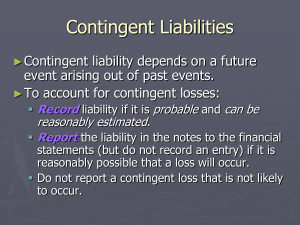

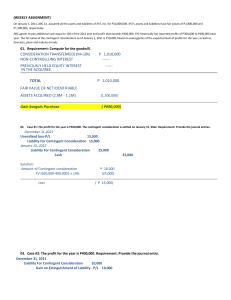

12 Provisions and contingencies 12.1 12.2 Identify, by indicating the relevant box in the table below, whether each of the following statements about provisions and contingencies is true or false. A company should disclose details of the change in carrying amount of a provision from the beginning to TRUE FALSE the end of the year. Contingent assets must be recognised in the financial statements in accordance with the prudence concept. TRUE FALSE Contingent liabilities must be treated as actual liabilities and provided for if it is probable that they will arise. TRUE FALSE Which of the following statements about contingent assets and contingent liabilities are correct? A contingent asset should be disclosed by note if an inflow of economic benefits is probable. (2) A contingent liability should be disclosed by note if it is probable that a transfer of economic benefits to settle it will be required, with no provision being made. (3) No disclosure is required for a contingent liability if it is not probable that a transfer of economic benefits to settle it will be required. (14) No disclosure is required for either a contingent liability or a contingent asset if the likelihood of a payment or receipt is remote. 1 and 4 only 2 and 3 only 2, 3 and 4 1, 2 and 4 12.3 A former director of Biss Co has commenced an action against the company claiming substantial damages for wrongful dismissal. The company's solicitors have advised that the former director is unlikely to succeed with his claim, although the chance of Biss Co paying any monies to the ex-director is not remote. The solicitors' estimates of Biss Co's potential liabilities are: Legal costs (to be incurred whether the claim is successful or not) Settlement of claim if successful 50,000 500,000 550,000 According to IAS 37 Provisions, Contingent Liabilities and Contingent Assets, how should this claim be treated in Bliss Co's financial statements? Provision of $550,000 Disclose a contingent liability of $550,000 Disclose a provision of $50,000 and a contingent liability of $500,000 Provision for $500,000 and a contingent liability of $50,000 BPP Questions 69 12.1* Identify, by indicating the relevant box in the table below, the correct action to be taken in the financial statements in respect of each item. The company gives warranties on its products at no extra cost to the customer. CREATE A DISCLOSURE The company's NO ACTION PROVISION NOTE ONLY statistics show that about 5% of sales give rise to a warranty claim. The company has guaranteed the overdraft of another company. The CREATE A DISCLOSURE likelihood of a liability NO ACTION PROVISION NOTE ONLY arising under the guarantee is assessed as possible. 12.5 Which of the following statements about the requirements of IAS 37 Provisions, Contingent Liabilities and Contingent Assets are correct? A contingent asset should be disclosed by note if an inflow of economic benefits is probable. (2) No disclosure of a contingent liability is required if the possibility of a transfer of economic benefits arising is remote. (3) Contingent assets must not be recognised in financial statements unless an inflow of economic benefits is virtually certain to arise. O All three statements are correct O 1 and 2 only O 1 and 3 only O 2 and 3 only 12.6 Wanda Co allows customers to return faulty goods within 11+ days of purchase. At 30 November 20X5 a provision of $6,548 was made for a refund liability (sales returns). At 30 November 20X6 the provision was re-calculated and should now be $7,634. What should be reported in Wanda Co's statement of profit or loss for the year to 31 October 20X6 in respect of the provision? O A charge of $7,634 O A credit of $7,634 O A charge of $1,086 O A credit of $1,086 70 Financial Accounting (FFA/FA) BPP 12.7 Doggard Co is a business that sells second hand cars. If a car develops a fault within 30 days of the sale, Doggard Co will repair it free of charge. At 30 April Doggard Co had made a provision for repairs of $2,500. At 30 April 20X5 Doggard Co calculated that the provision should be $2,000. What entry should be made for the provision in Doggard Co's statement of profit or loss for the gear to 30 April 20X5? A charge of $500 A credit of $500 A charge of $2,000 A credit of $2,000 12.8 Which of the following best describes a provision according to IAS 37 Provisions, Contingent Liabilities and Contingent Assets? A provision is a liability of uncertain timing or amount A provision is a possible obligation of uncertain timing or amount A provision is a credit balance set up to offset a contingent asset so that the effect on the statement of financial position is nil A provision is a possible asset that arises from past events 12.9 Which of the following items does the statement below describe? According to IAS 37 Provisions, Contingent Liabilities and Contingent Assets, 'A possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the entity's control'. A provision A current liability A contingent liability A contingent asset 12.10 Montague's paint shop has suffered some bad publicity as a result of a customer claiming to be suffering from skin rashes as a result of using a new brand of paint sold by Montague's shop. The customer launched a court action against Montague in November 20X3, claiming damages of $5,000. Montague's lawyer has advised him that the most probable outcome is that he will have to pay the customer $3,000. What amount should Montague include as a provision in his financial statements for the gear ended 31 December 20X3? BPP Questions 71 12.11 Mobiles Co sells goods with a one gear free warranty under which customers are covered for any defect that becomes apparent within a year of purchase. In calendar year 20X4, Mobiles Co sold 100,000 units. The company expects warranty claims for 5% of units sold. Half of these claims will be for a major defect, with an average claim value of $50. The other half of these claims will be for a minor defect, with an average claim value of $10. What amount should Mobiles Co include as a provision in the statement of financial position for the year ended 31 December 20X4? $125,000 $25,000 $300,000 $150,000 12.12 When a provision is needed that involves a number of outcomes, the provision is calculated using the expected value of expenditure. The expected value of expenditure is the total expenditure of: Each possible outcome Each possible outcome weighted according to the probability of each outcome happening Each possible outcome divided by the number of outcomes Each possible outcome multiplied by the number of outcomes 12.13 X Co sells goods with a free one gear warranty and had a provision for warranty claims of $64,000 at 31 December During the year ended 31 December $25,000 in claims were paid to customers. On 31 December X Co estimated that the following claims will be paid in the following gear: Scenario Probability Anticipated cost Worst case 5% $150,000 Best case 20% $25,000 Most likely 75% $60,000 What amount should X Co record in the statement of profit or loss for the year ended 31 December 20X1 in respect of the provision? 72 $57,500 $6,500 $18,500 $39,000 Financial Accounting (FFA/FA) BPP