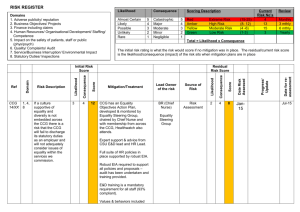

Inherent risk (before control) Low = 1, High = 5 Safety Controls Assurance Residual risk (remaining risks after controls have been applied) Risk Owner Risk Type Inadequately administering the contract During the Contract implementation -Leads to overruns on time or cost -Full benefits not achieved -Delivery of unsatisfactory product -Contract/supply disputes -Potential of Fraud and corruption 4 5 20 -Managing Contract performance. -Financial Regulations Budgetary control -Maintain up-to-date agency procedures and practices -Ensure all staff are suitably trained and experienced in contract planning and management -Assessment -Training -Contract checklist -Contract performance measurements 3 4 12 Head of Procurement Department Financial Reputational 2 Environmental risk: Covid-19 pandemic Before, during and after the Contract implementation -Delays in delivery -Delays in payment -Volume of selling/purchasing goods does not fulfill the required amount in the Contract 5 5 25 -Make a proper demand planning -Keep a considerable amount of inventory -Seek for substitutes -Contract 3 3 9 Warehousing Manager Financial Reputational 3 Loss or damage to goods in transit During the delivery phase -Delays in delivery -Downtime -Liability disputes 4 4 16 -Include appropriate packaging instructions in specification -Agree on insurance cover for supplier to provide -Accept delivery only after inspection -Know when title of goods is transferred to buyer -Contract -Insurance -Inspection Certificate 2 3 6 Transporting Manager Financial Environmental Residual Risk (L x C) 1 Inherent Risk (L x C) Consequence C (1-5) Potential consequences Likelihood L (1-5) Stage of the contract management Consequence C (1-5) Risk Description Likelihood L (1-5) Ref No. The risk register has an overall aim of improving the logistics contract management of Mega Market. This risk management plan sets out financial and other risks and how they will be mitigated. It explains the principles relating to the Company’s risk management strategy and the approach to be taken with respect to this scheme. It also refers to the contract management, governance, stakeholder engagement and communication, procurement and contract management. The Head of Procurement Department will be responsible for the management of risks associated with the scheme, including chairing regular risk workshops and maintaining the Risk Register. The risk management process improves when responsibility for individual risks are delegated to team members, where necessary. Therefore, risk workshops will be held at regular intervals during the delivery of the scheme and will be timed to coincide with various key milestones and activities shown on the programme. • Start of detailed design for scheme elements • Midpoint of detailed design for scheme elements • Start of procurement for individual scheme elements • Following award of contract for individual scheme elements • During mobilisation period • At frequent intervals during the contracting period. The effective management of risk and uncertainty through accurate evaluation and proactive mitigation of risks is critical to the success of the project. The following guiding principles will be adhered to: - Risk management is part of all project management board meetings and decisionmaking scheme risk will be managed as an on-going process as part of the scheme governance structure. A scheme risk register is maintained and updated at each of the two-weekly risk workshops. Responsibility for the risk register being maintained is held by the Head of Procurement Department. - Risk management will be proactively and consistently applied throughout the contract lifecycle - Risk communication will be open and transparent to all stakeholders - The management of risks is to ensure their reduction to a level as low as ‘reasonably practical' or adopt appropriate mitigation strategies. A risk assessment will be initiated at the beginning of the project, with the identification and assessment of risks in terms of their likelihood and associated cost outcomes. The risk assessment will be reviewed regularly and the Contract Management team will identify risks and measure their impacts on the programme. All risks will be documented in a register with the impact on the programme clearly defined and the mitigation set out. The programme will take account of the ‘most likely’ scenario after mitigation. The 1st step is the identification of all risks affecting the project through risk workshops and risk reviews, resulting in a risk register. Risk workshops typically include a mixture of expertise such as engineers, designers, finance officers, procurement specialists, and environmentalists. On the screen, we have 3 risks in the risk description, which is a summary of the hazard and what may cause it, after assessing with the members and specialists. Our group focuses on the analysis of the first risk “Inadequately administering the contract”. The consequence for not closely supervising the Contract is