Provisions, Contingent Liabilities & Assets - Accounting

advertisement

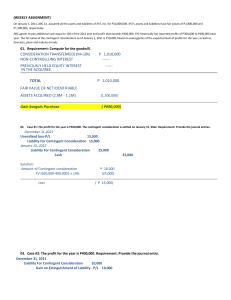

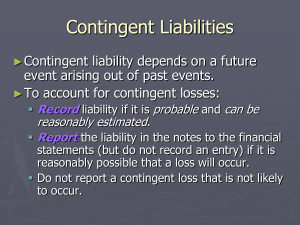

PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS Kiara Cerisse C. Singian, CPA Learning Objectives ▪ State the recognition criteria for provisions. ▪ Differentiate the accounting requirements of a provision, a contingent liability and a contingent asset. ▪ Describe the available measurement bases for a provision. ▪ Account for provisions. Provisions ▪ A provision is a liability of uncertain timing or amount. ▪ Provisions differ from other liabilities because of the uncertainty about the timing or amount of expenditure required in settlement. Unlike for other liabilities, provisions must be estimated. Although, some other liabilities are also estimated, their uncertainty is generally much less than for provisions. ▪ Other liabilities, such as accruals, are reported as part of “Trade and other payables” whereas provisions are reported separately. Provision vs. Contingent liability Provision Contingent liability ▪ Present obligation ▪ Possible obligation ▪ Probable and measured reliably ▪ Present obligation but not probable or Present obligation but not measured ▪ Recognized (accrued in the statement of financial position) reliably ▪ Not recognized (not accrued in the statement of financial position) Recognition of provisions ▪ A provision is recognized when all of the following conditions are met: 1. The entity has a present obligation (legal or constructive) as a result of a past event; 2. It is probable that an outflow of resources embodying economic benefits will be required to settle the obligation; and 3. A reliable estimate can be made of the amount of the obligation. Range of outcome Present obligation is Recognize or accrue a outflow of economic both probable and reliably estimable. Provide appropriate The future event is likely to As a rule of thumb, means more than 50% Present obligation is Disclose only a contingent liability. Present obligation is remote Do nothing. Do not recognize or accrue liability. The future event is less occur. The occurrence is less. The future event is least occur or the chance of the event occurring is very occurrence is 10% or less. Measurement Nature of the outflow Measurement basis 1. General rule ➢ Best estimate 2. Involves a large population of items ➢ Expected value (Probability Weighted 3. Each possible outcome in a range is as any other ➢ Mid-point Present value ▪ Where the effect of the time value of money is material, the amount of a provision shall be the present value of the expenditures expected to be required to settle the obligation. Expected disposal of assets ▪ Gains from the expected disposal of assets shall not be taken into account in measuring a provision. Gains shall be recognized only when the assets are actually disposed of. Reimbursements ▪ Where some or all of the expenditure required in settling a provision is expected to be reimbursed by another party, the reimbursement is recognized only when it is virtually certain that reimbursement will be received if the entity settles the obligation. ▪ The reimbursement shall be treated as a separate asset. ▪ In the statement of profit or loss and other comprehensive income, the expense relating to a provision may be presented net of the amount recognized for a reimbursement. Changes in provisions ▪ Provisions shall be reviewed at the end ▪ If it is no longer probable that an outflow of each reporting period and adjusted to of resources embodying economic reflect the current best estimate. benefits will be required to settle the obligation, the provision shall be reversed. Product warranties and guarantees ▪ If a customer has the option to purchase ▪ If a customer does not have the option a warranty separately (for example, to purchase a warranty separately, the because the warranty is priced or warranty is accounted for in accordance negotiated separately), the warranty is with PAS 37 Provisions, Contingent accounted for in accordance with PFRS Liabilities and Contingent Assets unless 15 Revenue from Contracts with the promised warranty provides the Customers. customer with a service in addition to the assurance that the product complies with agreed-upon specifications. Liability for premiums ▪ A customer option to acquire additional ▪ A customer option that does not provide goods or services for free or at a the customer with a material right is not discount is accounted for under PFRS 15 accounted for under PFRS 15; and if the option provides the customer a therefore, accounted for in accordance material right that the customer would with PAS 37. not receive without entering into that contract. Guarantee for indebtedness of others ▪ A provision for the guarantee for indebtedness of others is recognized when it becomes probable that the entity will be held liable for the guarantee, such as when the original debtor defaults on the loan. Contingent assets Contingent asset is probable Contingent asset is possible Contingent asset is remote Disclose only a contingent Do not recognize or accrue. Do nothing. Do nothing. APPLICATION OF CONCEPTS Application of Concepts Fact Pattern: Transcribe Co. is engaged in transport services. A lawsuit was filed against Transcribe Co. regarding a road accident that occurred late in December 20x1. Transcribe Co.'s legal counsel believes that Transcribe Co. will probably lose the case and pay damages. Sufficient data is available to make a reliable estimate of the damages. Should Transcribe Co, accrue a provision on December 31, 20x1? Provide a brief explanation of your answer. Application of Concepts 1. Answer: Yes. All the elements of the recognition criteria are met: a. Present obligation arising from past event – an accident already happened, and a lawsuit was filed against the entity. b. Probable outflow – the entity expects to lose the case and pay damages. c. Reliable estimate – the problem states that “Sufficient data is available to make a reliable estimate of the damages.” Application of Concepts Fact