assets d. Number of employees 4.) The following information pertains to Aria Company and its divisions for the current year: Sales to unaffiliated customers 20,000,000 Intersegment sales of products similar to those Sold to unaffiliated customers Interest earned on loans to other operating segments 6,000,000 400,000 Aria and all of its divisions are engaged solely in manufacturing operations. What is the minimum amount of segment revenue in order that a division can be considered a reportable segment? a. 2,640,000 b. 2,600,000 c. 2,040,000 d. 2,000,000 5.) The following information pertains to revenue earned by Timmy Company’s operating segments for the current year: Sales to Unaffiliated Segment customers Intersegment Total sales revenue Alo 5,000 3,000 8,000 Bix 8,000 4,000 12,000 Cee 4,000 Dil 43,000 Combined - 60,000 Elimination - Consolidated 60,000 4,000 16,000 59,000 23,000 83,000 (23,000) (23,000) - 60,000 In conformity with the revenue test, what is the total revenue of the reportable segments? a. 83,000 b. 71,000 c. 51,000 d. 60,000 6.) Grum Company, a publicly owned entity, is subject to the requirement of segment reporting. In the income statement for the year ended December 31, 2013, the entity reported revenue of P50,000,000, excluding intersegment sales of P10,000,000, expenses of P47,000,000 and net income of P3,000,000. Expenses included payroll costs of P15,000,000. The combined identifiable assets of all operating segments on December 31, 2013 totaled P40,000,000. 1. In the financial statements, the entity should disclose major customer data if sales to any single customer amount to at least a. 5,000,000 b. 4,000,000 c. 6,000,000 d. 4,700,000 2. External revenue for reportable operating segments must be at least a. 22,500,000 b. 30,000,000 c. 33,750,000 d. 37,500,000 7.) Graf Company discloses supplemental operating segment information. The following information is available for the current year: Segment Sales Traceable expenses X 5,000,000 3,000,000 Y 4,000,000 2,500,000 Z 3,000,000 1,500,000 12,000,000 7,000,000 Additional expenses are as follows: Indirect expenses 1,800,000 General corporate expenses 1,200,000 Interest expense 600,000 Income tax expense 400,000 The interest expenses and income tax expense are regularly reviewed by the chief operating decision maker as measure of profit or loss. Appropriate common expenses are allocated to segments based on the ratio of a segment’s sales to total sales. What is Segment Z’s profit for the current year? a. 900,000 b. 950,000 c. 800,000 d. 500,000 8.) Clay Company has three lines of business, each of which was determined to be reportable segment. The entity sales aggregated P7,500,000 in the current year, of which Segment No. 1 contributed 40%. Traceable costs were P1,750,000 for Segment No. 1 out of a total of P5,000,000 for the entity as a whole. For external reporting, the entity allocated common costs to the total income before common costs. In the financial statements for the current year, what amount should be reported as profit for Segment No. 1? a. 1,250,000 b. 1,000,000 c. 650,000 d. 500,000 9.) Colt Company has four manufacturing divisions, each of which has been determined to be a reportable segment. Common costs are appropriately allocated on the basis of each division’s sales in relation to Colt’s aggregate sales. Colt’s Delta division accounted for 40% of Colt’s total sales in the current year. For the current year ended December 31, Delta had sales of P8,000,000 and traceable costs of P4,800,000. In the current year, Colt incurred costs of P800,000 that were not directly traceable to any of the divisions. In addition, the Delta division incurred interest expense of P640,000. It is an entity policy that interest expense is included in the measure of profit or loss that is reviewed by the chief operating decision maker. What amount should be disclosed as Delta’s profit for the current year? a. 3,200,000 b. 3,000,000 c. 2,880,000 d. 2,240,000 10.) Taylor Company, a publicly owned entity, assesses performance and makes operating decisions using the following information for its reportable segment: Total revenue Total profit and loss 7,680,000 406,000 The total profit and loss included intersegment profit of P61,000. In addition, the entity has P5,000 of common costs for its reportable segments that are not allocated in reports reviewed by the chief operating decisions maker. What amount should be reported as segment profit? a. 350,000 b. 345,000 c. 411,000 d. 406,000 11.) Eagle Company operates in several different industries. Total sales for Eagle Company totaled P14,000,000, and total common costs amounted to P6,500,000 for the current year. For internal reporting purposes, Eagle Company allocated common costs based on the ratio of a segment’s sales to total sales. Additional information regarding the different segments follows: Segment Contribution to total sales Costs specific to the segment 1 25% 1,100,000 2 12% 1,000,000 3 31% 1,300,000 4 23% 880,000 5 9% 400,000 What is the profit of Segment 1? a. 3,500,000 b. 1,875,000 c. 2,400,000 d. 775,000 12.) Congo Company provided the following data for the current year: Sales 60,000,000 Cost of goods sold 28,000,000 Expenses 14,000,000 Depreciation 4,000,000 Income tax expenses 4,000,000 The entity has two major reportable segments, X and Y. An analysis revealed that P1,000,000 of the total depreciation expense and P2,000,000 of the expenses are related to general corporate activities. The remaining expenses and sales are directly allocable to segment activities according to the following percentages: Segment X Sales 40% Cost of goods sold 35 Segment Y 45% 15% 50 Expenses 15 40 Depreciation Others 40 40 20 45 15 What amount should be reported as profit of Segment X? a. 8,200,000 b. 6,600,000 c. 7,000,000 d. 5,400,000 13.) Revlon Company has expanded rapidly and segment reporting is now required. The following data are for the year ended December 31, 2013: Operating Segment Segment revenue Operating Identifiable profit (loss) assets 1 620,000 200,000 2 100,000 20,000 80,000 3 340,000 70,000 300,000 4 190,000 ( 30,000) 140,000 5 180,000 ( 25,000) 180,000 6 70,000 7 120,000 ( 20,000) 140,000 Others 380,000 ( 25,000) 140,000 400,000 10,000 120,000 The “others” category includes five operating segments, none of which has revenue or assets greater than P80,000 and none with an operating profit. Operating Segments 1 and 2 produce very similar products and use very similar production process, butt serve different customer types and use quite different product distribution system. These differences are due in part to the fact that segment 2 operates in a regulated environment while segment 1 does not. Operating segments 6 and 7 have very similar products, production processes, product distribution systems, but are organized as separate divisions since they serve substantially different types of customers. Neither Segments 6 and 7 operate in a regulated environment. What are the reportable segments for the year ended December 31, 2013? a. Segments 1, 3, 4 and 5 b. Segments 1, 3, 4, 5 and 7 c. Segments 1, 2, 3, 4 and 5 d. Segments 1, 3, 4, 5 and Segments 6 and 7 combined as one segment INTERIM REPORTING 1.) Farr Company had the following transactions during the quarter ended March 31, 2013. Loss from typhoon 700,000 Payment of fire insurance premium for calendar year 2013 100,000 What amount should be included in the income statement for the quarter ended March 31, 2013? Casualty loss Insurance expense a. 700,000 100,000 b. 700,000 25,000 c. 175,000 25,000 d. 0 100,000 2.) Harper Company incurred an inventory loss from market decline of P840,000 on June 30, 2013. What amount of the inventory loss should be recognized in the quarterly income statement for the three months ended June 30, 2013? a. 210,000 b. 280,000 c. 420,000 d. 840,000 3.) Wilma Company experienced a P500,000 decline in the market value of inventory at the end of the first quarter. The entity had expected this declined to reverse in the second quarter, and in fact, the second quarter recovery exceeded the previous decline by P100,000. What amount of gain or loss should be reported in the interim statements for the first and second quarters? First Quarter Second Quarter a. 500,000 loss 500,000 gain b. 500,000 loss 600,000 gain c. 500,000 loss 100,000 gain d. 0 0 4.) On June 30, 2013, Mill Company incurred a P1,000,000 net loss from disposal of a business segment. Also, on June 30, 2013, the entity paid P400,000 for property taxes assessed for the calendar year 2013. What total amount should be included in the determination of the net income or loss for the six-month, interim period ended June 30, 2013? a. 1,400,000 b. 1,200,000 c. 900,000 d. 700,000 5.) Mount Apucao Company operates in the travel industry and incurs costs unevenly throughout the year. Advertising costs of P2,000,000 were incurred on March 1, 2013, and staff bonuses are paid at year-end based on sales. Staff bonuses are expected to be around P20,000,000 for the year. Of that sum, P3,000,000 would relate to the period ending March 31, 2013. What amount should be included in the quarterly financial report ending March 31, 2013? Advertising Bonuses a. 2,000,000 5,000,000 b. 500,000 5,000,000 c. 2,000,000 3,000,000 d. 3,000,000 500,000 6.) Davao Company prepares quarterly interim financial reports. The entity sells electrical goods and normally 5% of customers claim on their warranty. The provision in the first quarter was calculated at 5% of sales to date which amounted to P10,000,000. However, in the second quarter, a design fault was found and warranty claims were expected to be 10% for the whole year. Sales for the second quarter amounted to P15,000,000. What amount of provision should be charged in the second quarter’s interim income statement? a. 2,000,000 b. 1,250,000 c. 1,500,000 d. 750,000 7.) Everest Company has historically reported bad debt expense of 5% of sales in each quarter. For the current year, the entity followed the same procedure in the three quarters of the year. However, in the fourth quarter, the entity determined that bad debt expense for the entire year should be P450,000. Sales in each quarter of the year were first quarter P2,000,000, second quarter P1,500,000, third quarter P2,500,000 and fourth quarter P4,000,000. What amount of bad debt expense should be recognized for the fourth quarter? a. 200,000 b. 150,000 c. 300,000 d. 400,000 8.) Kell Company reported P950,000 net income for the quarter ended September 30, 2013 which included the following after tax items: A P600,000 expropriation gain, realized on April 30, 2013, was allocated equally to the second, third, and fourth quarters of 2013. A P160,000 cumulative-effect loss resulting from a change in inventory valuation method was recognized on Aug. 1 2013. In addition the entity paid P480,000 on February 1, 2013, for 2013 calendar-year proper taxes. Of this amount, P120,000 was allocated to the third quarter of 2013. For the quarter ended September 30, 2013, what amount should be reported as net income? a. 910,000 b. 1,030,000 c. 1,110,000 d. 1,150,000 9.) The terms and conditions of employment with Pauline Company include entitlement to share in the staff bonus system, under which 5% of the profit for the year before charging the bonus is allocated to the bonus pool, provided the annual profit exceeds P50,000,000. The profit before accrual of any bonus for the first half of 2013 amounted to P40,000,000 and the latest estimate of the profit before accrual of any bonus for the year as a whole is P60,000,000. What amount should be recognized in profit or loss in respect of the staff bonus for the half year ended June 30, 2013? a. 1,500,000 b. 3,000,000 c. 2,000,000 d. 0 10.) Snider Company is preparing its interim financial statements for the first quarter ended March 31, 2013. Expenses in the first quarter totaled P4,000,000 of which 25% was variable. The fixed expenses included television advertising expense o P1,500,000 representing air time to be incurred evenly during 2013 for an equipment that was available for use on March 1, 2013. What amount should be reported as total expenses in the first quarter ended March 31, 2013? a. 4,000,000 b. 2,875,000 c. 2,325,000 d. 2,335,000 11.) On January 1, 2013, Builder Company entered into a P20,000,000 long-term fixed price contract to construct a factory building. The entity accounted for this contract under percentage of completion at the end of each quarter for 2013. Quarter Percentage of completion 1 10% 15,000,000 2 10% 15,000,000 3 25% 19,200,000 4 25% 19,200,000 Estimated cost No work was performed in the second and fourth quarters. What amount should be reported as income (loss) on construction contract in the quarterly income statements? First Second Third Fourth a. 0 0 0 200,000 b. 500,000 0 (300,000) 0 c. 500,000 0 0 0 d. 500,000 0 (120,000) 0 12.) Vilo Company has estimated that total depreciation expense for 2013 will amount to P600,000 and that 2013 year-end bonuses to employees will total P1,200,000. In the interim income statement for the six months ended June 30, 2013, what total amount of expenses should be reported? a. 1,800,000 b. 300,000 c. 900,000 d. 0 13.) On January 1, 2013. Akron Company paid real estate taxes for the calendar year 2013 in the amount of P600,000. In the first week of April 2013, the entity made unanticipated ordinary repairs to plant equipment at a cost of P900,000. What total amount of these expenses should be reflected in the quarterly income statements for 2013? March 31 June 30 September 30 December 31 a. 150,000 450,000 450,000 450,000 b. 375,000 375,000 375,000 375,000 c. 150,000 1,050,000 150,000 150,000 d. 600,000 900,000 0 0 14.) 15.) Bailar Company, a calendar-year entity, has the following income before income tax and estimated effective tax rate for the first three quarters of the current year: Income before tax First quarter 6,000,000 Second quarter Third quarter Effective tax rate 30% 7,000,000 30% 4,000,000 35% What amount should be reported as income tax provision in the interim income statement for the third quarter? a. 5,950,000 b. 2,050,000 c. 1,200,000 d. 1,400,000 CASH AND CASH EQUIVALENTS 1.) Pygmalion Company had the following account balances on December 31, 2013: Cash in bank- current account 5,000,000 Cash in bank- payroll account 1,000,000 Cash on hand 500,000 Cash in bank – restricted account for building construction expected to be disbursed in 2014 3,000,000 Time deposit, purchased December 15, 2013 and due March 15,2014 2,000,000 The cash on hand included a P200,000 check payable to Pygmalion, dated January 15, 2014. What total amount should be reported as “cash and cash equivalents” on December 31, 2013? a. 6,300,000 b. 8,300,000 c. 6,500,000 d. 8,700,000 2.) Thor Company provided the following data on December 31, 2013: Checkbook balance Bank statement balance 4,000,000 5,000,000 Check drawn on Thor’s account, payable to supplier dated and recorded on December 31, 2013, but not mailed until January 15, 2014 Cash in sinking fund 500,000 2,000,000 On December 31, 2013, what amount should be reported as “cash” under current assets? a. 4,500,000 b. 5,500,000 c. 3,500,000 d. 6,500,000 3.) Everlast Company reported the following information at the current year-end: Investment securities of P1,000,000. These securities are share investments in entities that are traded in Philippine Stock Exchange. As a result, the shares are very actively traded in the market. Investment securities of P2,000,000. These securities are government treasury bills. The reasury bills have a 10-year term and purchased on December 31 at which time they had two months to until they mature. Cash of P3,400,000 in the form of coin, currency, savings account and checking account. Investment securities of P1,500,000. These securities are commercial papers. The term of the papers is nine months and they were purchased on December 31 at which time they had three months to go until they mature. What total amount should be reported as cash and cash equivalents at the current year-end? a. 5,400,000 b. 6,400,000 c. 6,900,000 d. 7,900,000 4.) On December 31, 2013, the cash account of Roel Company showed the following details: Undeposited collections 60,000 Cash in bank – PCIB checking account 500,000 Cash in bank – PNB (overdraft) ( 50,000) Undeposited NSF check received from customer, dated December 1, 2013 15,000 Undeposited check from a customer, dated January 15, 2014 25,000 Cash in bank – PCIB (fund for payroll) 150,000 Cash in bank – PCIB (saving deposit) 100,000 Cash in bank – PCIB (money market instrument, 90 days) Cash in foreign bank (restricted) 2,000,000 100,000 IOUs from officers 30,000 Sinking fund cash 450,000 Financial asset held for trading On December 31, 2013, what total amount should be reported as 120,000 “cash and cash equivalent”? a. 2,660,000 b. 2,810,000 c. 2,770,000 d. 810,000 5.) Burr Company had the following account balances on December 31, 2013: Cash in bank 2,250,000 Cash on hand 125,000 Cash restricted for addition to plant (expected to be disbursed in 2014) 1,600,000 Cash in bank included P600,000 of compensating balance against short-term borrowing arrangement. The compensating balance is not legally restricted as to withdrawal. In the December 31, 2013 statement of financial position, what total cash should be reported under current assets? a. 1,775,000 b. 2,250,000 c. 2,375,000 d. 3,975,000 6.) On December 31, 2013, West Company had the following cash balances : Cash in bank Petty cash fund (all funds were reimbursed on 12/31/2013) Time deposit (due February 1, 2014) 1,800,000 50,000 250,000 Cash in bank included P600,000 of compensating balance against short-term borrowing arrangement on December 31, 2013. The compensating balance is legally restricted as to withdrawal. In the December 31, 2013 statement of financial position, what total amount should be reported as cash and cash equivalents? a. 1,850,000 b. 1,250,000 c. 2,100,000 d. 1,500,000 7.) Campbell Company had the following account balance of December 31, 2013. Petty cash fund Cash in bank – current account Cash in bank – sinking fund Cash on hand 50,000 4,000,000 2,000,000 500,000 Cash in bank – restricted account for plant addition, Expected to be disbursed in 2014 Treasury bills 1,500,000 1,000,000 The petty cash fund included unreplenished December 2013 petty cash expense vouchers of P10,000 and employee IOU of P5,000. The cash on hand included a P100,000 check payable to Campbell dated January 15, 2014. In exchange for a guaranteed line of credit, the entity has agreed to maintain a minimum balance of P200,000 in its unrestricted current bank account. The sinking fund is set aside to settle a bond payable that is due on June 30, 2014. What total amount should be reported as :cash and cash equivalents” on December 31, 2013? a. 7,435,000 b. 5,435,000 c. 4,435,000 d. 5,535,000 8.) ABC Company reported that the cash account per ledger had a balance at December 31, 2013 of P4,415,000 which is considered of the following: Petty cash fund 24,000 Undeposited receipts, including a postdated customer Check for P70,000 1,220,000 Cash in Allied Bank, per bank statement, with a check for P40,000 still outstanding Bond sinking fund 2,245,000 850,000 Vouchers paid out of collections, not yet recorded 43,000 IOUs signed by employees, taken from collections 33,000 4,415,000 What amount should be reported as cash in the December 31, 2013 statement of financial position? a. 3,379,000 b. 3,419,000 c. 3,489,000 d. 3,449,000 9.) The cash account in the statement of financial position of Tawiran Company consisted of the following: Bond sinking fund 1,500,000 Checking account in FEBTC (A P320,000 check is still outstanding per bank statement) 3,155,000 Currency and coins awaiting deposit 1,135,000 Deposit in a bank closed by BSP 500,000 Petty cash fund (of which P10,000 in is the form of paid vouchers) Receivables from officers and employees 50,000 175,000 6,515,000 What total amount of cash should be reported under current assets? a. 4,440,000 b. 4,330,000 c. 4,830,000 d. 5,830,000 10.) Islander Company provided the following information with respect to the cash and cash equivalents on December 31, 2013. Checking account at First Bank Checking account at Second Bank ( 200,000) 3,500,000 Treasury bonds 1,000,000 Payroll account 500,000 Value added tax account Foreign bank account- restricted (in equivalent peso) 400,000 2,000,000 Postage stamps 50,000 Employee’s postdated check 300,000 IOU from president’s brother 750,000 Credit memo from a vendor for a purchase return Traveler’s check Not-sufficient-fund check 80,000 300,000 150,000 Petty cash fund (P20,000 in currency and expense receipts for P30,000) Money order 50,000 180,000 What amount should be reported as unrestricted cash on December 31, 2013? a. 5,900,000 b. 4,600,000 c. 4,900,000 d. 6,900,000 11.) Ral Company reported that the checkbook balance on December 31, 2013 was P5,000,000. In addition, the entity held the following items in its safe on that date: Check payable to Ral, dated January 2, 2014 in payment of a sale made in December 2013, not included in December 31 checkbook balance 2,000,000 Check payable to Ral, deposited December 15 and included in December 31 checkbook balance, but returned by bank on December 30 stamped “NSF.” The check was redeposited on January 2, 2014 and cleared on January 9, 2014 500,000 Check drawn on Ral’s account, payable to a vendor, dated and recorded in Ral’s books on December 31, 2013 but not mailed until January 10, 2014 What is the amount to be reported as “cash” on December 31, 2013? a. 4,800,000 300,000 b. 5,300,000 c. 6,500,000 d. 6,800,000 12.) The checkbook balance of Dove Company on December 31, 2013 was P4,000,000. Data about certain cash items follow: A customer check amounting to P200,000 dated January 2, 2014 was included in the December 31, 2013 checkbook balance. Another customer check for P500,000 deposited on December 22, 2013 was included in its checkbook balance but returned by the bank for insufficiency of fund. This check was redeposited on December 26, 2013 and cleared two days later. A P400,000 check payable to supplier dated and recorded on December 30, 2013 was ,mailed on January 16, 2014. A petty cash fund of P50,000 with the following summary on December 31, 2013: Coins and currencies 5,000 Petty cash vouchers 43,000 Return value of 20 cases of soft drinks 2,000 50,000 A check of P43,000 was drawn on December 31, 2013 payable to Petty Cash. What amount should be reported as “cash” on December 31, 2013? a. 4,248,000 b. 4,200,000 c. 4,205,000 d. 3,748,000 13.) Account of petty cash fund of Timex Company showed its composition as follows: Coins and currency 3,300 Paid vouchers: Transportation 600 Gasoline 400 Office supplies 500 Postage stamps 300 Due from employees Manager’s check returned by bank marked “NSF” 1,200 3,000 1,000 Check drawn by the entity to the order of petty cash custodian 