Financial Concepts: Compound Interest & Time Value of Money

advertisement

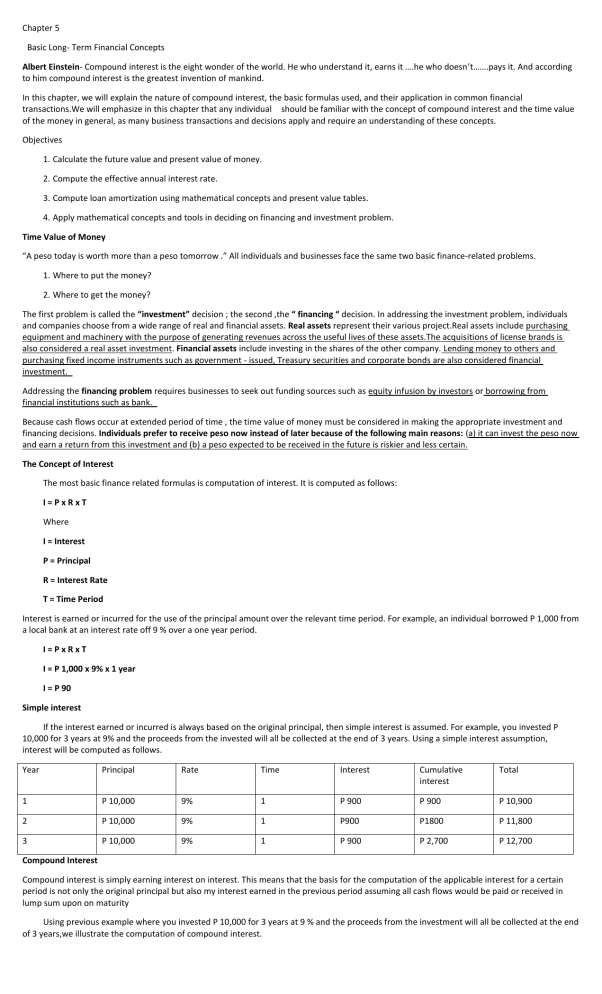

Chapter 5 Basic Long- Term Financial Concepts Albert Einstein- Compound interest is the eight wonder of the world. He who understand it, earns it ….he who doesn’t…….pays it. And according to him compound interest is the greatest invention of mankind. In this chapter, we will explain the nature of compound interest, the basic formulas used, and their application in common financial transactions.We will emphasize in this chapter that any individual should be familiar with the concept of compound interest and the time value of the money in general, as many business transactions and decisions apply and require an understanding of these concepts. Objectives 1. Calculate the future value and present value of money. 2. Compute the effective annual interest rate. 3. Compute loan amortization using mathematical concepts and present value tables. 4. Apply mathematical concepts and tools in deciding on financing and investment problem. Time Value of Money “A peso today is worth more than a peso tomorrow .” All individuals and businesses face the same two basic finance-related problems. 1. Where to put the money? 2. Where to get the money? The first problem is called the “investment” decision ; the second ,the “ financing “ decision. In addressing the investment problem, individuals and companies choose from a wide range of real and financial assets. Real assets represent their various project.Real assets include purchasing equipment and machinery with the purpose of generating revenues across the useful lives of these assets.The acquisitions of license brands is also considered a real asset investment. Financial assets include investing in the shares of the other company. Lending money to others and purchasing fixed income instruments such as government - issued, Treasury securities and corporate bonds are also considered financial investment. Addressing the financing problem requires businesses to seek out funding sources such as equity infusion by investors or borrowing from financial institutions such as bank. Because cash flows occur at extended period of time , the time value of money must be considered in making the appropriate investment and financing decisions. Individuals prefer to receive peso now instead of later because of the following main reasons: (a) it can invest the peso now and earn a return from this investment and (b) a peso expected to be received in the future is riskier and less certain. The Concept of Interest The most basic finance related formulas is computation of interest. It is computed as follows: I=PxRxT Where I = Interest P = Principal R = Interest Rate T = Time Period Interest is earned or incurred for the use of the principal amount over the relevant time period. For example, an individual borrowed P 1,000 from a local bank at an interest rate off 9 % over a one year period. I=PxRxT I = P 1,000 x 9% x 1 year I = P 90 Simple interest If the interest earned or incurred is always based on the original principal, then simple interest is assumed. For example, you invested P 10,000 for 3 years at 9% and the proceeds from the invested will all be collected at the end of 3 years. Using a simple interest assumption, interest will be computed as follows. Year Principal Rate Time Interest Cumulative interest Total 1 P 10,000 9% 1 P 900 P 900 P 10,900 2 P 10,000 9% 1 P900 P1800 P 11,800 3 P 10,000 9% 1 P 900 P 2,700 P 12,700 Compound Interest Compound interest is simply earning interest on interest. This means that the basis for the computation of the applicable interest for a certain period is not only the original principal but also my interest earned in the previous period assuming all cash flows would be paid or received in lump sum upon on maturity Using previous example where you invested P 10,000 for 3 years at 9 % and the proceeds from the investment will all be collected at the end of 3 years,we illustrate the computation of compound interest. Year Principal + Cumulative Interest Rate Time Interest Cumulative Interest Total 1 P 10,000 9% 1 P 900 P 900 P 10,900 2 P 10,900 9% 1 P 981 P 1,881 P 11,881 3 P 11,881 9% 1 P 1,069.29 P 2,950.29 P 12,950.29 Using the situations provided in Exercise 1 compute the annual interest ,total interest and amount to be received or paid at the end of the term