Pattern: Transcribe Co. is engaged in transport services. A lawsuit was filed against Transcribe Co. regarding a road accident that occurred late in December 20x1. Transcribe Co.'s legal counsel believes that Transcribe Co. will probably lose the case and pay damages. Sufficient data is available to make a reliable estimate of the damages. Transcribe Co.'s best estimate of the payment for damages is P4M. What is the entry to accrue the provision? Application of Concepts Dec. 31, 20x1 Probable loss on lawsuit Estimated liability on pending lawsuit 4,000,000 4,000,000 Application of Concepts Fact Pattern: Transcribe Co. is engaged in transport services. A lawsuit was filed against Transcribe Co. regarding a road accident that occurred late in December 20x1. Transcribe Co.'s legal counsel believes that Transcribe Co. will probably lose the case and pay damages. Sufficient data is available to make a reliable estimate of the damages. Transcribe Co.'s legal counsel believes that there is a 20% chance that Transcribe Co. will win the case. If, however, Transcribe Co. will lose, there is a 30% chance that it will pay damages of P9M (the amount sought by the plaintiff) and a 70% chance that it will pay damages of P4M (the amount awarded to the plaintiff in a similar case that was recently concluded). Other outcomes, are unlikely. A 4% risk adjustment factor is considered appropriate to reflect the uncertainties in the cash flow estimates. The court decision is expected to be finalized in December 20x2. The appropriate discount rate is 12%. What is the entry to accrue the provision? Application of Concepts Dec. 31, 20x1 Probable loss on lawsuit Estimated liability on pending lawsuit 4,085,714 4,085,714 Application of Concepts Fact Pattern: Transcribe Co. is engaged in transport services. A lawsuit was filed against Transcribe Co. regarding a road accident that occurred late in December 20x1. Transcribe Co.'s legal counsel believes that Transcribe Co. will probably lose the case and pay damages. Sufficient data is available to make a reliable estimate of the damages. Transcribe Co.'s legal counsel believes that Transcribe Co. will probably pay damages of not less than P2M but not more than P7M. The probability of any amount within the range is as likely as any other amount within that range. The plaintiff is offering an out-of-court settlement of P6.2M but Transcribe Co. does not agree. What is the entry to accrue the provision? Application of Concepts Dec. 31, 20x1 Probable loss on lawsuit [(2M + 7M) / 2] Estimated liability on pending lawsuit 4,500,000 4,500,000 Application of Concepts On December 31, 20x1, Aural Co. accrues a provision of P5M for an expected loss on a pending labor case. On December 31, 20x2, Aural Co. reviews its estimate and concludes that an estimate of P4.8M is more appropriate. The case is settled in 20x3 and Aural Co. pays damages of P5.1M. Provide the journal entries in 20x1 to 20x3. Application of Concepts Dec. 31, 20x1 Probable loss on lawsuit Estimated liability on pending lawsuit 5,000,000 Dec. 31, 20x2 Estimated liability on pending lawsuit Gain on revision of estimate 200,000 20x3 Estimated liability on pending lawsuit Loss on lawsuit Cash 4,800,000 300,000 5,000,000 200,000 5,100,000 Application of Concepts Ear Co. provides 5-year warranty for its products. Warranty costs, related to sales, are estimated at 2% in the year of sale and 4% in the subsequent years. The warranty obligation has a balance of P160,000 as of January 1, 20x1. Information for 20x1 and 20x2 is as follows: Year Sales Actual warranty costs 20x1 P10,000,000 P400,000 20x2 12,000,000 500,000 Requirements: a. Provide the journal entries in 20x1 and 20x2 to record the actual warranty costs and the provisions for warranty obligation. b. Compute for the balance of the warranty obligation on December 31, 20x2. Application of Concepts 20x1 Warranty expense (10M x 6% (a)) Warranty obligation 600,000 Warranty obligation Cash (or other asset account) 400,000 to record the provision for warranty costs to record the actual warranty costs (a) 600,000 400,000 2% + 4% = 6% 20x2 Warranty expense (12M x 6%) Warranty obligation 720,000 Warranty obligation Cash (or other asset account) 500,000 to record the provision for warranty costs to record the actual warranty costs 720,000 500,000 Application of Concepts Application of Concepts Listen Co. has an ongoing sales promotion. For every five bottle crowns returned to Listen Co., customers receive a T-shirt. The unit cost of the T-shirt is P100. Listen Co. estimates that 80% of sales will be redeemed. Listen Co.'s premium liability as of December 31, 20x0 is P720,000. Additional information is as follows: Units Sales in 20x1 500,000 Sales in 20x2 900,000 T-shirts distributed in 20x1 60,000 T-shirts distributed in 20x2 147,000 Requirements: a. Provide the journal entries in 20x1 and 20x2 to record the actual costs of premiums distributed and the provisions for premium liability. b. Compute for the balance of the premium liability on December 31, 20x2. Application of Concepts 20x1 Premium expense [(500K x 80% ÷ 5) x ₱100 )] Estimated liability for premiums 8,000,000 Estimated liability for premiums (60,000 T-shirts x ₱100) Premiums 6,000,000 to record the provision for premiums 8,000,000 6,000,000 to record the actual premiums distributed 20x2 Premium expense [(900,000 x 80% ÷ 5) x ₱100] Estimated liability for premiums 14,400,000 Estimated liability for premiums (147,600 T-shirts x ₱100) Premiums 14,760,000 to record the provision for premiums to record the actual premiums distributed 14,400,000 14,760,000 Application of Concepts Application of Concepts On January 1, 20x1, Loving Co. guaranteed a bank loan of Shameless Co. amounting to P1,000,000. On December 31. 20x1, Shameless Co. defaulted, and it has become probable that Loving Co. will be held liable to the bank for P1,000,000. What are the journal entries in Loving Co.'s books in 20x1? Application of Concepts Jan. 1, No entry 20x1 Dec. 31, 20x1 Probable loss on guarantee Estimated liability for guarantee 1,000,000 1,000,000 QUESTIONS?