2,700 What is the correct amount of petty cash fund for statement presentation purposes? a. 10,000 b. 7,000 c. 6,000 d. 9,000 14.) The petty cash fund of Liwanag Company on December 31, 2013 is composed of the following: Currencies Coins 20,000 2,000 Petty cash vouchers: Gasoline payments for delivery equipment 3,000 Medical supplies for employees 1,000 Repairs of office equipment 1,500 Loans to employees 3,500 A check drawn by the entity payable to the order of Grace de la Cruz, petty cash custodian, representing her salary 15,000 An employee’s check returned by the bank for insufficiency of funds 3,000 A sheet of paper with names of several employees together with contribution for a birthday gift of a co-employee. Attached to the sheet of paper is a currency of. 5,000 The petty cash general ledger account has an imprest balance of P50,000. What is the amount of petty cash fund that should be reported in the statement of financial position on December 31, 2013? a. 42,000 b. 27,000 c. 37,000 d. 22,000 15.) Yasmin Company provided the following information on December 31, 2013: Petty cash fund 50,000 Current account – First bank 4,000,000 Current account – Second Bank (overdraft) ( 250,000) Money market placement – Third Bank Time deposit – Fourth Bank 1,000,000 2,000,000 The petty cash fund included unreplenished December 2013 petty cash expense vouchers P15,000 and an employee check for P5,000 dated January 31, 2014. A check for P100,000 was drawn against First Bank current account dated and recorded December 29, 2013 but delivered to payee on January 15, 2014. The Fourth Bank time deposit is set aside for land acquisition in early January 15, 2014. What total amount should be reported as “cash and cash equivalents” on December 31, 2013? a. 5,120,000 b. 5,150,000 c. 4,130,000 d. 4,880,000 16.) On December 31, 2013, Erika Company reported “cash account” balance per ledger of P3,600,000 which included the following: Demand deposit 1,500,000 Time deposit – 30 days 500,000 NSF check of customer 20,000 Money market placement due on June 30, 2014 Saving deposit 1,000,000 50,000 IOU from an employee Pension fund 30,000 400,000 Petty cash fund 10,000 Customer check dated January 31, 2014 60,000 Customer check outstanding for 18 months 30,000 Check of P100,000 in payment of accounts payable was dated and recorded on December 31, 2013 but mailed to creditors on January 15, 2014. Check of P50,000 dated January 31, 2014 in payment of accounts payable was recorded and mailed December 31, 2013. The entity uses the calendar year. The cash receipts journal was held open until January 15, 2014, during which time P200,000 was collected and recorded on December 31,2013? What total amount should be reported as “cash and cash equivalents” on December 31, 2013? a. 2,010,000 b. 1,960,000 c. 1,860,000 d. 1,510,000 17.) Karla Company provided the following information on December 31, 2013: Cash on hand 500,000 Petty cash fund 20,000 Security Bank current account 1,000,000 PNB Current account no. 1 400,000 PNB Current account no. 2 ( 50,000) BSP treasury bill – 60 days 3,000,000 BPI time deposit – 30 days 2,000,000 The cash on hand included a customer postdated check of P100,000 and postal money order of P40,000. A check for P200,000 was drawn against Security Bank account, dated January 15, 2014, delivered to the payee and recorded December 31, 2013. The BPI time deposit is set aside for acquisition of land. What total amount of cash and cash equivalents should be reported on December 31, 2013? a. 4,970,000 b. 6,970,000 c. 4,770,000 d. 1,970,000 18.) Celine Company provided the following information on December 31, 2013: Cash on hand 200,000 Petty cash fund Philippine Bank current account 20,000 5,000,000 Manila Bank current account 4,000,000 City Bank current account (bank overdraft) ( 100,000) Asia Bank saving account for equipment acquisition Asia Bank time deposit, 90 days 250,000 2,000,000 Cash on hand included the following items: Customer’s check for P35,000 returned by bank December 26, 2013 due to insufficient fund but subsequently redeposited and cleared by the bank on January 10, 2014. Customer’s check for P15,000 dated January 10, 2014, received December 23, 2013. The petty cash fund comprised the following items on December 31, 2013: Currency and coins 5,000 IOU from an officer 2,000 Unreplenished petty cash voucher 12,000 Included among the checks drawn by Celine against the Philippine Bank current account and recorded in December 2013 are: Check written and dated December 23, 2013 and delivered to payee on January 3, 2014, P25,000. Check written December 26, 2013, dated January 30, 2014, delivered to payee on December 28, 2013, P45,000. What total amount should be reported as cash and cash equivalents on December 31, 2013? a. 11,125,000 b. 11,225,000 c. 11,155,000 d. 11,205,000 19.) At year-end, Myca Company reported cash and cash equivalents comprising cash on hand P500,000, demand deposit P4,000,000, certificate of deposit P2,000,000, postdated customer’s check P500,000, petty cash fund P50,000, traveler’s check P200,000, manager’s check P100,000 and money order P150,000. What total amount of cash should be reported at year-end? a. 7,000,000 b. 4,800,000 c. 6,800,000 d. 5,000,000 BANK RECONCILIATION 1.) In preparing the August 31, 2013 bank reconciliation, Apex Company provided the following information: Balance per bank statement Deposit in transit 1,805,000 325,000 Return of customer’s check for insufficient fund Outstanding checks Bank service charge for August On August 31, 2013, what is the adjusted cash in bank? a. 1,855,000 b. 1,795,000 c. 1,785,000 d. 1,755,000 60,000 275,000 10,000 2.) In preparing the bank reconciliation on December 31, 2013, Case Company provided the following data: Balance per bank statement 3,800,000 Deposit in transit 520,000 Amount erroneously credited by bank to Case’s account 40,000 Bank service charge for December 5,000 Outstanding checks 675,000 What is the adjusted cash in bank on December 31, 2013? a. 3,685,000 b. 3,645,000 c. 3,600,000 d. 3,605,000 3.) In an audit of Mindanao Company on December 31, 2013, the following data aree gathere: Balance per book Bank charges 1,000,000 3,000 Outstanding checks 235,000 Deposit in transit 300,000 Customer note collected by bank 375,000 Interest on customer note 15,000 Customer check returned NSF Depositor’s note charged to account 62,000 250,000 What is the adjusted cash in bank on December 31, 2013? a. 1,575,000 b. 1,065,000 c. 1,075,000 d. 1,325,000 4.) Core Company provided the following data for the purpose of reconciling the cash balance per book with the balance per bank statement on December 31, 2013: Balance per bank statement 2,000,000 Outstanding checks (including certified check of P100,000) 500,000 Deposit in transit 200,000 December NSF checks (of which P50,000 had been redeposited and cleared by December 27) 150,000 Erroneous credit to Core’s account, representing proceeds of loan granted to another company 300,000 Proceeds of note collected by Bank for Core, net of service charge of P20,000 750,000 What is the cash in bank to be reported on December 31, 2013? a. 1,500,000 b. 1,400,000 c. 1,800,000 d. 1,450,000 5.) Aries Company keeps all its cash in a checking account. An examination of the entity’s accounting records and bank statement for the month ended June 30, 2013 revealed the following information: The cash balance per book on June 30 is P8,500,000. A deposit of P1,000,000 that was placed in the bank’s night depository on June 30 does not appear on the bank statement. The bank statement shows on June 30, the bank collected note for Aries and credited the proceeds of P950,000 to the entity’s account. Checks outstanding on June 30 amount to P300,000. Aries discovered that a check written in June for P200,000 in payment of an account payable, had been recorded in the entity’s record as P20,000. Included with the June bank statement was NSF check for P250,000 that Aries had received from a customer on June 26. The bank statement shows P20,000 service charge for June. What is the cash in bank to be reported in the statement of financial position on June 30, 2013? a. 9,000,000 b. 8,300,000 c. 9,360,000 d. 9,180,000 6.) On March 31, 2013, Able Company received its bank statement. However, the closing balance of the account was unreadable. Attempts to contact the bank after hours did not secure the desired information. The following data are available in preparing a bank reconciliation: February 28 book balance 1,460,000 Note collected by bank 100,000 Interest earned on note 10,000 NSF check of customer 130,000 Bank service charge on NSF 2,000 Other bank service charges 3,000 Outstanding checks 202,000 Deposit of February 28 placed in night depository 85,000 Check issued by Axle Company charged to Able’s account 20,000 What is the cash balance per bank statement? a. 1,435,000 b. 1,532,000 c. 1,338,000 d. 1,557,000 7.) Stellar Company’s bank statement for the month of December included the following information: Ending balance, December 31 Bank service charge for December 2,800,000 12,000 Interest paid by bank to Stellar Company for December 10,000 In comparing the bank statement to its own cash records, the entity found the following: Deposits made but not yet recorded by the bank 350,000 Checks written and mailed but not yet recorded by the bank 650,000 In addition, the entity discovered that it had drawn and erroneously recorded a check for P46,000 that should have been recorded for P64,000. What is the cash balance per ledger on December 31? a. 2,500,000 b. 2,520,000 c. 2,540,000 d. 2,800,000 8.) On June 30, 2013, the bank statement of Bougainvilla Company had an ending balance of P3,735,000. The following data were assembled in the course of reconciling the bank balance: The bank erroneously credit Bougainvilla Company P21,000 on June 22. During the month, the bank charged back NSF checks amounting to P23,000 of which P8,000 had been redeposited by June 25. Collection for June 30 totaling P103,000 was deposited the following month. Checks outstanding on June 30 amounted to P302,000. Note collected by the bank for Bougainvilla Company was P80,000 and the corresponding bank charge was P5,000. What is the unadjusted cash in bank per ledger on June 30, 2013? a. 3,515,000 b. 3,557,000 c. 3,455,000 d. 3,497,000 9.) Letty Company’s bank statement for the month of April included the following information: Bank service charge for April 15,000 Check deposited by Letty during April was not collectible and has been marked “NSF” by the bank and returned 40,000 In comparing the bank statement to its own records, the entity found the following: Deposits made but not yet recorded by bank 130,000 Checks written and mailed but not yet recorded by bank 100,000 All deposits in transit and outstanding checks have been properly recorded in the entity’s books. A customer’s check for P35,000 payable to Letty Company had not yet been deposited and had not been recorded by the entity. The cash in bank account balance per ledger is P920,000 What is the adjusted cash in bank on April 30? a. 900,000 b. 865,000 c. 930,000 d. 965,000 10.) Carefree Company prepared the following bank reconciliation on March 31: Book balance Add: March 31 deposit Collection of note Interest on note 1.405,000 750,000 2,500,000 150,000 Total 4,805,000 Loss: Careless Company’ s deposit to our account Bank service charge Adjusted book balance Bank balance Add: Error on check No. 175 Total 3,400,000 1,100,000 45,000 1,145,000 3,600,000 5,630,000 45,000 5,675,000 Less: Preauthorized payments for water bills NSF check Outstanding check 250,000 220,000 1,650,000 Adjusted bank balance 2,075,000 3,600,000 Check No. 175 was made for the proper amount of P249,000 in payment of account. However it was entered in the cash payments journal as P294,000. The entity authorized the bank to automatically pay its water bills as submitted directly to the bank. What is the adjusted cash in bank on March 31? a. 3,660,000 b. 3,600,000 c. 3,630,000 d. 2,880,000 11.) Divine Company prepared the following bank reconciliation on December 31, 2013: Balance per bank statement Add: Deposit in transit Checkbook printing charge 2,800,000 195,000 5,000 Error made by Divine recording check No. 45 (issued in December) NSF check 35,000 110,000 345,000 3,145,000 Less: Outstanding check 100,000 Note collected by bank (includes P15,000 interest) Balance per book 215,000 315,000 2,830,000 The entity had P200,000 cash on hand on December 31, 2013. What amount should be reported as cash in the statement of financial position on December 31, 2013? a. 2,930,000 b. 3,095,000 c. 2,895,000 d. 3,130,000 12.) Margar Company keeps all cash in a checking account. An examination of the entity’s accounting records and bank statement for the month ended December 31, 2013 revealed a bank statement balance of P8,469,000 and a book balance of P8,524,00. A deposit of P950,000 placed in the bank’s night depository on December 29 does not appear on the bank statement. Checks outstanding on December 31 amount to P270,000. The bank statement shows that on December 25, the bank collected a note for Margar Company and credited the proceeds of P935,000 to the entity’s account. The proceeds included P35,000 interest, all of which Margar Company earned during the current period. Margar Company has not yet recorded the said collection. Margar Company discovered that check number 1000759 written in December for P183,000 in payment of an account had been recorded in the entity’s records as P138,000. Included with the December 31 bank statement was an NSF check for P250,000 that Margar Company had received from Ana Company on December 20. Margar Company has not yet recorded the returned check. The bank statement shows a P15,000 service charge for December. What is the journal entry to adjust the cash in bank on December 31, 2013? a. Net debit to cash in bank of P625,000 b. Net credit to cash in bank of P625,000 c. Debit to cash in bank of P935,000 d. Credit to cash in bank of P310,000 13.) While checking the cash account of ABC Company on December 31, 2013, the following information is discovered: Balance per book 6,776,000 Balance per bank statement (outstanding checks of P987,000) 6,532,000 Deposit in bank closed by BSP 1,600,000 Currency and coins counted 950,000 Petty cash fund (of which P100,000 is in the form of paid vouchers) Bank charges not yet taken up in the book Bond sinking fund Receivables from employees 50,000 6,000 1,000,000 70,000 Error in recording a check in the book. The correct amount as paid by the bank is P89,000 instead of P98,000 as recorded in the book, or a difference of 9,000 What is the adjusted cash in bank on December 31,2013 a. 6,535,000 b. 6,779,000 c. 7,769,000 d. 8,379,000 14.) Ron company provided the following data for the month of January of the current year: Balance per book, January 31 Balance per bank statement, January 31 3,130,000 3,500,000 Collections on January 31 but Undeposited 550,000 NSF check received from a customer returned by the bank on February 5 with the January bank statement Checks outstanding on January 31 Bank debit memo for safety deposit box rental not recorded by depositor 50,000 650,000 5,000 A creditor’s check for P30,000 was incorrectly recorded in the depositor’s Book as A customer’s check for P200,000 was recorded by the depositor as 300,000 20,000 The depositor neglected to make an entry in its books for a check drawn in payment of an account payable 125,000 What is the adjusted cash in bank on January 31? a. 3,130,000 b. 3,500,000 c. 3,400,000 d. 2,950,000 15.) In reconciling the cash balance on December 31,2013 with that shown in the bank statement, the following tacts are gathered from the records of Sam Company: Balance per bank statement Balance per book 4,000,000 2,700,000 Outstanding checks 600,000 Deposit in transit 475,000 Service charge Proceeds of bank loan, December 1, discounted for 6 months at 12%, 10,000 not recorded on Sam Company’s books 940,000 Customer’s check charged back by bank For absence of counter signature 50,000 Deposit of P100, 000 incorrectly recorded by bank as 10,000 Check of Sim Company charged by bank against Sam account 150,000 Customer ‘s note collected by bank in favor of Sam Company. Face 400,000 Interest 40,000 Total 440,000 Collection fee 5,000 Erroneous debit memo of December 28, To charge Sam account with Settlement of bank loan Deposit of Sim Company credited to Sam account 200,000 300,000 What is the adjusted cash in bank on December 31, 2013? a. 4,315,000 b. 3,925,000 c. 3,075,000 d. 4,015,000 16.) Esteem Company’s month-end bank statement showed a balance of P3,600,000. Outstanding checks amounted toP1,200,000, a deposit of P400,000 was in transit at month- end, and a check for P50,000 was erroneously charged by the bank against the account. What is the correct balance in the bank account at month-end? a. 2,750,000 b. 2,850,000 c. 2,050,000 d. 4,350,000 17.) The accounts of Susan Company showed the following facts on August 31, 2013. Balance of cash in bank account 1,300,000 Balance of bank statement 1,200,000 Outstanding checks, August 31: Number 555 10,000 761 55,000 762 40,000 763 25,000 764 65,000 765 70,000 Receipts of August 31, deposited September 1 Service charge for August NSF check received from a customer 275,000 5,000 85,000 The cashier-bookkeeper had misappropriated P30,000 and an additional P10,000 by charging sales discounts and crediting accounts receivable The stub for check number 765 and the invoice relating there to show that it was for P50,000. It was recorded incorrectly in the cash disbursements journal as P70, 000. This check was drawn in payment of an account payable. Payment has been stopped on check number 555 which was drawn in payment of an account payable. The payee cannot be located. What is the adjusted cash in bank in august 31, 2013? a. 1,240,000 b. 1,230,000 c. 1,210,000 d. 1,200,000 18.) The cash account of Gallant Company showed a balance of P4, 500,000. The bank statement did not include a deposit of P230,000 made on the last day of the month. The bank statement showed a collection by the bank of P94,000 and a customer’s check for P32,000 returned because it was NSF. A customer’s check for P45,000 was recorded on the books as P54,000, and a check written for P79,000 was recorded as P97,000.What is the correct balance in the cash account? a. 4,765,000 b. 4,571,000 c. 4,819,000 d. 4,801,000 19.) Mcbride Company provided the following data pertaining to the transactions and bank account for May of the current year. Cash balance per accounting recorded 1,719,000 Cash balance per bank statement 3,195,000 Bank service charge Debit memo for the cost of printed checks delivered by the bank; 10,000 the charge has not been recorded in the accounting record Outstanding checks Deposit of May 30 not recorded by bank until June 1 12,000 685,000 500,000 Proceeds of a bank loan on May 30, not recorded in accounting record, net of interest of P30,000 570,000 Proceeds from a customer’s promissory note, principal amount P800,000 collected by the bank not taken up in the accounting record with interest 810,000 Check No. 1086 issued to a supplier entered in the accounting record as P210,000 but deducted in the bank statement at an erroneous amount of 120,000 Stolen check lacking an authorized signature deducted from Mcbride’s account by the bank error 80,000 Customer’s check returned by the bank marked NSF indicating that the customer’s balance was not adequate to cover the check ;no entry has been made in the accounting record to record the returned check What is the adjusted in bank? a. 3,000,000 b. 2,910,000 c. 3,080,000 d. 2,990,000 77,000 20.) The last account in the ledger of Kate Company shows a balance of P1,652,000 at December 31 . The bank statement, however, shows a balance of P2,000,000 at the same date. The only reconciling items consist of bank service charge of P2,000, a large number of outstanding checks totaling P590,000 and a deposit in transit. What is the deposit in transit in the December 31 bank reconciliation? a. 150,000 b. 440,000 c. 154,000 d. 592,000 21.) Grass Company provided the following information: Balance per bank statement July 31 Balance per ledger, July 31 Deposit of July 30 not recorded by bank Debit memo – service charges Credit memo – collection of note by bank Outstanding checks An analysis of the canceled checks returned with the bank statement reveals the following: * Check for purchase of supplies was drawn for P60,000 but was recorded as P90,000 * The manager wrote a check for traveling expenses of P100,000 while out of town. The check was not recorded. What is the amount of outstanding checks on July 31? a. 970,000 1,240,000 750,000 280,000 10,000 300,000 ? b. 270,000 c. 550,000 d. 610,000 22.) The following information was included in the bank reconciliation for Bayside Company for October and November 2013: Checks and charges recorded by bank in November, including a November service charge of P4,000 and NSF check of P20,000 550,000 Service charge made by bank in October and recorded by depositor in November Total credits to cash in all journals during November 2,000 620,000 Customer’s NSF check returned in October and redeposited in November (no entry made by depositor in either October or November) 40,000 Outstanding checks on October 31,2013 that cleared in November What is the amount of outstanding checks on November 30,2013? a. 282,000 b. 300,000 c. 322,000 d. 302,000 230,000 23.) Jam Company providing the bank reconciliation on May31: Balance per bank statement 2,100,000 Deposit outstanding 300,000 Checks outstanding (__30,000) Correct cash balance 2,370,000 Balance per book 2,372,000 Bank service charge (__ 2,000) Correct cash balance 2,370,000 June data are as follows: Bank Checks recorded 2,300,000 Deposit recorded 1,620,000 Book 2,360,000 1,800,000 Collection by bank (P400,000 note plus interest) 420,000 NSF check returned with June 30statement 10,000 Balances 1,830,000 1. What is the amount of checks outstanding on June 30? a. 30,000 b. 90,000 c. 60,000 d. 0 1,810,000 2. What is the amount of deposit s in transit on June 30? a. 480,000 b. 120,000 c. 180,000 d. 680,000 3. What is the adjusted cash in bank on June 30? a. 1,810,000 b. 2,220,000 c. 2,240,000 d. 2,780,000 24.) Lazer Company had the following bank reconciliation on June 30, 2013: Balance per bank statement, June 30 Deposit in transit Total Outstanding checks Balance per book, June 30 3,000,000 __400,000 3,400,000 (__900,000) 2,500,000 The bank statement for the month of July showed the following: Deposits (including P200,000 note collected for Lazer) 9,000,000 Disbursements (including P140,000 NSF check and P10,000 service charge) 7,000,000 All reconciling items on June 30 cleared through the bank in July. The outstanding checks totaled P600,000 and the deposit in transit amounted to P1,000,000 July 31. 