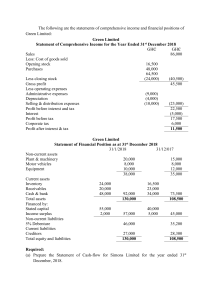

FINANCIAL MANAGEMENT COURSE PROJECT PROBLEM # 1: ESSAY PROBLEM- 15 POINTS PROBLEM # 2: CAPITAL BUDGETING PROBLEM – 35 POINTS PROBLEM # 3: FINANCIAL ANALYSIS PROBLEM – 45 POINTS I - ESSAY PROBLEM Instructions: Read the following scenario and explain your answer. Minimum of 150 words per item. Answer copied from the internet will incur point deduction 1. Explain the importance of Capital structure in business? 2. How cost of capital influence financial performance of the business? 3. If you were to put-up a business, develop a capital structure for your business, provide computation for cost of capital and explain its implication to your business. II - CAPITAL BUDGETING PROBLEM 1. Project X requires an initial investment of 45,000 but is expected to generate revenues of 13,000, 29,000 and 22,000 for the first, second, and third years, respectively. The target rate of return is 10%. Since the cash inflows are uneven, the NPV formula is broken out by individual cash flows. Compute for the following: Payback period NPV Profitability Index III - FINANCIAL ANALYSIS PROBLEM Instructions: Analyse the financial statement below and compute for the following financial ratios. The more the ratio computed the higher the score. Compute for the ratio of each year (2017 and 2018) Follow the PDF lesson on Ratio analysis for your guide. • • • • • • Liquidity ratios (at least 4 ratio per year) Solvency ratios (at least 4 ratio per year) Profitability Ratios (at least 4 ratio per year) Efficiency ratios (at least 4 ratio per year) Coverage ratios (at least 4 ratio per year) Market prospect ratios (at least 4 ratio per year) INCOME STATEMET 2017 2018 Revenue 78,824,158.00 98,559,553.00 Cost of Sales 57,166,887.00 68,470,167.00 Gross profit 21,657,271.00 30,089,386.00 Research and development expenses 6,183,641.00 7,541,998.00 Selling, general and administrative expense 9,808,376.00 11,731,213.00 Other income 1,373,961.00 2,946,890.00 553,014.00 659,069.00 Other operating expenses Total Operating expense 16,545,031.00 19,932,280.00 Operating profit 6,486,201.00 13,103,996.00 Interest income 5,703,261.00 3,912,513.00 Interest expense 5,993,099.00 3,820,151.00 Earnings before tax 6,196,363.00 13,196,358.00 Taxes (30%) 1,858,908.90 3,958,907.40 Net Profit 4,337,454.10 9,237,450.60 BALANCE SHEET ASSETS 2017 2018 Current Assets LIABILITIES AND EQUITY 2017 2018 Current liabilities Cash and cash equivalents 2,360,190 2,142,220 Trade and other payables 2,470,214 3,752,483 Short-term financial instruments 3,306,326 8,196,850 Short-term borrowings 4,052,832 4,280,493 Withholdings 161,212 275,994 Income tax payable 412,368 625,898 4,350,478 5,421,579 Available-for-sale financial assets 982,067 2,104,420 Accounts receivable 7,699,795 11,257,986 Advances 1,067,955 1,332,339 Other current liabilities 232,047 319,552 437,282 771,909 Total current liabilities 11,679,151 14,675,999 3,817,751 3,633,628 Other current assets 240,667 459,555 Total Current Assets 19,912,033 29,898,907 4,324,318 6,868,809 Retirement benefit obligation 725,195 613,791 Deferred income tax liabilities 819,541 493,371 Prepaid expenses Inventories Non-current assets Available-for-sale financial assets Accrued expenses Non-current liabilities Long term debt 1,128,853 1,308,675 Other non-current liabilities 174,010 202,918 Long-term investment 20,390,192 22,046,679 Total non-current liabilities 6,043,064 8,178,889 Property, plant and equipment 35,066,116 32,306,828 TOTAL LIABILITIES 17,722,215 22,854,888 1,020,146 1,020,209 Preferred stock 119,467 119,467 Deposits 271,405 256,503 Common stock 778,047 778,047 Long-term prepaid expenses 311,106 2,342,921 Share premium 4,403,893 4,403,893 Other non-current assets 557,358 428,632 Retained earnings 55,633,587 61,453,059 Total Non-Current Assets 58,745,176 59,710,447 Total Equity 60,934,994 66,754,466 TOTAL ASSETS 78,657,209 89,609,354 TOTAL LIABILITIES AND EQUITY 78,657,209 89,609,354 Intangible assets