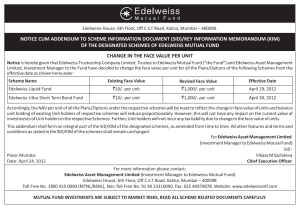

Edelweiss Group is an investment and financial services company based in Mumbai, India. It is not backed by a large conglomerate co-founded by RASHESH Shah. ● INTRODUCTION Edelweiss Group (officially known as Edelweiss Financial Services Limited) is an investment and financial services company based in Mumbai, India. It is not backed by a major conglomerate co-founded by RASHESH SHAH. The company operates in a variety of financial services ranging from brokerage services to life and non-life insurance, private equity and other investment-related services through subsidiaries. It has a network of sub brokers and authorized persons across India. It is registered with the National Stock Exchange of India, the Bombay Stock Exchange and the MCX Stock Exchange. Initially, the company worked on private equity syndication, mergers, acquisitions (M&A) and focused on advisory services. In 2000, the company had a capital of 50 million rupees. It acquired ROOSHNIL Securities in 2017. 1996-2004 EDELWEISS EMBEDDED ITSELF AS A MERCHANT BANK IN 2000. IT ALSO GAVE ASSISTANCE TO STARTUPS RAISE FUND THROUGH IPO ROUTE VENTURE CAPITAL & PRIVATE EQUITY FUNDS. 2004-2012 During this period, Edelweiss added the Institutional Brokerage and Non-Bank Financial Company (NBFC) activity to its portfolio. In 2007 Edelweiss obtained his Clearing Member license. The same year Edelweiss entered management assets with the launch of real estate funds. In 2007, Edelweiss Global Wealth Management was founded to provide solutions for wealth structuring, asset protection, asset transfer strategies, risk management and investment banking. In 2008, the EdelGive Foundation (the charitable wing of the company) was established with education and livelihoods as its main objective. In 2010, Edelweiss acquired Anagram Capital, for Rs. 164 crores. In 2011, Edelweiss TOKIO Life Insurance was created as a joint venture between Edelweiss and the Japanese insurer TOKIO Marine. Edelweiss held a 74 percent stake in the joint venture. CURRENT SCENARION In 2014, Edelweiss Financial Services acquired Mumbai-based asset management company, Forefront Capital Management. In 2016, Edelweiss Asset Management Company completed the acquisition of fund schemes of JP Morgan Asset Management India. In September 2016, Edelweiss Financial Services Ltd also agreed to acquire Ambit Investment Advisors' longshot hedge fund Ambit Alpha Fund. In 2016, Caisse de dépôt et placement du Québec (CDPQ), a pension fund manager in North America, acquired 20 per cent equity stake in Edelweiss Asset Reconstruction Company (EARC) with a view to investing annually in stressed assets and the specialized corporate credit segment, over a four-year period. (THIS PART IS BEING INTENTIONALLY LEFT BLANK) ANALYSIS ● ARTICLE 1 EDELWEISS’ shares decline on report of irregularities. Shares of Edelweiss Financial Services Ltd fell 5% after a report that the Department of Commerce (MCA) began investigating allegations of financial irregularities in the conglomerate's asset reconstruction division. According to online news site Money control, the MCA has ordered an inspection of the company's books following a shareholder complaint to the PM Office (PMO) and the Reserve Bank of India (RBI). Former Additional Solicitor General of India Paras KUHAD alleged that Edelweiss Group, the majority shareholder of Edelweiss Asset Reconstruction Co (EARC), together with its Canadian partner, CAISSE de Dépôt et placement du Québec (CDPQ ), will hold at least 1,800 crores in EARC. kuhad and his family own about 14% of EARC, which manages 45,000 crore in assets, according to the report. ● ARTICLE 2(ANALYSIS) SEBI IMPOSES Rs 5 LAKH ON EFSL’S COMPLIANCE OFFICER Compliance officer & CS BRENGANATHAN of edelweiss financial services limited was imposed with Rs. 5 lakhs by the market regulator SEBI for failing to close the trading window during the existence of the unpublished price-sensitive information. SEBI conducted enquiry in the dealing of the script of edelweiss financial services limited, to check the possible violation of PIT (prohibition of insiders trading) regulations for the period between January 2017 to April 2017. According to Sebi, RENGANATHAN, being