1. What is the cash balance per book on July 31? a. 5,400,000 b. 5,350,000 c. 5,550,000 d. 4,500,000 2. What is the amount of cash receipts per book in July? a. 9,400,000 b. 9,600,000 c. 8,600,000 d. 9,800,000 3. What is the amount of cash disbursements per book July? a. 6,550,000 b. 6,700,000 c. 7,300,000 d. 6,850,000 25.) Chris Company presented the following bank reconciliation for the month of November of the current year: Balance per bank statement, November 30 3,600,000 Add: Deposit in transit __800,000 4,400,000 Less: Outstanding checks Bank credit recorded in error Balance per book, November 30 1,200,000 _200,000 _1,400,000 3,000,000 Data per bank statement for the month of December follow: December deposits (including note collected of P1,000,000 for Chris) 5,500,000 December disbursements (including NSF, P350,000 and service charge, P50,000) 4,400,000 All items that were outstanding on November 30 cleared through the bank in December, including the bank credit. In addition, checks amounting to P500,000 were outstanding and deposits of P700,000 were in transit on December 31. 1. What is the cash balance per ledger on December 31? a. 4,100,000 b. 4,900,000 c. 4,700,000 d. 4,300,000 2. What is the amount of cash receipts per book in December? a. 5,400,000 b. 4,400,000 c. 5,500,000 d. 6,400,000 3. What is the amount of cash disbursements per book in December? a. 3,700,000 b. 3,300,000 c. 3,100,000 d. 3,500,000 26.) Lira Company prepared the following bank reconciliation dated June 30 of the current year. Balance per bank 9,800,000 Deposit in transit 400,000 Outstanding checks Balance per book (1,400,000) 8,800,000 There were total deposits of P6,500,000 and charges of disbursements of P9,000,000 for July per bank statement. All reconciliation items on June 30 cleared the bank on July 31. Checks outstanding amounted to P1,000,000 on July 31.What is the amount of cash disbursements per book in July? a. 8,600,000 b. 7,600,000 c. 9,400,000 d. 8,400,000 27.) Oro Company had the following bank reconciliation on March 31 of the current year: Balance per bank statement, March 31 Add: Deposits in transit Total Less: Outstanding checks Balance per book, March 31 Data per bank statement for the month of April follow: Deposits Disbursements All reconciliation items on March 31 cleared through the bank in April. Outstanding checks on April 30 totaled P750,000 and deposits in transit amounted to P1,500,000. What is the amount of cash receipts per book in April? a. 5,000,000 b. 6,500,000 c. 7,500,000 d. 5,500,000 ACCOUNTS RECEIVABLE 1.) Roxy Company had the following information for 2013 relating to accounts receivable: Accounts receivable on January 1 1,300,000 Credit Sales 5,400,000 Collections from customers, excluding recovery Accounts written off 4,750,000 125,000 Collection of accounts written off in prior year (customer credit was not reestablished) 25,000 Estimated uncollectible receivables per aging of receivable at December 31 165,000 On December 31, 2013, what is the balance of accounts receivable, before allowance for doubtful accounts? a. 1,825,000 b. 1,850,000 c. 1,950,000 d. 1,990,000 2.) Jay Company provided the following data relating accounts receivable for 2013: Accounts receivable, January 1 Credit sales 650,000 2,700,000 Sales returns 75,000 Accounts written off 40,000 Collections from customers 2,150,000 Estimated future sales returns at December 31 Estimated uncollectible accounts at 12/31 per aging 50,000 110,000 What amount should Jay report as net realizable value of accounts receivable on December 31, 2013? a. 1,200,000 b. 1,125,000 c. 1,085,000 d. 925,000 3.) The following data were taken from the records of Infra Company for the year ended December 31, 2013: Sales on account Notes received to settle accounts 3,600,000 400,000 Provision for doubtful accounts Accounts receivable determined to be worthless 90,000 25,000 Purchases on account 3,900,000 Payments to creditors 3,200,000 Discounts allowed by creditors Merchandise returned by customer Collections received to settle accounts Notes given to creditors in settlement of accounts Merchandise returned to suppliers Payments on notes payable Discounts taken by customers Collections received in settlement of notes 260,000 15,000 2,450,000 250,000 70,000 100,000 40,000 180,000 What is the net realizable value of accounts receivable on December 31, 2013? a. 605,000 b. 890,000 c. 825,000 d. 670,000 4.) When examining the accounts of Brute Company, it is ascertained that balances relating to both receivables and payables are included in a single controlling account called “receivables control” that has a debit balance of P4,850,000. An analysis of the make-up of this account revealed the following: Debit Accounts receivable – customer Credit 7,800,000 Accounts receivable – officers 500,000 Debit balances – creditors 300,000 Postdated checks from customer 400,000 Subscriptions receivable 800,000 Accounts payable for merchandise 4,500,000 Credit balances in customers’ accounts 200,000 Cash received in advance from customers for goods not yet shipped 400,000 Expected bad debts 150,000 After further analysis of the aged accounts receivable, it is determined that the allowance for doubtful accounts should be P200,000. What amount should be reported as “trade and other receivables” under current assets? a. 8,950,000 b. 8,800,000 c. 8,600,000 d. 8,850,000 5.) Miami Company reported that the current receivables consisted of the following: Trade accounts receivable Allowance for uncollectible accounts 930,000 ( 20,000) Claim against shipper for goods lost in transit (November 2013) 30,000 Selling price of unsold goods sent by Miami on consignment at 130% of cost (not included in Miami’s ending inventory) 260,000 Security deposit on lease of warehouse used for storing some inventories Total 300,000 1,500,000 On December 31, 2013, what total amount should be reported as trade and other receivables under current assets? a. 940,000 b. 1,200,000 c. 1,240,000 d. 1,500,000 6.) Faith Company provided the following information relating to current operations: Accounts receivable, January 1 4,000,000 Accounts receivable collected 8,400,000 Cash sales 2,000,000 Inventory, January 1 4,800,000 Inventory, December 31 4,400,000 Purchases 8,000,000 Gross margin on sales 4,200,000 What is the balance of accounts receivable on December 31? a. 8,200,000 b. 6,200,000 c. 2,000,000 d. 4,200,000 7.) On December 31, 2013, the accounts receivable control account of Honduras Company had a balance of P8,200,000. An analysis of the accounts receivable showed the following: Accounts known to be worthless 100,000 Advances payments to creditors on purchase orders 400,000 Advances to affiliated companies 1,000,000 Customers’ accounts reporting credit balances arising from sales returns Interest receivable on bonds ( 600,000) 400,000 Trade accounts receivable – unassigned 2,000,000 Subscription receivable due in 30 days 2,200,000 Trade accounts receivable – assigned (Finance company’s equity in assigned accounts is P500,000) 1,500,000 Trade installments receivable due in 1 – 18 months, including unearned finance charge of P50,000 850,000 Trade accounts receivable from officers, due currently 150,000 Trade accounts on which postdated checks are held (no entries were made on receipt of checks) Total 230,000 8,200,000 What is the correct balance of trade accounts receivable on December 31, 2013? a. 4,650,000 b. 4,700,000 c. 4,150,000 d. 4,050,000 8.) The financial statements of Katherine Company included the following information for 2013: January 1 Accounts receivable Allowance for doubtful accounts Sales December 31 1,200,000 60,000 8,000,000 Cash collected from customers 7,000,000 The cash collections included a recovery of P10,000 from a customer whose account had been written off as worthless customers’ accounts of P30,000. On December 1, 2013, a customer sttled an account by issuing a 12%, six-month note for P400,000. What is the net realizable value of accounts receivable on December 31, 2013? a. 1,640,000 b. 1,670,000 c. 1,780,000 d. 1,630,000 9.) Von Company provided the following data for the current year in relation to accounts receivable: Debits January 1 balance after deducting credit balance of P30,000 Charge sales 530,000 5,250,000 Charge for goods out on consignment 50,000 Shareholders’ subscriptions 200,000 Accounts written off but recovered 10,000 Cash paid to customer for January 1 credit balance 25,000 Goods shipped to cover January 1 credit balance 5,000 Deposit on contract 120,000 Claim against common carrier 15,000 Advances to supplier 155,000 Credits Collections from customers, including overpayment of P50,000 5,200,000 Write off 35,000 Merchandise returns 25,000 Allowances to customers for shipping damages 15,000 Collection on carrier claim 10,000 Collection on subscription 50,000 What is the balance of accounts receivable on December 31? a. 565,000 b. 595,000 c. 545,000 d. 495,000 10.) The following transactions affecting the accounts receivable of Wonder Company took place during the year ended December 31, 2013. Sales (cash and credit) 5,900,000 Cash received from credit customers, all of whom took advantage of the discount feature of the entity’s credit terms 4/10,n/30 3,024,000 Cash received from cash customers 2,100,000 Accounts receivable written off as worthless 50,000 Credit memorandum issued to credit customers for sales returns and allowances 250,000 Cash refunds given to cash customers for sales returns and allowances 20,000 Recoveries on accounts receivable written off as Uncollectible in prior periods (not included in cash amount stated above) 80,000 The following balances were taken from the January 1, 2013 statement of financial position: Accounts receivable 950,000 Allowance for doubtful accounts 100,000 The entity provided for uncollectible amount losses by crediting allowance for doubtful accounts in the amount of P70,000 for the current year. 1. What is the balance of accounts receivable on December 31, 2013? a. 1,300,000 b. 1,426,000 c. 1,280,000 d. 1,220,000 2. What is the balance of allowance for doubtful accounts on December 31, 2013? a. 120,000 b. 200,000 c. 250,000 d. 170,000 11.) On January 1, 2013, the statement of financial position of Square Company showed accounts receivable of P450,000 and allowance for doubtful accounts of P9,000. During the current year, the transaction were: Sales on account, P4,800,000. Cash collections of accounts receivable totaled P3,920,000, after discounts of P80,000 were allowed from prompt payment. Bad accounts previously written off prior year amounting to P5,000 were recovered. The entity decided to provide P26,000 for doubtful accounts by a journal entry at the end of the year. Accounts receivable of P700,000 have been pledged to a local bank on a loan of P400,000. Collection of P150,000 were made on such accounts receivable (not included in the collections previously given). What is the net realizable value of accounts receivable on December 31, 2013? a. 1,065,000 b. 1,060,000 c. 1,070,000 d. 1,074,000 12.) Germany Company started business on January 1,2013. After considering the collection experience of the other entities in the industry, the entity established an allowance for doubtful accounts estimated at 5% of credit sales. Outstanding accounts receivable recorded on December 31, 2013 totaled P460,000, while allowance for doubtful accounts had a credit balance of P50,000 after recording estimated doubtful accounts expense for December and after writing off P10,000 of uncollectible accounts. Further analysis showed that merchandise purchased amounted toP1,800,000 and ending merchandise inventory was P300,000. Good were sold at 40% above cost. The total sales comprised 80% sales on account and 20% cash sales. Total collections from customers, excluding cash sales, amounted to P1,200,000. What is the effect of the transactions on the accounts receivable and allowance for doubtful accounts, respectively? a. 10,000 understated 24,000 understated b. 20,000 understated 34,000 understated c. 330,000 understated 40,000 understated d. 330,000 understated 50,400 understated ESTIMATION OF DOUBTFUL ACCOUNTS 1.) Sheraton Hotel manages an extensive network of boutique hotels in the country. The entity has significant accounts receivable from three customers, namely: Bacolod Inn 5,000,000 Chicken House 9,000,000 Landmark Hotel Other accounts receivables not individually significant 8,000,000 4,500,000 The entity has determined that the Chicken House receivable is impaired by P1,500,000 and the Landmark Hotel receivable is impaired by P2,000,000. The receivable from the Bacolod Inn is not impaired . The entity has also determined that a composite rate of 5% is appropriate to measure impairment has loss of accounts receivable? a. 4,825,000 b. 3,500,000 c. 3,975,000 d. 3,725,000 2.) On December 31,2013, Celaica Company reported accounts receivable as follows: Trisha Company 800,000 Jerard Company 2,000,000 Marc Company 1,500,000 Francis Company 1,000,000 Other accounts receivable not individually significant 5,000,000 The entity determined that Trisha Company receivable is impaired by P500,000 and Francis Company receivable is totally impaired. The other accounts receivable from Jerard Company and Marc Company are not considered impaired. The entity also determined that a composite rate of 4% is appropriate to measure impairment of all other accounts receivable. What is the total impairment loss of accounts receivable? a. 1,840,000 b. 1,500,000 c. 1,700,000 d. 1,912,000 3.) Orr Company prepared an aging of accounts receivable on December 31,2013 and determined that the net realizable value of the accounts receivable was P2,500,000. Additional information is as follows: Allowance for doubtful accounts on January 1 280,000 Accounts written off as uncollectible 230,000 Accounts receivable on December 31 2,700,000 Uncollectible accounts recovery 50,000 For the year ended December 31,2013, what amount should be recognize as doubtful accounts expense? a. 230,000 b. 200,000 c. 150,000 d. 100,000 4.) Seiko Company reported the following balances after adjustment at year-end: 2013 2012 Accounts receivable 5,250,000 4,800,000 Net realizable value 5,100,000 4,725,000 During 2013, the entity wrote off accounts totaling P160,000 and collected P40,000 on accounts written off in previous years. What amount should be recognized as doubtful accounts expense for the year ended December 31,2013? a. 195,000 b. 150,000 c. 120,000 d. 150,000 5.) Roanne Company used the allowance method of accounting for uncollectible accounts. During 2013, the entity had charged P800,000 to bad debt expense, and wrote off accounts receivable of P900,000 as uncollectible. What was the decrease in working capital? a. 900,000 b. 800,000 c. 100,000 d. 0 6.) Mill Company’s allowance for doubtful accounts was P1,000,000 at the end of 2013 and P900,00 at the end of 2012. For the year ended December 31,2013, the entity reported doubtful accounts expense of P160,000 in the appropriate account in 2013 to write off uncollectible accounts? a. 60,000 b. 100,000 c. 160,000 d. 260,000 7.) Boholano Company used the statement of financial position approach in estimating uncollectible accounts expense. The entity prepared an adjusting entry to recognize this expense at the end of the year. During the year, the entity wrote off a P100,000 receivable and made no recovery of previous write off. After the adjusting entry for the year, the credit balance in the allowance for doubtful accounts was P250,000 larger than it was on January 1. What amount of uncollectible account expense was recorded for the year? a. 250,000 b. 100,000 c. 150,000 d. 350,000 8.) Tara Company provided the following information pertaining accounts receivable on December 31,2013: Days outstanding Estimated Amount Estimated uncollectible 0- 60 61 - 120 Over 120 1,200,000 1% 900,000 1,000,000 2% 60,000 3,100,000 During 2013, the entity wrote off P70,000 in accounts receivable and recovered P40,000 that had been written off in prior years. On January 1, 2013, the allowance for uncollectible accounts was P100,000. Under the aging method, what amount of allowance for uncollectible accounts should be reported on December 31, 2013? a. 90,000 b. 100,000 c. 130,000 d. 190,000 9.) Marian Company used the allowance method of accounting for bad debts. The following summary schedule was prepared from an aging of accounts receivable outstanding on December 31 of the current year: Number of days Probability outstanding Amount of collection 0 – 30 days 5,000,000 .98 31 – 60 days 2,000,000 .90 Over 60 days 1,000,000 .80 The following additional information is available for the current year: Net credit sales for the year 40,000,000 Allowance for doubtful accounts: Balance, January 1 Balance before adjustment, December 31 450,000 (cr) 20,000 (dr) The entity based its estimate of doubtful accounts on the aging of accounts receivable. What amount should be recognized as doubtful accounts expense for the current year? a. 470,000 b. 480,000 c. 500,000 d. 520,000 10.) Delta Company sells to wholesalers on terms 2/15, net 30. The entity has no cash sales but 50% of the customers take advantage of the discount. The entity used the gross method of recording sales and accounts receivable. An analysis of the trade accounts receivable on December 31, 2013 revealed the following: Age Amount Collectible 0 – 15 days 2,000,000 100% 16 – 30 days 1,200,000 95% 31 – 60 days 100,000 90% Over 60 days __ 50,000 50% 3,350,000 In the December 31, 2013 statement of financial position, what amount should be reported as allowance for sales discount? a. 20,000 b. 32,400 c. 33,500 d. 40,000 11.) Brain Company prepared the following schedule on December 31, 2013 and the uncollectible accounts experience of the previous five years. 0-30 days 4,500,000 31-60 days 1,500,000 61-90 days 800,000 91-120 days 200,000 Over 120days _100,000 7,100,000 Year-end 0-30 31-60 days 61-90 91-120 days days Over Year receivables days 120-days 2012 7,800,000 3% 9% 17.4% 2011 7,500,000 5 8 18.0 49.2 80.3 2010 6,800,000 4 11 19.0 53.7 82.0 2009 6,900,000 4 10 19.8 51.3 78.5 2008 7,200,000 2 11 17.8 49.9 85.2 52.1% 84.1% The unadjusted allowance for bad debts on December 31, 2013 is P300,000. What is the correct balance of the allowance for bad debts based on the average loss experience of the entity for the last 5 years? The average rate is determined by adding all the rates for each category divided by 5. a. 640,700 b. 300,000 c. 340,700 d. 597,500 12.) The following accounts were abstracted from Manchester Company’s unadjusted trial balance on December 31, 2013: Debit Accounts receivable Allowance for doubtful accounts Net credit sales Credit 5,000,000 40,000 20,000,000 The entity estimated that 3% the gross accounts receivable will become uncollectible. What amount should be recognized as doubtful accounts expense for 2013? a. 110,000 b. 150,000 c. 190,000 d. 600,000 13.) Ladd Company provided the following information for the current year: Allowance for doubtful accounts – January 1 180,000 Sales 9,500,000 Sales returns and allowances 800,000 Sales discounts 200,000 Accounts written off as uncollectible 200,000 The entity provided for doubtful accounts expense at the rate of 3% of net sales. What is the allowance for doubtful accounts at the-end? a. 435,000 b. 265,000 c. 235,000 d. 241,000 14.) Barr Company showed the following at the year-end: Allowance for doubtful accounts (debit balance) ( 16,000) Net sales 7,100,000 The entity estimated tits uncollectible receivables at 2% of net sales. What is the allowance for doubtful accounts at year-end? a. 158,000 b. 144,500 c. 142,000 d. 126,000 15.) Effective with the year ended December 31, 2013, Hall Company adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging of accounts receivable. The following data are available: Allowance for doubtful accounts, January 1 250,000 Provision for doubtful accounts during the current year (2% of credit sales of P10,000,000) Accounts written off Estimated uncollectible accounts per aging on December 31 200,000 205,000 220,000 After year-end adjustment, what is the doubtful accounts expense for current year? a. 220,000 b. 205,000 c. 200,000 d. 175,000 16.) Capetown Company began operations on January 1, 2012. The entity has found that its estimated bad debt expense has been consistently higher than actual bad debts. Management proposed lowering the percentage from 3% of credit sales to 2%. Credit sales for 2013 totaled P5,000,000, and accounts written off as uncollectible during 2013 totaled P550,000 What is the debt expense for 2013 a. 150,000 b. 100,000 c. 550,000 d. 240,000 17.) Oriental Company followed the procedure of debiting bad debt expense for 2% of all new sales. Sales Allowance for bad debts 2011 3,000,000 40,000 2012 2,800,000 60,000 2013 3,500,000 80,000 What was the amount of accounts written off in 2013? a. 50,000 b. 70,000 c. 10,000 d. 86,000 18.) Easy Company sells directly to retail customers. On January 1, 2013, the balance of the accounts receivable was P2,070,000 while the allowance for doubtful accounts was credit of P78,000. The following data are gathered: Credit sales Writeoffs Recoveries 2010 11,100,000 260,000 22,000 2011 12,250,000 295,000 37,000 2012 14,650,000 300,000 36,000 2013 15,000,000 310,000 42,000 Doubtful accounts are provided for as a percentage of credit sales. The entity calculated the percentage annually by using the experience of the three years prior to the current year. What amount should be reported as allowance for doubtful accounts on December 31, 2013? a. 110,000 b. 378,000 c. 300,000 d. 478,000 19.) From inception of operations in 2009, Axis Company carried no allowance for doubtful accounts. Uncollectible accounts were expensed as written off and recoveries were credited to income as collected. On March 1, 2013 (after the 2012 financial statements were issued), management recognized that the accounting policy with respect to doubtful accounts was not correct, and determined that an allowance for doubtful accounts was necessary. A policy was established to maintain an allowance for doubtful accounts based on historical bad debt loss percentage applied to year-end accounts receivable. The historical bad debt loss percentage is to be recomputed each year based on all available past years up to a maximum of five years. Information for five years is as follows: Year Credit sales Writeoffs Recoveries 2009 1,500,000 15,000 0 2010 2,250,000 38,000 2,700 2011 2,950,000 52,000 2,500 2012 3,300,000 65,000 4,000 2013 4,000,000 83,000 5,000 The entity reported accounts receivable of P1,250,000 and P2,000,000 on December 31, 2012 and December 31, 2013, respectively. What amount should be reported as doubtful accounts expense for 2013? a. 97,000 b. 78,000 c. 83,000 d. 92,000 20.) From inception of operations to December 31, 2013, Murr Company provided for uncollected accounts expense under the allowance method, provisions are made monthly at 2% of credit sales, bad debts written off were charged to the allowance account , recoveries of bad debts previously written off were credited to the allowance account , and no year-end adjustments to the allowance account were made. The usual credit terms are net 30 days. The allowance for doubtful accounts was P120,000 on January 1 ,2013. During the current year, credit sales totaled P9,000,000, interim provisions for doubtful accounts were made at 2% of credit sales, P90,000 of bad debts were written off ,and recoveries of accounts previously written off amounted to P15,000 The entity prepared an aging of accounts receivable for the first time on December 31, 2013 Classification November – December July January – October – June Prior to January 1, 2013 Balance 2,000,000 600,000 400,000 _ 200,000 Uncollectible 2% 10% 25% 75% 3,200,000 Based on the review of collectability of the account balances in the “prior to January 1, 2013” aging category, additional accounts totaling P60,000 are to be written off on December 31, 2013. Effective with the year ended December 31, 2013, the entity adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable. What is the year-end adjusted to the allowance for doubtful accounts on December 31,2013? a. 305,000 b. 180,000 c. 320,000 d. 140,000 RECEIVABLE FINANCING 1.) Moon Company assigned P3,000,000 of accounts receivable as collateral for a P2,000,000 loan with a bank. The bank assessed a 4% finance fee and charged 6% interest on the note at maturity. What would be the journal entry to record the transaction? a. Debit cash P1,920,000, debit finance charge P80,000, and credit note payable P2,000,000. b. Debit cash P1,920,000, debit finance charge P80,000, and credit accounts receivable P2,000,000. c. Debit cash P1,920,000, debit finance charge P80,000, debit from the bank P1,000,000, and credit accounts receivable P3,000,000 d. Debit cash P1,880,000, debit finance charge P120,000, and credit note payable P2,000,000. 