mentioned in the next column. The second step is to identify where the risks are going to arise during the Contracting period and the consequences to the activity if the risk were to materialize. For this Contract, the Team divided the risk management into 3 stages: before, during, and after implementing the Contract. For this risk, ineffective contract administration leads to overruns on time or cost and failure to meet the set aims. Other outcomes could be late deliveries, payment delay, disputes arising between the 2 parties as they fail to perform their obligations, or the worst scenario is the deliberate exploitation of the staff to embezzle the fund of the company. The third step of the process is the analysis of the various risks by defining their distributions in terms of probabilities, impacts and knock-on effects. This information is gathered through risk workshops and other interactions. A qualitative risk ranking will be undertaken in the form of a standard decision matrix or the inherent risk columns in the risk register. In risk management, inherent risk is the natural risk level without using controls or mitigations to reduce its impact or severity. It is measured by two factors – impact and likelihood on the scale from 1 to 5. The inherent risk is calculated by multiplying the 2 elements likelihood and consequence with the highest score of 25. Any risk scoring 20 or above (i.e. in the red shaded area, named Extreme) are serious in nature and, therefore, will be under strict control of the Team. The scores from 15 to 19 are in the High level, from 12 to 14 are in the Medium level, while the remaining is observed as Insignificant. Poor contract administration results in serious deficits, and there is a great possibility that the Contract is not under proper supervision, therefore, the team gives this risk the likelihood score of 4 and the impact score of 5. The inherent risk is 20 after calculating, which is an extremely high threat to the organization. The fourth step is to identify if there are any controls currently in place to mitigate those risks. If not, develop and document Risk mitigation actions. For those risks that have been ranked as medium, high or extreme, address with mitigating actions: - Medium: Mitigation actions to reduce the likelihood and seriousness should be identified and appropriate actions to be endorsed at a Divisional level. - High: If uncontrolled, a risk event at this level may have a significant impact on the operations of the Company as a whole. Mitigating actions need to be very reliable and should be approved and monitored by the contract owner with reporting to the responsible Dean or Executive Director. Even with mitigating actions in place, the Executor (contract signatory) should be advised of identified or potential risks which have been graded at this level. - Extreme: Activities and projects with unmitigated risks at this level should be avoided or terminated. Mitigation actions of these types of risks may outweigh the benefits of the activity to the Company. This is because risk events graded at this level have the potential to have significant adverse effects to the budget holder or the Company. As the score for this risk is 20, the Company takes serious controls such as managing Contract performance, budget control, maintaining up-to-date procedures and practices and staff training. For the Assurance, its aim is to track the effectiveness of the safety control through the meetings, verification, or internal audit. This risk is managed through assessment, training, contract checklist, contract performance measurements. The training and assessment aim to check the professional knowledge, understanding and skills of the staff, meanwhile the contract checklist is designed to provide valuable insights into the contract lifecycle management through contract performance measurements such as annualized contract value, quality/complaints resolved, perfect orders, etc. The sixth step is to re-assess and re-rank the risks based on residual results. Residual risk rating is the overall rating given to the hazard based on the likelihood and consequence after safety controls have been put in place. If the risk rating still remains high or extreme, there should be the interference of the specialists or third party consultants. The ranking of the risk after applying the mitigation strategies drops to 12, which is acceptably in the Medium level. The seventh step is to identify the name of the position responsible for the hazard and safety control. There can only be one risk owner per risk in order to avoid the duplicable responsibility. Head of the Procurement Department is in charge of this risk. The last one is the risk type. This column shows how the risks are going to affect which aspects of the Company. Financial risk is risk arising from insufficient funding, losing monetary resources, spending, fraud or impropriety, or incurring unacceptable liabilities. Meanwhile, reputational risk is risk from damage to the organization’s credibility and reputation.