the compliance officer of the company, failed to close the trading window during the period of January 25, 2017 to April 5, 2017. By his failure to close the trading window during this period, he has violated the provisions of minimum standards for code of conduct to regulate, monitor and report trading by insiders mentioned in the PIT regulations, the regulator added. Further, he has admittedly begun intimating stock exchanges on trading window closure only from January 2019. Accordingly, the regulator levied the penalty of Rs 5 lakh on him. ● ARTICLE 3(ANALYSIS) Edelweiss expects Tech Mahindra to deliver 13% revenue CAGR (compound annual growth rate) over FY21-23E. Tech Mahindra (TECHM), part of the Mahindra Group, is one of the top five IT services companies in India. Edelweiss expects Tech Mahindra to generate a 13% CAGR on fiscal 21-23E. An improved cost management execution engine, targeting large transactions, talent management and cash conversion, is expected to improve margins and further reduce financial costs, resulting in a CAGR PAT of 17% over the same period. Strong demand driven by digitalization is expected to support strong growth in the Enterprise (ES) segment of the company, the brokerage firm said in a note. As the communications segment (CS) has lagged, the momentum for 5G deals is accelerating. This should allow for a faster resumption of growth in CS. ● ARTICLE 4(ANALYSIS) EFSL’S ANNOUNCEMENT OF ALLOTING OF ESOP/ESPS. EFSL’S share allotment committee held a meeting and decided to allocate equity shares of 7,57,025 at face value of Rs 1, each under edelweiss employee stock incentive plan (ESIP) of the company. As it being a very impressive move by edelweiss financial ltd. To allot ESIP to its employee’s , it will surely make ESF ltd. a good employee satisfaction company the latter meeting was held on 16th of September 2021 which was further signed by TARUN KHURAN as him being the company secretary of the ESFL the last verification was to be carried by Khurana and the latter did the same. A SENSE OF OWNERSHIP As the EFSL allots ESOP/ESIPs to its employees they feel a sense of ownership which will motivate and eventually will boost the productivity of employee’s also they will develop an urge to do a mile more , perform better and add more trust among employees. ● ARTICLE 5(ANALYSIS) EDELWEISS FINANCIAL RAISES Rs 400 CRORE THROUGH NCD’s. EFSL raised a hefty amount of rupees 400 crore through NONCONVERTIBLE DEBENTURES , the 50% of total issue size got subscribed for 5 year & 10 year tenures, EFSL’s chairman & managing director RASHESH SHAH said in the release that “the issue has been oversubscribed which shows the faith of investors across categories have in our diversified model and appetite of high quality financial papers that offers competitive interest rates. The NCD issue has seen interest from investors across series and tenures offering annual, monthly, and cumulative interest options with the effective annual yield ranging from 9.09 per cent to 9.70 per cent, the release. The NCDs have been rated ACUITE AA (read as ACUITE double A) (Outlook: Negative) by ACUITE Ratings and Research and [ICRA]A+ (Negative) by ICRA Limited". EFSL ONCE AGAIN PROVED THE FAITH OF INVESTORS ACROSS CATEGORIES TOWARDS THE CORPORATE AS THE COMPANY WAS ABLE TO RAISE 400CRS ● ARTICLE 6(ANALYSIS) EDELWEISS FINANCIAL SERVIES TO SELL ITS 70% STAKE IN INSURANCE BROKING JV. The edelweiss financial recently spoke about its insurance broking business the latter said that it would sell its 70% stake to edelweiss Gallagher insurance brokers ltd. For 307.6 crores Gallagher which previously acquired 30% of the business shares now will be acquiring all the remaining shares by complete filling of all 100% shares. The company said, as per the agreement 37,00,000 equity shares of Rs 10 each representing 70 per cent of the paid-up share capital of Edelweiss Gallagher Insurance Brokers held by the company to be sold for a consideration of Rs 307.60 crore, in one or more tranches, in the manner as set out in the agreement. In addition to the sale consideration, Edelweiss Financial Services will also be entitled to receive a deferred contingent consideration based on the future revenue