2.) Star Company assigned P4,000,000 of accounts receivable as collateral for a P2,000,000, 6% loan with a bank. The entity also paid a finance fee of 5% on the transaction upfront. What amount should be recorded as a gain or loss on the transfer of accounts receivable? a. 200,000 loss b. 100,000 loss c. 240,000 gain d. 0 3.) 4.) 5.) Zeus Company factored P6,000,000 of accounts receivable to a finance entity on October 1, 2013. Control was surrendered by Zeus Company. The factored assessed a fee of 3% and retained a holdback equal to 5% of the accounts receivable. In addition, the factor charged 15% interest computed on weighted average time to maturity of the accounts receivable of 54 days. 1. What is the amount of cash initially received from the factoring? a. 5,296,850 b. 5,386,850 c. 5,476,850 d. 5,556,850 2. If all accounts are collected, what is the cost of factoring the accounts receivable? a. 313,150 b. 180,000 c. 433,150 d. 613,150 6.) Mazda Company sold P5,800,000 in accounts receivable for cash of P5,000,000. The factor withheld 10% of the cash proceeds to allow for possible customer returns and other adjustments. An allowance for bad debts of P600,000 had previously been established by the entity in relation to these accounts. What is the loss on factoring that should be recognized? a. 200,000 b. 700,000 c. 500,000 d. 800,000 7.) Flora Company factored P5,000,000 of its accounts receivable. The transfer is recorded as a sale by Flora Company. The factor retained 8% for sales adjustment and charged P300,000 as a financing fee. For simplicity, the estimated and actual amounts of the following items are equal: Sales adjustments Uncollectible accounts 250,000 100,000 What is the loss or financing expense to be recognized on the transfer? a. 300,000 b. 650,000 c. 350,000 d. 400,000 8.) 9.) 10.) 11.) Freeway Company provides financing to other entities by purchasing their accounts receivable on a nonrecourse basis. Freeway charges its clients a commission of 15% on all receivables factored. In addition, Freeway withholds 10% of receivables factored as protection against sales returns and other adjustments. Freeway credits the 10% withheld to Clients Retainer account and makes payments to clients at the end of each month so that the balance in the retainer is equal to 10% of unpaid receivables at the end of the month. Experience has led Freeway to establish an allowance for doubtful accounts of 4% of all unpaid receivables purchased. On December 1, 2013, Freeway purchased receivables from Motorway Company totaling P3,000,000. Motorway had previously established an allowance for doubtful accounts for these receivables a P100,000. By December 31, 2013, Freeway had collected P2,500,000 on these receivables. 1. What is the amount of cash initially received by Motorway Company from Freeway Company? a. 2,250,000 b. 3,000,000 c. 2,550,000 d. 2,700,000 2. What is the loss on factoring to be recognized by Motorway Company? a. 350,000 b. 450,000 c. 650,000 d. 750,000 12.) 13.) 14.) On July 1, 2013, Lee Company sold goods in exchange for P2,000,000, 8-month, noninterest-bearing note receivable. At the time of the sale, the market rate of interest was 12%. The entity discounted the note at 10% on September 1, 2013? 1. What is the cash received from discounting? a. 1,940,000 b. 1,938,000 c. 1,900,000 d. 1,880,000 2. What is the loss on note receivable discounting? a. 100,000 b. 75,000 c. 25,000 d. 0 15.) Apex Company accepted from a customer P1,000,000 face amount, 6-month, 8% note dated April 15, 2013. On the same date the entity discounted the note without recourse at Union Bank at 10% discount rate. 1. What amount of cash was received from the discounting? a. 1,040,000 b. 990,000 c. 988,000 d. 972,000 2. What is the loss on note receivable discounting? a. 50,000 b. 40,000 c. 52,000 d. 12,000 16.) On June 30, 2013, Ray Company discounted at the bank a customer/s P6,000,000, 6-month, 10% note receivable is dated April 30, 2013. The bank discounted the note at 12% without recourse. 1. What is the amount received from the note receivable discounting? a. 5,640,000 b. 5,760,000 c. 6,048,000 d. 6,174,000 2. What is the loss on the note receivable discounting? a. 252,000 b. 152,000 c. 52,000 d. 48,000 17.) On July 1, 2013, Kay Company sold equipment to Mando Company for P1,000,000. Kay accepted a 10% note receivable for the entire sales price. This note is payable in two equal installments of P500,000 plus accrued interest on December 31, 2013 and December 31, 2014. On July 1, 2014, the entity discounted the note at a bank at an interest rate of 12%. What is the amount received from the discounting of note receivable? a. 484,000 b. 493,500 c. 503,500 d. 517,000 18.) Rand Company accepted from a customer a P4,000,000, 90-day, 12% interestbearing note dated August 31, 2013. On September 30, 2013, the entity discounted the note with recourse at the Apex State Bank at 15%. However, the proceeds were not received until October 1, 2013. The discounting with recourse is accounted for as a conditional sale with recognition of a contingent liability. 1. What is the amount received from the discounting of note receivable? a. 4,017,000 b. 4,120,000 c. 4,103,000 d. 3,965,000 2. What is the loss on note receivable discounting? a. 40,000 b. 23,000 c. 17,000 d. 20,000 19.) On August 31, 2013, Sunflower Company discounted with recourse a customer’s note at the bank at discount rate of 15%. The note was received from the customer on August 1, 2013, is for 90 days, has a face value of P5,000,000, and carries an interest rate of 12%. The customer paid the note to the bank on October 30, 2013, the date of maturity. If the discounting is accounted for as a secured borrowing. What is the interest expense to be recognized on Aug. 31, 2013? a. 50,000 b. 21,250 c. 28,750 d. 25,000 20.) On January 1, 2013, Cactus Company sold land with carrying amount of P1,500,000 in exchange for a 9-month, 10% note with face value of P2,000,000. The 10% rate properly reflects the time value of money for this type of note. On April 1, 2013, the entity discounted the note with recourse. The bank discount rate is 12%. The discounting transaction is accounted for as a secured borrowing. On October 1, 2013, the maker dishonored the note receivable. The entity paid the bank the maturity value of the note plus protest fee of P10,000. On December 31, 2013, the entity collected the dishonored note in full plus 12% annual interest on the total amount due. 1. What is the amount received from the discounting of note receivable? a. 2,150,000 b. 2,021,000 c. 2,050,000 d. 1,921,000 2. What is the interest expense to be recognized on April 1, 2013? a. 50,000 b. 29,000 c. 21,000 d. 25,000 3. What is the amount collected from the customer on December 30, 2013? a. 2,150,000 b. 2,224,000 c. 2,160,000 d. 2,214,500 21.) On August 1, 2013, Vann Company’s P5,000,000 one-year non-interest bearing note due July 31, 2014, was discounted at Homestead Bank at 10.8%. the entity used the straight line method of amortizing discount. What is the carrying amount of the note payable in the December 31, 2013 statement of financial position? a. 5,000,000 b. 4,775,000 c. 4,685,000 d. 4,460,000 22.) On November 1, 2013, Davis Company discounted with recourse at 10% a oneyear, noninterest bearing, P2,050,000 note receivable maturing on January 31, 2014. The discounting of the note receivable is accounted for as a conditional sale with recognition of a contingent liability. What amount of contingent liability for this note must be disclosed in the financial statements for the year ended December 31, 2013? a. 2,050,000 b. 2,000,000 c. 2,033,333 d. 0 23.) Brooke Company discounted its own P5,000,000 one-year note at a discount rate of 12%, when the prime rate was 10%. In reporting the note prior to maturity, what rate should be used for the recording of interest expense? a. 10.0% b. 10.7% c. 12.0% d. 13.6% NOTES RECEIVABLE 1.) On June 1, 2013, Yola Company loaned Dale P500,000 on a 12% note, payable in five annual installments of P100,000 beginning January 1, 2014. In connection with this loan, Dale was required to deposit P5,000 in a noninterest-bearing escrow account. The amount held in escrow is to be returned to Dale after all principal and interest payments have been made. Interest on the note is payable on the first day of each month beginning July 1, 2013. Dale made timely payments through November 1, 2013. On January 1, 2014, Yola received payment of the first principal installment plus all interest due. On December 31, 2013, what is the accrued interest receivable on the loan? a. 0 b. 5,000 c. 10,000 d. 15,000 2.) On December 31, 2013, Jet Company received of two P1,000,000 notes receivable from customers in exchange for services rendered. On both notes, interest is calculated on the outstanding principal balance at the annual rate of 3% and payable at maturity. The note from Hart Company, made under customary trade terms, is due in nine months and the note from Maxx Company is due in five years. The market interest rate for similar notes on December 31, 2013 was 8%. The compound interest factors to the convert future value into present value at 8% follow: Present value of 1 due in nine months Present value of 1 due in five years .944 .680 What is the carrying amount of notes receivable in December 31, 20133 statement of financial position? Hart Maxx a. 944,000 680,000 b. 965,200 782,000 c. 1,000,000 680,000 d. 1,000,000 782,000 3.) On January 1, 2013, Ott Company sold goods to Fox Company. Fox signed a noninterestbearing note requiring payment of P600,000 annually for seven years. The first payment was made on January 1, 2013. The prevailing rate of interest for this type of note at date of issuance was 10%. Information on present value factors is as follows: Present value of Present value Period of 1 at 10% ordinary annuity of 1 at 10% 6 .56 4.36 7 .51 4.87 What amount should be recorded as sales revenue in January 2013? a. 3,216,000 b. 2,922,000 c. 2,616,000 d. 2,142,000 4.) Frame Company has an 8% note receivable dated June 30, 2013, in the original amount of P1,500,000. Payments of P500,000 in principal plus accrued interest are due annually on July 1, 2014, 2015 and 2016. In the June 30, 2015 statement of financial position, what amount should be reported as a current asset for interest on the note receivable? a. 120,000 b. 40,000 c. 80,000 d. 0 5.) On December 31, 2013, Park Company sold used equipment and received a noninterestbearing note requiring payment of P500,000 annually for ten years. The first payment is due December 31, 2014 and the prevailing rate of interest for this type of note at date of issuance is 12%. Present value factors are as follows: Present value of 1 at 12% for 10 periods 0.322 Present value of ordinary annuity of 1 at 12% for 10 periods 5.650 In the December 31, 2013 statement of financial position, what is the carrying amount of the note receivable? a. 1,610,000 b. 2,175,000 c. 2,825,000 d. 5,000,000 6.) On December 31, 2013, Chang Company sold a machine to Door Company in exchange for a noninterest-bearing note requiring ten annual payments of P100,000. Door made the first payment on December 31, 2013. The market interest rate for similar notes at date of issuance was 8%. Information on present value factors is: Present value of Present value ordinary annuity Period of 1 at 8% of 1 at 8% 9 .50 6.25 10 .46 6.71 In the December 31, 2013 statement of financial position, what is the carrying amount of the note receivable? a. 450,000 b. 460,000 c. 625,000 d. 671,000 7.) Pangasinan Company is a dealer in equipment. On December 31, 2013, the entity sold equipment in exchange for a noninterest bearing note requiring five annual payments of P500,000. The first payment was made on December 31, 2014. The market interest for similar notes was 8%. The PV of 1 at 8% for 5 periods is .68, and the PV of an ordinary annuity of 1 at 8% for 5 periods is 3.99. 1. On December 31, 2013, what is the carrying amount of the note receivable? a. 2,500,000 b. 1,995,000 c. 1,700,000 d. 1,495,000 2. What interest income should be reported for 2014? a. 505,000 b. 101,000 c. 159,600 d. 119,600 3. What is the carrying amount of the note receivable on December 31, 2014? a. 1,654,600 b. 2,000,000 c. 2,154,600 d. 1,495,000 8.) On December 31, 2013, Flirt Company sold for P3,000,000 old equipment having an original cost of P5,400,000 and carrying amount of P2,400,000. The terms of the sale were P600,000 down payment and P1,200,000 payable each year on December 31 of the next two years. The sale agreement made no mention of interest. However, 9% would be a fair rate for this type of transaction. The present value of an ordinary annuity of 1 at 9% for two years is 1.76. 1. What is the interest income for 2014? a. 216,000 b. 190,080 c. 108,000 d. 106,000 2. What is the carrying value of the note receivable on December 31, 2014? a. 1,200,000 b. 1,102,080 c. 2,302,080 d. 1,009,920 9.) On June 30, 2013, Pink Company sold goods for P5,000,000 and accepted the customer’s 10% one-year note in exchange. The 10% interest rate approximates the market rate of return. What amount should be reported as interest income for the year ended December 31, 2013? a. 500,000 b. 250,000 c. 125,000 d. 0 10.) On June 30, 2013, Green Company accepted a customer’s P2,500,000 noninterest-bearing one-year note in a sale transaction. The product sold normally sells for P2,300,000. What amount should be reported as interest revenue for the year end December 31, 2013? a. 200,000 b. 100,000 c. 250,000 d. 0 11.) On January 1, 2013, Emme Company sold equipment with a carrying amount of P4,800,000 in exchange for a P6,000,000 noninterest bearing note due January 1, 2016. There was no established exchange price for the equipment. The prevailing rate of interest for a note of this type on January 1, 2013 was 10%. The present value of 1 at 10% for three periods is 0.75. 1. I n the 2013 income statement, what amount should be reported as interest income? a. 90,000 b. 450,000 c. 500,000 d. 600,000 2. In the 2013 income statement, what amount should be reported as gain or loss on sale of equipment? a. 300,000 loss b. 300,000 gain c. 1,200,000 gain d. 2,700,000 gain 12.) On December 27, 2013, Lily Company sold a building, receiving as consideration a P4,000,000 noninterest bearing note due in three years. The building had a cost of P3,800,000 and accumulated depreciation was P1,600,000 at the date of sale. The prevailing rate of interest for a note of this type was 12%. The present value of 1 for three periods at 12% is 0.712. In the 2013 income statement, what amount of gain should be reported on the sale? a. 1,800,000 b. 648,000 c. 200,000 d. 0 13.) Ayala Company sold equipment with a carrying amount of P800,000, receiving a noninterest-bearing note due in three years with a face amount of P1,000,000. There is no established market value for the equipment. The interest rate on similar obligations is estimated at 12%. The present value of 1 at 12% for three periods is. 712. What amount should be reported as gain or loss on the sale and interest income for the first year? Gain(loss) Interest income a. 200,000 288,000 b. ( 88,000) 85,440 c. ( 88,000) 120,000 d. 200,000 96,000 14.) On January 1, 2013, Mill Company sold a building and received as consideration P1,000,000 cash and a P4,000,000 noninterest bearing note due on January 1, 2016. There was no established exchange price for the building, and the note of this type on January 1, 2013 was 10%. The present value of 1 at 10% for three periods is 0.75. What amount of interest revenue should be included in the 2014 income statement? a. 370,000 b. 400,000 c. 300,000 d. 330,000 15.) Pasadena Company sold machinery to Rodac Company on January 1, 2013 for which the cash selling price was P7,582,000. Rodac entered into an installment sale contract with Pasadena at an interest rate of 10%. The contract required payments of P2,000,000 a year over five years with the first payment due on December 31, 2013. What amount of interest income should be reported in 2013? a. 1,000,000 b. 634,020 c. 758,200 d. 0 16.) Alamo Company sold one of its factories on January 1, 2013 for P7,000,000. The entity received a cash down payment of P1,000,000 and a 4-year, 12% note for the balance. The note is payable in equal annual payments of principal and interest of P1,975,400 payable on December 31 of each year until 2016. What is the carrying amount of the note receivable on December 31, 2013? a. 4,500,000 b. 4,744,600 c. 4,624,600 d. 4,025,600 17.) On January 1, 2013, Ryan Company had the following balances: Note receivable from sale of building Note receivable from an officer 7,500,000 2,000,000 The P7,500,000 note receivable is dated May 1, 2012, bears interest at 9%. Principal payments of P2,500,000 plus interest are due annually beginning May 1, 2013. The P2,000,000 note receivable is dated December 31, 2010, bears interest at 8%, and is due on December 31, and all interest payments were made through December 31, 2013. On July 1, 2013, Ryan Company sold a parcel of land to Barr Company for P4,000,000 under an installment sale contract. Barr Company made a P1,200,000 cash down payment on July 1, 2013, and signed a 4-year 10% note for the P2,800,000 balance. The equal annual payments of principal and interest on the note totaled P880,000, payable on July 1 of each year from 2014 through 2017. 1. What is the total amount of notes receivable including accrued interest that should be classified as current assets on December 31, 2013? a. 3,540,000 b. 3,820,000 c. 2,940,000 d. 3,080,000 2. What is the total amount of notes receivable that should be classified as noncurrent assets on December 31, 2013? a. 7,300,000 b. 6,700,000 c. 4,500,000 d. 6,420,000 18.) Touch Company sold a piece of machinery with a list price of P1,600,000 to Archer Company on January 1, 2013. Archer Company issued a noninterest bearing note of P1,700,000 due in one year. Touch Company normally sells this type of machinery for 90% of list price. What amount should be recorded as interest revenue? a. 100,000 b. 260,000 c. 160,000 d. 0 19.) Jean Company purchased from Carmina Company a P20,000, 8%, five-year note that required five equal annual year-end payments of P5,009. The note was discounted to yield a 9% rate to Jean Company. At the date purchase, Jean Company recorded the note at the present value of P19,485. What is the total interest revenue earned by Jean Company over the life of this note? a. 5,045 b. 5,560 c. 8,000 d. 9,000 IMPAIRMENT OF LOAN 1.) Appari Bank granted a loan to a borrower on January 1, 2013. The interest rate on the loan is 10% payable annually starting December 31, 2013. The loan matures in five years on December 31, 2017. The data related to the loan are: Principal amount Direct organization cost Origination fee received from borrower 4,000,000 61,500 350,000 The effective rate on the loan after considering the direct origination cost and origination fee is 12%. 1. What is the carrying amount of the loan receivable on January 1, 2013? a. 4,000,000 b. 4,650,000 c. 4,411,500 d. 3,711,500 2. What is the interest income for 2013? a. 400,000 b. 558,000 c. 529,380 d. 445,380 2.) National Bank granted a loan to a borrower on January 1, 2013. The interest on the loan is 10% payable annually starting December 31, 2013. The loan matures in three years on December 31, 2015. The data related to the loan are: Principal amount Origination fee charged against the borrower Direct origination cost incurred 4,000,000 342,100 150,000 After considering the origination fee charged against the borrower and the direct origination cost incurred, the effective rate on the loan is 12%. What is the carrying amount of the loan receivable on December 31, 2013? a. 4,000,000 b. 3,807,900 c. 3,864,848 d. 3,750,952 3.) Philippine Bank granted a loan to a borrower on January 1, 2013. The interest on the loan is 8% payable annually starting December 31, 2013. The loan matures in three years on December 31, 2015. The data related to the loan are: Principal amount Origination fee charged against the borrower 3,000,000 100,000 Direct origination cost incurred 260,300 After considering the origination fee charged to the borrower and the direct origination cost incurred, the effective rate on the loan is 6%. What is the carrying amount of the loan receivable on December 31, 2013? a. 3,000,000 b. 3,160,300 c. 3,109,918 d. 3,210,682 4.) On December 1, 2013, Nicole Company gave Dawn Company a P200,000, 12% loan. Nicole Company paid proceeds of P194,000 after the deduction of a P6,000 nonrefundable loan origination fee. Principal and interest are due in sixty monthly installments of P4,450, beginning January 1, 2014. The repayments yield an effective interest rate of 12% at a present value of P200,000 and 13.4% at a present value of P194,000. 