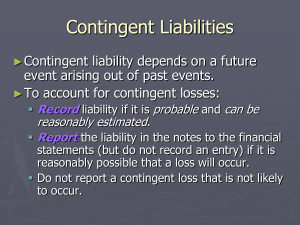

(WEEKLY ASSIGNMENT) On January 1, 20x1, ABC Co. acquired all the assets and liabilities of XYZ, Inc. for P10,000,000. XYZ's assets and liabilities have fair values of P2,800,000 and P1,100,000, respectively. ABC agrees to pay additional cash equal to 10% of the 20x1 year end profit that exceeds P400,000. XYZ historically has reported profits of P300,000 to P400,000 each year. The fair value of the contingent consideration as of January 1, 20x1 is P10,000, based on assessments of the expected level of profits for the year, as well as, forecasts, plans and industry trends. 01. Requirement: Compute for the goodwill. CONSIDERATION TRANSFERRED(1M+10k) NON-CONTROLLLING INTEREST PREVIOUSLY HELD EQUITY INTEREST IN THE ACQUIREE TOTAL P 1,010,000 ------------ P 1,010,000 FAIR VALUE OF NET IDENTIFIABLE ASSETS ACQUIRED (2.8M - 1.1M) (1,700,000) Gain bargain Purchase ( P690,000) 02. Case #1: The profit for the year is P650,000. The contingent consideration is settled on January 15, 20x2. Requirement: Provide the journal entries. December 31,2021 Unrealized loss-P/L 15,000 Liability For Contingent Consideration 15,000 January 15, 2022 Liability For Contingent Consideration 25,000 Cash Solution: Amount of Contingent consideration FV (650,000-400,000) x 10% Loss 25,000 P 10,000 (25,000) ( P 15,000) 03. Case #2: The profit for the year is P400,000. Requirement: Provide the journal entry. December 31, 2021 Liability For Contingent Consideration 10,000 Gain on Extinguishment of Liability - P/L 10,000