for each scenario using a compound interest assumption. Present Value Of Money To get the present value = Future Value (1+R) T or Present value= Future value x 1 T 1 R where as 1 T 1 R referred to as the present value interest factor . The PVIF is also called the discount factor and the whole process of determining the present value is referred to as discounting.the interest rate used is denoted as discount rate. For example, your father told you that he will entrust you with the funds for your graduate program education. He gave you two options : (1) receive the money now in the amount of P 200,000 or (2) receive p 500,000 ten years from now. The available investments opportunities to you provide a 10 % rate of return. Which option would you prefer ? Choosing the second method will require you to get the present value of the P 500,000 as shown as below. Present value = Future Value (1+R) T = 500,000 ( 1+10 %) 10 Present value = P 192 771.64 A present value table can also be developed using he present value interest factors. Simply find the intersection of the relevant time period (T) presented in the rows of the table and the relevant interest rate ( R ) presented in the columns of the table. Using our example, the PVIF given 10 years and a rate of 10 % is equal to 0.3855. This is equal to 1 10 1 10% = 0.3855( rounded off to four decimal places) To get the present value of our example P 500,000 x 0.3855 = P 192,771.64 Multiple cash Flows To a certain extent ,all our example contemplate a single lump cash flow at the end of the term. If multiple cash flow occur at the different times, the more difficult it becomes to compare these cash flows streams getting their present value becomes more imperative in order to make appropriate decision. Simply get the present values of the individual cash flows and add them together. Since the present values refer to the same date( today), these are value additive. Let us say that you are contemplating on purchasing a new laptop computer on which is worth P 70,000. if you pay for the whole amount today. The computer store also allows buyers to pay P 25,000 annually at the end of each year for the next three years. You regularly invest your savings in a time deposit account that provides an annual return of 5%. you are now deciding whether to avail of the installment plan or pay for the whole amount today. To aid in your decision, you need to get the present value of the multiple cash flows and compare it with the P 70,000 cash price . since the perspective taken is that of the individual disbursing money, you need to choose option ( lower present Value). You can follow the steps in addressing this problems. 1.Draw a timeline illustrating the relevant cash flows and the timing of these cash flows. 2.Compute for the presents values cash of each cash flows using the appropriate Interest (discount) rate 3.Add the individual present values and compare the sum to the cash price. Step 2 and 3 Total present value = P 25,000 P 25,000 P 25,000 + + 1 R T 1 R T 1 1 R T 2 Total present value = P 25,000 P 25,000 P 25,000 1 5%1 1 5%2 1 5%3 Total present value = P25,000 x 0.9524 + P 25,000 x 0.9070 + P25,000 x 0.8628 Total present value = P 68,080 Annuities In the previous example, the installment plan requires the buyer to pay equal payments of P 25,000 each year. This is an example of annuity - a series of equal cash flows - payments in this case, required for a specific number of periods. Instead of computing the individual present values by multiplying each cash flows by the relevant present value interest factor, an easier way is to multiplying the equal cash flow stream by the present value interest factor for an annuity ( PVIFA). the computation for the PVIFA provided below 1 1 R R1 R T Present Value of an Annuity = Cx Where C = equal cash flow stream R = interest rate T = time period Using our example the PVIFA given three years and a rate of 5 % is equal to 2.7232. To get the present value of our example =25,0000 x 2.7232 = P 68,080 Our example is called an ordinary annuity since the cash flow is required at the end of each year. If the cash flowws happen at the start of the year, then it is called an annuity due If the cash flow streams last forever or indefinite, then it is called a perpetuity. The present value of the perpetuity is determined by simply dividing the equal cash flow streams by