1. What amount of interest income should be reported in 2013? a. 2,233 b. 1,940 c. 2,166 d. 2,000 2. What amount should be reported as accrued interest receivable on December 31, 2013? a. 4,450 b. 6,000 c. 2,000 d. 0 5.) National Bank granted a 10-year loan to Abbo Company in the amount of P1,500,000 with a stated interest rate of 6%. Payments are due monthly and are computed to be P16,650. National Bank incurred P40,000 of direct loan origination cost and P20,000 of indirect loan origination cost. In addition, National Bank charged Abbo Company a 4point nonrefundable loan origination fee 1. What is the initial carrying amount of the loan receivable on the part of National Bank? a. 1,440,000 b. 1,480,000 c. 1,500,000 d. 1,520,000 2. What is the initial carrying amount of the loan payable on the part of Abbo Company? a. 1,440,000 b. 1,480,000 c. 1,500,000 d. 1,520,000 6.) Kalibo Bank loaned P5,000,000 to Caticlan Company on January 1, 2011. The terms of the loan require principal payments of P1,000,000 each year for 5 years plus interest at 8%. The first principal and interest payment is due on January 1, 2012. Caticlan Company made the required payments during 2012 and 2013. However, during 2013 Caticlan Company began to experience financial difficulties, requiring Kalibo Bank to reassess the collectability of the loan. On December 31, 2013, Kalibo Bank has determined that the remaining principal payment will be collected but the collection of the interest is unlikely. Kalibo Company did not accrue the interest on December 31, 2013. The present value of 1 at 8% is as follows: For one period 0.926 For two periods For three periods 0.857 0.794 1. What is the loan impairment loss on December 31, 2013? a. 423,000 b. 217,000 c. 222,000 d. 0 2. What is the interest income to be reported in 2014? a. 126,160 b. 142,640 c. 240,000 d. 0 3. What is the carrying amount of the loan receivable on December 31, 2014? a. 2,000,000 b. 1,925,640 c. 1,640,360 d. 1,783,000 7.) Beach Bank loaned Boracay Company P7,500,000 on January 1, 2011. The terms of the loan were payment in full on January 1, 2015 plus annual interest payment at 11%. The interest payment was made as scheduled on January 1, 2012. However, due to financial setbacks, Boracay Company was unable to make the 2013 interest payment. Beach Bank considered the loan impaired and projected the cash flows from the loan on December 31, 2013. The bank accrued the interest on December 31, 2012, but did not continue to accrue interest for 2013 due to the impairment of the loan. The projected cash flows are: Data of cash flow Amount projected on December 31, 2013 December 31, 2014 500,000 December 31, 2015 1,000,000 December 31, 2016 2,000,000 December 31, 2017 4,000,000 The PV of 1 at 11% is 0.90 for one period, 0.81 for two periods, 0.73 for three periods, and 0.66 for four periods. 1. What is the loan impairment loss on December 31, 2013? a. 2,965,000 b. 2,240,000 c. 5,360,000 d. 2,140,000 2. What is the interest income to be reported in 2014? a. 589,600 b. 534,600 c. 825,000 d. 599,456 3. What is the carrying amount of the loan receivable on December 31, 2014? a. 7,000,000 b. 5,449,600 c. 4,860,000 d. 5,949,600 8.) On January 1, 2013, Oceanic Bank made a P1,000,000, 8% loan. The 80,000 interest is receivable at the end of each year, with the principal amount to be received at the end of five years. At the end of 2013, the first year’s interest of P80,000 has not yet been received because the borrower is experiencing financial difficulties. The borrower negotiated a restructuring of the loan. The payment of all of the interest for 5 years will be delayed until the end of the 5-year loan term. In addition, the amount of principal repayment will be dropped from P1,000,000 to P500,000. The PV of 1 at 8% for 4 periods is .735. No interest revenue has been recognized in 2013 in connection with the loan. 1. What is the loan impairment loss on December 31, 2015? a. 338,500 b. 238,500 c. 388,000 d. 288,000 2. What is the interest income for 2014? a. 80,000 b. 52,920 c. 48,960 d. 0 9.) On December 31, 2013, Macedon Bank has a 5-year loan receivable with a face value of P5,000,000 dated January 1, 2012 that is due on December 31, 2016. Interest on the loan is payable at 9% every December 31. The borrower paid the interest that was due on December 31, 2012 but informed the bank that interest accrued in 2013 will be paid at maturity date. There is a high probability that the remaining interest payments will not be paid because of financial difficulty. The prevailing market rate of interest on December 31, 2013 is 10%. The PV of 1 for three periods is .772 at 9%, and .751 at 10%. What is the loan impairment loss on December 31, 2013? a. 1,242,600 b. 1,590,000 c. 1,357,050 d. 1,695,000 10.) On December 31, 2013, Solid Bank has a loan receivable of P4,000,000 from a borrower that it is carrying at face value and is due on December 31, 2018. Interest on the loan is payable at 9% each December 31. The borrower paid the interest due on December 31, 2013 but informed the bank that it would probably miss the next two years’ interest payments. After that, the borrower is expected to resume its annual interest payment but it would make the principal payment one year late, with interest paid for that additional year at the time of principal payment. The PV of 1at 9% is .772 for three periods, .708 for four periods, .650 for five periods, and .596 for six periods. What is the loan impairment loss for 2013? a. 634,640 b. 720,000 c. 721,960 d. 913,120 11.) On December 31, 2013, Oregon Bank recorded an investment of P5,000,000 in a loan granted to a client. The loan has a 10% effective interest rate payable annually every December 31. The principal is due in full at maturity on December 31, 2016. Unfortunately, the borrower is experiencing significant financial difficultly and will have difficult time in making full payment. The bank projected that the entire principal will be paid at maturity and 4% interest or P200,000 will be paid annually on December 31 of the next three years. There is no accrued interest on December 31, 2013. The PV of 1 at 10% for three periods is 0.75, and the PV of an ordinary annuity of 1 at 10% for three periods is 2.49. 1. What is the loan impairment loss for 2013? a. 752,000 b. 600,000 c. 250,000 d. 748,000 2. What is the interest income for 2014? a. 200,000 b. 424,800 c. 224,800 d. 500,000 3. What is the carrying amount of the loan receivable on December 31, 2014? a. 5,000,000 b. 3,750,000 c. 4,472,800 d. 4,672,800 12.) On December 31, 2013, London Bank granted a P5,000,000 loan to a borrower with 10% stated rate payable annually and maturing in 5 years. The loan was discounted at the market interest rate of 12%. Unfortunately, the financial condition of the borrower worsened because of lower revenue. On December 31, 2015, the bank determined that the borrower would pay back only P3,000,000 of the principal at maturity. However, it was considered likely that interest would continue to be paid on the P5,000,000 loan. The PV of 1 at 12% is .57 for five periods and .71 for three periods. The PV of an ordinary annuity of 1 at 12% is 3.60 for five periods and 2.40 for three periods. 1. What is the amount of cash paid to the borrower on December 31, 2013? a. 4,400,000 b. 4,500,000 c. 5,000,000 d. 4,650,000 2. What is the carrying amount of the loan receivable on December 31, 2015? a. 4,650,000 b. 4,790,000 c. 4,772,960 d. 4,720,000 3. What is the impairment loss to be recognized on December 31, 2015? a. 2,000,000 b. 1,442,960 c. 1,922,960 d. 1,670,000 13.) Diane Company sold loans with a P2,200 fair value and a carrying value amount of P2,000. The entity obtained an option to purchase similar loans and assumed a recourse obligation to repurchase loans. The entity also agreed to provide a floating rate of interest to transferee. The fair values are as follows: Cash proceeds Interest rate swap Call option 2,100 140 80 Recourse obligation ( 120) 1. What is the gain (loss) on the sale? a. 320 b. 200 c. (100) d. 120 2. What is included in the journal entry to record the transfer on the books of Diane Company? a. A debit to call option b. A credit to interest rate swap c. A debit to loans d. A credit to cash 3. Assume that Diane Company agreed to service the loans without explicitly stating the compensation. The fair value of the service it P50. What are the net proceeds and the gain (loss) on the sale, respectively? a. 2,200 and 200 b. 2,250 and 250 c. 2,150 and 150 d. 2,200 and (250) INVENTORY 1.) Brandy Company took a physical inventory at the end of the year and determined that P2,600,000 of goods were on hand. In addition, the entity determined that P200,000 of goods purchased in transit shipped FOB shipping point were actually received two days after the physical count and that the entity had P300,000 of goods out on consignment. What amount should be reported as inventory at year-end? a. 2,600,000 b. 2,800,000 c. 2,900,000 d. 3,100,000 2.) Scotch Company took a physical inventory at the end of the year and determined that P1,900,000 of goods were on hand. In addition, the entity determined that P240,000 of goods purchased were in transit shipped FOB destination. The goods were actually received three days after the inventory count. The entity sold P100,000 worth of inventory FOB destination. Such inventory is in transit at year-end. What amount should be reported as inventory at year-end? a. 1,900,000 b. 2,140,000 c. 2,000,000 d. 2,240,000 3.) Amman Company provided the following data: Items counted in the bodega Items included in the count specifically segregated per sale contract 4,000,000 100,000 Items in receiving department, returned by customer, in good condition Items ordered and in the receiving department 50,000 400,000 Items ordered, invoice received but goods not received. Freight is on account of seller. 300,000 Items shipped today, invoice mailed, FOB shipping point 250,000 Items shipped today, invoice mailed, FOB destination 150,000 Items currently being used for window display 200,000 Items on counter sale Items in receiving in count, damaged and unsalable Items in the shipping department What is the correct amount of inventory? 800,000 50,000 250,000 a. 5,700,000 b. 6,000,000 c. 5,800,000 d. 5,150,000 4.) Lunar company included the following items under inventory: Materials 1,400,000 Advance for materials ordered 200,000 Goods in process 600,000 Unexpired insurance on inventory 60,000 Advertising catalogs and shipping cartons 150,000 Finished goods in factory 2,000,000 Finished goods in entity-owned retail store, including 50% profit on cost 750,000 Finished goods in hands on consignees including 40% profit on sales 400,000 Finished goods in transit to customers, shipped FOB destination at cost 250,000 Finished goods out on approval, at cost 100,000 Unsalable finished good, at cost 50,000 Office supplies 40,000 Materials in transit, shipped FOB shipping point, excluding freight of P30,000 330,000 Goods held on consignment, at sales price, cost P150,000 200,000 What is the correct amount of inventory? a. 5,375,000 b. 5,500,000 c. 5,540,000 d. 5,250,000 5.) Ram Company provided the following information at the end of current year: Finished goods in storeroom, at cost, including overhead of P400,000 or 20% 2,000,000 Finished goods in transit, including freight charge of P20,000, FOB shipping point 250,000 Finished goods held by salesmen, at selling price, cost, P100,000 140,000 Goods in process, at cost of materials and direct labor 720,000 Materials 1,000,000 Materials in transit, FOB destination 50,000 Defective materials returned to suppliers 100,000 Shipping supplies 20,000 Gasoline and oil for testing finished goods 110,000 Machine lubricants 60,000 What is the correct amount of inventory? a. 4,000,000 b. 4,170,000 c. 4,270,000 d. 4,090,000 6.) Brilliant Company has incurred the following costs during the current year: Cost of purchases based on vendors’ invoices 5,000,000 Trade discount on purchases already deducted from vendors’ invoices 500,000 Import duties 400,000 Freight and insurance on purchases 1,000,000 Other handling costs relating to imports 100,000 Salaries of accounting department 600,000 Brokerage commission paid to agents for arranging imports 200,000 Sales commission paid to sale agents 300,000 After-sales warranty costs 250,000 What is the total cost of purchase? a. 5,700,0000 b. 6,100,000 c. 6,700,000 d. 6,500,000 7.) Corolla Company incurred the following costs: Materials 700,000 Storage costs of finished goods 180,000 Delivery of customers 40,000 Irrevocable purchase taxes 60,000 At what amount should the inventory be measured? a. 880,000 b. 760,000 c. 980,000 d. 940,000 8.) Eagle Company incurred the following costs in relation to a certain product: Direct materials and labor 180,000 Variable production overhead 25,000 Factory administrative costs 15,000 Fixed production costs 20,000 What is the correct measurement of the product? a. 205,000 b. 225,000 c. 195,000 d. 240,000 9.) Fenn Company provided the following information for the current year: Merchandise purchased for resale 4,000,000 Freight in 100,000 Freight out 50,000 Purchase returns 20,000 Interest on inventory loan 200,000 What is the inventoriable cost of purchase? a. 4,280,000 b. 4,030,000 c. 4,080,000 d. 4,130,000 10.) On December 28, 2013, Kerr Company purchased goods costing P500,000. The terms were FOB destination. The costs incurred in connection with the sale and delivery of the goods were: Packaging for shipment 10,000 Shipping 15,000 Special handling charges 25,000 These goods were received on December 31, 2013. On December 31, 2013, what total costs should be included in inventory? a. 545,000 b. 535,000 c. 520,000 d. 500,000 11.) On December 26, 2013, Branigan Company purchased goods costing P1,000,000. The terms were FOB shipping point. The goods were received on December 28, 2013. Costs incurred by the entity in connection with the purchases and delivery of the goods were normal freight charge P30,000, handling costs P20,000, insurance on shipment P5,000 and abnormal freight charge for express shipping P12,000. What is the total cost of the inventory? a. 1,050,000 b. 1,030,000 c. 1,055,000 d. 1,067,000 12.) Brooke Company used a perpetual inventory system. At the end of 2012, the inventory account was P360,000 and P30,000 of those goods included in ending inventory were purchased FOB shipping point and did not arrived until 2013. Purchases in 2013 were P3,000,000. The perpetual inventory records showed an ending inventory of P420,000 for 2013. A physical count at the end of 2013 showed an inventory of P380,000. Inventory shortages are included in cost of goods sold. What amount should be reported as cost of goods sold for 2013? a. 2,940,000 b. 2,980,000 c. 3,000,000 d. 3,010,000 13.) Stone Company had the following transactions during December 2013: Inventory shipped on consignment to Beta Company 1,800,000 Freight paid by Stone 90,000 Inventory received on consignment from Alpha Company 1,200,000 Freight paid by Alpha 50,000 No sales of consigned goods were made in December 2013. What amount should be included in inventory on December 31, 2013? a. 1,200,000 b. 1,250,000 c. 1,800,000 d. 1,890,000 14.) On October 1, 2013, Grimm Company consigned 40 freezers to Holden Company costing P14,000 each for sale and paid P16,000 in transportation costs. On December 30, 2013, Holden Company reported the sale of 10 freezers and remitted P170,000. The remittance was net of the agreed 15% commission. What amount should be recorded as consignment sales revenue? a. 154,000 b. 170,000 c. 196,000 d. 200,000 15.) On December 1, 2013, Alt Department Store received 505 sweaters on consignment from Todd. Todd’s cost for the sweaters was P800 each, and they were priced to sell at P1,000. Alt’s commission on consigned goods is 10%. On December 31, 2013, 5 sweaters remained. In the December 31, 2013 statement of financial position, what amount should be reported as payable for consigned goods? a. 490,000 b. 454,000 c. 450,000 d. 404,000 16.) Clem Company provided the following for the current year: Central warehouse Held by consignees Beginning inventory 1,100,000 120,000 Purchases 4,800,000 600,000 Freight in 100,000 Transportation to consignees 50,000 Freight out 300,000 Ending inventory 1,450,000 80,000 200,000 What is the cost of sales for the current year? a. 4,550,000 b. 4,850,000 c. 5,070,000 d. 5,120,000 17.) An analysis of the ending inventory of Lilac Company on December 31, 2013 disclosed the inclusion of the following items: Merchandise in transit purchased on terms: FOB shipping point 165,000 FOB destination 100,000 Merchandise out on consignment at sales price (including markup of 30% on cost) 195,000 Merchandise sent to customer for approval (cost of goods, P30,000) 40,000 Merchandise held on consignment 35,000 What is the reduction of the inventory on December 31, 2013? a. 355,000 b. 190,000 c. 203,500 d. 222,000 18.) Dean sportswear regularly buys sweaters from Mill Company and is allowed trade discounts of 20% and 10% from the list price. Dean made a purchase on March 20, 2013, and received an invoice with a list price of P600,000, a freight charge of P15,000 and payment terms of 2/10, n/30. What is the cost of the purchase? a. 432,000 b. 447,000 c. 438,360 d. 435,000 19.) On June 1, 2013, Pitt Company sold merchandise with a list price of P5,000,000 to Burr account. Pitt allowed trade discounts of 30% and 20%. Credit terms were 2/10, n/30 and the sale was made FOB shipping point. Pitt prepaid P200,000 of delivery costs for Burr as an accommodation. On June 11, 2013, what amount was received by Pitt from Burr as remittance in full? a. 2,744,000 b. 2,940,000 c. 2,944,000 d. 3,140,000 20.) On August 1 of the current year, Stella Company recorded purchases of inventory of P800,000 and P1,000,000 under credit terms of 2/15, net 30. The payment due on the P800,000 purchase was remitted on August 16. The payment due on the P1,000,000 purchase was remitted on August 31. Under the net method and the gross method, these purchases should be included at what respective amount in the determination of cost of goods available for sale? Net method Gross method a. 1,784,000 1,764,000 b. 1,764,000 1,800,000 c. 1,764,000 1,784,000 d. 1,800,000 1,764,000 21.) Rabb Company records its purchases at gross amount but wishes to change to recording purchases net of purchase discounts. Discount available on purchases for the current year totaled P100,000. Of this amount, P10,000 is still available in the accounts payable balance. The balances in the accounts as of and for the year ended December 31, before conversion are: Purchases 5,000,000 Purchases discounts taken 40,000 Accounts payable What is the balance of accounts payable on December 31 after the conversion? a. 1,490,000 1,500,000 b. 1,460,000 c. 1,440,000 d. 1,410,000 22.) Wine Company recorded purchases at net amount. On December 10, the entity purchased merchandise on account, P4,000,000, terms 2/10. n/30. The entity returned P300,000 of the December 10 purchase and received credit on account. The account had not been paid on December 31. At what amount should the account payable be adjusted on December 31? a. 74,000 b. 86,000 c. 80,000 d. 0 23.) Duke Company specializes in the sale of IBM compatibles and software packages and had the following transactions: Purchases of IBM compatibles Purchases of commercial software packages 1,700,000 1,200,000 Returns and allowances 50,000 Purchase discounts taken 17,000 Terms on all purchases were 2/10, n/30. All returns and allowances took place within 5 days of purchase and prior to any payment. What was the amount of discount was lost? a. 57,000 b. 40,000 c. 17,000 d. 41,000 24.) Cognac Company used the perpetual inventory and gross method of recording purchases. On December 1, the entity purchased P1,500,000 of inventory, terms 2/10, n/30. On December 5, the entity returned goods that cost P150,000. On December 11, the entity paid the supplier. On December 11, what account should be credited> a. Purchase discount for P30,000 b. Inventory for P30,000 c. Purchase discount for P27,000 d. Inventory for P27,000 25.) Hero Company’s inventory on December 31, 2013 was P6,000,000 based on a physical count of goods priced at cost and before any necessary year-end adjustments relating to the following: Included in the physical count were goods billed to a customer FOB shipping point on December 30, 2013. These goods had a cost of P125,000 and were picked up by the carrier on January 7, 2014. Goods shipped FOB shipping point on December 28, 2013, from a vendor to Hero were received on January 4, 2014. The invoice cost was P300,000. What amount should be reported as inventory on December 31, 2013? a. 5,875,000 b. 6,000,000 c. 6,175,000 d. 6,300,000 26.) The physical count considered in the warehouse of Reverend Company on December 311, 2013 revealed merchandise with a total cost of P5,000,000. However, further investigation revealed that the following items were excluded from the count. Goods sold to a customer, which are being held for the customer to call at the customer’s convenience with a cost P200,000. A packing case containing a product costing P500,000 was standing in the shipping room when the physical inventory was taken. It was not included in the inventory because it was marked “hold for shipping instructions”. The investigation revealed that the customer’s order was dated December 28, 2013, but that the case was shipped and the customer billed on January 4, 2014. A special machine costing P250,000, fabricated to order for a customer, was finished and specifically segregated at the back part of the shipping room on December 31, 2013. The customer was billed on that date and the machine was excluded from inventory although it was shipped on January 2, 2014. What is the correct amount of inventory that should be reported on December 31, 2013? a. 5,950,000 b. 5,750,000 c. 5,500,000 d. 5,700,000 27.) The inventory on hand on December 31, 2013 for Fair Company is valued at a cost of P950,000. The following items were not included in this inventory amount. Item 1: Purchased goods in transit, shipped FOB destination, invoice price P30,000 which include freight charge of P1,500. Item 2: Goods held on consignment by Fair Company at a sales price of P28,000, including sales commission of 20% of the sales price. Item 3: Goods sold to Grace Company, under terms FOB destination, invoiced for P18,500 which includes P1,000 freight charge to deliver the goods. Goods are in transit. The entity’s selling price is 140% of cost. Item 4: Purchased goods in transit, terms FOB shipping point, invoice price P50,000, freight cost,P2,500. Item 5: Goods out on consignment to Manila Company, sales price P35,000, shipping point cost of P2,000. What is the adjusted cost of the inventory on December 31, 2013? a. 1,042,000 b. 1,043,000 c. 1,040,000 d. 1,073,500 28.) Baritone Company counted and reported the ending inventory on December 31, 2013 at P2,000,000. None of the following items were included when the total amount of the ending inventory was computed: P150,000 in goods