of Edelweiss Gallagher Insurance Broker, in the manner set out in the agreement. EFSL’S MANAGING DIRECTOR & CHAIRMAN RASHESH SHAH SAID THE SALE WILL PROVIDE “FLEXIBILITY TO REALLOCATE CAPITAL AND INVEST IN SCALING UP OF OUR FAST- GROWING LIFE & NON-LIFE INSURANCE BUSINESS MAKING A WIN FOR BOTH OF US. ● ARTICLE 7(ANALYSIS) ACUITE RATINGS REAFFIRMS CREDIT RATING OF EFSL; STOCK ENDS 1% HIGHER. Company’s long term borrowing program of 1900 cr. Was affirmed negative by the credit rating agency ACUITE AA, Recently CRISIL had assigned CRISIL PPMLD AA-r/negative rating on the company’s Rs. 300crores long-term principal – protected market linked debentures . THE EFSL landed at Rs. 80.35 per piece up by Rs 0.8 or 1.01% from its previous closing of Rs 79.55 per piece on the BSE. The scrip being opened at Rs 80.25 and engaged with a high and low of Rs81.50 and Rs.79.50 respectively. ● ARTICLE 8 (analysis) EDELWEISS FINANCIAL Q1 NET PROFIT TURNS AROUND TO RS18.1 CR ON LOWER FINANCE COSTS AND LOWER IMPAIRMENT. EFS Ltd announced a -13.96% drop in total revenue for the June 21 quarter on a consolidated basis to Rs1,633.21cr. On a sequential basis, revenue decreased by -46.59% compared to revenue of Rs 3,057.88cr in the March 21 quarter, reflecting a sharp decline in net gains on changes in fair value. The interest income was sharply lower by over 25% on yoy basis due to a fall in interest rates in the economy leading to lower loan yields. However, insurance premium income was sharply higher but lower on sequential basis due to COVID 2.0. The net profit ascertained for the June-21 quarter turned around to profit of Rs 18.09 crore against the net loss of Rs 245 crore in the June 20 quarter due to corona virus strain. During the current fiscal, it will complete the demerger of edelweiss wealth. The mutual funds aum witnessed the tremendous growth of 111% to Rs 62,000 crore. ● ARTICLE 9 (ANALYSIS) EDELWEISS FINANCIAL SERVICES SHARE FALLS 5% FOR SECOND SESSION AFTER MCA ORDERS INSPECTION OF SUBSIDIARY’S BOOKS. The ministry of corporate affairs led to a fall of edelweiss financial share of 4.99% to making it Rs 76.15 when compared previously which was of Rs 80.15 0n BOMBAY STOCK EXCH. EFSL’S shares tumbled 5% for the second consecutive session in early trade amid reports that the corporate affairs ministry did ordered a through inspection of books of its firm ARConst. after a following allegation of funds been misused by a whistle blower. Whereas EDELWEISS ASSETS RECONSTRUCTION completely denied this intimacy & further added that the business operations have been fairly conducted and in a very transparent manner. It drowned from previous close of Rs 80.15 to 76.15 resulting in a fall percentage of 4.99% on BOMBAY STOCK EXCHANGE. EFSL’S stock swims higher than 20day,50day, 100 day and 200 day moving averages but lower than 5 Day moving averages. ● ARTICLE-10 (ANALYSIS) EDELWEISS FINANCIAL SERVICES REPORTS Rs 63 CRORE LOSS IN THIRD QUARTER. The EFSL recently opened up about its consolidated loss of Rs 63 crore for the third quarter ended in 2020. Subsequently it registered a opposite net profit of Rs 35.32 crore in the same quarter last year, the loss widened from Rs 56.12 crore in quarter ended September 2020. The company revealed its fee income during the quarter at Rs 477 crore was back to the pre covid level and there is a strong control across wealth management, asset management and assets reconstruction company. The customer assets rose by 17 percent from a year ago relatively which was at Rs 2.65 lakh crore. There were subsequent tremendous & robust recoveries in asset reconstruction of Rs 2,200 crore in Q3FY21, even with IBC suspension, it said. The Edelweiss group engages and operates in a total of 10 entities across NBFC’S, housing finance, life insurance, assets management, assets reconstruction, general insurance, insurance broking & wealth management. “As the Indian economy enters a phase of strong and firm economic growth, it brings thrilling and exciting opportunities for growth for each of our business. BIBLIOGRAPHY ● https://www.edelweissfin.com/ ● https://economictimes.indiatimes.com/ ● https://www.livemint.com/market/market-stats/company-bse-edelweissfinancial-services-ltd-132922.