the appropriate interest rate. Let us say that , you expect to receive P 25,000 annually ( 5 % interest rate ) in perpetuity then the present value is determined by: Present Value of Perpetuity = Perpetuity R = P 25,000 5% =P 500,000 Loan amortization. A classic example of a business transactions that pays out an equal cash flows stream regularly is an amortizing loan. Most housing and car loans. are amortizing loans that requires the borrower to pay that equal amount either annually,semi-annually, quarterly, or most of the time ,monthly. Example: On July1,2015, DD Company borrowed 3 million from ASC Bank at the rate of 10 % a year. The loan is paid at the rate of P 500,000 every December 31 and June 30 until the full amount is paid Amortization Table for P 3- Million Amortization Dates Payments Interest Principal payment Principal balance 3,000,000 December 31,2015 650,000 150,000 500,000 2,500,000 June 30,2016 625,000 125,000 500,000 2,000,000 December 31,2016 600,000 100,000 500,000 1,500,000 June 30,2017 575,000 75,000 500,000 1,000,000 December 31,2017 550,000 50,000 500,000 500,000 June 30,2018 525,000 25,000 500,000 Note that the interest rate of 10 % is for one year, therefore for six months,the interest rate is only 5 %. let us compute the interest expense from June 30 to December 31, 2015. Interest = 3,000,000 x 10 % x ( 6÷12) Interest = 150,000 For the next 6 months ending June 30, 2016, the interest expense is only P 125,000 because the principal balance is already reduced to p 2,500,000 as of December 31,2015. Equal Regular Payments ( Principal and Interest Combined ) Some loans require equal regular payments. In this case, how is the regular payment ( C ) determined? C= Present Value of Annuity PVIFA For example you plan to purchase a house worth P 3,000 000. Assuming you incur a 10 year loan that is repaid in equal annual installments with an interest rate of 10 %. What is the annual mortgage payment? C= Present Value of Annuity PVIFA C C= P3,000,000 PVIFA10%,10 P3,000,000 6.144 C = P 488,236.57 Effective Annual Interest Rate Interest rate are normally quoted as annual rates but the compounding frequency may differ peer transactions. This means that if the annual rate is 12 % but compounding is done more frequently, for example every quarter, then the effective annual rate is higher than 12 %. to determine the effective annual rate , the following formula used Effective Annual Rate = 1 R M 1 M Where R = Annual Interest Rate M = Frequency of Compounding For example, credit card companies usually charged a monthly interest rate of 3.5 % (exclusive of other charges ). the annual effective rate is not simply determined by multiplying 3.5 % by 12 months since this transactions assumes monthly compounding. To get the annual effective rate we compute the following: Effective Annual Rate = EAR= 1 R M 1 M 1 (3.5% x12 12) 12 1 EAR = 51.11% This means that if you purchase a P 1,000 dress at the start of the year and did not pay for it until after one year, then you should pay P 1,511 already exclusive of the other charges. Basic Application of the Time Value of Money on Investment Problems One of very useful application of the time value money is when the Net Present Value Method is used to determine whether a project should be accepted or rejected by a company. The basic decision rule is to accept the project if the net present value is positive and reject if the net present value is negative. This capital budgeting technique is applied by determining first all the different cash flows, positive, negative, of a project then calculating the present values of these cash flows using an appropriate discount rate (given the riskiness of the project). For example, a project requires an initial outlay of ₱100,000. The relevant inflows associated with the project are ₱60,000 in one year and ₱50,000 in years two and three. The appropriate discount rate for this project is 11%. To compute the net present value: Net Present Value= -₱100,000 + P60,000 P50,000 P50,000 1 R T 1 R T 1 1 R T 2 Net Present Value = P 100,000+ P60,000 P50,000 P50,000 1 2 1 11% 1 11% 1 11%3 Net Present Value= -₱100,000 + ₱60,000 x PVIF11%,1 P50,000 xPVIF11%, 2 P50,000 xPVIF11%, 3 Net Present Value= - ₱100,000 + ₱54,054.05 + ₱40,581.12 + ₱36,560.40 Net Present Value= ₱31,195.57 Since the net present value is positive, then the company should accept the project.