located in the entity’s warehouse that are on consignment from another entity. P200,000 in goods that were sold by the entity and shipped on December 30 and were in transit on December 31, 2013. The goods were received by the customer on January 2, 2014.Terms were FOB destination. P300,000 in goods that were purchased by the entity and shipped on December 30 and were in transit on December 31, 2013. The goods were received by the entity on January 2, 2014. Terms were FOB shipping point. P400,000 in goods that were sold by the entity and shipped on December 30 and were in transit on December 31, 2013. The goods were received by the customer on January 2, 2014. Terms were FOB shipping point. What is the correct amount of inventory on December 31, 2013? a. 2,500,000 b. 2,350,000 c. 2,900,000 d. 2,750,000 29.) Sterling Company reported the 2013 year-end inventory at P7,600,000 before the following adjustments: Goods valued at P1,000,000 re on consignment with a customer. These goods are not included in the year-end inventory. Goods costing P250,000 were received from a vendor on January 5, 2014. The related invoice was received and recorded on January 12, 2014. These goods were shipped on December 31, 2013, terms FOB shipping point. Goods costing P850,000 were shipped on December 31, 2103, and were delivered to the customer on January 2, 2014. The terms of the invoice were FOB shipping point. The goods were included in ending inventory for 2013 even though the sale was recorded in 2013. A P350,000 shipment of goods to a customer on December 31, 2013, terms FOB destination, was not included in the year-end inventory. The goods cost P260,000 and were delivered to the customer on January 8, 2014. The sale was properly recorded in 2014. An invoice for goods costing P350,000 was received and recorded as a purchases on December 31, 2013. The related goods, shipped FOB destination, were received on January 2, 2014, and thus were not included in the physical inventory. Goods valued at P650,000 are on consignment from a vendor. These goods are not included in the year-end inventory. A P1,050,000 shipment of goods to a customer on December 30, 2013, terms FOB destination, was recorded as a sale in 2013. The goods, costing P840,000 and delivered to the customer on January 6, 2014, were not included in 2013 ending inventory. What is the correct inventory on December 31, 2013? a. 9,100,000 b. 8,100,000 c. 9,950,000 d. 9,450,000 30.) A physical count on December 31, 2013 revealed that Joy Company had inventory with a cost of P4,410,000. The audit identified that the following items were: Merchandise of P610,000 is held by Joy on consignment. Merchandise costing P380,000 was shipped by Joy FOB destination to a customer on December 31, 2013. The customer was expected to receive the goods on January 5, 2014. Merchandise costing P460,000 was shipped by Joy FOB shipping point to a customer on December 29, 2013. The customer was expected to receive the goods on January 5, 2014. Merchandise costing P830,000 shipped by a vendor FOB destination on December 31, 2013 was received by Joy on January 5, 2014. Merchandise costing P510,000 purchased FOB shipping point was shipped by the supplier on December 31, 2013 and received by Joy on January 5, 2013. What is the correct amount of inventory on December 31, 2013? a. 5,300,000 b. 4,690,000 c. 3,800,000 d. 4,920,000 31.) Min Company submitted an inventory list on December 31, 2013 which showed a total of P5,000,000. Excluded from the inventory was merchandise costing P80,000 because it was transferred to the delivery department for packaging on December 28, 2013 and for shipping on January 2, 2014. The billing of lading and other import documents on a merchandise were delivered by the bank and the trust receipt accepted by the entity on December 26, 2013. Taxes and duties have been paid on this shipment but the broker did not deliver the merchandise until January 7, 2014. Delivered cost of the shipment totaled P800,000. This shipment was not included in the inventory on December 31, 2013. A review of the entity’s purchases orders showed a commitment to buy P100,000 worth of merchandise from Myrose Company. This was not included in the inventory because the good were received on January 3, 2014. Supplier’s invoice for P300,000 worth of merchandise dated December 28, 2013 was received through the mail on December 30, 2013 although the goods arrived only on January 4, 2014. Shipment terms are FOB shipping point. The item was included in the December 31, 2013 inventory by the entity. Goods valued at P20,000 were received from Darlyn Company on December 28, 2013 for approval by Mia. The inventory team included this merchandise in the list but did not place any value on it. On January 4, 2014, the entity informed the supplier by long distance telephone of the acceptance of the goods and the supplier’s invoice was received on January 7, 2014. On December 27, 2013, and order for P25,000 worth of merchandise was placed. This was included in the year-end inventory although it was received only on January 5, 2014. The seller shipped the goods FOB destination. What is the correct amount on December 31, 2013? a. 5,855,000 b. 5,055,000 c. 5,555,000 d. 5,830,000 32.) The physical count conducted in the warehouse of Leila Company on December 31, 2013 revealed total cost of P3,600,000. However, the following items were excluded from the count. Goods sold to a customer which are being held for the customer to call for at the customer’s convenience with a cost of P200,000. A packing case containing a product costing P80,000 was standing in the shipping room when the physical inventory was taken. It was not included in the inventory because it was marked “hold ofor shipping instructions”. Goods in process P50,000 shipped by a vendor FOB seller on December 28, 2013 and received by Leila Company on January 10, 2014. What is the correct inventory on December 31, 2013? a. 4,180,000 b. 4,230,000 c. 3,980,000 d. 4,030,000 33.) Black Company reported accounts payable on December 31 2013. at P4,500,000 before any necessary year-end adjustment relating to the following transactions: On December 20, 2013, Black wrote and recorded checks to creditors totaling P2,000,000 causing an overdraft of P500,000 in Black’s bank account on December 31, 2013. The checks were mailed on January 10, 2014. On December 28, 2013, Black purchased and received goods for P750,000, terms 2/10, n/30. Black records purchases and accounts payable at net amount. The invoice was recorded and paid January 3, 2014. Goods shipped F.O.B destination on December 20, 2013 from a vendor to Black were received January 2, 2014. The invoice cost was P325,000 On December 31, 2013, what amount should be reported as accounts payable? a. 7,575,000 b. 7,250,000 c. 7,235,000 d. 7,553,000 34.) Kew Company reported accounts payable on December 31, 2013 at P2,200,000 before considering the following data” Goods shipped to Kew F.O.B. shipping point on December 22, 2013, were lost in transit. The invoice cost of P40,000 was not recorded by Kew. On January 7, 2014, Kew filed a P40,000 claim against the common carrier. On December 27, 2013, a vendor authorized Kew to return, for full credit, goods shipped and billed at P70,000 on December 3, 2013. The returned goods were shipped by Kew on December 28, 2013. A P70,000 credit memo was received and recorded by Kew on January 5, 2014. On December 31, 2013, Kew has a P500,000 debit balance in its accounts payable to Ross, a supplier, resulting from a P500,000 advance payment for goods to be manufactured to Kew specifications. What amount should be reported as accounts payable on December 31, 2013? a. 2,170,000 b. 2,680,000 c. 2,730,000 d. 2,670,000 35.) Bakun Company began operations late in 2012. For the first quarter ended March 31, 2013, the entity provided the following information: Total merchandise purchased through March 1, 2013 recorded at net 4,900,000 Merchandise inventory on December 31, 2012 at selling price 1,500,000 All merchandise was acquired on credit and no payments have been made on accounts payable since the inception of the entity. All merchandise is marked to sell at 50% above invoice cost before time discounts of 2/10, n/30. No sales were made in 2013. What amount of cash is required to eliminate the current balance in accounts payable? a. 6,000,000 b. 5,900,000 c. 6,400,000 d. 5,750,000 36.) Aiza Company sold merchandise for P800,000 on December 31, 2013. The terms of the sale state that payment is due in one year’s time. The imputed rate of interest is 9%. The PV of 1 at 9% is .917 for one period What amount of sales revenue be recognized? a. 872,000 b. 733,600 c. 800,000 d. 0 37.) Lewis Company’s usual sales terms are net 60 days, F.O.B. shipping point. Sales, net of returns and allowances, totaled P9,200,000 for the year ended December 31, 2013, before year-end adjustments. On December 27, 2013, Lewis authorized a customer to return, for full credit, goods shipped and billed at P200,000 on December 1, 2013. The returned goods were received by Lewis on January 4, 2014, and a P200,000 credit memo was issued and recorded on the same date. Goods with an invoice amount of P300,000 were billed and recorded on January 3, 2014. The goods were shipped on December 30, 2013. Goods with an invoice amount of P400,000 were billed and recorded on December 30, 2013. The goods were shipped on January 3, 2014. What is the correct amount of net sales for 2013? a. 9,300,000 b. 9,100,000 c. 9,000,000 d. 8,900,000 38.) Fenn Company had sales of P5,000,000 during December 2013. Experience had shown that merchandise equaling 7% of sales will be returned within 30 days and an additional 3% will be returned within 90 days. Returned merchandise is readily resalable. In addition, merchandise equaling 15% of sales will be exchanged for merchandise of equal or greater value. What amount should be reported for net sales in the income statement for the month of December 2013? a. 4,500,000 b. 4,250,000 c. 3,900,000 d. 3,750,000 39.) On October 1, 2013, Acme Company sold 100,000 gallons of heating oil to Karn Company at P30 per gallon. Fifty thousand gallons were delivered on December 15, 2013, and the remaining 50,000 gallons were delivered on January 15, 2014. Payments terms were: 50% due on October 1, 2013, 25% on the first delivery, and the remaining 25% due on the second deliver. What amount of revenue from the sale during 2013? a. 3,000,000 b. 1,500,000 c. 2,250,000 d. 750,000 40.) On July 1, 2013, Loveluck Company, a manufacturer of office furniture, supplied goods to Kaye Company for P1,200,000 on condition that this amount is paid in full on July 1, 2014. Kaye had earlier rejected an alternative offer from Loveluck whereby it could have bought the same goods by paying cash of P1,080,000 on July 1, 2013. What amount should respectively as sales revenue and interest income for the year ended June 30, 2014? a. 1,080,000 and 120,000 b. 1,200,000 and 120,000 c. 1,080,000 and 0 d. 1,200,000 and 0 41.) On July 1, 2013, Kathleen Company handed over to a client a new computer system. The contract price for the supply of the systems and after-sales support at P120,000 and it marked up such cost by 50% when tendering for support contracts. What is the total revenue that should be recognized for 2013? a. 620,000 b. 800,000 c. 710,000 d. 0 42.) Ilocos Company produced 80,000 kilos of tobacco during the 2013 season. Ilocos sells all of its tobacco to a certain customer which has agreed to purchase the entire production at the prevailing market price. Recent legislation assures that the market price will not fall below P100 per kilo during the next two years. The costs of selling and distributing the tobacco are immaterial and can be reasonably estimated. Ilocos reports its inventory at expected exit value. During 2013, Ilocos sold and delivered to the customer 60,000 kilos at the market price of P100. Ilocos sold the remaining 20,000 kilos during 2014 at the market price of 150. What amount of revenue should be recognized in 2013? a. 6,000,000 b. 3,000,000 c. 8,000,000 d. 9,000,000 43.) Beverly Company provided service contracts to customers for maintenance of their electrical system. On October 1, 2013, the entity agreed to a four-year contract with a major customer for P1,540,000. Costs over the period of the contract are reliably estimated at P513,330. What amount of revenue should be recognized for the year ended December 31, 2013? a. 385,000 b. 128,330 c. 96,250 d. 32,080 44.) Marie Company, a distributor of machinery, bought a machine from the manufacturer in November 2013 for P10,000. On December 30, 2013, Marie sold this machine to Zoe Company for P15,000 under the following terms: 2% discount if paid within thirty days, 1% discount if paid after thirty days but within sixty days, or payable in full within ninety days if not paid within the discount periods. However, Zoe had the right to return this machine to Marie if it was unable to resell the machine before expiration of the ninety-day payment period, in which case Zoe’s obligation to Marie would be canceled. In the net sales for the year ended December 31, 2013, what amount should be included for the sale of this machine? a. 15,000 b. 14,700 c. 14,850 d. 0 45.) On January 1, 2013, Bell Company contracted with the City of Manila to provide custom built desks for the cit y schools. The contract made Bell the city’s sole supplier and required Bell to supply no less than 4,000 desks and no more than 5,500 desks per year for two years. In turn, the City of Manila agreed to pay a fixed price of P550 per desk. During 2013, Bell produced , 5,000 desks for the City of Manila. On December 31, 2013, 500 of these desks were segregated from the regular inventory and were accepted and awaiting pickup by the City of Manila. The City of Manila paid Bell P2,250,000 during 2013. What amount should be recognized as contract revenue in 2013? a. 2,250,000 b. 2,475,000 c. 2,750,000 d. 3,025,000 46.) Emco Company had the following transactions in 2013: Emco sold goods to a customer for P50,000, FOB shipping point on December 30, 2013. Emco sold three pieces of equipment on a contract over a three-year period. The sale price of each piece of equipment is P100,000. Delivery of each piece of equipment is on February 10 of each year. In 2013, the customer paid a P200,000 down payment, and will pay P50,000 per year in 2014 and 2015. Collectability is reasonably assured. On June 1, 2013, Emco signed a contract for P200,000 for goods to be sold on account. Payment is to be made in two installments of P100,000 each on December 1, 2013 and December 1, 2014. The goods are delivered on October 1, 2013. Collection is reasonably assured and the goods may not be returned. Emco sold goods to a customer on July 1, 2013 for P500,000. If the customer does not sell the goods to retail customers by December 31, 2014, the goods can be returned to Emco. The customer sold the goods to retail customers on October 1, 2014. What amount of sales revenue should be reported in the 2013 income statement? a. 350,000 b. 850,000 c. 450,000 d. 550,000 47.) Delicate Company is a wholesale distributor of automotive replacement parts. Initial amounts taken from accounting records on December 31, 2013 are as follows: Inventory on December 31 based on physical count Accounts payable Sales 1,250,000 1,000,000 9,000,000 A. Parts held on consignment from another entity to Delicate, the cosignee, amounting to P165,000, were included in the physical count on December 31 31, 2013, and in accounts payable on December 31, 2013. B. P20,000 of parts which were purchased and paid for in December 2013, were sold in the last week of 2013 and appropriately recorded as sales of P28,000. The parts were included the physical in the physical count December 31, 2013 because the parts were on the loading dock waiting to be picked up by the customer. C. Parts in transit on December 31, 2013 to customers, shipped FOB shipping point on December 28, 2013, amounted to P34,000. The customer received the parts on January 6, 2014. Sales of P40,000 to the customers for the parts were recorded by Delicate on January 2, 2014. D. Retailers were holding P210,000 at cost and P250,000 at retail, of goods on consignment from Delicate, at their stores on December 31, 2013. E. Goods were in transit from a vendor to Delicate on December 31, 2013. The cost of goods was P25,000. The goods were shipped FOB shipping point on December 29, 2013. 1. What is the correct amount of inventory? a. 1,300,000 b. 1,320,000 c. 1,334,000 d. 1,090,000 2. What is the correct amount of accounts payable? a. 835,000 b. 960,000 c. 975,000 d. 860,000 3. What is the correct amount of sales? a. 9,250,000 b. 9,290,000 c. 9,040,000 d. 9,000,000 BIOLOGICAL ASSETS 1.) Forester Company has reclassified certain assets as biological assets. The total value of the forest assets is P6,000,000 which comprises: Freestanding trees 5,100,000 Land under trees 600,000 Roads in forests _ 300,000 6,000,000 In the statement of financial portion, what total amount of the forest assets should be classified as biological assets? a. 5,100,000 b. 5,700,000 c. 5,400,000 d. 6,000,000 2.) Columbia Company is producer of coffee. The entity is considering the valuation of its harvested coffee beans. Industry practice is to value the coffee beans at market value and uses as reference a local publication “Accounting for Successful Farms” On December 31, 2013, the entity has harvested coffee beans costing P3,000,000 and with fair value less cost of disposal of P3,500,000 at the point harvest. Because of long aging and maturation process after harvest, the harvested coffee beans were still on hand on December 31, 2014. On such date, the fair value less cost of disposal is P3,900,000 and the net realizable value is P3,200,000. What is the measurement of the coffee beans inventory on December 31, 2014? a. 3,000,000 b. 3,500,000 c. 3,200,000 d. 3,900,000 3.) Joan Company provided the following data: Value of biological asset at acquisition cost on December 31, 2013 600,000 Fair valuation surplus on initial recognition at fair value on December 31, 2013 Change in fair value to December 31, 2014 due to 700,000 growth and price fluctuation 100,000 Decrease in fair value due to harvest 90,000 1. What is the carrying amount of the biological assets on December 31, 2014? a. 1,400,000 b. 1,310,000 c. 1,300,000 d. 1,490,000 2. What is the gain from change in fair value of biological asset that should be reported in the 2014 income statement? a. 100,000 b. 800,000 c. 710,000 d. 10,000 4.) Salve Company is engaged in rising dairy livestock. Information regarding its activities relating to the dairy livestock is as follows: Carrying amount on January 1, 2013 5,000,000 Increase due to purchases 2,000,000 Gain arising from change in fair value less cost of disposal attributing to price change 4,000,000 Gain arising from change in fair value less cost of disposal attributing to physical change Decrease due to sales 600,000 850,000 Decrease due to harvest 200,000 What is the carrying amount of the biological asset on December 31, 2013? a. 6,950,000 b. 6,000,000 c. 8,000,000 d. 7,150,000 5.) Bear Company produces milk for sale to local and national ice cream producers. The entity began operations on January 1, 2013 by purchasing 650 milk cows for P8,000,000. The entity had the following information available at year-end relating to the cows: Acquisition cost, January 1, 2013 Change in fair value to growth and price changes 8,000,000 2,500,000 Decrease in fair value due to harvest 250,000 Milk harvested during 2013 but not yet sold 400,000 1. What amount of gain in fair value should be recognized for biological asset in 2013? a. 2,500,000 b. 2,250,000 c. 2,900,000 d. 2,650,000 2. What amount of gain in fair value should be reported for agricultural produce in 2013? a. 2,250,000 b. 400,000 c. 150,000 d. 0 6.) Honey Company has a herd of 10 2-year old animals on January 1, 2013. One animal aged 2.5 years was purchased on July 1, 2013. No animals were sold or disposed of during the year. The fair value less cost of disposal per unit is as follows: 2 – year old animal on January 1 2.5 – year old animal on July 1 New born animal on July 1 100 108 70 2 – year old animal on December 31 105 2.5 – year old animal on December 31 111 Newborn animal on December 31 3 – year old animal on December 31 0.5 – year old animal on December 31 72 120 80 1. What is the fair value of the biological assets on December 31, 2013? a. 1,400 b. 1,320 c. 1,440 d. 1,360 2. What is the gain from change in fair value of biological assets that should be recognized in 2013? a. 222 b. 292 c. 300 d. 332 3. What is the gain from change in fair value due to price change? a. 292 b. 222 c. 237 d. 55 7.) Farmland Company produces milk on its mark. The entity produces 20% of the community’s milk that is confused. Farmland Company owns farms and had a stock of 2,100 cows and 10,050 heifers. The farms produce 800,000 kilograms of milk a year and the average inventory held is 15,000 kilograms of milk. However, on December 31, 2013, the biological assets are: Purchased before January 1, 2013 ( 3 years old) Purchased on January 1, 2013 ( 2 years old) Purchased on July 1, 2013 (1.5 years old) 2,100 cows 300 heifers 750 heifers No animals were born or sold during the current year. The unit fair value less cost of disposal is as follows. January 1, 2013: 1-year old 3,000 2-year old 4,000 July 1, 2013: 1-year old 3,000 December 31, 2013: 1-year old 3,200 2-year old 4,000 1.5-year old 3,600 3-year old 5,000 The entity has had problems during the year. Contaminated milk was sold to customer. As a result, milk consumption has gone down. The entity’s business is spread over different parts of the country. The only region affected by the contamination was Batangas. However, the castle in this area were affected by the contamination and were healthy. The entity feels that it cannot measure the fair value of the cows in the region because of the problems created by the contamination. There are 600 cows and 200 heifers on the Batangas farm and all these animals had been purchased on January 1, 2013. 1. What is the fair value of biological assets on January 1, 2013? a. 9,300,000 b. 9,600,000 c. 8,400,000 d. 7,200,000 2. What is the fair value of biological assets purchased on July 1, 2013? a. 2,250,000 b. 3,000,000 c. 3,750,000 d. 3,375,000 3. What is the fair value biological assets on December 31, 2013? a. 14,550,000 b. 15,750,000 c. 15,225,000 d. 11,850,000 4. What is the increase in fair value of biological assets on December 31, 2013? a. 3,000,000 b. 5,250,000 c. 4,950,000 d. 6,150,000 5. What is the increase in fair value of biological assets due to physical change? a. 1,260,000 b. 1,740,000 c. 3,000,000 d. 1,440,000 8.) Dairy Company provided the following information for the year ended December 31, 2013: Cash Trade and other receivables 500,000 1,500,000 Inventories 100,000 Dairy livestock – immature 50,000 Dairy livestock – mature Property, plant and equipment, net 400,000 1,400,000 Trade and other payables 520,000 Note payable – long-term 1,500,000 Share capital 1,000,000 Retained earnings – January 1 800,000 Fair value of milk produced 600,000 Gain from change in fair value 50,000 Inventories used 140,000 Staff costs 120,000 Depreciation expenses 15,000 Other operating expenses Income tax expense 190,000 55,000 1. What is the net income for 2013? a. 650,000 b. 600,000 c. 130,000 d. 185,000 2. What is the fair value of biological assets on December 31, 2013? a. 550,000 b. 450,000 c. 500,000 d. 400,000 INVENTORY VALUATION 1.) Marsh Company had P150,000 units of product A on hand at January 1, costing P21 each. Purchases of product A during the month of January were as follows: Units Unit cost January 22 10 200,000 18 250,000 28 100,000 23 24 A physical count on January 31 shows 250,000 units of product A on hand. What is the cost of the inventory on January 31 under the FIFO method? a. 5,850,000 b. 5,550,000 c. 5,350,000 d. 5,250,000 2.) ABC Company provided the following income and inventory: 2013 2014 Net income using LIFO 2,750,000 3,000,000 Year-end inventory – FIFO 1,400,000 2,000,000 Year-end inventory – LIFO 900,000 What is the net income for 2014 using the FIFO cost flow? a. 2,900,000 b. 2,600,000 c. 3,500,000 d. 3,100,000 1,600,000 3.) On April 1, 2013, Toronto Company had 6,000 units of merchandise on hand that cost P120 per unit. During the month, the entity had the following transactions with regard to the merchandise: April 5 Purchased on account 15,000 units at P140 per unit 8 Returned 1,000 units from the April 5 purchase. 29 Sold on account 16,000 units at P200 per unit. The entity used a perpetual inventory system and a FIFO cost flow. What is the cost of goods sold for April? a. 2,120,000 b. 2,200,000 c. 2,144,000 d. 2,080,000 4.) Rona Company used the perpetual inventory system. The inventory transaction for August of the current year were as follows: Units Aug. Unit cost Total cost 1 Beginning 20,000 4.00 80,000 7 Purchase 10,000 4.20 42,000 10 Purchase 20,000 4.30 86,000 12 Sale 16 Purchase 15,000 20,000 20 Sale 40,000 28 Sale return 3,000 ? 4.60 ? ? ? 92,000 ? ? The sale return relates to the August 20 sale. If the FIFO cost flow method is used, the sale return would be costed back into inventory at what unit cost? a. 4.00 b. 4.20 c. 4.30 d. 4.60 5.) The following information has been extracted from the records of Jayson Company about one of its products. Jayson Company used the perpetual system. Units Jan. 1 Beginning balance 8,000 6 Purchase Feb. 5 Sale Mar. 5 Purchase Mar. 8 Purchase return 800 Apr. 10 Sale 7,000 Apr. 30 Sale return 3,000 Unit cost Total cost 70.00 560,000 70.50 211,500 10,000 11,000 73.50 73.50 808,000 58,800 300 If the FIFO cost flow method is used, what is the cost of the inventory on April 30? a. 330,750 b. 315,000 c. 433,876 d. 329,360 6.) Mildred Company is a wholesaler of office supplies. The FIFO periodic inventory is used. The activity for inventory of calculators during August is as follows: Units August 1 Inventory 20,000 7 Purchase 30,000 12 Sale 21 Purchase 22 Sale 29 Purchase Cost 36.00 37.20 36,000 48,000 38.00 38,000 16,000 38.60 What is the ending inventory on August 31? a. 1,500,800 b. 1,501,600 c. 1,522,000 d. 1,529,000 7.) Lagoon Company accumulated the following quarterly cost data for the current year. Raw materials – beginning inventory Purchases 90,000 units @ P7.00 75,000 units @ P8.00 120,000 units @ P8.50 The entity transferred 195,000 units of raw materials to work in process during the year. Work in process – beginning inventory Direct labor Manufacturing overhead Work in process – ending inventory 50,000 units @ P14.00 3,100,000 2,950,000 48,000 units @ P15.00 The entity used the FIFO method for valuing inventory. What is the cost of goods manufactured for the current year? a. 7,535,000 b. 8,235,000 c. 7,515,000 d. 8,280,000 8.) Hilltop Company sells a new product. During a move to a new location, the inventory records for the product were misplaced. The entity has been able to gather some information from the purchases and sales records. The July purchases are as follows: July Quantity Unit cost Total cost 5 10,000 65 650,000 9 12,000 63 756,000 12 15,000 60 900,000 25 14,000 62 868,000 51,000 On July 31, 15,000 units were on hand. The sales for July amount to P6,000,000, or 60,000 units at P100 per unit. The entity has always used a periodic FIFO inventory costing system. Gross profit on sales for July was P2,400,000. What is the cost of inventory on July 1? a. 1,354,000 b. 2,400,000 c. 2,826,000 d. 426,000 9.) Lane Company provided the following inventory card during February: Purchase Units Balance Price Jan. 10 100 Units Used 20,000 20,000 31 Feb. 8 10,000 110 30,000 9 Returns from factory (Jan. 10 lot) Units 10,000 40,000 ( 1,000) 28 11,000 41,000 30,000 Using the weighted average method, what is the cost of inventory on February 28? a. 3,180,000 b. 3,150,000 c. 3,120,000 d. 3,300,000 10.) Anders Company used the moving method in determine the cost of the inventory. During January of the current year, the entity recorded the following information pertaining to its inventory: Units Balance on January 1 40,000 Sold on January 17 35,000 Purchased on January 28 20,000 What amount of inventory should be reported on January 31? a. 2,000,000 Unit Total cost cost 50 80 2,000,000 1,600,000 b. 1,850,000 c. 1,625,000 d. 1,500,000 11.) During the January of the current year, Metro Company which maintains a perpetual inventory system, recorded the following information pertaining to its inventory: Units Balance on 1/1 10,000 Purchased on 1/7 6,000 Sold on 1/20 9,000 Purchased 1/25 4,000 Unit cost 100 300 Total cost Units on hand 1,000,000 10,000 1,800,000 16,000 7,000 500 2,000,000 11,000 1. Under the moving average method, what amount should Metro report as inventory on January 31? a. 2,640,000 b. 3,225,000 c. 3,300,000 d. 3,900,000 2. Under the FIFO method, what amount should Metro report as inventory on January 31? a. 1,300,000 b. 2,700,000 c. 3,900,000 d. 4,100,000 12.) Frey Company recorded the following data pertaining to raw material Y during January of the current year. Units Date hand 1/1 8,000 1/8 4,000 1/20 16,000 Received Cost Inventory Issued On 200 Issue 4,000 Purchase 12,000 240 What is the moving average unit cost of the inventory on January 31? a. 220 b. 224 c. 230 d. 240 13.) Stephanie Company is a wholesaler of photographer equipment. The entity used the periodic average cost method to account for inventory. The activity for the inventory of cameras during July is shown below: Units Unit cost July 36.00 1 Inventory 20,000 7 Purchase 30,000 37.00 12 Sale 21 36,000 Purchase 50,000 37.88 22 Sale 29 38,000 Purchase 16,000 38.11 What is the ending inventory on July 31? a. 1,534,000 b. 1,569,120 c. 1,587,360 d. 1,594,640 14.) Celine Company provided the following data relating to an inventory item. Units Jan. 1 Beginning balance 5,000 10 Purchase 5,000 15 Sale 16 Sale return 1,000 30 Purchase 16,000 31 Purchase return 2,000 Unit cost 200 1,000,000 250 1,250,000 150 2,400,000 7,000 150 Under the perpetual system, what is the moving average unit cost on January 31? a. 167 Total cost 300,000 b. 165 c. 181 d. 225 15.) Yakal Company reported that a flood recently destroy many of the financial record. The entity used an average cost inventory valuation system. The entity made a physical count at the end of each month in order to determine monthly ending inventory value. By examining various documents, the following data are gathered: Ending inventory at July 31 60,000 units Total cost of units available for sale in July 1,452,100 Cost of goods sold during July 1,164,100 Cost of beginning inventory, July 1 4.00 per unit Gross profit on sales for July July 935,000 Units Unit cost 5 55,000 5.10 280,500 11 53,000 5.00 265,000 15 45,000 5.50 247,000 16 _47,000 5.30 _249,100 Total purchases 200,000 1. What is the number of units on July 1? a. 102,500 b. 140,000 c. 76,000 d. 60,000 Total cost 1,042,100 2. How many units were sold during the month of July? a. 242,500 b. 140,000 c. 302,000 d. 260,000 3. What is the cost of the inventory on July 31? a. 288,000 b. 410,000 c. 312,600 d. 240,000 16.) Elixir Company bought a 10-hectare land in Novaliches to be improved, subdivided into lots and eventually sold. Purchase price of the land was P5,800,000. Taxes and documents expenses on the transfer of the property amounted to P80,000. The lots were classified as follows: Lot class Number of lots Selling price per lot Total clearing cost A 10 100,000 None B 20 80,000 100,000 C 40 70,000 300,000 D 50 60,000 800,000 What amount should be allocated as total cost of class B lots under the relative sales value method? a. 1,176,000 b. 1,220,000 c. 1,276,000 d. 1,700,000 17.) Casa Company purchased a tract of land for P12,000,000. The entity incurred additional cost of P3,000,000 during the remainder of the year in preparing the land for sale. The tract was subdivided into residential lots as follows: Lot class Number of lots Sales price per lot A 100 240,000 B 100 160,000 C 200 100,000 Using the relative sales value method, what amount of cost should be allocated to Class A lots? a. 3,000,000 b. 3,750,000 c. 6,000,000 d. 7,200,000 18.) Solid Company purchased a plot of ground for P18,000,000. The entity also paid an independent appraiser for the land the amount of P500,000. The land was develop as residential lots at a total cost of P41,500,000. The lots were classified as follows: Number of lots Sales price per lot Highland 20 1,000,000 Midland 40 750,000 Lowland 100 500,000 What total cost should be allocated to Highland lots? a. 12,000,000 b. 11,900,000 c. 8,400,000 d. 8,300,000 19.) Apitong Company manufactures bath towels. The production comprises 60% of “Class A” which sells for P500 per dozen and 40% of “Class B” which sells for P250 a dozen. During the current year. 60,000 dozens were produced at an average cost of P360 a dozen. The inventory at the end of the current year was as follows: 2,200 dozens “Class A” @ P360 792,000 3,000 dozens “Class B “@ P360 1,080,000 Total inventory 1,872,000 Using the inventory sales value method which management considers as a more equitable basis of cost distribution, what is the measurement of the inventory? a. 1,170,000 b. 1,665,000 c. 1,872,000 d. 2,340,000 20.) Julius Company, a conglomerate, has three subsidiaries, Aye, Bee and Cee. Aye Company is in commodity business. Inventory on January 1, 2013 totaled P240,000. Aye Company used the weighted average method. Quantities on hand were 8,000 and 10,000 on January 1 and December 31, 2013 respectively Aye Company made purchases of P25,000 units in 2013 at a total cost of P816,000. Bee Company buys and sells land. On January 1, 2013, a tract of land was bought for P10,000,000. Costs of leveling the land amounted to P2,500,000. The lots were subdivided as follows: 25 Class A to sell for P400,000 each 30 Class B to sell for P300,000 each 10 Class C to sell for P100,000 each On December 31, 2013, the unsold lots consisted of 15 Class A, 6 Class B and 3 Class C. Cee Company sells beds. The perpetual inventory was stated at P1,960,000 on December 31, 2013. At the close of the year, a new approach for compiling inventory was used and apparently a satisfactory cutoff was not made. Some events that occurred are as follows: Beds shipped FOB shipping point to a customer on January 5, 2014 costing P200,000 were included inventory on December 31, 2013. Beds costing P900,000 received December 30, 2013 were recorded on January 2, 2014. Beds received costing P190,000 were recorded twice. Beds shipped FOB shipping point to a customer on December 28, 2013 per date shipping invoice which cost P700,000 were not recorded as delivered until January 2014. Beds on hand which cost P230,000 were not included. 1. What is the ending inventory of Aye Company? a. 320,000 b. 326,000 c. 300,000 d. 313,200 2. What is the ending inventory of Bee Company? a. 3,900,000 b. 4,050,000 c. 5,062,000 d. 4,875,000 3. What is the ending inventory of Cee Company? a. 3,090,000 b. 2,390,000 c. 2,200,000 d. 2,900,000 LOWER OF COST AND NET REALIZABLE VALUE 1.) Chicago Company has two products in the inventory. Selling price Materials and conversion costs General administration costs Estimated selling costs Product X Product Y 2,000,000 3,000,000 1,500,000 1,800,000 300,000 800,000 600,000 700,000 At the year-end, the manufacture of items of inventory has been completed but no selling costs have yet been incurred. What is the measurement of Product X and Y, respectively? a. 1,400,000 and 2,300,000 b. 1,400,000 and 1,800,000 c. 1,500,000 and 2,300,000 d. 1,500,000 and 1,800,000 2.) Based on physical inventory taken on December 31, 2013, Chewy Company determine its chocolate inventory on a FIFO basis at P 5,200,000 with a replacement cost of P4,000,000. The entity estimated that, after further processing costs of P2,400,000, the chocolate could be sold as finished candy bars for P8,000,000. The normal profit margin is 10% of sales. Using the measurement at the lower of cost or net realizable value, what amount should be reported as chocolate inventory on December 31, 2013? a. 5,600,000 b. 4,000,000 c. 5,200,000 d. 4,800,000 3.) Greece Company provided the following data for the current year: Inventory – January 1: Cost Net realizable value Net purchases 3,000,000 3,000,000 2,800,000 8,000,000 Inventory – December 31: Cost Net realizable value 4,000,000 3,700,000 What amount should be reported as cost of goods sold? a. 7,000,000 b. 7,100,000 c. 7,300,000 d. 7,200,000 4.) Gracia Company used the lower of cost or net realizable value method to value inventory. Data regarding the items in work in process inventory are presented below. Markers Pens Highlighters Historical cost 250,000 188,000 300,000 Selling price 360,000 250,000 360,000 Estimated cost to complete 48,000 50,000 68,000 Replacement cost 208,000 168,000 318,000 Normal profit margin as a percentage of selling price 25% What is the measurement of the work in process inventory? a. 720,000 b. 728,000 c. 676,000 d. 694,000 25% 10% 5.) On December 31, 2013, Julie Company’s ending inventory was P3,000,000, and the allowance for inventory writedown before any adjustment was P150,000. Relevant information on December 31, 2013 follows: Product 1 Historical cost 800,000 Replacement cost 900,000 Sales price 1,200,000 Product 2 1,000,000 1,200,000 1,300,000 Product 2 Product 3 700,000 500,000 1,000,000 600,000 1,250,000 1,000,000 350,000 Net realizable value 550,000 1,100,000 950,000 Normal profit 250,000 150,000 300,000 300,000 What amount of loss on inventory writedown should be included in cost of goods sold? a. 100,000 b. 200,000 c. 400,000 d. 250,000 6.) Uptown Company used the perpetual method to record inventory transactions for 2013. Inventory 1,900,000 Sales 6,500,000 Sales return Cost of goods sold Inventory losses 150,000 4,600,000 120,000 On December 24, 2013, the entity recorded a P150,000 credit sale of goods costing P100,000. These goods were sold on FOB destination terms and were in transit on December 31, 2013. The goods were included in the physical count. The inventory on December 31, 2013 determined by physical count had a cost of P2,000,000 and a net realizable value of P1,700,000. Any inventory writedown is not yet recorded. What amount should be reported as cost of goods sold for 2013? a. 5,020,000 b. 4,500,000 c. 4,720,000 d. 4,920,000 7.) Altis Company sells one product which it purchases from various suppliers. The trial balance on December 31, 2013 included the following accounts: Sales (100,000 units at P150) 15,000,000 Sales discount 1,000,000 Purchases 9,300,000 Purchase discount 400,000 The inventory purchases during 2013 were as follows: Units Beginning inventory, January 1 20,000 Unit cost 60 Total cost 1,200,000 Purchases, quarter ended March 31 30,000 65 1,950,000 Purchases, quarter ended June 30 40,000 70 2,800,000 Purchases, quarter ended Sept. 30 50,000 75 3,750,000 Purchases, quarter ended Dec. 31 _10,000 80 __800,000 150,000 10,500,000 The accounting policy is to report inventory in the financial statements at the lower of cost or net realizable value was P72 per unit. The normal profit margin is P10 per unit. What amount should be reported as cost of goods sold for 2013? a. 6,500,000 b. 6,300,000 c. 6,700,000 d. 6,900,000 8.) In 2013, North Company experienced a decline in the value of inventory resulting in a writedown from P3,600,000 to P3,000,000. The entity used the allowance method in 2013 to record the necessary adjustment. In 2014, market conditions have improved dramatically and the inventory increased to P3,200,000. What is included in the adjusting entry on December 31, 2014? a. Debit gain on reversal of inventory writedown P200,000 b. Credit gain on reversal of inventory writedown P400,000 c. Debit allowance for inventory writedown P200,000 d. Credit allowance for inventory writedown P400,000 9.) On December 31, 2013, Dos Company has outstanding purchase commitments for 50,000 gallon of raw material. It is determined that the market price of the raw material has declined to P17 per gallon on December 31, 2013 and it is expected to decline further to P15 in the first quarter of 2014. What is the loss on purchase commitment that should be recognized in 2013? a. 850,000 b. 150,000 c. 250,000 d. 0 10.) On October 1, 2013, Gorgeous Company entered into a 6-month, P5,200,000 purchase commitment for a supply of a special product. On December 31, 2013, the market value of this material had fallen to P5,000,000. On March 31, 2014, the market value of the purchase commitment is P4,900,000. What is the loss on purchase commitment to be recognized on March 31, 2014? a. 200,000 b. 100,000 c. 300,000 d. 0 11.) On November 15, 2013, Diamond Company entered into a commitment to purchase 10,000 ounces of gold on February 15, 2014 at a price of 310 per ounce. On December 31, 2013, the market price of gold is P270 per ounce. On February 15, 2014, the price of gold is P300 per ounce. What is the gain on purchase commitment to be recognized on February 15, 2014? a. 400,000 b. 300,000 c. 100,000 d. 0 12.) On November 15, 2013, Damascus Company entered into a commitment to purchase 100,000 barrels of aviation fuel for P55 per barrel on March 31, 2014. The entity entered into this purchase commitment to protect itself against the volatility in the aviation fuel had fallen to P40 per barrel. However, by March 31, 2014, when the entity took the delivery of the 100,000 barrels the price of aviation fuel had risen to P60 per barrel. What amount should be recognized as gain on purchase commitment for 2014? a. 1,500,000 b. 2,000,000 c. 500,000 d. 0 13.) On January 1, 2013, Card Company signed a three-year, noncancelable purchase contract, which allows Card to purchase up to 5,000 units of a computer part annually from Heart Company at P100 per unit and guarantees a minimum annual purchase of 1,000 units. During 2013, the part unexpectedly became obsolete. Card had 2,500 units of this inventory on December 31, 2013, and believed these parts can be sold as scrap for P20 per unit. What amount of loss from the purchase commitment should be reported in the 2013 income statement? a. 240,000 b. 200,000 c. 160,000 d. 360,000 GROSS PROFIT METHOD 1.) Lin Company sells merchandise at a gross profit of 30%. On June 30, 2013, all of the inventory was destroyed by fire. The following figures pertain to the operations for the six months ended June 30, 2013: Net 8,000,000 sales Beginning 2,000,000 inventory Net 5,200,000 purchases What is the estimated cost of the destroyed inventory? a. 4,800,000 b. 2,800,000 c. 1,600,000 d. 800,000 2.) Olivia Company provided the following information for the year ended December 31, 2013: Inventory, 650,000 January 1 Purchases 2,300,000 Purchase 80,000 Freight 60,000 returns in Sales 3,400,000 Sales 20,000 discounts Sales 30,000 returns On December 31, 2013, a physical inventory revealed that the ending inventory was only P420,000. The gross profit on sales has remained constant at 30% in recent years. The entity suspects that some inventory may have been pilfered by one of the entity’s employees. On December 31, 2013, what is the estimated cost of missing inventory? a. 151,000 b. 165,000 c. 420,000 d. 585,000 3.) On October 31, 2013, Pamela Company reported that a flood caused severe damage to the entire inventory. Based on recent history, the entity has gross profit of 25% of sales. The following information is available from the records for ten months ended October 31, 2013: Inventory, January 1 Purchases Purchase returns 520,000 4,120,000 60,000 Sales 5,600,000 Sales returns 400,000 Sales allowances 100,000 A physical inventory disclosed usable damaged goods which can be sold for P70,000. Using the gross profit method, what is the estimated cost of goods sold for the ten months ended October 31, 2013? a. 3,360,000 b. 3,830,000 c. 3,900,000 d. 3,825,000 4.) On September 30, 2013, Brock Company reported that a fire caused severe damage to the entire inventory. The entity has a gross profit of 30% on cost. The following data are available for nine months ended September 30, 2013: Inventory at January 1 1,100,000 Net purchases 6,000,000 Net sales 7,280,000 A physical inventory disclosed usable damaged goods which can be sold for P100,000. What is the estimated cost of goods sold for the nine months ended September 30, 2013? a. 5,500,000 b. 4,975,000 c. 5,096,000 d. 5,600,000 5.) Tonette Company provided the following information for the current year: Net sales 3,600,000 Freight in 90,000 Purchase discounts 60,000 Ending inventory 240,000 The gross margin is 40% of sales. What is the cost of goods available for sale? a. 1,680,000 b. 1,920,000 c. 2,400,000 d. 2,440,000 6.) Keepsake Company estimated the cost of the physical inventory on March 31 for use in interim financial statement. The rate of markup on cost is 25%. The inventory on January 1 was P5,500,000. During the period January 1 to March 31, the entity had purchases of P4,300,000. Purchase returns of P200,000 and sales of P7,500,000. What is the estimated cost of inventory on March 31? a. 2,100,000 b. 3,600,000 c. 3,975,000 d. 2,800,000 7.) A fire destroyed Newborn Company’s inventory on October 31. On January 1, the inventory had a cost of P2,500,000. During the period January 1 to October 31, the entity had net purchases of P7,500,000 and net sales of P15,000,000. Undamaged inventory at the date of fire had a cost of P150,000. The markup on cost is 66 2/3%. What was the cost of inventory destroyed by fire? a. 3,850,000 b. 4,000,000 c. 1,000,000 d. 850,000 8.) Moderate Company provided the following information: June July August Sales on account Cash sales 7,200,000 720,000 7,360,000 800,000 7,600,000 1,040,000 All merchandise is marked up to sell invoice cost plus 70%. Inventory at the beginning of each month is 30% of that month’s cost of goods sold. a. 5,760,000 b. 6,000,000 c. 6,080,000 d. 6,600,000 9.) On the night of September 30, 2013, a fire destroyed most of the merchandise inventory of Sonia Company. All goods were completely destroyed except for partial damage goods that normally sell for P100,000 and that had an estimated net realizable value of P25,000 and undamaged goods that normally sell for P60,000. The following data are available: Inventory, January 1 660,000 Net purchases, January through September 30 4,240,000 Net sales, January 1 through September 30 5,600,000 Total 2012 2011 2010 Net sales 9,000,000 5,000,000 3,000,000 1,000,000 Cost of sales 6,750,000 3,840,000 2,200,000 710,000 Gross income 2,250,000 1,160,000 800,000 290,000 What is the estimated amount of fire loss on September 30, 2013? a. 700,000 b. 615,000 c. 630,000 d. 580,000 10.) Cool Air Company lost 50% of its inventory by fire on December 31, 2013. No inventory had been taken on December 31, 2013. The following profit and loss data are available: 2013 2012 2011 Inventory, January 1 1,040,000 840,000 848,000 Purchases 3,600,000 2,876,000 2,836,000 Purchase returns 240,000 140,000 200,000 Sales 4,060,000 3,900,000 3,620,000 60,000 100,000 20,000 Sales returns What is the value of the inventory destroyed by fire? a. 1,600,000 b. 1,760,000 c. 800,000 d. 880,000 11.) Beyonce Company sells merchandise on a consignment basis to dealers. The selling price of the merchandise averages 25% above cost. The dealer is paid a 10% commission of the sales price for all sales made. All dealer sales are made on a cash basis. The following consignment activities occurred during 2013: Manufacturing cost of goods shipped on consignment Sales price of merchandise sold by dealers Payments remitted by dealers after deducting commission 8,800,000 9,600,000 6,300,000 What is the gross profit on sales? a. 2,400,000 b. 1,920,000 c. 1,700,000 d. 1,220,000 12.) Steven Company began operations in 2013. For the year ended December 31, 2013, the entity provided the following information: Total merchandise purchases for the year 7,000,000 Merchandise inventory on December 31 1,400,000 Collection from customers 4,000,000 All merchandise was marked to sell at 40% above cost. All sales are on a credit basis and all receivables are collectible. What is the balance of accounts receivable on December 31, 2013? a. 1,000,000 b. 3,840,000 c. 5,000,000 d. 5,800,000 13.) On December 31, 2013, Empress Company had fire which completely destroyed the goods in process inventory. After the fire a physical inventory was taken. The raw materials were valued at P600,000, the finished goods at P1,000,000 and supplies at P100,000 on December 31, 2013. The inventories on January 1, 2013 consisted of the following: Finished goods 1,400,000 Goods in process 1,000,000 Raw materials Supplies 300,000 400,000 Data for 2013 were: Sales 3,000,000 Purchases 1,000,000 Freight in 100,000 Direct labor 800,000 Manufacturing overhead – 50% of direct labor Average gross profit rate ? 30% What is the estimated cost of the goods in process on December 31, 2013 that were completely destroyed by fire? a. 1,300,000 b. 2,100,000 c. 2,000,000 d. 1,700,000 14.) In conducting an audit of Remy Company for the year ended June 30, 2013, the entity’s CPA observed the physical inventory at an interim date, May 31, 2013. The following information was obtained: Inventory, July 1, 2012 Physical inventory, May 31, 2013 875,000 950,000 Sales for 11 months ended May 31, 2013 8,400,000 Sales for year ended June 30, 2013 9,600,000 Purchases for 11 months ended May 31, 2013 6,750,000 Purchases for year ended June 30, 2013 8,000,000 a. Shipments received in May and included in the physical inventory but recorded as June purchases 75,000 b. Shipments received in unsalable condition and excluded from physical inventory. Credit memos had not been received nor bad chargeback to vendors been recorded: Total at May 31, 2013 10,000 Total at June 30, 2013 (including the May unrecorded chargebacks) c. Deposit made with vendor and charged to purchases 15,000 in April, 2013. Product was shipped in July, 2013 20,000 d. Deposit made with vendor and charged to purchases in May, 2013. Product was shipped FOB destination, on May 29, 2013 and was included in May 31, 2013 physical inventory as goods in transit 55,000 e. Through the carelessness of the receiving department a June shipment was damaged by rain. This shipment was later sold in June at its cost of 100,000 1. What is the cost of goods sold for the month of June 2013? a. 980,000 b. 960,000 c. 880,000 d. 780,000 2. What is the inventory June 30, 2013? a. 1,240,000 b. 1,140,000 c. 1,160,000 d. 1,340,000 15.) On April 30, 2013, a fire the office of Amaze Company. The following balances were gathered from the general ledger on March 31, 2013: Accounts receivable Inventory – January 1 920,000 1,880,000 Accounts payable 950,000 Sales 3,600,000 Purchases 1,680,000 An examination of the April bank statement and canceled checks revealed checks written during the period April 1-30 as follows: Accounts payable as of March 31 April merchandise shipments Expenses Deposits during the same period amounted to P440,000 which consisted of collections from customers with exception of P20,000 refund from a vendor for merchandise returned in April. Customers acknowledged indebtedness of P1,040,000 at April 30. Customers owed another P60,000 that will never be recovered. Of the acknowledged indebtedness, P40,000 may prove uncollectible. The average gross profit rate is 40%. Inventory with a cost of P260,000 was salvaged and sold for P140,000. The balance of the inventory was a total loss. What is the fire loss on April 30? a. 1,440,000 b. 1,300,000 c. 1,200,000 d. 1,340,000 FINANCLE LEASE – LESSEE Problem 48-1 Elysee Company leased a machine with a fair value of P 1,650,000 for a period of 5 years under a finance lease. The initial direct costs included in negotiating the lease amounted to P 12,500. The present value of the minimum lease payments discounted at the rate implicit in the lease is P 1,584,000. At what amount should the machine be recognized initially in Elysee’s financial statement? a. 1,650,000 b. 1,596,500 c. 1,662,500 d. 1,584,000 Solution- Answer b Present value of minimum lease payments Initial direct costs Total initial costs of machine 1,584,000 12,500 1,596,000 PAS17, paragraph 20, provides that an entity shall recognize finance lease as asset and liability at the fair value of the leased property or present value of minimum lease payments, whichever is lower. Paragraph 24 further provides that initial direct costs incurred by the lessee are added to the amount recognized as an asset. Problem 482-2 (IFRS) Mindoro Company lease a land and building for 20 years, the useful life of the building, with effect from January 1, 2011. At that date, the fair value of the leasehold interest was P7, 500,000 and of which P6, 000,000 was attributable to the building. Annual rentals of P800, 000 are payable in advance on January 1. What amount should Mindoro recognized as an operating lease expense in the year ended December 31, 2011? a. 800,000 b. 640,000 c. 160,000 d. 0 Solution- Answer c The annual rate should be split between the land lease and building lease based on their relative fair value. Leasehold interest 7,500,000 Attributable to building 6,000,000 Attributable to land 1,500,000 Operating lease expense (1,500,000/7,500,000x800, 000) 160,000 A land and building lease should be separated in two components namely, the land lease and the building lease. In general, a land lease is classified as an operating lease if title is not expected to pass to the lessee by end of the lease term. However under the amendment to PAS 17, a land lease of several decades (more than two) or longer maybe classified as finance lease even if the title will not pass to the lessee at the end of the lease term. The building lease is finance lease because in this case the lease term extends to end of the building useful life. Problem 48-3 Cassanova Company leased a warehouse with adjoining land for a period of 15 years. The fair values of the leasehold interests in the land and the warehouse are P5, 000,000 and P2, 500,000 respectively. The land has indefinite economic life whereas the warehouse has useful life of 15 years. Title to the land is not expected to pass at the end of the lease. At what amount should the asset in relation to finance lease be recognized in the financial statement of Casanova? a. 7,500,000 b. 5,000,000 c. 2,500,000 d. 0 Soultion – Answer c The warehouse lease is finance lease and therefore of the leasehold interest of P2, 500,000 is recognized as an asset. The land lease is an operating lease and therefore the leasehold interest of P5, 000,000 is not recognized as an asset. Problem 48 – 4 (AICPA Adapted) On January 1, 2011, Ashe Company entered into a ten year no cancellable lease requiring year end payment of P1, 000,000. Ashe’s incremental borrowing rate is 12% while the lessor’s implicit interest rate, known to Ashe, is 10%. Present value of factors for an ordinary annuity for ten periods are 6.145 at 10%, and 5.650 at 12%. On same date, Ashe Company paid initial direct cost of P200, 000 in negotiating and securing leasing arrangement. Ownership of the property remains with the lessor at expiration of the lease. There is no bargain option. The leased property has an estimated economic life of 12 years. What amount should Ashe capitalize as cost of the leased property of January 1, 2011? a. 6,145,000 b. 6,345,000 c. 5,650,000 d. 5,850,000 Solution - Answer b Present value of rentals (1,000,000 x 6.145) Initial direct cost Total cost of property 6,145,000 200,000 6,345,000 Problem 48-5 (IAA) On December 31, 2011, Tiger Company leased equipment from Zebra Company. Pertinent lease transaction data are as follows: The estimated seven – year useful equipment life coincides with the lease term. The first of the seven equal annual P200,000 lease payments was paid on December 31,2011 Zebra Company’s implicit interest rate of 12% is known to Tiger. Tigers incremental borrowing rate is 14% Present value of annuity of 1 in advance for seven periods is 5.11 at 12% and 4.89 at 14%. Tiger Company paid initial direct cost of P100, 000. What amount should be recorded by Tiger Company initially as cost of the equipment? a. 1,400,000 b. 1,022,000 c. 1,122,000 d. 1,078,000 Solution – Answer c Present value of rentals (200,000 x 5.11) 1,022,000 Initial direct cost 100,000 Total cost of equipment 1,122,000 The commencement of the lease is December 31, 2011 and the firm annual payment was made on December 31, 2011 in advance. Thus, the present value of an annuity of 1 in advance factor applicable to the implicit interest rate of 12% is used in determining the present value of rentals. Problem 48-6 (AICPA Adapted) Neal Company entered into a nine year finance lease on a warehouse on December 31,2011 Lease payment of P520,000 which includes real estate taxes and other executory cost of P200,000, are due annually, beginning on December 31,2012 and every December 31 thereafter. The interest rate implicit in the lease is 9%. The rounded present value of an ordinary annuity of 1 for nine years at 9% is 5.6. What amount should Neal report as lease liability on December 31, 2011? a. 2,800,000 b. 2,912,000 c. 4,500,000 d. 4,680,000 Solution – Answer a Lease liability (500,000 x 5.6) 2,800,000 Problem 48-7(AICPA Adapted) On January 1, 2011, Day Company leased a new machine from Parr with the following pertinent information: Lease term 6 years Annual rental payable at beginning of each year 500,000 Useful life of machine 8 years Implicit interest rate in lease 12% Present value of annuity of 1 in advance for 6 periods at 12% 4.60 The lease is not renewable, and the machine reverts to Parr at the termination of the lease. The cost of the machine on Parrs accounting record is P3, 755,000. At the beginning of the lease term, what amount should be recorded as lease liability? a. 2,055,000 b. 2,300,000 c. 3,755,000 d. 2,800,000 Solution – Answer b Present value of rentals (500,000 x 4.60) 2,300,000 Problem 48-8 Robbins Company leased a machine from Ready Leasing Company. The lease qualifies as finance lease and requires 10 annual payments of P100, 000 beginning immediately. The lease specifies an interest rate of 12% and a purchase option of P100, 000 at the end of tenth year, even though the machine’s estimated value on that date is P200,000. Present value of an annuity due (in advance ) 6.328 Of 1 at 12% for 10 periods Present value of 1 at 12% for 10 periods 0.322 What amount should Robbins record as lease liability at the beginning of lease term? a. 612,600 b. 648,600 c. 665,000 d. 697,200 Solution – Answer c Present value of rentals (100,000 x 6.328) Present value of bargain purchase option (100,000 x 3.22) Total lease liability – beginning of lease term 632,800 32,200 665,000 Problem 48-9 On January 1, 2011, Stoic Company became the lessee of new equipment under a noncancelable six years lease. The estimated economic life of this equipment is 10 years. The fair value of this equipment on January 1 was P4, 000,000. The lease does not meet the criteria for classification as a finance lease with respect to transfer of ownership of the leased asset, or bargain purchase option, or lease term. Nevertheless, Stoic must classify this lease as a finance lease if at inception of the lease, the present value of the minimum lease payments (excluding executory costs) is equal to at least a. 2,700,000 b. 3,000,000 c. 3,600,000 d. 4,000,000 Solution – Answer c To qualify as a finance lease, the present value of the minimum lease payments should be equal to atleast 90% of the fair value of the asset at the inception of the lease. Thus, 90% times P4, 000,000 equals 3,600,000. Problem 48-10 On January 1, 2011, Nori Mining Company (lessee) entered into a 5 year lease for drilling equipment. Nori accounted for the acquisition as a finance lease for P2, 400,000, which includes a P100, 000 bargain purchase option. At the end of the lease, Nori expects to exercise the bargain purchase option. Nori estimates that equipment’s fair value will be P200, 000 at the end of its 8 year life. Nori regularly uses straight straight line depreciation on similar equipment. For the year ended December 31, 2011, what amount should Nori recognize as depreciation expense on the leased asset? a. 480,000 b. 460,000 c. 300,000 d. 275,000 Solution – Answer d Cost of leased property 2,400,000 Residual value (200,000) Depreciable amount 2,200,000 Depreciation (2,200,000/8) 275,000 Problem 48-11 (AICPA Adapted) On January 1, 2011, Cole Company signed an eight year noncancelable lease for a new machine, requiring P 150,000 annual payments at the beginning of each year. The machine has a useful life of 12 years, with no residual value. Title passes to Cole at the lease expiration date. Cole uses straight line depreciation for all of its plant assets. Aggregate lease payments have a present value on January 1, 2011 of P1, 080,000 based on appropriate rate of interest. What amount should be recorded as depreciation expense of the leased machine for 2011? a. 0 b. 90,000 c. 135,000 d. 150,000 Solution – Answer b Depreciation (1,080,000/12) 90,000 Problem 48-12(AICPA Adapted) On January 1, 2011, Kosovo Compqny entered into a 10 year lease for an equipment. Kosovo accounted for the acquisition as a finance lease for P4, 900,000 which includes a P200, 000 guaranteed residual value. At the end of the lease, the asset will revert back to the lessor. It is estimated that the assets fair value at the end of its 12 year useful life will be P100, 000. Kosovo regularly uses straight line depreciation on similar equipment. For the year ended December 31,2011, what amount should Kosovo recognize as depreciation expense of the leased asset? a. 490,000 b. 400,000 c. 470,000 d. 480,000 Solution – Answer c Depreciation for 2011 (4,700,000/10) 470,000 Cost of leased equipment 4,900,000 Guaranteed residual value (200,000) Depreciable amount 4,700,000 Problem 48-13 Nova Company has leased an asset on a finance lease. The present value of the minimum lease payment is P686, 000 and the fair value of the asset is P700, 000. The asset useful life of 5 years and the lease is for a period of 4 years, after which the asset can be acquired for a near zero cost, which is substantially below the expected value of the asset at that date. The asset is depreciated on a straight line basis. What is the amount of the annual depreciation expense? a. 175,000 b. 140,000 c. 137,200 d. 171,500 Solution – Answer c Annual Depreciation (686,000/5 years) 137,200 Problem 48-14 (IFRS) On January 1, 2011, Diamond Company leased a van with a fair value of P3, 600,000 under a finance lease. The lease term is 6 years, and the present value of the lease minimum payment is P3, 552,000. The useful life of the van to the business was estimated at 8 years with no final residual value. The entity operates a policy of straight line depreciation. What is the depreciation charge on the van in 2011? a. 600,000 b. 450000 c. 592,000 d. 444,000 Solution - Answer c Annual Depreciation (3,552,000/6) 592,000 Problem 48-15 On January 1, 2011, Babson Company leased two automobiles for executive use. The lease requires Babson to make five annual payments of P1,300,000 beginning January 1,2011. At the end of the lease term December 31,2015, Babson guarantees the residual value of automobiles will total P1,000,000. The lease qualifies as a finance lease. The interest rate implicit in the lease is 9%. Present value factors for the 9% implicit rate are as follows: For an annuity due with 5 payments (in advance) 4.240 For an ordinary annuity with 5 payments 3.890 Present value of 1 for 5 periods 0.650 What is the finance lease liability immediately after the first required payment? a. 4,862,000 b. 4,407,000 c. 3,562,000 d. 3,107,000 Solution – Answer a Present value of rentals (1,300,000 x 4.24) Present value of guaranteed residual value (1,000,000 x 0.65) 5,512,000 650,000 Total lease of liability – January 1, 2011 6,162,000 Less: First payment on January 1, 2011 (1,300,000) Lease liability – January 1, 2011 4,862,000 Problem 48-16 On December 31,2011, Action Company signed a 7 year finance lease for an airplane to transport its basketball team around the country. The airplane’s fair value was P8,415,000. Action made the first annual lease payment of P1,530,000 on December 31,2011. Action’s incremental borrowing rate was 12% and the interest rate implicit in the lease, which was known by Action was 9%. The following are the round present value factors for an annuity due: 9% for 7 years 5.5 12% for 7 years 5.1 What amount should Action report as finance lease liability in its December 31, 2011 statement of financial position? a. 8,415,000 b. 7,803,000 c. 6,885,000 d. 6,273,000 Solution – Answer c Present value – December 31,2011 (1,530,000 x5.5) 8,415,000 Less: First payment on December 31,2011 1,530,000 Lease liability 6,885,000 Problem 48-17 Oak Company leased equipment for its entire nine year useful life, agreeing to pay P500,000 at the start of the lease term December 31,2011, and P500,000 annually on each December 31 for the next eight years. The present value on December 31,2011 of the nine lease payments over the lease term, using the rate implicit in the lease which Oak knows to be 10%, was P3,165,000. The December 31,2011 present value of the lease payments using Oaks incremental borrowing rate of 12% was P2,985,000. Oak made timely second lease payment. What amount should Oak report as lease liability in its December 31,2012 statement of financial position? a. 3,500,000 b. 2,431,500 c. 2,283,200 d. 2,485,000 Solution – Answer b Present value – December 31,2011 3,165,000 Less:First payment on December 31,2011 500,000 Lease liability – December 31,2011 Less: Second payment on December 31,2012 Interest for 2012 (10% x 2,665,000) Lease liability – December 31,2012 2,665,000 500,000 (266,500) 233,500 2,431,000 Problem 48-19 Newton Company leased a machinery with a fair value of P2,500,000 from another entity on December 31,2011. The contract is six year noncancelable with implicit interest of 10%. The lease requires annual payment of P500,000 beginning December 31,2011. Newton appropriately accounted for the lease as finance lease. Newton’s incremental borrowing rate is 12%. The present value of an annuity due of 1 for 6 years at 10% is 4.7908 and the present value of an annuity due of 1 for 6 years at 12% is 4.6048. What is the lease liability that Newton should report in the statement of financial position on December 31,2012? a. 1,895,400 b. 1,700,000 c. 1,584,940 d. 1,518,688 Solution- Answer c Present value - December 31,2011( 500,000x4.7908) 2,395,400 First payment on December 31,2011 500,000 Lease liability December 31,2011 1,895,400 Second payment on December 31,2012 500,000 Interest for 2012 (10%x1,895,400) (189,540) 310,460 Lease liability – December 31,2012 1,584,900 Problem 48-19 On December 31,2011, Roe Company leased a machine form Colt for a five year period. Equal annual payments under the lease are P1,050,000 including P50,000 annual executory cost and are due on December 31 of each year. The first payment was made on December 31,2011 and the second payment was made on December 31,2012. The five lease payments are discounted at 10% over the lease term. The present value of minimum lease payments are the inception of the lease and before the first and annual payment was P4,170,000. The lease is appropriately accounted for as finance lease by Roe. In its December 31,2012 statement of financial position, what should be reported by Roe Company as lease liability? a. 3,170,000 b. 3,150,000 c. 2,853,000 d. 2,487,000 Solution – Answer d Present value - December 31,2011 4,170,000 First payment on December 31,2011 1,000,000 Lease liability – December 31,2011 3,170,000 Second payment on December 31,2012 Interest for 2012 (10% x 3,170,000) Lease liability - December 31,2012 1,000,000 (317,000) 683,000 2,487,000 Problem 48-20 On Decmeber 31,2011, Ames Company leased equipment under a finance lease for 10 years. It contracted to pay for P400,000 on December 31,2011, and on December 31 of each of the nine years. The finance lease liability was recorded at P2,700,000 on December 31,2011 before the first payment. The equipment’s useful life is 12 years, and the interest rate implicit in the lease is 10%. Ames uses the straight line method to depreciate all equipment. In recording the December 31,2012 payment, by what amount should Ames reduce the finance lease liability? a. 270,000 b. 230,000 c. 225,000 d. 170,000 Solution – Answer d Lease liability - December 31,2011 Less:First payment on December 31.2011 2,700,000 400,000 Lease liability – December 31,2011 2,300,000 Second payment on December 31,2012 400,000 Interest for 2012 (10% 2,300,000) (230,000) Reduction of lease liability on December 31,2012 170,000